That’s the truth of it: we’re just about to head into August, and you really can’t tell anything about the overall market by looking at one slow month in the summer.

Same goes for December, save for perhaps the first week to ten days.

But would anybody in their right mind sit down in the first week of January, analyze the December market statistics, and try to use them to predict what lays ahead in January and February?

December just isn’t your typical month in the real estate calendar, and by the same token, neither is August.

I sat down to film my Pick5 video on Wednesday afternoon, and as I searched by area with the MLS mapping tool, there wasn’t a single area in the city in which I could find five quality properties to feature, analyze, and discuss.

Listings are light right now, but that’s to be expected – it’s the summer.

And things are only going to get slower as we move through August.

This is the first time since the start of January that I’ve found myself without a single listing.

I had a listing up until this morning, but we’re taking it off the market. The listing is a detached house, over $2M, located north of the 401. So basically one of the toughest properties to sell in the city right now, and there is a lot of competition.

So rather than letting the property sit on the market all summer long, rotting, getting stale, and encouraging lowball bids, we figured we would “put some time in between listings,” as I always say, stop the “days on market” from racking up on MLS, and give the listing a refresh in the second week of September.

Not every seller has that luxury, of course. Some sellers are selling because they’ve just bought, and they need to sell.

Of course, not every agent has that luxury either. I’m doing what’s right for the seller in the long run, and I know the business is there down the line. Most listing agents would n-e-v-e-r terminate a listing before the contract is up, because they’re afraid of losing it. And dare I say, that like many buyers that use “hope” and “faith,” and are naive when they submit offers of the list price in competition, many listing agents just “hope” a buyer will come along to make an offer on their stale, over-priced listing in the slowest period of the year.

So what can we really learn from the next six weeks in the Toronto real estate market?

Not a whole heck of a lot, at least in terms of what to expect moving forward.

If you’re a buyer, well holy cow – get out there! New listings are scarce, yes. But in certain pockets (like the one I mentioned above), there’s a logjam of properties. And with August typically being a slow month, there just might be deals to be had, in certain market segments.

I’ll still most likely write a blog in the first week of August, analyzing the July-stats, and trying to draw conclusions. But as you saw last month, even I was willing to suggest that the stats, and what I was experiencing out in the market, didn’t always correspond.

We see this a lot in the media too.

Of course, that can be said of virtually any topic, or industry, or especially when it comes to politics.

Look down south and compare Fox News to CNN.

Now I’m not ignorant, so clearly I don’t watch or support Fox News. But as big of a fan of CNN as I am (not to mention free speech, humanity, common sense, and everything that goes in the opposite direction of Donald Trump), I will admit that even CNN goes too far in the other direction sometimes. It almost risks undermining their integrity, at times.

Here in Toronto, we have the Toronto Sun and the Toronto Star, which basically report the same story, with completely different facts and conclusions. The two newspapers could literally feature a photo of a bug on a windshield on their front covers, and one headline would read “Poor Bug Gets Squashed By Bad Driver,” and the other would read, “Hero Driver Takes Out Nuisance Bug.”

Like I said, we could play this game all day.

And when it comes to real estate, this theme is ever-present.

Take a look at these three headlines:

Now this set of headlines is tremendously ironic, because all of them are from BNN.

But right next to “housing market bottoming out,” we have “home prices set to fall further.”

And this isn’t even a case of The Star vs. The Sun – it’s the same media outlet!

Here’s one I saved from earlier in the month, when the June stats were released:

Global reports negativity – that sales in Canada are down to a 5-year-low, and down 10% since last year.

Financial Post reports positivity – that Toronto represents Canada’s biggest gain in home sales this year. Using Toronto to lead Canada is a bit of creative story-telling.

And last but not least, Globe & Mail tells us that a 10% drop is actually a plus.

If you’re a buyer or a seller out there, how the hell do you make sense of all this?

So try today’s headline on for size:

“Toronto, Vancouver housing markets still ‘highly vulnerable’: CMHC”

That was written in the Globe & Mail on Wednesday.

And if you read the article in full, you’ll see that even the CMHC doesn’t really know how to view the market, or even how to issue their own warnings, risk assessments, and outlooks.

From the article:

Despite slowing sales, CMHC chief economist Bob Dugan said the warnings about vulnerability have not been adjusted in Toronto and Vancouver because the agency needs long-term evidence that the market is changing.

“Prices can fluctuate and be up one quarter, down the next, and if every quarter we’re reacting to that and changing our message, it becomes a little more confusing what the overall assessment of the market might be,” he said.

CMHC’s assessment of risk in Toronto’s market has been unchanged since October, 2016, while Vancouver’s assessment has been unchanged since July, 2017.

–

So essentially, the CMHC is explaining that market “prices can fluctuate,” which is great, because all this time – I didn’t know that…

But they’re also telling us that they prefer to be behind the market, than in front of it. They like to make predictions based on what’s happened in the past, and they’re weary of altering those predictions for the future, until they have more past data.

Great.

All this time, I thought they had a crystal ball…

Better Dwelling also picked up the story:

“Canada’s National Housing Agency Thinks Canadian Real Estate Is Overvalued”

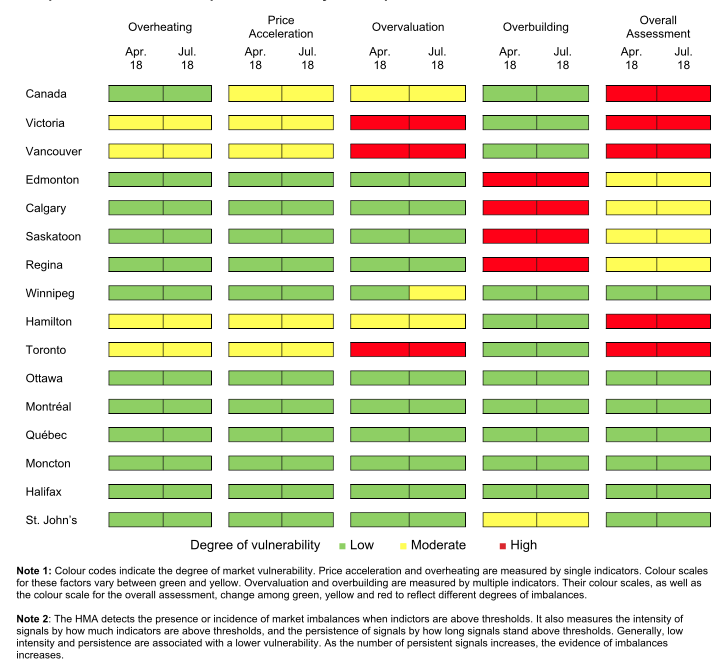

Take a look at the chart that dominated their article:

(Source: CMHC & Better Dwelling)

Yeah, well no kidding the CMHC don’t like changing their market outlooks!

There are eighty different assessments in that graph. Eight-zero.

And only ONE of them has been altered. Looks like Winnipeg is heating up!

So what then would you make of a headline like this:

“‘Market has bottomed out’: Housing prices in Toronto region set to climb again after brief slump”

Well, if you’re like me, you’re wondering

a) Who said this

b) Why

c) With what data

Was Albert Einstein’s great-great grandchild interviewed for this piece?

Maybe a few rocket-scientists?

At least an unbiased economist?

Nope. None of the above, but I’ll draw an analogy for you. Have you ever seen the owner of a restaurant outside on the street telling everybody “Don’t eat here, the food is awful”?

Well, by the same token, you’re probably not going to see the CEO of one of the largest real estate brokerages in Canada tell people, “The market is going to plummet. Stock up on bottled water, and stay inside.”

“Based on our analysis the market has bottomed out,” said Phil Soper, the CEO of Royal LePage.

–

Beautiful.

The best was the intro of the article, which made opinion sound like fact:

Housing prices in Greater Toronto Area are expected to reverse course in the second half of the year after a brief slump, according to a Royal LePage forecast, despite the threat of escalating Canada-U.S. trade tensions that could dent the Ontario economy.

–

Yikes.

Now to be fair, points b) and c) above were addressed, and that’s more than can be said with respect to a lot of predictions, and a lot of opinions. Your average random Internet-dweller loves to make opinions, but never back them up with data or facts. Of course on TRB, that rarely happens. Usually the readers provide so many links that the comments get flagged as spam! (PS if you’re ever wondering why your comment didn’t show up on the message board – that’s why).

So let’s look at what Mr. Soper said as to “why” prices are set to rebound:

Soper said recent headwinds for housing prices in the Toronto area will eventually be mopped up by the current under supply of new homes, as Ontario’s population continues to grow and in-migration levels reach their highest in more than 10 years. The province saw a net gain in migration over the first quarter of 2018, a nearly 50 per cent increase from the year earlier.

“We’re nowhere near the kind of housing construction rate that we need to accommodate these people,” he said.

–

Personally, I agree with him on that point.

The net migration in Toronto is likely 3-4 times new housing completions, and that’s a recipe for a massive housing shortage.

While we’re on that topic, here’s an excellent read:

“Toronto has lots of room to grow. It’s time to let that happen”

But perhaps that’s a topic for another day.

For a Friday in the middle of the summer, there are just too many thoughts happening in this one blog…

J

at 11:30 am

“Your average random Internet-dweller loves to make opinions, but never back them up with data or facts.”

“The net migration in Toronto is likely 3-4 times new housing completions”

I’d be interested in seeing data that backs this up. Statistics Canada’s data shows something different:

Census numbers show an increase in population for Toronto of 344,976 from 2011 to 2016 (or 1.2% growth per year). Average household size is 2.7, so this should correspond approximately to 127,769 net new households.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=535&Geo2=PR&Code2=35&Data=Count&SearchText=Caledon%20East&SearchType=Begins&SearchPR=01&B1=All

Housing completions in Toronto (census metropolitan area) totaled 173,752 from July, 2011 to June 2016 (I’ve chosen points in the middle of the year to align with the population data).

https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=3410014301

This suggests that net migration in Toronto is only 0.73x new housing completions, rather than 3-4x. Perhaps Statcan got it wrong or my analysis is incorrect, but it would be good to see the data source that contradicts this.

steve

at 12:19 pm

As the latest Globe article suggests, supply (and resulting high prices) is constrained due to planning policies which could be suddenly redrawn over-night. Not really very encouraging for people shelling out top dollar is some of today’s protected “Neighbourhoods” . Add to that the B20 legislation on top of interest rate creep and it’s not unlikely 2017 was the peak. Soon we may find ourselves in a sideways market at best. Condos have been hot due to lower prices, but even there signs are we are peaking.

I am not suggesting Toronto RE is a bad play, but constantly expecting higher and higher prices is an obviously foolish and irresponsible perspective.

J

at 12:25 pm

“Your average random Internet-dweller loves to make opinions, but never back them up with data or facts.”

“The net migration in Toronto is likely 3-4 times new housing completions”

I’d be interested in seeing data that backs this up. Statistics Canada’s data shows something different.

Census numbers show an increase in population for Toronto of 344,976 from 2011 to 2016 (or 1.2% growth per year). Average household size is 2.7, so this should correspond approximately to 127,769 net new households.

According to Statcan table 34-10-0143-01, housing completions in Toronto (census metropolitan area) totaled 173,752 from July, 2011 to June 2016 (I’ve chosen points in the middle of the year to align with the population data).

This suggests that net migration in Toronto is only 0.73x new housing completions, rather than 3-4x. Perhaps Statcan got it wrong or my analysis is incorrect, but it would be good to see the data source that contradicts this.

Craijiji

at 12:56 pm

It depends on how you want to skew your analysis.

For example, I took the average household size and applied those pro-rata against the 345k pop’n growth to get isolate the number of single dwelling homes required, when I do that I get 112k single dwelling homes and 87k multi-dwelling, so 199K homes total. Since there were 173k homes built, that leaves a shortage.

Housing Bear

at 5:39 pm

Huh? Must be missing something here. Why not just take the population growth and divide it by the average of 2.7?

Agree there would be a shortage of single free hold homes. Not enough room for everyone to have a home

Kyle

at 9:08 pm

Because the 2.7 average household size of Canada may not be representative of the average household size buying new units (which in Toronto are predominantly small condos).

J

at 12:31 am

The census data provides some clarity about this. There were 2,235,145 total private dwellings in the Toronto census metropolitan area in 2016 compared to 2,079,459 in 2011, for an increase of 155,686. So the ratio of net increase in number of households to housing completions seems to be 0.90.

Housing bear

at 2:41 am

I read that at as the 2.7 relates to Toronto specifically. If that’s Canada sure Toronto might be lower. Many couples do live in 1bdr condo (which I think is fine if you don’t have kids). In either case, the fact we are building more 1bdr condos then any other type of housing is probably reflective of a market deficiency, which could help to support prices in other areas, or torontonians don’t care about reproducing and we are just here for the one and done.

Chris

at 10:29 am

Average household size for the Toronto Census Subdivision (City of Toronto/416) is 2.4.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CSD&Code1=3520005&Geo2=PR&Code2=01&Data=Count&SearchText=toronto&SearchType=Begins&SearchPR=01&B1=All

They don’t have this data specific to households buying new units. Seems reasonable that, given most new units are smaller condos, household size would also be smaller for this subset of the population.

craijiji

at 7:56 am

Why not use 2.7? Because about 60% of households in Toronto have 1 person in them, not 2.7.

craijiji

at 12:57 pm

Still not 3-4x of course, which is probably a ridiculous assumption, but you could probably tweak the parameters enough to get it closer to 1.5x

Housing bear

at 5:36 pm

If you want to assume that every household needs to own two properties (primary and investment for example) that will get you your 3-4x shortage.

craijiji

at 8:11 am

That’s a bad assumption.

Jennifer

at 12:48 pm

I look forward to the day when we treat housing as housing, and not a place to park and/or make money (read: too much speculation). I’m not sure why agents/agencies care so much about being bearish or bullish. All they should care about is that there are transactions and right now they are SLIM. The land transfer tax and agent commissions as a result of the high house prices is really making people think twice about moving. Maybe if we lessened those there would be more supply?

Libertarian

at 2:44 pm

I prefer reading articles like the one you link to at the end than reading bull/bear articles analyzing the various stats.

It would be really interesting if the ideas in “Toronto has lots of room to grow. It’s time to let that happen” come to fruition. My favourite line was, “But replace two houses with a sixplex? Forget it.”

As Jennifer points out above, real estate is now about speculation, so the NIMBYs will prevent any sort of change cited in the article. It’s impossible to add housing and yet keep the status quo. So as long as everyone needs their house to remain expensive because that’s all of their net worth, nothing will change.

Appraiser

at 4:02 pm

Toronto is the ‘golden city on the lake’ for at least the next fifty – one-hundred -fifty years.

Along with the GTA, the Greater Golden Horseshoe and the expansive Quebec City – Windsor / Detroit Corridor, look out. The next century for southern Ontario will be epic.

Always think long-term when it comes to real estate – the big boys do.

Housing bear

at 5:54 pm

Maybe I have a bias for how great life in Canada is, so I will not challenge you on the first two paragraphs.

Last point; yes long term prices will be higher than they are today, just like at some point a loaf of bread will cost three times what it does today. The big boys however know when to cash out and lock in their profits. They also know when to take advantage of market conditions to get a great deal. Ever hear of the saying buy low and sell high. Concord bought most of the land for cityplace in 96 as an example (bottom of last market crash)

The myth of buying and holding for the long term no matter what or that over the long term you can’t lose was cooked up by the big boys so that the masses will provide the liquidity they need to get their profits out. While the masses are waiting 10-20 years for the investment to get back to even, the big boys have their money deployed in the next big thing.

Chris

at 10:39 am

Trying to predict where any market will go over the next century is also a ridiculous exercise.

One hundred years ago, people were probably predicting that the upcoming century would be epic for the German Empire and Kaiser Wilhelm II.

Carl

at 10:56 am

It is silly to make far-reaching conclusions on the basis of minute changes, a couple of percent up or down, of the price average. They are mostly statistical anomalies, caused by changes in the mix of housing types or a few outliers.

The real RE story this year is in the sales volumes. By the TREB MLS numbers for the first six months of 2018, the volume dropped more than 25% compared to 2017. If this holds up for the rest of 2018, the total will be less than in 2008.

No matter what your line of business, when the sales numbers drop by 25%, you’d better pay serious attention.