Monday’s blog post was somewhat eye-opening, right?

Throughout the province of Ontario in the past five years, we’ve seen nothing but price growth! Across the board, through twenty-four areas that CREA tracks, we saw anywhere from 39% appreciation in HPI in North Bay all the way up to 121% in Tillsonburg.

What I enjoyed even more than the stats themselves were the comments and emails!

I mean, Tillsonburg?

Blog reader, hoob tells a story about helping a friend move to downtown Tillsonburg in the year 2000.

Blog reader, Joel says he’s originally from Tillsonburg and his family still lives there.

And one of my former “baseball kids,” turned client, tells me that his wife is from Tillsonburg, born and raised. I never would have guessed…

Then there’s this comment from blog reader, Frances:

The market is depressing me right now. The gap in price between our 2 bedroom Toronto condo and the “starter-home” just keeps widening. I’m sure there are plenty of people like us who are stuck where they are and can’t afford to take the next step.

Woe is me!

This truly is “a topic for another day,” and it’s one that’s in the queue, trust me. That widening-gap has implications for the housing and condo markets respectively, and if we use historical trends, we can make accurate forecasts about what to expect moving forward. This might be a post for next week if I have time…

In the meantime, the take-away from Monday’s blog post was that all areas of Ontario have seen substantial real estate appreciation in the past five years, and if you’re looking for a more in-depth conclusion, perhaps we can agree that most of the big gains are in smaller areas with cheaper real estate prices.

But how does the rest of Canada look?

Well, CREA tracks a whopping twenty-four areas in Ontario, but only seventeen through the rest of the country. Maybe that’s fair, since Ontario is home to almost half the country’s population, but in any event, here are the other seventeen areas of the country for which CREA publishes the Home Price Index (HPI):

Chilliwack

Fraser Valley

Vancouver Island

Victoria

Okanagan Valley

Lower Mainland

Greater Vancouver

Calgary

Edmonton

Winnipeg

Saskatoon

Regina

Montreal CMA

Quebec CMA

Greater Moncton

St. John’s

Newfoundland & Labrador

Again, we see seven areas of British Columbia on the list, which is a far cry from the twenty-four in Ontario, but British Columbia is home to a little more than one-third of the population of Ontario.

So while my “Top Ten” of only seventeen areas is less impressive than with the twenty-four from Monday, here they are, nonetheless…

–

10) Winnipeg: +16%

Wow.

On Monday, we started at #10 with a 96% increase in the Huron Perth area, and here we are, looking at a paltry 16% increase?

Well, that’s an early indication of what’s to come, as I noted in today’s intro.

That’s as flat a line as you’ll see when it comes to price growth in Canada, although it’s worth noting that the year-over-year increase in December was 7.6%.

Between March of 2017 and January of 2020, there was movement on price up and down, but the prices at the start/end were almost identical. We’re just not accustomed to seeing this in Toronto. In almost three years, there was virtually no price growth? So, so different from what we’re used to…

–

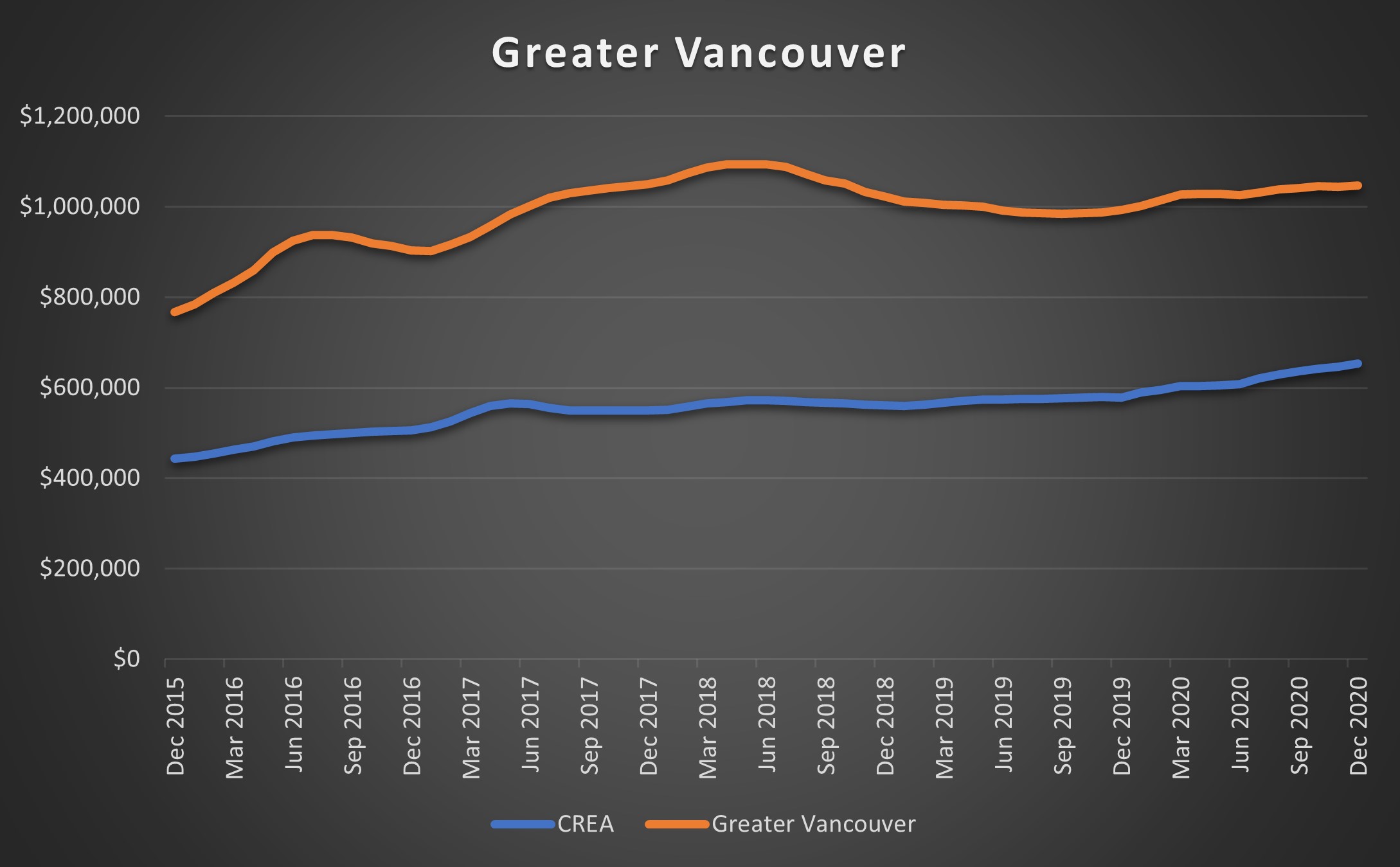

9) Greater Vancouver: +37%

Here’s an interesting chart!

People think “Vancouver” and automatically assume that prices have grown substantially, but it doesn’t seem like that’s the case.

Think back to the dramatic decline in Toronto prices that occurred in mid-2017, and I wrote about how Vancouver had seen this drop about 3/4 of a year earlier. This graph shows their ascent took place in early-2016 and the decline by mid-to-end of 2016. The market made a big recovery, however, and from January of 2017 to March of 2018, the HPI increased by 21.3%. But then it declined almost 10% by the summer of 2019, as you can see above.

Currently, the HPI is down by 4.3% from the peak in May of 2018.

–

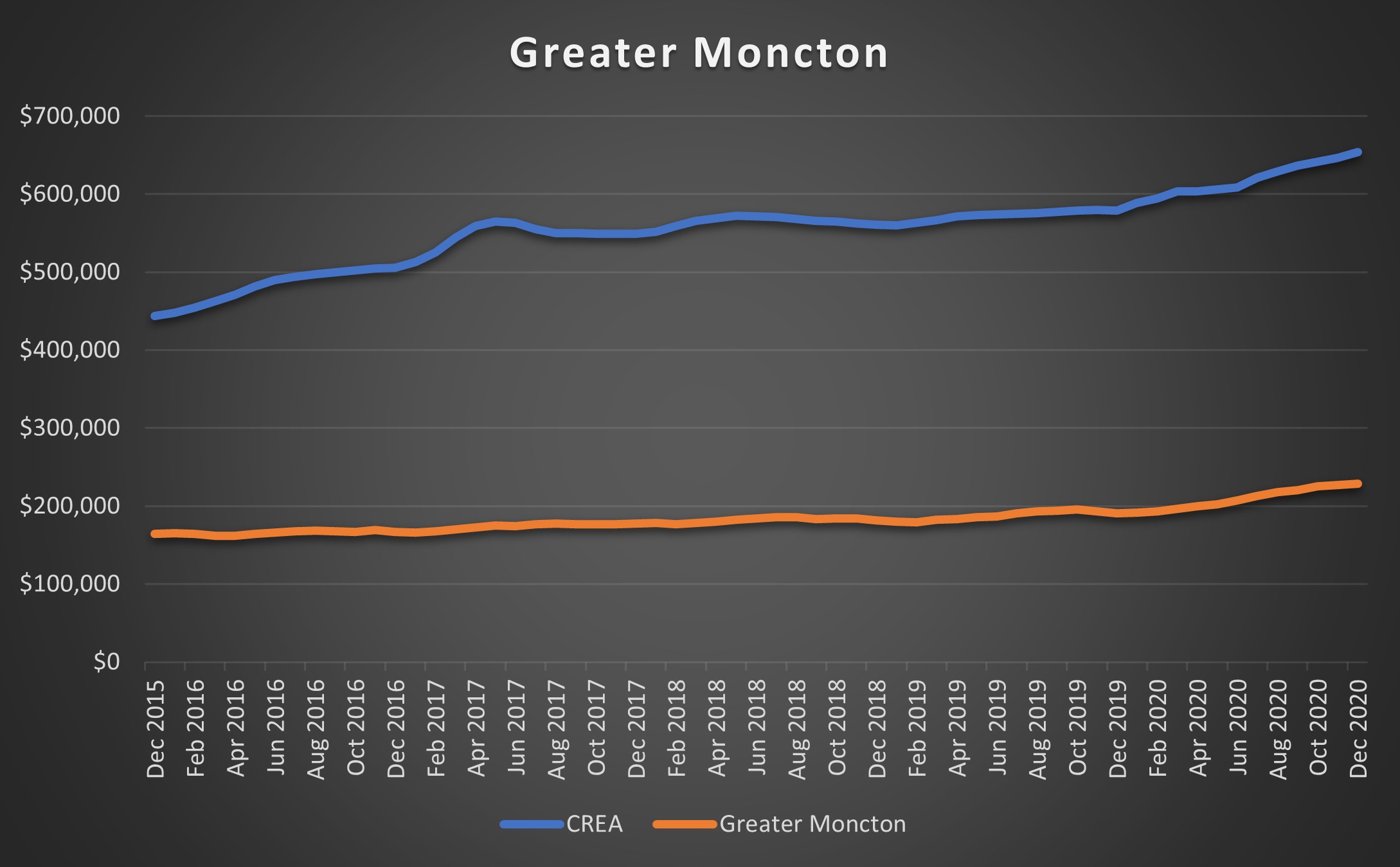

8) Greater Moncton: +39%

This is almost as boring a line as you’ll see; perhaps second only to Winnipeg.

I’ve never been to Moncton. In fact, I’ve never been out east. I really, really should go.

I often daydream about owning a house in Prince Edward Island, even though I’ve never been there. Is that weird? What if I said I was on VBRO last night looking at this vacation rental. That house, wow! What would that cost to purchase this house if it were in central Toronto? $5 Million? Probably. Now, what would I actually do in this house for a week with my family? They have a basketball court, but my daughter is only 4-years-old and my son just learned to walk last week. They have acres and acres of green grass. Maybe I’d run my kids through a sports boot camp? Maybe in a few years?

If anybody knows anything about P.E.I., please email me. This pandemic has us all making mental plans to escape as soon as we can, and I really want to travel out east.

Now, what about Moncton? I dunno. I got distracted by that beautiful house. Moving on…

–

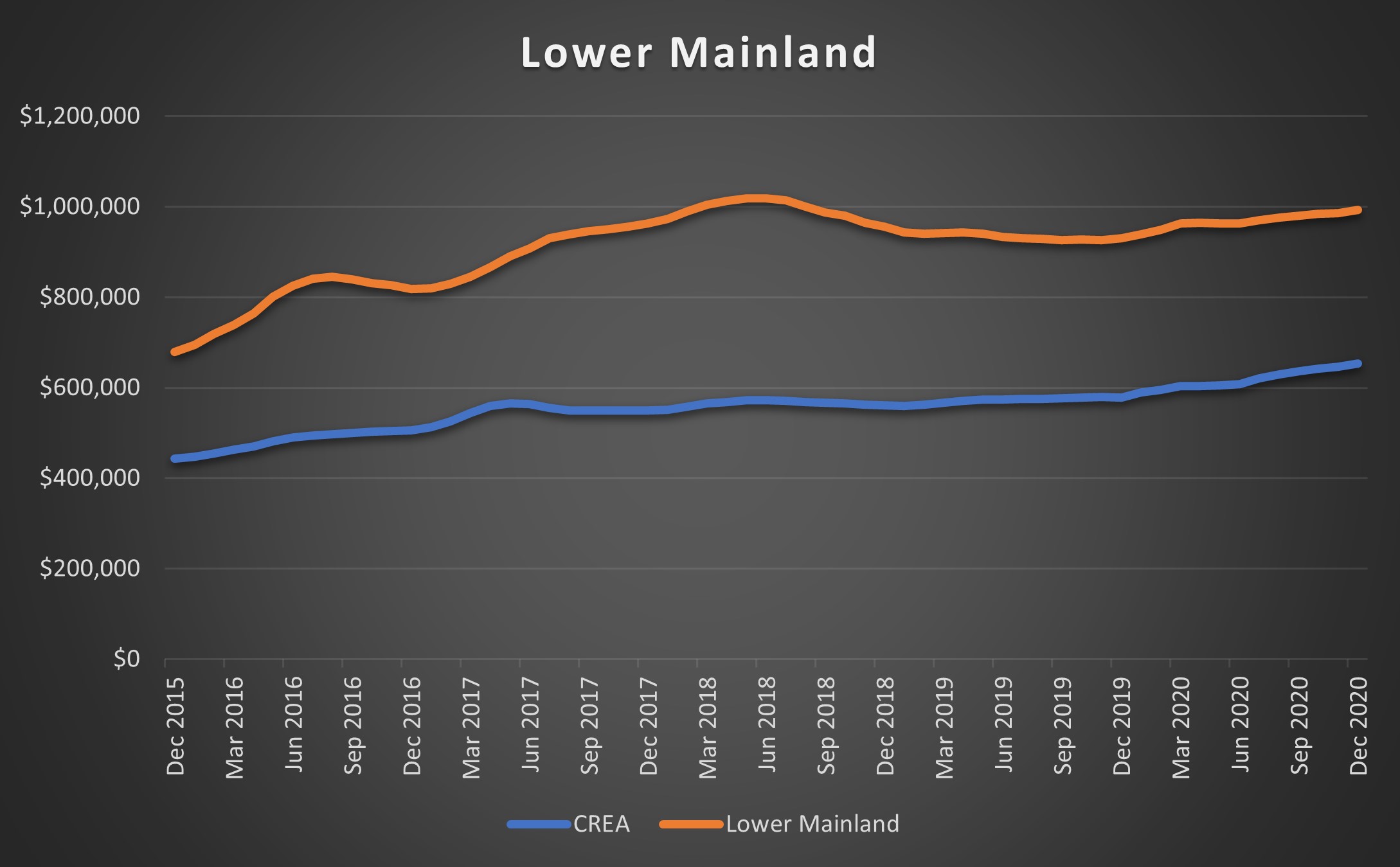

7) Lower Mainland (B.C.): +46%

Here’s yet another area of what a Torontonian would call “Vancouver.”

Then again, a Vancouverite might assume that Mississauga, Milton, Oakville, and Simcoe are all essentially “Toronto.”

The Lower Mainland’s curve is almost identical to that of Greater Vancouver. It would take a discerning eye to tell them apart! And with 46% and 37% appreciation in HPI respectively in five years, they’re really not all that different.

–

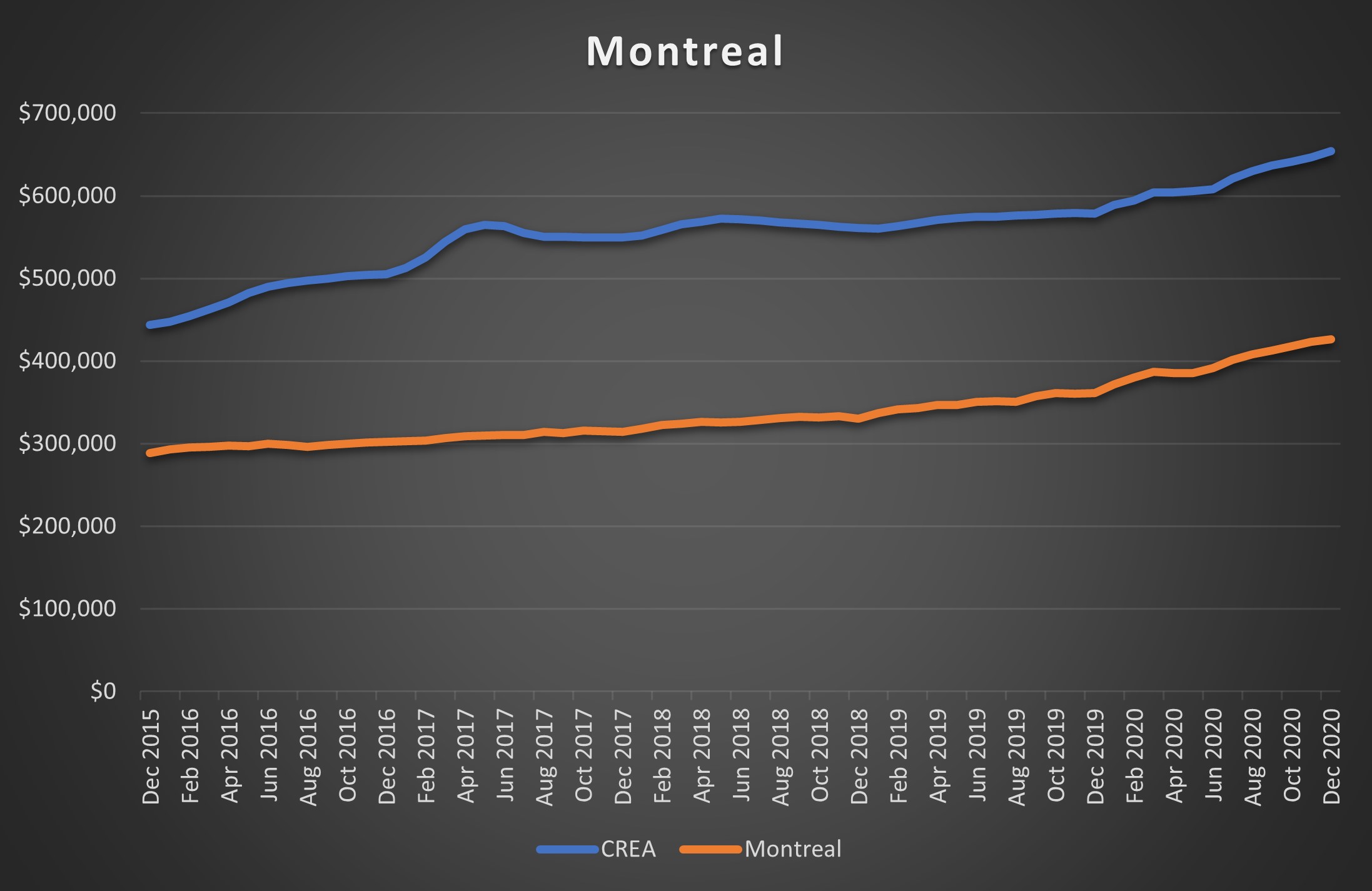

6) Montreal CMA: +48%

This one was quite interesting to me!

While Toronto and Vancouver seem to be forever linked as the top-two most expensive cities in Toronto, Montreal remains a bit of a mystery. If we’re looking a “big cities,” and maybe just playing off the ones that have NHL teams, then I’d wonder about Montreal, Ottawa, Edmonton, Calgary, and Winnipeg along with Toronto and Vancouver. But Montreal is different. The population is almost two million, it’s a party city, and it’s a huge destination unlike the others on the list (save for maybe the Calgary Stampede).

So why is real estate so cheap?

The HPI has gone from $288,400 to $426,500 in five years.

$426,500? In Montreal?

Greater Vancouver sits at $1,047,400 and Greater Toronto sits at $909,500. Why is Montreal so cheap?

Haters: this is your chance to speak up and provide reasoning…

–

5) Okanagan Valley: +51%

You might want to consider this “Vancouver #4,” but it’s not. It’s like calling Sudbury an offshoot of Toronto.

I don’t know that there’s another curve that traces the CREA HPI so closely, it’s amazing.

A 51% increase in five years is nothing to scoff at either.

–

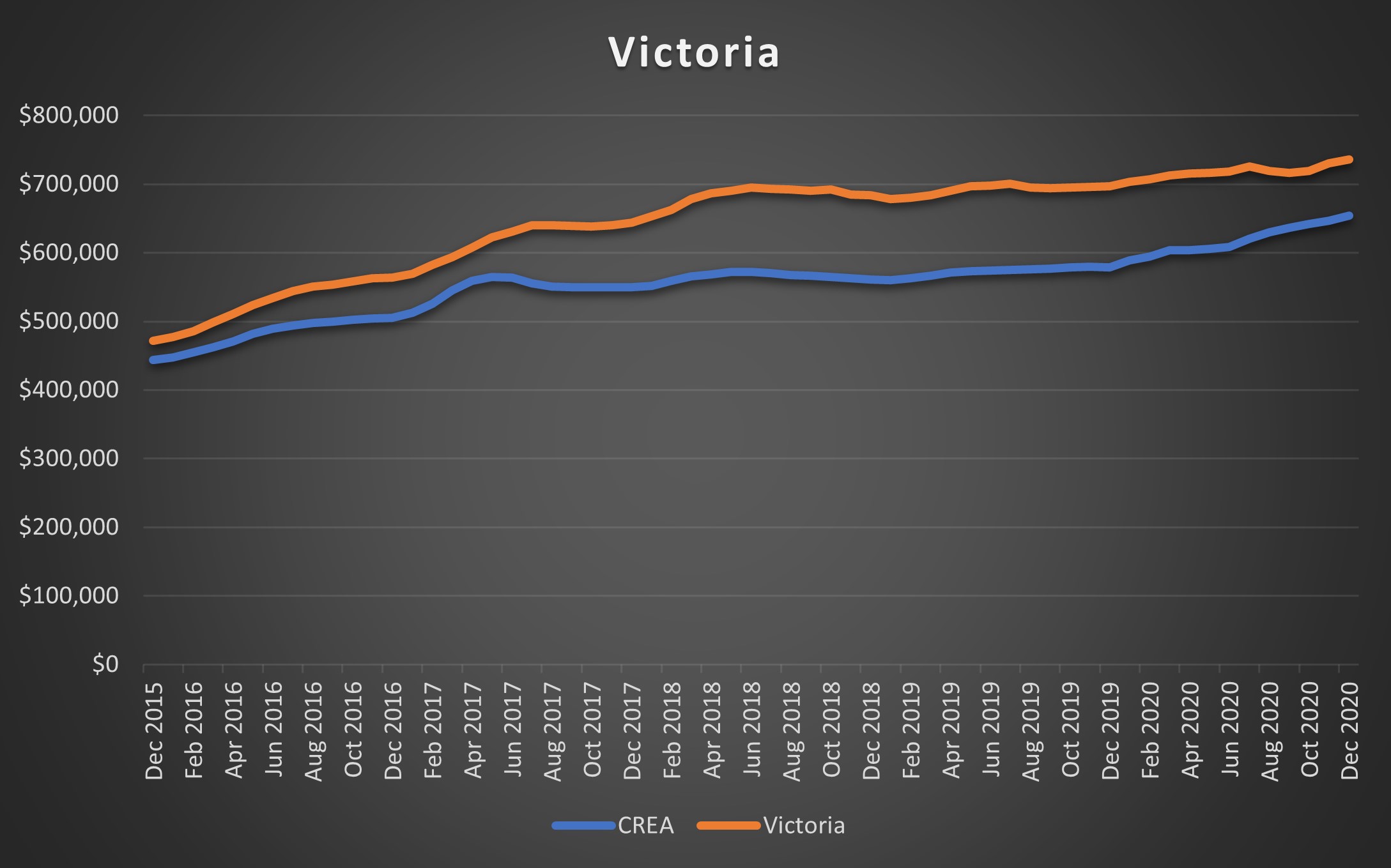

4) Victoria: +56%

Okay, so this is Vancouver, right?

No. It’s Vancouver Island.

But Vancouver Island has its own, separate data?

Yes.

Confused?

No.

Yes.

Maybe…

Victoria is the capital of British Columbia and is found on the southern end of Vancouver Island, home to only 100,000 people. But when you hear about your friends’ hippie parents that moved to “Vancouver Island,” and are playing the bongos all day with other 66-year-olds, that’s a completely different location.

In fact, it’s next on our list…

–

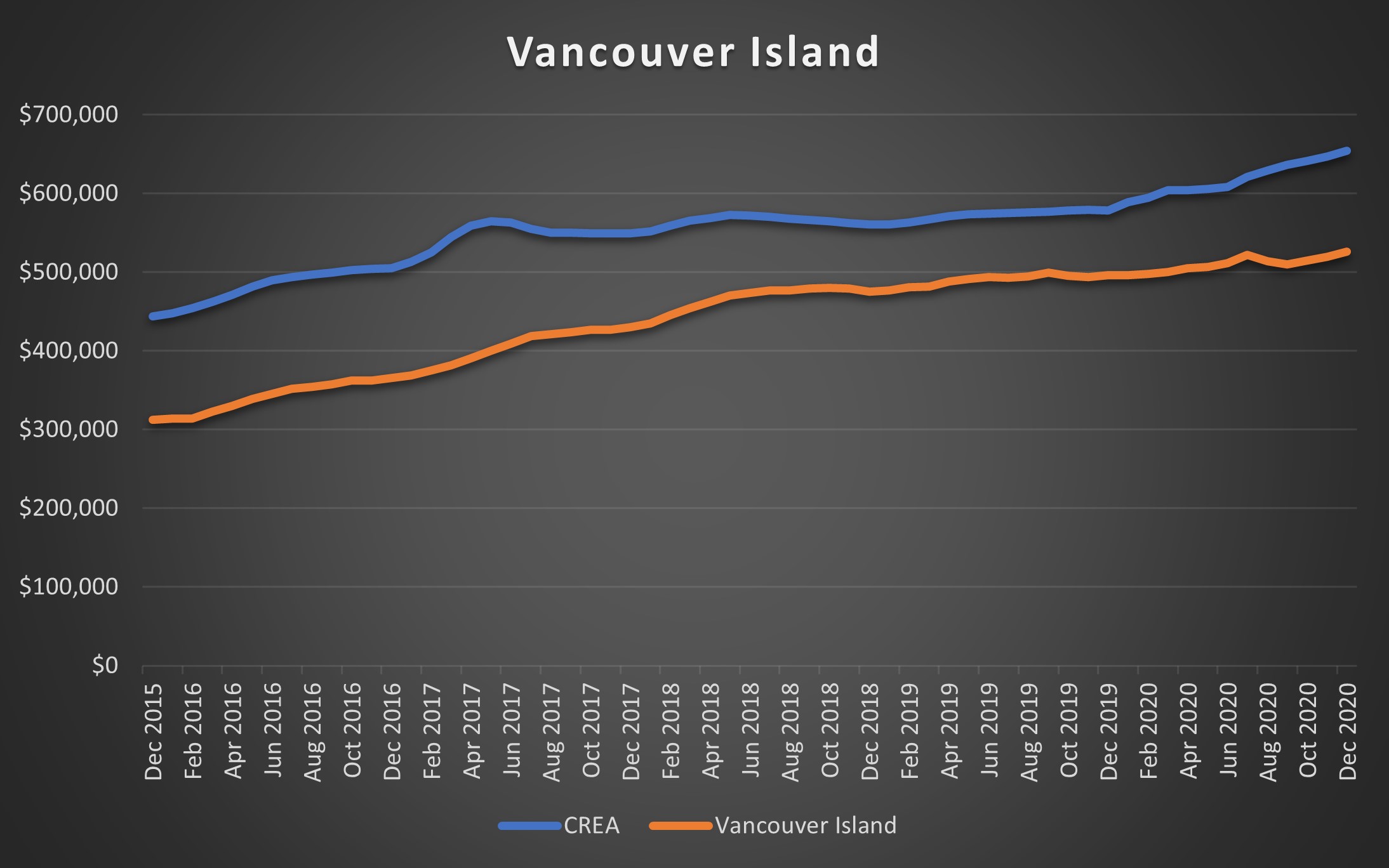

#3) Vancouver Island: +68%

I sold a house about seven or eight years ago for a couple who lived in the Beaches.

In the gentleman’s basement, behind his collection of guitars, was a copy of his LP from the 1970’s or 1980’s. He was a guitarist, and he had a lot more hair back then and was wearing way more leather.

They seemed really laid-back. And really into music, the arts, food, family, and mother earth.

So when they said they were going to sell their house, pack up, and move to Vancouver Island, I wasn’t surprised.

Am I typecasting? Yes.

Am I wrong here? No. We all know “that person” who moved to Vancouver Island, don’t we?

With a 68% appreciation in HPI in five years, Vancouver Island is well ahead of the 47% CREA mark.

–

#2) Fraser Valley: +69%

Vancouver east?

Kidding! I’m only kidding!

It’s like Mississauga to Toronto.

And the curve looks somewhat like that of Greater Vancouver or Lower Mainland.

While Greater Vancouver is down 4.3% from the peak in May of 2018, and Lower Mainland is down 2.6% from its peak in June of 2018, Fraser Valley is up 0.3% from the corresponding peak in June of 2018.

–

#1) Chilliwack: +76%

Coming in at #1 is Chilliwack, which can be found about an hour-and-change east of the city of Vancouver.

Prices are lower there, however. The current HPI is $563,900, up 76% from the $320,400 recorded in December of 2015.

Nevertheless, a mere 76% atop this list is nothing compared to the 121% we saw atop Monday’s list for Tillsonburg.

In fact, Chilliwack wouldn’t even crack the top-ten of all the areas that CREA tracks.

Now, what of the ‘other’ areas across Canada?

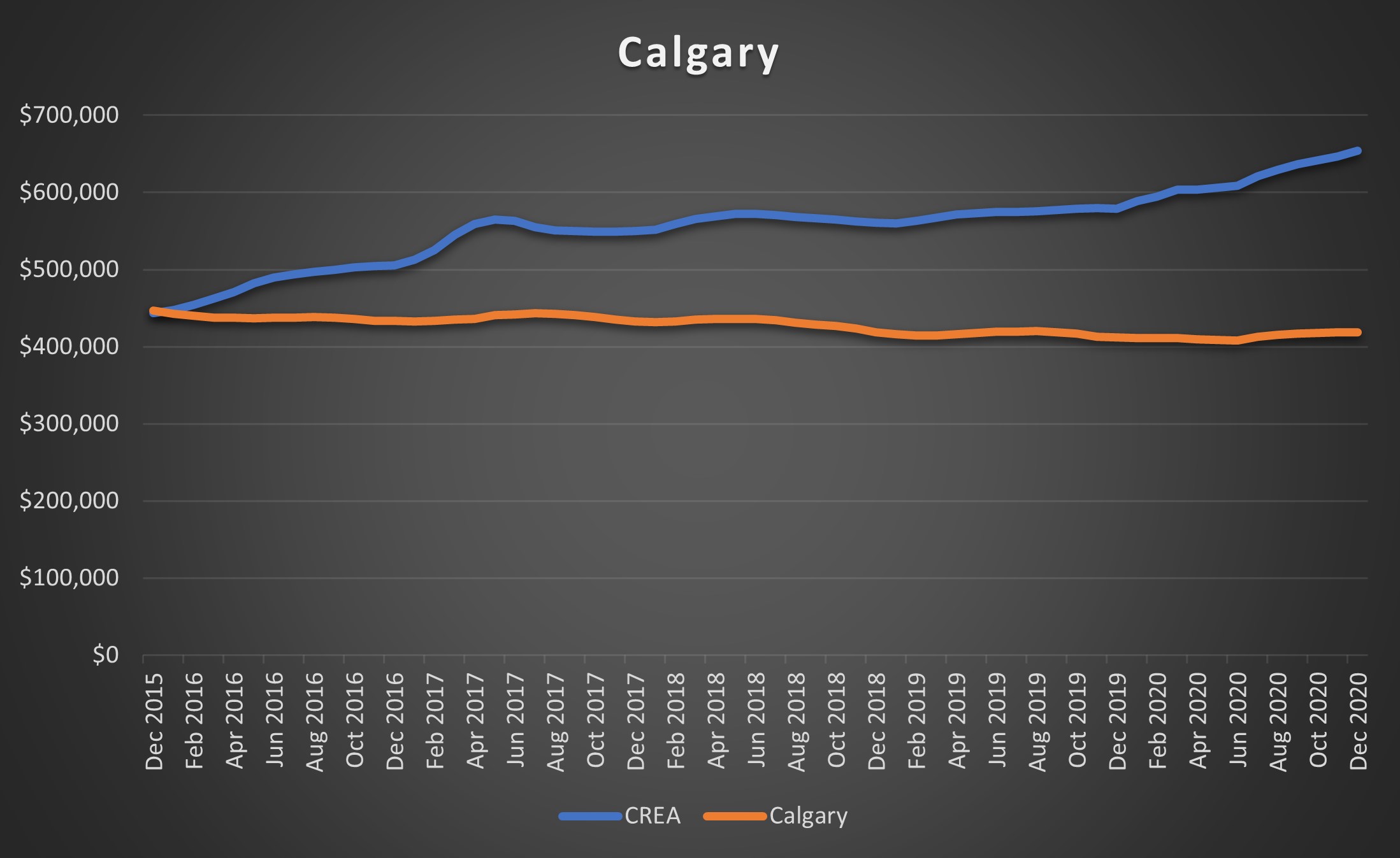

Before I get there, let’s go right to the bottom, and check out the graph for poor Calgary:

That’s rough.

For those of us living and buying in Toronto, it’s almost unimaginable to see a downtrend like this.

In December of 2015, Calgary was even with the CREA HPI.

In December of 2020, they were separated by $235,700, or 56%.

So let’s hear the argument of why Toronto could, in theory, lose value like Calgary.

Then let’s hear the argument why, in a million years, this will never happen.

As for the forty-two areas in total, let’s take a look at how the HPI has risen in each of them, together in one chart, with a yellow highlight for those in Ontario:

What’s the take-away here?

Or am I insulting your intelligence even asking?

The top nineteen are all in Ontario.

You could have literally thrown a dart at a map of the province back in December of 2015 and be expected to come out with a 90% return.

But that’s the past.

Who wants to talk about what to expect moving forward?

Francesca

at 7:18 am

Montreal will never be an expensive city because of the French language requirement for pretty much any job. Most immigrants coming to Canada would rather move to an English speaking city vs French, unless they are from Haiti or a Spanish speaking country seeing the two languages are more similar than with English. I lived in Montreal for three years as a kid and loved it. If you live in Montreal proper you can get away with not speaking a word of French assuming you aren’t working in a job that deals with the public. However the minute you leave Montreal it will be hard if you know no French. My husband works for a large CDN construction company and they do no work in Quebec, not only because of the language barrier but also because corruption runs rampant there in construction and other industries. Infrastructure in Montreal is falling apart. It’s a beautiful city, very European, great food, culture, people but the weather is terrible ( brutally cold in winter and hot and muggy in summer). Also you can only go to an English school if our parents come from an Anglo Saxon background if you are an immigrant or only if you come from an English province. When we moved there from Toronto, my dad was transferred by an Italian bank and had to get a written note saying why my sister and I could attend a private, not even public, English school as we were supposed to go to a French school! These are all reasons why real estate is cheap.

As for the west coast, when we visit my MIL in Vancouver proper we always tell people we live in Toronto even though we live in Markham as nobody there, unless they are Asian, know where Markham is. Vancouver proper is quite small in comparison to all the greater Vancouver areas of Burnaby, north and west Vancouver, Langley, Surrey, Port Coquitlam and New Westminster.

As for people moving to Vancouver Island I know two people here who just sold their house and are in the process of moving there!

Calgary real estate is tied up too much with oil performance unfortunately which in my opinion makes it too unreliable of a market to invest in.

Island Home Owner

at 8:17 am

I’m going to send you an email. 2020 is the best example in my nearly 40 years of why PEI is an AMAZING place to live.

We’re not perfect, no place is, but we have amazing social cohesion, lots of stuff for families to do and you could get an actual mansion with acres and acres of beautiful land for less than what your house costs in TO. Now, you couldn’t make as much money in he real estate game here, but I don’t doubt your knowledge and skills would allow you to set up a good practice here too.

Caprice

at 10:31 am

The slow pace of life on PEI would drive David crazy!

Island Home Owner

at 1:48 pm

Our difference with the rest of the world is much overexaggerated. Charlottetown is a very cosmopolitan city for it’s size and while the pace of life is a lot slower than Toronto, PEI is still part of Canada and culturally we’re not that much different that “away”.

Appraiser

at 10:16 am

416 Condo inventory has been cut to less than half from the peak in October, sitting at just 1.7 months.

416 Freehold inventory is only 1.5 months.

https://twitter.com/areacode416/status/1354124864332980224/photo/1

Marty

at 5:02 pm

Not to be nit-picky here, but as a guy that grew up in Victoria, let me just set it a bit straight.

While it’s true that the “municipality of Victoria” only has 100,000 people, it’s indistinguishable for most from the other 12 municipalities that make up Greater Victoria, that has nearly 400,000 people now. Greater Victoria is only 8km wide x 15km tall.

And it all sits on the very bottom tip of a 456km long island.

I’m actually quite supportive of changing the name to something other than Vancouver Island, because it IS confusing for visitors.

Fun fact: Okanagan Valley is where wealthy retired Canadian NHL players go to live after their playing careers. In Kelowna it’s crazy the amount you will run into at the finer restaurants etc.

Appraiser

at 6:27 am

January 416 Freehold sales are ahead of last year by +53%.

January 416 Condo sales are up over last year by a whopping +90% !

https://twitter.com/areacode416?lang=en

J G

at 7:09 am

You always leave out the bad part, I’ll let the readers click themselves and read.

Appraiser

at 8:20 am

“Toronto’s housing market so hot even the bully bidders are at war”

https://www.theglobeandmail.com/real-estate/toronto/article-torontos-housing-market-so-hot-even-the-bully-bidders-are-at-war/

Chris

at 8:46 am

“The price action for suburban houses looks a lot like the price action in GameStop.”

– Steve Saretsky

As I’ve said time and time again, none of these markets are operating normally. If you think this is simple supply and demand, you’re kidding yourself.

Appraiser

at 11:03 am

Yeah, you’re probably right.

It’s just a bunch of keyboard warriors on reddit artificially propping up the real estate market, to counter all of the short-sellers of real estate.

Got it.

Chris

at 11:13 am

I more meant extremely loose monetary and fiscal policy, driving all asset classes, including stocks, to record high valuations.

But you’re probably right, it’s probably just organic supply and demand across all these markets, in the midst of a pandemic and recession. That seems much more likely.

Jimbo

at 8:04 am

Montreal owner/renter numbers are a lot different than Toronto and Vancouver. I remember visiting Westmount in 2001 and was blown away you could get a very large house for $200k. A similar house in Toronto was $450k-$600k. I was far too young to buy then, bit I would’ve of I could.

I think a house in that area would cost $1m+ now.

Full disclosure it could’ve been Mt Royal area I just remember it the houses being on the side of a mountain (large hill if you are from out West).

Greg

at 9:43 am

Thank you for these amazing posts.