“Was that a sneeze?”

“Does she have a runny nose?”

“Did I hear that another kid in his daycare was sick?”

Times have changed, most certainly, and whereas we used to think of the fall season and conjure up thoughts and images of fallen leaves, corn mazes, and pumpkin patches, we find ourselves here in 2021 where it’s all about who might have a cold.

Raise your hand if back in April of 2020 you thought we’d still be doing this by the fall of 2021?

Such is life at the current moment, and I believe that most of us by now have accepted this as a part of our daily routine. We’ve adapted and adopted, and while we all stop to express frustration from time to time, this is simply our new normal.

COVID has affected everything around us. Nothing is the same.

For those of you who drafted your fantasy football teams over the long weekend, did you take a look at who is on the COVID list? Did you ever think that would be a part of your draft preparation? I sure hope the Dallas Cowboy’s offensive line can hold up without Zack Martin!

Is it trivial to lament that COVID has affected my fantasy football team? Yeah, but that’s now my point – my point is that COVID affects everything, no matter how big or how small.

When I look back at how COVID has affected the Toronto real estate market over the past eighteen months, I’m amazed. We went from “this is the end” to “the sky’s the limit.” The market was non-existent in April of 2020, but it’s done nothing but appreciate since early-summer of last year.

A client of mine emailed me last week about a property on the east side and said, “They have an open house this weekend so we’ll probably go check it out.”

An open house?

Do those even exist in Toronto right now?

Right or wrong, we’re going to see open houses make a comeback this fall. I will not be hosting them for my listings, but I know a lot of other agents out there will be.

I also think we’re going to see some real estate brokerages relax their appointment protocols while we see other real estate brokerages strengthen their rules.

Simply put, there is no “one size fits all” approach to a pandemic that is in the stretch-run of a two-year term, and buyers, sellers, and agents will all need to be on their toes this fall.

Case in point: a listing that my buyer-clients were interested in, up in Richmond Hill, was reviewing offers on Monday at 2pm. First of all, who in the world reviews offers on a long weekend, let alone on Labour Day? Second of all, this is a very Jewish area and Monday is Rosh Hashannah. Why would the seller and listing agent, themselves being Jewish, review offers only a few hours before family dinners take place for everybody who would be interested in that house, including my clients?

That was bizarre. But it’s an example of the motto I will hold near and dear this fall: take nothing for granted, be ready for anything.

So what do we expect for the real estate market this fall?

What topics, issues, and questions should be on our minds?

There’s no shortage of answers here, and everybody will have a few different ideas.

But as I see it, there are five major questions that we should all be asking with respect to the Toronto real estate market, so here we go…

–

1) How will the federal election shape the future of the housing market?

Quite simply, it won’t.

But I don’t think this tagline would fly with potential voters out there:

“The Liberal/NDP/Conservative Party want you to know that nothing they do will change the housing market, so they won’t bother trying!”

It doesn’t really have the same ring as a party leader making promises that he or she can’t, and likely won’t have to keep.

It’s “silly season” out there right now. The great “give away.”

$2 Billion for this, $700 Million for that.

The individual voter isn’t thinking about the big picture or the greater good; they’re thinking about what politicians will do for them. Free dental? Free child care? Free gouda cheese? Sounds good(a) to me! Here’s my vote!

This is how elections work. Make promises, offer handouts, and just like a tuna fisherman with multiple lines in the water, you’re hoping one of them catches. And when it comes to the housing market, everybody is affected, so politicians are going to offer ideas, solutions, and in many cases, handouts, in an attempt to fish voters in.

But the problem, as you and I know, is that most of the impact to be made in the housing market starts with the municipalities. Then the province. Then, and only then, the federal government.

I recently put together a land assembly of a dozen houses in a prime location off Yonge Street where a major Toronto condo developer planned to build a tower. This tower would have had 500 units, 30% of which would be affordable housing. But the city councilor for this area, who is extremely powerful and extremely popular, said that he or she didn’t want “intensification” and “densification” in the area, and said that he or she would fight the project.

So the developer walked away.

That’s a lot of housing that would have, could have, should have been available in 2025, but now will never be built.

The municipality has so much power and yet we’re being told by the parties vying for power in this federal election that they are going to do something about house prices and affordability?

The Liberal government has come up with some interesting ideas. A “ban” on blind bidding, for one. Again, real estate regulation falls into provincial jurisdiction, but the Liberals have said that they will make “blind bidding” a criminal act under federal legislation, so they’re trying to take control from other jurisdictions who’s responsibility it is. Sounds a lot like how politics in the United States work!

I’ll say this, and not as a real estate agent but just as a person who watches government like sport: this will never happen. It’s a great sound bite! “Blind bidding” was such a hot topic in the spring and we discussed it many times here on TRB, even though it had never been discussed to the same level in the previous fourteen years of TRB’s existence. So good for the Liberals, in their quest to find top-of-mind issues that resonate with voters, for coming up with this idea.

But it will never happen.

Why?

Because it doesn’t need to happen!

It just needs to be promised, or suggested, to get that party in power. Once that party is in power, they don’t really need to do anything. Maybe, what, one percent of the population really follows government policy? Most people out there don’t even know the candidates!

A ban on blind bidding isn’t coming. Neither is a ban on foreign buyers, because even if that legislation was written, it wouldn’t be enforced. Those foreign buyers are a lot smarter than the bobble-heads in Ottawa.

As I’ve written before countless times, the government continues to focus on the demand-side of the market. Blind bidding, foreign buyers, stress tests, et al. None of this will have an effect on the market. If the federal government, and the parties vying for the Prime Minister’s office, really wanted to “help” with housing affordability, they would focus on supply.

But they won’t, because that’s too complicated and will take too long, and politicians are in power for four-year terms (at best), so nobody is going to work on a 30-year plan.

(sigh)

I could write 5,000 words on this, but I won’t……..today. But tomorrow is another day…

–

2) What is going to happen with the condo market?

The condo market?

That’s the second-most burning question? Really?

Not the freehold market, or the detached market?

I mean, do we even need to ask, “What is going to happen with the freehold market?” It’s going to go up. So why bother asking the question?

When it comes to the condo market, however, it’s more of a real question, since the answer is anything but obvious.

The fall-2020 condo market was the worst I had ever seen. Not even close.

But by March of 2021, I was seeing 100+ showings booked on some of my 1-bed, 1-bath condo listings, and prices had not only regained lost ground from 2020, but new records were being set.

Over the last decade, we’ve used the word “unsustainable” many times in disbelief. No matter the property type or location, we continue to look at price appreciation and say, “This is unsustainable.” But is it? And when it comes to the condo market, what can we realistically expect for the fall?

I had planned a stats blog for Thursday based on the August TRREB numbers so I don’t want to spoil too many surprises, but let’s just consider, for a moment, what 416 condominium prices typically do in the summer.

What do you think prices would do in the summer?

They’d go down, right?

The market is far hotter in the spring, and while the condo market isn’t nearly as cyclical as the freehold market, we would all expect that the condo market would cool in the summer.

Only this year, it didn’t.

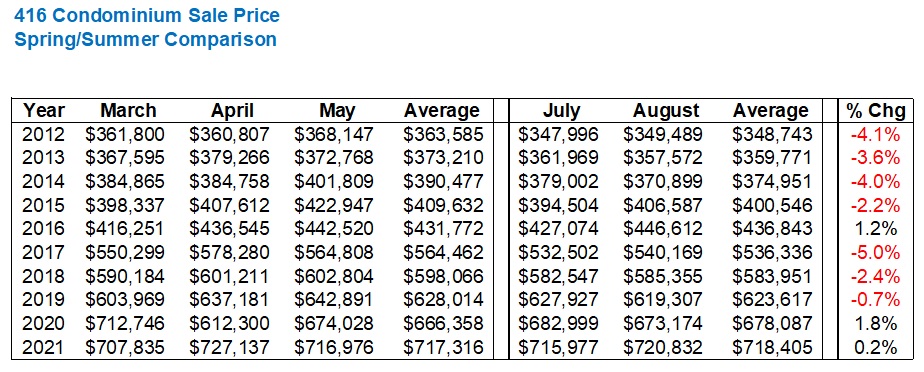

Let’s average condominium prices from March, April, and May, and compare them with July and August:

I’ll make this point again: 2020 was an outlier due to the pandemic.

Ignoring 2020, we see that only once in the previous eight years has the average condo price in the summer actually increased from that of the spring.

To see the August, 2021 average condo price check in at $720,832, which is more than the month of May, is downright shocking.

August condo prices are not higher than May. Never.

In fact, to test this theory, I looked at the data:

Now, you can tell me I’m guilty of making numbers say what I want them to, but I might simply tell you in response that I’m looking for statistical anomalies, and here I think we found one.

So what does all of this mean?

I shudder to think that we might see an average condo price north of $750,000, but the data is certainly pointing us in that direction.

Think about where prices were at the onset of the pandemic, how they recovered, and where they’ve gone since.

Here’s how the average GTA home price moved from the pre-pandemic peak in February through October of 2020, compared to 416 condominiums:

And remember that 416 condos are a part of “All GTA” so if we removed them from that data set (unfortunately, TRREB stats doesn’t provide this), the contrast would be even more stark.

But what if we re-ran the numbers comparing February of 2020 to August of 2021?

Shocking, right?

Here I am, talking about how hot the 416 condo market is, when all the while, it’s essentially on par with pre-pandemic levels, but the average GTA home price is up 17.6%.

But the average 416 condo price is up 12.6% from the trough in November of 2020, or 15.2% from the seasonally-depressed December figure, if we really wanted to cherry-pick data.

My point to all of this should be apparent by now: the market has not only recovered from the pandemic but shot to the moon since, as has every single housing type except for 416 condominiums. So with this upward momentum in condo prices through the summer, and the fact that 416 condo prices have lagged behind the overall market, shouldn’t we conclude that prices are going to take off this fall?

That’s my prediction…

–

3) What will happen with overall “housing affordability?”

Ummm, Toronto will become less affordable, not more.

Just don’t shoot the messenger, and don’t confuse my blunt delivery with a lack of sympathy here, but I figure there’s no point in beating around the bush.

At my football pool draft on the weekend, I saw a friend of mine from Kingston, Ontario, who moved a few years ago because he wanted a “different” life for his family. Toronto, born-and-raised, and from an upper-middle-class family, he simply couldn’t make Toronto work on the salaries that he and his wife pulled in. Now, they live a pretty great life 2.5 hours from the city.

I also saw a friend who lives in Vancouver, by way of Toronto, and Calgary, and while house prices in Vancouver aren’t exactly a breath of fresh air compared to Toronto, my friend has moved multiple times for work over the last decade, back-and-forth across the country multiple times, and it gets easier to disconnect from Toronto with every subsequent move.

Another one of my friends just purchased a parcel of land in Thunder Bay, on which he plans to build a “forever home” in the future. Two years, five years, or ten years, regardless, he’s going to “Get the fuck out of T-dot for good.”

One of my other good buddies bought a house out near Erin Mills in Mississauga four years ago, after having lived in Mississauga since he and his wife bought their first house in the Clarkson area in 2012. Their kids’ schools is out there, their friends and family are out there, and while they drive just inside the Toronto/Mississauga border for work every day, they’re no longer truly connected to Toronto, save, of course, for the Blue Jays.

Toronto is not an “affordable” city.

Maybe compared to New York, Paris, and London, but for the people who want to live here, and own, it’s not affordable.

Whether or not people should expect to be able to afford a home purchase here in Toronto, is another story. We’ve talked a lot about this in the past too, either how the home ownership rates in other world-class cities can be much lower, and it’s unreasonable to merely assume a person “should” be able to afford a home in Toronto, or, how the political climate over the last half-decade has provided the masses with a level of entitlement that assumes home ownership is a given.

But when we talk about what’s affordable on the whole, we’re also talking about renting as well.

When the pandemic first hit Toronto, rental prices dropped substantially. Your typical 1-bed, 1-bath, 500 square foot condo was increasing in rent by $150-$250 per year, and it got to a point where $2,200 for a small condo seemed, in a word, unsustainable.

Rents plummeted in the spring of 2020 and after rent strikes, rent reductions, and massive vacancies, the rental market eventually levelled out.

Fast-forward to the summer of 2021, and rental wars are upon us once again. I’ve heard of would-be renters offering 6-8 month’s rent up front, with an offer over the list price, and still losing out to another bid!

When looking at “affordability,” we have to remember that there’s no boogeyman here that’s jacking up the prices and rents. This is supply and demand at work, and there’s no should here; we can’t go around saying “Rents should be cheaper,” or “Working-class people should be able to buy a home in Toronto.”

It’s just a function of too much demand going up against not enough supply.

And if we go back to my first burning question, about how the federal election can help shape the housing market, we really have to think long-term with respect to our cities, or all hope is lost.

The run-up in rental prices in the summer was partially due to students and young people returning to downtown this September, but it was also just a return to rentals in general.

The rental-reprieve of 2020 is in the rear-view window, and it’s fading fast.

I expect rents to continue to rise this fall, and that’s not just for the condo market.

Clients of mine relocating from London, England to Toronto this summer found themselves in competition on a Beaches rental property. It was their “dream home,” at least for a rental, and they paid $4,800 per month, on a $4,400 list price, because there were two other prospective tenants offering over the list price. They provided four month’s rent up front with their handwritten letter to the seller (with cute family photo attached).

This isn’t a “luxury home” by any stretch. It’s just a home. But that’s what a Beaches home rents for these days!

And back to the average home price, even if for just a moment; what do we think will happen to prices this fall?

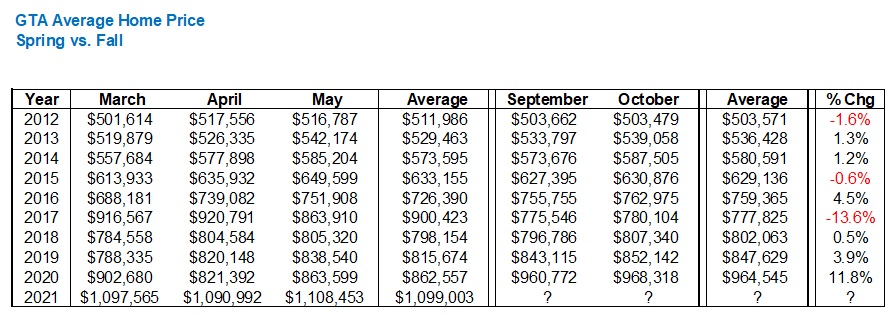

Let me re-run the same exercise as we did for condonimiums, comparing the March/April/May average to that of September/October for the last decade:

(this is going to show very small so click the image to enlarge)

If we take out 2020 because of the pandemic and subsequent rise in prices that fall, and 2017 because of the government interference and subsequent drop in prices that fall, we’re left with seven years, in which the fall price was higher than the spring price in four of those years, and lower in three.

Here’s one instance where the data isn’t giving us any definitive answers.

Call me biased, but I see 2021 looking a lot like 2019.

If we saw an average increase of 3.9% this fall, that $1,099,003 average from the spring of 2021 would lead to a corresponding average of $1,141,864 this September/October.

Do you see the average home price increasing to those figures?

Keep in mind, we just saw an average home price of $1,070,911 this past August, so a jump to $1,141,864 in September would mean a month-over-month increase of 6.6%.

That’s not unheard of, but it’s also a huge leap of faith.

One thing I will put money on, however: the average home price isn’t going down.

–

Alright, well those were my three biggest topics of discussion, and if we put the topics in question form, we get our “Burning Questions.”

I came up with TEN of those “Burning Questions” to start 2021 in a three-part blog series, but this fall, I think there are a lot fewer unknowns.

We won’t see any major changes in the mortgage market.

I don’t see any changes to government policy coming until at least 2022.

And in the three burning questions above, I think we’ve nicely touched on a host of other related topics.

Thanks to those of you who posted suggestions for future blog topics on the thread for last Friday’s blog. I’m always eager to hear what people are talking or wondering about.

We’ll meet back here on Thursday with either a recap of the August TRREB numbers, more burning questions, or more than likely, a combination of both…

Appraiser

at 9:13 am

I predict that David’s prediction regarding the fall market will be correct.

I further predict that the market will continue to grow along with the city and the province, for at least another 30 years.

On the concept of what can the municipalities / cities do quickly to add to the housing supply? One idea I read somewhere suggested repurposing some portion of the existing stock of downtown office towers that may never again be fully repopulated with office workers to residential zoning, mainly as rentals.

Maybe it could work as part of the solution to the housing crisis. Many of the service industries that usually underprop downtown office activity are the ones still on government support. Bringing people back downtown to live will put a roof over their heads and enliven the city. Plus landlords get to utilize otherwise empty office space while government income support is lessened as service industries come back to life.

It looks like a winning proposition. That’s why it will never happen?

Gillian

at 10:17 am

Re: city councillor who kyboshed development.

Name please.

David

at 4:03 pm

Rhymes with Batlow?

Edwin

at 11:06 am

David, do you have any contacts in the NYC real estate game. I would love to see a series of articles showing a real comparison of real estate across the two cities. Looking at more than the $/PSF in the associated downtown cores.

David Bergin

at 11:48 am

I live used to live in Toronto, i moved to the u.s. I make more money and have cheaper housing , good luck guys.

J G

at 3:41 pm

Excellent! Glad to hear there are smart people here.

USD-CAD more than1.25 over the past 7 years.