Alright, so when we say “detached” home, we’re not really referring to the house pictured above.

That’s just a *wee* bit different from what we’ve come to expect here in Toronto.

Last week, I provided an evaluation for a Cabbagetown home that was, according to both the previous listing and Public Records, “detached.” But if you saw it from the street, you’d scratch your head. This house was adjoined, or touching the house to the right, and there had to have been only 10-12 inches between this house and the house to its left.

“Detached” means many different things to many different people.

For some, it’s a status symbol.

For others, it’s a matter of functionality.

A semi-detached house shares a wall with the house next door. There’s a double-thick layer of brick that supports both houses. And in many cases, the foundations are adjoined as well.

So if a “detached” house is abutting or adjoining the house next door, and you honestly can’t tell whether it’s truly detached or semi-detached, do you still put a higher value on this house?

If a tree falls in the woods, and there’s nobody around to hear it, does it make a sound?

In the comments section of last Thursday’s blog, a reader asked how to explain the massive appreciation in condos, compared to the depreciation in detached houses.

I can explain the reason, as others did in response: supply and demand. And price. Yes, that too.

But before we have that debate, I first wanted to look at the numbers behind the argument.

For the nine thousandth time, I will say this: we can make numbers say whatever we want. I saw one such argument last week where a reader used the July detached figure up against the April, 2019 figure, to show that house prices have plummeted.

But is the one-month sample size of April 2019 enough? And since that is a “peak” month, and July is one of the three slowest months of the year in the detached housing market, along with August and December, is the argument valid, or are the numbers hand-picked?

I often use the Home Price Index as a better measure of where markets are, relative to where they’ve been, as it removes peaks and valleys, as well as seasonal differences.

So let me first demonstrate by charting the average Toronto (GTA) home price relative to the HPI.

Now having just made the above point, about seasonal differences, I’m going to use June instead of July, as the July average home price is depressed.

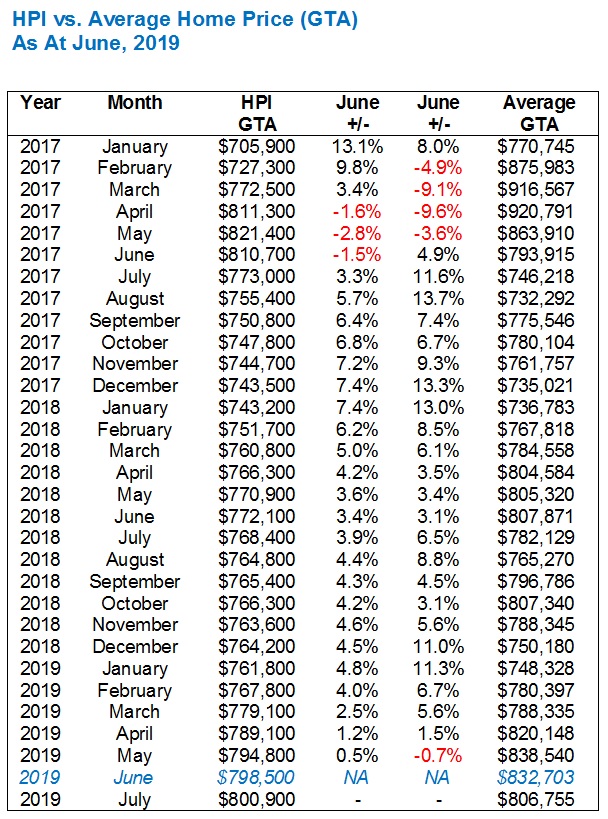

The following shows every month since the start of 2017, with a column for the increase/decrease from June of 2019, relative to that month:

As mentioned, I’m using the June numbers, but I’ve included July at the bottom to show how a “depressed” seasonal price looks. In case you’re not convinced about seasonal averages, look at December/January 2017-18 and 2018-19 as well.

So what we’re looking at here is the monthly price, both HPI and average, relative to June of 2019.

As we all know, the market “peaked,” at least statistically, in April of 2017 when the average home price hit $920,791.

The current $806,755 figure does nothing to convince anybody that our market is where it was in April of 2017, on paper, that is.

Because as we have noted, over and over, the market, for the most part, is “up.”

What is “up,” you ask? Well, it depends on the market segments, and geographic locations.

As a reader said on Friday, how can we explain the insane run-up in condo prices? But more on that later.

As for the difference between HPI and average, you can see that the current June, 2019 HPI is only down 2.8% from the peak in May of 2017, while the average price is down 9.6% from April of 2017. This is not my attempt to try to make any decline seem lower, but rather offer a more realistic look at the market, in my opinion.

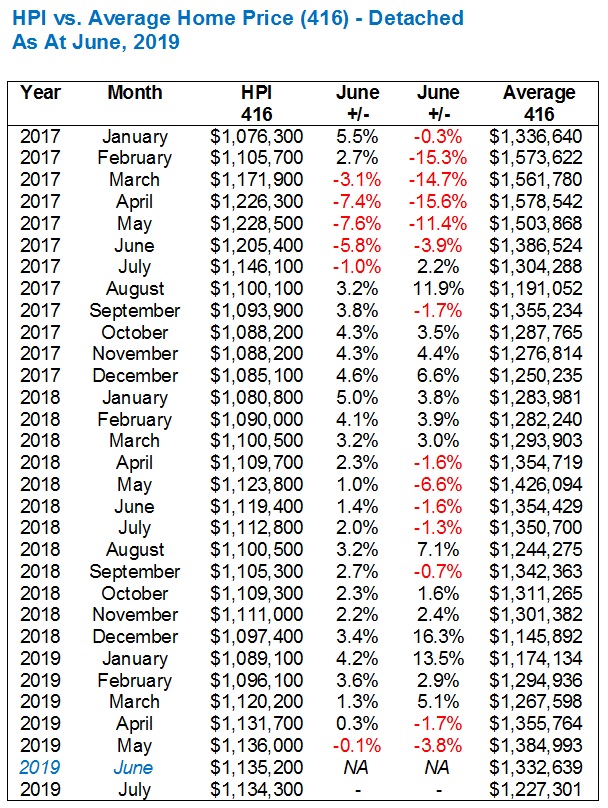

So when it comes to detached homes, how do the numbers look if we repeat them?

Well for this example, I’m going to go right to the 416 data, and not bother going GTA and then 416, to show that the GTA is worse off. Most of us are interested in the 416 (hot market in Scugog, notwithstanding), and the data is far more relevant for this discussion.

This is exactly what we would come to expect, given the chart above.

It seems to reason that the HPI for any property type would be less volatile, and thus the decline would be less steep, than for the overall average.

Now does this still mean that for any home buyer in April of 2017, that his or her house is worth 7.4% less today, than when they purchased? No, of course not. There are buyers in this city that would kill to pay April, 2017 prices for certain detached houses throughout the 416. But as mentioned previously, there are areas where prices are down, and some where prices are down even more than that.

I would also add that the accuracy of HPI vs. average is on display when we look at things like, for example, May of 2018. The HPI tells us that our recent June price is up modestly 2.3% over April of last year, when the average price would indicate a massive 6.6% drop! Does anybody really think that a detached home in the 416 is worth 6.6% less today than in May of last year? Probably not, and probably as unlikely as that house being worth 15.6% less than in April of 2017.

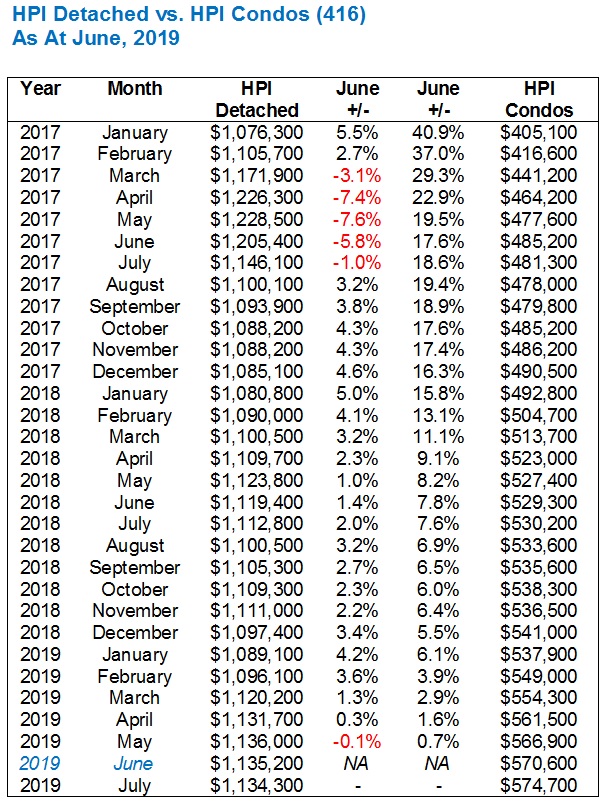

So now that we’ve established both how HPI vs. average displays better explains our market, as well as how detached homes have fallen, let’s plot our “detached HPI 416” versus our “condo HPI 416” and really drive home the point that so many readers have made:

Is this not the story of our current market?

Of all that’s going on in the Toronto real estate market, surely the incredible, unprecedented, and seemingly-unpredictable level of condo appreciation over the last 2 1/2 years is the tale worth telling, no?

When the market turned in 2017, condos kept moving.

And while certain market segments have been a slog, with peaks and valleys, ups and downs, the condo market has been absolutely resilient.

Imagine a 5.5% increase in the detached HPI since January of 2017, versus a 40.9% increase with respect to condos?

Tell me that January is an outlier month, as I have told you before. Then let’s look at, say, a “peak season” month like September.

The detached HPI is up a mere 3.8% since September of 2017, and yet condos are up 18.9%.

How, as several readers have asked, is this possible?

Is this about foreign buyers? No, it couldn’t be, since foreign buyers were scooping up just about everything, including both detached homes and downtown condos.

In my opinion, this is about affordability.

This is about the lowest rung on the ladder. The one that’s within reach of the highest number of would-be buyers, who are looking at the market on an absolute level, rather than a relative one.

Sure, maybe condo prices are up 50% in 3 years. But these buyers don’t care where the market was, they care where it is.

These are buyers that need a place to live, want to own, and either don’t notice, or choose not to notice, that condos are getting smaller and smaller, and prices are continuing to rise.

I had initially suggested that the cause of the disparity between appreciation in detached homes and appreciation in condos was mired in supply and demand, but consider that the equation becomes even more fascinating when you consider supply.

We know the demand is there. More and more buyers want entry-level real estate, and thus condos are the most targeted piece of real estate in the city.

But aren’t more and more condos being built? And isn’t the number of detached homes completely fixed?

Yes and yes.

So while more and more condos are being built, and the number of detached homes remains the same, the demand for entry-level real estate is still resulting in higher prices, which is just downright fascinating when you take both sides of the supply/demand equation into account.

If you had asked me, back in 2017, or even 2018 for that matter, whether a detached home was a better investment than a condo, I would have laughed in your face. In no world would a condo out-appreciate a detached home, I’d have told you.

But I was wrong. Dead wrong.

The numbers tell us that, no matter which numbers we choose to look at.

Francesca

at 7:52 am

The issue with condos appreciating faster than detached houses may explain in part why few seniors are willing to downsize further exacerbating the limited supply of detached houses on the market. There were several articles written about this predicament last week. When you look at the cost per sq foot of both resale and pre construction condos vs houses it seems to be so much higher for condos especially when you add in the added sq footage a basement gives you in a house . I find it unbelievable that a mere 100-200 sq feet can usually add $100-200k or more to the price of a condo when I doubt that would be the same for a house. We sometimes entertain the idea of selling our large detached suburban home to move somewhere more urban and central and when we look at prices of condos it makes absolutely no sense to us. My parents feel the same way about downsizing from their house into a condo so they have decided to stay put and move into a retirement home instead in a few years. Also don’t get me started on the exorbitantly high maintenance fees. We just came back from visiting my MIL in Vancouver and the maintenance fees there seem to be half the cost of condos here, possibly because of less amenities and less cost to heat and cool the buildings but the savings are definitely noticeable.

Professional Shanker

at 11:22 am

You raise a very interesting point here, I know numerous retirees who entertained the idea of moving to a condo but after looking at the price difference opted against it for the time being.

The idea is I will sell my suburban detached and get a cheaper urban condo (2 bed) with access to transit. After doing the math, they realize how expensive larger size Toronto condos are and the money they would have crystallized isn’t as enticing as initially dreamt of, so they defer the decision or look elsewhere for a condo.

These anecdotal stories don’t seem to be affecting condo prices in the least in the 416…..reason: spec investors!

Izzy Bedibida

at 2:39 pm

My widowed mom is in the exact same position. The condo fees on a proper family sized unit will more than cover the cost of a handyman/gardener on her current house. Plus her costs remain fixed, she has her garden, she’s in the neighborhood, and her young grandchildren can come for extended summer visits.

She’ll go straight to a retirement home as well like Francesca’s parents. it makes sense.

Kramer

at 11:47 am

Plus you avoid, or at least delay, significant agent fees + land transfer taxes that would occur upon downsizing.

FreeMoney

at 2:21 pm

I know of (and am hearing about) more and more boomer couples in Toronto who have abandoned their plan to downsize but stay within the GTA, if not Toronto proper, because of the shrinking price difference between houses and condos.

One alternative many of them are seriously considering is to take out a HELOC and use it to supplement their income in retirement, with no intention of paying one red cent against the principal until they have to move to a retirement home and/or pass away. In other words, the HELOC balance will grow to perhaps a couple hundred thousand dollars, which they (justifiably IMHO) figure will be far below the value of their house in ten, twenty or thirty years from now. One would assume that those without kids are the most likely to pursue this option.

But of course the chattering classes (primarily financial columnists) will throw up their hands in horror at this “risky, irresponsible, foolhardy and downright dangerous!” strategy which, to me, makes perfect sense for a large subset of our retirees and near-retirees. As one-half of a childless boomer couple living in the core of Toronto (Broadview & Danforth) I’m increasingly inclined to investigate this retirement strategy, damn the doomsayers.

Izzy Bedibida

at 3:17 pm

Its a perfect plan if you hate your kids, and want to leave them nothing 🙂

FreeMoney

at 3:23 pm

No kids, no problem!

Kyle

at 7:52 pm

Maybe not for everyone, but if i were an empty-nester boomer looking to monetize my asset, i’d rent out my basement before i tried living off of a HELOC.

You get to keep your home equity intact and with today’s rents you can pretty much cover most if not all of the monthly cost of your home.

Kramer

at 9:58 am

That would be the best option. You’re not shedding big dollars away to banks, real estate agents, government, lawyers. Rather you’re generating income and maybe even growing your balance sheet/net worth. How novel.

My parents should be out of their house, but the mere chance that they would sell/move into a condo for as little as 2-3 years before being forced to sell/move into a retirement home/hospital/graveyard makes it a non-starter in their eyes.

Absorbing the cost of two sales and one buy over a short period of time, translating into a “cost of living per year” of ridiculous proportions… they simply will not consider it. I quote “We’re staying in this house until we are forced to move (medically).”

They’re not staying out of nostalgia. It’s financial. They will not risk pissing away $100,000 in fees/taxes over 2-3 years. They will not even risk setting it as an example to my siblings and I… That the family’s lifelong earned and grown equity/net worth is so easily expendable for short-term change.

I am certain this is a common perspective among Seniors these days. Cost of moving is so high, and as previously stated, the gap between larger condos and houses is shrinking. All things considered, I am not surprised for a second that older folks are more likely to stay put these days.

Marina

at 10:35 am

Detached prices have reached a critical point where fewer people can afford them. Condos are the only possibility for most people. Hence the appreciation disparity.

From a value perspective condos are insane, but if it’s all you can afford then value is moot.

Professional Shanker

at 11:23 am

The introduction of B-20 goosed condo prices and the slow and/or immediate withdrawal of B-20 in the future will be a large headwind for condo prices.

Kyle

at 1:32 pm

One minute you guys say B20 is a retardant, next you’re saying it’s an accelerant. Sorry but it can’t be both.

Professional Shanker

at 3:15 pm

B20 altered the price point at which market participants were able to transact……depends on which end of the spectrum people were buying and selling as to whether it was an retardant or accelerants….but you already knew that.

Kyle

at 3:39 pm

That’s not the way math works. B20 effectively made ALL property types less affordable. It’s like taking the property ladder and pushing each buyer down a couple of rungs, and the buyers on the lowest rungs drop right off the ladder.

Said differently, if say the top 15% of household incomes could afford a property before B20, then only the top 10% could afford one after.

If you take B20 away, all property types will become more affordable and all those that got knocked off the ladder get to climb back on. And if you understand the bell-like shape of a normal distribution curve, you will actually understand that the number of people that get to climb back on the ladder (i.e. the portion closer to the mean and further from the tail) who can now afford condos is far larger than the portion you expect to now afford SFH instead of condos.

Kyle

at 3:48 pm

If you think taking away B20 will make condos cheaper, you definitely don’t get how math or economics work.

If you want to know what was actually goosed by B20 and what will actually get relief from taking away B20, it’s Toronto’s rental rates.

Professional Shanker

at 12:34 pm

This is an interesting observation you have provided, it very well could be valid. Although what I question/am not sure of, is where the stress test lies within the distribution of the data set post B20.

I believe you might be overestimating the size of the lower portion of the curve that the removal of the stress test will impact (GTA specific).

If prices at the lower end (condos) have increased by 20% since the implementation of the stress test than the removal of the stress test which reduced purchasing power by 20% (amount which was referenced numerous times), will provide no incremental increase in buyers as they would be no better off from an affordability standpoint (pre and post B20).

Removal of the stress test would impact existing owners and push them up the ladder to higher prices segments of the market (condo to semi, semi to detached) which have become relatively speaking slightly more affordable.

Implementation of B20 did increase rental rates, no argument there.

Kyle

at 3:13 pm

“If prices at the lower end (condos) have increased by 20% since the implementation of the stress test than the removal of the stress test which reduced purchasing power by 20% (amount which was referenced numerous times), will provide no incremental increase in buyers as they would be no better off from an affordability standpoint (pre and post B20).”

The income distribution and the population within it changes constantly.

So it doesn’t matter what the shape/size the curve was when they put in B20. What matters is right now the current income distribution shape/size supports right now’s condo prices, so removing B20, with right now’s curve, will result in a lift from right now’s condo prices.

Professional Shanker

at 10:11 am

The income distribution has not changed significantly in 2018 and 2019, wage growth shows this. Immigration continues yes, without actual data this conversation goes no where.

The only way we are able to test our theories is with a conservative win in the fall, not very likely according to polls.

B-20 will be removed during the next recession and a host of other factors will mask the removal.

Kyle

at 1:43 pm

It’s not the income distribution per se that is changing it is the number of households that that distribution represents. That has changed and that number is increasing. Every time a millenial moves out of their parents home, every time some household moves to Toronto that number increases.

And that is what is actually goosing condo prices. B20 is and always will be a retardant, it was never ever an accelerant. The reason condo prices grew and continue to grow, is that the number of new households being formed (or that are switching from renting to owning) are growing. In the absence of B20, condo prices would have been much much higher. Where it not for B20, many of those households stuck in the current rental crisis would have also joined the ranks of condo buyers.

June

at 12:58 pm

I’ve got nothing to add here except a thank you! Thanks for spending the time on this data which I don’t think i could find anywhere else! ????

hoob

at 12:40 pm

There’s not necessarily a brick wall between the two. Many houses in the original Toronto era of expansion (1910-1930) still just have a wood demising wall.

In my (half) house it is a central load bearing balloon framing style 2×4 wall. I dream of a brick wall. But Roxul SnS + double wall board helps a lot with the noise.

Jimbo

at 12:51 pm

I agree with the mantra that just because an AVG price is 10% lower than April 2017 doesn’t mean that today you are getting a place 10% cheaper than one that was sold in April 2017.

I also think just because a house cost 10% more than last month doesn’t mean I’m going to be paying 10% more for a house.

Vancouver looks to be going against the mantra as houses bought in 2017 are selling for $150k-300k less than bought in 2017. I always thought Toronto lagged Vancouver in its peaks and valleys I just don’t think Toronto will follow that pattern.

Just a thought

at 3:28 pm

Has anyone considered the reason behind the AVG price is 10% lower than April 2017 is because the top end of the market isn’t moving. Dave might want to compare sales by price category rather than average price across the board.

Kyle

at 3:07 pm

Marina and Izzy are bang on. Boomers aren’t downsizing, in fact it’s the opposite a CMHC report released recently shows the proportion of homes owned in Toronto by Seniors has grown by 4.5% to a quarter of all homes.

https://www.bnnbloomberg.ca/rich-aging-boomers-poised-to-keep-millennials-out-of-housing-1.1299035

According to other reports, don’t expect Baby Boomers to start downsizing in a meaningful way for another 20 years.

https://globalnews.ca/news/5345954/boomers-not-downsizing/

All this while half of Toronto’s millenials are still living with their parents and entering their prime home buying years.

https://www.huffingtonpost.ca/2017/08/02/canadas-young-adults-living-with-parents-longer-as-housing-pric_a_23061702/

Don’t expect Toronto real estate prices to fall anytime soon.

crazyegg

at 3:36 pm

Hi All,

People continue to pour into the GTA in droves. This includes current Canadians from other regions coupled with new immigrants and international students.

This creates stress on housing in the short term, especially on rentals.

As an investor, I continue to preach buying midrise new construction condos under 500SF that are just outside the downtown core, with a locker but no parking spot. These typically provide the best relative appreciation.

Regards,

ed…

Appraiser

at 11:40 am

“Does anybody really think that a detached home in the 416 is worth 6.6% less today than in May of last year? ”

~David Fleming

Answer: Not this appraiser.

Once again great number-crunching.