I can already hear the complaints about this blog post on the real estate Facebook groups.

For the record, I’m not a part of any of these groups. Thousands of agents are, and there are some big groups!

But I find them to be inherently negative, often in denial, and they often want to ignore market truths.

Every so often, a colleague will say, “You should see what so-and-so said about you on this-that Facebook group!”

Like I give a shit. Some old bird who does two deals a year is complaining because I talk openly about the fact that most realtors don’t transact? No kidding, she wants real estate transactional data kept quiet! Or another agent takes me to task for divulging the terms and conditions of an offer night, in full, in a blog post? Yeah, he’s afraid of how he would explain anything to anybody if the industry changed at all.

So with that said, today’s blog post is going to highlight a “changing market,” and I know that the agents who work these areas are going to be pissed.

But so long as I’m being truthful, is there really any merit to a complaint?

A reader suggested in Monday’s comments section that I talk more about how many properties in Courtice are being listed over-and-over, often with different pricing strategies.

On that, I’m happy to oblige!

But I’m not going to stick to Courtice. I’m going to look at all of Durham Region.

Now, a couple of qualifiers first and foremost:

1) Properties are still selling, often well! There are lots of sales for 140% of the list price, many properties getting bully offers, and many receiving multiple offers. I’m not looking to paint the whole region with a negative brush, nor am I going to deny strength in the market for some property types, areas, or price points.

2) I’m not picking on Durham. I chose this region because I’m looking for one region on which to focus, and because I was asked by a reader. Halton and York are also showing these “changing market” signals.

3) I cannot divulge sales data. Because of TRREB’s rules that prohibit realtors from providing sales data, all the houses will have the addresses blacked out. Regular readers are familiar with this, but for the people reading because they found this on a Sub-Reddit somewhere, this is why I black out the addresses. And for the realtors working these areas, who still don’t like this post, who will claim, “So what if the address is blacked out, people can still do some digging and find out the addresses,” let me remind you that doing some digging is where the idea of “divulging sales data” becomes something different.

So without further adieu, let me introduce you to a changing market.

–

Failed Offer Night Leads To Plan B

Here’s an example of where the seller go what he or she wanted in the end, so you can call this a success.

But it shows a changing market nonetheless:

This property was listed on April 29th for $699,900 with an offer date.

The offer date failed.

They re-listed for $969,000 and sold for $900,000.

I’d call that a success.

I left the original purchase price from 2015 there just so you can see that, despite a “drop in prices” in Durham Region, appreciation has still been insane.

–

Same Thing, In Reverse

Here’s an example of the complete opposite of the above, but which was still a success.

The seller elected to list higher, at fair market value, rather than under-list with an offer date.

Who knows why the seller switched gears after only four days, but they re-listed $150,000 lower, with an offer date, received multiple offers, and sold for $765,000.

No, it’s not every penny of the original $799,900 asking price, but it’s still a sale in a changing market.

–

I Absolutely Hate That This Worked!

This is awful.

I can’t believe this actually worked:

They listed at $1,097,800, clearly looking for $1.2M+, and did this not once, but twice!

Then they took the veil off and re-listed for $1,237,800.

Likely getting zero showings, they abandoned this strategy after three days.

They re-listed lower, and even lower than their first listing, this time at $997,800.

They sold for 121% of the list price.

I hate that this worked!

–

If At First You Don’t Succeed, Try, Try Again!

Here’s another success story, although it shows you how somebody played the long game:

These sellers listed for $949,900 in March and were on the market for 26 days without selling.

Now here’s the rub: in Durham, it’s very common for sellers to list at a price that they will not accept, with no offer date, and leave the listing up. “False advertising,” in my opinion, but a topic for another day.

So did the sellers expect more than $949,900? I’m not sure. But I would be very surprised to hear that they didn’t, given they re-listed for $699,900 and sold for a whopping $999,000.

This is an odd one, folks!

–

If At First You Don’t Succeed, Try, Try Again V 2.0

Here’s another example, and in this one, you can clearly see that the sellers were listed at a price they never intended to sell for:

In fact, listed at $800,000, the MLS remarks read: “offers any time.”

They did not have an offer date, and yet, they had no intention of accepting $800,000.

They re-listed at $600,000, and to my utter dismay, they tricked the market and sold for $923,000.

–

You Were Right The First Time!

These guys sold for what they were first listed at, but not before trying Plan-A and Plan-B before Plan-C:

Listed at $1,099,888 in early April, they did not sell on offer night, and promptly listed $150,000 higher.

Two weeks on the market and they terminated and re-listed $75,000 lower.

Then they sold for $75,000 less.

Do the math, follow the bread crumbs, and they sold for their original list price which was their “artificially low to solicit multiple offers,” price.

–

Wrong Once, Wrong Twice…

Here’s a case like the above, except where they failed on Plan-A, Plan-B, and Plan-C:

They listed at $799,000 and were on the market for 27 days before raising the price, after a failed offer night, to $848,800.

That didn’t work.

Likely needing to sell the house asap, they re-listed for $729,900 and sold for $710,000.

–

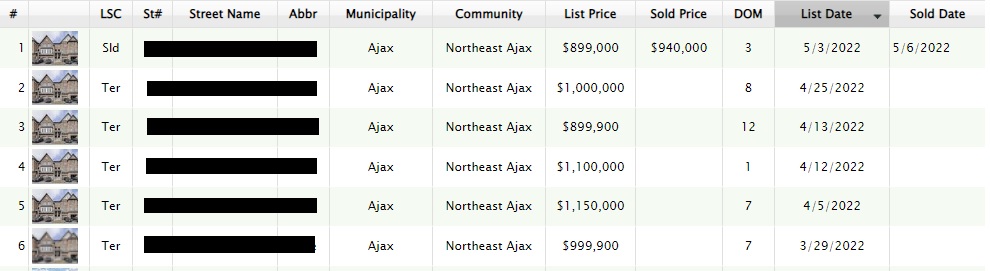

Wow, Did That Ever Backfire!

Surely, we’re going to see cases of people selling for less money than they had already been offered.

I suspect this might be a good example:

These guys listed in March for $999,900 with an offer date.

That didn’t work. So they re-listed for $1,150,000 with offers any time.

That didn’t work. So they re-listed for $1,100,000 with offers any time.

That didn’t work, although they only tried it for one day, so they re-listed for $899,900 with an offer date!

That didn’t work, so they raised the price again, this time to $1,000,000 even.

That didn’t work, so they tried $899,000 again, and this time, sold for $940,000.

That’s $60,000 less than their first “underlisted” price.

–

A 25% Haircut

These might be all starting to look the same to you, but trust me, they’re not!

Check this one out:

Similar pattern as the last few.

They tried “under-listing” at $1,099,000, which, ironically, they didn’t even get two months later!

They hit a peak list price of $1,299,000 in March and ended up selling for $980,000 in May. That’s 25% less than their highest list price.

–

A 26% Haircut

This is the property I showed you on Monday, having sold in the interim:

Their $1,279,000 list price was based on a previous sale, except, of course, it was HIGHER than that sale!

Greed, eh? It makes people do crazy things.

Listing at $699,900 after having been listed at $1,279,000 three weeks earlier just reeked of desperation.

Having sold for $950,000, you have to wonder: what was the most money they turned down in the previous month?

–

Worst Case Scenario: Breach

This is the worst case scenario for any seller:

Do you see what happened here?

These sellers listed for $799,900 in February, sold for a whopping $1,035,000, and were ready to move on with the rest of their lives.

The deal was scheduled to close on April 25th.

On April 29th, the property was re-listed by the same owners.

May we assume that there was a breach on closing day? I am not privy to the details, but that is the only explanation.

On May 9th, the property sold for $850,000. That’s 18% less than the property sold for in February.

The seller can now sue the original buyer for the $165,000 difference, plus the right to keep the deposit, plus costs of the action. If the sellers sees this through, likely 2-3 years, and likely $40,000 in costs, then the seller will win. No doubt about it, the seller will win. But does the seller want to go through this? Time will tell.

–

Worse(er) Case Scenario!

Same situation here as with the above:

This property sold in January for $1,650,000.

It was scheduled to close in March.

It did not close.

The original sellers, still the owners, re-sold for $1,330,000.

They will now have to start litigation to recapture their loss.

–

As I said at the onset, the goal here isn’t to pull selected “tough sales” from an area to prove a point about that entire area.

There are still houses in Durham Region selling for 132% of the list price. One house I know of received eighteen offers last week.

But there are also listings like the ones we saw above which we were not accustomed to seeing in the first quarter of 2022.

The market is changing.

And this is what a changing market looks like.

One day, a house sells for an absurd price. The next day, a house is reduced in price by a large amount. The day after that, a property is re-listed for 40% less, and now there’s an offer date.

As a buyer, it’s tough make sense of it all. This market will keep you on your toes.

As a seller, you simply have to acknowledge that the market has changed, and change with it. Failure to do so will be met with spectacular failure as we saw in many cases above…

Ryan

at 6:48 am

Great post. Curious to know the “types” of homes that are doing well in this market?

Are the “premium homes” (Custom closets, upgraded fixtures, etc) doing well, but the homes with wear and tear/cheap upgrades receiving little interest?

Feels like the well-maintained and good homes are still doing well, but the other side of the market is struggling

hoob

at 7:59 am

It’s ado, not adieu.

Then again, I think you might be the type of person to put it wrong just to see if anyone comments (micro-trolling!), and I’m the type of person who will comment just to point it out, so….

Mxyzptlk

at 5:42 pm

@hoob

Glad you pointed it out. It’s always kind of bothered me (pedant that I am).

Francesca

at 11:07 am

Today in the Toronto Star. Will be interesting to see how many people can’t close or refuse to in the next few months. David, maybe a future blog post? To me this looks a lot like deja vu from the spring 2017 market after the foreign tax introduction. The suburbs then got hit the hardest as it appears is happening now too with the one difference that in 2017 York region seemed to be the most effected while now all of the 905 is feeling the pain of a slower market. We left the suburbs in 2021 and after living there for 12 years I honestly don’t know how people are so eager to pay so much to live there especially now with gas prices increasing daily and people going back to work. We are so glad to be back in Toronto proper and will never look back.

https://www.thestar.com/business/real_estate/2022/05/11/bought-a-house-when-the-market-was-hot-and-now-regret-it-youre-not-alone.html

Average Joe

at 12:59 pm

I think as people start to rediscover the world outside their home and backyard, a lot of that enthusiasm will die out. Far from work, far from nightlife, far from nature. You have to really love your home and car because that’s where all your time is spent.

Geoff

at 8:50 pm

It’s amazing to me that these people in the article think forfeiting their downpayment is the extent of their financial obligation. I mean honestly, you can borrow a million dollars but you can’t understand basic legal obligations? Who are these people?

David

at 11:31 am

A quick question about the breach – does the seller get to keep the deposit & get the difference? Or is it just $160K + costs?

Geoff

at 9:27 am

my understanding is the ‘deposit’ is never really held by the seller, it’s held in trust for the seller. So if it doesn’t close, I don’t believe the ‘deposit’ gets moved over to the seller automatically, rather it’s part of the total amount that’s sued for. (so in a way, yes the seller will get the deposit and the difference, but they will have to fight for it). Not a lawyer.

Sirgruper

at 11:57 pm

Pretty bang on. Never too late to join.

Fudge

at 3:25 pm

As a seller with a property sitting for weeks in the 416(prestigious willowdale) any tips on how to change with the market ? Not sure really as you said some places are going for more some going for less..lower prices and expectations ?

Mxyzptlk

at 5:53 pm

No tips to offer other than to advise you to get a good agent (easy to say, harder to do). And not to look for tips online.

Rickthethick

at 11:22 pm

Lower the price. North York got too hot and will see a major correction IMO. It’s mostly downtown where there is extremely tight supply (south riverdale, annex, little italy) that is holding up well. Everywhere else is looking like a buyers market.

Libertarian

at 4:13 pm

It will be interesting to see if the examples that David “hates” end up closing. If this blog ever reaches those buyers, I wonder whether they’ll have buyer’s remorse. Did they bid so much because their buyer agent told them to? Did the buyer agent do any homework?

It’s entirely possible that these were legitimate, intensive bidding wars with numerous serious bidders, but the chances of that are low.

Mike Stevenson

at 2:39 pm

The change is just beginning, imo. People will be shocked by how much momentum and leverage works in both directions.