“It feels like 2017 out there.”

I must have said that a hundred times in January.

And trust me when I say that I was hearing this said to me, just as often as I was the one saying it.

At the risk of repeating myself from the last few Pick5 videos, and my eNewsletter from last week, this past month of January had tight market conditions that were only rivaled by January of 2017, when all hell broke loose.

Every agent that I spoke to, whether on the buy-side or the sell-side, felt the same way.

Inventory was tight, offers were through the roof, and so too were prices.

You might have read my blog from two weeks ago, titled: “The 1-Bedroom Condo Market Is On Fire!”

Things have only gotten worse, or better, depending on your viewpoint, since then.

The condo market started 2020 with a roar, and the housing market was slow to develop. But this wasn’t for lack of interest, but rather lack of listings. Since I wrote about the 1-bedroom condo market, the freehold market has absolutely exploded.

Step into a house that you feel “should” be worth $950,000, and prepare yourself to bid $1,000,000.

How do you feel when it sells for almost $1.1 Million?

That is how 2017 felt, and it started right away; right out of the gates.

As we know, the pressure built, and prices rose through April, until the Liberal government stood in front of a podium and told the public they were going to cool the market. Come May, inventory skyrocketed, demand dropped, and prices came back down.

I believe, anecdotally, that prices in some market segments rose 25% from January 1st of 2017 to end-April. Prices dropped, but have since recovered, and been surpassed in just about every market segment in the 416.

So does 2020 resemble 2017?

And if so, what can we expect to happen from February onward?

Let me answer the second question first, since it’s probably easier, although some of you might not agree with my answer. I believe that short of the government making a similar announcement as they did in 2017, this market will continue it’s trend. I don’t believe that, if we have four months of rapid appreciation, that we’ll see that appreciation continue thereafter. Not to the same extent, at least. But I don’t believe we’re going to see true “relief” in the market in spring or summer.

As for the question of how January looks in the rear-view mirror, and whether it resembled 2017 in practice as well as in the data, I have to really look at the numbers to draw that conclusion.

Before I get to the numbers (and I have yet to make a conclusion on this – I’m basically blogging and deciding in real-time), I will say this: January of 2020 was the tightest, and at times, the toughest, market I have worked in, outside of Jan/Feb/Mar/Apr of 2017. It just “felt” like 2017.

But do the numbers support that?

There have been times before when the numbers didn’t align with my “feel,” let’s not forget.

So first, let’s look at prices.

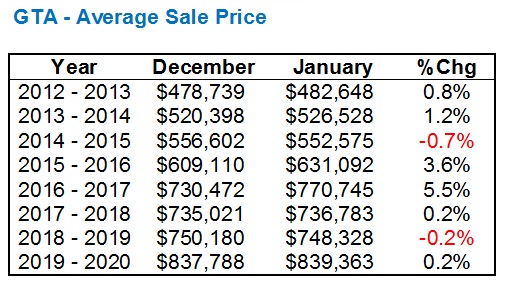

The average sale price in Toronto (GTA) in January was $839,363. This actually surpassed December. So my first question would be, “How often does the January price surpass that of December?”

Here’s the answer:

It seems that the average sale price has increased from December to January in 5 of the previous 7 years.

So this is much ado about nothing.

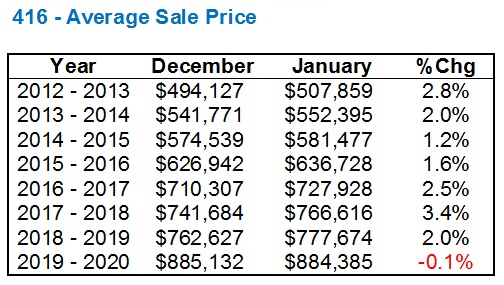

As for the 416?

Interesting!

Even though 0.1% is a rounding error, it’s still an outlier – even at 0%.

So is it possible that we’re experiencing 2017-like conditions in January, when the 416 average home price barely moved from December, which it always does?

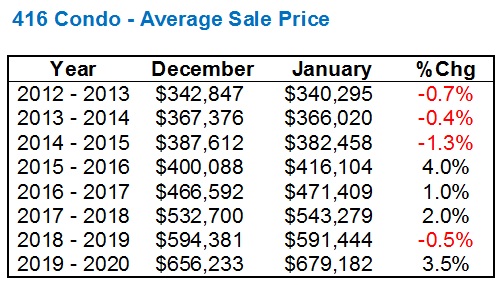

The condo market told a different story:

This makes sense.

The average condo price rose 3.5%, month-over-month, from December. This is an average, of course. But it backs up how the condo market felt out there.

It’s interesting that in 2017, the average condo price was only up 1.0% in the same period. But in 2017, it was freehold that led out of the gates to start the year. Condos actually followed.

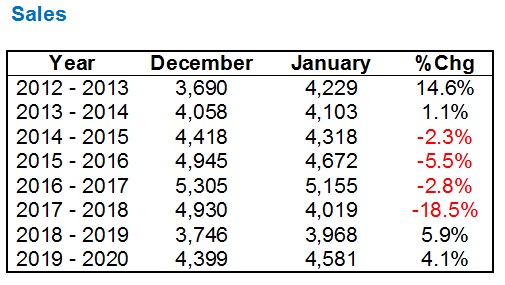

Sales were up 4.1%, month-over-month, which is somewhat in line with last year, but not at all in line with the previous years:

The month-over-month data can only take us so far, which is why, when we’re finished this, we’ll look at year-over-year.

Trying to determine whether it’s common or uncommon to see more sales in January than in December is difficult.

This has been the case in the past two years, but before that, we saw December trump January in four straight years. To be fair, we know that sales in January of 2018 dropped off significantly because of the up-and-down year of 2017, but that figure would still be red regardless.

From the sales data, the only conclusion that I’ve drawn is that I can draw no conclusion.

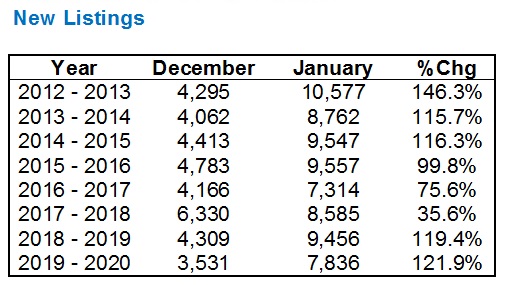

Looking at new listings, we see that 2020 is in line with 2019 perfectly:

Listings should rise in January, over December.

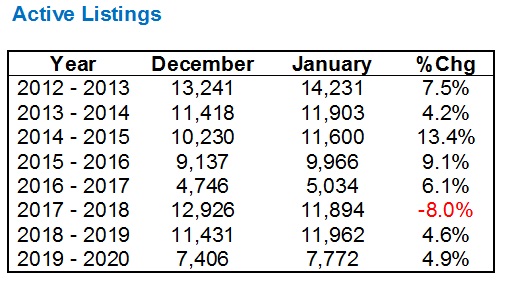

When it comes to active listings, again, I would maintain that this data is not really telling us much:

The month-over-month data sort of fizzles out as we get into listings, and so far, the only thing the data tells us is that the condo market rose significantly to start 2020, but all the other data is somewhat in line with expectations.

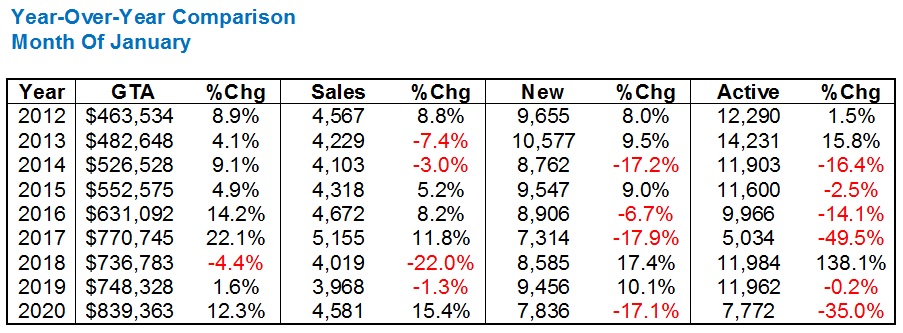

So what did the January 2020 data show us, year-over-year?

This:

Price (GTA): +12.3%

Price (416): +13.7%

Sales: +15.4%

New Listings: -17.1%

Active Listings -35.0%

Perhaps we could have started with this data, but I didn’t want to paint this picture right after talking about how hot the market is. First, I wanted to compare December to January, and look at how previous years can tell us whether the market is in line or not.

Now, looking at January of 2020 compared to January of 2019, we can see where our current market is.

Prices are up double-digits in the GTA, and when we hone in on the 416, it’s even higher.

Sales are up 15.4% year-over-year, and that’s amazing considering inventory is down.

It doesn’t take a rocket scientist to determine that if sales are up, and inventory is down, then prices will rise as well.

With simply more demand, and the same amount of supply, prices would rise.

But with more demand and less supply, well, a 12.3% increase in the average home price is no surprise.

So let’s look at the year-over-year data for all the months of January in recent memory, just as refresher:

Now this, I find quite interesting.

I remember all of these periods and why certain stats stand out.

For example, the RED average home price in January of 2018 was merely because of how hot 2017 was.

Same goes for that +138.1% blight on the active listings column in 2018, and the -22.0% figure for sales in 2018.

These were all a by-product of the crazy 2017 spring market.

So what then can we conclude about how January of 2020 compares with January of 2017?

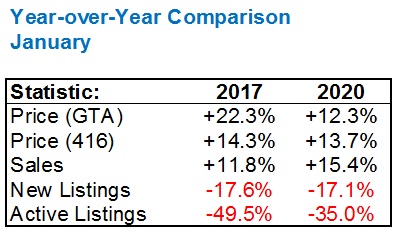

Well, I will present you with this:

While the month-over-month data didn’t make the market seem like it was all that hot, this comparison of January of 2020 and January of 2017 sure does!

The figures line up almost perfectly.

The average home price in January of 2017, in the GTA, saw a far higher increase over the previous year, just as the active listings saw a much more dramatic drop. But save for those two figures, aren’t these numbers telling you that this past January did, in fact, feel like 2017?

This data, I do believe, is undeniable.

And if the first week of February is any indication, this is going to continue.

Last week, I lost two bids on houses that both had twenty offers or more.

I asked a colleague how many offers he had on his cookie-cutter, 1-bedroom condo listing and he said, “Only ten.”

Only ten.

If that two-word sentence doesn’t sum up 2020 so far, I don’t know what does…

Appraiser

at 8:04 am

Demand will continue to overwhelm supply, until such time as there is more supply.

Professional Shanker

at 8:29 am

Certain 416 buyers do not believe we will see increased supply in the spring!

Professional Shanker

at 8:26 am

From what I am seeing, hearing and smelling the 416 market is hot as ever, some of the sold prices in the affordable pocket (1 to 1.5m) for Toronto professionals are comical, congrats to the people who are selling their moderately renovated semi!

A key question is are these people selling out or are they moving up, not sure of the price movement of detached?

2016/2017 spring – marked the rise of the amateur specuflipper in the 905 detached market.

2019/2020 – I have no doubt this marks the rise of the amateur investor class in 416 condos.

Appraiser

at 8:53 am

TRREB data for January: Can you say move-up buyer ?

Detached home sales up +23% !

Detached prices up +17% (in 416) +11% (GTA)

You’re going to have to try to smell harder.

Francesca

at 10:09 am

Looks like some people are moving out of Toronto entirely according to this article in Globe and Mail

https://www.theglobeandmail.com/real-estate/toronto/article-rise-in-toronto-home-prices-has-downsizers-and-young-families-hitting/

Also Toronto Life seems to be featuring a weekly article of people not necessarily cashing out but of moving out of TO entirely for the high real estate prices

https://torontolife.com/real-estate/gabriel-wanted-quiet-street-where-he-could-play-hockey-beatrice-wanted-a-bigger-bedroom-why-this-family-ditched-toronto-to-build-a-life-in-kingston/

I live in Markham and can attest that even here things are picking up all of a sudden after two very bad and slow years in real estate. I have a friend who is a realtor who sold a detached house two weeks ago in 2 days with several offers as she told me there is absolutely no inventory here either. There is a house behind me that was bought at the peak of the market in 2017 and rented out. They have tried to sell it at least 4 times since then and just last week they finally sold it. This is telling me that perhaps even in the 905 things are finally starting to change and that bidding wars may start to happen again like they were common between 2016-17 if supply doesn’t pick up. There is a ton of new construction still happening to meet demand but the builder prices are astronomical in comparison to resale which is another reason I can see prices for resale homes going up.

Appraiser

at 4:09 pm

As always people are moving in and out of the city.

The net migration in to Toronto however, is massive.

Kyle

at 9:15 pm

@ Francesca

Toronto’s intraprovincial migration is negative and worsening only slightly in the last few years, but overall the negative intraprovincial migration is far outweighed by positive international and interprovincial migration. In fact on a net basis only 2003 showed Toronto’s population actually shrink. You can see the trends here:

https://twitter.com/idragovic26/status/1224752989149319171/photo/1

Appraiser

at 8:54 am

Great link Kyle.

crazyegg

at 3:15 pm

Hi Kyle,

Great data indeed.

Here is the complete datafile:

https://www.toronto.ca/wp-content/uploads/2019/04/8ed4-City-Population-Growth-by-Component-02-18-Mar-28-2018-AODA.xlsx

Note that outside of the the “City of Toronto” (the rest of Toronto) immigration actually downticked but the interesting metric here is that more folks here are leaving the province.

But the highlight for me is that there are 2x the number of net new immigrants coming into the City of Toronto vs the rest of Toronto.

Downtown living is the hub for growth. Not a surprise.

Regards,

ed…

Kyle

at 8:18 pm

@ crazyegg

Thanks for the complete data set and good observations.

I think a lot of major cities have gone through something similar. Young people tend to be attracted to large cities from outside (international, and interprovincial) due to job opportunities and lifestyle. As they get older, start families and need more room, some decide to leave the City (intraprovincial), and if they’re looking for better RE value, moving to the 905’s isn’t really that much better a proposition once you factor in time and commuting costs, you may as well go to the 519 or 705’s.

Bal

at 11:54 am

I think FOMO and speculator are pushing the price… I noticed almost every other house after selling…coming in the market for rental…so I think demand is some what artificial……

Appraiser

at 4:10 pm

Data please.

Bal

at 10:10 am

My data is my neighbourhood…i see this happening around me

Craijiji

at 4:18 pm

Ya, this is nonsense.

Bal

at 10:10 am

May be nonsense for you….but I say what I see

Julia

at 9:57 pm

Similar situation is happening in my area ( Avenue and Eglinton) – again, this is based on observation only but I am surprised by how many houses are being bought only to be rented out….

daniel b

at 10:23 am

my anecdotal impression of spring 2017, specifically in old Toronto, is that the huge run up of 2016 had spurred a bunch of sellers to list their properties and that there was a noticeable uptick in supply in the spring which combined with the policy changes to let the air out of the market. In our neighbourhood just a few houses were listed in the summer and fall of 2016 and sold for eye popping numbers. A bunch of owners saw those numbers and decided they were willing to sell at those prices, and started prepping to list (i.e. doing touch up renos, lining up their moves, etc) but didn’t bring their houses to market till spring. Curious to see if the recent madness inspired a new wave of sellers who are in the process of prepping to list in the spring.

condodweller

at 4:07 pm

I believe the 2017 run up definitely enticed people to cash out. Even if prices surpass those numbers, if one was thinking about selling anyway it was a good time to sell.

I was following several buildings downtown and in some buildings it was rare for a one bedroom listing to come up and I couldn’t believe it when a new one was listed practically on a weekly basis in one of them. In another one a couple sold while there had been virtually no 1 bed listings all year.

Libertarian

at 11:00 am

David….any plans on writing about this?

https://www.hgtv.ca/shows/hot-market/

Apparently, it’s Toronto’s version of Million Dollar Listing. I did not watch the first episode.

Were you asked to be on it? Everybody on here knows that’s right up your alley. Hahaha!

David Fleming

at 12:29 pm

@ Libertarian

I hadn’t heard of it. Although I only watch sports, news, and Netflix (with the wife). Actually, that’s a lie, sometimes I watch “Forged In Fire” which is one of those silly formula-shows, basically the same as the baking challenges that I make fun of my wife for watching, except these guys make knives and swords.

I wrote about this on my blog years ago, but back in 2012-2013, I did a pilot for an HGTV show that would be modelled after Toronto Realty Blog, called “The Last Honest Realtor.” I signed a 5-year contract. 13 episodes per year. It was supposed to debut in the fall of 2013, but they pushed it back, then decided they wanted to come up with a “new concept.” That was the greatest thing that ever happened to me. That show would have ruined my career, although I didn’t know it at the time. I thought that 13 episodes would provide me with 13 listings, and from there, I’d end up with a slew of clients. Each episode was going to be a 5-day committment; 60 hours. Speaking to people in the industry a year later, they laughed. They said each episode would indeed take 60 hours, then re-shoots, then voice-overs, etc. etc. They said to triple the estimated committment. There was no way I’d have had a real estate career if I was trying to have a TV career. When I wrote about this on my blog, a few readers said I had sour grapes, and that to pooh-poo the idea AFTER my pilot wasn’t picked up, was in poor taste. That’s one way of looking at it. But every day I wake up, I thank Gawd that I didn’t go that route. Just my two cents.

condodweller

at 3:59 pm

Thanks for the link, I hadn’t heard of this one yet either. David, you are probably right. I’m not surprised your show was cancelled as people don’t want honesty but drama and conflict on these shows. It’s entertainment after all. I wouldn’t be shocked if those guys on million dollar listing who “hate” each other and fight all the time are best buddies.

Wait, are you saying these people don’t get paid to be on the show that you have to count on extra exposure to gain extra business to get paid? I just looked at the trailer and is it really necessary for top agents to be driving Porsches and Ferraris? Isn’t that type of in your face wealth a turn off even for those shopping in the multi million market?

Chrystal

at 6:19 pm

I used one of these realtors about 4 years ago to purchase an investment property in the King West area. At the time I was just getting my feet wet in the market and still felt like I knew much more about what was going on then she did. I saw her in one of the ads for the show and was shocked that she was now considered a top agent because I did not use her again. I’ve watched the first episode and can definitely say this show is more fluff than educational in any way.

David Fleming

at 9:02 am

@ condodweller & Chrystal

My contract in 2013 was for $13,500 per episode, with escalators, performance bonuses, etc.

I have no doubt these people get paid, but there are five of them. The pot is split.

At the risk of running afoul of RECO and their rules, let me channer my inner Donald Trump and say, “People might say – these aren’t top agents. I’m not saying that, but people might say that.” I would add to The Donald’s comment that top agents don’t have time to film TV shows, nor does it make financial sense. This is the tragic lesson I avoided learning in 2013.

As for the people on the show, maybe they don’t want to sell real estate. Maybe they prefer acting. To each, their own. One day down the line, they’ll be able to show their kids, and say they were on a TV show. I don’t think this is about real estate for these people; it’s about acting.

Not Harold

at 2:17 pm

For the New York version check out Ryan Serhant.

He has a Youtube channel, a book, speaking events…

He also has a team of people (agents and staff) working for him.

Then take a look at the pace of their sales. It’s definitely not the insane whirlwind of Toronto $1.5 to $3.5 Million detached listings that have offer dates 8-9 days after listing and frequently get bullied off the market within 2 days.

They’re doing listings in the 10+++ range you need global eyeballs, not just the local MLS, and you need buyers who aren’t buying.

The Canadian version is sad, just like the Canadian editions of Bachelor, Real Housewives, etc. The real way to make $$$ in reality television in Canada is to get recruited to be on an American show. The Canadian girls on the US Bachelor know this, as do Kevin O’Leary and Rob Herjavec.

As to cars.. it all depends on the level of houses you’re selling. Not that a customer is going to see a broker’s Ferrari up close, since hardly any of them have usable backseats. Several brokers in Toronto are well known to have a Rolls and it hasn’t cratered their business.

There could be problems in the $1-2Million range but at $5 Million and up hardly anyone is going to care. It doesn’t take too many $5 Million sales to pay for a car in cash, and brokers are notorious for leasing, which makes cars that much more accessible.

Appraiser

at 8:00 am

Serhant is a washed up former soap opera actor who’s daddy is a multi-milllionaire and Vice Chairman of State Street Global Advisors. Hardly a self-made man in any way. Sort of like Trump.

What’s really sad is that you watch any of the shows that you’ve described above and are able to critique them. Yikes!

Libertarian

at 4:05 pm

I hadn’t heard of it either. My wife watches a lot of HGTV, but I didn’t see any publicity for it. Plus, it airs at 11:00 p.m., which isn’t a normal time slot for new episodes of any show.

I remember your post about that show. I totally understand why you’re glad that show didn’t happen.

Mxyzptlk

at 12:51 pm

@Appraiser

Yes, but “he has a Youtube channel”!!! What more do you want???

J

at 11:08 am

“Sales: +15.4%”

The methodology that TRREB uses when comparing sales is problematic, and should offend anyone with even a modicum of respect for statistics. In figures such as the one above they are comparing the latest unadjusted sales to previous sales that have been adjusted due to sales falling through, etc. Therefore it is an apples plus oranges to apples comparison. This results in a perpetually over-stated sales increase, month after month, and these figures are frequently parroted by the media.

Specifically in TRREB’s latest Market Watch report, they report the unadjusted figure of 4,581 sales in January, 2020 and compare this with the adjusted figure of 3,968 from January 2019:

http://www.trebhome.com/files/market-stats/market-watch/mw2001.pdf

Compare that to the unadjusted figure of 4,009 sales in January, 2019 reported by TRREB one year ago:

http://www.trebhome.com/files/market-stats/market-watch/mw1901.pdf

In this instance the impact isn’t huge (a decrease of only 1% in overall sales) but it is more significant when looking at a delta in sales. This also casts a foul stench over the rest of their data and analysis, raising questions about what else might be off.

Appraiser

at 4:18 pm

Many highly respected statistical projections and data are continuously revised. Including Statistics Canada and the the U.S based Bureau of Economic Analysis.

Ben Rabidoux used to beat this dead horse about TRREB stats for years. Even he gave up.

Delta that.

J

at 4:32 pm

My point isn’t that data shouldn’t be revised. Of course it can be and should be – you can’t predict how many future deals will fall through.

The unsavoury aspect of TREBB’s analysis that I’m referring to is that they are always comparing revised data with unrevised data. And the revision of the sales data in this case only ever goes in one direction: down. So it’s not just that the analysis is randomly inaccurate, off in one direction one month and the other direction the next month. Month after month they are overstating the increase in sales and they do nothing to correct this.

I would hope that if StatCan or the BEA encountered such a perpetual skew, they would build a means to normalize it in their models. In the case of sales data, an estimate of future canceled sales could be factored in.

Appraiser

at 7:06 pm

Majoring in minors gets very tiresome.

You are quibbling about a rounding error.

Something to do with not being able to recognize the forest for the trees ?

J

at 7:30 pm

If we put in slightly more effort than TREBB and assume the same amount of cancelled transactions as last year (41) then the actual increase in sales would be 14.1%, or 7% lower than the reported increase of 15.4%. Minor? Maybe, I acknowledged so myself in my original post, with some caveats.

Not quite sure what your angle is – first you suggest I’m wrong, then you say the conclusion I’ve drawn is correct but minor. Without any facts to share your contributions amount to nothing more than minutiae.

Joel

at 6:47 pm

I am seeing a huge influx in people looking to get pre-qualifications for mortgages and this is the busiest beginning to a year I have had as a mortgage broker in 6 years.

I think we are going to see a very active spring with prices pushing up. Demand feels the same or higher than it was in 2017, it will really just depend on how much inventory is put into the market over the next 3 months.

Mo_Realtor

at 7:52 am

Came here just because it feels like 2017 out there. I knew Dave would be writing about this. Thank you Dave for this great blog.

Appraiser

at 9:13 am

Like it or not, Toronto is the centrepiece of the megalopolis known as the Quebec City-Windsor corridor, an area containing roughly half of the country’s population. A region that boasts no less than 8 of the 12 largest metros in Canada and 7 of the top-10 rated universities. https://www.timeshighereducation.com/student/best-universities/best-universities-canada

Sometimes compared to the Boston-Washington corridor in the U.S. and of similar economic importance in relation our nation, the future growth of the QuebecCity-Winsdor corridor is inevitable.

P.S. The Gordie Howe bridge is under construction. https://www.gordiehoweinternationalbridge.com/en

Professional Shanker

at 12:41 pm

With all of msm coverage of prices expected to increase by at least 10% this year, a blog post should definitely be warranted.

How dare the media create FOMO, very irresponsible of them!

lacky

at 2:01 am

Thanks for sharing this post i really helpfull this post keep it up

Foreclosure and Power for sale