I can’t possibly tell you how many pictures I went through to choose the three (spoiler alert!) feature photos that I’m going to use for this three-part blog series.

What would you search for?

I looked for “mind” as well as “brain,” and you can imagine what images resulted.

“Thinking” was another keyword, as was every variation from “thoughtful” to “pensive,” and beyond.

After a while, I had seen more pictures of people staring out windows to last a lifetime. That, and images of the “thinking man,” which hits too close to home for me.

Raise your hand if you have parents that buy you things that they, themselves, like or covet?

I have parents like that.

And for whatever reason, my dad likes to buy me variations of “the thinker” sculpture.

This is the mantle above the fireplace in my living room:

Yeah, they’re cool and all.

I love art, don’t get me wrong. And I love anything hand-carved and anything that’s an original.

But those three “thinking men” are simply the appetizer for what my old man has put on one of our family room shelves…

Yeah. Well.

We keep the other dozen in storage… 🙂

We’re four days into the 2025 real estate market and I’m already adding blog topics to the queue, but for now, let’s pick up where we left off on Monday. I’ll regale you with the thoughts, opinions, concerns, and conundrums that my inner thinking man is tossing back and forth between the left and right sides of my real estate brain…

–

4) Sales Volume

The TRREB stats weren’t released until January 7th.

In a completely unrelated story, I had a mild panic attack on January 6th…

Now that 2024 is completely in the books, we can look back at the complete year. Of course, those that read this blog regularly are aware that, much to my chagrin, TRREB changes every single statistic by the time it’s published the next year, ie. there are 6,881 sales in June, as per the stats released in the first week of July, but then by next June, that figure reads 6,892 sales instead.

Rounding error? Yes.

Frustrating for an OCD stats nerd? Oh, hell yes.

So with that disclaimer out of the way, let me put the following in writing:

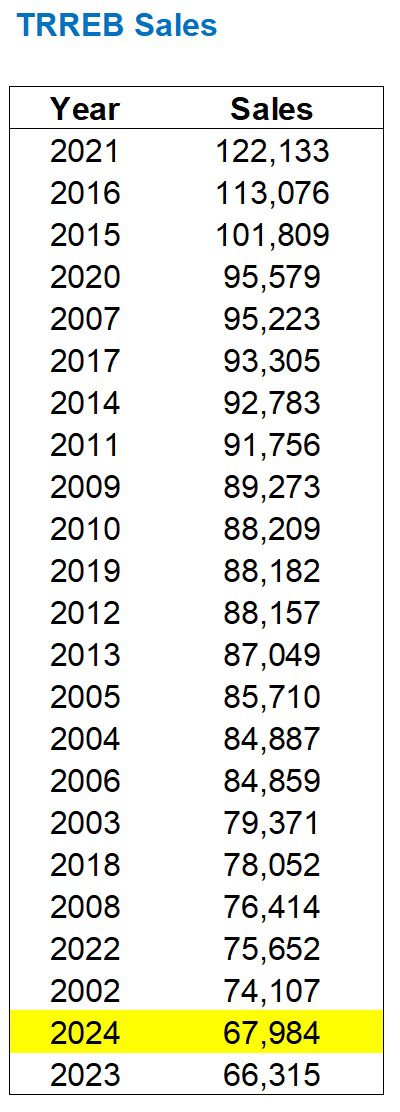

There were 67,984 sales in TRREB districts in 2024.

That is the sum of each month’s total, but of course, this number will read slightly different at some point down the road.

Recall that in a late-2024 blog post, I made the assumption that, for the month of December, we could count on “around” 3,800 sales. This was based on the prevailing year-over-year trends, and that enabled me to predict a sum total of 68,425 sales for 2024.

That number, as it turns out, proved high.

Amazingly, there were only 3,359 sales in the month of December, which is actually lower than the 3,419 sales recorded in December of 2023.

That’s only a 1.8% year-over-year decline, but it shrinks the expected number of sales for 2024 by that much more.

Here’s an updated list of the yearly sales since 2002:

“Great work, everyone! Really, really solid! Way to give it a hundred and ten out there!”

Yes, we beat out the lowest year of sales ever.

Ever, relative to population growth, since as regular readers know, I don’t go back pre-2002.

So after all was said and done, we basically repeated 2023 in 2024 with respect to sales.

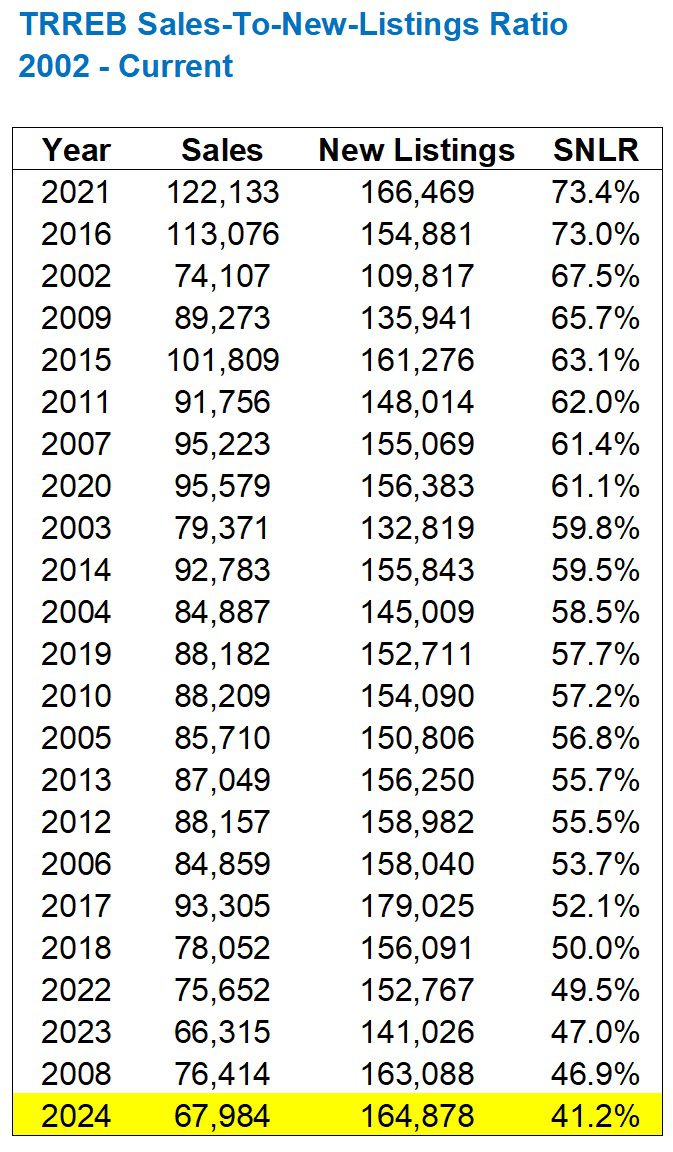

And when you factor in sales as a percentage of listings (absorption rate), we could argue that the year of sales in 2024 was actually “worse.”

Consider that in 2023, those 66,315 sales were based on 141,026 “new listings.”

That’s an absorption rate or “sales to new listings ratio” of only 47.0%.

But while we did see more sales in 2024 than in 2023, we also saw more “new listings.”

A lot more new listings.

In fact, while sales increased by 2.5%, new listings increased by 16.9%.

The result is the following:

That’s right, folks!

We now have statistical evidence to claim the following:

2024 was the worst year for GTA sales in the 21st century.

I mean, if I had to vote for “worst year in sales” between the 66,315 sales from 2023 (up against 141,026 new listings), or the slightly better 67,984 sales from 2024 (up against 164,878 new listings), I would whole-heartedly choose the latter.

Sales volume is on my real estate mind as we enter 2025, and despite the above statistics, I remain optimistic.

I know, I know, you’re thinking, “Here comes some sales nonsense,” and maybe I don’t blame you.

We just saw the worst year of sales this century and I’m claiming this is, magically, evidence that this year will be better?

Yes. Yes I am.

Because all the markers are there.

We haven’t talked about interest rates yet (sorry, but we will next week…) but with the reduction in rates from the peak of a Bank of Canada rate of 5.00%, purchasing power has increased by 13%.

That means every buyer with a $1,000,000 budget then has a $1,130,000 budget now.

And rates are still declining.

The average number of new listings in a calendar year from 2002 to 2024 is 152,577.

The average number of sales in a calendar year from 2002 to 2024 is 87,821.

Ergo, 2024 sales were 22.6% off the average, and 2024 new listings were only 8.0% off the average.

There is nowhere to go from here but up.

Any return to the mean in sales would see a higher absorption rate, even if listings remain the same as in 2024 and don’t return to the mean.

Clients of mine are bringing their Leslieville home to market next week.

As I often do, I have shared a Google doc with them that tracks all the new listings in E01, E02, and E03 so far this year so that we can keep tabs on the competition.

So far, there are 18 new listings for properties under $1,600,000.

But of those 18 listings, how many are re-lists from 2024?

13.

Only five of the 18 new listings, under $1.6M, on the east side, are actually new.

And of the five, only two are what I would call “quality listings.”

I told my clients that we should use the “list low, hold back offer” pricing strategy as a result, since there is virtually zero competition out there right now.

By the end of 2025, we may very well see a new record for new listings and beat out the 179,025 figure from 2017.

But with the quality of listings down, and with the number of re-listings up, I think there’s going to be serious demand for great product out there.

Sales are going to increase in 2025.

What was my prediction last year? 88,000 sales?

Yeah, sure, I’ll stand by that…

–

5) Home Ownership Rate

Have you ever felt like you were the first person to use a certain phrase or buzz-word?

Or have you ever felt like you accurately predicted the “breakout” of a previously unheard-of professional athlete?

What I’m asking, I suppose, is have you ever been well out ahead of something? And if so, have you ever put that in writing?

I’ve written so many things on the Toronto Realty Blog over the years that I’m sure I’ve been wrong many times about many things, but I’m also proud to say that I got the jump on a lot of issues as well.

As I have opined in this space before, it often irks me once the media and societal bandwagons jump on after the fact

I spent years complaining about the perils of pre-construction before anybody else did.

I was warning people about condo cancellations before politicians started promising to protect consumers from unfair development practices.

I started the conversation about just how much of the cost of new homes is made up of taxes.

And although I really don’t want to go here, I warned everybody about a university dropout who became a high school drama teacher and then decided he was fit to run an entire country. And now, here we are…

The intersection of politics and real estate is a significant one, but not always for the right reasons.

Just as political leaders have looked to “blame” housing market woes on anyone, and anything, from foreign buyers to property flippers, the same leaders have told us that we can tax our way out of any problems that exist.

During election cycles, we’re fed great ideas like Shared-Equity Mortgages, or promises of affordability for people that can’t, shouldn’t, and likely will never own homes.

It’s my opinion that in 2025, we still start to be fed stories about the “home ownership rate” in Canada, and I’m not saying that this will from the Liberals or the Convervatives, or that it’ll be used for good or for bad. What I am saying is that over the last twenty years, I’ve watched politicians, governments, media, and society alike latch on to certain phrases, buzz-words, or ideologies that serve as that particular flavour of the week, month, or year, and I think that “home ownership rate” will be the next one.

How will it be used?

By whom?

And for what purpose?

I don’t know. And I don’t profess to.

But I feel as though, headed into an election year, there needs to be a new focus on housing when politicians yammer back-and-forth, make promises, and try to draw attention and gain favour. It’s my opinion that in 2025, this will be a large topic of discussion.

Do you want to live in Kazakhstan?

I’m not sure that I do.

I haven’t visited recently. Wait, that’s not true….I haven’t visited at all, but I’m sure my old man has. He might be there right now. Last I checked, he’s been to 127 countries, but I digress…

I will freely admit, right here and now, despite potential backlash from the Kazakhstani people, that I have no desire to move there. Ever.

But if I did, there’s one massive advantage that Kazakhstan has over the rest of the world.

What is it?

Their home-ownership rate is 98%.

True story. Check out this link HERE.

But what does Laos, who is #2 on the list at 95.9%, do differently than Canada?

What do Romania, Albania, and Slovakia have that we don’t?

Is the home ownership rate in China really sixth-highest in the world at 93%? Or is this like Vladimir Putin gaining 100.0% of the vote in a free and democratic election?

Topic for another day, fine, I know you don’t want to insult two of the world’s powers right now, I understand.

But where does Canada rank out of 195-something countries in the world in terms of home ownership rate? And what is that rate, as a percentage?

52nd place.

66.5%

Is this good? Bad? Much ado about nothing?

I’m asking rhetorically, because nobody really knows.

Much of the data on that list is stale anyhow, as evidenced by Canada’s “latest” figure from 2021. Although, relatively speaking, that’s not bad when compared to Laos’ data from 2015…

I truthfully don’t know if 66.5% is good, bad, or just fine and dandy, but I do know that during my two decades in the real estate industry, “home ownership rate” hasn’t been a topic of conversation, a phrase in the newspaper headlines, or a talking point for politians, and that is exactly why I think it will be in 2025.

Sometimes, we see lack originality. Sometimes, we make a Spiderman trilogy and then make another eight of them just because we can’t think of anything better.

Then other times, we thrive on originality. Other times, we come up with the idea for a film where a man has a romantic relationship with his operating system, like in Her.

People are funny. Just when you think you’ve got them figured out, they surprise you.

And while you might think there’s no originality left in Canadian political theatre, there are bound to be new themes and topics brought to the forefront as would-be leaders battle for the public’s affection.

Sadly, the most recent data I can find on Canada’s home ownership rate is from 2001 via THIS article from StatsCan. If anybody has something newer, please let me know.

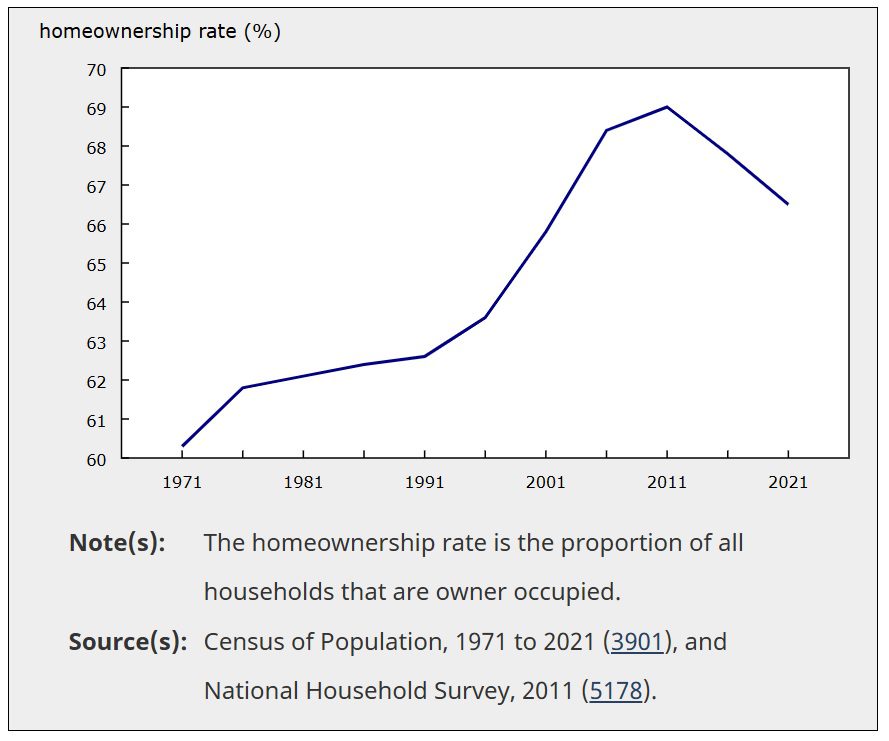

As noted above, Canada’s home ownership rate in 2021 – the most recent year on record, was 66.5%.

This is unfortunately down from the peak experienced a decade earlier, after a meteoric rise:

Maybe the federal government hasn’t had time to update the stats over the last four years? I assume they were busy huddling around the money-printing machine while using any free time they had to gaze upon themselves in the mirror, but once again, I will, in fact, digress…

So we’ll get a census soon. We hope.

And we’ll see where the home ownership rate is in Canada in 2025 or 2026, but who among you would look at the above chart and suggest that the rate will have increased since 2021?

Wide-eyed optimists, you are!

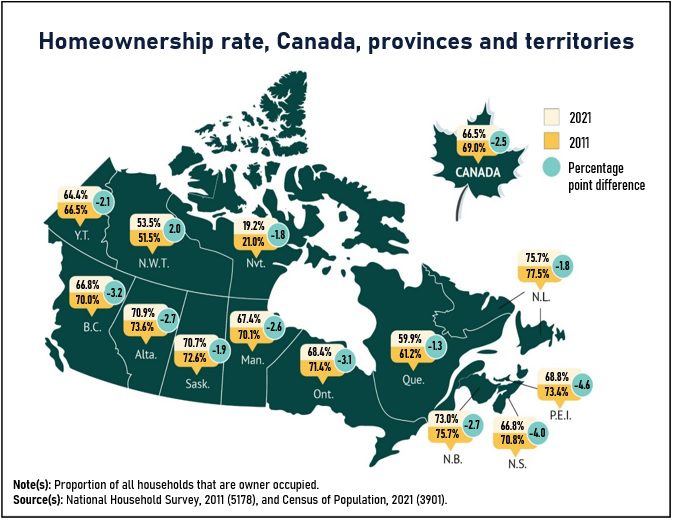

But the data from 2021 further demonstrates that virtually every province saw a decline in home ownership rates from 2011 to 2021:

Northwest Territories. So hot right now!

And let us ask TRB reader and frequent commenter, Island Homeowner, what the heck is happening out there? Your little island saw the largest decline in home ownership rate of any province in the country?

So what should our rate of home ownership be? Any ideas?

If this is the first time you’ve really sat down to think about it, then maybe there’s a relative number that would fit the bill?

Say, look at similar countries and compare to their rates of home ownership?

Which countries would those by?

Maybe our closest neighbour, the United States? That could be a good place to start.

Maybe our matriarch over there in the United Kingdom? That could be another good comparison.

And maybe our commonwealth cousin down under in Australia? Yes, I think that’s an option.

Well, as luck would have it, these countries are all clustered together in the list of countries ranked by home ownership:

Coincidence?

Or was this planned in the car ride home tonight?

Say what you want about “housing affordability” in Canada and talk to me about the plight of “first-time buyers” via this “housing crisis” we’re having.

But I remain convinced that those buzz-words are played out, and 2025 will be the year that “home ownership rate” is slowly etched into your brain.

–

6) Federal Politics

I can’t remember, but at the end of 2024, didn’t I say I would try to talk about politics on the Toronto Realty Blog just a little bit less?

It’s fine.

It’s almost over.

By this time next year, we’ll have a new Prime Minister, a new political party in power, and a new direction, ethos, ideology, vision, and future.

Who doesn’t love the sound of that?

I used to love my country dearly and it was a part of my heart and my soul.

But Justin Trudeau took away my identity. Or tried to, at least.

Of all the radical, insane, insulting, embarrassing, and toxic things that Mr. Trudeau has said and done over the past nine years, this might be what offended me the most:

“There is no core identity, no mainstream in Canada. That makes us the first post-national state.”

How incredulous that this one man thought he could decide on and implement an identity for all of us.

I used to revel in the stereotype of a Canadian being a bearded man wearing a plaid jacket, leaving his igloo in the morning, driving a dog-sled to work while drinking maple syrup from the bottle and listening to the Tragically Hip before leaving work and heading to the rink for some pickup shinny hockey.

Yeah. That was so awful that Mr. Trudeau wanted to take it away from us.

Mr. Trudeau wanted to “re-make” Canada in his vision, without any input from Canadians or the advisors around him. He wanted to explain to us who we are and our values. He wanted to tell us what we could say, what news we could read, and of course, what views we could have. Because he believed in free speech, but not “unacceptable views.”

By “resigning as party leader” but remaining as Prime Minister and proroguing parliament for three months, Mr. Trudeau has cemented his legacy as the most unqualified, ill-fitted, useless, clueless, ineffective, arrogant, self-serving, self-righteous, virtue-signalling, sanctimonious, hypocritical, and obnoxious politician this country has ever elected to office, but I fear that it’s actually worse than that.

The country needs a new leader and a new direction now, but as his final act of insult, Mr. Trudeau has ensured that we will languish without a leader, direction, or advocate, at a time when we desperately need it, so that the Liberal party can have a public popularity contest to be trotted from town to town.

We all know a Conservative government is coming, whether in April or October.

It’s impossible to consider housing without considering the political environment, and just as the financial markets can shift depending on who’s in power and what legislative changes are being implemented or even rumoured, the direction of this country’s leadership and leadership race are going to have a major impact on our real estate market.

The Dow Jones jumped over 1,500 points on November 6th, the day after the U.S. Federal Election. Tesla stock is up up 63.2% since then and yet the fundamentals of the company haven’t changed.

Just as an economist will differentiate between inflation and that of expected inflation, I would also offer that our real estate market will be affected by legislation and policy, on the one hand, and then consumer sentiment on the other.

Call it “consumer confidence” if you’d like, but what I mean is that a government can directly influence the eoncomy, financial markets, or real estate markets, but they can also indirectly influence those markets by changing the relative sentiments and confidence levels of the consumers who act within those markets.

If we saw a spring election and, for argument’s sake, the Conservatives did and said all the right things, rose to power, and promised to show us the sunny way, and if the public ate this up, jumped on the bandwagon, and felt confident about the leadership of this country and the direction in which they’re guiding us, then I think the real estate market would move accordingly.

Not only that, in times of election, politicians get creative in their efforts to buy off the constituents.

Before the 2019 federal election, the Liberal government trotted out their “First Time Home Buyer Incentive,” or their notion of a shared-equity mortgage, which was timed to gain favour with the voting public.

What do our deluge of political parties have in store for us before the next election?

Curiosity may have indeed killed the cat, but creativity when it comes to the “generosity” of government can kill the economy.

The spendthrift government has no doubt driven inflation over the past several years, and it was rather interesting to see the American voting public reject ideas like Kamala Harris’ promise to give everybody who wants to buy a home, $25,000 in order to do so.

But could the pendulum actually swing the other way with a Conservative government?

When I interviewed economist Ben Rabidoux back in November, he mentioned that a Conservative government might undo some of the existing policies affecting real estate, notably within the CMHC.

As it stands now, the federal government is chomping at the bit to finance purpose-built rentals, and is offering 95% loan-to-value to developers building rental apartments instead of condominium apartments.

Would a Conservative government reverse this policy?

Ben seemed to think so when we met last year, and while I am all for smaller government, I wonder what it would mean for the real estate market if the CMHC was forced to take a step back.

Last year, we saw the CMHC extend the mortgage insurance ceiling from $1,000,000 to $1,500,000, which would help many more people get into the real estate market, but would also enlarge the existing burden that that the CMHC carries – on the backs of Canadian taxpayers. We also saw the CMHC extend mortgage amortization from 25-years to 30-years across the board which, once again, helps buyers with affordability but adds to the burden for the CMHC and Canadians.

Would a Conservative government tighten the reigns at the CMHC?

I read a great article in Maclean’s over the holidays:

Canada’s Pierre Poilievre Era Will Begin in 2025

By: Stephen Maher for Maclean’s

December 12th, 2024

The sub-title reads:

He’ll likely win a majority and immediately kill all the Liberals’ sacred cows.

Is policy at the CMHC one of those sacred cows?

The article is worth a read, trust me on that.

But if you’re interested only in the sections that pertain to real estate, then this is what you need to know:

Housing has been Poilievre’s strongest file: he has successfully and repeatedly argued that the federal government should do more to push gatekeepers out of the way and get houses built. He’s convinced voters that he will break the supply logjam that’s made so many of them miserable. He may be overpromising, since housing supply depends on a lot more than federal policy, but he may benefit from recent Liberal actions, which could bear fruit as he comes into office. Poilievre has also promised to eliminate the GST on new homes sold for under $1 million—a huge rebate to buyers, which he would pay for by killing federal housing programs. It’s a perfect Poilievre promise, distilling his smaller-government philosophy into a carefully targeted pitch to a key demographic.

Although I clearly champion the Conservatives, I will admit that until somebody actually does something about housing, this is all just rhetoric to me.

“Push the gatekeepers out of the way.”

Great idea.

But the problem exists with municipalities so I don’t know what the Conservatives or any other government will do about this.

Now, at the risk of running off on a tangent here, I want to draw your attention to the last paragraph of the article because it introduces a concept and an economic ideology that, coincidentally or otherwise, I have read about a lot lately in the mainstream media:

Since childhood, Poilievre has been a devotee of University of Chicago economist Milton Friedman, who argued that government should only involve itself in citizens’ lives when absolutely necessary. That has never been the governing philosophy of Canada, where citizens have come to expect a European-style welfare state and businesses are protected from international competition by regulators. Poilievre would like to reduce the size of the welfare state—he has declined to make any promises about maintaining the pharmacare and dental programs the Liberals brought in with the NDP—but history shows that voters often punish governments that take away benefits they are accustomed to receiving. It will be a great reckoning, cheered by some, feared by others.

Milton Friedman.

So hot right now!

This is actually one of three recent articles that mentions Milton Freidman and his economic theories.

Coincidence?

Or is it a sign of the times? Is it the result of “re-make” of Canada in 2025?

Here’s an article from last week, and while the title isn’t important, it’s the section I’ll highlight below that is:

“Canada’s Welfare State Crumbles Under The Strain Of Irresponsible Immigration”

National Post

January 5th, 2025

The sub-title:

We have behaved in the 2020s exactly like a welfare state that was determined to test Milton Friedman’s principle, and we found it to be true.

As I said: Milton Friedman, so hot right now!

“Friedman’s revenge” is wreaking havoc out there, and it’s going to take a while before the fallout subsides.

The last article to mention Milton Friedman, which I had filed away in my brain, is this one:

“The Only Way To Save Canada Post Is To Privatize It”

National Post

November 27th, 2024

From the article:

The postal service’s record of losing money brings to mind Milton Friedman’s astute explanation of private versus government enterprises. The private system “is often described as a profit system, but that’s a misleading label,” Friedman explained. “It’s a profit and loss system, and the loss part is even more important than the profit, because it’s what gets rid of badly managed, poorly operated companies.” Meanwhile, in the government system, badly managed, poorly operated companies can lose money and continue shambling on — like Canada Post.

If the leader of the Conservative party, who will likely lead the country later this year, is a devotee of Milton Friedman, then we are going to see a very different attitude toward the role of the public sector in the housing market.

What changes the Conservatives could make, remains to be seen.

Milton Friedman didn’t believe in the government’s use of fiscal policy as a means to control demand in the marketplace, which is something virtually every government uses.

Maybe I’m making a mountain out of a mole hill here, but I don’t think we can underestimate just what an incredible difference exists between the economic ideologies of the current Liberal government and a potential Conservative one.

Justin Trudeau says things like “The budget will balance itself,” and recently, “I don’t have time to care about monetary policy.”

If the future leader of this country is a devotee of Friedmanomics, then the role of government in the real estate market could change dramatically.

–

Well, I certainly didn’t intend for the last section to be more than a handful of thoughts, but hell hath no fury like a Canadian scorned…

I hope you’ve enjoyed the last two posts and the first six items on my real estate mind in 2025.

Have a wonderful weekend, and I’ll see you back here on Monday for the conclusion!

Peter

at 9:18 am

Liberalism is over, David. It had its fair share of supporters but Justin Trudeau hijacked it and turned it into sad comedy. But the pendulum swings, as you say. In ten years, we might be lamenting a decade of Conservative rule.

Steve

at 9:38 am

It’s basically a guarantee, people look back on it more fondly now but the closing years of the Harper government were also not without their own share of vitriol – and of course his proroguing of the parliament not once but twice set the precedent Justin is now exploiting. I’d love to see the formal justification from the governor general for accepting the request and why three months is justified.

Julie

at 1:30 pm

Stephen Harper wanted to put criminals in jail. He didn’t want to provide drug addicts with “clean drugs” and let them shoot up in playgrounds. He didn’t allow international students to start auto theft rings and then fly home after six arrests.

Violent crimes are up 50% since 2015.

Murders are up 28%.

Auto thefts are up 46%.

Gun crimes are up 116%.

Extortion is up 357%.

I agree that Liberalism didn’t work. But I disagree with the idea that it ever did.

Steve

at 9:36 am

“Great idea. But the problem exists with municipalities so I don’t know what the Conservatives or any other government will do about this.”

As we’ve been repeatedly reminded locally in the past few years the municipalities are creations of the provinces, so in the end if the provinces really wanted to they could break the zoning logjam at the flick of a pen.

Yet when it came to the Feds’ idea of allowing the building of quadplexes as of right on residentially zoned land who was it who pushed back on that? Oh right – the province.

It turns out that the provincial governments are subject to the same constituent pressures as the municipalities.

Serge

at 9:40 am

You may also recall that T2 said that “housing is not a federal responsibility”. (But then changed his mind a bit.)

Oscar Lutgardis

at 10:31 am

lol all you talk about is interest rates…. Meanwhile Canada about to get slapped with tariffs and unemployment rising but no worries y’all interest rates are down!!!! Everybody BUY NOW

Gord McCormick

at 11:15 am

….never was ready….

Ace Goodheart

at 2:41 pm

Ahhh, the fireplace mantle picture.

I still remember the long, animated argument I had with my partner about that one.

I wanted pictures of our children.

She wanted something from an artist. The more expensive and famous, the better.

I argued, we don’t even know these people. You are putting a painting in arguably the most important place in our house, painted by a person neither of us has ever met.

She argued, it’s the living room fireplace mantle, it has to be formal, important, imposing, famous. It has to say something.

So I hired a somewhat famous, important and well known Toronto photographer to take some artsy pics of our kids. I put them on the mantle, signed by my expensive photographer and said to her, there you go, important, famous, imposing, AND our kids are there too.

In the 19 years that I have been in a relationship with her, it is the only argument I have ever won.

David Fleming

at 8:17 am

@ Ace Goodheart

My wife and I also disagreed about the fireplace mantle picture.

I mean, we agreed about the artwork, which is a photograph of wild horses from Wyoming that we purchased in Jackson Hole.

But when I came home with the framed piece, we disagreed about the brown frame, brown mat, and dark photo.

I loved the brown mat. It was velvet. It was sharp. It was different.

But she hated it. So did her friend, who took her side.

And when my very own father, who introduced me to my long-time picture-framer, said, “It’s not his best work” I agreed to swap out the brown mat for the white mat.

I much prefer the white mat….

Kevin

at 7:18 pm

There’s nothing for sale on my neighbourhood. A couple listed in my mother’s area but they are re listings from last summer or fall. I know it’s only been 9 days but I think this idea of too much inventory in the market is overblown. I remember that post you wrote about quality listings last year and now I understand.

Appraiser

at 7:58 am

“Canada set to be fastest growing economy in G7 in 2025, IMF forecasts” https://financialpost.com/news/imf-forecasts-canada-fastest-growing-economy-g7-2025

“Canada’s deficit-to-GDP ratio in 2024 was the lowest in the G7, tied with Germany.” https://www.budget.canada.ca/update-miseajour/2024/report-rapport/overview-apercu-en.html

Island Home Owner

at 10:59 am

99.9% sure the Leader of the Official Opposition is the only federal political Party leader to have dropped out of university … Also, the only one who’s never had a job outside of politics as an adult …

Ace Goodheart

at 6:11 pm

Trudeau dropped out of his Master’s program. He also had a false start in another program if I remember correctly. He did complete his undergrad.

Island Home Owner

at 11:04 am

As far as the explaining the decline in the home ownership rate on the Island goes, I would it’s largely caused by the significant increase in home prices but also big demographic changes led by an increased population of new Canadians (necessarily for the Island long-term sustainability IMHO%)

Appraiser

at 7:21 pm

“In the Trudeau years, the Canadian economy grew by 41 per cent, to $3.2 trillion. It grew by just 18 per cent under Trudeau’s predecessor, Stephen Harper, who governed for roughly the same amount of time.

Per capita income grew by more than 23 per cent on Trudeau’s watch, to $77,700, according to the International Monetary Fund (IMF). Trudeau’s predecessor managed only a 7.6 per cent increase.

In the main, Canadians became wealthier in the Trudeau years. The median net worth of Canadians soared by about 66 per cent between 2016 and 2023, to $519,000, according to Statistics Canada.” https://www.thestar.com/business/say-what-you-want-about-justin-trudeau-theres-still-no-arguing-canadians-became-wealthier-while/article_bd6afbaa-cc3c-11ef-8a5a-b7468842b9a6.html?utm_source=rakuten&utm_medium=affiliate&ranMID=53416&ranEAID=je6NUbpObpQ&ranSiteID=je6NUbpObpQ-dx87ubhAJlPHAKnbTxKSvQ

David Fleming

at 11:30 am

@ Appraiser

I love you, but you’re too smart to take this Toronto Star article to heart.

You have to read this:

https://nationalpost.com/opinion/adam-zivo-no-trudeau-did-not-make-canada-richer

Now that Prime Minister Justin Trudeau’s political career is coming to an end, some of his fans are romanticizing his economic track record. Yet it is indisputable that, under his leadership, the economy sputtered and Canadians, robbed of a decade of growth, were left relatively poorer than their global peers.

Perhaps the best example of this historical revisionism can be found in a fawning column published in the Toronto Star just hours after Trudeau’s resignation. Penned by the paper’s business columnist, David Olive, the article claimed that “Trudeau’s successors will be hard-pressed to improve on his economic track record” as there’s “no arguing Canadians became wealthier while he was in power.”

To substantiate his argument, which grossly exaggerated Canada’s post-2015 economic performance, it was claimed that Trudeau grew the economy by 41 per cent throughout his time in office, while his Conservative predecessor, Stephen Harper, who governed for roughly the same length, saw only 18 per cent growth.

These figures are useless, though, because they aren’t adjusted for inflation or population growth — and addressing these factors is essential to credible economic analysis.

If you ignore inflation, Canada’s GDP has indeed grown by roughly 41 per cent since 2015 until now — from US$1.56 trillion (C$2.24 trillion) to US$2.33 trillion, according to the International Monetary Fund. But that isn’t actually illuminating, because the cumulative inflation rate of the U.S. dollar, which the IMF uses for its analysis, over that period was 33.1 per cent, so, obviously, much of this increase was simply inflation disguised as growth. This problem exists if you measure GDP using Canadian dollars, too.

To filter out the effects of inflation, Statistics Canada offers “real” GDP data where all figures are adjusted to 2017 Canadian dollars (there is nothing special about 2017; it’s just an arbitrary benchmark). This data suggests that Canada’s economy actually grew by 24.4 per cent under Harper and 21.4 per cent under Trudeau — so apparently Harper was the better economic steward.

The gap between the two Prime Ministers grows starker once the effects of immigration are accounted for.

GDP can be boosted by increasing a country’s population — more workers usually means more economic activity, after all. But this doesn’t necessarily mean that everyone, on average, gets richer. If you import a large number of workers, but everyone’s income stagnates or slightly decreases, that can still boost total GDP and conceal a sputtering economy.

This appears to be precisely what’s happening in Canada today, where growth has, in recent years, been primarily driven by unprecedented immigration.

If you want a more accurate sense of living standards, you need to look at real GDP per capita. Although Statistics Canada’s main dataset here currently ends at Q4 2023, the available numbers are dismal for Trudeau. During his tenure, this metric increased by only 0.8 per cent — and fell far short of the growth achieved during the Harper era (4.5 per cent). Worse yet, Canada’s real GDP per capita is now precipitously declining. It fell by 4.4 per cent between Q2 2022 and Q4 2023, which is a rate comparable to the recession of the early 1990s, and appears to still be dropping.

In reality, economic growth during the Trudeau years was less than 20 per cent of what was achieved during the Harper era (+0.8 per cent real GDP per capita, versus +4.4 per cent), not twice as much, as claimed by Olive.

The Toronto Star’s business columnist also argued that Canadians’ median net worth “soared by about 66 per cent between 2016 and 2023,” but this claim is both inaccurate and misleading.

The relevant Statistics Canada dataset (which only covers 1999, 2012, 2016, 2019 and 2023) shows that median net worth actually grew by 44 per cent between 2016 and 2023. More importantly, its growth was an anemic 5.6 per cent between 2016 and 2019, which equals to an average of 1.86 per cent per annum, or half the growth rate seen under the Harper era. Then, between 2019 and 2023, it jumped to 36.4 per cent — or an average of 9.1 per cent per annum.

What happened between 2019 and 2023? COVID-19.

During the pandemic, the net worth of North American households surged due to skyrocketing home and stock prices, along with massive government stimulus and decreased consumer spending. In the United States, the net worth of a typical household increased by 37 per cent between 2019 and 2022.

Statistics Canada, meanwhile, estimated that, between 2020 and 2021, Canadian households increased their annual saving rate from $1,704 to $13,105 — a 769 per cent spike that, while short lived, was nonetheless impactful.

It is misleading to present these increases, which were driven by ballooning home prices and debt-fuelled stimulus, as evidence of a strong economy or admirable fiscal governance on the part of Trudeau.

Despite its many flaws, the Toronto Star’s op-ed has been widely shared by Liberals, including Immigration Minister Marc Miller, which suggests that senior figures within the party may have a weak grasp of basic economics.

Canada is going through a rough time right now. A lost decade, combined with eroding living standards, has been painful for many Canadians. Our American neighbours have become far richer than us since 2015, which may elicit entirely justifiable frustration and envy. Promoting decontextualized data will not change this.

Jenn

at 8:26 pm

😂😂😂

Appraiser

at 7:34 am

An explanation that long and that contrived from the National Post is no surprise.

Appraiser

at 9:18 pm

“Canada’s job gains smash expectations and unemployment rate drops:

Economy gains 91,000 jobs, nearly quadruple the number forecast”

“This was as positive a labour market report as we could expect,” said James Orlando, senior economist with Toronto-Dominion Bank, in a note to clients.

https://financialpost.com/news/economy/canada-job-gains-beat-expectations-unemployment-rate-drops

cyber

at 10:06 am

Ugh we should only be comparing Canada’s home ownership rate to the rest of the G7, or at least just to OECD countries.

I come from one of the “Top 10”. These countries with the super-high ownership rate are pretty much exclusively non-comparable because their context can include counting slum settlements and/or largely rural DIY dwellings built with no permits, as well as formerly massive government-built housing stock that’s been transferred to tenants in sweetheart one-time privatization deals (almost free in ex communist/socialist block, 99 year lease in Singapore)

Countries like Italy have higher ownership rate due to some combo of not-amazing economy/relatively high unemployment and cultural prevalence of multi-generational living (or at least, adult unmarried children living at home with parents as the default)

I’d argue Canada has an artificially high home ownership rate due to post WWII tax incentives (primary residence tax exemption) and government funding programs (CMHC mortgage insurance & back-end commercial lender programs that make it basically risk free to lend). This has in part negatively contributed to lack of productivity growth – which has been negative for 2 years – as labour is not geographically mobile due to being anchored by mortgages fueled by government policy and cultural pressure that one is not a real adult until they become a home owner.

Saya Homes

at 12:02 am

Liberalism has run its course, David. It had its time with strong backing, but under Justin Trudeau, it’s been taken off course and turned into something almost laughable. That said, as you point out, the pendulum always swings. Ten years from now, we might find ourselves reflecting on a decade of Conservative dominance with a sense of regret.