Do you squirm when you hear that real estate prices are down in Manitoba?

What about if prices were down in another major Canadian city like Edmonton, or Calgary?

If the overall price of a Canadian home decreased, but the price of your Toronto home continued to increase, would that worry you?

I know where my opinions lay, but let’s look at this article from the CBC, and discuss…

Here’s an analogy that perhaps some of you can relate to…

Not to long ago, I attended a social event that contained friends, acquaintances, and strangers, but probably more of the latter.

When my wife and I looked at each other with that “it’s time to go” look, we slowly began to slide on our coats, and proceeded to begin saying goodbyes.

One of the people who we’ll call an “acquaintance” approached us and said, “You’re leaving already?”

We had attended the event (a birthday at a restaurant, I think…), had our fun, done our mingling, talked our talk, and were now ready to depart.

But the young girl offered, “You guys are sooooooo lame! Seriously, it’s like midnight! Stay and have some fun!”

My wife and I both offered sheepish smiles, and placated the girl, “Oh, well, you know…..we’re gonna head home, and keep the party going!”

Really, we just wanted to leave. We were tired. We worked all day. And we weren’t part of that “scene” of people who party until 4am, three nights per week.

The girl persisted, “Seriously, your’e so old and boring! Oh my God, you’re the only ones leaving! What’s wrong with you?”

Nothing, actually.

In fact, we’re quite happy.

My point to this story is that I have no idea why this girl cared what we were doing with our time, and why we were leaving. She wasn’t the birthday girl – she was just some chick; some random friend-of-a-friend that seem incredibly pre-occupied with our lives, rather than focusing on her own.

Despite her persistence, I never felt the need to say, “What’s wrong with you? Your life revolves around drinking until 4am and sleeping until 3pm the next day, which is okay when you’re 19, but not pushing thirty. You’re so pathetic!”

What’s the point?

I don’t care what she’s doing with her evening.

And I don’t understand why she cares what my wife and I do with ours.

By the same token, I don’t understand why somebody who owns real estate in Toronto would be pre-occupied with what is going on outside of Toronto, and of course, why the perennial bears use Canadian real estate as some measure of the Toronto market.

You can’t paint the whole country with the same brush.

If you ate at two bad restaurants out of five, you can’t say, “All restaurants have bad food.”

Alright, I’m deep in the analogies today. Let me just move on to the CBC piece:

“Home Prices Slide In 8 of 13 Major Markets In February”

CBC News – March 12, 2015

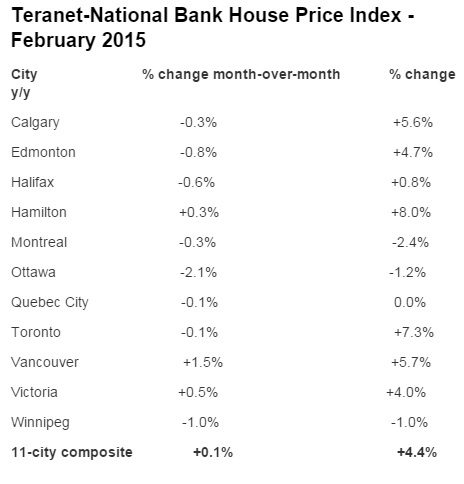

Home prices fell in eight of 11 major Canadian real estate markets in February as more weakness crept into the real estate market, according to figures released Thursday.

The Teranet-National Bank national composite house price index rose by 0.1 per cent last month. But that was largely because of strength in the Vancouver market, where prices gained 1.5 per cent from January.

Prices also rose month-over-month in Victoria (0.5 per cent) and Hamilton (up 0.3 per cent).

But in eight other markets, prices fell from the month before — and that downward trend is becoming increasingly evident in some markets.

In Toronto, prices fell 0.1 per cent month-over-month.

In once-booming Calgary, prices fell for the fourth month in a row, as the city’s energy-focused economy deals with a sharp drop in oil prices. Home prices have fallen by a cumulative 2.3 per cent since November.

“The effects of significantly lower oil prices had already turned up in resale activity, with sales in Calgary and Edmonton down more than 40 per cent and 30 per cent respectively, from October to January,” notes TD economic analyst Admir Kolaj in a commentary.

“Calgary had been on a decelerating streak since November. Today’s data release indicates that cracks are also beginning to appear in Edmonton.”

Kolaj predicts that Canada’s energy-driven markets, including St. John’s, are likely to experience price corrections of up to 10 per cent “peak-to-trough” through the year.

Price corrections were even larger in some other cities. Prices in Ottawa-Gatineau dropped for the fifth time in six months and are now down 5.2 per cent in that period. Montreal prices fell for the sixth time in seven months — down 5.0 per cent overall. And in Halifax, prices have dropped 5.5 per cent in the last five months.

On a year-over-year basis, prices are up 4.4 per cent nationally. But that represents the fourth straight month that the yearly increase has decelerated.

Annual price increases in Hamilton (up 8.0 per cent), Toronto (up 7.3 per cent), Vancouver (up 5.7 per cent) and Calgary (up 5.6 per cent) were above the national average. But year-over-year prices were lower in Winnipeg (down 1.0 per cent), Ottawa-Gatineau (down 1.2 per cent) and Montreal (down 2.4 per cent).

The Teranet-National Bank National House Price Index looks at how the price of the same home changes over time, so that only properties with at least two sales are entered into the mix.

So let me ask again, to all of you who own real estate in Toronto: does this matter to you?

I don’t want to sound like a real estate cheerleader.

And I certainly don’t want to sound ignorant. I know that to say what’s going on around the country has zero impact on Toronto real estate prices is naive.

But I don’t see a direct impact, nor do I see a cause for concern.

I always get asked about the same two things – the drop in price of oil, and the drop in the value of the Canadian dollar relative to the American dollar.

And my reply is always the same: “We don’t produce oil in Toronto, and we still buy our houses and condos in Canadian dollars, not American.”

There’s an indirect impact, of course.

The Canadian dollar has declined, so that $3,000 trip to Florida now costs $3,900, and thus that’s $900 less in savings that could go toward a house.

But that’s not a direct affect on the price of houses and condos in Toronto. It’s not like it suddenly costs us 30% more to buy a house or condo in Toronto.

So do we really care if the real estate market in Quebec City is slow?

Is it a concern if prices are down in every neighbourhood of Red Deer, Lethbridge, and Medicine Hat?

The funny thing about that CBC article, is they chose to post this graphic at the end:

So the whole point about “home prices slide in 8 of 11 markets” is month-over-month, not year-over-year.

Who cares about month-over-month?

Oh, Toronto’s market is down 0.1%? Really?

A month is a small sample size, and February has 28 days, compared to 31 in January, so it also bothers me when they talk about number of sales declining month-over-month, since one month happens to be 10% shorter than the other.

So back to the topic at hand, should the overall value of a Canadian home be of interest to the owner of a house in Toronto?

Or is Toronto simply a part of the overall picture, and free to move up, down, or sideways?

You probably know where my opinion lays, and it’s not because I sell real estate.

Toronto is its own animal, and while I wouldn’t compare it to Quebec City, Calgary, Edmonton, et al, I also wouldn’t compare it to Vancouver either, despite the constant joining-at-the-hip of our two cities.

Vancouver and Toronto couldn’t be more different, and it can’t be expected that the two will always move in tandem.

I choose to see Toronto as not only the defacto capital of Canada, but also a world-class city, with a population that will continue to grow, as commerce continues to explode.

Is it fair to say that Calgary’s reliance on oil is ten times greater than Toronto’s reliance on any one industry? Isn’t Toronto pretty well “diversified” when it comes to how people make a living?

Do we expect Quebec City’s population to rise? Is there any reason for that, and as a result, any reason why the demand for housing might increase, and help push prices along as well?

Every city in Canada is different, so when I see an article like this one – that shows how “most of Canada’s real estate is declining in value,” I find it to be terribly misleading to those that read it here in Toronto. And let’s be honest – fear sells. “If it bleeds, it leads.” The media wants Toronto real estate owners to take notice, and thus buy their papers, and watch their shows.

That’s just my two cents.

But if you can provide an argument as to why the Nunavut real estate market should be of grave and immediate concern to those of us downtown-Toronto-dwellers, I’m all ears…

Pete

at 7:45 am

While I agree that markets should be evaluated on their own terms, one factor that could influence Toronto prices is the overall perception of how Canada is faring. If the dollar continues to slide, unemployment numbers go up, etc, then consciously or subconsciously, people will begin to think the economy is trouble, and that could affect willingness to spend and take on date, which in turn would hurt the economy more. So while Toronto’s RE market may be strong, the general mood of the country could seem in Torontonians’ minds and that could affect the RE market.

Appraiser

at 7:55 am

The Teranet-National Bank national composite house price index may be many things, but one of them is not being up to date. The index utilizes sale prices as recorded in the various land registry systems of the cities that they track. In other words, it monitors closed transactions only. Unfortunately, in the fast moving world of real estate, that’s yesterday’s news.

When the index gives data for February, it is in fact recording data from the previous 2-3 months of sales activity, the vast majority of which are MLS sales of the various real estate boards involved. So while the index is consistent and reliable, it’s not very current. That’s why there are often wide discrepancies between monthly reports from Teranet, CREA and TREB, the latter two of which report firm sales transactions in real time. In fact TREB produces up-to-date sales stats twice per month!

As for month over month comparisons, anyone who follows real estate closely knows that home sales are seasonal and that it is far more valid to compare year over year data. Sadly, it appears that whatever makes the headlines seems to appease the masses.

Darren

at 9:14 am

What happened to prices in the Toronto market during previous national corrections David?

Kyle

at 9:31 am

Seriously, using Canada’s real estate prices to predict what will happen to Toronto prices? And inferring a trend based on month over month changes, in something as seasonal as house prices? Have the bears really become so desperate that they actually believe in this tripe?

Toronto real estate bears are like men lost at sea frantically treading water in the middle of a giant ocean named Reality, desperately clinging to any bit of flotsam that goes by to keep their heads from going beneath the surface. The media readily provide this flotsam in the form of “news” articles or “expert” opinions. And regardless of how flawed, unreliable, stupid or just plain ridiculous the article or theories are, seems there will be those who would rather maintain their delusions than face reality.

Boris

at 10:50 am

Yet guess what, they will be right at some point.

It could be 4 years from now. It could be 4 months. But when the correction comes, there is a chance it is a significant drawn out one.

Kyle

at 11:08 am

If (big if) such a scenario ever happened i would hardly consider them to have been “right”. There is a huge gulf between causation and spurious correlation. Predictions based on garbage that eventually come true (for factors completely irrelevant to the garbage the prediction is based on), are still predictions based on garbage.

Appraiser

at 2:47 pm

@ Kyle. It’s true, the bears are hilarious. From David Madani, who’s 4 years into his “max. 3-year” prediction of a housing crash, to Ben Rabidoux who’s working on year 5, or Robert Shiller who first shot off his mouth 6 years ago, to the all-time winner and still champion, Garth Turner who’s now 8 years along in his dire prediction of a Canadian real estate melt-down.

Of course there’s alway Macleans magazine that has run so many sensationalistic housing crash headlines that it’s hard to keep count. Who could forget this gem from 2 years ago?

“Great Canadian real estate crash of 2013.”

“The housing bubble has burst, and few will emerge unscathed.”

Chris Sorensen, January 9, 2013 http://www.macleans.ca/economy/business/crash-and-burn/

Joe Q.

at 11:11 am

“Seriously, using Canada’s real estate prices to predict what will happen to Toronto prices?”

Where in the article do you see this?

Kyle

at 11:34 am

If you read between the lines, it’s pretty clear that is the inference and will be the conclusion drawn by many bears. I read the writing of well known bears, and i find it comical that many no longer make actual predictions or conclusions any more (probably because they’re sick of being wrong day in day out forever), so instead they lob out some garbage stat or ratio to try and suggest, infer, connote and otherwise lead those that want to believe their narrative. Over time it has really become quite funny watching the change in their behaviours and tone as they try to sell the same tired garbage narrative. Years ago the story was “prices in Toronto will fall because of factors: a,b&c”. Well prices didn’t fall and instead rose, so the story became”prices in Toronto are over-valued because of a,b&c”. Again prices kept rising, so now they don’t even have a story, instead just state things that infer a,b&c are happening.

Chris Valei

at 1:23 pm

If you are arguing against what you read between the lines then you are really arguing with yourself.

Kyle

at 2:59 pm

“But in eight other markets, prices fell from the month before — and that downward trend is becoming increasingly evident in some markets.

In Toronto, prices fell 0.1 per cent month-over-month.”

They’re basically lumping Toronto in with the other markets that are down m/m, wthout mention that it is the second best performing of the 11 on a y/y . If you think there’s validity to what they’re saying and how they’ve presented it then you are the target fool they’re after.

Chroscklh

at 10:10 am

I read study most interesting – city with barrier to expansion fare better, less likely correct vs other city. NY (manhattan is island), Toronto (green belt), Vancouver (ocean, mountain) – just can’t build more. No bust. Calgary, Las Vegas, Chicago – sprawl is easy, many more boom-bust cycle. Much more volatile. Also, for Chroscklh, I dont mind Calgary, Edmonton, Fort Mac have big correct, make national ave low – but regional still go up. I deal with Int’l investor who wait house correct, just to invest in Canada (not even real estate) – see evidence in national average, convince ‘soft landing’, safe proceed.

Ben Myers

at 10:20 am

Great article David. There is such a misunderstanding of real estate data and its implications, I’m constantly fighting this battle with individuals that invest in Fortress projects.There is correlation between markets for sure, but the decline in one metro area doesn’t mean there will be a decline in another metro.

I tackle the “overvaluation” studies in my latest report: http://fortressrealdevelopments.com/news/market-manuscript-spring-2015/

Kyle

at 3:49 pm

Now this is a proper analysis. Each CMA is discussed on its own merit and supported with logic and data.

Contrast it to the CBC article which simply lumps a bunch of disparate cities together based on whether they were up or down m/m (a nonsensical methodology). And to make the article even more irresistible to bears they’ve added a picture of a very concerned looking couple standing around the kitchen with their Realtor and highlighted the text ‘Cracks’ Appearing.

It’s clear one of these is meant to inform, while the other is meant to misinform. unfortunately most bears are unable to discern which is which.

George

at 1:08 pm

Few major issues I have with your report:

– assumes that interest rates won’t rise, when in fact it might not even be up to BOC to make that decision. What happens to the “affordability ratio” when/if rates go from 3% to 5-6%? Wouldn’t that, right there, necessitate 25-30% pricing correction for the ratio to remain stable?

– assumes new jobs growth – which sector? services?

– assumes wage increases

– assumes actual available jobs for “high skilled” immigrants – again which sector?

I get it, 70% of Canadians, including me, are home owners. One side of me wants the party to continue, on the other, how can prices keep increasing 5% or more YoY indefinitely. We’d all be “priced out” at some point in the very near future.

How any people on this blog have been getting a 5-10% raise every year, for the past 10 years?

Wut

at 2:10 pm

How any people on this blog have been getting a 5-10% raise every year, for the past 10 years?

If in the same job, probably difficult, but if changing jobs/employers it isn’t that difficult. Besides, once you have a mortgage, the home price is irrelevant, all raises make paying the mortgage easier. If you’re worried about your kids not being able to afford a sfd in toronto then that’s probably going to be true, and it is like that in many cities around the world.

And the correct answer to the blog is all markets are regional and the price of a house in Calgary or YVR has no effect on the price of a house here here. Jobs and interest rates is what matters.

Kyle

at 2:59 pm

@ Wut

You nailed it. Doesn’t require everyone in the economy to get a 5-10% raise every year for house prices to go up 5-10%, because A) There are under 100K house sales per year in GTA, where 6M people live, so it technically only requires less than 1.7% of the people to get a 5-10% raise. B) people don’t buy or re-buy (for those that already own) their house every year, so it only matters whether you can afford it at the time of purchase. B) Once someone owns, their home is also appreciating 5-10% so they’re mostly hedged if they want to move.

Kyle

at 3:20 pm

The last one should be C – Duh

Joe Q.

at 11:31 am

David writes: “So let me ask again, to all of you who own real estate in Toronto: does this matter to you?”

To the extent that changing real estate values in Canadian cities provides a window on the state of the national economy, I think it matters, in an indirect way, to everyone (whether they own RE or not).

“Isn’t Toronto pretty well “diversified” when it comes to how people make a living?”

I think the data you are looking for can be found in this link:

http://www1.toronto.ca/wps/portal/contentonly?vgnextoid=b281e9f7d18ba310VgnVCM10000071d60f89RCRD&vgnextchannel=e71032d0b6d1e310VgnVCM10000071d60f89RCRD

under the heading “Location quotients by industry”. I think the GTA is probably more “diversified” than Calgary, but we still have an outsized reliance on the cultural / media industries and the FIRE sector.

Sam

at 1:14 pm

I should forward your article to the hardcore bears of the Vancouver blogs/message forums who always uses Windsor Ontario & Detroit as what affordable housing should be. They always post I’m leaving for greener pastures where housing costs are cheaper but for some reason they always seem to post messages on an ongoing basis. You would think Vancouver no longer applies to them since they claimed to have ‘moved’.

Steve

at 4:14 pm

Bears have been kept at bay by rising debt levels. Nobody expected people to take on such huge mortgages! I think most of us here, involved in RE one way or another, do not want the good times to end, so we tend to look the other way when unfavourable stats come in. But keep in mind that extremes happen on the margins.

Appraiser

at 7:44 pm

@ Steve:

The stats are the stats, if they are presented in an unfavourable light, that’s called slant.

Judging by mortgage default rates (all-time lows), debt service ratios (declining), credit card defaults (all-time lows) and any other objective measure of affordability, Canadians on the whole, are being logical and prudent in their borrowing decisions.

I realize that logic and prudence make for terrible headlines, but then again some people divine their uninformed opinions at the margins.

Capital One

at 10:10 am

David.

Well, they matter to some degree. x% of the moving population will have a choice on where they want to live. Immigrants, entrepreneurs, teachers, nurses, new grads … Take a job in Edmonton or St. John’s? One of the factors for these people would be the relative cost of living. There are many other factors, but this would be one.

You’re a brand-spanking-new nurse and you’ve applied to four hospitals in Ontario. Kingston, Ottawa and London are very nice cities – so why pick Toronto? One of the factors against Toronto would be the cost of living.

So y% of the x% (i.e. who have a choice) will forgo Toronto because of the house prices. I don’t know what “y” is, but it would tend to grow as the delta in house prices grows.

CO

Appraiser

at 3:56 pm

@ Capital One:

Did you consider the fact that Toronto has over 30 hospitals, offering abundant career options and prospects for advancement? Just one of the reasons a new nurse might choose T.O. over other Canadian cities.

Pick any profession or trade and the same metrics apply. It’s called opportunity.

Many expensive cities are densely populated and still growing, i.e. London, New York, Paris. The delta in house prices in those thriving cities is a fact of life, just as it is in Toronto.

Capital One

at 5:58 pm

@ Appraiser

I said it was A factor, not THE factor. Unionized nurses get paid the same across the province, I think. Some may choose Toronto for the reasons you gave. Some may choose anywhere-but-Toronto for the extra cash in pocket.

CO

Appraiser

at 3:49 pm

@ CO

I’m not sure where you’re going with this train of thought, because it’s certainly nothing new. Toronto has been the second most expensive city for housing in Canada since 1989, when it was surpassed by Vancouver. And THE most expensive city prior. Yet it keeps on growing.

The bottom line is that over 8,000 new people per month think T.O. is it, regardless of the cost of living. Just as in previous decades, that’s not likely to change.

Capital One

at 6:11 pm

@ Appraiser

I re-read the post – and I didn’t answer the question. The question was directed to people who already owned real estate in Toronto. So you and David are right – the house prices in the rest of the country don’t matter that much.

My point was that the delta does matter to some people who are considering moving in. But, that wasn’t the question …

CO

AndrewB

at 11:32 am

Nurse here.

Many people are looking for jobs out of school however a lot of them are out of the city. Many want to work in Toronto however the hospitals are competitive, so many new grads look for jobs in other cities for experience, with the goal of going back to Toronto. Yes, most hospitals are unionized so pay rates are the same across the province. However most smaller cities are employed with senior nurses and a new grad would never get a permanent job. That’s if the hospitals doesn’t lay off nurses or replace them with RPNs to save money. All in all, Toronto has the opportunity.

Natrx

at 4:54 pm

It’s more of a canary in the coal mine thing.

Yes, canada housing is very regional. So a bit overblown by the media.

But here are some reasons it matters:

-Once a directional trend occurs, it’s difficult to stop. “Why should I buy now when it’ll be cheaper next month”.

-If or when defaults start occurring, the banks will start laying off everywhere. Including Toronto. Large telecom companies too.

Mortgage approval will get more difficult.

-If CMCH has to step in even the most remote way in Calgary, that will have a huge impact across the country. Including Toronto.

Rules might change overnight, Canada’s credit rating might take a hit, increasing their borrowing costs.

Just like how many in 2006 thought the US sub prime was very limited as a whole, Canada’s now sub prime market of Calgary can infect the whole system.

Both cases will result in increased mortgage cost across the board as the Gov’t and the Banks must compensate for the added risk.

Natrx

at 5:01 pm

I forgot to add the impact of inflation and loss of purchasing power. Canada imports more than they export. ~500+ Bil of imports to ~450 bil of exports. Something like 130 bil of that is crude exports.

So inflation in almost everything we consume will make us feel poorer in the long run. Food prices, clothes, cars, books, school supplies, etc. that’s a more long term effect. But very real as it could impact a whole generation in how we view taking on debt.

So please think bigger David. Not just in the immediate 2-3 yr outlook and prism of such localized real estate.

Appraiser

at 7:44 pm

“Canadian housing bubble looks ripe for popping.Trend of rising prices and rising debt cannot be sustained.”

By: Adam Peterson Published on Sun Jul 14 2013.

http://www.thestar.com/opinion/commentary/2013/07/14/canadian_housing_bubble_looks_ripe_for_popping.html

blair rota

at 4:05 am

residential home available in Kamloops

http://blairrota.com/properties-list/