…and don’t take your eyes away from the computer screen.

Don’t leave the house, don’t plan any social events, and don’t leave your cell phone for a single second! If you’re going to take a shower, Apple-be-damned, take the goddam thing in there with you!

If you’re a buyer of a freehold, single-family home in the 2015 Fall market, you’re on high alert as soon as a listing comes out, since that damn “bully offer” is sure to make an appearance eventually…

I’ve said it before, and I’ll say it again: I wish I was a buyer on Property Virgins.

It’s not just the fact that being “naive” is “cute” on the show, and being “stupid” is even cuter! Like the person who says she doesn’t like the colour blue, but for some reason, doesn’t know that this thing called “paint” was invented centuries ago.

No, it’s more the fact that the buyers on the show are able to view three properties, then go have a beer and talk about which one they liked the most, then make an offer under asking, and negotiate a successful purchase!

Oh, the magic of television!

Let’s not get into that whole “the show is filmed in reverse after they’ve bought a house, and the entire segment is faked and scripted” thing, not even for a moment! Let’s just sit, wait, and wish that the Toronto market worked like that.

Imagine?

Imagine going out on Saturday to look at three houses, and then having TIME to think about your decision!

I know, it’s crazy, and I’m insane for even suggesting it…

I’ve said this before too though: the “offer date” is hated for good reason, but the “bully offer” is even worse.

You’re damned if you do, and damned if you don’t.

Set an offer date, and you’re greedy. You’re gouging buyers. You’re trying to create a bidding war.

Don’t set an offer date, and you’re being lazy. You’re not working hard enough. You’re not being FAIR! You’re not allowing all the interested buyers to see the house!

Now throw the “bully offer” into the mix, and it’s chaos.

The simple fact is this: if you want to buy a house in Toronto this fall, you will be a slave to real estate until you do so.

It sucks, I know.

I didn’t make the rules, but I can sure explain to you how they work.

The only good thing about the “offer date,” which most people argue will cause a bidding war, is that you have certainty regarding the time and place on which the property will be sold.

What good is a Christie’s auction for Pollock’s, Monet’s, and Picasso’s if you have no idea where the auction is being held, and what day it’s on?

Enter the “bully offer,” and now we have absolutely no clue when a house is going to sell.

The MLS listings says, “Offers Graciously Reviewed On September 25th at 7:00pm,” but those words are about as meaningless as a politician saying they won’t raise taxes.

In 2015, we’ve seen bully offers become what I call “the new normal.”

You almost have to assume a house is going to sell via bully offer, if it looks great on paper, and you know buyers will be interested.

And as a result, you basically have to go see a new listing the very night that it comes out, otherwise, it could sell, and you could be left behind.

So yes, you have to become a slave to real estate if you want that 3-bed, 3-bath renovated semi-detached house on Heward that you’ve been waiting all summer for………along with eighty other buyers just like you.

Wait until tomorrow? Well, it could have sold the first night it was listed.

Wait until the weekend open house? You’re just asking to get left behind, aren’t you?

Not every house gets a bully offer, and not every bully offer is accepted.

But is one enough for you to become a slave to real estate?

How about that one that your significant other fell in love with, and still talks about? The one that he or she feels will never be beat this fall market?

Or how about half? How about half of quality, single-family freehold homes getting a bully offer? Is that enough for you to become a slave?

I’m not trying to bully you here. I’m just providing some tough love.

Because at the end of the day, we Realtors have created a system that we can’t even figure out ourselves, and it means we have to be on guard 24/7 if we’re going to serve the needs of our buyers.

If you read the “instructions” on MLS listings, you’ll see just how silly the whole game is.

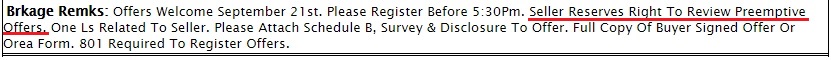

Here’s a typical MLS listing, with an offer date, and a note that most agents believe needs to be included in order to entertain bully offers:

Pretty straightforward, right?

All an agent has to do is put in “Seller Reserves the Right To Review Preemptive Offers” and they can sell the property out from under everybody else, right?

Right?

The truth is: we don’t know.

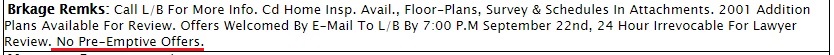

How about this:

![]()

That doesn’t say anything about “Seller Reserves The Right To Review Preemptive Offers,” so can the seller accept a bully offer?

The seller will argue, “It’s my house, I can do whatever I want.”

And rules stipulate that any offer “has to be presented,” so it’s not like you can tell the seller he can’t see the offer because the listing doesn’t include that line.

Now what about this:

Does “No Pre-Emptive Offers” break every fax machine, photocopier, and scanner in the city?

Just because the listing tells you “No Pre-Emptive Offers” doesn’t prohibit you from drafting and submitting one.

And what if that listing, with that caption, sold via bully offer?

What happens then?

Again, we don’t really know.

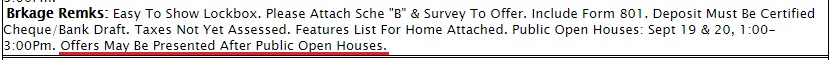

How about this:

![]()

Great. Do you trust that “instruction” for offers?

Or how about this one:

Okay, so what time?

3:00pm?

Or “after” like the next day?

And does that instruction prevent the agent and seller from entertaining bully offers?

How about this one:

![]()

That’s comical!

They’re holding back offers, but they want bully offers.

That makes no sense.

–

So what is the conclusion here? I know you don’t want me to say “It’s chaos, so quit your job and stare at your screen all day.” I know you want an answer.

So here it is: RECO was dealing with hundreds, if not thousands, of complaints about bully offers, from the public.

RECO felt that it was “misleading” to the public, to say you’re going to review offers on a certain date, and review them on another. Yes, in other news, the sky is blue…

It was determined that the line “Seller Reserves The Right To Entertain Bully Offers” should be included in MLS listings, to absolve the listing agent and the seller of any blame for selling the property before the scheduled offer date.

But what wasn’t really determined was whether or not there would be reprimand for Realtors who don’t include that line, and do sell the property before the scheduled offer date.

There have been cases of agents being fined, but very few, and it’s a very selective process.

I like to imagine a gigantic stack of file folders, piled to the ceiling of a conference room or office, and then somebody randomly selecting one from the middle, pulling it out, reading the complaint inside, and then deciding to “charge” a Realtor with breaking a rule.

That is most likely how complaints about bully offers are dealt with at RECO.

They simply don’t have the resources to police the entire industry, and if a listing doesn’t say “Seller Reserves The Right To Consider Preemptive Offers” in the brokerage remarks, and the property sells before the scheduled offer night, there’s no “automatic” reprimand and/or fine.

Everything works on a case-by-case basis, and I don’t see that changing.

Besides, including the text “Seller Reserves The Right To Consider Preemptive Offers” doesn’t really accomplish anything anyways. It’s just an attempt to justify the way the system works.

It’s not like buyers will say, “Oooooooh, okay! I didn’t know a seller could accept an offer before the listing date!”

Nothing new. Just legal wrangling.

The truth is, when a 2-bed, 2-bath semi on Withrow hits the market on a Tuesday, and it’s sold by the time your client (who is only casually looking, and not quite ready to pull the trigger anyways), heads to the open house on Saturday and emails you to say, “There’s a SOLD sign up and the lights are all off in the house,” you pretty much have to expect that to be the case these days.

Yes, that happened to me and my buyer.

But if we were seriously interested in the house, we would have been in there the first night the property was listed.

Sorry, folks. The fall market is insanely busy, and it moves quickly.

The best advice I can give you is to “stay sharp,” like a wily Vietnam-war platoon leader tells his troops as they prepare to get some shuteye.

But wait. How can you sleep and stay sharp?

Welcome to the Fall market in 2015…

Kyle

at 9:20 am

From a “fairness” perspective, i generally don’t see much of a problem with bully offers. It really is the same as taking offers any time and it really isn’t any different than the way other products are sold (i.e. first come first served, and when it’s gone, it’s gone). The problem i see (though i could be wrong), is that the technology to push new listings to potential buyers in real time does not exist. My understanding is that these stratus reports go out as a batch once a day. Basically the market practices have evolved much quicker than the MLS system which creates unfair opportunities.

When i see listings sell with 0 days on market, i suspect that A) the bully buyer may have had information before the general public. B) the seller probably didn’t get full exposure. Sure you can argue that the information was actually available in MLS for all buyer Agents to retrieve (assuming an Agent did nothing but continuously check for new listings for all of his clients throughout the day), but i think the reality is Agents working out of the same office will likely tip each other of upcoming listings giving that Brokerage an unfair advantage and there is obviously a financial incentive for a Brokerage to encourage this behaviour. Again, i don’t work in real estate and this is based on my understanding of how things work, so i would appreciate if anyone more knowledgable could correct me if i’m wrong.

Appraiser

at 10:48 am

@ Kyle. Point well taken. A listing without an arbitrary “offer date” doesn’t require a bully offer disclaimer. First come-first served. Hey, just like the good old days.

FYI, MLS listings and updates are uploaded in real time either by the listing agent directly, or office support staff, not in one daily batch.

And yes, insider information within a brokerage is a factor, albeit a relatively minor one. In-house double-enders are nice, but no brokerage could survive by shielding upcoming listings from the broader market.

Kyle

at 4:28 pm

I agree these are not big issues. My contention as a consumer is that when i get my daily email blast of “new” listings, it in fact is stale information. It would be a tough pill for me to swallow, if a house listed in the morning and sold the same afternoon. Next morning when i receive my email blast i would be oblivious that it was ever even on the market, let alone sold. What would really kill me is if i found out later that it sold via an Agent from the same office, and that i would have been willing to make a better bully offer.

That to me is a major technological gap with the system. In a market where houses routinely sell in under 2 days, getting new listing information the next morning just isn’t good enough, IMO. Real time email blasts are probably not feasible, but having the email blasts scheduled multiple times a day could easily fix this problem.

Jimbo

at 7:46 pm

It is most likely possible but do you really want to receive onesys and twoseys all day long?

Kyle

at 8:12 pm

If I were a buyer in today’s market and the house matched my criteria, absolutely!

Jimbo

at 10:35 pm

Fair enough, if I was looking for a place as a customer I would love that access. As a realtor I think I would prefer a database of new properties all at once that I could parse with parameters.

Kyle

at 4:00 pm

Pretty sure that is exactly what they already have. The database that Realtors have access to contains all the active and solds in real time as they are being updated, and they can query it based on any of the fields you see in a listing, including when something was listed. However they have to pull this information vs the emails buyers get the next morning which is automatically pushed information.

Jimbo

at 11:55 am

Yeah I misread the above statements. Your comment of well yeah I would want that as a customer makes mores sense now than it did when I first read it. I missed the word customer somehow.

Queueing a database to extract relevant properties for individual customers and automatically e-mailing them is an easy task to implement. The agent may not always agree with the properties being sent for one reason or another (maybe there is something in the description that says parking spot not included but in a field it says it is etc.)

You could set the sample queue every 10 minutes if you want without getting the same property twice.

Buckley B Buckington

at 2:32 pm

When the deck is stacked against you, the best course of action is not to play. When I hear about these kinds of frenzies and read quotes like “You’re just asking to get left behind, aren’t you?” then it’s a clear sign to me that we’ve departed from rationality. Read about any financial mania dating back to the South Sea Bubble and you will hear similar stories. Sure there may be a bit more money to be made, but Toronto real estate is looking more and more like a mug’s game at this point.

Appraiser

at 7:54 pm

I am always amused by those that endeavor to drop trite idioms, as if they were profound pearls of wisdom. As though their use proclaims of a wise and unassailable conclusion. Sadly, it’s usually the opposite.

Definition of mug: A person who is easily deceived.

Definition of mug’s game: A profitless or futile activity.

The only mugs I know are the ones that have been praying for a crash the last 20 years.

Yeah, yeah I know – it’s a game of musical chairs, and the music is about to stop. Yaaaawn!

David Fleming

at 10:27 pm

@ Appraiser

I don’t know if the eternal bears have a dollar value to put to their mistakes.

Great idea for a blog post – imagine the person who said, back in 2001, that the market was going to crash, and sold his/her house to rent.

Crunch the numbers:

1) How much has that property appreciated since then?

2) What is the tax-free capital gain lost, and based on the average take-home pay for a Canadian, how many years would that person have to work for free to make it back?

3) How much was spent on rent?

4) What else can we fit in here……

I hate writing blogs that make me look like a total real estate cheerleader, but this idea is too good to pass up. I think I’l work on this over the weekend…

Jimbo

at 10:55 pm

I would recommend 2009 over 2001. The market was relatively calm until 2005 (correct me if I’m wrong). I would also say that the panic about housing started in 2009.

I believe it is all relative, how much money have you gained since buying your house? Have you gained any if you need to sign an agreement with a bank to take money out of it and pay extra interest on that money? I think housing has given Canadians a lot of easy access to valuable credit that they can use to purchase what they want or need (maybe to reinvest in your house to make it worth more), I also think that it does boost your networth. Can we really put a value on that networth, if you don’t plan to sell for the next 10 or 20 years?

I think it is important to realise you are always paying rent in Canada. For 5-40 years you pay rent to the bank to own the house and for the whole life of the house you pay rent to the municipality. Is it a deminished value compared to what you would pay as a senior? I think so but as you get older you need family to help repair or you pay out of pocket to keep your asset valuable and livable.

Libertarian

at 10:22 am

I agree with Jimbo’s train of thought. There’s more to the debate than the proverbial “rent vs. buy”. To me, the question is: How much of one’s income is being allocated to shelter? As buying gets more expensive, then a larger portion of your cash flow goes to shelter. Is that a wise thing? I guess it depends on your personal preferences. But to me, there is more to life than owning a home. I might argue that David feels the same way because as he always says, he lives in a condo even though he knows that a freehold home is a better “investment.”

Appraiser

at 10:33 am

@Jimbo: Nice try, but paying a mortgage is not rent. A completely fallacious argument. Are you building equity with each rental payment?

The average time to pay off a mortgage in Canada is 17 years. Given that most people have to pay for a roof over their head for 50 plus years – that’s a bargain. Sure, you still have to pay realty taxes and maintenance, but then again that’s not rent. Incidentally, renters also pay realty taxes and repairs – for their landlord that is.

Kyle

at 10:37 am

I can tell you the Toronto market was definitely not calm until 2005. When i bought my first place in 2003, i recall people saying the market was over-priced and telling me to wait for the inevitable pull back. Bidding wars were a new thing, so people definitely thought it was the zenith of craziness and were certain the peak of the market had arrived. I had lost 4 bidding wars before finally winning. Same nonsense was said back then about the winner of the bidding war actually being the loser. Back then houses in BWV were listing for high-300’s, and selling for just over 400. These same houses are now worth 2.5 – 3x as much now. Think about that for a bit, if someone put down 25% on a $425K house in BWV back in 2003. Same house is going for bout 1.1M today. That person’s mortgage would only be about 213K. They now have close to a million dollars in equity. Sure they also had the cost of mortgage interest, property tax, and maintenance, but that doesn’t equate to “renting”. Had someone rented the same property over that time, the mortgage interest, tax, maintenance and a fat wad of equity to the landlord would be more than covered by the rent they paid. Otherwise there would be no such thing as landlords.

Jimbo

at 1:48 pm

@Kyle

Do you know what they were selling for in 2000-2003? What kind of price appreciation are we talking about? The price appreciation between 2003 and now is quite substantial(even 2009 – now is quite substantial from what I’ve seen).

I think bidding wars would signal the start of a hectic time by my definition.

I think my question is what is equity? Is it something we can just draw on as we please with no consequences like the cash in our bank account? Or is it something else that we count on to be there when we sell?

In your example you have committed around $620,000 to purchase a house that sold for $425,000. The house is now worth $1,100,000 give or take. That is a substantial windfall, but this windfall is not normal for the Toronto market. I don’t think we can say that this is the new normal either just because it happened over a decade. I am starting to think maybe Toronto was undervalued for a very long time and people are starting to wake up. How long can this growth continue before it becomes fairly valued? Once fairly valued will the appreciation more or less be in line with inflation and not large 5%+ gains? If it does indeed continue above inflation after fair market value I would confidently argue that it would hurt Toronto economically.

The bears say a crash will happen any year now and I really don’t think that is the case. The bulls say buy now or forever be priced out because price appreciation will always be a “moderate” 5%, which I also doubt to be true. I honestly believe we will plateau for awhile before we have more normalizing growth rates. I just can’t determine where that will be for Vancouver or Toronto. The rest of Canada seems to be following my claim as of right now.

One more point/question about your example, is this person not stuck in their current house regardless of the equity? If they wanted to trade up what kind of mortgage would they be taking on and how would they be further ahead or behind than when they started on their first mortgage? I think we can cover the fact that if they didn’t buy they would be paying way way more, but what if you bought with the intention of trading up after 5 years. Would you have been better just to buy that trade up in 2003 rather than 2013 or 2015?

I wouldn’t buy a house to be further ahead in 5 – 10 years. I would buy a house so that in 20-25 years I would only have to pay land tax to live until I couldn’t physically work on the house any more. At that point I would use the equity to purchase something more manageable or add it to my retirement portfolio and live off of it while I rent.

All of this equity talk and how we can use it to purchase things/ go on vacation is just stupid mismanagement of your money IMO.

Kyle

at 2:53 pm

“Do you know what they were selling for in 2000-2003? What kind of price appreciation are we talking about? ”

I didn’t follow the market as closely in 2000, but by 2003 the market in the City’s core certainly wasn’t very different than it is today.

“I think my question is what is equity?”

I use the Accounting definition, Assets – Liabilities = Equity. If you buy a house a portion of the relatively stable cash flows spent on housing goes to equity and some goes to expenses. And as the house appreciates your Assets increases and that gain goes to equity as well usually on leveraged basis until your mortgage is paid off. Sure if your asset decreases, you lose equity (i’ll explain why this is an overblown concern below). If you rent ALL of the cash flow (and this amount basically rises every year) goes to an expense and none goes to equity. I think what people choose to do with this equity (save for retirement or blow it on toys) is moot. The point is equity grows when you own and it doesn’t when you rent.

“How long can this growth continue before it becomes fairly valued? Once fairly valued will the appreciation more or less be in line with inflation and not large 5%+ gains? If it does indeed continue above inflation after fair market value I would confidently argue that it would hurt Toronto economically.”

First, people need to stop trying to apply their own constructs based on flawed metrics, faulty expectations or biased belief systems to peg “fair value”. The very definition of “fair value” is the price something would trade at in an arms length transaction in a liquid market (i.e. the current prices ARE fair value). Something many people can’t grasp is probability. This is why i think fears of losing equity from falling prices are overblown. Here are the historic prices of Toronto real estate over the last 46 years (close to half a century). What you will see is that 5%+ gains ARE normal. In fact the average annual gain is 7.21%. The probability of making more than 5%+ return in a year is actually 62%, while the probability of making a -5% return or worse is only 7%,

“is this person not stuck in their current house regardless of the equity?”

This obviously depends on the person, but most household’s incomes have risen since 2003. And in this person’s case the cost to carry the 318,750 borrowed in 2003 has dropped due to interest rates. So it is likely this person can afford to upgrade if they chose to. Contrast that to the person that rented since 2003, i highly doubt they would be in a position to buy this house, let alone consider upgrading.

I agree, that blowing equity generated through home ownership is probably no better than renting, but you’re assuming everyone who owns just goes and blows their equity on vacations and trinkets. This is not supported by anything.

Kyle

at 2:56 pm

Forgot the link to the historic prices:

http://www.torontorealestateboard.com/MARKET_NEWS/market_watch/historic_stats/pdf/Historic_1508.pdf

Jimbo

at 5:32 pm

@Kyle

I agree with your def of equity. Although I will add your equity is affected by more than our simple examples, I would argue that it is a multi-variable equation with many inputs where little changes in each input impacts the overall output. We can’t really debate the complexity bc it is a waste of time and full of what ifs. I will still concur that equity does grow but it doesn’t do you any good until you sell and tap into it correctly. There are other ways to raise you net worth outside of home ownership but with today’s society I would never argue that it is as effective as home ownership in the general case but in special cases it is as good or better (unless we talk 2002-2015) clearly an asset bought on credit worth $400k is going to outperform a $75k investment when sold.

I took your file and finally complied it into excel (I have had it for a while now thanks for the link btw). What I have found with real estate gains is the following: The mean gain is 7.2% with a median of 6%, the midrange has a 14% value and the variance is 0.8%. This will tell the average person that there are some real outliers in this sample. Instead of talking probabilities talk using an alternative hypothesis test, with a confidence interval of 99%. My confidence interval resulted in gains in a range of 1% to 10% a year. If you drop it to 80% confidence you range in the 4-7% per year gain. Keep in mind that this is just a one variable mean/confidence test and I haven’t performed an alternative hypothesis test in over 12 years.

I know when I say things like match inflation it just sounds like another bs argument made up to support a point so I took the value of a house for each subsequent year 1969-2014 and applied the years inflation from 1969 – 1970, 1970-1971, 1971-1972, ……. , 2013-2014. The pattern I notice is that price appreciation follows inflation up until 2001 for the most part. After 2001 price appreciation has outperformed inflation unreservedly. average inflation between 1969 – 2015 is 4% 1969 – 2001 5.3% 2001 – 2015 1.8% (using the bank of canada’s inflation calculator). As you can see I am not completely out in left field when I ask how long can we outperform inflation before it becomes an issue?

As for the equity and upgrading question I Think I was a little too simplistic. In the persons case if they bought a house for $425,000 in 2003 but really wanted a $640,000 house in 5 years. They had to commit to $560,000 – $610,000 to purchase that house (given an avg interest rate between 3-4% over 20 years). Both houses appreciate at the same average rate until 2015 and therefore the gap between prices grows, can you still upgrade and is your equity worth as much as you think in that situation? This is what I mean when it is all relative. In 2003 I’m pretty sure the idea for the average person was they could buy a condo and in 5 – 10 years upgrade to a house. Well I’m pretty sure it is easier for them to upgrade to a house than a renter but they would’ve been better off biting the house bullet in 2003. This price appreciation has hurt them more than helped them IMO and the price appreciation between a detached house and a condo far outstrip the detached to detached example above. Now I’m not saying they can never upgrade but the further the spread the longer they have to wait until their equity starts making a dent in their dream houses appreciation. This is one of the variables in the equation, the velocity of house trades. I believe we are in a sweet spot right now but how long can this spread continue to grow apart?

I don’t mean to insinuate that the general population blows a portion of their equity, I know that for a decent majority this is not an issue, all I am saying is that equity is useless until you sell and realise your gain or upgrade without taking on too many extra years on your mortgage.

I don’t mean to come across as a windbag or a bear, I’m just a gen x’r that likes to make sense of what is happing in Canada. I’m very lucky to have a DB pension that will pay $52k a year in today’s money with inflation matching each year starting at age 45. I really don’t need to worry about investing and can focus on a house but I really worry about how Canadians in my age group can stay sustainable when we dedicate over 30% of our after tax income to sustain a house without the cost of general bills added in. Always appreciate your thought provoking rebuttal.

Kyle

at 9:27 am

Nice number crunching in the second paragraph, i think we ended up at the same place. When you can say at an 80% confidence level that TO Real estate will return 4-7%. It should be clear that real estate returns do not mirror inflation. What confuses me, is that after all that good work, you decided to dismiss it as flawed for not matching your conclusion and instead looked for some other form of mined data that does support your argument (i.e. overlaying two lines over top of each other and only focusing on the parts were they overlap to conclude something that has no basis in reality, while ignoring the parts where the lines don’t overlap). Jimbo, don’t resort to RE bear economics, you’re better than that.

This notion that RE returns inflation over the long run is obviously bunk. If it did then countries with higher inflation would have more expensive real estate than countries with lower inflation. Clearly this is not the case, think Buenos Aires vs Tokyo. Also if this was true then mathematically each city’s price (within a country) would be a linear function of that country’s

inflation rate times the age of the given city. Kingston Onatario which is 342 years old would then be 54% more expensive than Toronto which is only 222 years old. Again clearly not the case.

The third paragraph you seem to come back around, and we again are on the same page. If i can paraphrase one is better off buying more house sooner, than someone who buys less house who in turn is still better off than someone who never bought at all. This i 100% agree with. Especially when you add in the transaction costs of upgrading. You realize however that paraphrasing this it translates into buy now or be priced out forever.

I also agree that spending more than 30% of your income on housing is risky i’m not advocating that everybody should own, i’m simply saying that people who can afford to own, will be better off by doing that.

I too enjoy your rebuttals, in this case however the third paragraph does not seem logical.

Kyle

at 9:29 am

Sorry that should say “the fourth paragraph you seem to come back around”

Jimbo

at 2:34 pm

@Kyle I’m not trying to cherry pick but when I look over the data from 1969 – 2001 and over the 31 years the price appreciation has been 3% above inflation 11 times, within 2% of inflation 10 times and 3% less than inflation 10 times I can’t help but feel there is a correlation there. This correlation stops in 2001. We can not yet conclude this is an outlier or a non-outlier. What I can say is this needs to be included within the linear regression model with many other things. (I will try to go in more detail below after I look at two other points you bring up)

The two cities you use are from counties that are bunk. One has been going through deflation and the other went through hyper inflation. Maybe we could choose two other countries that model our controlled growth inflation a little more closely. Compare from 1950 or 1969 – 2001. I only choose 2001 because that is a point where things appear to have changed(transitioning economies from regional to global). This change in real estate could be permanent and we enter another era or it could be an anomaly. I don’t think we have enough evidence to determine the path yet.

I think your example of Kingston with Toronto is too far outside of the box. The way we settled in communities has changed, how we bought houses has changed. If we look at my grand parents era, they had to provide 40% down payment to buy a house. As our economy grew and our availability to pay off future debts increased we ease up on how we buy things. This easing up is a variable we use to control inflation. Inflation targeting wasn’t really a thing in the 60’s and 70’s but we knew about it and we have included shelter as a principal part of our inflation calculation.

What I will say is if you come up with a base price for each city in the modern era(suburban expansion 1950s maybe 40s and beyond) and apply inflation to the houses value you will come up with a number that is close to the houses value. That being said Kingston’s value will be a lot more linear than Toronto’s and it will start off lower because of other factors such as immigration, economic output etc. With Toronto I can cherry pick data from a year and make it say what I want. Example being, you bought a house in 1989 for $273k and it only met inflation in 2010 when it was worth $431k vs inflations $423k, or 1969 $29k worth $431k in 2010 vs inflation value of $180k. Even 2001 is off by $100k. That just tells the reader that Toronto is not exactly linear but it doesn’t mean it is far off the linear regression line.

I think we do a disservice by exploiting data points and not applying the whole data set.

You can paraphrase that paragraph any way you like, and perhaps typing rather than talking out loud is limiting how to get my point across. They way you paraphrase it is one of a few accurate ways to portray it. I think that our ability as a society to put down roots and purchase a house with the plan of upgrading our house to fit our families needs in the future was a major change in our society that occurred in the 1980’s. I think generally our grand parents bought a house to live in for life and raise a family. 4/5 kids in 2 bedrooms for them no big deal. What I am trying to point out is that this ability to upgrade is becoming a lot harder than it was in 1996, 1985, 2001, 2003 etc. In any one of those years you could upgrade fairly easily without extending your mortgage term (my opinion not proven fact). Right now our growth is outpacing entry level buyers from doing that and I would even argue that in your $425k example that any person is that scenario is losing the ability to upgrade without taking on more years of debt instead of just more debt. The ability to upgrade is a major factor in the velocity of sales. I believe this is a risk because our wage is influenced by inflation, inflation helps growth, growth brings profits and profits bring better wages. Simplistic model I know but it illustrates the base case for the most part. Without career progression and promotion most companies do their best to give you a raise of 2% in the moral hope it matches inflation.

For a linear regression model 1950-2015 or 1950-2001. I strongly believe that inflation needs to be grouped in with immigration, emigration, economic output, new supply, supply taken out, interest rates, number of new grads, unemployment rate, number of sales, number of houses for sale etc. etc. Once you have your basic statistics you can then start to do a linear regression analysis by breaking the model into two groups before 1980 and after 1980 or before 2000 and after 2000 to see what has a weak correlation and a strong correlation. Of the strong correlation what can be taken out because it adds no value(doesn’t change our r value much) to the result and over complicates the model. You can then test the model from your first group on the second group of real data to see how strong it really is and if it is strong enough you can keep it for a predictor for your confidence interval. A classic example of this was in baseball, when every team focused on batting average to determine which player would help them win/determine their salary. Oakland decided to create a model with on base average instead of batting average and ended up with a team that paid their players a lot less than the rest of the league but had a team with one of the best records in the league (they may have even won the MLB that year).

I respect that you choose to throw inflation out the window because it really hasn’t fit the Toronto market since 2001(maybe that is your on base average statistic that changes everything), but I really choose not to for a valid reason. Unfortunately we do not have access to the statistics to run a few examples through R to compare what is and isn’t really relevant.

Why I think it is relevant:

How can a company give you a 2% raise if they’re not selling their product for 2+% more than last year? Why is the cost of housing which is a part of the inflation calculation going higher but other products are not keeping pace at the same rate keeping inflation at a lower level than previous years. Maybe placing jobs off shore to save money which eliminates some jobs here, and they are finding efficiencies. I don’t think that is the whole story.

In the end our ability to get access to credit and money revolves around how much we make, and if inflation doesn’t drive our salary higher what will?

I really try to keep these short but I overdo it every time….

Kyle

at 3:31 pm

Jimbo i think you’re actually agreeing with me again. Look i’m not “throw(ing) inflation out the window because it really hasn’t fit the Toronto market since 2001″ I agree it is a factor, but it is far from the only factor (heck it is far from even being a large factor), as suggested when you wrote, ” If it does indeed continue above inflation after fair market value I would confidently argue that it would hurt Toronto economically.”

I’m simply showing that there is WAY more to house prices than inflation. There is a notion (often held by bears) that over the long term house prices “should” only return the rate of inflation and that returns over inflation will be followed by returns below inflation to bring this relationship back in line. This again is pure unmitigated garbage. You actually nailed it when you said, “I strongly believe that inflation needs to be grouped in with immigration, emigration, economic output, new supply, supply taken out, interest rates, number of new grads, unemployment rate, number of sales, number of houses for sale etc. etc.” House prices are a multi-variable model that goes something like this RE Return = f(inflation, net immigration,economic activity, net supply, interest rates, etc….). All i am saying is that anyone who looks objectively at the available data will see the contribution inflation has is weak and it is clearly not the main determinant. Forget about lines, and periods, and data points and just think about where the highest real estate prices are in the world: it should be clear these are not cities with high inflation, rather they are cities with low, stable inflation. It should also be clear that the contribution from net immigration, economic activity, net supply and interest rates far outweigh the contribution of inflation. Toronto has each and every one of those factors going for it, this is why house prices here will continue to outpace inflation and can do so, as long as the other factors remain healthy.

Buckley B Buckington

at 4:25 pm

“this is why house prices here will continue to outpace inflation and can do so, as long as the other factors remain healthy.”

Yet more bunk. Stop for a minute and think about what RE prices outpacing inflation over an infinite (or sufficiently long) timespan would imply. It is an economic and mathematical impossibility!

Kyle

at 4:28 pm

If you think it’s impossible show me the math then, because i assure it is possible.

Kyle

at 9:53 am

@Buckley

Clearly you are still desperately trying to find the math to show it is impossible. Let me save you some time because you won’t find it.

Here’s how the world actually works. Housing is a component of inflation. Inflation is a LAGGING measure of what prices USED TO BE. So to be crystal clear, HOUSING PRICES DRIVE INFLATION, NOT THE OTHER WAY AROUND.

Of course when you look back you will see there is correlation betwen house prices and inflation, just as if you were walking around in a desert there would be correlation between your foot steps and your foot prints. But correlation does not equal causation. Inflation does not drive house prices no matter how badly you want to believe it does.

Appraiser

at 11:03 am

@ David

One example that comes readily to mind would be our old friend Garth Turner. Two or three years ago he sold his house in Toronto to rent another one, also in T.O. On his blog he claims that he lives in a $2M home and pays $4,000 rent per month, and that obviously his landlord is subsidizing his rent. I find that laughable since Turner has no way of knowing his landlord’s finances or whether there is even a mortgage on the property.

Here’s what I do know. At a conservative 5% annual appreciation, that $2M home is now worth at least $200,000 more since Garth moved in. That works out to an appreciation rate of approx. $8,300 per month. On top of the $4,000 that Garth pays in rent, his landlord is ahead by $12,000+ per month since Garth signed the lease.

Jimbo

at 1:12 pm

The 17 year stat is a great stat for Canadians, it shows how fiscally responsible our parents and for some their grand parents were. I must argue that a Canadian stat is not a Toronto stat just like the Canadian market is not a Toronto market. I believe that if you separated the Toronto mortgages you would see the number of years increase to somewhere above but around 20 years. That being said I don’t think that will be a relevant stat for Toronto buyers who bought after 2009. 1.3 million dollars is just too much of a mortgage to pay off in 20 years (880,000 mortgage over 25 years) without a more significant inflation rate.

Tell me the difference between rent and mortgage interest + land tax other than a portion of your mortgage is principal and that principal builds your equity. You’re paying your banks bills and maintenance instead of your land lords, hardly a difference (unless you piss your money away). I am not arguing that buying a house is wrong, I think in most cases it is the right thing to do, but you should capture all of the costs involved before saying it is right for you.

You are right when you have to pay for a roof over your head for 50 plus years owning can be quite a bargain, but most people are not going to be living in a house they paid for, for 50 plus years. What is the average age of a buyer in Toronto right now? If the average age is 25 (university education with 3 years savings) are they going to be living in a house when they are 75? Most likely they will be renting or in a condo with maintenance fees. If not they have a great family or will be paying someone to maintain and repair their property. How many renovations do you do over 35 years to keep the houses style current to retain top market value? How many renovations do you need to do to keep the house within current codes and regulations to keep it insured when you want to sell? There are so many costs to owning a home that we never hear about. I think the only winners in Canada are the ones who purchase a house that only eats up 30% of their after tax income (mortgage + land tax only) and is smart enough to invest some of their left over earnings into a TFSA or other investment vehicle for future growth. Using more than 50% of your after tax income just for the right to own a house is delusional and more of a mistake than renting IMO.

crazyegg

at 12:40 pm

Hi All,

I am a fellow real estate bull but I still believe the need to at least consider the financial benefits of renting:

* Rental tax credits come tax time

* Using extra disposable income on REITs and other dividend based equities which have potentially 0% tax payable (depending on one’s taxable income levels).

* 50% of the capital gain on the property is taxable when it is sold. Not applicable for renters who are enjoying the 5%+ yields on their REITs

Don’t be close minded and leverage all options that are available to all Canadians.

Regards,

ed…

Jimbo

at 1:17 pm

Rent is only a tax credit in some provinces and I believe that the 50% capital gain is for second properties not primary. I do agree that renting is a more valuable option for a young professional who may need to change cities before they are established in their field.

Appraiser

at 2:20 pm

@ crazyegg

I don’t see how it’s an all or nothing game. There is no reason that a homeowner can’t also invest in REIT’s, ETF’s, stocks, bonds or perhaps even more real estate. To my way of thinking, a paid- off tax-free principal residence is the bedrock of financial security, on top of which you can add other assets.

Appraiser

at 6:34 pm

@ Jimbo

You state that “equity is useless until you sell.” This statement betrays obvious naiveté. Equity provides numerous options to tap into before liquidation. From putting yourself or your children through university, to investing in a business, or any number of other lucrative opportunities, equity in one’s home (at very attractive interest rates) is anything but useless.

Jimbo

at 7:18 pm

I can agree with that, but again this is not your money, it is just better acces to credit and at a better interest rate I’m sure. I just don’t see the need to use it if you’re getting paid other than for a business venture.

I am of the belief that using it to pay $10k a year for a kids university education is a terrible use of credit. It costs less than child care. To me this is a prime example of how to throw your networth away.

As a sidebar, I will point out that you can go to school and live on campus for free at any Ivy league school, MIT and I know there are a couple of others out there in the united states and germany if you qualify to get in. Depending how much you as a parent make will determine how much your kid pays. Something I wish I knew going through high school.