Oh wow, am I ever having a flashback to childhood.

Do any of you know where I’m going with this one? If the title of today’s blog post is any indication, you might recall:

“Don’t do as Donny Don’t does.”

Remember that line from The Simpsons?

Even as a child, I knew that the writers of this show were including just enough cerebral humour and jokes geared towards adults to keep them from turning the channel when their kids were watching.

Confusing, but funny.

So goes today’s blog title, although many of the readers will not find the antics pertaining to days on market all that humourous.

What are days on market?

Simply put, it’s how long a property has been listed for on MLS. We abbreviate as “DOM” sometimes, and yet expect everybody to automatically know what this means. DOM is a statistic that, like many others, has been losing meaning over the last few years. “Sale-to-List ratio” is yet another example, and we have explored this at length before.

Have we ever had a dedicated blog post about DOM? I don’t think so.

And yet I do believe we’re at the point where one is necessary.

So today, I’ll explain some of the current issues with the days on market statistic, specifically how the stat is used, and I’ll ask a series of questions. For those of you that are in the market, or have been recently, and/or those MLS junkies who have their own thoughts and opinions about how things should be done, please feel free to answer the questions as you see fit.

As mentioned in a blog post two weeks ago, a reader emailed me out of frustration and told me that agents were starting to utilize a new technique that allowed them to increase their personal stats: sell a property, and then simply terminate the listing, and re-list new, hence showing zero DOM.

She emailed me the property she was talking about, and it was already on my radar. I had seen this before a few times that week already with other listings.

The major issue we have with DOM is also linked to the issue with “new listings” on MLS, and it has the ability to undermine the integrity of the statistics that the Toronto Real Estate Board publishes. If a property at 789 Smith Street is listed for sale on January 1st, and sits on the market, unsold, for 42 days before it is terminated, and re-listed on February 11th, then not only do the days on market start over at zero, but the listing counts as a “new listing” when it’s not.

Question #1: Should DOM continue to run on MLS with a property, regardless of re-listing?

Answer as you see fit, but this, of course, opens up other doors that we must walk through.

Let’s say that you would argue DOM should act as an easement, which is to say that it “runs with the property.”

In that case noted above, once the property is re-listed, the next day will show as the 43rd day, not the 1st.

But there are several “what if” scenarios.

Question #1a: What if the price has been changed?

Is it really fair to continue the DOM if the price has been changed?

Let’s say that 789 Smith Street was listed for sale on January 1st at $1,199,900, and it was terminated after 42 days as described above. The property was then re-listed at $1,149,900.

Should DOM start over?

The argument for the “no” side would be that it’s unfair to attribute 43 “days on market” to that listing, at $1,149,900, because it surmises that the property has been for sale that long at that price. The consumers might be confused, or led to believe something other than what is fact.

The argument for the “yes” side would be that the property is still for sale, and DOM is merely counting “days on market,” regardless of price.

You decide.

Now another nugget:

Question #1b: What if the listing brokerage has changed?

Do we look at “DOM” in terms of the property, or the listing agent?

Do whom, or what, are we applauding or chastising when DOM is low or high?

From the brokerage perspective, it would be entirely unfair to continue the days on market when a new and different agent takes over the listing. If John Smith of Re/Max has the property listed at $1,199,900 from January 1st to February 11th, the listing is cancelled, and the property is then re-listed with Jane Jones of Royal LePage, then should Jane really “inherit” those days on market?

Perhaps the consumers will say, “I don’t care. Agent statistics are not my concern, and the integrity of the listing and thus the MLS system should come first and foremost.”

I’m inclined to agree, as a consumer. But I would disagree as a broker, and I can see a middle ground here. TREB has, finally, developed a very simple “History” button on our own internal MLS system that allows users to click and have a new browser window open with the entire history of htat property. Would TREB allow something like that for consumers? Haha, that was rhetorical. They never would. That would be way too helpful, after all.

But buyer agents can run searches, and they should be educating their buyers. It’s very easy to email, or send multiple listings, and say, “This has been on the market for 2 days, but was previously listed with another company for 43 days.”

Now what if an agent simply wants to “re-start” the DOM?

You know what I mean, right?

The agent wakes up one morning, sun shining, birds chirping, let out a big yawn with an accompanying stretch and say, “You know what? I don’t like how the DOM are piling up for 789 Smith Street. I think I’m going to refresh that listing.”

Refresh, re-start, recharge, re-do, whatever you want to call it, we know it looks something like this:

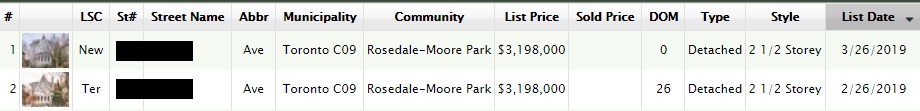

Here’s an example from this week where the property was re-listed for the same price, by the same listing brokerage (not shown).

So is there any difference between these two listings?

No. There is not. Same property, same price, same listing brokerage, and yet different “days on market.”

Question #2: Should a listing agent be able to re-list for the same price, and re-start the DOM?

I think this is a spot where most of you will agree the answer is “no,” and personally, I wouldn’t disagree.

This is a blatant end-around the integrity of DOM, and completely undermines what it is, and how it is supposed to help guide consumers.

For all intents and purposes, this house is now on its 27th day on market, no questions asked, no debate. And yet here we see the listing on day zero.

So shall we outlaw this practice? Most certainly!

But then it merely encourages agents to re-list at $1 lower, and we start to play games once again.

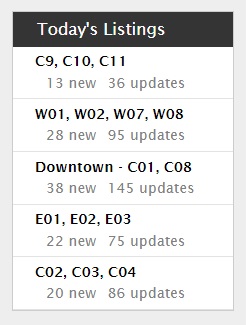

On the front of agents’ MLS home pages they all have a customized feature called “Today’s Listings,” as seen here:

I live in this box, really, and truly.

I click those links dozens of times every day, maybe into the hundreds. It’s how I choose to monitor market activity and new listings, and I check every single night at 11:50pm before the new listings reset.

So what are the “updated” listings, you ask?

Those are listings that have been altered in any way. You’d like to think that this reflects price changes (or increases…), removal of “offer dates,” or more important matters. But agents know how to manipulate listings to ensure their listings show up in the “Updated Listings” section, often by simply inserting a single comma into the text section.

My point is that if we were to outlaw the practice of re-listing at the same price, with the same agent, to try to “re-start” the days on market to zero, I believe that agents would think outside the box in that regard, just as they already do with respect to Updates.

Moving on, how do the days on market work with regards to a conditional sale?

Well, if you list a property on January 1st, and the property is sold conditionally on January 10th, but the waivers aren’t all completed until January 20th, how long is the property on the market?

You would argue that the property is on the market for 19 days. Technically 20, but MLS has this notion of “zero days on market,” as we know. Semantics…

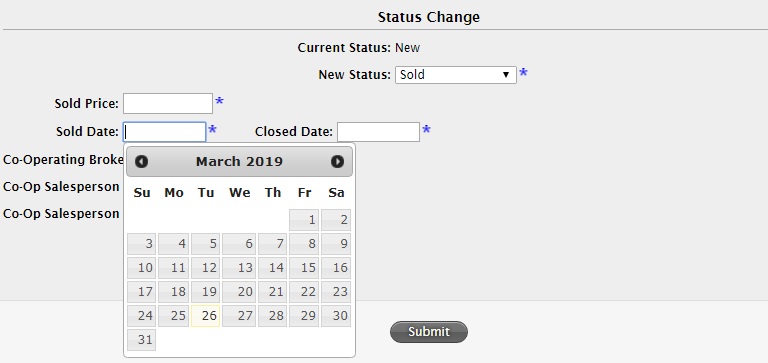

When it comes time to input the actual “sale date,” there is a grey area.

Some might believe the property was “sold” on January 10th, and some might believe it was “sold” on January 20th.

And guess what? It’s up to the user to decide. I have add/edit capabilities on MLS, so I can do as I please. See:

Many brokerages have an administrator do this, and many allow their agents to do so.

Bottom line: the actual “sold date” is a grey area, and that affects the days on market.

Question #3: Should ‘days on market’ reflect the total days before a firm sale, or only up to the conditional sale?

The easiest answer is, “A sale is a sale. Use the first date, and as a result, the days on market will be an unintended benefit.”

Okay, sure. But what if the property is sold conditionally on January 10th, then the waivers are due on January 20th but the deal falls through. Then the property is re-sold on January 31st, firm? Wouldn’t that throw the previous methodology out the window? You simply can’t have it both ways.

And for those agents who do believe that the “sold date” is the date on the offer, which date on the offer is that?

a) The offer date

b) The date the confirmation of acceptance is signed

An offer written on January 10th might not be formally accepted, conditional or unconditional, until January 12th if there are sign-backs. So in the case where an agent argues the “sold date” should reflect when the property was first sold, ie. conditionally or unconditionally, they might still choose from two dates.

–

As with anything a prospective real estate buyer may see on MLS, whether it’s functionality of the site, layout of the listings, features (or lack thereof), or metrics and/or statistics, there are going to be differences in opinion with respect to what should and shouldn’t be done. We can always build a better mousetrap, and we can also agree that the forces of good and evil will always intersect among the agent community.

I don’t believe that a statistic or a metric has a purpose if it cannot be, a) properly defined, b) properly implemented, c) protected from misuse.

When it comes to the days on market metric, we don’t really know how to define it, we certainly haven’t implemented any standards, and clearly the metric has been misused.

This isn’t quite as bad as reporting sales at $1 back when agents and sellers were rebelling against the Competition Bureau’s ruling that forced TREB to share sale data, but I’m in favour of cleaning up any misuse on the MLS system.

Personally, I think Question #2 proposed above has the simplest answer, but again, there’s also a work-around for those agents who don’t agree.

I welcome your two cents on the matter, if you can spare the change…

Ed

at 8:17 am

DOM doesn’t matter to me, if I was considering a property I would want a history of that property. Having said that if I wasn’t working with an agent and therefore didn’t have access to the history then it would matter to me.

Kyle

at 8:43 am

DOM is like List Price now, it really doesn’t mean much. The full mls history is pretty much available to anyone with an Agent or Housesigma password, so only a complete imbecile Agent would think he is getting away with anything by delisting/relisting.

I do think there are some legit reasons to delist and relist that don’t have anything to do with gaming the DOM, such as if a seller wants to take their property off the market over the holidays or the example mentioned in Monday’s blog, were a house experienced a flood.

Jennifer

at 12:39 pm

I think you would have to suspend. Does that reset the DOM?

Kyle

at 1:58 pm

Good point, maybe they don’t need to delist under those situations.

Chris

at 8:48 am

DOM is a nearly useless statistic. Too easily gamed.

Perhaps an alternative statistic, like Cumulative Days On Market would help, but even then, as Ed said, I’d prefer to see the full history, including previous sales, price changes, etc.

Thankfully, websites like Housesigma and Bungol now provide this information to the public.

Batalha

at 3:40 pm

My main takeaway from this blog entry (one of David’s recent best, IMHO) is how difficult it is for organizations like TREB (and CREA, and StatsCan, and CMHC, and FSCO, and….well, you get the picture) to regulate/monitor/legislate against “grey area” practices engaged in by (some of) their members or other individuals or corporate entities or governments or any other actors.

Simply “cutting red tape,” as the mindless cliché goes, is laughingly simplistic and essentially meaningless, not to mention potentially dangerous, in a world populated by (some might say “infested with”) all-too-fallible humans, whether selfish or altruistic.

Thanks for another insight into the complexity that dogs you every day, David.

Derek

at 4:47 pm

Presumably, DOM exists because historically it was generally understood to be defined and was a metric to indicate something about the market. Presumably, it has been allowed to become a farce deliberately because it is not so complicated that it cannot be standardized. If there are people who can’t resist fudging numbers, remove their ability to have the final click on the data entry.

If a question deals with an agent’s concerns it shouldn’t be a factor. The agent’s pride isn’t on the market; the house is. Price change is irrelevant because list price is irrelevant. You can’t simply buy for listed price; price is a strategy and not an element of DOM . Regarding 3, I say it is off the market when it’s off the market, i.e. not entertaining new offers. If a deal falls through thereafter then do the math subtracting the dead days.

Joel

at 6:20 pm

I think if a buyer has a decent agent then any of these games dont make any difference. Anyone can ho to housesigma and get the detailes listing history.

It’s one of those things agents think is sneaky, but no one cares.

If the buying agent did their job and put in more effort than setting a client up for an automated email the this wouldn’t even be a thing. Lazy agents are the cause for this and proactive agents would be the solution.

If you want your 25k commission on a million purchase look over the listings and call/email your clients when one that actually fits their needs comes up. Don’t have an automated email do your job for you!

crazyegg

at 12:35 pm

Hi All,

Agreed. The DOM debacle (among other pitfalls) is easily navigated with any competent realtor.

This is yet another arrow in the quiver for championing realtors. Perhaps having a campaign to promote this fact to educate the general public

Regards,

ed…

Chris

at 9:09 am

Seems TREB may be addressing the issues surrounding DOM:

“To provide a more accurate measure of average days on market for a property, TREB has developed a new statistic called Average Property Days on Market”

https://www.movesmartly.com/hubfs/listing_days_on_market.pdf

In other news, RBC’s latest affordability report out today. Even with recent rent increases, they calculate the premium of ownership for a 2-bed apartment in Toronto to be $1,138 compared to renting. They also declare the the Vancouver-area housing market to be “in full-blown correction mode”, while Toronto sales volumes are expected to remain depressed, prices flat, with “even further downside risk”.

Appraiser

at 6:23 pm

Statscan estimates that Toronto CMA population grew by 125,298 people in 2018. There were 37,750 new housing completions last year, or about 3.3 people for every new housing unit: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710013501 …

Via ~ Ben Myers

Jimbo

at 6:27 pm

Ben Myers formerly from Fortress Real Developments??

Jimbo

at 7:00 pm

http://links.e.carp.ca/servlet/MailView?ms=MTUzNTc2NDMS1&r=MTQzODQ0MDQ3MjA2S0&j=MTYwMTk5MjI3MgS2&mt=1&rt=0

Ben Myers says *38% ROI when including capital appreciation……. Based on historical information of course.

Ben Myers

at 3:51 pm

I’m giving a 10 minute presentation at that event about the state of the condo market. None of what is in the invitation was provided by me or even provided to me to proof read, I’m not there to endorse the project, simply provide data.

Jimbo

at 9:13 am

Best of luck to you during the presentation.

The water is pretty murky with claims like that.

Jason H

at 8:14 am

Why not make it based on the 365 days back from the current day? There would be some negatives to that approach, however I think it would be offset by removing the DOM issue where listings are consistently relisted in order to make them look fresh.