Which of these three below doesn’t belong with the other two:

- Real estate prices are skyrocketing

- It’s becoming harder and harder to get into the market

- Home ownership rates have increased

Huh?

How in the world could the third point be accurate if the first two are as well?

In this market, I’m not surprised by a statistic all that often. When it comes to monthly TRREB data, there’s always a stat or two that might not entirely line up with what I had experienced in the previous month, but for a major statistically-backed trend to come as a surprise is quite rare.

Case in point: home ownership rates in Canada are increasing.

Yes, you read that correctly, and no, it’s not impossible for the three points above to co-exist.

I’ll admit, I certainly wasn’t aware of this, and had I been asked to guess or weigh in on the subject, I’d have assumed that home ownership rates are decreasing.

Think about it this way:

On the one hand, lower interest rates should significantly help buyers get into the market.

On the other hand, prices are rising faster than the savings from low-rate mortgages can offset.

Then again, it’s possible that Canada-wide, home-ownership rates are increasing in the face of decreasing rates in certain cities.

Before I present you with the statistics, let me say this: stats like this are always delayed by 1-2 years. If you want statistics for 2021, your standards are too high. And if you want statistics for 2020, you’re still out of luck.

Trading Economics is a site I frequent for stats and that’s where these were pulled from.

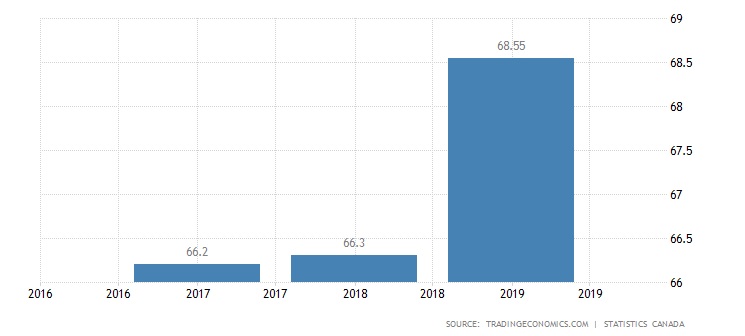

Here’s how the home ownership rate in Canada looks for the last five years for which we have data:

From 2018 to 2019, we saw the home ownership rate increase from 66.3% to 68.55%, which is hardly insignificant.

With an increasing population, we might expect that the number of new dwellings constructed is not in line with the number of new entrants to the market. I certainly would!

Not only that, part of the immigrant population is made of refugees, who aren’t going to be able to afford to buy property, and I would speculate that an individual or a family immigrating to Canada, in general, is less likely to be able to afford a purchase than a Canadian resident already on the ground here. No data to back that up, but I can’t imagine it being the other way around.

So if we’re seeing increasing home ownership rates, how do we make sense of that? What is the root cause?

Perhaps it’s low interest rates.

Perhaps it’s simply a desire among millennials to want to be home-owners. There’s been no shortage of media coverage on this topic over the last year, case in point: “How The Pandemic Pushed Canadian Millennials To Home Ownership”

Whatever the case, with the price of real estate rising each and every year in most Canadian cities, it’s odd to see an increasing rate of home ownership.

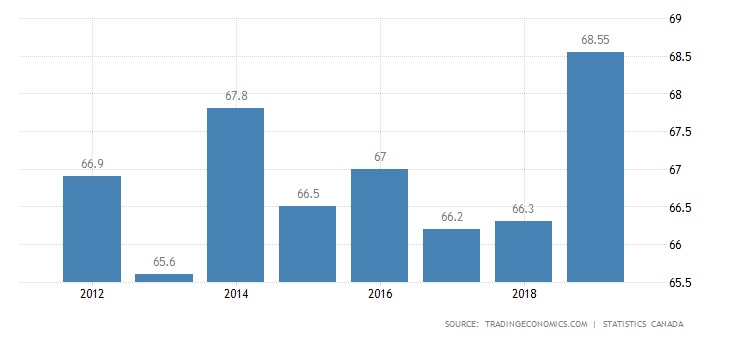

Here’s a 10-year trend:

Here we see that the 68.55% home ownership rate recorded in 2018 is actually a decade-high.

Again, you might not be all that moved by 1% here or 1% there, but we have 38-39 Million people in the country, and how many of them are over 18-years-old? Half? So what’s one percent of that? We’re talking about a lot of people owning or not owning homes when these figures fluctuate by one percent.

We’re two decades into a bull-market now, and so the following 25-year chart may come as a surprise:

We’re sitting at a record-high level of home ownership in Canada, despite the fact that prices have been accelerating almost the entire time.

Perhaps this is a self-fulfilling prophecy: prices are increasing because the proportion of home owners is increasing as well?

Many of the TRB readers have lived in different countries, and/or have parents that have lived abroad as well. From time to time, we discuss how home ownership here in Canada stacks up against the rest of the world, with some readers commenting that it’s too hard, too expensive, and too unfair to would-be owners, with others commenting on how home ownership rates look elsewhere.

So why not paint a pretty picture to address those comments, shall we?

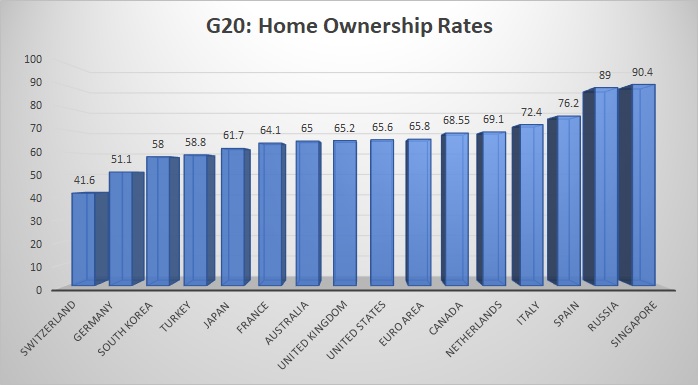

Here’s the rates of home ownership in the G20 countries, for which data is available:

First, and foremost: Singapore.

Singapore is an anomaly in 2021, and they are either way ahead of the rest of us, or they’ve just done something that no other country is going to do.

This is one of the wealthiest countries, not just in Asia, but in the world. They have almost eliminated poverty entirely, and with a ridiculous 90.4% home ownership rate, there’s obviously a “catch,” right?

From BillionBricks.Org:

In Singapore, all public housing estates are planned by the government under the Housing Development Board (HDB). The flats are controlled by a complex system of checks and balances to ensure they remain affordable to all Singaporeans. Although resale flats regularly hit SGD $1 million, and the average 4 room apartment cost an average of SGD $500 000. However, a new flat can be bought for as little as SGD $100 000 paid over 10-20 years with generous government subsidies and loans. This has made home installments occasionally even cheaper than renting.

Housing estates also follow a standard ‘formula’. Approximately 20 to 40 HDB blocks form an estate. Each estate is designed to be self-contained with amenities within walking distance from each other. Almost all public housing estates follow this system and configuration. HDB blocks are also being built with standardized construction systems. Flats all follow relatively standardized sizes and configurations. A system of construction using standardized prefabricated concrete pieces has greatly decreased construction time and cost. This enables flats to be built quickly, efficiently and of high quality.

That certainly explains a ridiculous 90% home ownership rate!

It also explains why Canada’s 68.55%, while trailing the “leader” by over twenty percent, is actually about as high as we can reasonably expect to get.

As for Russia, I don’t even know what to say. That’s a complex government and political system that I don’t understand at all. So I’ll just leave it at that.

So Canada is sandwiched between “Euro Area” and the Netherlands, which is another very, very complicated real estate market!

A client of mine who lives in the Netherlands told me the following about how their real estate market works:

- Real Estate agents don’t work past 6 pm, and rarely show houses on weekends (but that’s common for most Dutch professions – weekend no work).

- You can get a mortgage for 100% of the value. Previously you could get 104% to cover closing costs, but this was phased out last year.

- Rates for a 5 year and 10 year fixed are <2% and virtually the same. Standard amortization is 30 years.

- You don’t get mortgage pre-approvals – just an estimated ceiling.

- As a buyer, you have to pay your own realtor – not compensated as a commission through the seller. Pros and cons.

- Land transfer tax is 2% of the property value

- Typical 2 bed, 900 sqft unit is 375,000 euro in a central/nice area of Den Haag

- Once you agree to a price with the seller – it can take up to 8 weeks to get all the mortgage approvals in place.

- Houses doing get staged. Never. It’s fucking mind blowing.

- MLS equivalent is called Funda – if you thought MLS was bad… at least it is semi-current/updated. Funda is a disaster.

It’s always fun to hear from clients who live in other markets!

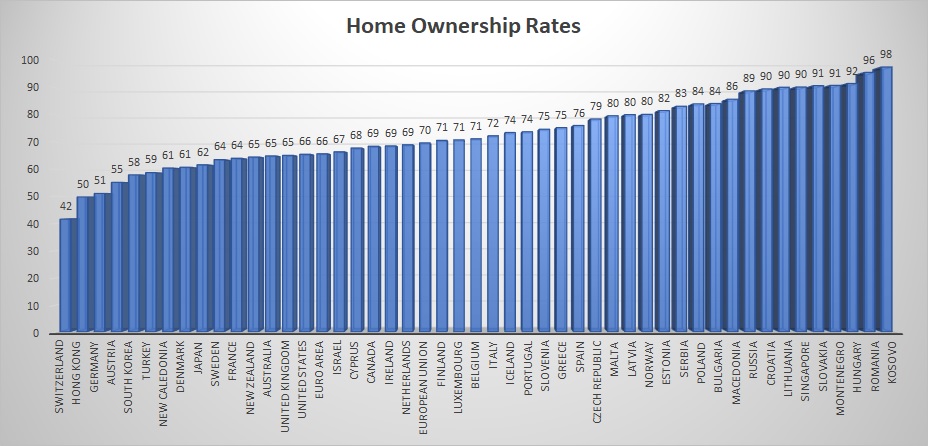

In any event, let’s look at how Canada’s 68.55% rate of home ownership stacks up against all the countries for which we have data:

I’m not going to research Slovakia, Montenegro, Hungary, Romania, and Kosovo just yet, but I am interested in how a 98% home ownership rate is possible. Is anybody out there from Kosovo? Care to share?

Worldwide, on this graph, Canada doesn’t look so hot, but you can always make a statistic look better or worse by comparing it to other data sets. In the G20, Canada looks like a rockstar.

So does sound about right to you?

A home ownership rate in Canada of 68.55%?

Every day, I read articles like this:

“Home Ownership To Become Distant Dream For For More Canadians”

That’s a headline from the Financial Post, two weeks ago.

So if home ownership is going to become a distant dream for more Canadians, then how can our home ownership rate of 68.55% be an all-time high?

Keep in mind, we haven’t even seen the 2020 data yet. With record sales last year, and the trend of millennials flocking to the market, I can only expect that rate of home ownership to increase even further. How high? 70%? More?

According to the article above, RBC economics increased their price appreciation forecast in Canada for 2021 to a whopping 12.9%. So the analysts believe the market is going to continue to run, they also believe sales will continue to climb, but all we ever read about in the media is how difficult it is to own a home, despite the all-time high level of home ownership.

Confused?

Yeah. Me too.

Happy Monday, folks!

Verbal Kint

at 8:41 am

Boy, this one’s just a vomit of bad takes, chart crimes and cluelessness. Half of Canadians are under 18? Just because you’re having trouble finding a daycare spot…

Appraiser

at 10:01 am

Clue the rest of us in Verbie.

Chris

at 10:21 am

The age breakdown is a pretty simple one.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000501

8.1M Canadians are 19 or younger, of a total population of 38M. Equates to 21%.

Appraiser

at 9:40 am

Oy!

Damian

at 12:09 pm

All it takes is one off-the-cuff remark in an entire blog post to get your knickers in a knot huh?

EastYorker

at 9:28 am

Item #9

Houses doing get staged. Never.

Is this a typo ?

cyber

at 11:45 am

Ahem!

Home ownership rate is actually defined as attached to the house, not the person – it measures % of households that are owner-occupied, as opposed to renter-occupied.

Therefore, higher % ownership does NOT mean that greater share of population is owning their own home – it means that there are more and more multi-generational households, less young people choosing to form their own rental household, and/or moving back in with the parents.

How do I know this? I’m originally from one of the countries on the right tail of your home ownership graph (>80% home ownership rate), and this is exactly what happens. Young people have higher unemployment, or if employed don’t earn enough to go rent on their own (and definitively can’t afford to own). So many grandparents living in same household as their grandchildren… definitively not an indicator of a healthy or affordable housing market.

Pragma

at 3:19 pm

thank you very much for the additional colour. That’s the problem with many global economic indicators, you are never comparing apples to apples. Also as you pointed out, if grown adult kids are unable to afford a home and are living in their parents that does not affect the home ownership rate. So what is the true home ownership rate in Canada? The maximum it can be is 68%.

Roger

at 2:12 pm

The average Canadian has no idea what a good/bad rate of home ownership is. You could tell the population that the rate is 88% and many people would still complain. Until everybody who wants a house is essentially gifted one by the government that complaining won’t stop. Then when everybody has a house they’ll start complaining that houses just aren’t big enough. Neat post today but it’ll fall on deaf ears.

serg

at 4:46 pm

Russia is a very simple thing. Before 1991 almost all housing (except a few condos and rural houses) belonged to the state. After 1991 the new state allowed everyone to privatize where they lived (if you lived in a hut, that was a hut, if in a mansion, that was a mansion). That explains this number. Same in Cuba; as well, could explain all of the former Soviet block.

cyber

at 8:10 am

This is true, but but does not explain high ownership rate, or effectively the low rental rate.

If you look at the graph, especially the right tail, it’s roughly aligned with GDP per capita becoming lower as you go further to the right (Kosovo = $4000 USD per year). Without strong economies that generate higher-paying service sector jobs in cities, which in turn generate the need and incentive for new rental housing, % rental will be low because everyone is just “stuck” wherever they were born into.

DT

at 11:05 am

That section on Singapore makes so much sense to me. This is really what our government should be investing in. Standardized high quality affordable housing, designed to last a long time, done on a large scale, within walking distance of amenities. Add to that high quality passive insulation, to help reduce our reliance on fuel for heating & cooling. Do it on a large scale and it brings the price down.

Jasmine

at 1:01 pm

I’m from Singapore and after seeing what you have commented on our home-ownership rate, decided to give you a little background on how it works in Singapore.

1) Singapore has 1 of the lowest tax rates in the world, you can ask google for the details

2) BUT… we contribute 20% of our salary + employers contribute 17% to our CPF account. (works a little like CPP)

3) This 37% is locked in the CPF account until you are 55, government gives us a 4% interest rate (imagine how much they make off it).

4) When you are 55, you must keep a minimum sum set by the govt ($181,000 in 2020 and increases by 5,000 annually) and you can choose to withdraw the rest 1 time or in monthly payouts.

So what can you do with the forced savings of 37% monthly?

1) A portion of it goes to a government run medical insurance that will cover some medical expenses at public hospitals

2) You can invest it via the government

3) You can buy a HDB (government built houses you mentioned!)

Every apartment is 99 years “lease-hold”, meaning the government takes back the land/apartment after 99 years. If you buy a resale, it’s value drops significantly once it reaches about 40 years old. It is possible to pay for the apartment 100% with money from your CPF account. This to me is the reason why home ownership rates are so high. People have this money sitting there that cannot be touched anyway, so why not buy a home? No issues about needing parents who are rich or saving up “all your life” for a downpayment.

Fun Fact: Only married couples can buy HDB. Singles can buy after they turn 35 but are restricted to the brand new 1 bedroom apartments which are not common or resale which is more expensive.

Leo

at 8:41 pm

You know those numbers are bullshit right?

Home ownership rate is only collected with the census, there is no annual estimate from StatsCan (feel free to show me the table # if I’m wrong on that)

Don’t believe every chart you see online.

Maudlyn

at 6:20 pm

The media place too much emphasis on peoples home the price of house is too high it makes me sick to my stomach i worked two jobs to own a home on my own i sacrifice a lot to own a home so for all the people who are jealous of the sacrifice we made to own a home get off your butt work hard set a goal save your money stop buying expensive shoes and cloth stay on a buget you can do it make sure your credit score is good. Please stop talk about house price is too high is it a bad thing for us homeowner I dont think so knowing what we put out to own our home stop whining homeowners most of us are immigrant that came here with nothing hard work and sacrifice paid off.