You never know what legal troubles are going to sprout up, until you’re neck-deep in one.

As I write this, I’m dealing with a new issue; one that you will all suggest I should have seen coming, but one that I have never experienced before nonetheless.

I sold a condo in December that went through a series of sign-backs, and as those of you who have been through this before know, the paper is almost illegible by the time you’re done.

Almost illegible, that is. Lots of words, prices, initials, and items crossed out, but at the end of the day, you still know what the final agreement said.

One day before the closing of this condo, the buyer’s lawyer called the seller’s lawyer to ask what the final sale price was.

The final sale price was $725,000, of course. This should never have been in doubt. But the “$715,000” price that’s written under the $725,000 price on the Agreement of Purchase & Sale hadn’t been crossed out with a thick-enough pen, or a dark enough line in an electronic signature program.

A case could be made that the Agreement of Purchase & Sale showed two possible sale prices.

This was all much ado about nothing, since the two parties had agreed to $725,000, and the sale price had been reported on MLS as $725,000, but it still didn’t stop the buyer’s lawyer from making a fuss.

I have no doubt that the buyer wasn’t making this an issue. Consider that if you are the buyer, and you’re 24 hours away from closing on your first condo, you have packed up your apartment, and you’ve booked a moving van for Saturday, you want your deal to close! But is it possible that the buyer’s lawyer told him, “We could try to squeeze out some money here”?

As the son of a criminal lawyer of 40+ years, I know the way lawyers think. They don’t ever want to see anything as clear; there is no black and white, everything is grey. Everything is up for discussion and debate. I actually felt that the seller’s lawyer (my client is the seller), rather than nipping this in the bud right away, fell back into his lawyerly ways and started to debate the merits of “two sale prices.” It’s just habit for most lawyers, who love to debate, and whose favourite word is “could.”

“Well, there could be a case here that there are two sale prices agreed upon.”

“The buyer could have a viable objection in this case.”

Even though the seller’s lawyer knows he works for the seller, it’s just second-nature to want to look at possibilities, and scenarios, and potential situations, ad nauseam. Not all lawyers think like this, but only lawyers think like this!

After speaking to my seller’s lawyer directly, my beliefs were confirmed; this was more of interest to the lawyer as a case study than it was, in practice, working for his client.

Frustrated as I was, I kept everybody in the situation cool, and ultimately the buyer did want to close on the transaction, and the buyer’s agent did confirm that we had agreed on $725,000, and all worked out in the end.

But looking back on this as I now am, I can’t help but give my head a shake. How could I not see this coming? How could I not look at that faint line crossing out the “$715,000” and think that, perhaps, it could be challenged?

I’m being partially facetious here, but I’ve always felt that learning from your mistakes not only enables you to use real-world experiences as a guide, but also ensures you don’t replicate your failures.

So in the spirit of trying to look ahead and anticipate future legal squabbles, let me introduce you to a concept called “Anticipatory Breach.”

I feel that this is a subject we might see and hear more about in the 2019 market, and my solution to the issue is one that I think many of you will benefit from.

When you sell your property, you will always require a deposit in consideration of the agreed-upon offer.

An agreement without consideration is not an agreement.

And thus we routinely submit a deposit cheque with the offer, or thereafter.

Different market conditions call for different procedures with respect to the deposit. For example, in a red-hot market, where you have a property listed with a specified offer date, and where there are multiple offers, you would expect that any offer submitted is accompanied by a certified cheque or bank draft for 5% to serve as a deposit. In a cool market, there would be no issue with making an offer without a deposit, waiting for an agreement, and then delivering the deposit the next day.

It’s that latter situation that I want to talk about, because I feel as though many people have been burned in the past year by not addressing this properly.

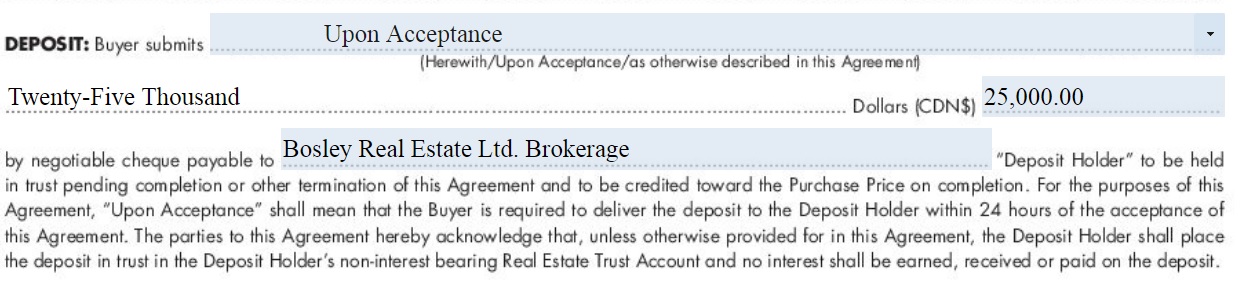

In every Agreement of Purchase & Sale, there is a section that describes how the deposit will be received. There are three options:

1) Herewith – meaning that the deposit is in hand when the offer is made, and in practice, the cheque is often paper-clipped to the physical offer.

2) Upon Acceptance – meaning that a deposit will be delivered after the offer is accepted, in accordance with the provisions laid out thereafter in the APS.

3) As Otherwise Described – meaning that the Schedule A will outline how the deposit is to be delivered, and we see this when there are multiple layers to the deposit, ie. the deposit is $50,000 but only $25,000 will be provided “herewith” and a further sum of $25,000 will be provided within three business days.

So if you’re a seller and you receive an offer on your property, pull the trigger and sign the APS, and the deposit is to be delivered “Upon Acceptance,” what should you expect?

Well it’s outlined pretty clearly in the Agreement:

There you go, they even put “Upon Acceptance” in quotations!

“Upon Acceptance” shall mean that the Buyer is required to deliver the deposit to the Deposit Holder within 24 hours of the acceptance of this Agreement.

But what’s missing here, folks?

The lawyers among you, tell me what you see here. Tell me what we’re missing, and why this can become troublesome?

Anybody catching on here before I divulge?

Okay, so after that last section, “…within 24 hours of the acceptance of this Agreement,” it’s missing anything pertaining to what happens if the deposit is not delivered within 24 hours. And unfortunately, the Realtor community is not up to speed on this.

I sold a condo last year, representing the buyer, where the listing agent threw an absolute fit that we didn’t have the deposit cheque “on time.” Technically-speaking, he was right. We did the deal at noon on a Tuesday, and he wanted the cheque on Tuesday morning. I may have been too cavalier about it, suggesting that “one day” was essentially “24 hours,” but my buyer-client had the deposit cheque and was going to drop it off at the listing brokerage at 5pm after work.

“Not good enough!” I was told by the listing agent, and again, he was right. Technically-speaking. I’m not trying to give myself a pass here, but for a condo that had been on the market for three weeks, and an offer that took four days to turn into an agreement, forgive me if we were 4-5 hours late.

The issue was, the listing agent decided that at 12:01pm, the offer was null and void.

But it wasn’t.

It doesn’t work that way.

And for those of you that caught on to the verbiage (or lack thereof…) in the deposit section from the Agreement of Purchase & Sale above, there is no explanation of what happens if the deposit isn’t received within 24 hours.

The listing agent in this case was a drama queen with an over-inflated sense of self-importance, who thought he was on Million Dollar Listing, and decided he would play fast and loose by suggesting that we “top up” our offer price in lieu of having the deposit delivered on time.

In the end, my client dropped the deposit off at 5pm, received a deposit receipt, and once the two brokerages had all the paperwork and the transaction was processed, the listing agent just faded away.

But what if the situation were different?

What if the buyer just never showed up, and was never heard from again?

Would the offer be null and void?

Could the seller then enter into another Agreement of Purchase & Sale with another buyer.

No, and no.

What happens in reality is you need to unwind the transaction. Legally-speaking, you, the seller, are still bound by the Agreement. Even though the buyer never produced a deposit, you are still tied to that Agreement, and cannot sell the property to another party until a Mutual Release has been signed.

And that is where the anticipatory breach comes into play.

If you, as the seller, anticipate that a breach is possible, then it’s best to get out ahead of it.

Again, we’re talking about a very small fraction of deals here; to suggest this is 1% would be overstating things.

But if you’re a seller, and you have two interested parties, and agree with one of them, you want to keep the door open to dealing with the second party if the first party neglects to show up with the deposit.

If you simply enter into the Agreement as most do, with the deposit delivered in accordance with the verbiage above, then would need a mutual release to be signed in order to sell to the second party.

How do you get around this?

Simple. Make the offer conditional upon receiving the deposit.

This Agreement is conditional upon the Buyer delivering to the Seller or the Seller’s agent a negotiable cheque to serve as a deposit for the real property stated herein, within 24 hours of acceptance of this offer, failing which this offer shall be null and void.

There.

I just wrote that off the top of my head. It’s not rocket science, and I’m sure we could clean that up a bit, and/or have a lawyer actually draft it, but you get the idea.

A buyer who intends to show up the next day, or even that evening, with a deposit cheque has no issue with this condition. And it allows the seller to keep the door open to working with a second party if, and only if, the first party never materializes with the deposit.

Through fifteen years in this business, I have only come across this situation twice. The first time was when my client, after purchasing a condo, called me the next day and started with, “You know, David, last night I sat down with a scotch and got to thinking…,” and suffice it to say, he pulled out of the deal. He did so illegally, but basically said, “I’m not giving them the cheque, so figure a way out of this for me and let me know when it’s done.” The second time was when I represented a seller of a Corktown condo, and the buyer’s agent told me his client “got cold feet.” I had another buyer waiting in the wings, and had resold the property conditional on the first party being released from the existing Agreement. We got the mutual release from the first party, and the sale to the second party went through.

I don’t expect that this is going to become a common theme in this market, but it’s good to have this in your knowledge-bank, as a seller.

And if you’re a buyer and you see this condition, just know that there’s nothing funny about it. So long as you bring a cheque as required, you have nothing to worry about.

Mark

at 9:03 am

The underlying premise of this post is wrong (speaking as a lawyer who litigates these sorts of disputes). The deposit is simply security for performance of the agreement. It is not the “consideration” for the agreement. The “consideration” from the buyer that makes it a valid contract is the promise to make payment of the purchase price on closing. An agreement of purchase and sale is binding even without a deposit having been delivered.

David Fleming

at 10:05 am

@ Mark

You are correct, that’s my mistake.

“Consideration” is the sum paid for the property, not the deposit.

I got my verbiage mixed up there. I appreciate the correction!

Verbal Kint

at 10:49 am

Another “verbiage mixup” from back in the day:

https://torontorealtyblog.com/blog/whats-the-point-of-the-deposit/

Daniel

at 11:08 am

Wow. Really great “gotcha” moment. Yawn.

Keyser Söze

at 12:22 pm

Some people major in minors.

Derek

at 11:19 am

Mark, has there been any uptick in claims for the deposit plus damages for sales that failed to close? Any anecdotes?

Jimbo

at 3:57 pm

Maybe I should post this on the blog entry before this but I think the regular commenters will see it here easier.

With the idea that median income should not measure affordability as David pointed out; not every member within a sample set will be able to afford real estate in that market. What would the proper metric be?

I have some ideas:

1. If 65% of residents own in a city take the top 65% of median income and come up with a new value off that sample set?

2. Track average net worth within the market and peg it to median income? Off the cuff, 7% of houses were bought in 2012 and this is the income you would need then, add on house appreciation to from that time to guess net worth.

Any other thoughts or there?

JG

at 5:36 pm

Appraiser – you mentioned in a recent comment that stocks and financial assets have crashed.

Well, since Christmas Eve the s&p index has rallied 14%. It’s too bad RE is illiquid and likely won’t recover quickly.

Appraiser

at 10:54 am

Still well off the peak.

Lots of money was lost over Christmas. People mostly sell into a storm.

Fear of loss is a greater motivator than opportunity to gain.

It’s tough competing with complex algorithims and powerful high-frequenceny trading platforms.

Appraiser

at 11:36 am

P.S. Real estate in general has already recovered. Did I miss a crash somewhere?

And Condos never stopped plowing higher. Great investment so far; and you get to live in it or rent it out, or sell it. Lot’s of options.

JG

at 2:59 pm

Most people sell into storm??Hahaha, maybe a first time 22 year old investor with 3k portfolio. Most (working) people go with ETFs/index funds. With family and kids, not many have individual stocks as the majority of their portfolio.

Let’s be honest, XUS and XSP has more than doubled in the past 10 years, outperforming 416 RE. In case you don’t know, these are 2 of the most popular US broad market ETFs that most people buy and hang on to (not sell into storm). You may want to look into buying some instead of pumping RE all day.

The best thing, I look at it for about 10 minutes every week on my computer. No looking for tenants, posting Kijiji ads, keep track of propert taxes, insurance, condo fees, maintenances, etc. etc. etc. And this is all assuming you don’t get bad tenants.

Appraiser

at 3:10 pm

Can you live inside your ETF’s?

Asking for a friend.

Eddie

at 3:18 pm

Zing!!!!

JG

at 3:35 pm

I already bought. I want make sure people who are on the fence about buying investment condos in TO know there are much better (and easier) alternatives.

Your arrogance do not show well to the readers, at least not the older/more established ones with money to invest, not the dude above who said “zing”. Good luck with your debt my friend.

Appraiser

at 3:35 pm

P.S. Condo price gains for the last 3 years.

2016: 14.2%

2017: 18.1%

2018: 8.9%

JG

at 6:23 pm

You like cherry picking eh? Downtown condo appreciation in the past 3 years..

Well here are two companies that’s part of many people’s portfolios (including myself) and many US based index funds.

AMZN

2015: 117.78%

2016: 10.95%

2017: 55.96%

2018: 28.43%

NFLX:

2015: 134.38%

2016: 8.24%

2017: 55.06%

2018: 39.44%

Zing!

Appraiser

at 1:05 pm

Cherry picking indeed. What are the returns on the entire portfolio?

And can you live inside of it, or rent it out to make income?

Can you leverage the purchase of stocks to match real estate, or do you have to have all of the capital up front?

My friend is still curious.

Gabby

at 3:16 pm

@Appraiser

The answer to all your rhetorical non-questions is, of course, “no.” However, unlike a house/condo, you can sell a portion of an investment portfolio (pretty much any portion you desire) in seconds. It’s called liquidity, and while it may not be as vital as a roof over one’s head, it can be pretty important as day-to-day life unfolds. Cheers.

Chris

at 5:22 pm

Again with the “you can’t live in an ETF!!!!” argument? We’ve discussed this already, appraiser.

As Nobel Laureate Economist Robert Shiller put it, “stocks pay cash dividends and housing pays ‘in kind,’ in the form of housing services; that is, you get to live in a house.”

We’ve also already discussed the stocks vs. real estate investment question. To once again quote Shiller, “Here is a harsh truth about home-ownership: Over the long haul, it’s hard for homes to compete with the stock market in real appreciation…It would perhaps be smarter, if wealth accumulation is your goal, to rent and put money in the stock market, which has historically shown much higher returns than the housing market.”

As for leverage, most people will not be permitted to take on as much debt in buying stocks as when buying real estate. But leverage is a double edged sword; it amplifies gains on the way up, but declines (like TREB’s -4.3% average price movement from 2017 to 2018) is also amplified.

If you believe people widely sell into a storm when it comes to their stock portfolios, would you expect them to act differently if holding a cash-flow negative real estate investment that was highly leveraged and depreciating in value?

Jimbo

at 4:23 am

Year Sales Price Prime Total Cost Sales Volume

1985 45,509 $109,094 11.00% $ 278,436 $ 4,964,758,846

1986 52,919 $138,925 11.00% $ 354,574 $ 7,351,772,075

1987 43,475 $189,105 9.25% $ 426,492 $ 8,221,339,875

1988 49,361 $229,635 9.75% $ 537,054 $11,339,605,935

1989 38,960 $273,698 12.25% $ 758,740 $10,663,274,080

1990 26,779 $255,020 13.50% $ 764,435 $ 6,829,180,580

1991 38,144 $234,313 12.25% $ 649,557 $ 8,937,635,072

1992 41,703 $214,971 7.50% $ 424,260 $ 8,964,935,613

1993 38,990 $206,490 6.75% $ 383,697 $ 8,051,045,100

2000 58,343 $243,255 6.50% $ 442,845 $14,192,226,465

2005 84,145 $335,907 5.25% $ 550,280 $28,264,894,515

2010 85,585 $431,276 5.75% $ 737,418 $36,893,505,420

2012 85,496 $497,130 2.25% $ 619,779 $42,502,626,480

2013 87,049 $522,958 3.00% $ 699,773 $45,522,970,942

2014 92,829 $566,696 3.00% $ 758,299 $52,605,822,984

2015 101,213 $622,121 3.00% $ 832,463 $62,966,732,773

2016 113040 $729,837 2.70% $ 949,526 $82,500,774,480

2017 92263 $822,572 2.70% $1,070,176 $75,892,960,436

2018 77426 $787,300 3.20% $1,073,271 $60,957,489,800