Yesterday, we talked about last week’s announcement that BMO is offering a new 2.99%, five-year, fixed-rate mortgage, and a reader asked, “What options would people want in their mortgage the most?”

Great question!

But is this a question that people ask often enough?

Believe it or not, the rate you get might not be the most important aspect of your mortgage. If you think that five basis-points is enough to turn a blind eye to the fine print, think again…

As my regular readers know, I have one mortgage broker that I recommend to my clients, as I have worked with him and his team for ten years now.

This person is not my father, nor is he my best friend.

I don’t get kickbacks or referrals, and even if they weren’t illegal and unethical, I still wouldn’t expect a thing.

All I want is the best service for my clients, and I’m smiling from ear-to-ear.

When we start working together, I tell my buyer-clients, “Make sure you have an experienced, knowledgeable, up-to-date mortgage broker that works in Toronto, and does high volume. Your interest rate is not the most important part of your mortgage. You have to remember that.”

For some buyers, it goes in one ear and out the other. They only care about the rate, and when I tell them, “My mortgage broker has the VP’s of lending institutions and mortgage insurers on his speed dial; he can get anything done, and answer any question,” they don’t listen, and turn back to whether or not BMO can beat TD’s rate by 0.01%, and whether they can then shop that to CIBC for another one basis-point.

I firmly believe that knowledge and experience pays huge dividends, just like it does with Realtors. You can hire the cheapest Realtor out there, or even get “cash-back” from using some weird discount-model brokerage that only employs bottom-dwelling Realtors that have flamed out of the business, or you can use a top Realtor, who knows the market inside and out, and that Realtor will provide you with the insight, advice, and knowledge that will pay off for 10-15 years as you live in your home.

A mortgage broker can have the exact same impact, and just like using a Realtor, you don’t pay them a cent.

What I’m leading into here is this: when mortgage lenders introduced their 2.99%, five-year, fixed-rate mortgage last year, they offered a very stripped-down version of a typical mortgage, and the terms and conditions were all different.

While “Bob at BMO,” who works at the very front line, would likely tell borrowers that the mortgage is a great product, and that there’s no difference between it and the 3.49% mortgage they were offering a week ago, a good mortgage broker would point out every single difference there is.

On Wednesday, I’m going to ask my mortgage broker to do exactly that: point out the fine print in the 2.99% mortgage, and distinguish between it and the other products offered at higher rates.

But today, I’d like to ask what features borrowers are looking for, and start a discussion about whether rate is the all-important item, or whether the fine-print can completely trump that bargain-basement rate.

Here are some of the questions you should ask yourself:

What is the amortization period?

Once upon a time, we had forty-year amortizations!

Wait……that was only a couple years ago….

Today, we have a choice between a 30-year amortization, and a 25-year amortization in Canada.

A 30-year amortization allows you a smaller monthly mortgage payment.

A 25-year amortization allows you to pay off your mortgage quicker, as well as pay less interest.

Each product is right for different people, but the choice should hopefully rest with the borrower!

What is the pre-payment privilege?

While some people are living paycheque-to-paycheque, and scoff at the idea of “paying down” the mortgage, others might consider this a fantastic feature in the event that they have cash on hand.

We all run our personal finances differently, and we all have varying risk tolerances.

Some people would love to put their $40,000 April bonus right into their mortgage and pay down principal, and others would say “Why would I pay down a measly 3.29% mortgage when I can put that money to work for me in a DOW Jones that increased 30% last year?”

Again – we all have different ideas of what to do with our money, but paying down the mortgage has got to be on the minds of anybody with cash savings.

Can you increase monthly payments?

For those that don’t have the money, or the flexibility, to make a large lump-sum payment of principal, there’s always the option of increasing the monthly mortgage payment, and paying less interest, and more principal each month.

I understand that while some borrowers might like to decrease their monthly payments instead, if they’re falling on tough times, I probably run into just as many people who would love to pay down the mortgage faster.

This is a great feature for some, and completely irrelevant for others.

What are the break fees?

If you want to break the mortgage before your five-year term is up, there’s going to be a cost.

I once had a client (the dreaded “friend of a friend of a friend), who didn’t quite understand commerce in general.

I told her that since she and her husband had a mortgage at 4.49%, and the rates had dropped to about 3.49%, she would have to pay the interest rate differential between the two rates, which in this case, amounted to about $17,000.

“We can’t pay that,” she said, as if it somehow affected the sale of her house.

I told her that while I sympathized with the situation (this was a divorce, where they both cheated on each other with multiple partners, so I really didn’t feel all that bad for the mess that they made – with their 3-year-old daughter sitting between them), there was absolutely nothing they could do about the mortgage break fees.

That’s when she casually waved her hand in the air, and announced, “Don’t worry – I’ll call them tomorrow.”

Really, eh?

You’ll call them?

“Hellooooo…….bank? This is Jane Smith, calling……”

And just like that……POOOF! No more mortgage break fees?

No.

Mortgage break fees are as sure as death and taxes, because the lender is going to get paid, even if you don’t want the mortgage that you signed on for.

So what are the mortgage break fees and how do they work? Well, every mortgage is different.

Maybe it is important to read the fine print!

Is the mortgage portable?

What if you want to buy a larger house, or move out of the city?

What if you’re only two years through your five-year term, but unlike the situation above, you don’t want to break the mortgage; you just want to take it with you to a new property.

Can you do that?

What if you have a $300,000 mortgage on your $600,000 house, but you want to move into a $1,000,000 house? Can you bring that $300,000 mortgage to the new house, and “blend-and-extend” that rate and principal with added principal at a prevailing rate?

Well, it all depends on……wait for it…….the fine print!

And by the way – the print isn’t that fine. It should be spelled out for you, but then again, if you’re only concerned with the interest rate, then maybe you’re too busy to notice…

Can you refinance? Do you have options?

What if you want to take out equity on your home?

Let’s say you’re eyeing a cottage up in Muskoka, but all your equity is tied up in your primary residence.

Can you refinance?

Can you shop around?

Do you have to use the same lender?

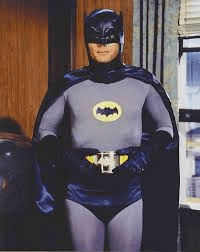

All this and more will be discussed in tomorrow’s blog post when I bring in special guest: BATMAN!

(Note: the special guest is not Batman. It’s just my mortgage broker).

Tune in tomorrow!

Same……..Bat-Time.

Same……..Bat-Channel!

(note: if you don’t get the reference, then you clearly didn’t go for Halloween as Adam West like I did in 1988…)

Darren

at 8:49 am

Hands down the most important thing for me is the break fees. If it’s any more than the standard 3 months interest I won’t touch it.

I also like the extra payment option too. On my last mortgage I had the option to pay 25% extra on each payment and took full advantage.

Joe Q.

at 9:53 am

Pre-payment privileges are very nice, but my recollection of survey data is that only a minority of homeowners take advantage of them. I seem to remember the number being around 30% (fraction of Canadian mortgage-holders, surveyed in 2013, who reported putting down an extra payment against their mortgage in the previous year).

In any case, any figures on the number of mortgage brokers in the GTA? It seems like they’re everywhere these days.

Dan O

at 9:59 am

I’m new to this but for me, I think portability and the ability to make lump-sum payments would be features I would be interested in looking at. At the level of interest rates now, I dont think break fees are as important as portability.

jeff316

at 10:16 am

I’ve found that the ability to adjust pre-payments at will has been valuable – none of this anniversary date, or twice a year, or once a quarter stuff to think about. I’m not getting anywhere near 20/20 limit but we put anything from 5% to 100% extra on monthly payments and have adjusted it so many times I’ve lost count. I’m sure we’re annoying but it is handy.

Break fees are pretty important and particularly with some of the ultra-low fixed rates they can be significant. When we signed our mortgage a few years back everyone said we’d never have to worry about the penalties in this low rate environment. We’ve never considered breaking the mortgage but even with our more conventional penalty formula if we were to do so whatdoyouknow with current rates, the “discount” and all that baloney the IRD is significant.

DocBenway

at 10:40 am

Really looking forward to tomorrow’s article! I have also read that most don’t take advantage of putting down more monthly or as a lump sum. So the higher rate for that flexibility is useless to them.

For me I like the flexibility of paying more each month. Seems like a good thing to do when rates are so low and mortgages for most people are huge. Peace of mind, for when rates eventually will climb.

Jeff316: what is a 20/20 limit?

jeff316

at 1:19 pm

Most mortgages limit the amount you can prepay over the term to a proportion of the principal, and/or limit the cumulative amount you can prepay over the course of the term as a proportion of your payment. Some are 10/10, others 25/25. Others in between.

Alex

at 12:07 pm

Being able to increase monthly payments and do pre-payments would be most important for me. I don’t know how much of an interest rate increase it would be worth to me though. If my monthly payments would be a few hundred bucks higher then I’m less likely to be able to save up extra money to pay it down faster anyway, and I’d rather go with the lower rate.

I don’t understand the break payment part. Why would you break a mortgage? If it’s just to get a new mortgage at a lower rate why would you do that if you have to pay the difference now anyway? If it’s because you’re moving wouldn’t you use the money from your house/condo sale to pay off the rest of the mortgage? Assuming you’re allowed lump sum payments and prices have gone up. If you can’t do lump sum payments and/or prices have gone down, then why not use the money from the sale to pay for your new place and keep the old mortgage?

jeff316

at 2:28 pm

“If it’s just to get a new mortgage at a lower rate why would you do that if you have to pay the difference now anyway?”

Because sometimes it is worth the penalty depending on rates or your life situation. Depending on the penalty formula, you’re not necessarily paying the difference between your current rate and your new rate.

Darren

at 1:59 pm

Alex,

I have twice sold a place to then move into a rental unit. I can’t assume that I will be wanting to transfer a mortgage so I need flexibility.

M

at 9:49 am

Flexibility is hugely important for me. We’ve had a home equity plan for about 10 years now. We were approved to borrow up to 75% of the appraised value, and could borrow in a combination of varying terms (e.g. 1 year, 5 year, secured line of credit). That has been invaluable for us over the years. Splitting the borrowing up into varying terms spreads out the risk of having a big rate spike on renewal. And

we used the equity to do renovations, and to purchase a cottage. (Then paid it down in between those times). The downside is that because you never have all your mortgage maturing at once, it does leave you tied to one institution. But they’ve given very good service, rates, and flexibility over that time.