My fingers are still a bit stiff from my epic opus on Monday, but with some light stretching and healthy eating, I think I’ll be okay to get today’s blog down on paper.

Every year, I think I prefer either the “top stories” or “top blogs” only to have one become more tedious and uninspiring than the other, and I think this changes every year. Actually, it changes during the writing process itself, as I teeter back and forth between one and the other.

There’s often a lot of overlap between the “stories” and the “blogs,” since I do write blogs about the overarching themes and big stories in the Toronto real estate market, and I usually use the blogs I’ve written to steer me in the direction of what “Top Stories” to consider.

Now you would think that the same stories must be repeated each and every year, no?

I mean, isn’t the PRICE of real estate going to be a top story every year in perpetuity?

Believe it or not, while overlap is unavoidable, there have been a host of different themes on the annual “Top Stories” list over the past few years.

Have a look (posts hyperlinked in the date):

From 2015:

5) Urbancorp “Stealing” Their Condos Back

4) Real Estate Commissions

3) The Media’s Continued Obsession With The Pending Real Estate Collapse

2) CMHC, The Bank of Canada, & Monetary Policy

1) The Market

From 2016:

5) New Mortgage Regulations

4) Foreign Ownership

3) The Business Of Real Estate And The Real Estate Industry

2) Kathy Tomlinson & Vancouver Real Estate

1) Prices

From 2017:

5) International Real Estate

4) Rental Market

3) Business of Real Estate

2) Government Intervention

1) Spring Insanity

From 2018:

5) TREB vs. the Competition Bureau

4) The 2017 Market

3) The Rental Market

2) Financial Literacy And Personal Responsibility

1) The Future Of The City Of Toronto

Those really, truly bring back memories.

The real estate market, as sad as this might sound, is essentially a timeline of my adult life. Each of those stories brings me back to a time and a place…

Unlike Monday’s blog, where I admitted that I only had six or maybe seven “Top Blogs” for my short-list, today’s exercise was labourious.

I had no fewer than fourteen different ideas, and I switched the order of importance several times before adding four to the “must have” list, and then rounding out the top five.

Tell me if I’m wrong here, please. But here are the Top Five Real Estate Stories of 2019 as I see it through my very own eyes:

5) Prices

Ah, of course!

What seemingly should be the #1 story every single year hasn’t even made an appearance in the past two years. Not since this was atop the 2016 list have we talked about price.

In 2019, we didn’t directly talk about price very much, and perhaps that’s why this is only #5 on the list.

But indirectly?

Well, indirectly, price was in every single conversation we had about real estate.

Talking about development? New condos? City levies? That’s going to affect price.

Talking about areas of interest? Neighbourhoods? Housing styles to love and hate? That’s all about price.

Talking about offer nights? Pricing strategies? Stories from the trenches? Price is going to be the common thread in all of those.

And in the end, prices rose across the board in 2019, no matter where you look.

Just for fun, let’s talk about prices as they currently stand. Forget about December, since we don’t have stats for this month yet, and since it’s such a down month. And let’s not use this past November’s sale prices to compare to January of this year, or December of last year, in some sort of “year to date” increase, since those latter two prices are depressed as well.

Simply looking at November of 2018 to November of 2019:

GTA Average up 7.1% – $788,345 to $843,637

416 Average up 8.1% – $842,483 to $910,419

416 Detached up 4.5% – $1,301,832 to $1,360,24

905 Detached up 4.4% – $903,517 to $943,494

416 Semi-Detached up 0.6% – $1,060,359 to $1,067,027

905 Semi-Detached up 7.3% – $655,504 to $703,272

416 Townhouse up 3.2% – $739,837 to $763,298

905 Townhouse up 3.4% – $613,846 to $634,450

416 Condo up 10.8% – $695,678 to $659,855

905 Condo up 12.2% – $454,288 to $509,559

TREB HPI – up 6.8% – $763,600 to $815,800

416 HPI – up 7.0% – $844,600 to $903,700

And if you wanted to look at the GTA total, ie. both 416 and 905 together, for each of the four major categories (detached, semi, row, and condo), obviously we’d have four more numbers in the black ink.

Across the board, every area, every property type, we see black ink.

And we’re not talking modest increases either.

If you think seeing 416 condos go up a whopping 10.8% is something, just look north to the 905 where condos went up even more: 12.2%, wow!

I’m not trying to cheerlead here, folks. I’m just looking at the numbers, and how can I not say “wow” at double-digit increases in condo price? “Wow” is an understatement.

Are you telling me that somebody who paid $475,000 for a 1-bed, 1-bath in Liberty Village in November of 2018 is now living in a $526,300 condo?

Yes.

Absolutely, and if there were a question about it, which I don’t think there is, it would go something like this: “Are you sure that condo is only worth $526,300?”

I’m not drooling over this because I work in real estate, but rather because it’s just so damn shocking.

Now the market bears will be quick to point out that the 2019 price increases, over 2018, ignore that prices dropped in 2017. Yeah, well, so what?

The average condo price in the 416 at the “peak” in April of 2017 was $578,280. The average condo price is up 20.2% since then.

I’m cherry-picking the condo figure, I know. The average sale price, GTA-wide, was $943,947 in April of 2017, and it’s only $843,637 today.

But this isn’t a story about 2017, this is a story about how prices have risen from 2018 to 2019, which spits in the face of so many folks who thought that 2017 was “just the beginning.”

There’s no question that pockets of the 905 are down 25-35% since April of 2017, and I’ll be the first to admit that speculating on an infill townhouse in a subdivision at Bayview & 16th probably wasn’t a good idea, but I sure as hell wasn’t selling them!

The 416 remains red-hot, and the central core was absolutely on fire in 2019.

Prices rose across the board in 2019, and that has to be considered, at the very least, a Top-5 story.

4) The Inner-Workings Of The Real Estate Transaction

This is a topic that could be on the list every single year, but in 2019, we discussed this ad nauseam.

The year started with the idea of changes to the Real Estate & Business Broker’s Act (which we’ll discuss in point #2) that would allow buyers to see the prices of competing offers, in competition.

February 15th, 2019, I wrote: “Should Buyers Have The ‘Right’ To View Competing Offers?”

There was discussion not about forcing sellers and listing agents to provide the price of competing offers to buyers, but rather allowing sellers and listing agents to do so. This is ironic, of course, because nobody in their right mind would ever choose this route.

You might say that you would. You might even convince yourself that you’d walk down this path if and when you sell your home, too. But if you knew that doing so would cost you, say, $60,000 of tax-free capital gain, you’d be like everybody else out there, throwing stones in glass houses.

While I sympathize with buyers about sky-high real estate prices, and while I continue to acknowledge that there really isn’t one, set, identifiable process for dealing with multiple offers, I will say that the pipe dream of an “open auction format” is exactly that: a dream. It would never work in practice, and those that regularly point to Australia as some sort of beacon of hope should read my 2018 blog entitled, “Is The Grass Greener Down Under?”

Once you understand how these auctions work, you’ll realize it’s a lot easier to train a dog than a kangaroo…

Previous to the blog above, on February 13th, 2019, I wrote: “Are Bidding Wars Coming To An End?”

This was a sarcastic look at the media’s spin on idea that allowing sellers the option of disclosing competing prices would somehow end “bidding wars.”

The headline said it all: “Frustrated By Bidding Wars? Home Buyers May See Some Changes Ahead”

If that’s not the most misleading headline I saw in 2019, then I don’t know what is. That was literally connecting dots that don’t exist.

February 27th, 2019, I wrote: “Bird Dog Fees & Referral Fees”

This was my attempt to educate buyers (and the agents that read my blog) about to whom their loyalties lay, on behalf of whom they should be working, and why I personally don’t think it’s acceptable to receive a fee from a home inspector, mortgage broker, and the like.

This happens all the time, folks. Sometimes it’s documented, and sometimes it’s not.

Call me old-fashioned, but I don’t “need” a fee from my mortgage broker or home inspector. What I need is for them to provide the best possible customer-service to my clients, and nothing more.

Real estate agents who are looking to collect fees, in my opinion, are not the top agents in the business. In fact, they are more likely to have drinks with the agent featured above who duped a blind man out of his home. I don’t actually know any top agents that seek referral fees, and while I’m aware of the generalization that I’m making, I really, truly believe that good agents would never accept such fees, because they don’t need to.

I touched on a few oddball topics this year, like in March of 2019: “Days On Market Do’s & Dont’s”

These are the types of blog posts that introduce you to topics you didn’t even know existed in real estate!

April 5th, 2019, I wrote “The Whole ‘Bully Offer’ Thing”

This is a blog post that could probably be included in section #3 below too. But it seems to me, many agents out there have no idea how to transact in this complex, dynamic, fast-paced market, especially in the case of pre-emptive or “bully” offers.

If you don’t know how to break-dance, and have never sought out a lesson, let alone been taught by a professional, how do you expect to spin around and around on the point of your head?

So many buyers and buyer agents are absolutely lost when it comes to bully offers, and in that blog post, I outlined some of the bizarre questions I had received upon listing a certain property in the spring market.

A few days later, I followed up with this: “Two Perspectives On Offer Nights & Bully Offers”

Excuse my braggadocio, but this kind of thing should be taught to agents at OREA, and this should be mandatory reading for any buyer looking to get into the Toronto market.

To transact in this market, you need to understand the inner-workings of what I believe is the most complicated system we’ve ever been in.

May 1st, 2019, I wrote: “Can The ‘List-Low’ Strategy Backfire?”

Sure it can!

And in this blog post, I demonstrated why, how, where, and who is the most likely buyer and buyer agent to screw up a strategy that is successful, more often than not.

You wanna talk about an even more complicated market? May 13th, 2019, I wrote: “Selling Your Home Conditional On The Sale Of A Buyer’s Property.”

Those of you reading this outside of the GTA are thinking, “What’s the big deal? We do this all the time!”

You do. But people in Toronto do not. Ever. N-E-V-E-R. And to not know that, is to know almost nothing about what drives our market.

And in one of my most brutally-honest posts of the year, and the one that was cut from my “Top Five Blog Posts of 2019,” on May 21st, 2019, I wrote: “Realizations & Revelations.”

This post contained five revelations and realizations that dawned on me during the sale of a rare estate in the Summerhill/Rathnelly area:

1) The public has absolutely no clue what they’re doing.

2) Everybody thinks he or she is a genius.

3) Joe Average Buyer would cut his or her agent’s throat in a heartbeat.

4) Agents might be as clueless, or more, than some of the public.

5) The public hates us for the same reason that they want to love us. We are damned if we do, damned if we don’t.

Maybe I’ve already said this, but if you read just one blog most linked in today’s blog, read that one.

As I said at the onset, the topic of “The inner workings of the real estate transaction” could be on this list every single year, without fail, and it would never get old. But wow, was 2019 ever a year for diving into the nitty-gritty of purchase and sales…

3) Professionalism In Real Estate

This could not only be #1 on the list, with the proverbial bullet (still not sure I understand the origin of that saying…), but I could have also broken this down into multiple different topics.

I also could include this every single year, and I would not be overselling it.

Last but not least, I could have put “un” in front of “professionalism,” or perhaps used “lack of” there too. But any way you slice it, this was a top story on Toronto Realty Blog, it’s much talked about in our industry (at least among the agents who wouldn’t find themselves the subject of one of these blog posts), and it seems as though OREA has taken notice, and put some new rules in place to help improve the industry.

But how did we get to this point?

Well, as I’ve said before a few dozen times, real estate attracts people for very different reasons. These people come from different backgrounds, whether that’s cultural, moral/ethical, educational, geographic, et al. These people have different work ethics, are of different ages and at different places in their life cycles, and all come into the business with different ideas about how the industry works; some right, some wrong.

There is one thing that all agents have in common: they are their own boss.

This means that there is nobody to look over an agent’s shoulder, and nobody to tell that agent if and when he or she is acting in a manner that he or she shouldn’t be. Every agent does as he or she sees fit, and that is where the fork in the road begins.

I mean, how in the world does somebody do this:

“Blind Man Files $1.25M Suit Against Realtor Who Allegedly Tricked Him Into Selling Home”

That’s not fake news, folks. That’s real. That actually happened.

Note the word “alleged,” of course, but unless this old man is lying, and made the whole thing up, then this piece of shit human with a real estate license really, truly, duped a blind person into selling his house in which he and his wife had lived for over two decades.

This agent was not only a Chartered Professional Accountant, but also a mortgage broker, and a Realtor.

I don’t believe that a person should act as both a mortgage broker and a real estate agent, just as I don’t think I would get sports medicine therapy on my surgically-repaired right knee from somebody my dentist. They’re two different occupations, and my inner Adam Smith believes in specialization. But this is a topic for another day, and I apologize for the tangent…

In fairness to our industry, we’ve seen thousands of incidents of lawyers acting inappropriately and perhaps stealing funds, or overbilling. We’ve seen thousands of cases of medical malpractice. There are all kinds of improprieties in wealth management and financial services. Real estate is no different.

But the difference for me is: I spend every day wishing the industry in which I work, was better.

As part of OREA’s multi-year study on how to better the industry, I spoke to Tim Hudak, I did surveys, and I was part of focus groups. Not too long ago, I did a blistering phone interview with a couple of poor souls who weren’t ready for the fury which I unleashed. I sure hope that anonymity is truly a part of that study, because I named names, I pointed fingers, and I stuck my neck out further than it’s ever been – and that’s saying a lot.

Throughout 2019, I wrote more than a dozen articles, by my count, specifically detailing incidents and experiences where agents either acted unprofessionally, or as is most often the case, acted without any clue what they hell they were doing.

September 11th, 2019, I wrote “It Happened Again”

This was a story about a house that languished on the market, with the listing agent begging for the opportunity to give the damn thing away, only to see her drop the price to something stupid-low, hold an “offer night,” and then see morons line up to bid the price well, well above what they were originally listed for.

It’s like watching somebody bite into a hot dog, spit it on the ground, and then sixty seconds later, thinking: “Hey……..free hot dog?”

March 8th, 2019, I wrote “Another Bright Idea?”

This was essentially the same story as the one above, except the “strategy” didn’t work, and the property was listed over and over, up and down on price multiple times, and all the while, I wondered how this agent even existed in a market like ours today.

November 22nd, 2019, I wrote “Mixed Emotions”

This was a blog post about agents getting extremely emotional in their dealings, and costing their clients an opportunity to purchase a property.

November 13th, 2019, I wrote “I’m Sad For Toronto Condo Buyers”

If you decide to read one of these blogs I’m outlining here, read this one.

This post was about the overwhelming level of incompetence among the buyer agents who presented offers on a King West condo listing of mine, and just how bad I felt for their buyers, who decided to hire these jokers in the first place.

In 2018, I infamously wrote a blog post called, “Realtor Stats: How Many Transactions Were Agents Doing In 2017”

I took a lot of heat from this, as I’ve noted in multiple posts since.

At a company-wide meeting at TREB, the subject of this post was brought up during a Question & Answer period with a certain member of the TREB brass, and he or she commented, “We don’t feel that the article accurately depicted the ‘average’ TREB agent.”

He or she was right.

Because the “average” TREB agent is way, way more unqualified, inept, clueless, hopeless, and hapless than those statistics show.

In 2019, the level of competence among the 55,000+ licensed real estate agents in Toronto has never been lower.

There are too many inexperienced, uneducated, unsophisticated individuals masquerading as agents, and it’s the clients of these people I feel so, so sorry for.

I wish I could end this section on a more positive note, but I just don’t see this getting any better in 2020…

2) Government Intervention & Politics Affecting The Market

Here’s a familiar story in this space!

But we’re not the United States, where residents literally take up arms when their Home Owners Association raises the rates by an unforeseen amount. We’re little old Canada where the government has their hand in every single thing we do.

We’ve come to expect it.

So it’s no surprise that so much of the real estate news cycle in 2019 was dominated by stories about various levels of government and how they indirectly, or sometimes, directly impact the real estate market.

As mentioned above, one of the bigger stories toward the end of 2019 was how the Ontario Real Estate Association successfully lobbied the provincial government to update the Real Estate & Business Broker’s Act, written in 2002, by enacting new legislation in the form of TRESA, or the Trust In Real Estate Services Act.

Another big story this year, at the municipal level, was the establishment of new rules pertaining to short-term rentals in the City of Toronto. This would seemingly change AirBnB forever, and this had investors and proponents of short-term rentals threatening to appeal the ruling, with folks on the opposing side of the battle arguing that the ruling did not go far enough.

November 25th, 2019, I wrote: “Monday Morning Quarterback: AirBnB & REBBA”

I covered both topics in one post, since they happened a few days apart.

My take-away from the second part, about REBBA and TRESA, was simple: this will not affect anybody outside real estate. In fact, I chalked it up to a lot of talk, a sexy headline, but little impactful change.

As for AirBnB, you can make all the rules you want; how are you going to enforce the rules?

Put a sign on the side of the highway that says “MAXIMUM 100 KM/H” but do you really expect people to drive that slowly?

There was a lot of talk in this election-year about what the federal government was going to do to help home-buyers, and the chatter started early on.

January 28th, 2019, I wrote: “Liberal Government To Make Home-Buying Easier For Millennials”

This was the beginning of a litany of promised made by the federal government, in an election year, that was really just bribing voters with their own money.

As I wrote:

You’re naive if you think that any political party or any politician is more concerned with the best interests of constituents, over their own best interests. It’s that inherent conflict of interest that makes politics completely self-defeating. We elect these people, in theory, to make decisions on our collective behalfs, based on our collective well beings. These people, in turn, are paid for their work. If these people were not elected, they would not be paid. And thus, their election is their priority, above all else.

I think I covered my thoughts on the idea of politics on Monday, but you get the point.

A political party in power wants to stay in power, and needs to get votes to do that. Votes are most-easily earned by promising and giving to people who want and need, and with millennials said to represent the largest voting block in this election, it was no surprise to see the government starting 2019 by promising to help millennials buy homes.

But it wasn’t until March that we saw just how much the government was set to interfere, or help, in the housing space.

Recall that I said at the time I posted my blog, on March 3rd, 2019, that I was contemplating writing about the concept of “shared equity mortgages” even before the government made its announcement.

I had people in my office saying, “Sure you did. Also, who is going to win last year’sSuperbowl?”

Alright, well here’s proof. Look at the date of my draft post:

That’s on March 16th, which was before the announcement. So there. Vindication!

March 3rd, 2019, I wrote: “Should The Feds Introduce Shared Equity Mortgages?”

This was on absolutely nobody’s radar (except mine….pat pat…), and it came out of nowhere. The idea that the federal government was going to loan first-time buyers money for down payments on their houses was absurd. Absolutely, positively, insane. But only to about 95% of the educated, informed population…

It wasn’t until June, ie. when the federal campaigning got underway, that we finally got a glimpse of how this program would work.

On June 19th, 2019, I wrote “Much Ado About Mortgage Announcements”

Ah yes!

It was on this glorious day that we learned the program would apply to purchases near a maximum of $500,000, which basically eliminates everything in Toronto and Vancouver, where an eighth of the country lives, and where Canadians truly need the most “help.”

My prediction for 2020: this program either won’t actually be rolled out, or will be, and very few people will use it. I expect the federal government to announce that it’s a massive success, no matter what happens.

On another subject, how about this topic from April 29th, 2019, when I wrote: “Should ‘Green & Clean” Force Us To Change Ontario’s Building Codes?”

Oh, I can’t wait for the day when the city, province, or feds start telling us how, when, and where to build condos, made of what…

2019 was a huge year for government intervention in real estate, and politics helping to shape policy.

Can we expect 2020 to be much different?

1) Help

I’ll bet you didn’t see this one coming, right?

After years and years of repeats, interlaced with some one-offs like Kathy Tomlinson blowing up the Vancouver news cycle, we’ve got a few unique topics atop the list.

I looked back at 2018’s top story, which I called “The Future Of The City Of Toronto,” and I had started that section with “I bet you did not see this topic coming.”

Well, I assure you that I’m not trying to come up with something unique, but rather when I short-list all my ideas, I notice some trends and a few patterns. At the end of 2018, I realized that the city of Toronto was in an odd place when it comes to real estate, but also when it comes to the city as a whole. I believe that the city is, in part, shaped by the real estate market, since the real estate market determines who lives here, where, and how that affects their standard of living. Fast-forward one year, and that theme is still present, only the city, the province, and virtually the entire country have come together to announce what they need in order to continue living: help.

People need help.

Or at the very least, people want help.

That’s been the most noticeable trend through 2019, and it’s shown through my blog posts, but also through just about everything you read in the media, and see and feel outside today.

People are suffering when it comes to housing, and you can even read this in some of the most recent blog comments.

Now the fiscal conservative inside of me wants to play devil’s advocate, before we move on and discuss this “suffering,” of course.

I think it’s fair to ask, out there in society today, when a family of four with an annual household income of $75,000 gripes about affordability, whether it’s housing, taxation, medical/pharma, et al, whether or not their two children, aged 11 and 13, have cell phones.

I know, I’m a jerk. Right?

But society has so incredibly entitled that I don’t believe we have the ability to distinguish between wants and needs anymore.

As a fiscal conservative, and a person who buys chicken in bulk at Costco and freezer-wraps it to save money, I would ask whether two parents, making $37,000 and $38,000 respectively, should be buying iPhones for their children. Is it a right to own a cell phone?

Go into public housing, right now, and tell me if the people who live there, own a flat-screen TV.

We’ve completely done away with self-control and the notion of financial responsibility in society, and that’s where the idea of “help in the housing market” is very confusing to me.

How do we help?

Who do we help?

Why do we help?

And when do we help?

The public is clamouring for help, every single place you look.

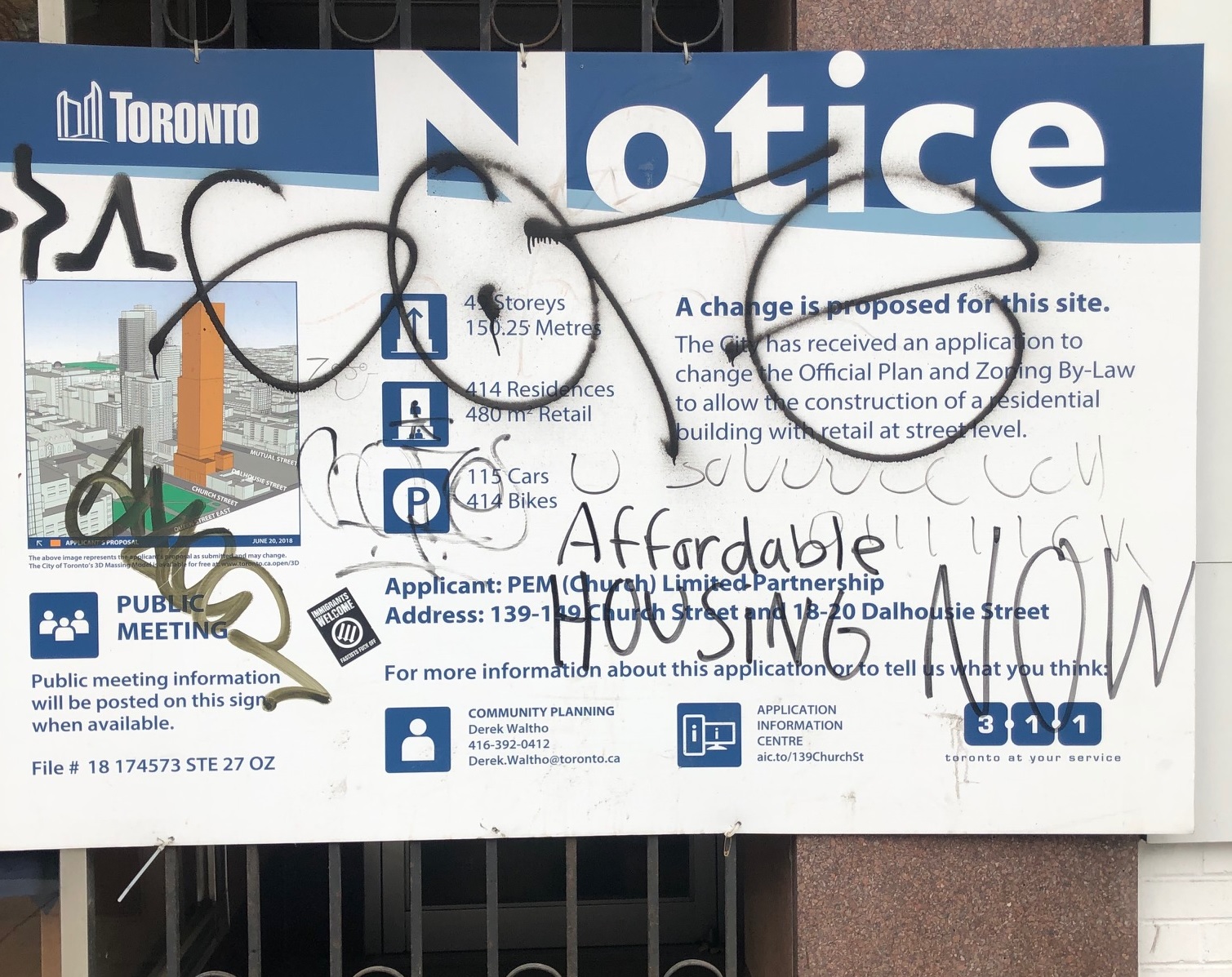

Here’s a sign I just drove by today:

This is outside a property on Church Street that was sold to a developer, and where condominiums will be built.

The graffiti, “Affordable Housing NOW” is written out of frustration, but also, dare I say, misunderstanding.

To whom is this note directed?

It can’t be directed toward the condo developer, since it’s not their job to provide affordable housing. The developer is an individual or entity, conducting commerce in a free market.

It can’t be directed toward the seller of the land, since that individual used the capitalist system and free market in a democratic society to engage in trade, taking on risk, paying appropriate taxes, following established laws, and will ultimately profit financially, as is his or her right.

Is this message directed at the City of Toronto, who posted the notice?

I mean, it should be directed at the City. But I think you and I both know that the person who defaced this sign is simply frustrated, hurt, and without solution to his or her woes.

Toronto has become an exceptionally expensive city in which to live, and that isn’t changing.

We do need affordable housing, there’s no question about it.

But how do we have time to come up with an affordable housing strategy when we’re busy complaining about a Peloton advertisement that is, apparently, misogynist and sexist? It’s amazing we get anything done, with all the first-world complaining we do on a regular basis. We have turned every single thing in our lives into a problem. We are at the point now where we’re actively looking for problems, as evidenced by the uproar to the Peleton ad, but I digress.

Sorry to be the Debbie Downer here, folks, but the truth is, people will never be satisfied with housing, affordable or otherwise.

Build 10,000 units next year? It’s not enough.

Build 10,000,000 units next year? They should be free.

Make them all free? Why don’t they come with better WiFi?

My cynicism is overwhelming, but it’s in response to the day-to-day actions of a society that is actively looking to create problems, and complaints, and one that has become so entitled, it’s hard to fathom.

I also believe that a lack of understanding of economics has shaped the desire for everything to be free, and for a hand to be extended at every opportunity. But thankfully, colleges are now teaching Adulting.

I don’t personally think that the federal government should be “helping” buyers by providing borrowed down-payments for houses. Remember, I work in real estate, so the biased and company-line rhetoric should be that I think this is GREAT!

But I think the idea stinks. I think the government has already put such a high burden on its citizens with the CMHC that to enter into the lending arena is a recipe for chaos.

If a buyer doesn’t have the money for a down payment on a house or condo, then that buyer should not buy a house or a condo. Full stop.

If the government wants to “help” people, then educate them. Don’t coddle them. Don’t baby them. Don’t lead them to believe that it’s all going to be okay, and that we are all delicate snowflakes, because I believe that the leaders both here and in the United States (the Dems, that is) have led people to believe that they deserve what they want, and they should have everything they want, when all the while, they should be touting personal responsibility instead, and seeking to educate and empower, not pamper and placate.

Should we build more affordable housing? Absolutely. Start building, and don’t stop.

Should we lend money to people to buy real estate? No. Sweet, God no.

Double-phew!

These two posts were far too long, and for that, you’re welcome, and I apologize.

I pour my heart and soul into Toronto Realty Blog every day of the week, and I feel as though a year-end post should be epic.

Cynical, sarcastic, ranting, raving, but always brutally honest and ripe with opinion.

It’s been a pleasure to write for you all through 2019, and thank you for reading and commenting today!

See you Friday!

Andrew

at 9:24 am

David, something I’ve been meaning to ask you for a while now: how long does something like this take to write?

David Fleming

at 3:20 pm

@ Andrew

Some blogs take me 30-45 minutes, but that’s rare. Those are the “stories” that are usually furiously typed when just experienced.

The statistics-based blogs require reading the market updates, inputting data, creating graphs/charts/pics, then analyzing and writing. Maybe 2-4 hours on average.

These two blogs require researching my own blog posts through 2019, and re-reading many of them. Then the writing, which I admit got out of hand. But all told, maybe 6-8 hours per blog?

Chris

at 10:02 am

“Canadian underlying inflation hit the highest in a decade in November, reinforcing a decision by policy makers this month to refrain from cutting interest rates despite concerns around slowing growth.

Inflation rose 2.2 per cent in November from a year earlier, compared with 1.9 per cent in October, on higher shelter and vehicle costs, Statistics Canada reported Wednesday.”

https://www.bnnbloomberg.ca/canadian-inflation-accelerates-to-2-2-core-highest-in-a-decade-1.1364372

Looks like no interest rate cuts anytime soon.

Bal

at 11:17 am

How does this inflation work? I feel everything is going high in price from food to houses to gasoline…but how come inflation is staying input..under target

Chris

at 11:42 am

“The Consumer Price Index (CPI) is an indicator of changes in consumer prices experienced by Canadians. It is obtained by comparing, over time, the cost of a fixed basket of goods and services purchased by consumers. Since the basket contains goods and services of unchanging or equivalent quantity and quality, the index reflects only pure price change. ”

You can read more about the methodology here: https://www23.statcan.gc.ca/imdb/p2SV.pl?Function=getSurvey&SDDS=2301

Additionally, inflation of 2.2% is not under target, but actually above the Bank of Canada’s inflation target, which is 2.0%. This target was set in 2016 and will be in place until the end of 2021.

Bal

at 12:40 pm

Honestly, I am only interested in this blog as my younger son looking to buy a house next year…as a lovely mother, I am…trying to understand the concept…lol

Chris

at 12:50 pm

As I’ve said many times before, the decision to rent or buy hinges on a lot of personal and unknowable variables.

Can he afford a home (mortgage payments, taxes, insurance, maintenance, etc.), how long does he plan to live there, how stable is his income, what are home prices and equity prices going to do, does he have interest in being a homeowner, etc. etc.

There is no one-size-fits-all answer to if you should buy a home.

Appraiser

at 2:07 pm

“The average of Canada’s three measures for core inflation, which are considered better gauges of underlying price pressures, was 2.17 per cent compared with a revised figure of 2.10 per cent for October.

The core readings are closely monitored by the Bank of Canada, which adjusts its key interest rate target to manage inflation.”

https://www.cbc.ca/news/business/inflation-november-2019-statistics-canada-1.5400624

Chris

at 2:11 pm

Exactly. And 2.17% is above the BoC target of 2.0%. Additionally:

“Core inflation — seen as a better measure of underlying price pressure than the headline figure — increased 2.2 per cent, the highest reading since 2009”

Hence, unlikely there are any interest rate cuts coming soon.

condodweller

at 11:59 am

@Bal The problem with inflation is that the CPI index excludes the biggest items such as food and energy. I read recently that food inflation this year was close to 4% which is double the target inflation rate of 2%. Energy is also excluded. Inflation is highly misleading unfortunately. This is part of the reason why the standard of living is constantly decreasing for a lot of people. With food inflation near 4% and pay increases of 1% or less it’s no wonder housing is an issue in this city.

Bal

at 12:15 pm

Oh damn….so the necessity of life( food…house and energy) is not included .strange way to measure inflation

condodweller

at 12:31 pm

Exactly. I didn’t state the obvious, which may not be so obvious to many is that housing is also not included. Raise your hand if food/energy/housing are your biggest expenses…….behind your taxes.

Appraiser

at 2:19 pm

For a deep dive in to the CPI : https://www150.statcan.gc.ca/n1/en/pub/62-553-x/62-553-x2019001-eng.pdf?st=k31naPtY

As for housing and the CPI, here is a direct quote from the above link:

“Statistics Canada’s approach is to measure the impact of price

changes on the costs incurred by homeowners while they own a home. These costs include mortgage interest, replacement cost (depreciation), property taxes, home and mortgage insurance, maintenance and repairs, and other expenses. The first three of these cost categories account for three quarters of the total owned accommodation basket weight.”

Whaaa?

at 1:52 pm

Condodweller, I don’t know where you get your information (I’ll assume you believe it and are not simply “winding people up” with blatantly false assertions) but food, energy and housing are all most definitely included in StatsCan’s “headline” inflation figures. Food and energy are excluded from “core inflation” (in virtually all developed nations, not just Canada) because of their month-to-month volatility. Regardless, both measures are routinely reported.

https://business.financialpost.com/news/economy/canada-inflation-accelerates-to-2-2-core-highest-in-a-decade

BTW, who in the world told you that housing/shelter is not included in the CPI?

https://www150.statcan.gc.ca/n1/pub/62f0014m/62f0014m2019001-eng.htm

Libertarian

at 9:39 am

Good rant about the role of gov’t in “1) Help”. It’s not the gov’t’s job to be a genie and grant everyone 3 wishes.

The gov’t’s job is to provide the infrastructure (health care, education, roads, public transit, etc.) that allows people to flourish. If they don’t flourish, that’s their problem.

We are less than 2 weeks away from the year 2020. I am old enough to remember that 2020 was a big deal. We’d all have flying cars and a four-course meal would be replaced by a pill. Sadly, none of that has come to fruition. Even sadder is that we as a society are regressing back towards socialism. We already had this battle, and I thought capitalism won handily. But I guess that’s what happens when new math is created – as long as interest rates are low, gov’ts can borrow, borrow, borrow, and borrow some more. What a load of nonsense!

So everybody can cheer that low interest rates are making their real estate increase in value and making them wealthy, but the gov’t is going to take that wealth, so at the end of the day, nobody is better off.

Appraiser

at 12:04 pm

“If they don’t flourish, that’s their problem.”

Wrong, it becomes society’s problem.

Libertarian

at 2:21 pm

I get the feeling that you’re referring to extreme poverty. I was not. I was referring to the majority of people, such as the example David uses – a family of four with a household income of $75K. They’re not rich, but they’re definitely not poor either. They should not be a problem for society.

Appraiser

at 2:22 pm

Which begs the question.

How shall a just and modern society deal with those who do not flourish?

Libertarian

at 4:28 pm

Aren’t you part of the problem? You own numerous properties; probably more than necessary. You are part of the increased demand, which has increased prices for everyone else. You charge people rent and raise that rent regularly. How are you helping people flourish?

If we help people flourish by giving them money, isn’t that enriching you even more because they use that money to pay you rent?

Appraiser

at 4:53 pm

I fail to see how someone’s business acumen or financial success is keeping others from flourishing.

P.S. I was thinking more along the lines of John Stuart Mill, rather than some lame personal attack.

Libertarian

at 9:20 am

“I fail to see how someone’s business acumen or financial success is keeping others from flourishing.” – That’s what I wrote above in my original comment, which you criticized, and now you use it to defend yourself.

Talk about a lame comment.

condodweller

at 11:49 am

Good summary for the year David. Thank you for taking the time out of your busy life to write these. These year end summaries are probably more benefit to occasional readers who want to catch up vs the regular readers.

Given it’s the holiday season I want to say something about your #1 but first let me briefly touch on two other items in one go regarding your comments about prices and bears pointing out the 2017 highs.

I know many would label me as a bear even though I consider my self a realist who likes to draw conclusions on existing data and make educated guesses as to what the future might bring based on the data and my insight. I would never make bold predictions on future prices etc. At the same time I’d have difficulty calling today’s market red hot when we are below 2017 highs.

Secondly I find myself starting to become sensitive to being labeled a bear though I understand how/why I’m considered one in contrast to other bulls here. I actually do consider myself a bull I’m just not a cheer leading raging bull as some others.

I fully agree that people need to become self reliant and realistic about housing in TO. However, it makes me sad to see the level of homelessness in our city. In a recent CBC show I heard about a man who lost his job 10 years ago and hasn’t been able to find another one which forced him to live in a shelter for the past 10 years. There was also another man who lives under a bridge in a tent who surprisingly seemed like an average well kept person with clean clothes vs the stereotypical homeless person with the over grown beard who seemingly hasn’t had a shower in months.

I think it’s a cop-out to say if you can’t afford to be in the city you should just leave. I believe we should accept the fact that homelessness is a problem and it’s not going away. Therefore, in a “rich”, civilized country like Canada we should be able to come up with a solution and provide shelter for these people to live in dignity. I’m surprised that philanthropists haven’t taken up the cause to solve the problem given the government isn’t doing anything about it or at least not nearly enough.

Appraiser

at 2:26 pm

Did someone cry help?

“Feds, Ontario commit $1.4B for affordable housing for low-income families”

https://www.cbc.ca/news/canada/toronto/housing-announcement-toronto-1.5402103

Derek

at 2:40 pm

There’s an article in The Star with a few more details about the program. The program does not appear to have much to do with affordable housing other than the fact that the potential recipients of the scheme are likely to be lower income: “Priority will be given to households eligible for or on a “social housing waiting list and households in financial need living in community housing. This includes survivors of domestic violence and human trafficking, persons experiencing or at risk of homelessness, Indigenous persons, seniors and people with disabilities,” a government release states.” I’m not sure how an extra $200 per month or thereabouts ameliorates the “problem” of affordable housing. If you don’t look too closely, I guess you think the government is doing something about the “problem”.

Mxyzptlk

at 3:43 pm

Why do you put “problem” in quotation marks (twice)? Do you not consider the lack of affordable housing in the GTA a problem?

Derek

at 4:40 pm

Labeling it a “problem” invites poorly targeted “solutions” like the one reported today. I believe that low wages, eroded Labour protections, temporary work schemes (e.g. Fiera Foods), gig economies are problems. Policies that promote higher wages and secure employment with strong labour protections are worthwhile endeavours, perhaps as an adjunct to transferring tax revenue to people struggling to make ends meet. I think unaffordable housing is a symptom of such broader issues. Mind you, what “I think” is to be weighed against my qualifications to opine on such things 🙂

Mxyzptlk

at 5:03 pm

“Policies that promote higher wages and secure employment with strong labour protections are worthwhile endeavours.”

I’m with you 100% on that.

Clifford

at 9:43 am

Derek, I agree 100%

Kyle

at 4:57 pm

I thought this was funny:

https://www.realtor.ca/real-estate/21416338/0-bedroom-single-family-house-2277-queen-st-e-toronto-the-beaches

Merry Christmas, Happy Holidays everyone!

Derek

at 6:23 pm

Of course it’s positioned for a bidding war; Typical!

Kyle

at 8:01 pm

Darn, they took down the listing. Oh well there were no inside pics, and that’s never a good sign.

Appraiser

at 7:33 am

Record population growth during the third quarter of 2019, Statistics Canada.

“Canada’s population increased by 208,234 from July 1 to October 1, 2019, driven mainly by an influx of immigrants and non-permanent residents. This was the first time that Canada’s population increased by more than 200,000 in a single quarter.”

https://www150.statcan.gc.ca/n1/daily-quotidien/191219/dq191219c-eng.htm

Bal

at 8:13 am

Good for Canada….i guess…..

Kyle

at 8:40 am

Thank goodness the Government didn’t buy into that garbage “study” done by Josh Gordon a few years ago, that claimed we’re over-building relative to population growth. If you think this is a housing crisis now. Just imagine how much worse off people would be had the Government listened to that utter rubbish.

Chris

at 9:17 am

“claimed we’re over-building relative to population growth”

Not quite. Gordon states “This data shows that housing construction is keeping up with population demographics”. He states there is a risk of over-building over the medium term future, but never claims that the current situation was one of over-building.

His policy recommendations to government were not to stop building. Rather, he recommended a Foreign Buyer Tax (since adopted by the BC and ON governments, and may soon be adopted at the Federal level) and a Progressive Property Surtax (which would be offset by income taxes, thereby hitting those homeowners with foreign income or who have evaded taxation).

You can read his entire paper here:

https://www.ryerson.ca/content/dam/citybuilding/pdfs/2017/CBI%20POLICY%20PAPER-In%20High%20Demand-March20171.pdf

Chris

at 9:07 am

40% of this population growth came from non-permanent residents. That’s the highest proportion going back to the 1980s.

“The NPR category is a rotating door, and Canada has a history of seeing outflows in this category during recessions, notably in the early 90s when NPRs declined by 50% over 7 years.” – Ben Rabidoux, North Cove Advisors

“Economic growth comes from labour force growth, productivity growth, and export growth. Exports are being hammered by trade wars; productivity growth has mostly stalled in Canada since 2015; and population aging combined with falling fertility rates means newcomers will be the only source of net labour force growth as early as 2025. As newcomers become a major economic driver, both their levels and nature matter.

Few temporary residents ever make the transition to permanent status.

The balance of intake between temporary and permanent residents shapes the evolution of the labour market and society. More turnover and more temporary workers slows wage and benefit growth for all workers, not just the temporary ones.” – Armine Yalnizyan, Atkinson Fellow on the Future of Workers

On a somewhat related note, news this morning:

“Statistics Canada says retail sales fell 1.2 per cent to $50.9 billion in October as sales at motor vehicle and parts dealers as well as building material and garden equipment and supplies dealers declined.

Economists on average had expected an increase of 0.5 per cent for the month, according to financial markets data firm Refinitiv.”

Kyle

at 9:14 am

Do temporary or NPR workers not need a roof over their heads?

Chris

at 9:23 am

While they’re here, of course. But the 82,438 NPRs we added in the third quarter may not still be here in coming years.

Kyle

at 10:34 am

“productivity growth has mostly stalled in Canada since 2015; and population aging combined with falling fertility rates means newcomers will be the only source of net labour force growth as early as 2025. As newcomers become a major economic driver, both their levels and nature matter.”

Why won’t they be?

Chris

at 10:36 am

“Few temporary residents ever make the transition to permanent status.” – Armine Yalnizyan, Atkinson Fellow on the Future of Workers

Kyle

at 10:40 am

Yes but if we need them to work here in order to support our Economy, who cares whether they become permanent residents? They need to be housed.

Chris

at 10:51 am

Because if they are not permanent residents, they will only be here temporarily.

If we add ~125,000 permanent residents (through immigration and births) each quarter, in five years time, it’s a fairly safe bet that we will have an additional ~2.5M people from these sources. So we can plan for these 2.5M people.

If we add ~80,000 non-permanent residents each quarter, in five years time, it’s unlikely that we will have an additional ~1.6M people from this source. Because, as we add some NPRs, others will leave. So we probably shouldn’t plan for 1.6M. Rather, we should plan for some lower number, that takes into consideration the typical inflows and outflows of NPRs.

Kyle

at 11:08 am

You are not addressing the question. There were 208K people who came here. And by the quote you provided, i think we agree they are necessary to our continued Economic growth.

Whether 82K decide to stay here in five years or not is irrelevant. Maybe they do, maybe they don’t, maybe they go back, and another 82K (or even more) replace them. Contrary to the rubbish Gordon writes, they all NEED to be housed TODAY, and there already is an existing housing crisis

Chris

at 11:25 am

You asked “who cares whether they become permanent residents?”. I addressed that question by explaining why we should care if they are permanent residents or not, with a simple mathematical example.

It is absolutely relevant if migrants are still here in five years time, as we cannot realistically build homes and infrastructure today to respond to today’s needs. Rather, we should be building and planning for the future.

Having all 208K residents we added in the third quarter still here in five years is a different situation from having only 60% still here. These two scenarios require different planning.

I do agree that migrants are necessary for our economic growth, however I would prefer more permanent residents and fewer temporary ones. Ms. Yalnizyan’s comments on wage and benefit growth are one good reason for this preference.

And again, Dr. Gordon never postulated that people don’t need to be housed, nor did he suggest we are over-building. I’m not sure what exactly you think he said, but I would recommend you refresh your memory by re-reading his report, linked to above.

Kyle

at 11:32 am

Per the quote you provided, needing immigrants AND NPRs is the future. If you are suggesting that we only build enough for immigrants, then you are effectively saying we either do not allow NPR’s in five years or we make them live in tents when they arrive.

Chris

at 11:49 am

Sorry, but you seem to have misunderstood me.

First of all, the quote I provided says we need “newcomers” not “immigrants and NPRs”. Additionally, Ms. Yalnizyan makes a compelling argument for more immigrants and fewer NPRs. Personally, I would agree with her.

What I am suggesting is exactly what I have said. We should plan for what our population is realistically likely to be in the future; which means accounting for the different retention rates we are almost certain to see between permanent and non-permanent residents. And this recent population growth figure shows a record high proportion of NPRs.

Kyle

at 1:02 pm

Not sure why you are so fixated on retention in five years. There is a gap between what our population’s natural reproduction can sustain and what is needed to keep growing economically, that needs to be filled by new comers. This gap does not suddenly disappear in 5 years if anything it probably gets bigger. There isn’t going to be a sudden increase in our naturally reproduced working age population that materializes from thin air, and our population isn’t going to un-age. So if those NPRs go home, some one else will fill in. You and Ms Yalnizyan may prefer then to be immigrants over NPRs, but that is irrelevant. Whatever form of residency they come in they will need to be housed.

Chris

at 1:15 pm

I think you’re missing my point here.

I am fixated on retention because it obviously impacts future population numbers.

Clearly NPRs need to be housed today. But of the ~80,000 we added in the third quarter, how many will still be here in, say the next quarter? If hypothetically half of those individuals leave, and we add another ~80,000 NPRs, we shouldn’t plan for ~160,000 people in Q1 2020, but rather ~120,000.

In addition, nobody has suggested a working age population will materialize from thin air, or un-age. Those are straw man arguments.

Kyle

at 1:23 pm

You keep only counting one flow – when they exit. It isn’t only a one way flow, Some leave new ones come into replace them. So long as there is a gap (which there will be), there will be a need to house whoever fills that gap. Full stop.

Kyle

at 1:33 pm

And also no one is suggesting that we build housing based on a quarterly population increase. That is a strawman argument.

New supply IS based on whether they can pre-sell units TODAY, which is not where the supply bottleneck is. The bottleneck hindering adequate supply is the zoning and planning.

Chris

at 1:44 pm

“You keep only counting one flow – when they exit.”

…no, in my example I accounted for ~80,000 coming this quarter, a hypothetical ~40,000 of those leaving, and an additional ~80,000 coming next quarter. That is clearly not only counting one direction of flow; feel free to scroll up slightly to confirm.

“And also no one is suggesting that we build housing based on a quarterly population increase.”

Which isn’t what I suggested either, but I narrowed the scope of my example to two quarters as we didn’t seem to be able to get on the same page regarding future planning when I was discussing an example using a five year population change.

Clifford

at 9:46 am

Less disposable income. Wages are unchanged, taxes have increased, people are spending more money on rent and mortgages. Not suprrising

Spencer

at 7:06 am

To be fair flat screen TVs are just TVs.

I defy you to find a deep, tube TV for sale anywhere.

shen walji

at 10:46 am

Oakville realtor Shen walji

Whelan

at 3:35 pm

Never thought that online trading could be so helpful because of so many scammers online not until I met Christina Taylor who changed my life and that of my family. I invested $500 and got $5500 all Within a week. She is an expert and also proven to be trustworthy and reliable.

Contact her via:

Email: Christinatayloreve@gmail.com

Facebook: m.me/christinataylor01

Whatsapp/Call/SMS: +44 7418 315017

VIP Incorporation

at 4:18 pm

Buyer beware! Realtors might want to make sure the seller is dressed before taking a home tour. Knocking is a standard protocol for realtors before they show a home. But a knock might not be enough notice for some sellers.

rohan

at 3:53 am

US property, I have read all the comments and suggestions posted by the visitors for this article are very fine,We will wait for your next article so only.Thanks!

jimi

at 10:08 pm

Apartments for sale in New Cairo I think this is an informative post and it is very useful and knowledgeable. therefore, I would like to thank you for the efforts you have made in writing this article.

asif

at 1:20 am

Philadelphia Luxury Real Estate A very awesome blog post. We are really grateful for your blog post. You will find a lot of approaches after visiting your post.

Adnan

at 5:30 am

Good to see this post and i was looking for best real estate in toronto and it is very helpful for me. house for sale in toronto

jimi

at 2:33 am

Rittenhouse condos philadelphia pa Thank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our.

jimi

at 1:41 am

oil tank sweep I have read all the comments and suggestions posted by the visitors for this article are very fine,We will wait for your next article so only.Thanks!

Herry

at 11:56 am

Thank you

Sweede

at 11:58 am

Best movers in Abu Dhabi