I want to tell you something a little embarrassing, so here goes.

I’ve always liked the song, “The Heat Is On,” by Glenn Frey, as it reminds me of my childhood. Whether it’s the association with Beverly Hills Cop, or whether it’s that unmistakable saxophone in the song’s opening, I”ve always liked this song.

My favourite part was always the chorus:

Oh-wo-ho, oh-wo-ho

Caught up in the action I’ve been looking out for you

Oh-wo-ho, oh-wo-ho

When we were kids, my sister and I listened to this song on the radio and “oh-wo-ho” really, truly sounded like “Hold the waffle” to us. We were positive this song was about Eggo’s.

That might not make sense now, but trust me, it did when I was five-years-old…

That’s not the embarrassing part.

What’s embarrassing is that I had no idea Glenn Frey was one of the founding members of The Eagles.

And upon learning this last week, I fell deep into a Wiki-hole that had me comparing and contrasting the solo careers of Glenn Frey and Don Henley after The Eagles broke up in 1980. It’s amazing that they both found the level of success that they did.

So humour me (only those over 40 will do this…) and tell me which was a better song:

1) Don Henley, “Boys of Summer,” 1984

2) Glenn Frey, “The Heat Is On,” 1984

Not easy, right?

“Boys of Summer” evokes more nostalgia. It makes you more emotional for the 80’s.

But “The Heat Is On” makes you smile, bop to the sax, and sing along with the waffle-like chorus.

We need a voting feature on TRB. It’s time…

Well, folks, in any event, the heat is on the Toronto real estate market.

It’s Hell’s Kitchen in here.

The market is red-hot. It’s on fire.

“The floor is lava,” your child shouts as he or she plays that never-ending game, but you can’t help but think they’re talking about the lobby-floor of that condo you were in last week; that condo that had twenty offers and sold for 35% over list.

The market is scorching. It’s searing. It’s roasting. It’s torrid. It’s sweltering.

Broiling. Boiling. Burning. Baking. Blistering. Blazing.

If you can think of an adjective (and avoid the ice-cream headache that comes with it…), that word probably applies to the Toronto real estate market right now.

Simply put, I can’t wait until the end of the month to give you market statistics. You simply need to know now.

Ask anybody who has been active in the market this year, “How’s it going?” You’ll likely receive a response that begins with a pause, which leads to a deep inhale, followed by an indistinct facial expression, then either a widening of the eyes or a puffing of the cheeks, which culminates in a furious and exasperated exhale.

That’s how it’s going.

And it’s not easy for anybody right now, whether you’re a buyer, seller, or agent. Everybody’s feeling it, and perhaps the toughest part of this market to wrap your head around is that it’s not going to change any time soon. Maybe in April, maybe in March if we’re lucky. But maybe not until June, who knows.

I’ve lost in multiple offers on behalf of buyers several times already this year, with the fewest number of competing offers being one and the highest being twenty-nine.

I’ve submitted bully offers on behalf of buyers and both won and lost.

I’ve had multiple offers on every property I’ve listed.

And the members of my team are out there every single night showing properties, many of which have offers already registered, or people lined up on the sidewalk or down the condo hallway. We’re losing three or four times as many offers as we’re winning, which sounds bad, but it’s actually not. That is how crazy our market is.

Coming into 2022, I figured that blog topics on TRB would start with the obvious “predictions” or “discussion points,” then look at some early trends or “stories from the trenches,” but I thought it would take a while for us to talk about prices and have data to back up opinions on where the market is.

Well, I was wrong!

Because through only three weeks in the 2022 market, the data is impossible to ignore.

And while I would prefer to wait until we have the January TRREB statistics to put hard data to my opinion on the market, that would simply be too late.

This is the hottest market I have seen since 2017, and by that I’m referring to the low inventory combined with high demand which is leading to an absurd number of offers on properties and a massive escalation in house prices since Christmas.

Today, I want to look at the freehold market and I’ll come back on Wednesday to look at condos.

I have to draw a line in the sand somewhere, so I’m going to look at the market from January 1st through Friday, January 21st.

Let’s first look at some big-picture numbers then we’ll delve into some more specific data points.

From January 1st through January 21st, there have been 342 freehold sales.

Now, not all of these sales were for properties listed in 2022. That’s our first distinction here, and I find the breakdown to be rather interesting:

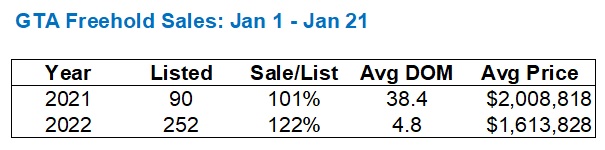

Of the 342 freehold sales in 2022, only 252 of those were listed this year, meaning that 90 were listed last year.

In theory, we could have seen a property listed on December 30th with an “offer date” of January 6th, but I believe that in practice, a generalization that “most of these properties were stale listings” is fair, given the average days on market, which comes in at a whopping 38.4, compared to a paltry 4.8 thus far for the properties listed and sold in 2022.

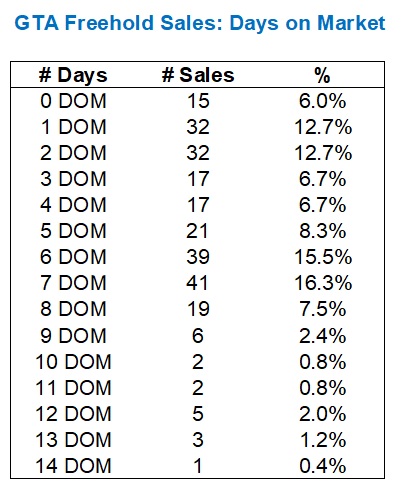

Think about that for a moment: the average days on market for freehold properties listed and sold in 2022 is 4.8. That’s how busy our market is, folks! A typical “holdback” on offers is at least six days and typically no more than eight or nine (some stupid agents hold back for two weeks but this actually works against them). So if we should see an average of seven days on the market for properties with a holdback on offers, and yet the average days on market is 4.8, that means many properties are selling after a day or two.

Actually, why not break it down? It’ll only take me a moment…

That’s the breakdown for 252 freehold properties listed and sold in 2022.

The fact that 30.7% of properties have sold between 0 – 2 days tells you how quickly buyers need to act in this market, and let’s not forget that some agents take a day to update MLS!

Notice how the DOM decreases at 3, 4, and 5 days, then increases again at 6-7 days. This is because most “offer dates” are set 6-7 days after listing.

It’s also important to note that the average sale-to-list ratio for the 90 properties listed in 2021 and sold in 2022 was 101% compared to 122% for the 252 properties listed in 2022 and sold in 2022.

Lastly, note the average price is drastically higher for the 2021-listed properties. This is because more of the larger, detached, “luxury” houses listed in 2021 that sat on the market for a while ended up selling this year. I know of one such listing that was listed for $5M in 2021 and sat on the market for three months only to end up with five offers in the first week of January.

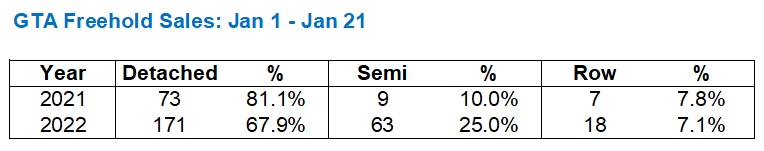

As for the proportion of detached, semi-detached, and rownhouses, this is exactly what I expected to find:

Looking at properties listed in 2021 and selling in 2022, versus those listed and sold in 2022, we see a far higher proportion of semi-detached than detached.

This was noted in the section above, with respect to average sale price and days on market, but it’s backed up with the data here.

Now, what about sale-to-list ratios?

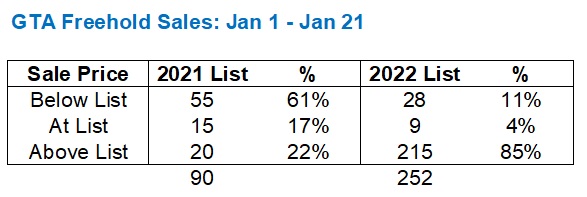

Not to beat a dead horse, but obviously, properties that were listed in 2021 and sold in 2022 likely aren’t going to sell over the list price, or at least not as regularly as those listed this year:

This will be our last comparison between the 2021 and 2022 list dates, since it’s really only relevant to help explain why we’re stripping down the 342 total sales to 252 for further analysis.

However, the takeaway here is that 85% of freehold properties listed in 2022 have sold above the list price, and we know the sale-to-list ratio is 122%.

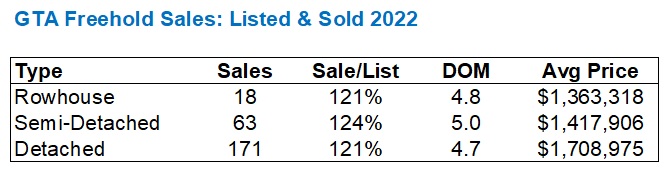

Let’s now focus on those 252 sales and break the data down further:

This is absolutely fascinating!

We see almost no difference in sale-to-list ratio among the rowhouses, semi-detached, and detached. To be fair, “rowhouses” are typically thrown in the bucket with semi-detached houses, so this isn’t really it’s own category for the most part. But either way, the average sale-to-list ratios for all freehold properties are almost identical.

Then when it comes to days on market, we see the same trend! We’re averaging 4.8 DOM overall and 4.8 DOM between the three categories.

Talk about an efficient market!

It might be frustrating, it might be frenetic, and it might be fast, but it’s not like detached houses are on the market twice as long as semi’s, or the sale-to-list ratio for semi’s is 20% higher than detached. This market is moving very quickly but it’s doing so across the board for all property types.

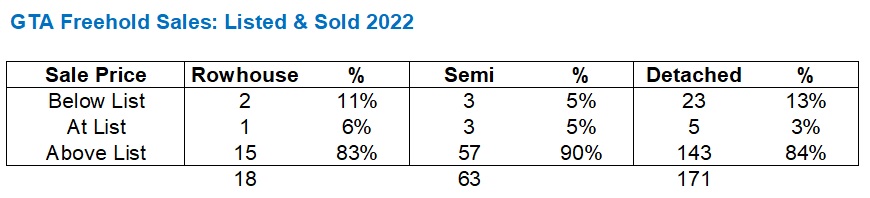

Now, let’s re-run the sale-to-list ratios for each segment and count how many sold for below-list, at-list, and above-list as we did comparing 2021 listings to 2022 listings above, and see if there’s any one segment that’s doing better than the others:

Maybe, maybe we see that semi-detached are in their own category, with a whopping 90% of properties listed in 2022 selling over the list price.

I know this isn’t much to brag about, since most houses are listed artificially low and sell in competition, but it’s still a data point worth monitoring as we compare to other segments.

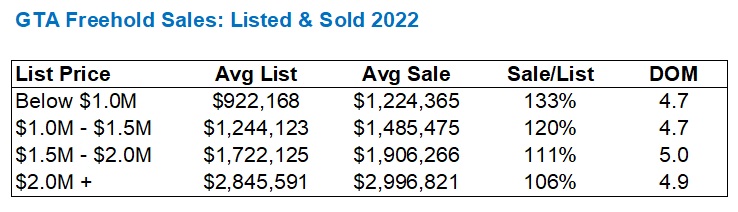

So what’s the difference between various price segments?

Well, before I ran the data, I surmised that the sale-to-list ratio would decline, the higher the price range. I also figured that the days on market would increase along with the list price.

It seems I went 1/2 in those predictions…

Again, I’m so fascinated by the days on market remaining relatively unchanged.

What does it say about our market that the average days on market for houses listed below $1,000,000 is 4.7 but houses over $2,000,000 is only 5.0?

I might call this the fastest-moving market I’ve ever seen.

As for the sale-to-list ratio, note that it declines as we move through the four price segments above.

For those looking at houses listed at $799,900, $899,900, or $999,900, you’ll want to take note of the 133% average sale-to-list ratio. So when you see that $799,900 listing and you ask your agent, “Do you think we can get this for $999,999, qualifying us for our 7.5% down payment?” you have to realize that there are a dozen other bidders out there thinking the same thing.

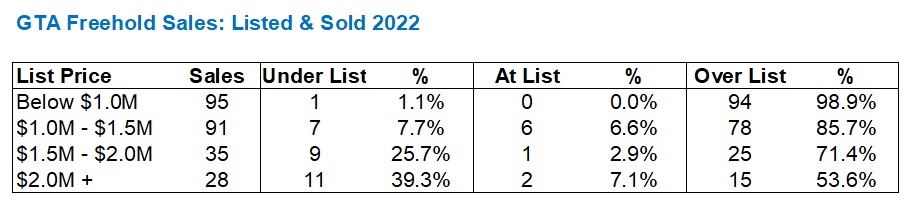

Our last chart will look at the same four price segments we analyzed above, only this time we’ll want to know whether properties are selling under list, at list, or above list, in each category:

No surprise here.

I mean, it’s surprising to see that 94/95 properties listed below $1,000,000 sold for above the list price, but is it surprising because “so many” sold over list, or because “not all of them” did? That’s seeing the market through two different sets of eyes.

I might also add that for 53.6% of properties listed above $2,000,000 is surprising.

Either way, the percentage of properties selling over list declines as the price segments rise, just as we saw with respect to sale-to-list ratio in the chart above.

So which properties sold for mind-boggling prices?

Well, there were a lot of them!

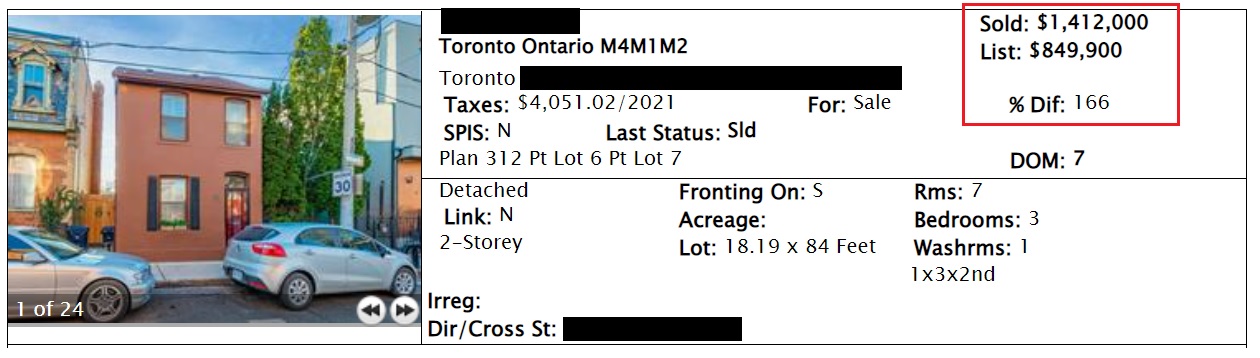

But if we’re going to use sale-to-list as our metric, here are the top three:

(Apologies for having to black-out the addresses, but TRREB still has their archaic rules about real estate agents disseminating “sales data,” even though this is all available to you through other apps….)

This “house” was basically four walls and a roof.

Well, to be fair, I suppose it’s a little more than that, but it was a complete “gut.”

The crazy thing is: a brand-new house on this lot, in this location, built in a super sleek, modern style that resonates with the younger demographic who is flush with cash, might sell for $2.3M today. But to build that house would cost at least $800,000. Factor in land transfer tax, carrying costs, financing, et al, and you can’t build that house and break even, let alone flip.

If you were looking to renovate, I think the numbers are even worse. This house needs a $400,000 renovation but even then, I don’t think it’s a $1,800,000 house. The basement needs to be underpinned and that’s $100,000, not to mention finishing the basement thereafter.

There were twenty-two offers on this house.

It was the first house listed in 2022. Literally listed on the morning of Tuesday, January 4th, and everybody in the city looked at it. I submitted a bully offer on this property two hours after it was listed, and that went nowhere.

If you had told me this would sell for $1,412,000, I’d have quit my job…

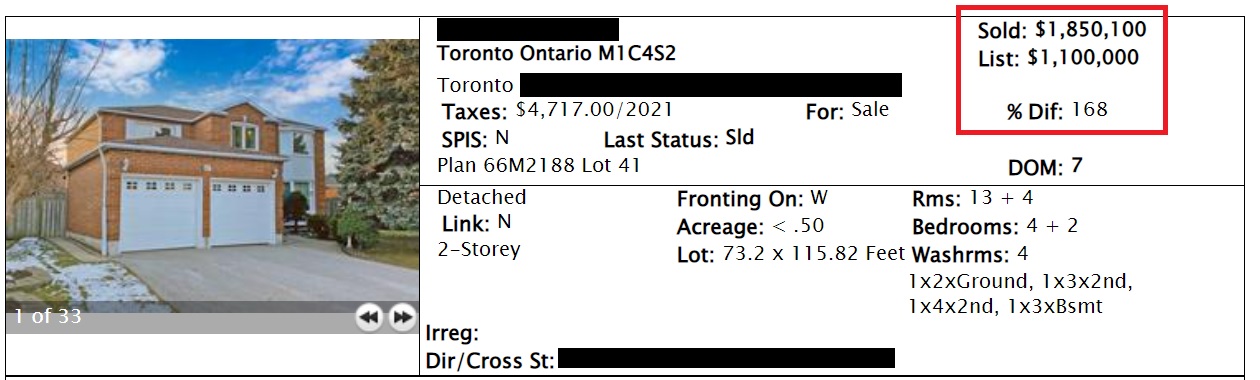

How about this one:

The last sale in this pocket was for $1,060,000 in 2020 and it was only a 40-foot lot, so I don’t know how good a comparison that is.

However, this house wasn’t in great shape, advertised as “First time on the market in 34 years,” and it was listed by an agent from Peterborough.

Was this a case of mistaken underlisting, or did somebody just happen to pay $400,000 more than it’s worth?

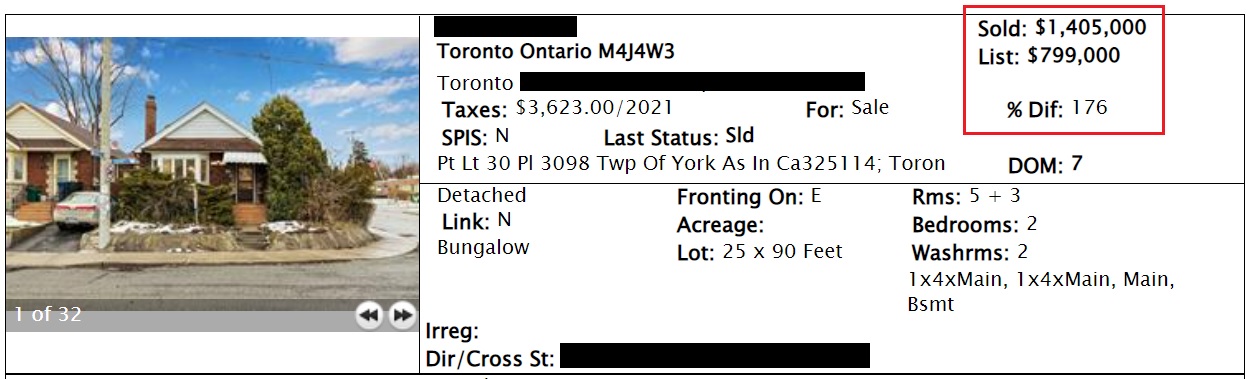

Last, but not least, the sale that had us all talking:

This is a corner lot and in an area dominated by development, I don’t think building a new 2-storey house on this lot is as easy as it looks. There are serious limitations and the lot is only 25 x 90.

Based on comparable sales from the fall, this “should” have been worth around $1,100,000, and while none of us thought it would sell for that, nobody predicted $1,405,000.

I mean, it’s livable, but it’s far from luxury…

Well, that’s it for freehold!

Let’s take a look at condominium on Wednesday.

But our blog isn’t finished, folks. Not even close.

You all owe me and The Eagles the duty of watching these two music videos and voting below.

Come on, it’s Monday morning, you’re reading this at 9:15am as you drink coffee at your desk and look to kill another fifteen or twenty minutes before your first actual meeting/call/assignment of the day, so have some fun…

Francesca

at 7:51 am

I was ten years old when both songs came out. I agree that heat is on is more catchy but boys of summer is less dated.In fact I still listen to that song regularly and it brings back so many memories. I have always loved the Eagles too.

As far as what’s going on in the market, it also evokes memories of 2017 for me. I read an article somewhere this past weekend on how low inventory is right now justifying these crazy prices. If 2017 repeats itself and interest rates rise and play the part of the spring 2017 foreign tax role, prices could drop and whoever bought now will see their place depreciate in value so they better not intend to flip it. It took until fall of 2020 for house prices in york region to return to what they sold in the peak of spring 2017 so good luck to current buyers. Hopefully they plan to live there long term but to me these prices are ridiculous…one million for 20 year old townhouses in the burbs? Where’s the value in that? At that point I’d rather spend a million to live in a nicer more central condo in the city. There are a lot of overpriced homes in the city too but Toronto will always rebound faster than the suburbs if prices decrease. Besides low inventory I think right now there is a general sense of FOMO which is a risky reason to be overpaying this much for a property.

Ken

at 8:09 am

Sorry David, but Don Henley was twice the solo musician that Glenn Frey was, may he Rest In Peace.

Glenn Frey had two huge hits with “The Heat Is On” and “You Belong To The City” but both were mainstream because they were title tracks from a movie and a TV show (Beverly Hills Cop and Miami Vice).

Don Henley was one of the best solo artists of the 1980’s. Not quite Phil Collins but also not far off.

David, you have a very curious taste in music. Rap music one day and 80’s mainstream rock the next.

No comment here on the real estate market as I know more about music than housing prices.

David Fleming

at 5:59 pm

@ Ken

I listen to just about every genre of music. Like literally all of them.

Recently, I started listening to listening to Classical. That’s the one genre I’d never listened to, but over the last few years, I’ve found it impossible to write blogs while listening to music with lyrics. I always had, previously. So I typed “Classical” into Spotify, and boom! Now I’m a fan of Ludovico Einaudi.

Favourite bands: Green Day, RHCP, Pearl Jam, Blink 182, Offspring, et al from my teen years and early adulthood.

Massive Tom Petty Fan though.

Also was a monster Guns n Roses fan – listening since 1991 when I was way too young for the lyrics for Appetite for Destruction, but I had the cassette and parents who didn’t care.

Love 90’s hip hop: Wu Tang, Nas, NWA, De La Soul

Love early-2000’s ‘alternative’: Our Lady Peace, Headstones, Bush, Sum 41, Finger Eleven

Love 1980’s rock: Def Leppard, INXS, Depeche Mode

Love 1980’s metal/hairbands: Motley Crue, Skid Row, Poison, G&R

I also love a lot of stuff from the 1960’s which my dad introduced me to at an early age. The Doors, Steppenwolf, Jimmy Hendrix – bands that 8-year-olds didn’t listen to, and yet I did. I took a course in third-year university called “Popular Music” and I found myself listening to bands I had never got into like the Beach Boys, for example. Just never had occasion to listen to them, but what an impact they had on music. I started playing The Doors, Roy Orbison, Creedance Clearwater Revival et al for my daughter when she was 2-years-old and she knows the lyrics.

I love all kinds of music, all kinds of bands. I just love putting on like “Best of 1997” and hearing Eagle-Eye Cherry “Save Tonight,” and experiencing that 1/4 of a second where you feel like you’re back in 1997, that time at that place with those people…

I love nostalgia. I love The Travelling Wilburys because it reminds me of my childhood, but also because they are an incredible supergroup who flew under the radar. Also – I played their album on my second date with my now-wife, and while I was naming the guys singing……..”That’s George…..that’s Tom……..that’s Bob…..” and she fell asleep!

I often get very distracted when I hear a song I haven’t heard in a long time, or one for which I didn’t know the artist. Then I open up Wikipedia and read about them, often download more songs, and then realize it’s been twenty minutes and I was writing an email.

But music, to me, is a timeline. It’s life. I have an absurd long-term memory and smells and sounds always jog it. I can often listen to a song and feel that time in my life, and I love it.

Ed

at 4:23 pm

You mention all these different genres and you missed the best one. 80’s alternative/new wave.

Back in the late 70’s and early 80’s CFNY was playing music that received no air time on the other stations and it was awesome. Because of this Toronto was exposed to a music scene that none of the rest of the country heard. Also I believe that the only other mid to large broadcasting stations that played this music were located out of Chicago and Los Angeles.

Here are two internet stations to have a listen to.

http://www.sanctuaryradio.com -Retro 80’s station. A mix of alternative and some mainstream. They also have an incredible library of remixed/club mix songs.

http://www.flashbackalternatives.com -This definitely leans more to the alternative. The music will vary quite a bit depending on the dj and the theme of the program.

Both are free and commercial free. Give it a shot.

Condodweller

at 4:49 pm

I’m guessing we rubbed shoulders at Star Sound at one point. Or was it Starrr Sound? My parents had a double tape deck and I used to tape Chris Sheppard’s shows on Friday nights (this was more late 80s) and make mixed tapes of the ones I liked the most. I loved those club remixes. I ….ahem..acquired a bunch of club mix disc sets from the 80s/90s. They still make for great workout music.

Kyle

at 4:58 pm

@Ed

Are you talking about bands like Joy Division, New Order, Depeche Mode, and The Cure?

Ed

at 5:50 pm

Yes and to add to that list.

-Propaganda/ACT

-Altered Images

-Bad Manners

-Big Pig

-Camera Obscura

-Ministry

-Lena Lovich

-Missing Persons

I could go on forever.

Try out the stations, I’m sure a song will pop up that you haven’t heard for 30 plus years.

Kyle

at 6:36 pm

Nice, thanks for the links!

David Fleming

at 11:09 pm

@ Ed

I was just naming a few genres! Like I said, I listen to almost all genres of music.

I’m a huge fan of 1980’s retro. As a child of the 80’s, every single song can take me back to a time and a place. Many songs give me goosebumps.

New wave, for sure! Tears for Fears, Talking Heads, Depeche Mode, Duran Duran. And the hits that came from one-hit-wonders, or two-hit-wonders, there are so many! A-Ha, Flock of Seagulls, Loverboy, Devo, OMG – Toto! How about Simple Minds? New wave or rock?

Then there’s synth pop. I can’t get enough of it. You might say, “I just can’t get enough…..I just can’t get enough….”

Condodweller

at 2:38 pm

I’m also one of those who listens to all types of music. When people ask what type of music I like I usually say I like good music which is then usually met with a blank stare. Every type of music has good and bad examples and of course the definition of “good” is ver personal.

As I get older I find myself listening to things that not only I would not have considered before, but I outright said I didn’t like and would never listen to. Jazz and blues fall into this category. Then I found out that some of my favourite songs are based on blues. Now I can’t stop listening to it. A friend gave me an Eric Clapton (it was probably Cream) mixed tape that I loved. Take a look at his Slowhand concerts.

Classical was always on my radar I always heard my parents listen to the popular favrourites but I often listen to it now. Depends on the mood.

I think a lot of it depends on listening to a high quality sound system, either speakers or headphones to fully appreciate some music.

Dan

at 8:38 am

Boys Of Summer and it’s not even close.

Ed

at 10:43 am

+1

sunshine

at 9:32 am

We sold and bought within a two week period in late Feb early March of last year. At the time it seemed like the market had lost its mind in terms of offers, bullies and prices. I was somewhat worried that we got in at the top (though not a major concern as this is our forever house) and that we would see a moderation and even a decline for detached houses in the 416. I know its early, but everything you have shared suggests that we are seeing something even crazier than last year around this time. I will say its much less stressful to be a viewer as opposed to a player! Good luck to anyone active in this market!

Ryan

at 2:10 pm

Agreed. Semi-shopping the market right now to upgrade my home and this has all of the signs of a blow off top/melt-up.

Going to suck for the people with $1MM mortgages + $300,000 HELOCs and rates a few BP higher knowing that their home isn’t worth what they paid for it.

Condodweller

at 9:37 am

This week’s lesson, Peter Gabriel founded Genesis and not Phil Collins. Phil Collins joined after he left. A conversation a long time ago:

Do you know Peter Gabriel?

No who is he?

The singer from Genesis.

Who is Genesis?

Appraiser

at 12:00 pm

Phil Collins was the drummer for Genesis and joined the band around 1971. Peter Gabriel left the group to go solo after the album “The Lamb Lies Down On Broadway” in 1974.

David

at 9:59 am

Both are good songs, but I will forever associate Heat Is On with the opening scene of Beverly Hills Cop, and as the prelude to the stolen truck full of cigarettes chase.

Average Joe

at 12:05 pm

Maybe everyone is selling stocks and buying condos. The financial markets this month are pure panic selling.

Bal

at 12:47 pm

Today is pretty brutal ……damn all RED

Average Joe

at 2:37 pm

“The stock market has never started a year falling as quickly as it is now.

The S&P 500 has dropped 11% — heading into correction territory — in the first 16 trading days of 2022 in its worst-ever start to a year, according to Bloomberg data that goes back over nine decades.” – Bloomberg

The heat is off and we haven’t had a single rate hike yet.

Jay

at 12:14 pm

Ever wonder what one of those great speculative bubbles must have felt like in history? It feels like this.

You might consider diversifying your currency holdings at this stage of the game.

Rich

at 12:24 pm

Boys of Summer – is it even close?!

EastYorker

at 12:30 pm

Know that last corner lot. I live at the other end around the corner. Sometimes walk by it to get to the library. My lot is bigger at 33×100.

Wow !!

Wonder what mine is worth now ?

Marty

at 12:53 pm

1) Don Henley, “Boys of Summer,” 1984 **** better, but only by a bit, honestly.

2) Glenn Frey, “The Heat Is On,” 1984

I just picked up a pair of tickets for OMD, May 3rd in Toronto (at Drake’s new club). Wowza!

Murasaki

at 10:20 am

I saw OMD at Danforth Music Hall a few years ago. Fantastic show, although in my opinion they didn’t do enough from “Architecture & Morality,” one of my all-time favourite albums. Enjoy!

David Fleming

at 2:29 pm

@ Murasaki & Marty

I’m a big fan of the podcast, “The Ongoing History Of New Music” with Alan Cross.

He did a great episode on synth-pop and OMD was interviewed:

https://www.ajournalofmusicalthings.com/the-ongoing-history-of-new-music-episode-869-the-golden-age-of-synths-as-told-by-omd/

GinaTO

at 1:39 pm

Hey hey David, that Moncton house is a 10-min walk from us ???? same school catchment as my kid. Which is to say, great place to live!! And most people here pay a snow removal service for the season. Big driveways, and lots of snow already.

GinaTO

at 1:44 pm

Comment meant for the previous post, obviously. Stupid phone.

Ed

at 1:57 pm

You should get a smart phone.

GinaTO

at 7:32 pm

Well, it’s supposed to be smart, but the person operating it, sometimes I wonder…!

Condodweller

at 2:02 pm

it’s true what they say, smart phones make us dumber…

EastYorker

at 2:11 pm

Boys of Summer.

But, The Ataris version

Mike Stevenson

at 8:13 pm

Today’s buyers will get annihilated, imo.

Boys of Summer, but both artists were in a good groove at that point. Top 40 music was insanely competitive in the first half of the 80s and it forced everybody to bring it.

Appraiser

at 8:40 am

What is the best nickname for the conga line of unvaccinated redneck rubes making their greasy way to Ottawa whilst needlessly and dangerously clogging up vital roadways in the winter:

1) KarenConvoy

2) FluTruxKlan

It’s all a grift anyway. Oh! and 90% of Canadian truckers are already vaccinated and as per American regulations, no unvaccinated trucker can enter the U.S. and the Canadian Trucking Alliance is condemning it…but that is somehow Trudeau’s fault:

https://deanblundell.com/news/some-truckers-descend-on-ottawa-in-the-name-of-grifting-i-mean-freedom/

Condodweller

at 2:18 pm

Breaking news…

I just read that an ex-fed member commented that he expects the fed to raise interest rates to above inflation:

“Former Federal Reserve Governor Randal Quarles said Tuesday that he thinks the Fed will move swiftly to raise its policy interest rate above the inflation rate because that is the only way to defeat inflation.

When the policy rate is above inflation, it is what is known as a positive real rate of interest.”

Currently US inflation is at 7%, in Canada it’s just under 5% the last time I looked. Mortgage rates are what, 1-2% above the BOC rate? If the comment is true and if it happens that will mean mortgage rates of at least 6%. What does that do to house values? Notice I said values, not prices.

Mike Stevenson

at 6:48 pm

You know where I stand on that. I’d bet hard against them raising rates anywhere near that much, but they won’t have to. 2% is all it takes now. Just talking about it has cratered the most speculative asset classes.

Condodweller

at 9:09 am

It will be a tug of war between the BOC and the finance minister.

Either way it won’t happen overnight. Just in time for people who bought recently and their 5 year renewal.

Kyle

at 2:19 pm

Boys of Summer is still a staple of radio stations throughout cottage country, so for many people regardless of generation it’s become part of the soundtrack of summer whenever their heading out of town. The Heat is On, never made it out of the 80’s.

Mike Stevenson

at 12:30 pm

Kyle, you’re so right. When Glenn Frey and David Bowie died in the same month in 2016, my daughter was all over the David Bowie story. No idea who Glenn Frey was. I said “You’ll know this one” and played her The Heat Is On. No recognition of it whatsoever. I was sure she’d know it at least from a commercial for a furnace company or something!