Why didn’t I think that posting my thoughts on federal politics, Justin Trudeau, and the Liberal party would result in a flood of comments on last week’s blog post?

I don’t know. Maybe I just didn’t think about it?

But I’m thinking now!

I believe I’ve said all that I have to say on the topic and that nothing good can come from more discussion on the matter.

I’ll leave things as they are until they need to be discussed again, ie. when legislation or policies affecting real estate are announced or introduced.

Now, let’s pick up things where we left off last week!

–

6) Interest Rates

Just when you thought that maybe, just maybe, we had heard the last of this topic after being inundated by it for the previous three years, it becomes the girlfriend you just can’t break up with.

Well, if it’s any consolation, “inflation” isn’t a topic for today.

What can I say?

Interest rates are on my mind, and while it’s become a boring topic, it’s still newsworthy and just as important as ever.

When I closed on my first investment condo last February, my monthly payment was just under $2,500 per month. After one more rate cut on January 29th (fingers crossed), the payment will drop below $2,000.

That’s a big difference, whether you’re an investor or an end-user, and keep in mind, I’m on a variable rate. For those who want to lock into a fixed-rate (which I’ll do at some point this year), the payment would drop even lower.

Having said that, are we going to see a rate cut on January 29th, as many expected?

It’s amazing how many times the experts, analysts, economists, and onlookers will revise their predictions.

Consider that last fall, we were expecting a fifty-point cut in October a fifty-point cut in December, and then a 25-50 point cut in January.

Fast forward to the new year, and we’re seeing articles like this in the newspaper:

“The Odds Of A Bank Of Canada Rate Pause Have Now Clearly Increased”

The Globe & Mail

January 10th, 2025

From the article:

Money markets are pricing in lower odds that the Bank of Canada will cut interest rates again later this month following a robust jobs report today that showed nearly quadruple the number of new jobs created in December than forecasted.

The economy added a net 90,900 jobs last month, largely full-time work, according to Statistics Canada data. The job gains were spread across several industries, the agency said. The unemployment rate ticked down to 6.7%. Analysts polled by Reuters had forecast a net gain of 25,000 jobs and that the unemployment rate would rise to 6.9% from the near eight year high of 6.8% in November.

The robust jobs data show the economy ended the fourth quarter on a high note, easing the pressure on the Bank of Canada to continue rapid rate cuts to spur growth.

What am I missing here? It seems like the only positive going for us is that things aren’t as bad as many had predicted.

Analysts thought the unemployment rate would rise from 6.8% to 6.9%, and instead, it declined from 6.8% to 6.7%.

And?

Is that it?

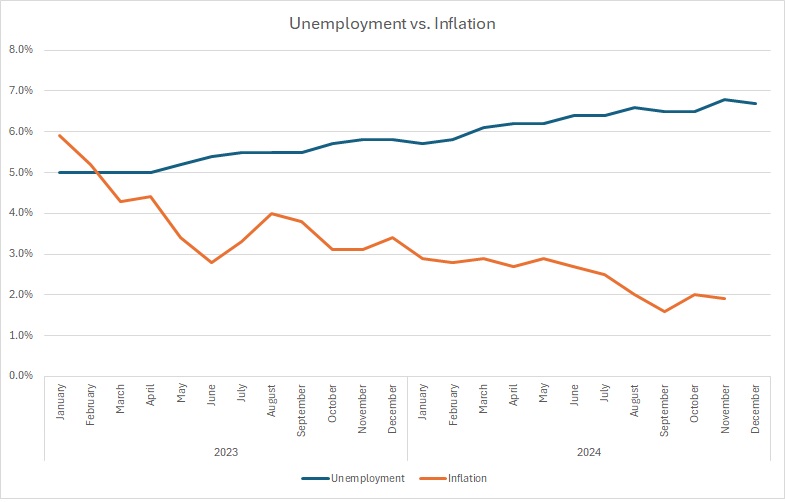

May I remind you that we started 2024 with an unemployment rate of 5.7%.

May I remind you that the unemployment rate steadily increased, almost every month, until it hit 6.8% in November.

So, what, then? We see one decline by a tenth of a percentage point, from 6.8% to 6.7%, from November to December, and now analysts and economists are celebrating?

I may not be an analyst with a bank title, but I don’t agree with this logic.

Perhaps the following chart, which I keep by my bedside, will shed some light on this:

Increasing unemployment –> need lower interest rates

Decreasing inflation –> need lower interst rates

Do you see the very tail end of the blue line on the chart? Yeah, that’s all the “excitement” from last month. It’s the decline in the unemployment rate from 6.8% to 6.7%, even though the blue line has been steadily increasing since January of 2023.

I know what’s coming.

“Look at this guy; he wants interest rates to decline so he can sell more real estate!”

Another 25 basis-points makes zero difference to me, the market, or it’s participants. The point I’m trying to make is that I don’t share the positivity about the economic indicators out there, specifically as they translate to a pause on interest rate cuts.

I don’t want to belabour this, since we’ve been talking about it for two years, and because #8 and #9 on the list of things on my real estate mind are both better reads, but I will say this:

By the end of 2025, the Bank of Canada rate will be, at most, 2.50%.

And now, we wait for that December inflation number…

–

8) Alternative Real Estate Investments

Are you familiar with an intimate little outfit called “RioCan?”

Probably.

They’ve been around for a while.

And while they’re not the largest real estate investment trust in Canada, they are the second-largest.

As per Wikipedia, they own 188 properties with a leasable area of 33,000,000 square feet and as love 2024 are worth approximately $14.3 Billion.

Suffice it to say: they probably know what they’re doing.

Who doesn’t know what they’re doing?

Many, many people.

People, groups, companies, start-ups, investors, speculators, and wide-eyed opportunists. If 2024 taught us anything it’s that people can make mistakes when it comes to real estate investing, and I don’t expect this to change moving forward.

Can we work through an example?

Let’s do that, and I promise that it won’t be the only example we use today…

–

Let’s call this one, “The Mom & Pop Investors”

Susan and Bradley live in Barrie. They are both gainfully employed; one works in education and the other works in dentistry.

They have lived in Barrie since 2006 and have two children, aged 12 and 10 respectively.

Their investments are managed by a friend who works for one of the big-five banks, and they consistently perform somewhere around average or slightly less.

In 2019, another friend told them how well his Toronto condominium investments were doing, and their interest was piqued. They started to browse listings online and would email listings of interest every day, eventually keeping a spreadsheet and a folder of what interested them.

Eventually, a sales representative from one of the online lead-farm websites that they frequented reached out and asked if they wanted to see any condos in person, so they took him up on the offer.

A short while later, they bit the bullet and purchased a one-bedroom condo for $585,000.

Their plan was to lease the unit out, long-term, and perhaps in a decade one of their children would live there.

They closed on the condo in February of 2020, secured a rock-bottom interest rate, and put the unit up for lease for $2,200 per month.

Then along came the COVID-19 pandemic and all their plans were thrown into absolute chaos.

The condo sat empty for four months and they reduced the price multiple times.

Eventually, they wanted to “stop the bleeding” and they secured a tenant at a ridiculously reduced rate of $1,500 per month, which meant that the unit would be cash-flow negative by $1,000 per month, but it was better than losing a full $2,500 per month by having it sit empty!

The tenant they secured was a constant headache. She emailed them incessantly, often complaining about mundane “issues” in the condo, and simply put, drove them nuts.

But the tenant remained in place – at $1,500 per month, to make matters worse, and this went on for four years!

To make matters even worse, Susan and Bradley purchased the condo with a variable rate mortgage back in early 2020, so their monthly carrying costs began to soar in 2022.

They were bleeding money.

And the tenant was still driving them crazy.

In the fall of 2024, the tenant gave notice to vacate, and their prayers were answered.

They listed the condo for sale and while the tenant made showings extremely difficult, they eventually received a lowball offer one week before Christmas, and they happy accepted.

All told, including land transfer tax, real estate fees, legal fees, monthly losses, and the net loss on the sale of the condo, they were out $150,000.

But they chalked it up to a “learning experience,” and simply vowed never to touch real estate again.

–

How common do you think this example is?

It would never happen to you, right?

You can deal with a problem tenant.

You wouldn’t have your wife’s tennis friend and part-time Barrie real estate broker work on your downtown Toronto condo investment.

You wouldn’t have taken a variable-rate mortgage in 2020.

And yet how many mom-and-pop investors got burned since the onset of the COVID-19 pandemic? And how many of them wish they’d simply invested in a REIT instead?

RioCan Real Estate Investment Trust is currently trading on the TSX for a little over $18 per share.

The yearly dividend is just over 6.0%.

Right there, without any appreciation of the stock itself, you’re already looking at a return on investment that would make many pension funds happy.

We can discuss personal finance and market expectations another day, but suffice it to say, this is a very good return.

This then begs the following question:

Why would anybody invest in physical real estate in 2025?

Well, the answer would obviously be, “Because they’re searching for a higher return.”

But one of the many things on my real estate mind in 2025 is just how much more we’re going to hear about all the fantastic returns that exist in real estate without actually buying physical real estate.

Again, let’s simply Google “real estate investment trusts in Canada” and see which sponsored advertisement pops up first.

This one:

Oh, wow!

12% annualized, you say?

That’s twice what RioCan’s dividend is. Giddy-up!

And if you had the time, desire, or both, you could find literally hundreds of advertisements that offer huge returns in-and-around the real estate market, without actually having to purchase, own, and manage a downtown condominium or a six-plex in Niagara Falls.

Some of these opportunities are shares in publicly traded companies, some are through private equity vehicles only available to high(er) net worth individuals, and then some are smaller in scale and open to individual investors.

Here’s one that I recently accessed through an old-fashioned banner ad as I was browsing online:

They’re “only” targeting an 8-12% return.

Womp Womp.

But what’s their plan? Simple:

I don’t know this company, nor have I looked into exactly what their offering is, so I won’t speak directly to this offering.

But what I will say is that there are all kinds of real estate funds like this one, and many of them are started by folks with slightly more investing experience than “Susan” and “Bradley.”

I’m consistently approached by people – often young men, right out of school, who have an idea.

What’s the idea?

“Collect money from, like, a lot of different investors, then buy real estate, manage it, and provide a return.”

No kidding?

It’s genius!

It’s not unlike this other idea that many people – often young men, right out of school, have also proposed to me many times over the years:

“Buy a property, fix it up, add some value, then sell it for more money.”

That’s genius too. And as a matter of fact, I’ll cover that in the next section.

But one of my expectations for 2025 is that we will see a lot of ways that investors can put money into the real estate market, and some of these ideas will be new, but many will be the same-old, same-old. New name, new colour scheme, and better advertising.

I’m not advocating for physical real estate over REITS, funds, and private equity, or vice versa. There is a “right” investment for everybody.

–

9) Property “Flipping”

Here’s something funny…

Just to see what would happen, I decided to Google “Is Flipping Dead In Canada?”

Guess what came up as the very first result?

You probably already know where this is going…

Yep, that’s a blog post that I wrote back in 2011! Perhaps my Google results will differ from yours, but I couldn’t help but chuckle when my thoughts and opinions from 14-years-ago were offered up to me.

Looking back with the benefit of hindsight, I can confidently say that flipping was not dead back in 2011.

That was before the double land-transfer tax.

That was before another five or six increases in both land transfer taxes.

That was before increased CMHC premiums.

That was before the cost of materials absolutely skyrocketed during the pandemic.

And that was before the cost of labour was jacked up as well.

But here we are in the year 2025 asking the question again: “Is property-flipping in Toronto dead?”

Dead in central Toronto? Dead in the GTA? Or dead in the entire country?

There will always be better and worse geographic pockets to try anything in real estate, but on the whole, I think that the days of property flipping in Toronto and Vancouver are all but gone, save for those who are truly experts in the field.

Sure, once upon a time, two know-nothings could purchase a house, install an IKEA kitchen, throw stick-down linoleum over the putrid bathroom tiles, add a coat of paint, and flip the house in the hotter market later that year.

But we’re coming out of our second year of a flat market with no automatic 8% appreciation rates that so many folks grew accustomed to. Interest rates are higher. There are more taxes associated with flipping and far more barriers to even attempting a flip, let alone coming out with a successful one.

Propery-flipping wasn’t a topic at the forefront of discussion here on TRB last year, but I believe it will in 2025.

There were notable articles in the media last year, of course.

Who could forget this one? Becasue I certainly couldn’t…

“An $845,000 Loss, Forced Home Sales: Is The Era Of The Pandemic Home Flipper Coming To An End?”

The Toronto Star

October 5th, 2024

From the article:

Nestled in an East York neighbourhood where single family homes line a suburban-looking street one sticks out like sore thumb. The once small one-bedroom bungalow is gone and in its place a cement foundation and wooden skeletal outline of a first floor that appears abandoned.

According to city and real estate records, the home was bought in August 2021 for $825,000, with the buyer receiving building permits the following year to tear it down and build a modern four-bedroom, five-bathroom property with a finished basement and garage. The buyer then sold the property in the spring of 2023 for almost $1 million, the project unfinished.

The new buyer continued with the project, but last month, it was put up for sale again for $999,000, this time as a power of sale, according to the listing history on property data site HouseSigma. The listing record shows it sold for $1.15 million on Sept. 12, but a week later it was relisted for less money, though that listing was quickly suspended.

This is just one example of a home flip gone wrong.

It’s a sexy story!

And whether you’re a real estate lover or hater, bear or bull, the “$845,000 loss” is fantastic click-bait!

But is that all this is? Clickbait?

Because one week after this article about “home flipping coming to an end,” the same newspaper offered this:

“How Home Flipping Is Pushing Up Toronto Housing Prices”

Toronto Star

October 11th, 2024

That’s odd, no?

One week, reporting on $845,000 losses and the “end” of home-flipping, then the very next week, reporting on home flipping “pushing prices up.”

Even more odd, perhaps, was seeing this article posted in the same newspaper five days later:

“Two Prolific Renovators Bought A Junction Semi And Sold It For Double The Price.”

Toronto Star

October 16th, 2024

From the article:

They bought the heavily water-damaged home for $950,000 and sold it for over $1.8 million

Well, geez!

Maybe the article about how “flipping is dead” was premature?

Or maybe it’s simply saved for the 1% of the wanna-be flippers who actually can make a profit. Because the way I see it, most of the people getting into the game are dreamers, amateurs, and eventually – regretful losers.

How about another example?

Let’s call this one, “The Reno Bros”

Grayson and Wyatt are two enterprising young men in their mid-20’s who, despite their ages, believe they have enough real-world experience and learned life experience to quit their unsatisfactory day jobs and head out to make “real money.”

Whether it was that seminar they attended that explained how to make money flipping real estate and investing in crypto-currency, or whether it was simply the realization that after three long, hard years working in a cubicle, there were “easier” ways to make money out there, they decided to try their hands at flipping properties.

Both Grayson and Wyatt are well-connected, social, and know a lot of people who work in and around construction, in various trades, in various industries, and they feel that while neither of them can actually swing a hammer themselves, they will have access to every person and every asset that they need to pull off this successful flip.

A friend of theirs who works in marketing but also has a real estate license has agreed to represent them on their purchase, but also provide them with half of the buyer agent’s commission back after closing. As a result, Grayson and Wyatt are essentially looking at properties with no representation, experience, or guidance.

The boys settle on an east-end property which they purchase for $900,000, thinking that they can flip this for $1,300,000 in only four months, and that the market will be “better” in the spring.

They purchase the property with only 7.5% down, or $67,500, not really understanding that the CMHC mortgage insurance of “only” $92.50 per month, needs to be paid back in full when they discharge the mortgage.

The land transfer tax on the property is $28,950, but thankfully, their friend gave them $11,250 in cash from the commission he earned by selling them the property.

The monthly mortgage payment on the house is just under $5,000, but the boys only plan to hold the house for four months during their renovation, so it’s not a big deal.

They borrowed $150,000 in cash for the renovation at 9% interest, which means a $1,500 per month interest-only payment, but again, they’re only holding this property for four months.

The renovation begins and everything goes to plan – at first.

But not long after, they start to notice that the quality of workmanship from their plumber, who is doing carpentry, isn’t what was promised. Their tile-guy isn’t as good at electrical work as they thought he would be, and when they opened up the walls, they found a lot of knob-and-tube wiring that they weren’t expecting.

There was also an asbestos-wrapped pipe and the attic had a significant amount of mold.

They don’t understand why their friend and part-time agent didn’t advise them on any of this.

Many of their materials are delayed, some are on back order, and some of the materials from the site go missing.

Between the mold and asbestos remediation, they’re out about $10,000 that they didn’t plan for, but they figure they can simply ask $10,000 more for the house.

In their second month, they have to consistently leave their respective gyms and yoga studios on a daily basis to come down to deal with problems at the site. It’s almost like this is a real job.

Workers are showing up late or not at all. Three-day jobs are taking two-weeks. And all the while, the trades offer to simply up-and-leave, but Grayson and Wyatt have no other options.

The four-month renovation takes seven months.

Instead of the property being ready for early-May, which Grayson and Wyatt figured would be “prime spring market,” they’re not finished until early-August.

The house isn’t nearly as nice as they thought it would be and they compromised on a lot of features, finishes, and materials in order to save money, but they figured, “You can’t lose money on a house in Toronto!”

Their friend who sold them the house lists it for them, but there’s just a sign on the lawn and no actual efforts to market the home.

They list the property for $1,299,000 and it’s absolute crickets.

They’re barely getting showings.

They figure that it’s probably because it’s the summer, and summer is slow, so they bide their time until the “busy fall market” begins.

They re-list again at $1,299,000, but after Labour Day, a massive flood of houses hits the market.

Again, they’re barely getting any showings.

By October, they’re starting to worry. They’ve held this house four months longer than expected, which is another $20,000 in mortgage payments, plus another $6,000 in interest on their construction loan.

In November, their agent tells them, “Let’s list at $999,000 and set an offer date. We’ll get to $1,300,000,” no problem.

But that doesn’t work.

So they re-list at $1,299,000 again, and by November, they’re approaching four months on the market.

December rolls around and they try listing at $899,900 with an offer date, but that doesn’t work.

Is there any chance of selling in the slow month of December?

They leave the listing up at $1,299,000 through Christmas because, “Why not?”

In January, they take stock of their situation.

They’ve been holding this property now for ten months.

They went over budget on their renovation and spent $190,000, including their $150,000 construction loan plus additional savings.

They’re out $17,700 for the difference between land transfer tax and what their friend/agent gave them back from his commission.

They’ve made ten mortgage payments of $5,000 each, or $50,000, but just under $41,000 of that is interest, and they’ve paid $15,000 in interest on their construction loan.

Their friend the part-time agent took a discounted 3.25% commission, so with HST on a $1,299,000 sale, that’s “only” $47,705, but they’re starting to wonder if maybe having a professional advise them and work on their behalf might have been worth it.

All told, their break-even on this house is $1,211,405.

So not all is lost, right?

Except, well, the house is an absolute piece of crap.

And as is the case with every one of these garbage flips, the boys hold the property through to July of that year and dump it for $1,120,000.

After owning the property for 16 months, the boys do the math:

$900,000 purchase

$190,000 renovation

$17,700 land transfer tax (net of agent commission rebate)

$3,000 lawyer’s fees

$65,600 in mortgage interest

$24,000 in construction loan interest

$41,132 in real estate fees

$3,000 lawyer’s fees

$1,242,432

Oh, snap!

The boys lost over $122,000.

Wait, wait, hold on, that’s not exactly right.

Because didn’t they conveniently forget that the $92.50 per month CMHC insurance premium was only part of the $33,300 total due over the course of their 30-year mortgage?

Yes. Yes they did.

So add another $31,820 to the total, and just to be completely accurate here, let’s add a mortgage break fee of three month’s interest, or $12,300 and…..

……drumroll please…..

The Reno Bros lost $168,552 on this house-flipping venture.

And now they have to fight Olivia Chow’s bill for the vacant home tax, since the property was empty for 16 months! 🙂

–

Again, tell me that this won’t happen to you.

Tell me that if you swapped out “Grayson & Wyatt” for the harder-working, scrappier, and more resourceful, “Anil & Kunal” who are just happy to have the opportunity, that the situation would be different.

But I’m not convinced that it would be.

Between land transfer tax, real estate fees, and legal fees, the flipper is already behind the eight-ball.

With the potential for municipal vacancy taxes, provincial and federal anti-flipping taxes, and the federal underused housing tax, the risk of loss becomes even greater.

And with the cost of labor and materials where it is, plus a high(er) interest rate environment, and a housing market that (gasp!) stopped appreciating 8-10% per year, I just don’t know if there’s money in house-flipping anymore.

Not for the 99% who try it, at least. Assuredly, there will always be room for the experts in any field.

–

Well, geez, that went by fast. Right?

Eight days, three blogs, nine topics on my real estate mind, and we got it done in just over…….13,000 words.

Brevity was never my strong suit.

But we’re actually listing properties this week and I’m excited to get back to the grind!

See you back here on Thursday and hopefully, we’ll have something from the market to discuss…

Your_Favorite_Tenant

at 11:18 am

Well, the good news for Grayson and Wyatt is they won’t be on the hook for anti-flipping taxes, cause they didn’t make a profit!

Marina

at 12:48 pm

I also think flippers with no experience risk spending money on things that don’t sell. Let’s say Grayson and Wyatt were much luckier with the financing side of things. But then they put in a crappy kitchen. And the shower was under a sloping roof so only short people can shower standing up. And the master bedroom has no closet. And the whole main floor is tiled in white marble that no normal person wants to clean. I’ve seen it way too often.

There is a new built in my area that has stayed unsold for 2 years. It’s really pretty from the outside, and they did put in very nice finishes. But it’s a $2.5M house (theoretically). And the main living space was designed by morons who broke up all the areas so the whole thing feels super poky. For the same price you can get a much nicer renovated old brick house that actually has flow and livable space. who’s paying 2.5 mil to live in a rat maze?

Izzy Bedibida

at 12:44 pm

I know what you mean. It’s even scarier that many of these flippers think they are “tradesmen” and end up creating what can best be described as a “Mike Holmes Training House” 🙂

Anwar

at 10:48 am

Here’s the problem: Grayson and Wyatt can’t do anything themselves because they’re rich, useless frat bros, so they will overpay somebody to do a good job because they know what quality looks like. They just can’t budget for that. Anil and Kunal can do the work themselves and will slave 18-hour workdays, paying with sweat equity. But they can’t see how poor quality their renovation is because in their minds, it’s way better than what people have back home.

Steve

at 7:16 pm

This was a terrific post. Mom & Pop should have bought RioCan !!

Still, we really do need flippers (professionals) to update all those older downtown homes!

KM Realty Group LLC

at 3:23 am

Enjoyed your insights! The 2025 market feels uncertain, but your take on buyer mindset and interest rates makes a lot of sense. Do you think first-time buyers will still have a fair shot in this kind of market?