Do you want to accompany me on a walk down memory lane?

Not so much in terms of my memories and experiences, but rather conversations and explanations that we had many, many years ago about the utterly ridiculous system of “occupancy” that occurs in the pre-construction world.

Many of you understand and many of you have no clue what I’m talking about. Then there are those that think they know, but regardless, I think a very thorough refresher is in order…

Condominiums in Toronto are sold before a shovel is ever put in the ground. In fact, and while this might surprise some, many condos are sold before the necessary approvals are even in place.

But whenever and however these “units” are sold, it’s what occurs when an individual unit is completed that will fascinate many, and frustrate others.

Consider that when you purchase a pre-construciton condominium, you don’t “own” the unit until well after your unit is finished, and well after the entire building is finished.

After all, a condominium is a “corporation,” and that corporation needs to be formed. That corporation can only be formed when all the units are completed and the regulatory authorities have signed off.

Until that happens, the developer is the one that “owns” the unit, even if you – the buyer, are living in it.

Do you follow?

Let’s say that there’s a 66-storey building in Toronto and all the units have been pre-sold.

Now, let’s say that your unit – #608, on the 6th floor, is complete.

The developer can and usually will notify you and your lawyer that you are to take “occupancy.”

You simply do as you’re told at this time as the pre-construction purchase agreements are iron-clad. There’s no delaying occupancy, no renegotiating occupancy, and no fighting or arguing.

More importantly, and more unfortunately, while your unit on the 6th floor might be “finished” and ready for occupancy, there’s no guarantee that units on the 7th floor are still being built. There’s also no guarantee that the hallways aren’t a construction zone, or that the main floor lobby to the building doesn’t resemble a materials storage depot. And if you’re looking forward to using the amenities that were promised in the marketing, you’ll be waiting years.

So what does this mean for the buyer?

Financially, it means that the buyer is now the legal “occupant” of the unit, or to the developer, that occupancy has been “delivered.”

This is when the buyer begins to pay an occupancy fee, which some people refer to as a “phantom mortgage,” to the developer.

Again, it’s important to note that the buyer/occupant does not own the condo.

The buyer/occupant cannot mortgage the condo since the buyer/occupant doesn’t own the condo.

The buyer/occupant will continue to pay the “occupancy fee” until all the units in the building are completed, delivered to the buyers for occupancy, and until the building is officially registered as a condominium corporation in the Province of Ontario.

After registration, usually within thirty days, a “turnover meeting” occurs where the developer literally turns over ownership to the newly-formed condominium corporation.

Many pre-construction buyers have no idea how this works, and many are caught off guard. Since I began writing about the perils of pre-construction condominiums on TRB in 2007, I have been arguing that this process is absolutely ludicrous and there’s no reason why any end-user of a condo should want to endure the time spent in “occupancy.”

This occupancy period is indeterminate. I’ve seen buildings take over twenty-four months to be registered and I’ve seen buildings provide occupancy at the time of registration – but the latter is extremely rare.

For the most part, if you’re a pre-construction buyer, you can assume that you will be in “occupancy” of your unit, and paying a monthly occupancy fee, for eight to twelve months.

What does the occupancy fee look like?

Well, assuming you have a 20% deposit with the builder, you’re essentially paying interest on the remaining amount. You’re also paying the equivalent of monthly maintenance fees and property taxes.

So let’s say that you’ve just been given occupancy of the pre-construction condominium that you purchased in 2019 for $600,000.

Assuming that the developer is holding a 20% deposit, you’re looking at somewhere around $2,150 per month in interest on the balance.

Your condo fees are probably around $450/month.

And your estimated property taxes are likely around $300/month.

All told, you would likely be paying an “occupancy fee” of $2,900 per month.

But what if you’re not moving into this condo yourself?

What if you purchased this condo as a long-term investment?

What if you purchased this condo with the intention of flipping it upon completion?

What if you planned to move into this condo, but now own a house with your partner?

Or what if you thought you’d move into this unit, but took a job in New York City, and now have no plans to occupy it?

In all of these cases, it would be very, very costly to absorb that $2,900/month occupancy fee for a year.

That’s $34,800.

That’s no joke.

So you have this bright idea: you’re going to rent out the unit as soon as occupancy is given!

Yes, you and a million other people…

That brings us to the crux of the matter today, because you can imagine what happens when “occupancy” occurs in one of these new condominiums.

Rental units flood the market.

So if you happen to “occupy” a 1-bed, 1-bath condo and are paying $2,900/month occupancy fee, and you want to rent your unit out.

How much competition should you expect?

Let’s look at an example, shall we?

“Time & Space Condo” is located at 158 Front Street East, and as an aside, I simply cannot believe how time flies because I remember living down in the St. Lawrence Market area and shopping at Sobey’s on Front Street, looking at the empty parking lot where the condo would eventually stand, and marvelling at the ridiculous pre-construction prices.

In any event, the first listing for lease at 158 Front Street East appeared on MLS in June of 2022.

There were five listings that month, in a building with 482 total units.

But then things really started to heat up…

Keep in mind, that most buildings provide a staggered occupancy.

Occupancy for Unit #2301 is likely months after occupancy for Unit #501, as occupancy is often given when the unit is complete, not the building.

But imagine receiving occupancy of your unit in December of 2022 and listing it for lease up among forty lease listings that month alone? And how many of the twenty-three listed for lease in November carried over?

If you occupy unit #701 and are asking $2,400 per month for rent on MLS, what happens when Unit #702, 703, 704, 705, 706, 707, and 708 are all listed for lease on the same day?

In theory, prices would be affected, no? Unless the market can absorb all of these units in a quick fashion, then eventually, owners will reduce the price.

Reducing the price by $100/month will cost the owner $1,200 per year, but losing a month’s rent costs $2,300 or $2,400.

By this logic, reductions should be immediate.

But what happens when more and more units are listed?

What is the worst-case scenario here?

There’s a common school of thought among real estate enthusiasts that “most pre-construction condos are bought by investors.”

Define “investors,” first of all, since there’s an investment component in the decision to purchase pre-construction instead of resale, if you’re an end user. But I suppose what many people think is that most pre-construction condos are purchased by people who have no intention of residing in the unit at any point, whether they intend to keep the unit-long term, sell it after the condominium corporation is registered, etc.

When we look at Time & Space condo, we see that more than 10% of units in the entire building were listed for lease within the first three months of occupancy, and those likely represent investor-owned units.

But again, I go back to the “worst-case” scenario with units flooding the market and I wonder if this could intersect with the thinking, “most pre-construction condos are bought by investors.”

One condominium comes to mind, just off the top of my head.

Don’t get me wrong, there are a lot of buildings in the downtown core where units have “flooded” the market in recent years, but based on where I used to live and where I find myself transacting, my mind is telling me to look at a condominium on the southeast corner of Jarvis & Dundas.

Perhaps this is because, many years ago, before children, I used to golf on Sunday mornings and I would always stop at the Tim Horton’s that formerly stood where the condo now is to secure my XL coffee and whatever sad excuse for food I chose to ingest that day.

But it’s also because I was offered business in this building at one time and turned it down, simply saying, “I can’t help you,” and that memory stands out in my mind to this day.

The building is 181 Dundas Street East, also known as “Grid Condos.”

This is a 51-storey, 564-unit building, completed in 2019.

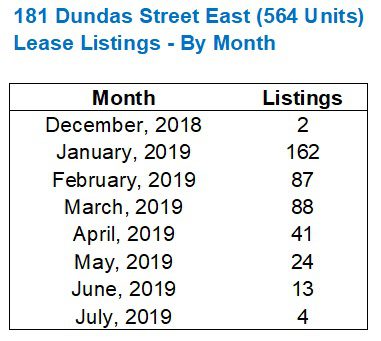

It was December of 2018 when the first unit in this building appeared for lease on MLS.

There were two lease listings offered in December of 2018

Two.

In your absolute wildest estimation, how many units do you think were listed for lease the following month?

Assuming that “occupancy” was provided to the buyers of pre-construction units in the building in December or January, how many lease listings came after the mere two from December?

Ten?

Twenty?

Thirty?

More?

In a building with 564 units, where occupancy dates are likely staggered across several weeks or months, how many lease listings could we possibly see?

One hundred and sixty two.

No joke. No type. That’s why I typed it out.

In fact, from January of 2019 through March of 2019, there were a whopping 337 lease listings posted on MLS.

Take a look:

This is incredible.

The stats, that is. The stats are incredible, but as for the rest, it’s anything but good.

From a supply-and-demand standpoint, what does it say when there are 162 lease listings in a single month, in a building with 564 units where many of those units are still under construction?

It says that prices should plummet, in theory.

But it also speaks to the idea that “most pre-construction condos are bought by investors.”

This clearly demonstrates that these units were not owner-occupied, hence why they were put up for lease!

Imagine listing your 1-bedroom condo at 181 Dundas Street East for lease on January 14th, 2019.

There were thirteen other 1-bedroom condos listed for lease that very same day.

There were one hundred and one 1-bedroom condos listed for lease in the building that month.

What in the world does this to do prices?

Let’s look at the 1-bedroom-plus-den units as an example.

On January 5th, 2019, the first two such units were listed for $2,400 and $2,200 respectively.

The first 1-plus-den units to be leased were on January 9th, 2019. Four of them, in fact, with lease prices as follows:

$1,900

$2,050

$2,050

$1,900

Of course, these could be different model units, different layouts, and of different sizes, but the sample size is large enough to work with, and there were eighty listings in January of 2019 for 1-plus-den units overall.

On the last day of the month, January 31st, 2019, three 1-plus-den units were leased for the following prices:

$1,800

$1,850

$1,850

Follow the data here.

Prices declined as the month wore on and a deluge of units hit the market.

As they should, right?

This underscores and demonstrates the most basic fundamentals of supply and demand, and while there is some “stickiness” in the resale market from time to time, it doesn’t seem to happen in the rental market when a massive glut of condos hits the market at the same time.

I don’t know that I’ve ever seen anything like 162 units coming up for lease in a 564 unit building in the very same month. If you’re an agent reading this, and you have a more recent example, please let me know!

On a related topic, many of you might be thinking, “Who would want to live in this building in January of 2019?”

Fair question.

The building is primarily comprised of 1-bedroom units, it seems as though most are investor-owned, and it looked like – in January of 2019, that the entire building was going to be renters.

Not only that, you have ongoing construction and maintenance, incomplete common areas, and I can’t imagine what the moving elevators are like, not to mention whether the concierge is up to speed yet, if he or she is even present.

However, I recorded a podcast this week (released on Friday) with my team member, Tara Amina, who does a lot of work in the rental space, and this was one of the topics we explored.

Her thoughts:

“There’s something to be said for a unit that is brand-new. Maybe it sounds silly to some people, but imagine being the first person to take a bath in that bathtub – the one that’s mint condition, never used, and with no visual as you sit there taking a soak after a long day of work, wondering who else has been in that tub?

You know that blue, plastic film that’s on top of the stainless-steel appliances? Peeling that off is, first of all, very satisfying! But it’s also sort of like unwrapping a present on Christmas, just as an adult, and when you know what’s inside.

Nobody has ever cooked in the oven or put their food in the fridge. Nobody has warmed up their leftovers in the microwave before.”

She smiled the whole time she told me this because she was waiting for me to say, “That’s ridiculous.”

But she even told me that as somebody as obsessive-compulsive as I am, and as somebody who keeps a very clean house, that I should understand.

She added:

“There’s not a lot going for young people in the Toronto real estate market, okay, so let them have their win – when they move into a brand-new, never-lived-in space that is truly their own.”

Then almost as an afterthought, she said:

“Plus, the prices are lower. That goes without saying. Nobody really cares about the amenities not being finished or a hallway not having wallpaper. These young people care that they rented a unit for $2,200/month that should be $2,450/month, if not for the fact that there are forty competing units up for lease.”

That further proves the point of today’s blog.

Maybe next time I can save the hour spent downloading data from MLS and just ask Tara?

Have a great weekend, everybody!

Sirgruper

at 9:21 am

David

Often the builder’s agreement says that you can’t list or lease during occupancy or only with their designated broker. Also your interest on the unpaid balance is based on boc 1 year mortgage rate and therefore above market.

Also, I have never understood why builders (with some notable exceptions like Tridel) treat their buyers like dirt through the occupancy and closing process. Strange way to sell.

Makes you wonder why so many people are buying pre construction….. oh right, they’re not……….for now

David Fleming

at 9:56 am

@ Sigruper

Very good points all around, but let me elaborate on your first point.

“You can’t list or lease during occupancy.”

This was very true back in the day and it absolutely killed the return on investment for people who didn’t want to live in the unit, kept it empty, and then had to watch $2,000 fly out the window every month until registration. Will registration take three months? Six months? A year? Two years? Every month that passes by, that unit sits empty, and investors get killed.

Somewhere along the line, developers started to allow “family or friends” to occupy the unit. My first tenant pretended to be my sister. True story.

Years later, developers started to SELL the “right to lease” in pre-construction contracts. You might pay $10,000 extra when you sign your purchase agreement to be allowed to lease the unit during occupancy.

Some time later, developers would advertise “right to lease – no cost!” as a perk. Oh, gee, thanks. Let me lease out MY condo? Seriously, thank you!

And today, the right to lease is pretty much standard.

“You can only list to lease with our designated representative.”

Great point!

I have a client who used to flip pre-construction units. He would buy through the sales centre in pre-con, then list with me years later to sell as a resale. But there were a couple of instances where he was told to terminate his lease listing with me – and he was forced to list with an agent who worked for the developer.

But here’s the kicker: the developer and the lease agent were price-fixing. He wasn’t allowed to list the unit for $1,800 or $1,850, but rather he was forced to list his unit for $2,000 per month with about seven or eight other units that were all sitting on the market.

I wrote a blog about it here:

https://torontorealtyblog.com/blog/price-fixing-in-the-toronto-rental-market/

Ace Goodheart

at 10:31 am

And to add to all the other stuff now pushing down prices in general, this guy is back:

https://financialpost.com/personal-finance/taxes/tax-home-equity-latest-liberal-housing-bogeyman

If there is one person who I disagree with completely, on every level, on every point and every argument, it would be this person.

Apparently he is a University Prof out in BC (with an indexed pension paid for by other people’s taxes).

His thesis is simple: every person who currently owns a house, must have purchased that house back in the 1980s, when houses were affordable, because it is simply not possible for anyone to purchase a house now (or apparently for the last 40 years or so).

The people who this person targets are called “boomers” (this term loosely relates people born between the end of WW2 and 1965, who are apparently the most evil and reviled people ever – and the only people in Canada who own houses).

He proposes a “modest” yearly “housing fairness” tax, to be levied on any person who owns a house with an assessed value of $1 million dollars or more.

A person owning a million dollar house would pay a “modest” amount of about $4000.00 per year. For a person owing a $2 million dollar house, the “modest” amount would rise to about $20,000.00 per year.

This “fairness” tax would only be payable, with interest, when the house is sold. So when the person sells their $2 million dollar house, after 20 years of ownership (the tax would be retroactive to the purchase date of the house), they would owe $20,000 x 20 x compound interest.

As I said, the idea is, the only people who own houses in Canada right now are “boomers” and they all bought their houses in the 1980s. Since 1980, no one has purchased a Canadian house.

Anyone who recently bought a house in Canada, didn’t really buy it at all because that doesn’t work with his thesis. If you bought your 1.5 million dollar house in Toronto last year with 20% down and a $1,200,000.00 mortgage, you would still owe about $10K per year in “housing fairness” tax (but you don’t have to pay until you sell your house).

If you read his website, it is basically communism 101. The idea is that eventually a large government department would own all Canadian houses, and they would be allocated based on some sort of woke principles rather than based on market price sales. I am assuming he intends to lead this large socialist housing department (likely with an equally large salary and pension plan).

Bottom line is, this guy wants your family home. He intends to tax it out from under you. He has decided you are a “boomer” (whether you actually are or not), that you bought your house in the 1980s (when you were in diapers or not even born yet) and that you have benefited from house price appreciation “while you slept or sat watching TV”.

Trudeau and Freeland seem to support this guy, so in the unlikely chance that Trudeau wins a majority government next year, you can expect this tax to get applied to your family home. We then all watch as our equity is slowly drained and our house gets socialized and made into a government welfare project.

Did I mention I really, really, really disagree with this person?

David Fleming

at 10:36 am

@ Ace Goodheart

You’re stealing my thunder, bro!

This is Monday’s blog post!! 🙂

Ace Goodheart

at 10:38 am

I strongly, strongly dislike this person’s ideas. I see we are on the same page with this. The fact that Trudeau and Freeland just met this guy and seem to support him is very concerning.

Looking forward to Monday!

Moonbeam!

at 12:40 pm

Also Trudeau thinks it’s ‘unfair’ for a senior to live alone in a house – “too much space”. That would be me… and I paid for my house and I LOVE my empty nest.

Ace Goodheart

at 12:58 pm

They are targeting homeowners to score cheap political points with the 20 somethings.

And the most aggravating thing about it is, they are lying to them. This “housing fairness tax” won’t result in any money at all going to 20 somethings who want to buy houses. The government just absorbs the extra tax revenue, and if you know tax and spend liberals, they will find a way to blow it all with very little, if any of that money ever getting back to anyone who is not connected to or working for the government.

The result will also be less houses being sold as who is going to sell their house when all of your equity goes to “housing fairness tax”. By selling your house you are depleting your entire net worth and you will never own another house. People will just stay put.

And any 20 or 30 something who already owns a house, gets hit with a tax meant for “boomers” because again, they are being lied to. This tax isn’t a tax on old folks, it is a tax on the home equity of anyone who owns a house.

They are literally lying to young people. And trying to, for lack of a better word, “steal” houses from people who spent their entire lives paying for them and keeping them up and who are now retired and living in their family homes.

Crofty

at 6:32 am

Fortunately, 20-somethings are the least likely age group to actually show up on election day, and I see no reason for that to change anytime soon, particularly since polling consistently shows that the Liberals will get hammered in the next election, which will almost certainly dampen “voter enthusiasm,” such as it is.

DR

at 8:01 pm

I also disagree with the notion of taxing home equity. Since you rail against this as “communism” do you also acknowledge that the housing market in Canada is not in fact based on free market principles?

First you have CMHC, a government run entity that allows people to get mortgages who wouldn’t normally qualify, and gives banks incentives to loan to those people. Then you have central banks artificially lowering interest rates to raise house prices. The government then also pressures banks to allow extended amortizations and other means to give home owners an easy time.

If you rail against the “communism” of taxing people’s home equity, as you should, I hope that you also fight against the other forms of “communism” that exist in our system. Similarly, if house values start to crash I hope you will speak out and ensure the government doesn’t intervene and instead let the free market do its job to clean out the malinvestment. The free market hasn’t been able to do its job for a long time now.

Ace Goodheart

at 6:28 pm

You are correct. I used to say that the only way to stop run away house price appreciation in Canada was to reign in the borrowing.

For example, say you go to your bank and tell them you want to buy 1.5 million dollars of a particular stock. You only actually have 5% of that, but not to worry, the government will insure the loan using other people’s tax money. The bank proposes a five year payment plan at the end of which, the 1.5 million dollars will be completely repaid.

You balk at the payment terms. You can’t afford the monthly amounts.

So you tell your bank, just pretend the repayment period is actually 30 years, even though it is not. Then in five years, I’ll just refinance the whole thing and pretend the repayment period is actually 30 years.

Your bank says “sure”. As the loan is crazy and not at all credit worthy, they propose a 12% interest rate.

But wait, you say. I should be getting below prime. You want 4.5%.

Sure, says the bank. So out you go with your 1.5 million dollar loan, with a fake 5 year amortization period, fully insured by the tax payers, with 5% down, and you buy the stock of your choice.

Then, rates go up. So the government agrees to allow your bank to capitalize the interest, so your payment stays the same. All risk for the loan continues to be taken by tax payers.

Sound nuts?

That is how houses are purchased in Ontario.

Want to end the housing crisis real quick? Require people to actually pay back their mortgages, in full, within five years.

Don’t insure houses with tax payer money.

Don’t play games with amortization.

House Keys

at 10:45 am

If you get bored, it would be really, really interesting to see the data over a longer period of time ([3] years?) to see how sale and rental prices reach a market equilibrium following construction completion at a new development. Said differently, if I was to buy a pre-construction condo, how long does it take the market to absorb the supply, and how long do I need to hold it after construction completion to sell at “market” levels? If we look across a few buildings, do some hit this faster and some slower? Other than building size (more units likely take longer to absorb), are there any conclusions we can draw based on pricing vs. market pre-devleopment, builder/perceived quality, amenities, investor interest, location, etc. etc. that influence absorption, and are indications of higher returns for investors?

Dee O

at 9:26 am

Not the mention the fact that many people bought these condos to operate legal airbnb’s out of, but now (recently) the city bylaws have changed and Toronto does not allow airbnbs unless owners “live” in the unit. Not necessarily a bad thing for the city but it very suddenly changes the game for these investors. Buyer Beware I guess.

Geoff

at 9:46 pm

Phrasing.