I was in a bit of a silly mood yesterday and I proposed something to my team:

I wanted to change occupations.

No, I wasn’t actually suggesting that I leave the real estate industry, since I signed a lifetime contract with the Devil many years ago, but rather I was kidding around about the concept of a new role for somebody at the Toronto Regional Real Estate Board having to do with a new metric…

“Quality Listings.”

It’s a statistic that doesn’t exist and yet I feel as though it should.

Every month, TRREB provides us with a statistic for “New Listings,” which is simply the number of properties listed for sale that month, regardless of whether this is the first or the tenth listing, as well as “Active Listings” which is a count of the number of properties listed for sale at the end of the month.

Those metrics are static and never change.

But maybe, just maybe, there’s an overall quality of new listings that can ebb and flow?

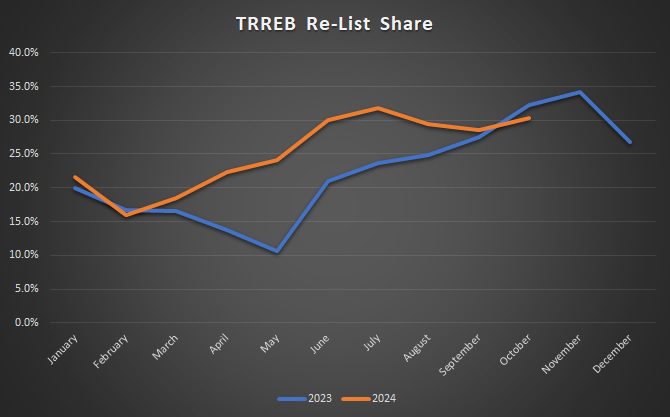

Consider that TRREB offers a new statistic called the “Re-List Share.”

As I have written about previously, I was like a kid on Christmas when this statistic made its debut, since it provided me with yet another data point to analyze.

If a property is listed for sale in September for $799,900 and there’s an “offer date,” but the offer date doesn’t produce the desired result for the seller, and the listing is terminated, with the property re-listed for $1,049,000 the next day, then this counts as two “New Listings” for stats purposes.

What if there’s a market where far more properties are being terminated and re-listed than in a previous market cycle? Wouldn’t it be nice to have statistics on this?

Well, that’s what the TRREB “Re-List Share” is for!

And since this data is usually provided a few days after the overall TRREB stats for the previous month, it means we haven’t seen an update on this lately.

Here’s an updated chart:

The percentage of re-listed properties increased from 28.6% in September to 30.3% in October.

This is a substantial amount of the overall listing pool!

Notable, however, is that this 30.3% figure is lower than the 32.3% recorded in October of 2023.

But that tracks, right?

Last fall was really, really bad. I’m not surprised to fewer properties being re-listed this fall than last.

In any event, we have a statistic for re-listings, which is a game-changer as far as data analysis is concerned.

An increase in the re-list share, whether month-over-month or year-over-year, would help to draw conclusions about current market conditions. This statistic has been tremendously helpful to me in my research since it was introduced by TRREB.

Now, what about the concept of “Quality Listings?”

That’s where I was being somewhat silly with my team yesterday.

Imagine me, for argument’s sake (and for dramatic purposes…) sitting atop a throne at the Toronto Regional Real Estate Board, being handed “New Listings” by the court jester, one at a time. Now imagine me taking each listing and throwing it into one of two buckets: “Quality Listings” and well, we can just label the second bucket “Other” for now.

Who decides whether a listing is “quality” or not?

I suppose, in theory, the market does.

But wouldn’t it be nice if we could somehow, rather magically, produce a metric to this end?

Whether I am anointed King Quality Controller or not, the concept of a “Quality Listing” is one that would be so helpful to us in this market, and yet, it falls somewhere between an impossible-to-define variable and an outlandish excuse for me to distract my team with visions of me in a robe with a crown.

What would you consider a quality listing?

I suppose the easier question to answer is: “What would you consider not to be a quality listing?”

I would break it down as follows:

1) Properties listed over and over.

We can debate whether a property listed a third time is still a quality listing or whether it’s the fifth, sixth, or seventh listing that strips the “quality” tag away.

But overall, I think we can agree that if a property was listed for sale in November of 2023, then February of 2024, then August of 2024, and now November of 2024, that this doesn’t really speak to the definition of “quality,” right?

There are always exceptions to the rule, and in a slower market or a changing market where sellers and listing agents don’t necessarily have a firm grasp on market conditions, many “great” properties happen to be listed over and over.

But they’re still not really quality, right?

A quality listing is for a well-priced, well-represented, in-demand property, and a property that’s on its sixth listing raises a huge red flag.

In trying to assess what a “quality” listing is, we’re not saying that all other listings are “awful.” They can be “poor” or merely “so-so,” but the point is that they’re not quality.

2) Properties listed at false prices.

This is something we have talked about a lot over the last few weeks, and unfortunately, there’s just no way to stop sellers who want $2,500,000 for their homes from listing at $1,700,000, without an offer date, or without a concept like a “reserve price” as I wrote about on Monday in this post:

“King For A Day: What I would Change On TRREB MLS”

Because a “reserve price” doesn’t exist.

And while we have established over the last twenty years that listing a $1,000,000 house for $799,900 and specifying an “offer date” signals to the market that the property is priced for competition, there are still listing agents and sellers who fail to understand this format and go out of their way to do something stupid and counterintuitive.

I’m an analogy person, so let me try to think of one…

Ah, alright: let’s say that you stand on the street corner with a sign that says “Kick Me” and then somebody kicks you. For you to say, “Hey, why would you do that? I don’t want to be kicked,” is completely counterintuitive.

So too is listing a house at $1,499,900 when you will only accept $1,800,000, not specifying an “offer date” to signal to the market that the property is under-priced, then sitting on the market for 120 days, and berating buyer agents when they (gasp!) bring you offers for $1,499,900.

There is one such property on the market in the east end right now that every buyer agent knows about. This property is priced similarly to the example I just gave, and it may as well not even be listed.

It’s invisible. It’s pointless.

And it’s anything but a “quality listing.”

3) Properties listed excessively above fair market value.

I can’t recall if I told this story on TRB or not, but here goes…

I received an email from somebody who said, “Looking to sell my house immediately,” and with an accompanying address.

I looked up the property, which had been listed for $1,799,000 only one week prior, and noticed that the listing had been terminated.

A very simple, quick search of listings in that area told me that this property was not worth anything close to $1,799,000. In fact, the identical house – right next door – was listed for sale for $1,499,900.

Tell me that this guy’s house has a WOLF range, a state-of-the-art home theatre, and gold faucets. But don’t tell me it’s worth $300,000 more than the same house next door.

Actually, make that $400,000. Because that $1,499,900 listing had been up for 87 days, telling me it’s probably worth closer to $1,400,000.

The funny part about this story is that when I replied to the owner and asked what I could do for him, he said, “Looking for a company to buy my house in cash.”

Sure.

Those companies buy houses from unsuspecting people for seventy-cents on the dollar, but you’re looking for a company that runs a business by over-paying by twenty-five percent?

In any event, before that last listing for $1,799,000 was terminated, would you have considered this a “quality listing?”

Is this a property that’s “in-demand” by the buyer pool?

As with the previous two points, the excessive examples are always no-brainers to label “not quality,” but where do you draw the line? And in what market conditions? Who can possibly determine fair market value, then slightly above fair market value, then excessively above fair market value?

4) Properties on the market for 90+ days.

I would expect push-back on this one, and for good reason.

Many buyers will go out of their way to target properties that have been sitting on the market for 90+ days because buyers might figure that these sellers are more negotiable or that there’s more leverage.

I wouldn’t disagree with that.

However, the efficient market theory would hold that any property that should sell would sell and that if a property has been listed for 90+ days then there is a bonafide reason or reason(s) why it remains unsold.

Price is usually the issue, and if you have a property listed for $699,900 and on the market for 110 days, you might assume it’s worth $650,000 at most, or maybe closer to $600,000. So is that listing “quality?”

No. I would argue that it’s not.

But some buyers will say, “That’s the listing I want! I want to negotiate! I want something that’s been sitting on the market so I can lowball!”

I understand that, but in this example, a condo worth between $600,000 and $650,000 that’s listed for $699,900 is still not “quality.”

If the property were re-listed for $649,900 and was an in-demand product, either because of the location, building, property style, or all of the above, then I would argue it’s “quality.”

5) Condominium assignments.

I’m sorry, but I don’t ever see these being considered “quality listings.”

I have never sold an assignment to a buyer and I never will.

But even though many agents have and will again, I still don’t consider any condo assignment to be a “quality listing.”

First of all, these aren’t actually condos. Most of the time, these are pieces of paper that are trading hands, and even if the condominium is under construction, or finished and in the “occupancy phase,” there is still no title changing hands.

That’s not quality.

Secondly, even in a red-hot market, condominium assignments do not sell well or quickly. Show me the hottest condo market of all time, say, February of 2022. Even then, condominium assignments weren’t flying off the shelves and weren’t meeting the definition of “in-demand,” so I refuse to accept that at any point in time, a condominium assignment could be considered a “quality listing.”

6) Properties that do not fall into the “in-demand” bucket.

This goes without saying, but that doesn’t mean we’re not going to say it.

If a property isn’t “in-demand” then it’s not quality.

I believe we’ve spoken to that in the previous five points but more than simply properties that have been listed over and over, or are listed at false prices, or have been rotting on the market, we might have a certain property type that’s just not in demand.

What properties are not selling out there right now and do not have demand for them?

Micro condos.

Show me the best micro-condo in the city right now that’s also extremely well-priced and I don’t believe this meets the definition of “quality” because the demand isn’t there.

While the market for 1-bedroom condos is slowly coming back, I would have argued that an overwhelming majority of 1-bedroom condos wouldn’t have met the definition of “quality” in September, simply because the buyer pool wasn’t there for the and because of the sheer number of listings.

Of course, most of these units were also over-priced (sellers expecting a price from a previous market cycle…) and many sellers and listing agents were cutting costs by not staging, taking professional photos, or even cleaning.

But the point is this: in a red-hot market for 1-bedroom condos, that loft at Candy Factory is “quality” but so too is that cookie-cutter condo in CityPlace because there’s demand for it, but in an ice-cold condo market, no matter how nice or well-priced that CityPlace condo is, without the demand for the overall market segment, the properties in the bottom 50-70% of that segment are not going to be considered “quality.”

–

So……subjective enough?

Maybe I don’t have a future as King Quality Controller, but I feel my point has been made.

Without quantifiable data to back this up, I’m going to offer the following:

Quality listings in the fall, 2024 real estate market are down substantially over previous market cycles.

I don’t have data but I do have empirical evidence…

Clients of mine have been looking for a home in Leaside now for six months. Their needs are quite simple: a detached, 4-bedroom, 4-bathroom home for around $3,000,000.

When I met with them in August, I said, “The busy fall market is coming up. I think we’ll have 2-3 options per month to consider, so get ready!”

Here we are, two-and-a-half months into the fall market, and we’ve seen exactly one house that met their needs.

As luck would have it, the house – listed for $2,749,000, received four offers, including ours, and promptly sold for $3,150,000.

Sure, there have been other houses, but whether these houses had half of a basement, or lacked a fourth bedroom, they weren’t what the clients were looking for.

These clients aren’t picky and are somewhat location agnostic as far as Leaside goes, and yet we’ve been presented with one option for them through two-and-a-half months in this fall market.

Ask any active real estate agent who is currently working with buyer clients and they will tell you the same thing:

“There just aren’t any quality listings out there right now.”

Now ask those same buyer agents what their clients are looking for and you’ll hear answers all across the board…

JF007

at 12:15 pm

Question for you David or maybe a topic for another day- in a Scenario where the new build condos that are being finished or have been handed over or are on assignment- lets say the market falls from underneath their feet if not already- people unable to close- renters or buyers not wanting to rent or buy them..what do you think happens to these micro condos so to say? I read people cheering downward price movements but at the same time they also decry the size of these condos swearing they will never live in them..so where doe that leave these “so called” un-habitable condos?

Different David

at 4:15 pm

Same thing that happens when a buyer can’t close on a resale. Seller moves for anticipatory (or actual) breach of contract. Lawyers work out whether or not they just need more time. If they need more time, likely increased deposit + some sort of damages. If they can’t close, either release deposit and move on, or try to sell it to another party and see you in court!

The only upside is that since this is a new build, there is no domino effect where the seller can’t close on their new property and so on etc. etc.

JF007

at 9:46 am

I was actually talking of a hypothetical where everything legally is sorted and yet neither there is a buyer or a renter…has it happened that condos remain empty for years or building gets abandoned…what if the province or city just buys them and converts them into Rental apartments that are subsidized for the needy? If i were a city planner looking at housing this might be perfect opportunity to scoop up bunch of apartments/buildings on the cheap and addressing much needed rental apartment need in the city…but again just my opinion

R

at 6:57 pm

99.9% of listings are not quality.

Cookie cutter, bad design, McMansion, faux modern, un-architectural containers full of too many LED lights, terrible giant script addresses over the too tall front entrance, travesty.

I wish there was a listing of only good design. But it would be pretty empty.

Nobody

at 12:25 pm

As to age of listings…

Over last 16 months I have seen many properties stay on market for months, de list, and then come back just to sit again.

Sellers can need a LONG period of time for the market to tell them their expectations are off and, as you noted with some examples from Power of Sale properties, people can just be too slow to adjust over a span of years and ultimately lose the house.

2 main reasons for an owner to be slow to adjust – they have >80% equity and thus don’t need to sell even if they’ve bought another house and are no longer living in the property, or their investors/lenders are unwilling to accept low or negative returns and thus can’t take a bid at today’s market price.

Lots of examples of 100% equity houses in Summerhill/Rosedale/Deer Park/Lytton Park etc where owners are VERY slow to adjust because they’d like to sell but have no need to sell. They need 90+ days to accept that the market isn’t where they thought and that either they should have listened to their Agent or that their Agent told them what they wanted to hear on price to win the listing. Certain very nice properties have needed 3x listings before accepting that the market wasn’t where they wanted, especially given the need for substantial renovations/updating.

Then there’s the new builds where the developer has equity partners or lenders who have to agree to a price that wasn’t where they expected 3-5 years ago when the project got started. Hard enough to get one person to accept that the market moved against them but many people? Then if it’s an employee at a bank who will be judged negatively for taking a loss when in 6-12 months they could be in another role and the black mark go against somebody else.

Plus if you decide to accept a loss while a loan is in good standing you’ll likely be looked at worse than if it was delinquent for 9 months, even if taking a loss quickly reduces the total amount of loss. Large organizations are hard to manage and loan officers don’t have the same mentality as a bond trader. Plus nobody has been taking losses on Toronto mortgages in 30 years! A decision that’s bad for the bank as a whole can be completely rational for the individual employee and their 1-2 steps management!

So I would argue that 90+ listings ARE quality if you have the right mindset. But you have to be a more financially focused purchaser rather than the family who NEEDS to move in the next 90-180 days. Someone who is specifically looking to avoid a bidding war and who can get a quality asset at a good price after accounting for any work that needs to be done. Much like how you found a condo at an attractive price because you were the only bid in the market after the owners realized that they HAD to sell and just wanted out.