Every fall, we publish a magazine called Real Estate INSIGHTS, or simply what we call “Insights” for short.

This is mailed to all of our clients and published on the Toronto Realty Group website.

Having already shared an article on multiple representation by TRG’s Matthew Morrison, as well as my own article about the history of pre-construction condos, I’d like to continue the series today.

Up next: an article on Toronto’s housing crisis by TRG’s Chris Cansick…

Toronto’s Housing Puzzle: Why Supply Alone Won’t Solve The Crisis

By: Chris Cansick, Broker

September, 2025

Complex problems are not often fixed with simple solutions.

You’d be hard-pressed to find a Torontonian who hasn’t read, heard about, or discussed the housing crisis in our city. Housing has not only been a continuous media headline, but also the focal point of just about every political campaign in our city, province, and country over the last decade.

Housing is and will continue to be a hot-button issue in Toronto, where home prices and rents have climbed to untenable levels for many, squeezing middle-class families and sidelining first-time buyers alike. But while all three levels of government recognize the urgency of the crisis, their approaches to solving it differ significantly.

At the municipal level, the Toronto City Council has rolled out initiatives like inclusionary zoning and expedited development approvals to encourage the creation of more affordable housing. Their focus has largely targeted affordability in the rental market, which has seen rents continue to rise.

Most recently, the city has focused on combating “renovictions,” whereby landlords must obtain a rental renovation license before issuing an N13 notice to tenants. Applicants must now prove the necessity of tenant displacement through approved permits and provide temporary accommodation or compensation plans.

Toronto is also completing the final phase of new short-term rental (STR) bylaws. These rules reinforce earlier regulations requiring STR operators to register, pay increased operator fees, and restrict advertisements for partial-unit rentals. The goal is to safeguard long-term rental availability by limiting STR operations to primary residences.

But as a recent article in The Economist, titled, “If You Can’t Find A Place To Rent, Blame The Government,” points out, continuing crusades against landlords have made housing shortages worse.

“Many policies aimed at easing pressure in rental markets have been treating the symptoms of the problem rather than the cause. They have thereby ended up making things worse for the people they were meant to help.”

Making it more difficult for landlords to build and investors to rent units is likely not going to solve the larger problem, which leads us to the focus of the provincial government.

Under Premier Doug Ford, the Ontario government has adopted a more aggressive strategy, including legislation to override municipal zoning bylaws and fast-track development through their Housing Supply Action Plans.

Examples of their recent efforts include the approval of mass timber buildings up to eighteen storeys, an increase from the previous 12-storey limit. This change, effective January 1, 2025, aims to reduce construction costs and time while supporting local jobs in forestry and manufacturing. This, along with further Amendments to the Ontario Building Code to eliminate over 1,700 technical variations between provincial and national standards in order to reduce regulatory barriers for developers, are aimed at increasing the supply of housing.

The idea here is that more liberal construction policies will beget more liberal housing markets, to everyone’s benefit.

At the federal level, the government has also made efforts to speed up construction of new housing, recently committing billions in funding through the National Housing Strategy and the Housing Accelerator Fund to support local governments.

In March 2025, the federal government released the final renderings and floor plan layouts for the Housing Design Catalogue, featuring approximately 50 standardized housing designs for rowhouses, fourplexes, sixplexes, and accessory dwelling units. These designs aim to simplify and accelerate housing approvals and construction by providing adaptable, energy-efficient, and cost-effective options for builders and communities.

Each government clearly has its own perspective on the issue and, of course, its own agenda, but despite the varied policy tools and often ideological divides among our levels of government, they do converge on a common refrain: a need to increase the supply of housing.

This seems rudimentary for most people to grasp; if we have an increasing population, we need more housing units, and an increase in the supply of housing should have an inverse impact on the prices homebuyers must incur.

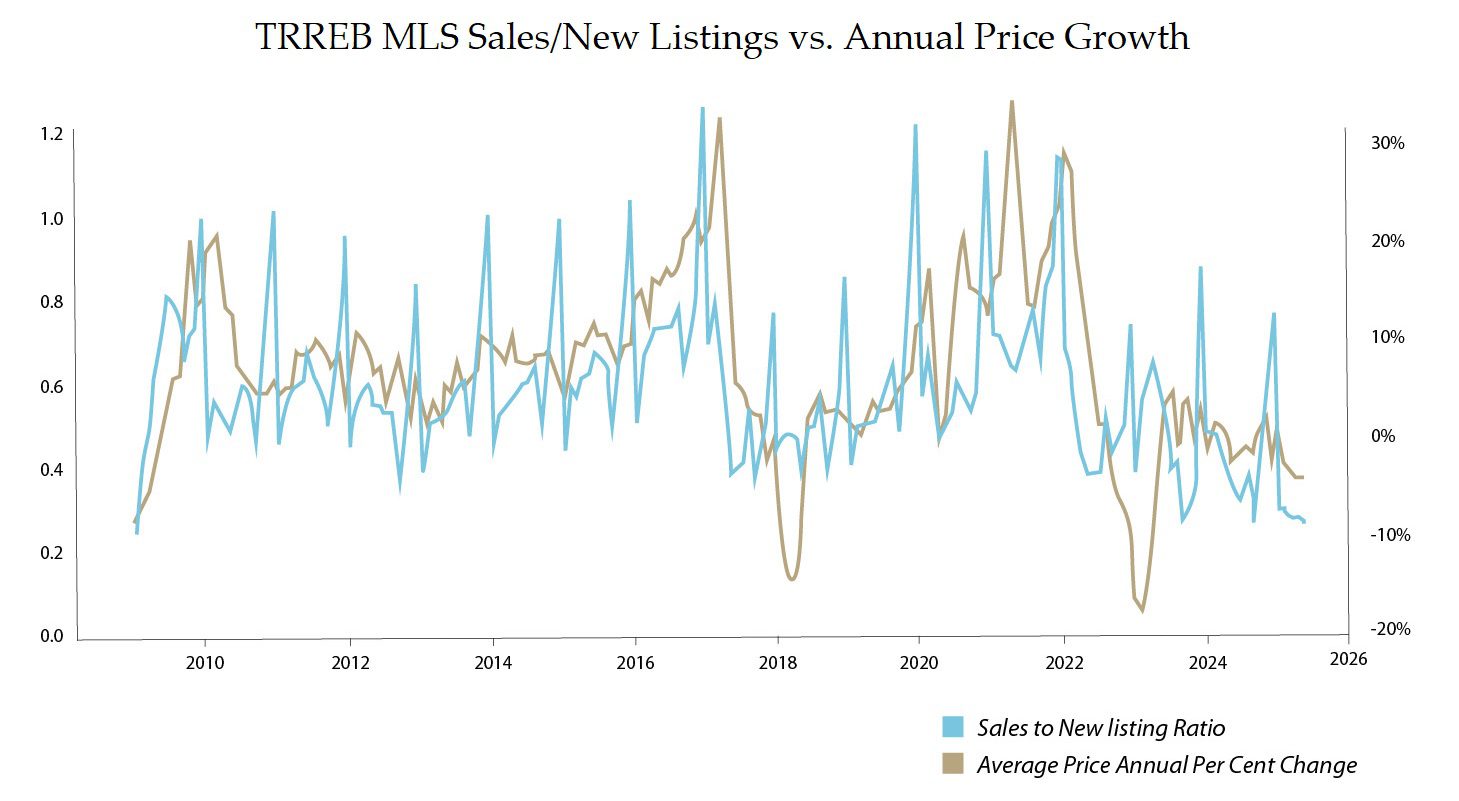

Illustrated below are the historic sales-to-new-listings ratio, a metric of supply vs. demand (in blue), and the corresponding change in annual price growth (in yellow.)

There is a clear correlation here, but as we have recently seen, an increase in active and often vacant condo units for sale in Toronto, while simultaneously witnessing an almost complete dearth of any new preconstruction interest. It seems more and more likely that increasing supply alone cannot resolve the housing crisis.

The recent Toronto market data reveals a sharp increase in active listings across the city.

Specifically, condos, once hot commodities, are now lingering unsold for longer periods. Investors who previously banked on these condos for quick appreciation and lucrative returns are retreating, spooked by rising interest rates, stagnating prices, and new taxes targeting short-term rentals and vacant properties.

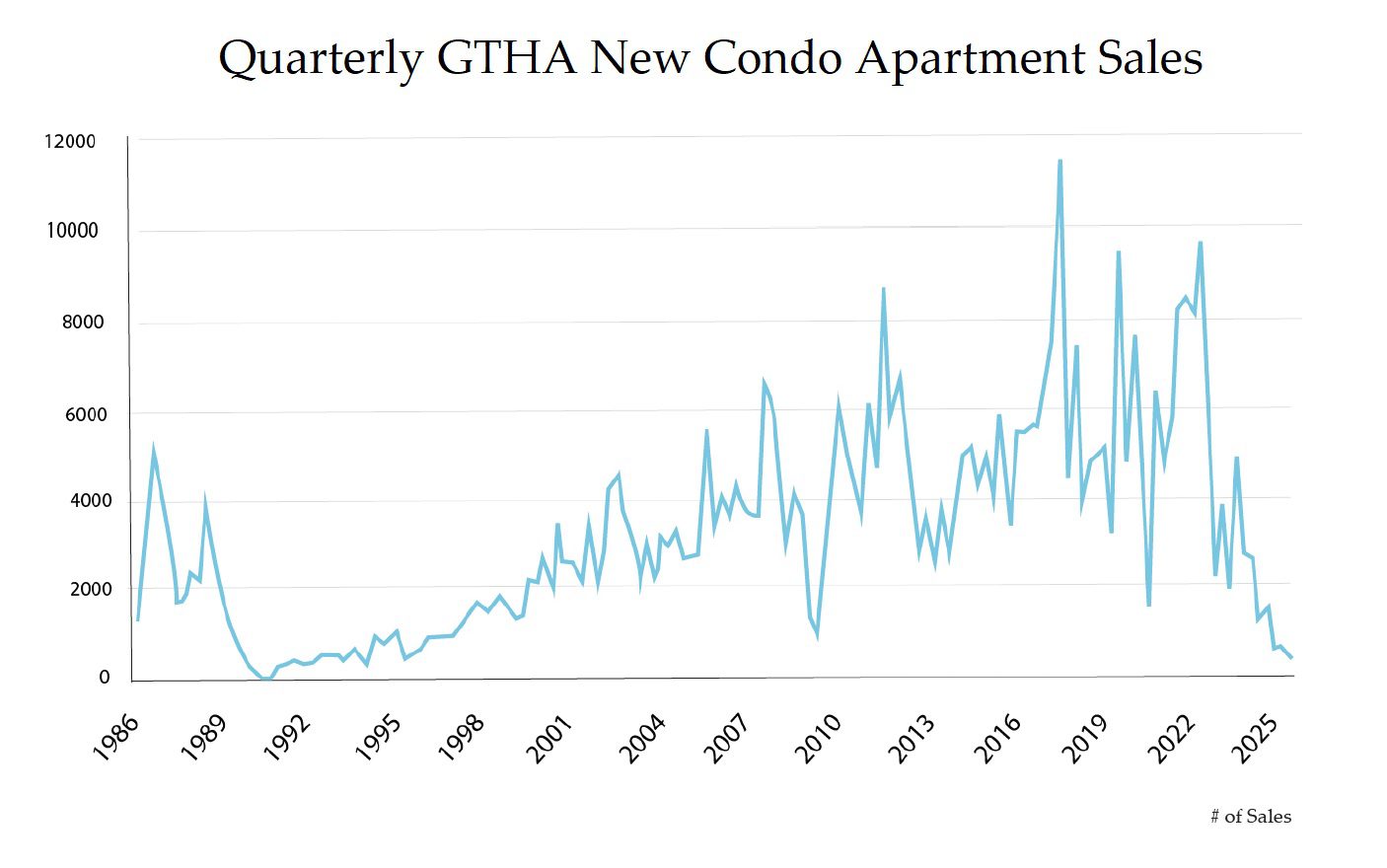

Additionally, as Urbanation, a leading source of condominium sales data, reported earlier this year, sales for new construction condos have dropped dramatically, and unsold preconstruction inventory totaled 23,918 units, increasing 6% from a year ago and 58% higher than the 10-year average.

Unsold inventory is now equal to 78 months of supply based on the pace of sales averaged over the last 12 months, a record high that was approximately seven times greater than a balanced level of 10-12 months of supply.

Cancellations of high-profile projects, developer hesitations, and dwindling presale activity signal a sector in distress.

This collapse is particularly concerning because condos have been the backbone of new housing supply in Toronto, especially in the downtown core.

Shaun Hidlebrand from Urbanation articulates quite clearly that “the new condo market is currently working through its most challenging period to date, which has become further impacted by the uncertainty and cost escalations…”

So with almost no demand for this new housing and many existing units sitting without any offers from buyers, it begs the question: Is more supply really the answer to the housing crisis?

While the focus has largely been on boosting supply, less attention has been paid to the nature of the demand for housing.

Who is buying, who is renting, and who is being left behind?

It’s all well and good to build as many dwellings as possible to boost supply, but many new units are out of reach for average-income earners. Investor-owned properties often prioritize returns over long-term affordability, leading to higher rents and less stable tenancies. At the same time, immigration-driven population growth and demographic shifts are pushing up demand in ways that pure supply-side solutions can’t fully absorb.

Affordability is further complicated by the financialization of housing, where homes are treated more as investment vehicles than places to live. This dynamic inflates prices and disconnects housing from local incomes. Without addressing demand-side pressures like investor speculation, and income inequality, increased supply alone will not translate into meaningful affordability.

Only the federal government has the means to meaningfully address the demand side of the equation. And although they’ve increased the insured mortgage allowance from $1 Million to $1.5 Million, allowing more Canadians to qualify for mortgages with a down payment below 20%, and have also expanded the eligibility for thirty-year amortizations to all first-time homebuyers and buyers of new builds, which aims to lower monthly mortgage payments, they can and likely will have to do more here!

Toronto’s housing crisis is complex and multifaceted. The current surge in unsold condos and the faltering preconstruction market underscore a deeper truth: supply without affordability is an illusion of progress.

Policies must do more than pave the way for new units; and they must ensure those units meet the needs of residents.

What’s needed is a coordinated approach that integrates supply-side initiatives with demand-side reforms.

This includes stronger protections for renters, support for non-profit and cooperative housing, disincentives for speculative ownership, and measures to align housing costs with local incomes.

All three levels of government are correct in identifying the need for more housing, but the data reveals a cautionary tale: more isn’t always better if the housing isn’t accessible, affordable, or aligned with real-world needs.

The rise in active condo listings and the decline of the preconstruction market are signals that supply alone won’t mend the housing crisis.

A genuine solution requires more than bricks and mortar. It demands an integrated, thoughtful strategy that balances supply with affordability, investor regulation with tenant security, and market incentives with social responsibility.

Only then can Toronto hope to build not just more housing, but a livable, inclusive city for all.

Thanks to Chris Cansick for sharing his thoughts, which I’ve been told represent a “different voice” from mine.

I told somebody last week, “There’s nothing wrong with being optimistic, so long as you’re right in the end. Otherwise, hindsight says you were just naive.”

But Chris has been described as the ying to my yang, so a Jerry Maguire-esque moment that offers, “More housing isn’t always better” is nothing short of refreshing.

Have a great weekend, folks!

Ace Goodheart

at 12:37 pm

Having read this twice, I can honestly say that I have no idea what he is trying to say.

He seems to try very hard to not make a point or come to a conclusion.

Is he saying we need more protection for tenants? Or is he saying that more protection for tenants results in less people wanting to be landlords and reduced supply, higher prices?

Should the government intervene? If so, how?

What about all the taxes? Does it make sense to add six figures in tax to a new build, if you want to make them more affordable?

What is the purpose of doubling land transfer tax? Was the thought that doing so would make it cheaper and more affordable to buy a house?

Why do we ban foreign landlords? So we can create more rental supply? Doesn’t banning landlords who don’t live here actually do the opposite?

Many questions.

Izzy Bedibida

at 1:43 pm

I agree, it sounds like the author is talking out both sides of his mouth

Libertarian

at 11:18 am

Not a lot of comments…..probably everybody is excited for the World Series tonight. Go Jays go!

Ace’s comment above asks what was the point of the article.

My interpretation is that he is going against the herd in the industry, including David. The industry has one point – build, build, build. Doesn’t matter what is built, just build because of supply vs. demand, population growth, ownership, etc., etc.

Studies have shown there are enough “residences” in the province for the population, but the problem is, as Ace always says, that people have such high expectations for the residence they want. There is nothing the 3 levels of government, real estate agents, and builders/developers can do to resolve that, so this debate will go on forever.

This debate is a waste of time, energy, resources, and most importantly, brain cells.

Ace Goodheart

at 6:27 pm

This is very true.

Everyone wants a large detached house in a popular school zone, in one of Canada’s most expensive cities.

There are lots of cheap houses for sale right now.

However they aren’t in Leaside or High Park, they don’t look like something off the cover of Better Homes and Gardens, their kitchens don’t have appliances with fancy Italian names and cupboards designed by famous designers, and your kid won’t get to go to a popular elementary school if you move there.

But they are live able houses. Just fine if the buyer is being reasonable and has learned to live within their means.

Not so great if the buyer feels entitled to live far above their own financial reality.

Libertarian

at 2:04 pm

We both forgot to mention…people want the house you describe for the same price as a big mac combo.

Never going to happen and debating all the different possibilities is a waste of time.

JF007

at 1:28 pm

we need Singapore style home ownership rules if we need to stop investimization of home ownership..every purchase after 1st exponentially increases the registration costs and for foreign buyers automatically has a higher registration cost as well. that discourages exorbitant cost increases and incentivizes builds that ppl need to have a family in at the same time makes sure expectations are in check as to how big a family condo can be.

Izzy Bedibida

at 1:51 pm

The author does bring up a good point of how housing has become an investment vehicle to make money. Either through buying/flipping condos or using your home as a retirement plan. It skews lots of what is being built.

The author also brings up the point of what is being built as well. Lots of micro-condos will not solve any issues. They are all being built to satisfy investor needs and arbitrary price points. Not what is long term livable and needed.

Just as suburbs feature much bigger houses than what is needed. The you can’t have a family in anything under 2500 sq ft marketing. Or tall narrow townhouses that are ill-suited for families with toddlers or seniors. They are tbuilt to divert traffic to the 2500+ sq ft homes for only an extra $xxx/mth more x xxx more yrs.

Ace Goodheart

at 7:07 pm

Interesting development in residential rental laws.

What has essentially happened with residential rentals (and why I won’t run rental buildings anymore) is that when you sign a lease with a tenant, you have agreed, as a landlord, to provide that tenant with housing, at a set price that can only be raised by a tiny fraction each year, for the rest of their lives.

This of course is nuts.

I am in my mid fifties and plan to retire in ten years.

I do not want to be obligated to provide problem free housing to people by contract, for as long as they live.

It looks like the Provincial government will be changing this, so that a years lease really means a year, and must be renegotiated or terminated at its anniversary date.

If you want to give your tenant a 20 year lease, or a life lease I can.

But I am not legally required to do so.

If this goes through I might actually get back into landlording.

Cyber

at 9:04 pm

No way this goes through, way too many voters would get way too upset.

Whats likely to go through is the removal of needing to pay one month’s rent if evicting for personal / family use with minimum 120 days notice & ability to have more control over who lives in the unit (ie no uncontrollable additional roommates, especially non-related).

The weird part is, DoFo could easily mandate guaranteed 2 week arbitration for non-payment of rent, and just generally fund more LTB arbitrator, instead of blowing 75 mil to “stick it to Trump” … and probably 80% of landlord concerns would be addressed.

Steve

at 9:54 pm

“Interesting development in residential rental laws.”

It should pass, otherwise more and more Mom & Pop landlords will exit the space and leave the arena to the big guys…….. Um, hold on, maybe that is the objective?

Tree Removal Arvada LLC

at 9:20 am

This article does a great job of explaining why just increasing housing supply may not solve the full problem. I appreciate how you emphasize factors like affordability, infrastructure, and long-term planning along with supply. It gives a more realistic picture than many housing discussions tend to offer. I hope more people read posts like this before expecting a quick fix. Thank you for sharing such a thoughtful analysis.

Fencing Companies Arvada