The term itself doesn’t sound all that pleasant, or safe. But then again, I guess it depends on how sharp the knife is?

“Catch A Falling Knife”

Most people know this idiom, however, it has different meanings to different people.

Some consider this to mean “buying a risky investment.”

I wouldn’t agree.

Some believe it means “buying an asset on the way down,” which holds true, but doesn’t quite capture the full effect of the phrase.

Others believe this is about “making up losses on an investment that’s quickly declined in value,” but that assumes you already own the asset.

A translation from Investopedia says the phrase means, “waiting for the price of an asset to bottom out before buying it.” I think that’s the best explanation.

Where the idiom goes awry, in my opinion, is that nobody wants to catch a falling knife. There’s no benefit, despite the risk.

So the saying, I believe, would have originally come with the word: don’t. As in, don’t try.

“Don’t try to catch a falling knife.”

There’s no upside.

Although in the stock market or the real estate market, there is.

If the market is falling, some believe they have the intuition necessary to know when to buy back in; when the market has hit bottom. If the market is rising, those same people might believe they have the superpowers necessary to know when the market has hit the peak, and thus when to sell.

Over the long-term, the real estate market will always rise in Toronto. Whether it’s inflation or simply the nature of the asset, it will always rise higher.

Stocks, on the other hand, don’t have the same guarantee. Companies can go bankrupt. Companies can be bought. Stocks can split. It’s just not the same comparison.

I think the phrase, “Don’t try to catch a falling knife” assumes far more risk in the equities market than the real estate market, but people will continue to use this phrase to describe both.

In the current Toronto real estate market, many people are beginning to make their predictions, prognostications, educated guesses, and complete shots in the dark about when the Toronto market will rebound.

Define “rebound,” first and foremost.

When will the GTA average surpass the $1,334,554 recorded in February of 2022? Likely not for a year or more. Some will say longer. Others will say much longer.

When will the 416 average surpass the $1,243,070 recorded at the “peak” in April of 2022? Who knows, but it will be much sooner than the point at which the GTA average surpasses $1,334,554, and that’s simply due to the rapid ascent – and subsequent descent, of the value of properties in the suburbs.

As a buyer, trying to catch a falling knife in the real estate market comes with less risk than a person attempting the same thing in the equities market, since the real estate buyer has an actual use for the purchase, ie. a home in which to live. There’s no question that September buyers will happily purchase at prices discounted from February, even though they know there’s a 50/50 chance that the property could be worth less in October or November.

But what I want to discuss today is what’s going through the minds of sellers.

And since a TRB reader challenged me via email last week, and said, “David, you continuously talk about the ‘decline in the suburbs’ but you’re not giving any examples of what’s happening in the 416,” I’ve decided to use a downtown Toronto condo as an example.

The 416 market has not been immune to the market decline.

On paper, the average condo price in the 416 is down 10.5%, March to July. This comes with caveats, or course, one being that it’s summer, but regardless, we all know that a condo the downtown core, the 416, or the GTA is worth less today than in March.

So what are sellers doing?

How are they handling the decline?

It really depends on the seller, and of course, the agent.

I spoke to a client on Friday who said she had bought a house in the United States in which to retire, and that while she knows the market has declined since we last spoke in March, she’s ready to sell in September.

That was easy. She did my job for me! She said, “David, let’s have the tough conversation now and talk about price.”

I told her that the condo is down from about $1,400,000 to the low-$1,300,000 range, and she said, “Okay then.”

That was that.

Not everybody can be so accepting, however.

Then again, many people simply get caught – wait for it – trying to catch a falling knife.

In a seller’s case, it’s the opposite, really. They’re trying not to “chase the market,” as we say.

As a seller, you need to get out ahead of where the market is going.

Think about a professional football player; a quarterback. Think about his relationship with the wide receiver.

When you go to the park with your buddies, you throw the ball to them. You look at them, they look at you, and you throw it to them. Easy, right?

A professional quarterback throws the ball nowhere near the receiver. He throws the ball to where the receiver is going. The receiver starts on the left side of the field, and is running into the centre of the field at a high speed, so the quarterback throws the ball there.

That’s what sellers need to do in a falling market.

They need to see where the market is going, and target that.

It’s much, much easier said than done, especially when the market is in the midst of changing.

So let’s work through an example of a condo that is now on its ninth listing since March and look at the strategies involved.

Disclaimer here, of course: I am not permitted to give out sold prices, advertise a competitor’s listing, or disparage a competitor’s listing, so I’ve blacked out the address of this property. I would also add that I’m not attempting to slag the owners or agents of this property. This is simply for educational purposes.

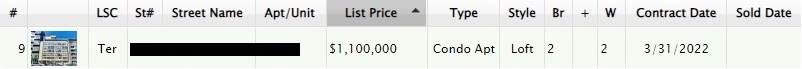

The condo was first listed for sale on March 31st, 2022:

We were still in a relatively hot condo market at the time, and this condo was listed for $1,100,000 with an offer date set for Wednesday, April 6th.

It’s a gorgeous unit, no doubt about it.

The location is great, the building is very popular, and the space is fantastic. There’s a huge terrace, high ceilings, and it’s a soft loft style.

If I had a client for this unit at the time, I would have happily sold this unit to them!

But the unit didn’t sell on offer night.

So it was re-listed on April 7th, the day after the scheduled offer date of April 6th:

The new listing was for $1,320,000, although this says $1,278,000 because that was a price reduction at a later date.

We don’t know if they received any offers when listed at $1,100,000 with an “offer date,” and if so, how much they were for.

But we do know that they re-listed $220,000 higher.

Eventually, they reduced to $1,278,000, as you can see from the listing above.

The property sat on the market for 27 days.

On May 4th, they re-listed:

They re-listed at the same price of $1,278,000.

This is what we call “re-running the listing” and TRREB doesn’t like it. We all do it though. It’s a way to re-start the “days on market” but more importantly, to get fresh eyes on the listing.

The property was on the market for 13 more days on this, their third listing.

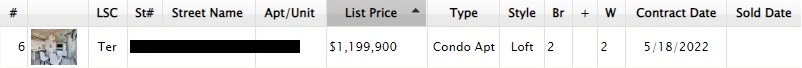

On May 18th, the property was re-listed, now for a fourth time:

At $1,199,900, they reduced by $78,100. That’s substantial. That would have, could have, should have moved the market.

But it didn’t.

22 more days went by for this, their fourth listing.

Somewhere around the two-month mark, either the sellers or the agent, or both, decided to try a different strategy.

We’ve seen this discussed many times before on TRB, right?

We all know where this was going?

On June 9th, they re-listed for $999,999, with an offer date:

This was now their fifth listing and their second attempt at an “offer night.”

This time, the property was listed $100,000 lower than during the first “offer night,” but would that move the market?

I suppose it depends on the seller’s expectations.

The average 416 condo price in March, when they first listed, was $831,531, and now in June, it sat at $771,267. That’s a 7.2% decline. Now, for a downtown condo that also happens to be a hot loft, maybe the decline is 4-5%. Even still, this condo, if it was “worth” $1,200,000 on March 31st, was now worth $50-60K less.

So did the second offer night work?

No.

The property was re-listed at the same $1,199,900 that they were at before the second attempt at an offer date:

This was their sixth listing.

June 15th meant they had been on the market for 77 days.

This listing noted, “3% Commission To Co-Op Agent If Sold By June 30.”

They were trying to get creative and offer more money to buyer agents, which is something that many listing agents have done in this market. In fact, there’s a high-volume east-end agent who is offering 3% on all of his or her listings right now.

In this case, the bonus commission didn’t work, and the price wasn’t well received.

This listing lasted for 18 days.

The listing was terminated on July 3rd, but the property wasn’t re-listed right away, like it had been every time before.

Why?

Because the sellers switched agents!

On July 21st, the property was re-listed with a different brokerage, a reduced price, and this market their seventh listing:

Now at $1,124,900, they were about $25,000 higher than their first list price, which of course, was apparently “low” to solicit multiple offers on their “offer night.”

Three months had passed!

The market had declined.

I’m seeing a lot of properties selling for a price equal to where they were first listed, months before, at their “low” price.

Ironic, right?

Also note that the property was listed as a 1-plus-den, and not a 2-bedroom. Perhaps the new listing agent figured that buyers were being turned off by the idea of a true second bedroom, only to find a den. The classic “bait-and-switch” never fails to disappoint.

Speaking of disappointing, this listing lasted for 21 days and was termianted.

Here is the eighth listing which came out on August 11th:

Now down to $1,000,900, it seems like these sellers are finally ready to move the property!

It takes guts and a come-to-Jesus moment do drop your price by $125,000.

However, it turns out that this was just a big misunderstanding.

This listing was terminated, same day.

And then this listing came out:

Ah!

Somebody inputted the price incorrectly!

It wasn’t $1,000,900, but rather $1,099,900. That’s a spicy meatball right there, folks!

This was probably the last thing these sellers needed, now entering their fifth month on the market, but perhaps now they’re priced appropriately?

This $1,099,900 list price is the same price at which they made their debut on March 31st, before they raised the price $220,000.

Would they have sold on March 31st for $1,099,900? In my professional opinion, yes, they would have. That would have been a fantastic price at that time.

But the market was different. That was March. We’re now in August.

Hindsight is 20/20, and while many of you will call out the actions of these sellers, who knew, on March 31st, where this market would be on August 15th?

This is, however, a classic case of “chasing the market.”

They never got ahead of the market so they never gave themselves a chance to sell. They were reactive instead of proactive. They waited instead of anticipating.

I’m sure there are many other examples of this, but having seen that pricing-typo last week when the new listing came out, this one definitely caught my eye.

Whether the market rebounds in the fall, and whether your definition of “rebound” is the same as mine, it’s paramount that would-be condo and home sellers recognize the current market conditions rather than focusing on the ones in the rear-view mirror.

It’s as easy as catching a falling knife, right?

Marina

at 10:11 am

Friends just sold an investment property, for about 50K less than it would have sold for in March. But their tenants didn’t move out (voluntarily) til July. Is it nice to lose 50K? I doubt it. But I also don’t think they lost sleep over it. Because if they kept trying to squeeze every last dollar, they might have “lost” another 50K.

But I think it’s really hard to look at those sales in Feb and swallow that 10% cut.

There is a house in the east suburbs that another friend has been looking at for the last 2 months. It’s gorgeously renovated, beautiful property. But the seller wants to recoup the 300K they put into renovation. They bought at a mil and want 1.3. Property is worth max 1.2, if that. My friend put in an offer and was told “the seller wants to recoup their investment”. How is that the buyer’s problem? But there we are.

Condodweller

at 12:48 pm

As David has said many times, where the market was in the past is irrelevant today. If you sell today, you get the market value today. If your investor friend bought during the last year and sold because of market conditions that would make them the worst investor ever. The more likely scenario is they bought at least a few years ago and they still made at least $100k if not significantly more. So why lament the “lost” 50k?

Bryan

at 2:03 pm

I have always marveled about how people’s perspective on this works.

Imagining Marina’s friend’s condo was the average condo (lumping townhouses and apartments) in the 416, it was worth $731k last June, $745k in at the end of December, $846k during the march peak. If they sold at the end of June (my graph does not have July numbers…) it would have been worth $788k. That is up 7.5% year over year, up 6% in 2022, and down 7% since March. Invariably people say “I should have sold in March, I’ve lost 7%!” but you don’t see a lot of “I’m glad I didn’t sell in December, I’m up 6%”.

Nobody

at 1:22 pm

This is even a problem in commercial real estate where people are supposed to be more rational and forward looking.

Guy I know is looking for a decent amount of office space downtown. He’s got a successful business and would be a great tenant. But EVERYONE leasing and offering CRE knows that we have AT LEAST 2 more rate hikes in Canada so prime will be AT LEAST 1% higher in the very near future. Same with the US. And that’s going to be substantial for our economy, on top of the overall reduced demand for office downtown and large amounts of new space coming online in the next 24 months.

Despite all this, landlords of all sizes aren’t really willing to accept cuts in prices to match today’s rates and demand, never mind November’s. So spaces sit empty until enough pain is felt. And this is where everyone’s a professional and is supposed to be more math driven and rational expectations of where rates will be in 4 months.

In residential everything is so much worse with emotions and with people where a loss could be VERY painful/catastrophic.

Ed

at 2:56 pm

It’s the buyers problem because the sellers won’t sell it for 1.2

Marina

at 9:04 pm

Well, that’s true. But if nobody buys it at 1.3, the seller has to keep paying, taxes, insurance, utilities and maintenance, plus interest on the mortgage. When will the property go back up to 1.3 and how much will they have paid by then?

Ed

at 9:57 am

Well that’s his/her problem then.

Condodweller

at 12:42 pm

It’s a difficult call for sure. If we’re going to compare the stock market to RE I would argue that people who saw the market drop and scrambled to put up their unit/house for sale to cash out are doing the same as an investor who is trying to time the market. But that’s ok, they believed what they were told that the market can only go up at their peril. If you are a seller, why not sell when the market is hot and it’s a seller’s market? But there is something to be said about recognizing that the market has turned, believing it will likely continue falling or stay lower, and pulling the rip cord and getting out. But of course, that involves accepting the first offer.

Given the situation we’re in now I think the old saying that the first offer is your best offer may be true. If prices are going down, take a deep breath and accept what the market is willing to give you at that time. As this owner found out you may not see that offer again for a long time. In this case, they have hope that the busy fall market may bring higher prices since the summer lows but they’re not likely to see the Feb highs again. But buyers may be smart enough now and not raise their offers in September, who knows? If I’ve been on the market for 6 months and staying is not an option, I would probably take the highest offer in the fall.

Regarding the falling knife, I always pictured a sharp knife falling and cutting through a hand. Either taking fingers or cutting it in half, meaning the momentum will take it much further down from where the hand is trying to catch it and no one knows where the bottom is.

Trying to catch a falling knife or don’t try to catch it to me is the same thing from two perspectives.

Appraiser

at 2:48 pm

“Overall, the average rent in central Toronto rose 24 per cent year-over-year in July.

For a one-bedroom unit, rent sat at $2,257 in July, marking a 21.6 per cent year-over-year increase in Toronto.

For a two-bedroom apartment, that increase climbed 25 per cent to $3,259.”

https://www.cp24.com/news/this-is-how-much-the-average-rent-in-ontario-rose-in-july-1.6026813

Jimbo

at 5:50 pm

That one bedroom is what, a $400k mortgage payment?

Ed

at 3:02 pm

Don’t try to catch a falling knife to me means the potential for harm by catching the knife is greater than having it maybe hit your foot (did we specify shoes or no shoes).

Sirgruper

at 9:21 pm

I agree with Appraiser. Catching a falling knife means it still falling. When it stops it could also be a dead cat bounce.

Also Toronto real estate doesn’t have to always go up long term. Detroit, Buffalo, Kansas City we’re all up and coming cities until they were not. I doubt it will happen here but you never know what the future will bring.

Appraiser

at 9:04 am

Not sure what you are agreeing with me about.

Comparing Toronto to the 3 economic backwaters on your list is laughable.

News Flash: The housing crisis is still with us. In fact, it’s worse. The crisis has now shifted in a nasty direction for both renters and buyers.

J G

at 1:14 pm

How do you know? In 1950, City of Detroit had population of 1.85M people, that’s comparable to Toronto City in 2000 (50 years later!).

It was the center of universe for automakers (just like you think Toronto is center of universe today). I’m sure there were a lot of “Appraisers” who were bullish about Det RE back in 1950.

By 1970, it was already turning into a shithole due to globalization of manufacturing, and you know where it is today.

Sirgruper

at 11:04 pm

I was agreeing on the knife part. JG nailed it. Also Buffalo was the tenth largest city in the USA. People used to travel to Buffalo for finer dining and entertainment from Toronto. Kansas City had mansions that rivalled Forest Hill and Rosedale. Cities change overtime and Toronto is not immune.

JPR

at 4:54 am

“THERE’S NO QUESTION that September buyers will happily purchase at prices discounted from February, even though they know there’s a 50/50 chance that the property could be worth less in October or November.”

A tad presumptuous & definitive, no?

JL

at 9:09 am

We’re all forgetting interest rates in this discussion. I don’t think price drops have yet offset financing cost increases, and for those looking primarily at the near term monthly payments, they certainly haven’t fallen so much to make purchasing in the current market seem like a good deal. Some people are waiting not because they think they can get a better deal later, but because the “knife” needs to fall lower for them to even be able to “reach it”. When financing costs increases are such a large part of the equation (and more than countering the price drops), it doesn’t surprise that buyers are staying patient for the time being.

Alexander

at 10:12 pm

Exactly. What’s a point buying 1.1 mln house with 35% down and over 4 K in monthly mortgage payments NOW when I know you can rent for cheaper and mortgage interests are rising anyway for now one knows how long? You have to be deep in love with the house or dim.