Well, maybe Thursday’s blog was a mouthful. But can you blame me? All that time off over the holidays without an outlet for my thoughts – both about real estate, and not, and you had to know that the first blog back in January would be lengthy.

It’s blogs like these that often make me feel guilty of being unoriginal, however.

Is our market really the “same old, same old?”

Prices are rising, affordability is falling, inventory is low, bla, bla, bla. That’s the same-old, same-old, but trust me when I say that once our market is underway in a few days, we’ll be exploring new trends, business practices, and I’ll be regaling you with stories galore!

For now, it’s the question(s) at hand. It’s the adults in the room. It’s the serious talk. It’s the topics that we need to put at the forefront of all real estate discussions if we want to be informed and ahead of the curve.

So let’s pick up where we left off last week…

3) Will the rental market regain lost ground?

If real estate is a zero-sum game, then it’s hard to have a “winner” without a “loser.”

But the only true “winners” to come out of the pandemic in the Toronto real estate market were tenants.

My cynical side says it’s because many of them were allowed to get away with not paying rent, or packing up and moving out in the middle of the night, sticking their landlords with vacant properties and avoiding their contractual obligation. But aside from the government basically telling people, “It’s okay to not pay your rent,” and scores of gainfully-employed individuals taking advantage of this, I’d say that the decline in rent rates in Toronto was truly a big “win” for renters.

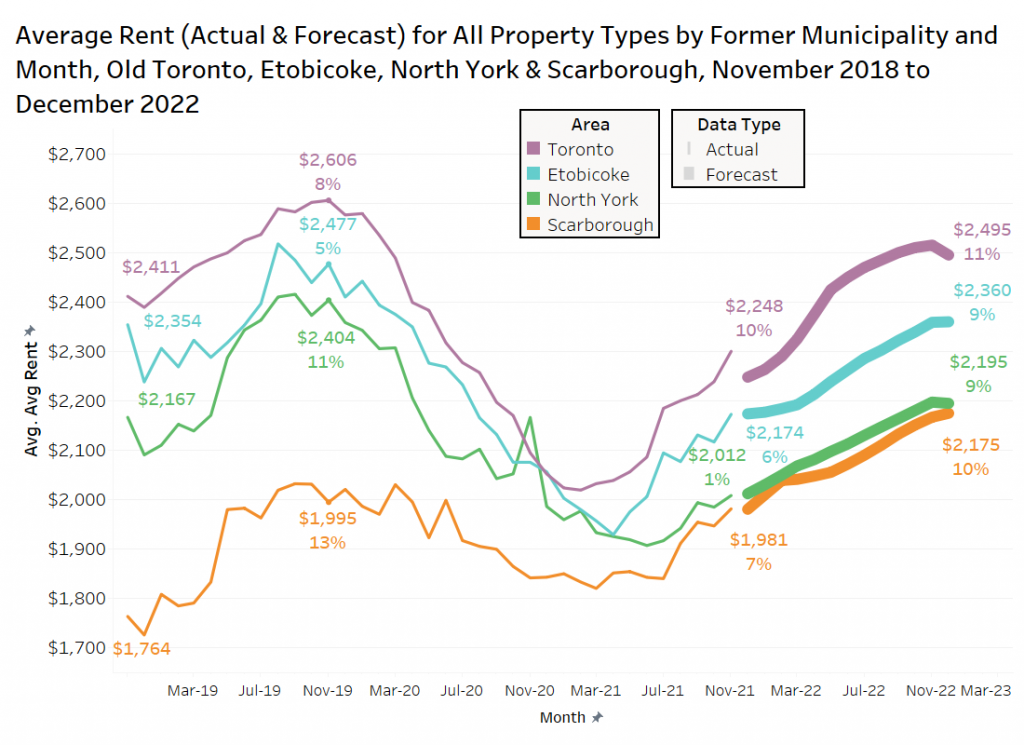

For those of you who don’t know just how much rents in Toronto were affected by the pandemic, here’s a graph from my colleagues at Bullpen Research & Consulting:

The decline in rents, specifically in Toronto, cannot be understated.

The onset of the pandemic in 2020 absolutely brutalized the rental market, and the market has still not made back those gains.

However, the rental market did gain ground last year.

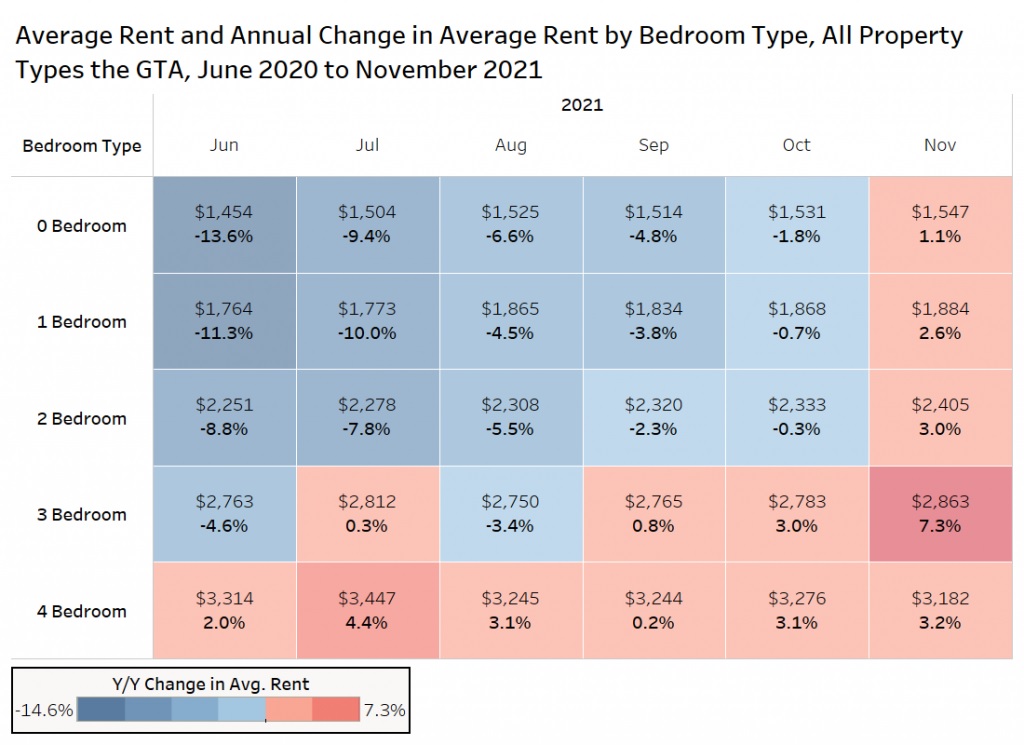

In Bullpen Research & Consulting’s December newsletter, we see that an overwhelming majority of the recovery happened in the summer and early fall of 2021:

The average rent for all property types in the GTA was up 4.3%, year-over-year, in November of 2021, as we don’t yet have the December data in hand.

But the above chart shows you where and when much of the ground was made up.

Perhaps the mad dash to secure rentals for September 1st, that took place in June, July, and August, can explain this.

Just look at the increase in the average price of a bachelor condo, which went from $1,454 in June to $1,547 in November. With movement like that, it won’t be long before rental prices have exceeded pre-pandemic levels.

There are two reasons why we care about rental prices:

1) Because renting is a component of the real estate market, even if most of us only concern ourselves with sales

2) Rental prices will ultimately have an impact on resale prices, especially in world of downtown Toronto condos

I’ll be honest when I say that in 2021, most of the investors I represented look at current rents along-side pre-pandemic rents, or “future rents.” I’ve never been a huge fan of this move, especially when you see the listing agent for a four-unit property advertising a 4.8% cap rate, only to dig into the financials and see it’s based on “estimated rents,” which are 30-50% higher than “current rents.” If the property has a tenant who’s been there for twelve years, and clearly isn’t going anywhere, then what good is that estimate of a future/current rent?

But in the downtown Toronto condo market, there’s more turnover than ever before. I would estimate the average length of tenancy for a 1-bedroom condo to be about 1.5 years. If you’re a landlord, you might be concerned with the turnover cost if you’re hiring a real estate agent to secure a new tenant, but if you can lease a condo for $2,300 in 2022 that leased for $2,100 in 2021, then theoretically, you’re increasing the value of your investment.

This is all on paper, of course.

Until one chooses to sell. And that is where I think the rental market is going to have a huge impact this year.

When we’re looking at a condo for investment, we don’t start out by looking at what the existing tenant is paying, but rather we consider Unit 2308, look up the recent leases in the building for that “08” model, and see what is the most recent. If the last unit leased for $2,300 and the current tenant, who has been there since 2019, is paying $1,850, we pay them no mind. That tenant will leave, and ultimately the value of this condo from an investment standpoint is going to be determined in part by that market value rent.

It only takes one recent comparable to start a trend. I wish it weren’t so, but it is. Like a legal precedent in a court of law, the real estate judge will simply rely on the previous ruling.

From an absolute perspective, I think rents in Toronto are ridiculously high. A 23-year-old starting an entry-level job, making $55,000 per year at a downtown firm, can’t really “afford” to pay $2,200/month for a 1-bedroom condo, but they do. And they will. Once upon a time, paying 48% of your gross salary toward rent wasn’t an acceptable idea, but today, it’s the norm.

From a relative perspective, I think Toronto rents are quite reasonable. I know people hate the New York comparison, but if the average price for a Manhattan rental is $4,140 USD, or $5,300 CAD, then the $2,167 CAD average that Torontoians are currently paying is, by the very definition, reasonable.

4) Who is actually buying pre-construction condos?

Here comes the conspiracy theory, right?

But if I’m being honest, I want to know! I want to understand who is actually paying $2,000+ per square foot for pre-construction condos, because I don’t know a single person in the city, personally or through a colleague, that’s buying this stuff.

So if it’s not us, then who?

And here’s where the conspiracy theory comes into play, as well as the potential to be labeled xenophobic or overly nationalistic.

So I’ll risk being called a bigot to ask an important question, although I’m probably going to steer clear of specifics.

Let’s just say that it’s a well-known fact in Toronto that international investors are buying up pre-construction condos. I do not have hard data to support this, of course. Developers likely don’t keep this data, and if they did, they’d never, ever make it public! But I know pre-construction sales agents, I know developers, and I know financiers. We talk candidly about this all the time, and it’s no longer a “best-kept secret” that foreign money is buying up pre-construction condos.

Then again, what constitutes an “international investor” anyways? Or a “foreign buyer?” If $2,000,000 that originated overseas is used by a Canadian resident here on the ground to purchase a condo, then is the purchase made by a “foreign buyer” or not?

I can’t answer this.

But I can tell you that there are many, many clues to who’s buying these condos, and they aren’t all based on stereotypes and unruly assumptions.

But whether it’s the Middle East, Asia, or former Russian territories, we see loads of money pouring into Canadian real estate every single year, and I don’t believe for a second that your buddy Brayden from university is the one spending $2,200 per square foot on a pre-construction condo at Yonge & Delisle.

So what’s the conclusion here?

Any objection to our real estate being bought up by other countries?

Recently, I’ve been encouraging many of my clients in their 30’s and 40’s to start buying one-bedroom condos as investments for their children, currently anywhere in age from 6-months to 15-years-old. I honestly believe that in twenty years, an overwhelming majority of our population will be renting houses and condos from landlords who, at least in part, originate overseas.

Tell me I’m hyping the market and I’ll tell you, “Just wait.”

If you have a child who’s, say, 3-years-old right now, there’s not a hope in hell that your child will be able to buy a home when he or she is 30-years-old. No way, no how.

There’s way too much money in the world and far too many countries have deeper pockets than we do.

I see foreign money buying up swaths of farmland north of the GTA and this is one example where I do have evidence, since a family friend represents many of these farmers, some of whom have had the land in their families for a century, who are now selling to offshore trusts, controlled by other trusts, and the origin of the money is impossible to ascertain.

But as far as the downtown Toronto condo market goes, it’s probably the easiest example of the foreign money coming into our market. And that foreign money doesn’t want a resale condo at 230 King Street East or 1 Shaw Street; it wants to be parked in a project that is five or six years from completion. More importantly: the prices don’t matter. Many of these people just want to get money out of their country of origin and into hard assets in an inviting country like Canada.

This is why developers can continue to charge higher prices in pre-construction and actually sell out!

To be fair, part of the reason is the increased price of land, materials, labour, fees, et al, and developers don’t work for free. But we’re now seeing run-of-the-mill condos selling for $1,600 per square foot like it’s normal.

Indirectly, foreign capital is helping to build Toronto real estate.

–

5) Will any of the governments ‘ideas’ to help housing affordability actually help?

We talked a great deal about this in 2021, both before the election, during, and after.

As a cynic, I suggested that none of the policies either implemented or being floated by the federal government were going to help buyers of any type either to make properties more affordable or to simply get into the market altogether.

But at some point, the government has to take real action.

As I noted above, I really, truly believe in my heart that in three decades, an overwhelming majority of Torontonians will rent simply because of how much real estate is being bought by investors, both foreign or domestic.

Is the government going to stand by and watch this happen?

I recall an article from last fall in the Globe & Mail. Let me see if I can dig it up…

Ah, here:

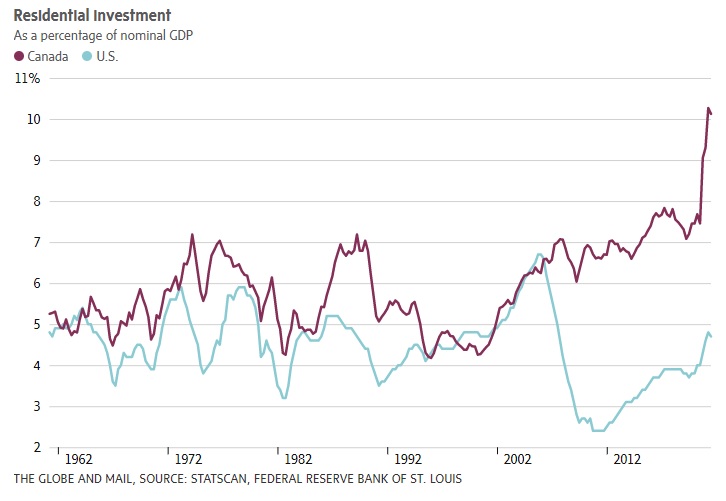

“Canada Bet Big On Real Estate. Now, It’s An Economic Drag”

From the article:

Before the COVID-19 health crisis, residential investment routinely amounted to 7 per cent of nominal gross domestic product. More recently, that’s surged to more than 10 per cent – or roughly double the equivalent rate in the United States. Stuck at home in the pandemic, people spent big on new properties and renovations, with help from rock-bottom interest rates that were critical to the crisis response.

Can the government actually do anything about this?

The idea of “slowing down” the real estate market, real estate investing, or the role that real estate plays in GDP would send shockwaves through the Canadian economy.

Just look at this chart from the Globe & Mail article above:

I honestly can’t opine on what a “healthy” level of residential investment looks like, and likely neither can you.

But show me any chart that looks like this, especially when juxtaposed to that of the United States, and I think we’ll both agree that this could be problematic.

The issue, of course, is that so much economic output is derived from the real estate market. We could probably play a game: go around in a circle and each one of us names an occupation that is tied to the construction, renovation, sale, or existence of real estate, and I think the game would last for hours.

But do the figures above account for, say, an administrative assistant in a condominium developer’s office? Or a residential window-washing company?

The government has two concurrent problems on their hands:

1) The cost of home ownership is unaffordable for many Canadians and prices will not stop increasing

2) Far too much of our economic output is tied, directly or indirectly, to real estate

Do those two problems make it impossible to cure one without exacerbating the other?

Not only that, as we’ve noted before many times, the tax revenue derived from real estate construction, renovation, and sales, is something that the three levels of government desperately need and I don’t believe they’re in any position to see a reduction in any of these revenues.

So what will the governments; federal, provincial, and municipal, do in 2022 to “help” with housing affordability?

Not much, in my humble opinion.

But we’ll surely be talking about this at year’s end once again.

6) Will buying equities or crypto become sexier than real estate?

Do any of you personally know an individual that made a “killing” in Bitcoin?

We know these people exist, and we know they love sponsored ads on social media touting their brilliance and foresight, and offering us coaching and mentorship in their new business for a nominal fee, but do any of you know a person who invested at the onset and never sold during the downturn?

Bitcoin was trading at $1,000 to start January of 2017, and by December of 2017, it was at $25,000.

Do you know somebody who sold for that 25x profit?

More to the point, if you know somebody who bought at $13,000 in November of 2017, who saw the first peak at $25,000 in December of 2017, do you know if they held on for the three years it took for the price to get back above $25,000 in November of 2020?

Bitcoin is now at $53,000, down from over $80,000 in November.

There is no more volatile investment than crypto-currency, and there is no investment that produces more bullshit, nonsense talk from frat boys, wanna-be-bankers, and anonymous online peanut galleries.

Why is that?

Well, because it’s the sexiest investment out there!

Forget the fact that, in my opinion, 80% of people who invest in crypto-currencies end up losing money. Maybe more. Maybe almost all. I’m not convinced that amateur investors can hang on during tough times. Most sell, as evidenced by those who saw the peak in 2017 and didn’t hold on until 2020.

But crypto is cool! It’s technologically advanced. It’s 2022. It’s going to appeal to the next generation far more than “buying stocks,” right?

How about buying real estate then? That used to be so cool!

There’s an argument to be made that if buying real estate over buying equities was the 2012 version of cool, then buying crypto is the coolest in 2022.

We’ve talked ad nauseam on TRB about “real estate versus equities” and I could make an argument either way, if I were so inclined.

You could have bought shares of TD Bank in January of 2021 for $75.00. One year later, they’re trading at $100.00. That’s a 33% profit, not to mention the 4% dividend, but nobody cares about 4% these days. Only the smart investors, institutional investors, pension funds, et al…

So a 37% return, you say?

Fair game?

Talk to me about diversification, fine. Buy each of the five major bank stocks. Or buy an ETF.

The Dow Jones went from 31,000 to 37,000 last year; a gain of 19%.

So why do we recommend investing in real estate, then?

Well, I would argue that real estate is a leveraged investment, and any gain is 5x. I know that you can open a margin account and trade with leverage, but few do, and I would argue that any amateur investor using 5x leverage is simply going to lose five times as much. Maybe not you smart TRB readers, trading in your online accounts, but the 22-year-old hot-head out of university who is individually picking stocks isn’t going to benefit from that leverage in the same way that any buyer of a downtown Toronto condo would.

If the condo you purchased goes up 3% in value in one year, you’re up 15%, based on your 20% down payment, not to mention the principal repayment on your mortgage. I know the proponents of equities investing will have a problem with this, but I believe there’s a 5x profit baked into any real estate investment in Toronto, in a market that’s gone up every year for over two decades, and that the same is simply not true of the equities market.

However, why stop at 5x when you can look for 10x, 20x, or 100x in crypto!

Ethereum, Litecoin, Zcash, Stellar Lumen – my God, we’re all going to get rich!

Why buy real estate when we can buy crypto and fly our private jets to our luxury yachts by this time next year?

I’m very curious to see where the money flows in 2022.

While I recognize that the pandemic has caused financial hardship to many, it’s also left many others unaffected, or even been a boom. There’s so much money in this city and it all must find a place to land.

Is that money going to land in real estate, equities, or crypto in 2022?

With constant chatter of the government inventing new taxes on “investors,” perhaps this is the year that some take their money and look to the safe-haven of the DOW, or gold, or maybe take on the associated risk to gain the potential upside of crypto.

Or maybe none of that happens. Maybe Toronto real estate sees even more investment dollars in 2022 than ever before.

Either way, this topic really piques my interest and I’ll be monitoring it very closely this year!

7) Will we see a continued trend with respect to the securitization and financialization of real estate?

One of the themes I spent considerable time on in 2021 was the “securitization” of real estate.

Whether it’s buying a condo through Key Living to reside in, with a modest 2.5% down payment rather than the government-mandated 5%, or whether it’s buying “shares” in a condo through Addy or Buy Properly, we saw new business models spring up last year all throughout the real estate landscape.

I mentioned last year that of the kids I use to coach on the baseball diamond more than a decade ago called me up and pitched me an idea very similar to that of Key Living, and they have major financial backing.

That’s only one competitor to Key LIving that we know of. How many others are being worked on right now?

Last week, this article appeared in the Globe & Mail:

“We’re Going To Hear A Lot More About The Financialization Of Housing This Year”

It’s a spectacular read, but in case you don’t have time or if it’s behind a paywall, here’s the best excerpt:

It’s useful to think of a residence as providing two types of value: use and exchange. Use value, as the name implies, refers to the shelter and locational attributes of a structure to its occupants, whereas exchange value refers to the market value of said structures. These two attributes of housing have always existed in an uneasy relationship and pose a key question to Canadian federal public policy: If a roof over our heads is necessary for survival, shouldn’t these roofs be publicly distributed on the basis of need rather than left to the vagaries of a private market?

Go back to my Burning Question #4, and read it again.

Foreign money is being pumped into our country’s real estate as easily as water flows from a bathroom faucet. Financialization of Toronto real estate isn’t new; it’s just being talked about now because we’re in awe and disbelief about where our market has gone. As is usually the case with real estate, the media and the government are always late to the party and always reacting to something from yesteryear.

Toward the end of 2021, we were inundated with this idea that “investors” were to blame for our skyrocketing real estate prices.

Is this going to continue in 2022?

Will the government take note of, let alone, aim new policies at the securitization of real estate and foreign or domestic private market money buying up real estate in swaths?

This might be the last Burning Question on my list, but it was certainly not the least-asked question over my holiday break…

Alright, folks, that’s it for my look ahead into 2022.

Sure there, are other topics to discuss, questions to raise, and concerns to be looking out for, but these are truly the points that stuck out the most in my mind heading into this year.

On Wednesday, I’ll take a look at the December TRREB stats and while this is likely the most historically volatile month of the year, I think there are some projections to be made.

EastYorker

at 4:04 pm

Is this the horse that is after the cart ?

Appraiser

at 9:02 am

The NRST (Non-Resident Speculation Tax) was introduced in the spring of 2017. The NRST requires foreign nationals, foreign corporations, and taxable trustees to pay a 15% tax on residential home purchases within the Greater Golden Horseshoe Region. This is in addition to land transfer tax.

Clearly this tax has had a no effect on runaway real estate prices.

The solution of course is obvious – more taxes!

Bal

at 9:42 am

we have more domestic flippers than foreign. many people flipped houses with zero upgrades i with in last six months profit of 600,000 … i think there should be come control on domestic flippers ……

Kramer

at 10:24 am

What causes so many flippers to show up? Whatever it is, let’s focus on addressing that… rather than just hitting the turbotax button again and again.

Kyle

at 10:33 am

I agree, taxes are not the answer. I’m not convinced that flipping has any effect on prices.

If a flipper doesn’t upgrade and pays market price at point in time X and then sells at market price at point in time Y, then how did they affect market prices?

I guess, one might argue they added demand when they bought at time X, but then they added supply when they sold at time Y. Had it been an end user that bought instead, A) the end user would have probably bid higher than a flipper at time X, since they’re not looking for profit and B) they likely wouldn’t put the house back on the market for a long time, which reduces future supply.

Ed

at 9:28 am

“There is no more volatile investment than crypto-currency”-David

///////////

NFT’s would like a word with you.

Kramer

at 9:37 am

Both speculative dogsh##, just a slightly different breed of dog.

Kyle

at 10:36 am

I think Meta real estate will become the shit a dog shits out after eating other dogs’ shit.

Kramer

at 12:02 pm

Agreed. All this shit is based on a phoney scarcity angle. This is worse than websites in 1999.

Kramer

at 12:12 pm

All of this shit… all of it… on day 1 of development the people behind it asked “OK, even though the function on computers still work…….. HOW CAN WE MAKE THIS SCARCE? … let’s start there, set those parameters, and then see what dogshit we can make and sell”.

Sorry, but you cannot create real moat that way… you can make the next tulip appear, but eventually the music stops. Eventually 50,000,000,000 “plots of digital land” become available because someone’s button got stuck for a few seconds.

Kramer

at 12:14 pm

hmmm lost some words that were key there, apologies. Last post for day.

All of this shit… all of it… on day 1 of development the people behind it asked “OK, even though the COPY-PASTE function on computers still work…….. HOW CAN WE MAKE THIS SCARCE? … let’s start there, set those parameters, and then see what dogshit we can make and sell”.

Sorry, but you cannot create real moat that way… you can make the next tulip appear, but eventually the music stops. Eventually 50,000,000,000 “plots of digital land” become available because someone’s ENTER button got stuck for a few seconds.

Marty

at 10:05 am

Will any of the governments ‘ideas’ to help housing affordability actually help?

Not significantly, but don’t let a poor 30 or 50-year track record stop governments from being seen to be “doing” something.

Appraiser

at 10:46 am

“I honestly can’t opine on what a “healthy” level of residential investment looks like, and likely neither can you.”

As Shakespeare wrote…”ay there’s the rub”

The Globe & Mail chart is a prime example and display of content without context, correlation without causation, and simplistic bi-variate analysis.

There is no definition of what the ideal amount of residential investment for an economy should be. Without a target, one is left to wonder if the U.S. is not investing nearly enough or indeed if Canada is also not investing enough?

Or are they both investing too much?

Is there a solid argument as to why Canada and the U.S should have similar levels of investment in real estate?

Should we be perhaps comparing Canada to countries of similar size / GDP ?

Also, is it possible that simplistic country to country comparisons of this type are generally worthless?

There’s that word simplistic again.

Kyle

at 11:04 am

You are bang on…

I didn’t read the article, because frankly the Globe’s content isn’t worth two cents a week let alone $2/wk. But what i can say, based on the headline and from others spouting similar nonsense, is that the Author has no clue how economics works.

Money naturally flows to where the risk adjusted returns are. The economy isn’t being “dragged” down because too much money is flowing into real estate. The reality is money is flowing into real estate because there isn’t more compelling things to put money into. Taxing or preventing money from gong into real estate doesn’t suddenly create new productive opportunities elsewhere in our economy.

Appraiser

at 3:00 pm

Re: the economic drag theory.

There is a school of thought populated mostly by bears or former bears ( do they ever truly shed their fur?) and wannabe economists that have come to believe that investment in residential real estate in non productive.

The entire theory is based on one article a few years ago whereby the author determined that investment in housing was somehow less productive than other economic endeavors. Another empty theory that the pandemic has thoroughly and clearly debunked.

Of course the rhetoric soon transformed the words “less productive” into “non productive” and it’s all bullshit anyway.

John

at 6:51 pm

The blog section of this site should have a like button of sorts

Land84

at 4:16 am

“Like”

Libertarian

at 11:18 am

“I honestly believe that in twenty years, an overwhelming majority of our population will be renting houses and condos from landlords who, at least in part, originate overseas.”

That’ll take all the fun out of the “rent vs. buy” debate!

But that paints a really sad picture for the city’s future because most people are financially illiterate and don’t have the discipline to save and invest. We’re going to be a population of haves and have nots. I can only imagine what the government will do then.

Real estate is expensive now and has been for a while, which is why I think the “rent vs. buy” has been so prevalent. It’s trying to show people that by saving and investing you can still grow your net worth.

Adrian

at 11:47 am

I work in construction lending and have been involved in providing financing for new build condos to developers for over 10 years. The idea that foreign money is fueling Toronto’s pre-construction purchases is a boogy-man that’s been around for years with no real evidence. I have seen the pre-sales lists on many projects and most purchasers are Canadian citizens. People use their home equity lines of credit to make deposits on units and it is definitely the more wealthy who are buying these units for investments and selling them on assignment or renting them out on completion. Not to say there is zero foreign money but I’d estimate it’s not more than 15% of units purchased, maybe less.

$2,200 per sf is not accurate, units downtown are more like $1,200 psf for new builds. Yes some units in Yorkville can exceed $2,200 psf but that is not representative of the market.

The reason pre-construction condos sell at such high prices is the same reason that resale homes do- not enough supply, low interest rates, etc.

My caveat to this discussion is that I have started working on projects in Vancouver over the last few years and in my opinion foreign money is a HUGE issue in that market. You can see the difference in how projects are marketed overseas, marketing material is provided in mandarin and I think Vancouver is lovely but does not have the economic activity or the population to justify paying more than what you would in Toronto for condo unit. The pre-sales lists are sometimes mostly/entirely foreign buyers (I know this because lenders often require that foreign buyers are declared as such and also require higher deposits). There’s way more foreign developers too, Toronto developers are more old money guys, newbies are still rare.

tl;dr in a world where re-sale homes are increasing at 15%-20% per year is it so odd to price new construction condos that will be ready in 3 years 20%-40% higher than currently available resale units?

Appraiser

at 2:43 pm

Not odd or unreasonable at all to expect 20-40% higher prices in 3 years time.

Listing inventories are at all-time lows on the MLS. Employment in Ontario is exploding.

What is standing in the way of continued price escalation?

John

at 7:10 pm

Great insights I haven’t ever seen elsewhere.

This blog is not only a gem on its own but also thanks to some high quality common sense comments.

I would only disagree with $1,200 PSF for the downtown new builds. From the little I’ve seen, in the last 6-9 months it has become more of the Mississauga/Etobicoke starting price point for larger units. The equivalent downtown price is in the $1,350-1,500 price range while smaller units start at $1,500-1,600.

Land84

at 4:22 am

“Like”

Edwin

at 1:31 pm

So if the foreign money for precons every dries up, what happens. The City, developers, their contractors, and everybody involved in the precon industry now ahs their business models built around these crazy prices. It doesn’t work if they have to go back to selling precon units for $1000 PSF.

Appraiser

at 2:35 pm

If / when the foreign money “dries up” the void will be filled by Canadian residents in a heart beat, if we don’t build more housing.

Condodweller

at 2:20 pm

“it wants to be parked in a project that is five or six years from completion.”

David what’s the rationale behind this vs buying existing units? If we discount future prices to today, and the currently available prices are lower why would anybody prefer to pay the higher price?

Adrian

at 4:07 pm

If you have money to invest why not invest it in a unit that is appreciating in price over a few years that you don’t even have to rent out? An existing rental unit requires finding a tenant, managing issues, obtaining a mortgage etc. A preconstruction unit allows you to pay only 15% of the purchase price and reap the capital gains on completion with very little work. This is why units are almost exclusively bought by investors (though not necessarily foreign ones) rather than those looking for a place to live. It’s pretty inconvenient to buy a preconstruction condo for your personal residence

and not know when it will be finished or what your personal circumstances will be 4-5 years from now when it’s ready.

Condodweller

at 12:14 am

Well if they have a high conviction that the market will be up the next few years ok. It makes sense that no property tax/maintenance fees along the way make for higher returns but I’d still be concerned about the project being canceled.

Good insights in your other comment.

Anwar

at 6:52 pm

Because it’s a great way to bring dark money into the country.

Condodweller

at 12:49 am

I had a chance to read the last few burning questions. Each of these deserves its own blog IMO.

#6. I looked into crypto a bit and from what I can tell the danger isn’t so much the valuation/volatility but the security of the wallet. It reminds me of the start of the internet. In the early 1990s when the first dialup providers started to pop up people and companies had no idea of the potential and it took about 6 years to reach the peak. The problem with crypto is all the fraud and the outright theft of the wallet.

As for equity investments, there are a lot of opportunities to make significantly better returns with less risk than RE for someone who is willing to do their research and can overcome emotions even with leverage. The best description I saw was from a daytrader who likened it to a sniper instead of a machine gun approach. High-quality companies go on sale regularly and return quick 15-20% in a short time frame. David mentions the bank’s ~4% dividend return which is great, what’s even better is when they go on sale and you can get a 6-8% dividend. If one picked up the Canadian banks at the bottom of the financial crisis they were paying out ~8% which they have increased since regularly. I keep hearing about people who collect 20%+ from the banks in dividends only. There are some older people who are getting 100%+ dividends on their original investment, not including capital gains. So no, RE is not the only game in town, nor the best. What I have said in the past, is that RE has been good for the average person who doesn’t have the knowledge of equity markets. While RE does have the leverage advantage, even that can be done in the equity markets and using HELOC money.

#7 If prices keep rising I totally expect this segment to grow. IMO for one of these companies to succeed, they have to provide a fair deal to people and it’s very important to establish credibility. It’s the same as bitcoin. If your name is not on the deed, it’s very susceptible to fraud. Even if it’s not outright fraud, you are at the mercy of the company’s terms.

Average Joe

at 1:23 pm

My place has gone up another $100K+ since a realtor last looked a few months ago. I wonder how much longer anyone will pay for pilot training or med school when they can just get a GED and a real estate license. Or better yet buy any dump near the GO tracks and ride the gravy train to freedom 35.

Bal

at 8:30 pm

Agreed…actually i am feeling bad for my boys as i kept pushing them to do medical …now i am thinking what is the point ….it is really depressing