Let’s pick this up where we left off on Wednesday.

I honestly thought I could hammer all this out in one blog post, but as the days went on, the more factors I thought needed to be discussed. And the more I thought about each one, the more I wanted to say!

Today, let’s try to get past the obvious: pre-construction condos, and get into some points you might not have thought about, like perhaps how the Internet and advances in real estate websites not called “MLS” are finally giving consumers what they want…

Just when I thought this post couldn’t be longer than Wednesday’s….

4) Pre-Construction Condos

I absolutely hate talking about this subject.

I feel like I’ve said everything there is to say, and I’ve done so a thousand times already.

But in 2014, we saw two major catastrophes in the pre-construction condo world:

1) Buyers at Centrium Condos had their deposits stolen by the developer, and they’ll never get their money back.

2) Emerald City Condo was completed WITHOUT direct access to the subway, as promised, and advertised, in pre-construction, and the developer, Elad Canada Inc., now faces a $30 Million lawsuit.

Honestly, it’s the second point that bothers me more than the first.

You do NOT get what you pay for when you buy pre-construction condos. The developer has absolutely no obligation to build access to the subway, so read your goddam Agreement of Purchase & Sale.

But maybe, just maybe, stories like the two above might give some buyers pause?

Two days before Christmas, I had a young girl in my office in tears, acknowledging that she’s going to lose a year’s salary on her pre-construction condo down on York Street.

She paid $398,000 for a 545 square foot, 1-bed, 1-bath, with no parking, no locker, and no outdoor space, on the 6th floor, with a view of the highway.

That’s $730/sqft.

The building is scheduled for completion in 2015, but being on the 6th floor, in a 65-storey building, she knows that when she’s given occupancy, construction might continue on the building for over a year. She also knows that it might take up to two years for the building to get registered.

And the worst part is – she knows that despite having bought into this project almost three years ago, the property isn’t worth $730/sqft with no parking, no locker, no outdoor space, and no view.

She’s going to pay $8,150 in Land Transfer Tax when she closes, and since she didn’t insert a clause to cap her levies, the developer could charge her essentially anything he chooses – likely in the $20,000 range. To sell the unit, even at $400K, would cost her $20,000 in Realtor fees, and paying a lawyer twice is going to cost her $4,000.

All told, she’s looking at a potential $50,000 loss.

And that’s not including occupancy fees, which will be around $1,500 per month, every month, until the building registers. So she has to find a tenant to offset those fees, and then become a landlord, which she doesn’t want to do.

She also might have to pay HST upon closing, and you can imagine just how much deeper into the red she’ll get.

Anyways, you’ve heard stories like this from me before, but this one really struck a chord because this girl sat there in our meeting room and cried! (and yes, she said I could write about this on my blog…)

In 2014, I must have fielded 25-30 calls from people asking how to get out of their pre-construction condo deals, and whether or not I could help them sell their condos (they’re not condos – they’re pieces of paper, essentially a liability, not an asset) via “assignments.”

I said “no” to all of them, because I don’t believe there’s an active market for it, and because all of them were in negative equity positions.

In case you’re wondering, I get these calls because I’m all over Google – with all the negative stuff I’ve written over the years, and people keep finding me!

As for the industry itself, as long as developers keep offering 4-5% commissions to agents who get 2.5% for selling resale condos, there’s always the leeches out there that will “specialize” in this sector of the business.

In late November, I went to some lunch/group/seminar/think-tank that shall remain nameless because it’s well known, but that I never wanted to attend, for exactly the reason I’m about to explain.

While eating a really crummy salad and dreaming about pizza, somebody across the table looked at me and said, “Hey, I know you. You’re that blog asshole, right?”

Naturally, I replied, “Yes, I am.”

I knew right away that he was some hot-head pre-construction sales “expert,” since 99% of my industry colleagues love my blog, and the ones that don’t, are exactly like this guy.

A conversation ensued – one which I really didn’t want to partake in, but after letting this guy ramble on and on, I finally asked, “Can you please give me five examples of clients who sold this year, who made money, having bought 3-4 years ago?”

He stuttered, stumbled, and eventually said something like, “This conversation isn’t worth my time.”

One of his own colleagues from his brokerage then leaned over and told me, “He’s only been in the business for two years.”

THAT is who is selling pre-construction condos, folks.

So hire them – hire them today, and get what’s coming to you.

A sucker is born every day.

I just hope a lot fewer are born in 2015….

5) The Stock Market

Bullish or bearish?

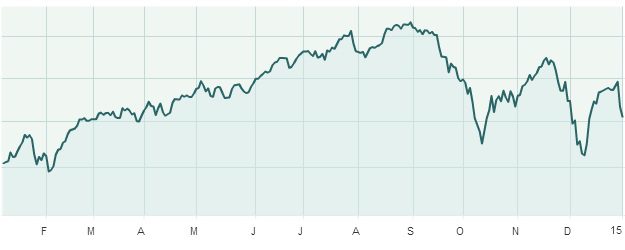

The S&P/TSX Composite Index started 2014 at 13,548.86, and finished the year at 14,753.65 – an increase of 8.9%.

Of course, the August high of 15,625.73 would have represented a 15.3% increase, but alas, the market is prone to ups and downs.

So while the Toronto real estate market added 8.5% in 2014, according to the average home price, the stock market actually performed BETTER, despite a massive dip in the fall.

Actually, it was a double-dip, and perhaps a triple is in the works.

What do you feel when you see this chart:

It’s certainly not the same feeling you get when you compare granite counters, to Caesarstone, to quartz, to Corian.

I’ve always felt that because of the ability to know what a stock, or an entire index, is trading for at any second of the day, it makes the average equity investor/owner far more anxious than the real estate owner.

Real estate also has no fixed value, and it’s traded in far lower quantities.

The chart above, if you’re more into John J. Murphy than Benjamin Graham, might lead you to believe that the index is about to break through the floor reached in February, on this, it’s third attempt in the past three months.

Your heart tells you it won’t but this chart says it will.

Your stock broker says it won’t, but what does fundamental analysis tell you, if anything?

I don’t know. I don’t pretend to know.

But I do know that whenever the stock market is volatile, a lot more people put their money in real estate.

Yes, the transaction costs associated with real estate are infinitely higher, but the outlook is longer, and the decision is more thought out.

If Joe Slightly-More-Than-Average got a $30,000 cash bonus in April, and thought about putting it into the stock market, he might think twice if the TSX is weak, and or volatile. He might, instead, think about buying an investment property, with a 5-7 year outlook, where his transaction costs will be spread out that time period.

Real estate isn’t nearly as liquid as a portfolio of stocks and bonds, but it’s not nearly as volatile either.

I’ve always found that when the stock market is doing poorly, I get more business from people looking to invest in real estate.

FYI, here’s a great column from this past week: Bears Beware: U.S. Stock Prices Still Fair.

6) Media Sentiments

You can’t help but be influenced by what you see in newspapers, magazines, and on TV.

Many of my clients start conversations with, “I read in the paper that…,” or of course, “I was watching the news the other day, and they said….”

As I wrote in Monday’s blog, the Internet isn’t the only place we’ve been seeing predictions of doom and gloom for the real estate market over the past decade.

Simply put: it’s everywhere.

I find that negativity sells more than positivity, and it makes for better headlines as well.

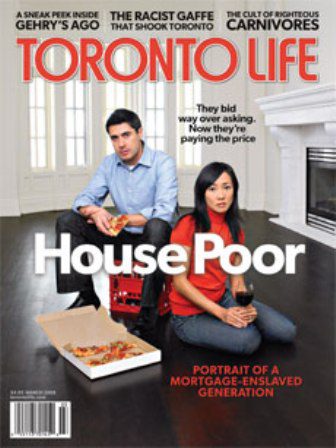

Just take a look at this cover of Toronto Life from 2008:

If I could change ONE thing about the way the media writes about real estate, it’s enough of these tales of woe of the home-buyer, or would-be home buyer, and how hard the market is on them. It’s hard on everybody.

I don’t feel bad for the people pictured above, who according to the headline, “bid way over asking,” back in 2008, and have seen a 50% increase in value of the price of their home.

I do, however, feel bad for the person who bought this magazine, and decided to rent instead.

It’s not just Toronto Life (although they certainly have been more bearish than bullish over the past six years…), but rather EVERY newspaper or magazine in Toronto, at one point or another. And it’s not just columnists who opine and predict, but also reporters who have to tell us what Joe Economist is thinking, when he announces that the market is over-valued.

HERE is a beauty from today’s Financial Post, where Deutsche Bank claims Canada’s real estate market is over-valued by 63%. Well thank you, Deutsche Bank. I don’t tell you how to make bratwurst, so please don’t tell us how over-valued our market is.

So while it’s not the Financial Post that believes the market is over-valued by 63%, they still have to report what others believe. Having said that, it won’t be long before Gary Marr does an opinion piece about how the market is over-valued by 64%, so what’s the difference…

I heard a great saying once, that still rings true:

“The media have accurately predicted seven of the last two recessions.”

And while I’d like to think that the average Torontonian isn’t completely and totally influenced by the media, I don’t think that’s necessarily the case.

Let’s see how the media treats the 2015 real estate market…

7) Online Real Estate Resources

Once upon a time, www.mls.ca was the only place to find Toronto real estate!

For some reason, they changed the URL to www.realtor.ca a few years ago, but it was like rearranging the deck chairs on the Titanic.

I’ve always hated the interface on MLS, and from what we now know, the public hates it too.

For the longest time, it seems like CREA has thought itself invincible when it comes to the online world, and perhaps a false sense of security was why CREA let the website turn into a 2004 version of itself.

Needs create opportunities, and those opportunities were relished by hundreds, if not thousands, of entrepreneurs who figured they could build a better real estate resource, when the need for one become apparent via today’s consumer.

The result?

www.zolo.ca, which is where a lot of my clients send me links to listings.

www.zoocasa.ca, where to be honest, you likely won’t find a good Realtor (and I don’t know if the business model is working), but where the interface is quite popular.

And my absolute favourite: www.condos.ca

Even though, technically, www.condos.ca is my competitor, how can I not give credit where credit is due to the guys that built this website?

I had this idea back in 2006. I bought the domain www.torontocondodatabase.com because my dream was to build the most comprehensive condo database on the planet. I decided to start Toronto Realty Blog instead, and perhaps it proved to be the better option.

But www.condos.ca is a resource that all of my clients use. Even if I don’t necessarily agree with their calculations on “price per square foot” since we all interpret data differently, being able to find out the developer, registration date, number of units, number of floors – of any Toronto condo, is an incredible resource.

There’s a ton of other websites that people frequent, and hundreds that were tried, but never really got off the ground with any momentum.

In any event, CREA no longer holds the key to MLS listings, since there are a host of grey areas (check out my Pick5, for example…), and valuable real estate resources are popping up.

The old guard in real estate doesn’t want me talking about this, but I’m a realist, and I change with the times.

I also don’t want to stand in the way of progress, especially where there’s a need.

Alright, these 2,000 word blog posts are getting out of hand.

I have a new member on my team, and she told me that despite coming from the online world and seeing everything (or so she thought…), she’s never seen a blogger who can’t stop talking like me.

Then again, I laugh at Realtors who have blogs (or so they call them…) that are updated bi-monthly, with a two-paragraph story about getting an iced latte at a great new hot-spot on Queen Street, where the real estate is up and coming.

Perhaps there’s a happy medium, and perhaps one day I’ll find it.

It’s been somewhat of a slow “first week back” when it comes to new listings, so I have my fingers crossed for next week.

Have a great weekend, everybody!

Boris

at 8:58 am

Side bar – check this out: http://www.theglobeandmail.com/report-on-business/cooling-calgary-home-sales-add-to-fears-beyond-energy-sector/article22371154/

new listings up 42%. Ouch.

Another component that’s already hurting Toronto, and will get worse, is weakness in Bay Street hurting the high end ($1.5mm and up) market. Bonuses are light, underwriting is soft, mining and energy in the toilet. The high end is linked in this city to finance to a large extent, and things are getting worse. The 5 year party on Bay St. is ending folks.

Long Time Realtor

at 10:19 am

@Boris: You can cherry-pick numbers if it makes you fell better, especially in relation to a record year for the City of Calgary. For a liitle perspective, it might be relevant to consider that new listings in Calgary are actually down -12% from the historical average to start the year, while sales are inline with 2010, 2011, 2012 and 2013.

For a thorough analysis of the Calgary market, minus the hyperbole and hyper-negative spin that the bears apparently prefer see:

http://calgaryrealestatereview.com/2015/01/08/january-1-7-2015-calgary-real-estate-market-update/

Boris

at 10:36 am

Has nothing to do with how I feel. I don’t give shit about where Calgary housing goes. Would you make the same comment to the Globe author?

Having said that things are f-ing bad at major E&Ps in Calgary. Not getting better soon. What you linked to is backward looking. Read the hundreds of updated corporate guidance numbers and look at the Alberta capex cuts. We are talking tens of billions. This is in the top of the first inning.

Boris

at 10:37 am

Why are 98% of realtors permabulls? I get it, but why do you care about other provinces?

Appraiser

at 11:48 am

@ Boris:

“new listings up 42%. Ouch”.

The above quote is yours.

Apparently you ‘felt’ something, or were at least trying to convey the concept of ‘pain’. So nice try, but you can’t unring that bell.

I would say that 98% of Realtors are pro-home ownership and not necessarily perma-bulls convinced that the market always goes up. Big difference.

Many home owners, perhaps even the majority, don’t pay much attention to the current value of their home. Unlike most stock market junkies who go all atwitter on a daily basis and can’t seem to take their eyes off the wiggly lines on the charts.

Boris

at 12:22 pm

The stat is mine? I made that up, “out of my ass” as you like to say? What is your peabrain talking about this time, meatstick?

Totally disagree. Fleming is pretty agnostic and honest and that’s why this blog works and why he is an interesting guy. Why? because 98% of realtors (or some other number that I pulled out of your ass this time) are permabulls.

I agree on your last point. Price reversions in one asset class are like turning around an aircraft carrier and the other is as neurotic as a jew in Islamabad. Having said that, when this carrier finally turns around, I fell there are going to be pockets of the market that are going to be completely flattened by payments, debt etc. When this happens, who the f knows.

Martian

at 9:31 am

I know you hate talking about it but… WHY do these people buy pre-construction? I mean I could go find 100+ comparable resale units like you described in the next 20 minutes – right downtown, 1 br 1 bath is probably the most common listing around.

I get pre-construction for unusual things like a 3 br in the beaches where there’s not much development and it’s hard to find family units. I wouldn’t do it myself, but I get it. But dime-a-dozen 1 bedrooms in mega-buildings… there are already a TON of those you can have right now.

Joe Q.

at 9:42 am

I think there is the financial factor (people think they are getting a better deal by buying pre-construction) but also a psychological aspect of being the first to own something.

I work in the burbs, and have a few colleagues who have told me that they cannot imagine living in a house that has been occupied before, when you have the option to live somewhere brand-new. I find that outlook more than a bit crazy, and the practical implications are somewhat frightful, but this attitude does exist.

Martian

at 9:49 am

I get that mentality for a new car. Thing is you don’t wait 2+ years for Ford/GM/Hyundai to custom build your car, and then find out they don’t technically need to provide the engine you agreed upon. Obviously real estate is different and the developer needs a bunch of money up front to make it happen. But why not just buy a new, never-lived-in unit on the market and available right now?

It’s not the new home idea that I object to, but locking up money for years with all these conditions. And as I said, what David describes is THE most generic condo unit ever.

Kyle

at 11:01 am

@ Martian

Haha, your problem is that you’re thinking about it from a rational person’s point of view 🙂 I too know people who will only ever live in a new home. I think it is partly based on irrational ideas (e.g. What if the previous owners divorced, got sick a lot or lost their jobs, maybe this house has bad karma) and partly based on naivete (e.g. How do i know the furnace was maintained? What do i do if things start breaking down or wearing out?). From my experience though, logic and finances does nothing to change their minds.

Martian

at 12:06 pm

I get it but aren’t there new, non-precon homes? I’ve never heard anyone mention karma as a reason not to buy a house but hey, I’m not a realtor…

Clifford

at 8:47 pm

I think a lot of people truly don’t know how many hidden costs are in pre-construction. It is sheer madness how people so easily hand over money for overpriced crap.

Overpay for a tiny shoebox with a small, linear kitchen, no window in the bedroom, no light in the bedroom (yes, that’s extra now) and poor soundproofing at that (ever heard your neighbor yawn?). And on top of that you get gouged at closing for another $20K+ and have to chase the builder to fix deficiencies that Tarion won’t help you with.

But people are greedy and misinformed and think prices will rise forever. Well, I stopped buying precon 5 years ago and will never buy again. Ever. I try to tell as many people as I can not to do it. There’s next to no value in it.

As far as realtor.ca..the site is an embarrassment. It”s a shame that in 2015 agents are marketing million dollar homes with 2×2 grainy thumbnail images.

Joe Q.

at 9:39 am

It will be interesting to see how much of an effect low oil prices have on the Toronto real-estate market as we move through 2015. Arguments can be made either way, but we are talking about an industry that has been directly or indirectly responsible for a large chunk of Canadian economic activity that is now becoming unprofitable. Gas may be cheap, but there are also a lot of companies now making a lot less money than they were last year.

As for real estate and stocks, it is absolutely true that “real estate isn’t nearly as liquid as a portfolio of stocks and bonds, but it’s not nearly as volatile either”, but I think it is also worth remembering that it is easy to make gradual or partial moves into or out of a portfolio of stocks and bonds, whereas the same is not really true for real estate (except perhaps for those with a large collection of properties).

Kyle

at 5:01 pm

Regarding Alberta, we’ll have to see how it plays out. But i am aware of people who went to work there with the express purpose of staying 3-5 years, picking up some skills, while getting paid two to three times the going rate and banking as much of that cash as they could. If the party is over in Alberta (which still remains to be seen), there will be some people coming home with some very well padded bank accounts.

Steve

at 10:59 am

“I work in the burbs, and have a few colleagues who have told me that they cannot imagine living in a house that has been occupied before” …. Wow, can you believe this attitude of entitlement?

I too know people like this. Here’s what I can tell you about them …. they almost always have no savings or investments. But our consumer economy depends on them.

Keep on shopping in the free world ……

Kyle

at 1:56 pm

Could not agree more about #6 Media Sentiments. In 2015, it would be nice if the media could at least try to find someone with an ounce of credibility to present the bear’s case (or perhaps such a person doesn’t exist).

Year after year it’s the same thing, they quote the same incompetent clowns, recycle the same flimsy data-mined hypotheses, and interview the same FML blogger who has turned her pity party into a cottage industry. Come on media, if you’re going to try and manufacture a story about an impending Toronto real estate crash, put some effort into it, OK?

jeff316

at 4:07 pm

Yeah, I enjoy her blog and all, but the Toronto Star article about the FML blogger was ridiculous.

There is a real sense of entitlement when it comes to real estate. Not everyone gets to live in a decently updated three bedroom with two washrooms, a yard and parking, just a 10 minute walk from a subway station.

Toronto is certainly unaffordable for many many people.

But a family with a purchase range of about 600 000$ is not one of those people. They’re just not liking what they can afford or where that money will get them.

That’s a story about expectations, not affordability.

Kyle

at 5:24 pm

You are bang on about the entitlement. Her story for why she sold her Richmond Hill home and became a renter keeps changing to dial up and down the pity. But it sounds to me like someone tried to time the market got caught out and now blames real estate agents, the market, the banks, and anyone else for all her woes. FML indeed.

Here she said, “We owned a condo in North York. We sold it and we were looking for a house in Richmond Hill. It was all we could afford and it was a beautiful dream house. After six months of living there, the commute was terrible and we’re not suburb people. We moved downtown and just sold the house. We have to rent now.”

http://www.theglobeandmail.com/news/toronto/if-its-got-pot-lights-it-must-be-worth-1-million/article550640/

Here she claims:

“…owned a house briefly, but found themselves too stretched financially. Since then, they’ve rented a two-bedroom apartment in the east-end while standing on the sidelines — watching and waiting for a housing correction that’s never come.”

http://www.thestar.com/business/real_estate/2014/12/11/stuck_on_the_sidelines.html

Here she claims:

“They aren’t naïve first-time buyers. They’ve owned a condo and traded up to their 1,800-square-foot “dream home” in Richmond Hill four years ago. But they decided to lease it out and move into a rented downtown condo”

http://www.thestar.com/life/homes/2012/02/11/toronto_real_estate_why_home_is_where_the_hurt_is.html#

jeff316

at 2:56 pm

I had no idea. I think you’ve figured her out. I do feel a bit bad for her, as I would for anyone that’s had some bad luck. Even if she’s not tried timing the market, I can see making a decision like she did without realizing the potential consequences of a strong run on house prices. I just don’t like the phoneyness of the media narrative she’s promoting.

jeff316

at 4:17 pm

To add…

…I’d also like to see the media add some institutional memory. I’m not particularly ruffled by a “bearish” or “bullish” article that might be light on facts.

But Toronto Life, if you’re going to post another housing is about to tip article (which is your right) then maybe reference the last three or four that you did since 2008? Have an in-depth discussion about why we keep writing the same article again and again? Give some thought to the media’s role in shaping the market and buyer expectations?

(My favourite – when they thought the market was about to bust, they switched from monthly profiles of buyers to sellers, only to now revert back to largely profiling buyers again! )

Long Time Realtor

at 6:24 pm

Speaking of the complete lack of institutional memory, how about the “venerable” MacLeans Magazine headline circa 2013, announcing that the real estate crash had actually arrived!

http://www.macleans.ca/economy/business/crash-and-burn/

How Embarrasing!

And they wonder why they’re ridiculed. Apparently one columnist, Jason Kirby “stands by” every word of his magazine’s previous real estate prognosis (post oil-crash of course).

http://www.macleans.ca/economy/economicanalysis/why-the-oil-crash-is-bad-for-canadian-house-prices/

How is that even possible? Once you’re wrong, you’re wrong!

That ship already sailed Jason.

Appraiser

at 7:21 pm

Hate to say I told you so (not really).

Via CMT (Candian Mortgage Trends):

RateSpy.com @RateSpy

5 lenders drop their best 5yr fixed rates by .05 to .10 %-pts in last 24 hrs.

Capital One

at 10:24 pm

David,

Thanks for you excellent blog. Full disclosure – I follow you and Garth Turner regularly and lean towards Garth’s POV – but not always.

At the risk of inciting the wrath of “The Appraiser” – he makes me think of “Khan” in the ST world.

1) Interest rates

The Fed and BoC rates have nothing to do with fixed mortgages. It’s the bond market. Agreed? As in – the Fed could raise rates by 0.25% but the bond yields could drop the 5-yr fixed morgages by 1%. Or raise them by 1%. So the risk to home buyers is that the interest part of their mortgage payments could jump if the bond market decides it needs to raise the yields

2) Land Transfer Tax

Agreed. Horrible. Especially since it’s it’s “just” at %. Does it really cost city any more to process a $300,000 house vs a $1,200,000 house.

Of course, the same can be said of those exorbitant realtors fees. If realtors were REALLY concerned about the plight of the new-home-buyer, this would be a front-and-centre issue.

3) Cdn $

No opinion here. Except .. what is the draw to Toronto (vs Montreal. Detroit or Regina)? What is the industry here? Bay Street, OK. No one else has this. After that … what would keep any industry here?

4) Pre-Construction Condos

Fully agreed

5) The Stock Market

Have to side with Garth here. The stock market is a wide and wondrous thing. You can diversify, diversify, diversity. Buy a house as an investment – one really big asset in one really illiquid market. The time you want to sell is usually the time when EVERYONE wants to sell.

6) Media Sentiments

What can you do?

Agree with Garth again. The numbers here are way too important to leave to CREA or TREB. Imagine the same model for stocks or bonds! Until there is non-partisan gathering of metrics, you’ll have to live by the sword, die by the sword.

7) On-Line resources.

Disagree. I rather like MLS.ca. I know this is owned and operated by realtors, but it’s not too bad. A zillow.com equivalent would be good for Cdn buyers, but if you stay on top of mls.ca, you can figure things out.

APPRAISER – have at it!

Capital One

Appraiser

at 12:18 pm

@Capital One:

Correction: There are no Realtor fees for new home buyers. As for Realtor fees in general, a good treatise is available from Long Term Realtor on the previous post.

Garth Turner is a charlatan. When he doesn’t like the numbers from the various real estate boards or CREA he claims that they’re fudged. When he does like them, they’re gold. Note how he can’t stop quoting Calgary MLS stats verbatim lately.

Tell us something @ Capital One. Does the fact that Garth Turner has been dead wrong about the real estate market for 8 years in a row concern you in the least?

If there is one thing I have learned from Turner, it’s that the old saying, “you can fool some of the people all of the time” is absolutely true.

Capital One

at 5:37 pm

Yes – he does tend to cherry-pick numbers but his core message is bang on. Having most of one’s net worth in one illiquid asset is very risky. Especially one that has has a lot more downside potential than upside. And you can achieve essentially the same thing (rent that condo, don’t buy it) at a much lower risk level.

The solution for the sales number reporting is fairly straightforward – some third party with no vested interest in them. Like Zillow.

As for the Land Transfer Tax and realtor fees. I’m sure someone can make the case in favour of the tax as well (pays for roads, schools …). And I don’t doubt that realtors add value but 5% on a $800,000 home is way out of whack. That’s $40k of the home owners net worth … gone. I’m pretty sure the cost of marketing a house hasn’t gone up much over the last 5 years, but the commissions sure have.

CO

Appraiser

at 11:47 am

Speaking of Zillow, here’s an interesting quote: …“consumers don’t really care about commissions. They say they care, and they talk a big game in the off-season. But when push comes to shove and it comes time to sell their home, the transaction is so infrequent and so highly emotional and expensive—and consumers are so prone to error—that they turn to a professional.”

Spencer Rascoff, CEO, Zillow

For the full article: http://www.businessweek.com/articles/2013-03-07/why-redfin-zillow-and-trulia-havent-killed-off-real-estate-brokers#p4

jeff316

at 1:11 pm

Re: real estate commissions, could it not be argued that in today’s market – given the multiple bid scenarios – the real estate agents are doing more for their dollar than they did in the past days of “list and wait”?

Appraiser

at 1:25 pm

@ Capital One:

P.S. Zillow derives much of it’s data directly from cooperating real estate board MLS systems and the bulk of it’s revenue from Realtors who advertise on the Zillow website. Would you consider that a vested interest in organized real estate?

Capital One

at 10:35 pm

Appraiser:

Yes – but the realtors don’t own the data or own what’s presented. Zillow gives potential home buyers so much more information (that, presumably, realtors don’t want to be shown or it would be in MLS.ca already). Eg:

– day on market

– estimated value based on similar sales

– estimated value of each and every property in the neighbourhood

– price history

– property taxes

Here’s an example picked at random:

http://www.zillow.com/homedetails/204-W-Center-St-Eagle-Lake-TX-77434/87235640_zpid/

Don’t get me wrong – I like MLS.ca and I understand that realtors own it and are under no obligation to do anything that’s not in their best interest. But the info Zillow provides is really key for buyers. And sellers, I guess.

Again – I think realtors add value (and order) to real estate transactions. I just have issue with the concept of % based fees. Same with financial advisors. Does it really cost 10x more to advise on a $1,000,000 portfolio vs a $100,000 portfolio?

CO

GregV

at 10:26 pm

Someone just posted their closing costs on a pre-construction condo on a RFD discussion:

http://forums.redflagdeals.com/toronto-condo-closing-fees-53-971-350k-1-bedroom-unit-1651295/

The builder passes on every possible charge!

Nearly 54k on a $349.9k unit (half HST).

Surprised I have not heard more about this. Scary.

Paully

at 11:11 pm

That buyer should be thankful for the little things…at least there was no charge listed for Vaseline or KY.

AG

at 7:53 am

Good