The real estate agents reading this blog might relate to the following story, so here goes…

The phone rings one day and there’s a voice on the other end of the line with an underlying tone or attitude that can be at opposite ends.

Sometimes, it’s sheepish and nervous.

Other times, it’s brimming with bravado and confidence.

Either way, I sigh when I hear the statement offered by the voice on the other end of the line:

“I’m looking to buy foreclosures at auction.”

Sure you are.

And why wouldn’t you be?

If only such a thing existed here in Toronto, especially in the way you want it to.

“I’d like to buy distressed properties at a substantial discount,” the voice offers.

This voice is always male. Just saying.

I’ve received this call so many times over the years, and maybe it’s because people randomly find me online, or maybe because I’ve written about this topic in the past. But the voice on the other end of the line always seems to know more than every other human on the planet when it comes to foreclosures, power-of-sales, and auctions.

Oh, auctions!

There’s this novel concept, invented in the heads of young men who know nothing about real estate, that somewhere in the city of Toronto, there’s a secret auction of homes, all selling for 20% of fair market value.

Whenever I receive one of these calls, I try to picture the person on the other end of the line. I assume they’re right out of university, or maybe they didn’t go to school and are just tired of whatever industry they fell into, and they’re trying to capture the essence of that pet-rock, those magic beans, or those 17th century tulip bulbs…

After a little bit of prodding, I usually receive an explanation like this:

“What I’m looking to do is find an ‘in’ with an auction, somewhere, and basically buy distressed properties, or foreclosures where the bank just wants to unload the asset, or, um, basically, just create like some value, maybe fixing the house a bit and re-selling it for a big premium, or something like that.”

But the best part is – many of these callers ask me, after the fact, “Do you happen to have anybody that would want to invest in something like this?”

Yeah.

It’s one thing to have a ridiculous idea.

It’s another thing to lack the money to do it…

Unfortunately, the Toronto real estate market is not an episode of “Storage Wars,” nor is it a place where you can purchase a home for $1 so long as you pay the back taxes.

I have never really understood where people get the idea that homes in Toronto routinely sell for pennies on the dollar, or that banks want to “unload” homes once they foreclose. I do understand that something mildly like this might occur in other places across the globe, but not in Toronto.

Sorry to those who randomly found this blog post while Googling “how to buy distressed Toronto homes at auction.”

Having said that, power-of-sale listings do appear on MLS.

Banks do foreclose on homes.

How often? What’s the market share? What are the prices like?

That is what I want to talk about today, as well as what a power of sale “looks” like, and how one gets to the point of foreclosure.

Last month, this article appeared in the Toronto Star:

“Power-Of-Sale Listings More Than Double As Mortgage Lenders Repossess Homes From Over-Leveraged Buyers”

The Toronto Star

October 7th, 2024

Alright, so the title is too long, but don’t let that deter you!

From the article:

The Toronto area has seen a 112 per cent increase in power of sales over the last year as more homeowners struggle to pay their mortgage, leaving some lenders with no option but to take over the home and sell it.

In September across the GTA, there were 204 power-of-sale listings, more than double the 96 power of sales reported in September 2023.

In 2020, the average number of power-of-sale listings per month was 4.5. In 2021, that number rose to 33, then 38 in 2022, jumping to 83 in 2023. So far, 2024 has seen the largest average monthly power of sale listings at 159.

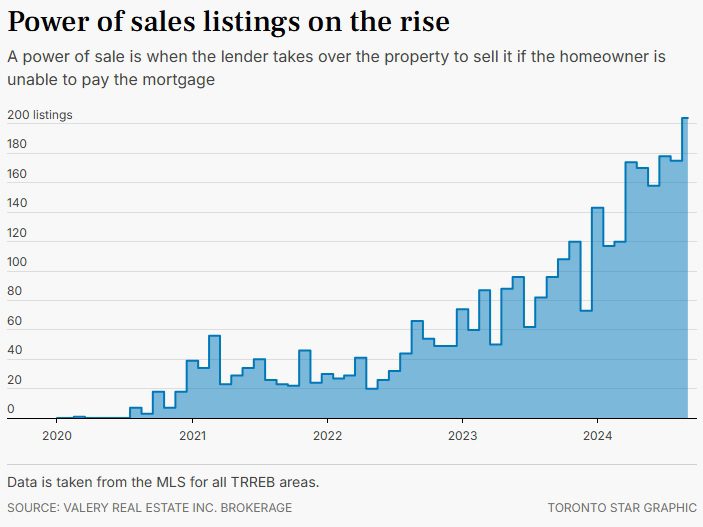

The article also offers us this chart:

Remember back in 2020 and 2021 when rock-bottom interest rates were being offered and the word on the street was that, come 2024 or 2025, the market would be flooded with properties because every Bob, Jane, and Suzy wouldn’t be able to afford their mortgage payments and would have to walk away from the house?

That didn’t happen.

The above chart shows that power-of-sale listings are up substantially, but this isn’t enough to move the needle in the overall real estate market.

It’s a few sad cases. A handful, if you will.

From the article:

There were more than 25,000 active listings in the GTA in September, according to the Toronto Regional Real Estate Board (TRREB), so 200 power-of-sale listings is a tiny percentage of the overall listings. And mortgages in arrears by three months or more are still below pre-pandemic levels.

This is true.

And because I am an exceptional nerd, I track this sort of thing.

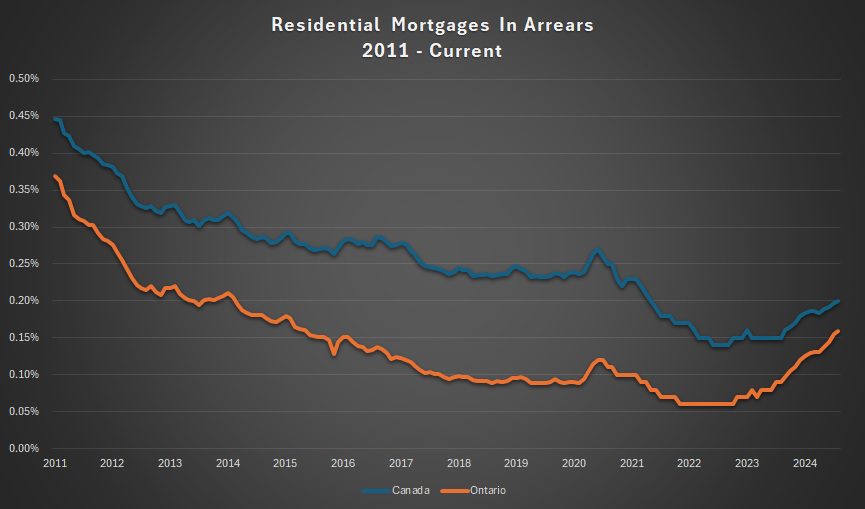

Here’s a look back at the residential mortgages in arrears from 2011 to the present:

Residential mortgages in arrears have increased in 2024, as expected.

But perhaps not nearly at the rate that some predicted?

This data is through August, and shows that of 2,195,894 mortgages in the province of Ontario, only 3,508 are in arrears.

In Canada, of 5,025,495 mortgages, only 10,064 are in arrears.

That’s 0.16% and 0.20% respectively.

So what does a power-of-sale look like in reality?

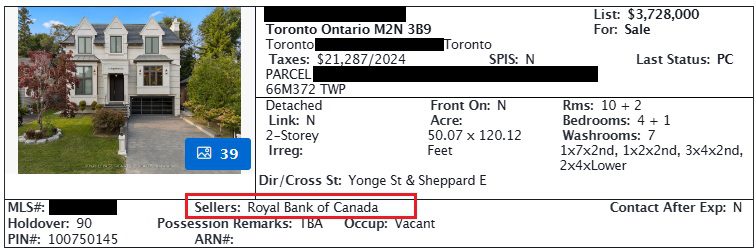

If I go to MLS right now and search all properties (freehold and condo) and all areas (TRREB), inserting the word “bank” in the field for SELLER NAME, I get exactly 119 results.

Let’s pick one at random and explore it.

This one:

How did we get to the point of foreclosure here?

Was this the case of a buyer who went from a variable rate of 1.79% to a variable rate of 6.99% and couldn’t afford the monthly payments?

Was this the result of somebody owning nine Lamborghini’s?

Unlikely.

If you look at the listing history, here’s what the property looked like when it was purchased:

Ah, I see, I see, said the blind man.

So this was what you call “an adventure in the nature of trade.”

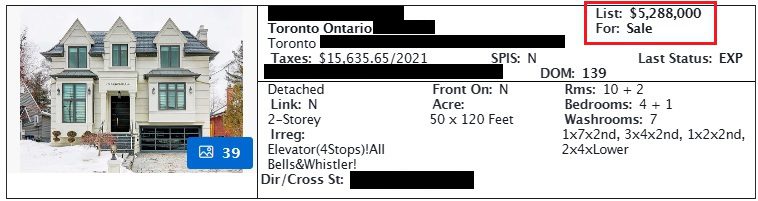

The property was first listed for sale for $5,288,000 in February of 2022:

If you recall, February of 2022 was, statistically speaking, the “peak” of the market as we know it.

If there had ever been a time to sell this house for top dollar, it would have been February of 2022.

The property was listed for sale for 139 days at $5,288,000 and the listing expired in June of 2022.

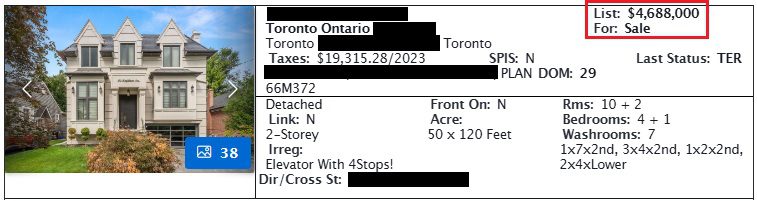

In September of 2023, the property was re-listed for $4,999,000, but then reduced very quickly to $4,688,000:

The price change from $4,999,000 to $4,688,000 took place after only 15 days on the market.

During the first listing, which lasted 139 days, the price wasn’t touched at all.

This time around, the price was dropped by $311,000 after a little more than two weeks.

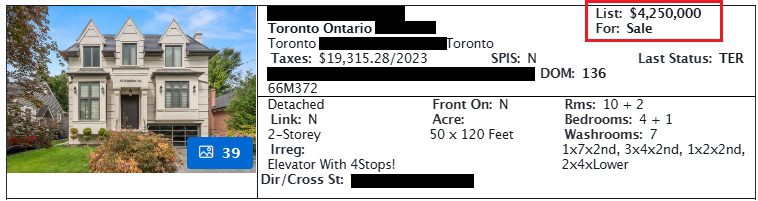

Incredibly, the next listing took place at only $3,998,800 – but with an offer date!

That failed, and then the price was increased to $4,250,000:

The property sat on the market for 136 days in total.

By now, we were into November of 2023.

The property had now been listed for on MLS for 304 days, but including the time that it had not technically been “listed” on MLS, it had now been twenty-one months since the first listing in February of 2022.

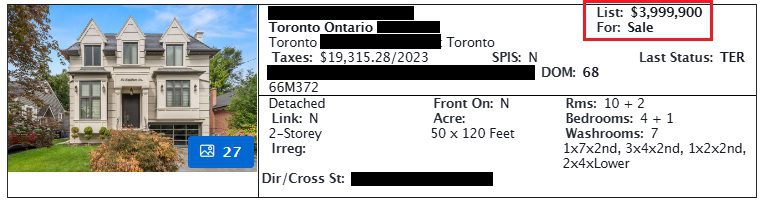

In February of 2024, the property came back out once again:

Once again, an “offer date” was set, but that clearly didn’t work.

The price was increased to $4,250,000 again, then decreased back to $3,999,900 before the listing was terminated.

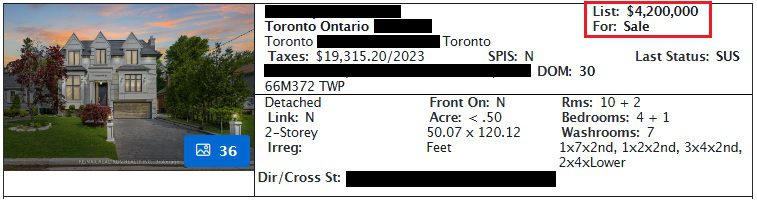

In May of 2024, the property was listed one final time by the owner of the home:

It didn’t sell at $3,999,900, so why not try $4,200,000?

Sure.

Desperate times call for desperate measures, and this was literally the last gasp.

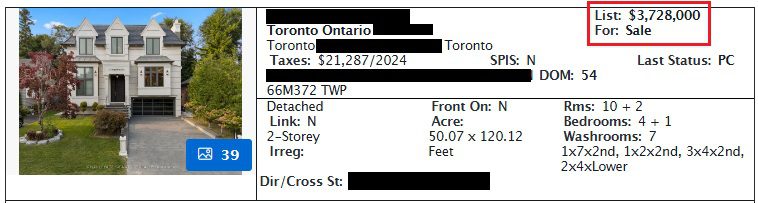

In September of 2024, Royal Bank of Canada listed the property for sale for $3,950,000.

The price has since been reduced to $3,728,000:

Call this sad. Call this unfortunate. Call this what you will.

But this is an example of a home that was foreclosed on by the lender and which is now being sold under “power of sale.”

The topic of conversation today isn’t to analyze how or where the seller went wrong, or offer 20/20 hindsight on how/when the seller should have pulled the trigger in 2022, 2023, or 2024, even though we could probably do so.

The theme today is looking at power-of-sales and how they came to be listed on MLS, or why.

And for the record, not every power-of-sale is some rural property with a seller who took out three mortgages, or a builder who went bust.

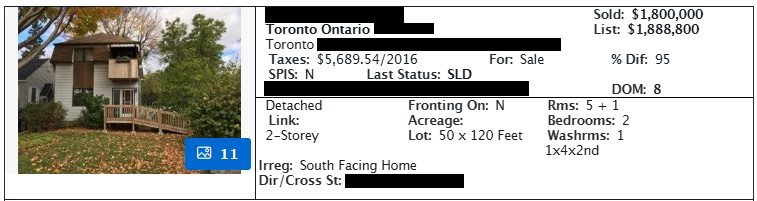

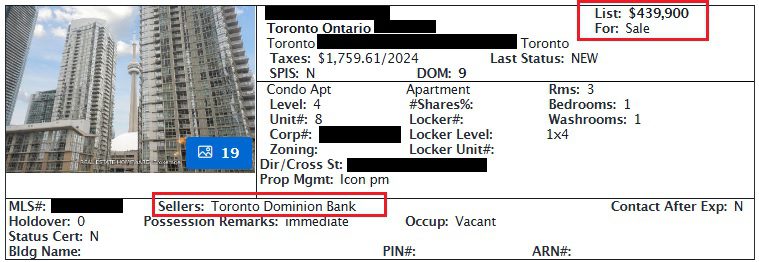

Check this out:

This property was listed 9 days ago for $439,900.

Before that, the property had been listed for $474,900 for 90 days.

But unlike the previous example, those 90 days at $474,900 didn’t represent the owner trying to sell before he or she was foreclosed on.

In fact, that was merely the first listing by the Toronto Dominion Bank.

This property was never listed by the owner.

The owner bought the property in 2018 and that was the last appearance for this property on MLS.

The next time we would see this property on MLS was after the foreclosure and once the Toronto Dominion Bank had control.

See, not every power-of-sale has a long trail of the seller panicking and frantically listing, over and over, trying to get out before the bank takes over.

Many of these power-of-sale listings represent the first attempt at selling.

You might ask, “How could a property owner let this happen?”

Or, “Why would a property owner wait until the bank came knocking on their door – why wouldn’t they try to sell first?”

I suppose you’d have to ask every one of these sellers. But in my experience, the property owners just keep telling themselves, “I’m never going to be forced to leave.”

I have only one experience with a power-of-sale, and I told this one on my blog many years ago, but it’s prudent now.

I was referred to a private lender who was about to invoke a power of sale.

He told me to meet him at the house one morning so I could do a walkthrough, take some measurements and photos, and get the property listed for sale ASAP.

But what he didn’t tell me made all the difference.

He didn’t tell me that today was the day that the occupants were being physically removed by the sheriff.

I showed up and found a dumpster on the front lawn and a woman screaming on the front porch.

“You can’t take my house,” she kept saying. “This isn’t right.”

I was absolutely shaken!

But the private lender turned to me and said, “Don’t let her fool you. We’ve been telling her this day was coming for six months; every single day. Every day. She had her chance, and she continued to taunt us, saying ‘You’ll never go through with it.'”

The sheriff stood there and said, “If you want anything from inside the house, it will be placed outside the home and on the lawn today, feel free to take what you’d like.”

Inside, the house was completely untouched.

Not a single thing had been moved or packed.

There was food in a pan on the stove.

Breakfast.

This lady had cooked breakfast on the morning of the day she was being evicted.

There were multiple eviction notices stapled to the front door. She knew this was coming.

But what I was so shaken by was why she did nothing about it. Why didn’t she plan ahead?

Feel free to speculate all you want.

She was financially illiterate.

She didn’t understand the laws.

She received poor advice.

Who knows, but as bad as I felt for her and the child that apparently lived there (but who wasn’t on site), I was more mad at her than anything. Yes, I felt for her, but why didn’t she do anything? Why didn’t she prepare for this?

“She probably never thought she’d be physically removed from her house,” a colleague told me later at the office, after I came back, horrified, and shared what I had seen.

But does that excuse her?

Can ignorance be used as an excuse?

In any event, this is my one experience with a power of sale and it provides a real life answer to the question I receive most:

“Why do so many people get caught off guard during a forclosure, and why don’t people attempt to mitigate beforehand?”

Every time a property is listed as a power-of-sale, the first move for most agents, buyers, or interested parties is to see if the property was listed before.

In cases where the property has not been listed, we all wonder why not?

Then again, not everybody gets a chance to “escape” before the bank forecloses.

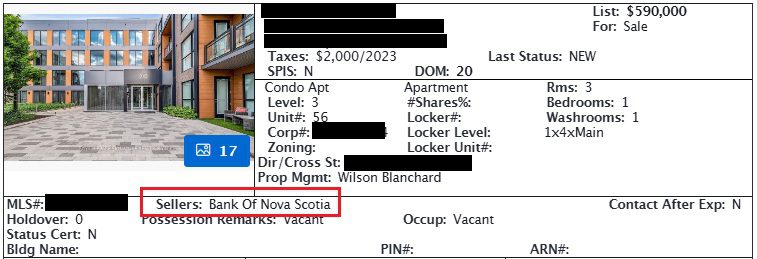

Check out this listing:

This is the first and only listing for this property.

For sale, that is.

But if you run the listing history, you can see that this has been used as an investment property for the last eight years:

In this case, it feels like a situation where the owner couldn’t afford to keep the unit – rented for $2,100 per month, against the monthly payments that he or she was making to the bank.

This isn’t to say that the owner couldn’t have listed the unit for sale with the tenant attached, but maybe the tenant was a nightmare, or maybe the owner had other financial issues.

While looking at those 119 properties listed on MLS that have the word “bank” in the name of the seller, the interesting thing to me was that the listings were right across the board.

There were 81 houses and 38 condos.

There was a low-end of $349,900 and a high-end of $3,728,000.

And just from the first handful of properties I’m looking at, the geographic locations are:

Niagara Falls

Hamilton

Midland

Brantford

Welland

Cambridge

Innisfil

Toronto

Collingwood

St. Catharines

Barrie

Oshawa

Ajax

Southgate

Georgina

Whitby

Markham

Vaughan

And on, and on.

No location is immune.

No price range or owner profile is excused.

No property type is more or less likely to have an owner that cannot keep up with payments to the bank, and thus every listing you see has an equal chance of being different from the next…

Appraiser

at 8:57 am

Great piece. Yes who can forget the “bargoon” hunters looking for that steal of a deal.

In the early 1990’s I sold 14 power of sale properties for now defunct trust company. It was a recession so the number of POS properties on the market was considerably higher than today, but still only a small fraction of the torrent of MLS listings available at the time.

Many of the listings I dealt with were in poor condition and eventually sold for lower prices than otherwise comparable sales. In other words fair market value.

I can see how lower prices may erroneously leave the impression with some buyers that POS properties are a steal. That is almost always a mirage. The lender is legally obligated to obtain fair market value.

My experience was that owners often clung to the house for as long as possible for various reasons but eventually vacated the property well before being turfed. I did have to accompany the sheriff once.

As I recall, most of the sellers had no equity left in the property so they did not bother to list the property themselves.

Jenn

at 1:28 pm

Okay I can’t stop laughing that these power of sales are referred to as a “POS” because maybe that’s what most of them are???

Ed

at 9:40 am

What stood out to me in that first power of sale was the increase in taxes after the the house was renovated.

2021- $15,635

2023- $19,315

2024- $21,287

From 2021 to 2024 the taxes increased by 36.15%

Marina

at 5:00 pm

Things are not that bad until banks start to aggressively sell properties. Right now they are still trying to get a decent price. I worked in foreclosures back in 2008 and then you really could get bargains (with commensurate risk since people are very creative when mad). And banks were doing all kinds of stuff to get properties to move. Until a bank actually pays someone to please not trash the property on their way out, I’m not taking notice.

Mike

at 8:54 am

You should have clarified that Canadian banks, with the exception in Manitoba, do not do foreclosures, it is always power of sale, and that’s where the, “I want a deal on a house the bank’s unloading” comes from. Foreclosures allow banks to seek what’s owed, power of sale requires the home to be sold at fair market value. Foreclosures, the bank’s own the home, power of sale, the only have writ possession, which grants them the ability to sell.

Appraiser

at 9:54 am

Foreclosures are legal in Ontario but they take longer and are supervised through the courts. POS is much faster and cheaper for the lender.

It should be mentioned that with a power of sale the lender must forward any excess monies from the sale of the property to the original homeowner. However, this is almost never the case as lenders often take a loss on the sale.

Under power of sale homeowners also have the “right to redeem” the mortgage by paying the arrears plus interest and expenses at any time before the sale closes. This also almost never happens.

Genxestate

at 1:19 am

“I’ve been looking for information on this topic, and this post is exactly what I needed. Thank you for taking the time to write this.”

thank you