…and then a friend of mine said, “Remind me never to travel with you guys.”

Maybe he had it backwards. Maybe the idea was to always travel with us.

Let me explain…

I’m a pretty easy-going guy for the most part, or so I’d like to think so. Yes, I’m a workoholic. Yes, I have extreme obsessive-compulsive disorder, self-diagnosed attention deficit disorder, and I can be inflexible.

I like control. And order. And routine.

And when it comes to my expectations for people, society, and day-to-day happenings, my bar has been set so low that I’m rarely surprised or disappointed.

As mentioned on the blog last week, Jenna, Maya, and I went up to Deerhurst for six days to finish out the summer, and they both begged me not to work. You guys didn’t miss me, and who’s reading the blog on the Friday before a long weekend anyways?

Deerhurst is great, it really is. We’re not talking luxury here, but who’s expecting that? At 39-years-old, with a pregnant wife, and a soon-to-be 3-year-old, I’m really just looking for a place my that my kid can have a great time, and where my wife can avoid stress and anxiety. Deerhurst has a beach, a great pool, an arcade, an indoor playground, a climbing wall, petting zoo, putting green, and a great open space for my 3-year-old to fly a drone. True story.

But Deehurst also has a lack of staff, and organization. And in my opinion, the problems they encounter are easily solvable.

Deehurst has this insane 4:00pm check-in time, which, having travelled around the world, I can say is the latest you will find anywhere. This does exist elsewhere, but it’s rare. I’d say the average check-in is 2:00pm, and some places have 1:00pm, some have 3:00pm. Throughout the United States, it’s not uncommon to approach the front desk before check-in, and have them say, “Oh, well would you look at this? Your room is ready, sir.”

Not Deerhurst.

Having already stayed up there for a couple of nights in early July, we came prepared this time. We left the city later in the day so I could work the full morning and afternoon, and arrived at the “resort” at 4:00pm.

Do you think our room was ready?

We took Maya to the arcade, blew $40 on games that produced enough “tickets” to buy $1.00 worth of cheap plastic toys, produced in China, and then went back to the front desk at 5:15pm.

Do you think our room was ready?

We went for dinner, with my wife saying, “Please, please don’t make a scene if the room still isn’t ready,” and I tried to convince her that I wouldn’t.

At 6:00pm, our room still wasn’t ready.

We played outside for another forty-five minutes, and by now, it was well into my daughter’s bath-time routine.

Approaching 7:00pm, we were finally handed the key-cards for our room. Yes, 7:00pm. No typo, no exaggeration.

I was livid.

But I hadn’t yet blew my lid, until they gave us keys for a room that was not the one we had reserved. You know, reserved. When you ask for something, and the person on the other end of the line says, “Okay, great. You got it.” Having reserved the same model room as last time, we were instead given a room on the ground level, different layout, different view. The one thing my wife didn’t want was a ground level unit. And it’s the one thing we got.

Tell me I’m making something out of nothing. Go on.

I told you above – my bar has been set very low. But when you RESERVE something, it’s supposed to be, well, reserved.

In this case, they gave us the worst room in the building.

And I went insane.

“Give me somebody else’s room,” I told them. “Somebody who hasn’t checked in yet.”

They tried that; they actually did. The three poor ladies whose lives I was now making difficult. But there were no other 2-bedroom, lake-facing units.

I argued for a while. Always respectful, although my Jerry Seinfeld routine about how “anybody can take reservations, but it’s the holding of reservations that’s important” probably felt condescending.

Eventually, I relented.

After I told them, “I’m not paying for anything else on this trip. Go and print us six dinner vouchers, and six breakfast vouchers.”

And they did.

That’s like $700 worth of vouchers, and I felt okay.

It didn’t stop me from calling the next day and getting another $300 off the first night room rental, but overall, I’d say a G made up for the incredible lack of preparation and customer satisfaction that resort provided.

The room they gave us for the first night, just to add context, was disgusting. We moved the next day, and the rest of the trip was amazing.

I told this story to a friend back home, and he said, “Remind me never to travel with you guys.”

But wait, was I out of line? Am I a “complainer” by definition? Isn’t getting all those rebates worthwhile? Isn’t that a reason why you would travel with somebody?

I went back the next day and told the young lady at the front desk that I was sorry for putting her through that experience, and that Deerhurst put front-line staff in a position to take heat from people such as myself. I explained that, obviously, nothing was her fault. She told me my antics weren’t even in her top-ten worst that day, and I was able to walk away feeling like less of an asshole.

What can I say?

I’d like to think I’m the nicest guy in the world, until a line has been crossed. I’m binary. I only know two speeds.

Okay, so that went on a little longer than expected, but I figured some context for the last week away would be nice.

I felt that the last week of summer wasn’t the best time to be coming up with new, groundbreaking, eye-catching blog material, and that even the readers needed a break before the busy fall market.

So here we are, with the page turned to September, and a blank canvas ahead of us in the form of a fresh real estate market cycle.

The summer did finish hot, for what it’s worth. I’ll tell a few stories about that next week.

But we all know how “peak” seasons can look and feel, and where they happen to fall on the real estate calendar is no secret. September and October are, historically, extremely busy months, and I expect this year to be no different.

The start of the fall market is also likely a threshold like no other. The spring market doesn’t have such a stop-and-go feel to it, and the buyers and sellers aren’t nearly as choosey with where they transact, as they always seem to be, the very day after Labour Day.

I’ll leave my predictions for Thursday, as today, I want to run down the factors that will ultimately affect our fall market, and beyond.

Predictions are fun, but what are those predictions based on? What external factors will shape those predictions, and ultimately affect their accuracy?

I’ve come up with a list of about a dozen, but here’s what I see as being the most important:

–

1) World Politics

Tell me I’m taking too big a view here, or that my inner Chicken Little is showing.

But are these crazy times we’re in, or what?

A wise woman who’s worked the front desk at Bosley Real Estate for about three decades, once told me, “Davie, every single generation thinks that the next generation is going to be responsible for the end of the world,” and I can see how that’s true. I mean, I’m worried about the next generation and their thoughts, opinions, values, and objectives, just as my parents worried in the same way about me and my generation.

But what the hell is going on in the world in 2019?

Our grandparents will laugh at us for having this conversation. They lived through Nazi Germany and a true world war, when nothing else mattered, and the future of mankind was completely unpredictable. The next generation lived through civil rights protests, Viet Nam, and a changing socio-political landscape that makes it hard to believe only thirty years ago, the city of Berlin was divided by a wall.

And here we are, in 2019, with a higher standard of living than ever before, more at our fingertips in a day than previous generations could find in a month, and the world seems just as confusing.

The United States and China are in a trade war that will have ramifications across the globe.

The United Kingdom is still trying to find a way to leave the European Union, a full three years after they voted to do so.

Germany, the economic engine of Europe, is on the brink of recession. THIS article in the New York Times sums it up nicely.

There’s an absolute lunatic in the White House, in a chair reserved for the single most powerful person in the world.

But maybe when you add all of this up, it doesn’t seem nearly as bad.

I don’t know what the average person out there thinks about world politics right now, or how many of the younger generation even care. I know, I know, I’m hammering on millennials and Generation-Z again. But when I see that two-thirds of millennials don’t know what Auschwitz is, I’m concerned. I’m sure this isn’t taught in public school anymore, because education, like comedy in 2019, has been cleansed, but I digress…

The reason that I have this as #1 on the list is because it should be on the minds of every citizen of Planet Earth, but oh-so-many folks have their heads buried in the sand.

Again, as the younger generation goes, some believe it’s more important to be morally correct than factually correct. Yes, a sitting, 29-year-old congresswoman is setting this example for her generation.

So does any of this matter?

Does the average home-buyer, or home -seller, care about Brexit, or the trade-wars, or the world economy?

Do Baby Boomers look at how Donald Trump’s manipulation of the stock market affects the economy, and thus when they should downsize?

Do millennials consider potential economic booms and busts after Brexit and the 2020 United States election, and how it will affect where they end up in the housing market?

There are two elements to all of this:

1) The psychological effect

2) The actual effect

I’m not convinced the former holds any weight anymore, since people don’t fear as much as they did in previous generations. But will there be an actual effect on the real estate market, from the global turmoil that currently exists? Maybe. But if and when we do see recessionary signs, will it affect the housing market in the GTA?

–

2) Canadian Election

When I first got into the real estate business, there was a saying that most agreed with: “Do not list your home for sale during an election.”

There a couple of reasons why this mantra no longer applies. First, the market is resilient. The market has done nothing but go up for two decades, and rather than the Toronto real estate market being shaped by the election, it’s as though the market and its participants are the ones doing the shaping. Second, the market is far too active and alive to ever “pause,” especially in peak selling-seasons when elections are usually held. I mean, October? Sellers can’t really be expected to avoid listing for 5-6 weeks in the midst of a plum fall market!

So while I truly do believe that the tables have been turned, and rather than kowtowing to the election, the real estate market now moves according to its own pace, I will also be the first to suggest that the elected party come October will have a lot to say about the future of housing in Canada.

Once upon a time, buyers might be inclined to put their plans on hold and take a “wait-and-see” approach when there’s an election ahead, but I don’t see that happening this year. Those who “need” to find a home are going to do so no matter what, and would put far more stake in their employment prospects and current interest rates than whether the Liberals or Conservatives hold power in Ottawa. And I see a younger generation who are likely less interested in, and would feel less affected by, whichever party wins out.

Where we will feel the effect should be obvious, and I made this point back in March when the federal Liberal government rolled out their Budget 2019, and included measures to help first-time buyers, among other things. I suggested at the time that, since these measures wouldn’t be implemented until after the federal election, that not only were these announcements made to try to woo voters, but also that there was absolutely no guarantee that the new regulations would ever see the light of day.

As a refresher, here is the Budget 2019 section on housing:

“An Affordable Place To Call Home”

Here’s the meat of the proposal as it pertains to first-time buyers:

To help make homeownership more affordable for first-time home buyers, Budget 2019 introduces the First-Time Home Buyer Incentive.

- The Incentive would allow eligible first-time home buyers who have the minimum down payment for an insured mortgage to apply to finance a portion of their home purchase through a shared equity mortgage with Canada Mortgage and Housing Corporation (CMHC).

- It is expected that approximately 100,000 first-time home buyers would be able to benefit from the Incentive over the next three years.

- Since no ongoing payments would be required with the Incentive, Canadian families would have lower monthly mortgage payments. For example, if a borrower purchases a new $400,000 home with a 5 per cent down payment and a 10 per cent CMHC shared equity mortgage ($40,000), the borrower’s total mortgage size would be reduced from $380,000 to $340,000, reducing the borrower’s monthly mortgage costs by as much as $228 per month. Terms and conditions for the First-Time Home Buyer Incentive would be released by CMHC.

- CMHC would offer qualified first-time home buyers a 10 per cent shared equity mortgage for a newly constructed home or a 5 per cent shared equity mortgage for an existing home. This larger shared equity mortgage for newly constructed homes could help encourage the home construction needed to address some of the housing supply shortages in Canada, particularly in our largest cities.

- The First-Time Home Buyer Incentive would include eligibility criteria to ensure that the program helps those with legitimate needs while ensuring that participants are able to afford the homes they purchase. The Incentive would be available to first-time home buyers with household incomes under $120,000 per year. At the same time, participants’ insured mortgage and the Incentive amount cannot be greater than four times the participants’ annual household incomes.

Budget 2019 also proposes to increase the Home Buyers’ Plan withdrawal limit from $25,000 to $35,000, providing first-time home buyers with greater access to their Registered Retirement Savings Plan savings to buy a home.

If the Liberal party wins the election, these measures will likely be introduced. I say “likely,” of course, because just about everything in politics and governance is subject to change.

If the Conservatives party wins the election, I don’t believe these proposals will become reality. I do believe that the party will enact measures to address affordability, but nothing like this.

Budget 2019 aside, the fall federal election can have an even greater effect on the real estate market, again, depending on which party is in power, and what ideas they bring to the table. And I don’t mean directly affecting the market, ie. shared-equity mortgages, first-time buyer incentives, tax rebates, etc. I mean in terms of which party can take the country forward with a higher GDP. Give me another measure of success if you want, but you know what I’m getting at. Which leader, which party, which policies.

The election is on October 21st. Right, smack, dab in the middle of the fall market…

–

3) Interest Rates

Tell me that this should have been first on the list instead of my tangential rant about world politics, and I won’t disagree.

But interest rates are a function of many things, one being the decisions of the government in power (affected by the election), two being the economic climate in the country (affected by the economic climates in other countries, specifically those we trade with), and three being the political landscape worldwide (which, of course, affects all world economies).

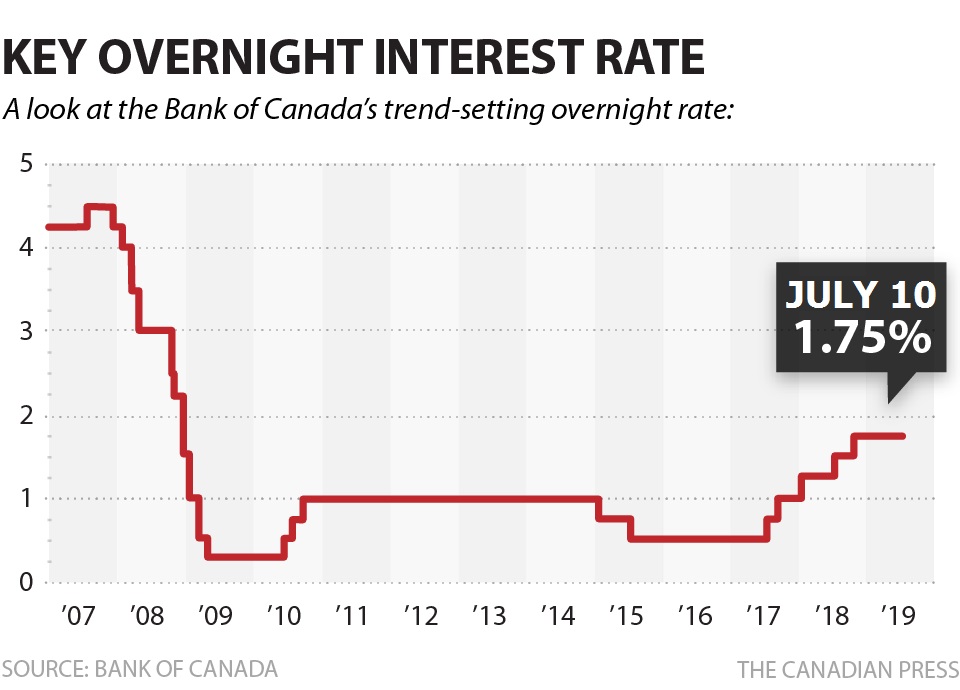

As it stands right now, the overnight lending rate remains at 1.75%, where is has been since October 24th, of 2018 – the last time the rate was raised:

As we can see, the 1.75% rate pales in comparison to where rates were more than a decade ago, but considering rates were at 1% for the better part of a half-decade, with no change, and that rates have steadily been rising since mid-2017, the 1.75% overnight rending late is “high” for this decade.

I wrote a blog two months ago called, “What Happens If Interest Rates Don’t rise?”

Comments from the readers were mixed, with the usual bullish comments championing the healthy, robust market, and the bearish readers finding blame for the market, whether it’s speculation, foreign investment, AirBnB, etc.

But what happens when interest rates go down?

Because rates are going down, mark my words.

The 5-year, fixed-rate mortgages, which are what an overwhelming majority of buyers take, have been steadily coming down since the spring. 2.99% to 2.89%, and then 2.79%. That’s a great rate, no?

But what about 2.69%? That’s just about when people start calling it “free money.”

How many of you out there have a rate locked in at 2.59%?

How many got stripped-down, no-frills 2.49% rate?

Those rates are out there, folks. And they’re going to keep coming down.

If and when the Bank of Canada cuts the overnight lending rate again, which they’ll likely have to do this fall to keep pace with the United States, variable rates will drop, and the fixed rates might keep going down as well.

But does it even matter? Be honest, investors aside, if you’re a 29-year-old couple who are pregnant with a child, whether you get a 2.39%, 5-year, fixed-rate mortgage, or a 2.79% rate, is it going to affect if you buy? No. Is it going to affect when you buy? Probably not. How much you spend? Maybe.

In The Huffington Post today:

“Interest Rates Are Plunging. Here’s What That Means For Canadians’ Lives.”

From the article:

These are strange times in the world of finance. The markets are spooked, with investors worried about the U.S.-China trade war, excessive debt levels and possibly overpriced stocks.

And when the markets panic ― long story short ― interest rates come down.

Today, much of the world is seeing record low interest rates, and in Canada we are just off record lows. A 10-year Government of Canada bond paid out an abysmal 1.16 per cent on the last trading day of August.

And rates could still drop further. In Europe, many government bonds are now trading at a negative interest rate.

Oh, right. I almost forgot about negative interest rates.

Should we talk about this too?

I mean, it’s not all gravy, as Diane Francis wrote in this brilliant piece in last week’s Financial Post:

“When The Next Recession Hits, We’ll Have A Hell Of A Time Clawing Our Way Out Of It”

The headline doesn’t exactly in-still confidence, does it?

The sub-heading reads, “In a world of negative interest rates, the biggest fear is that a recession becomes a depression and low inflation becomes deflation.”

That’s scary too.

But how about the photo that accompanied the article?

Okay so that’s a down-trending chart, which could represent interest rates, but could also represent life expectancy, happiness………or maybe newspaper subscriptions…

But what’s more interesting than than the down-trending chart is the colour selection here, and the two-dimensional contrast between the chart and the background.

It kind of reminds me of……

….hmmm…..

…..ah, yes, this:

Yep, that’s what was in my mind’s eye when I first saw the article.

Hell.

Perhaps I’m reading too much into the photo that accompanied the article, but, then again, they could have used blue, but they didn’t, did they?

From the article:

Tumbling stock markets are worrisome, but the growth of negative interest rates bodes badly for markets, companies and individuals.

And one famous commentator maintains that the world is at the tipping point of another Great Recession, without tools to pull the global economy back.

Negative interest rates are a sign of economic malaise, a desperate move by central banks to stimulate moribund economies. But they are beneficial for borrowers. Here’s how it works: at minus one per cent interest rate, a bank lends $100 and pays $1 to the borrower who would then have $101 after one year.

Negative rates hurt the banking system and don’t grow an economy but shrink it. Unfortunately, the practice is spreading across Asia and Europe. Their economies slow, and the amount of debt (loans, bonds) worldwide with “negative interest rates” is an estimated US$16 trillion, or nearly the size of the U.S. economy.

Canada’s vulnerability is that a weakening world economy will lower both sales and prices for our commodities. Rate cuts, and cheaper mortgages, may also stimulate housing sales and prices. This is not beneficial because housing bubbles exist already in Toronto and Vancouver, so lower rates will exacerbate the existing structural dysfunction.

Douglas Porter, BMO’s chief economist, recently told media that the biggest risk to Canada’s housing market was a return to “nosebleed levels of price growth.”

Now, we all have our own opinions on how a government can stimulate an economy.

Cut taxes, cut spending and services, or roll out the welcome mat for inflation.

I mean, the federal government pays $64 Billion in interest on our debt ever year, and I would argue that spending money you don’t have, with no end in sight, probably isn’t the soundest long-term plan, but who wants to talk politics on a beautiful day like this?

But the take-away from this article is a little scary: if and when we hit negative interest rates, and/or see signs of a recession, these low-interest rates will only help to increase the price of real estate even further.

The long-time readers know that I believe Toronto is an animal like no other, and that what’s happening in Canada is often of little concern to those of us here. So it should come as no surprise when I say that I truly believe if the country dips into a recession, even if some folks here are forced to sell their homes as a result, there will be two, three, or ten other people ready to buy that house, if for no other reason than net-zero interest rates.

For those of you that own houses, you’re happy to hear this. For those of you that don’t own houses, well, you’ll argue against my theory. Please, be my guest…

–

4) Inventory

This is now slowly becoming the longest blog post I have ever written, albeit with a lot of copy-and-paste from the articles above, plus an unnecessary tale about my adventures up north. Nevertheless, I will try to sum this one up quickly.

What happens in our Toronto real estate this fall will depend, more than anything else, and more than the three points above, on inventory.

When I think back to January of 2017, when there was absolutely nothing for sale, and active listings were down 49.5% year-over-year, I think about how we all just knew things were about to get crazy.

Then in February, active listings were down 50.5%.

We all know how the first four months of 2017 went…

If we see a healthy amount of inventory this fall, then I can see prices remaining relatively stable.

If inventory lags, then the sky is the limit on prices.

I have a few stories to tell from last week that will shine a light on just how hot the market is (even over a long weekend…) so stay tuned for these next week. But let me just say that when a 3-bed, 2-bath with no parking, at Greenwood & Gerrard received thirteen offers just before the long weekend, you know inventory is low.

So what are we looking for?

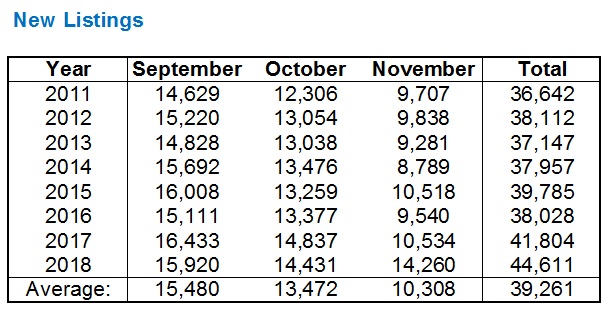

Well, let’s take a look at the fall inventory numbers over the last eight years:

In the fall of 2018, we see 55,435 total new listings, which is well above the eight-year average of 51,049.

This also represents the third-highest total in the eight-year period.

And yet the average home price still rose, both year-over-year, and month-over-month from September into October as the market remained robust.

2016 was an inventory outlier, as you can see. So the 20,089 active listings in the month of September, for example, compared to the 18,488 average, looks worse than it is. Without 2016, the average would be 19,521. I know the saying about “ifs” and “buts,” however it bears mentioning.

As for new listings, the numbers paint a slightly different picture:

Here we see that, in 2018, the 44,611 total new listings in the fall market was not only well above the eight-year high (13.6% above, compared to 8.6% with active listings), but this also represents the eight-year high.

If I didn’t know better, I would think that in the fall of 2018, the market was flooded with new listings.

Only, again, prices went up.

I’ll save my thoughts on this for Thursday when I give you my predictions blog.

Until then, I welcome your thoughts, as always.

Appraiser

at 9:51 am

I concur that chronically low listing inventory has been the bane of the GTA real estate market for lo these many years.

Consistently robust demand is keeping inventories at under two-months supply, in almost every corner of the GTA, whereas 4-6 months worth of listings is generally accepted as a balanced market.

Old and empty theories regarding the inevitable onslaught of baby-boomers abandoning their (mostly humble) abodes en masse to “flood the market with listings” has not materialized yet again and won’t any time soon.

As per Statistics Canada latest data, the average 65 year old Canadian (both sexes) can expect to live until 85.8 years of age, as seniors live longer and healthier lives. I predict that ageing in place has / will become the coolest trend.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310011401

Oh, and there has also not been the much ballyhooed “rush to the exits” of investors for the umpteenth year in a row, either.

With the punitive mortgage stress test “shock and awe” period wearing thin and interest rates likely not on the rise who knows when, all systems are go for buyers this fall… and beyond.

BillyO

at 6:33 pm

Always enjoying reading your insights. Good stuff Appraiser.

Appraiser

at 7:17 pm

Thanks @ BillyO

SW

at 11:50 am

David: Isn’t the number of active listings a stock number, not a flow? If so, you can’t add them up!

David Fleming

at 5:49 pm

@ SW

Good catch!

I was working off the same template as the “New Listings,” which I had done first.

GinaTO

at 12:19 pm

Hey, you’re burying the lede! Congrats on the upcoming second kiddo! It will be just as wonderful as the first one, albeit busier 😉

Libertarian

at 9:38 am

I agree. Congrats David! After having my first a month ago, I don’t know how anybody handles two!

Combine this news with the tidbit from a couple of weeks ago that David seems to have moved, lots happening with the Fleming household.

We should have a poll for commenters to vote for whether David kept or sold his condo. My guess is he kept it, but I think he should have sold it. haha!

Chris

at 4:30 pm

To be fair to Millennials, from the article you shared:

“Asked to identify what Auschwitz is, 41 percent of respondents and 66 percent of millennials could not come up with a correct response identifying it as a concentration camp or extermination camp.”

I find it pretty concerning that 41% of all people surveyed didn’t know what Auschwitz was, Millennial or otherwise. Anyways…

I don’t think the election will impact the Fall market. As we’ve discussed before, I doubt that the Liberal’s equity sharing program will have much impact, if any, on the GTA market.

As for interest rates, I’m not so sure the BoC cuts this Fall. Keep in mind, we didn’t raise rates as much as the Fed, so we don’t necessarily have to “keep up” with them as they lower rates. As explained in a CBC article today, “A poll of 40 economists by Reuters now shows a majority foresee no rate cuts in 2019.” Tough to predict these things though, so we’ll see what happens with the global and Canadian economy.

Further, lower interest rates boost many different asset prices, not just real estate. Stocks also typically see an increase from lower rates.

Finally, even with the lower interest rates on offer today, the 5-year fixed mortgage rate remains above the lows of 2017, while residential mortgage credit growth is still paltry compared to 2015-2017, though has ticked upwards recently:

https://www.scotiabank.com/content/dam/scotiabank/sub-brands/scotiabank-economics/english/documents/scotia-flash/scotiaflash20190903.pdf

(refer to chart 6)

I will concede though that 2019’s market has, so far, been better than I had expected, given the events of 2017-2018. Wouldn’t shock me if we get more of the same for the Fall, with ~2-3% YoY average price growth, and sales volumes in line with 2017-2018, yet below 2014-2016. Look forward to reading your predictions on Thursday.

Appraiser

at 6:49 am

RBC economist says “correction in Canada’s housing market is over”

“Mortgage rates continue to surprise to the downside despite persistent warnings of ‘going back to normal’, because ‘normal’ today is much lower than in the past.”—@BMO

Chris

at 7:35 am

Certainly doesn’t look like the correction is over in Vancouver or Calgary. Never was a correction in Montreal. Toronto has been pretty flat after a mild downturn; we’ll see where it goes from here. Either way, too many markets doing too many different things to make such broad statements on the “Canadian housing market”.

As demonstrated in Scotiabank report, mortgage rates remain higher than 2017. Combine that with B20, and households’ already record high debt burdens, and we’re unlikely to see a repeat of the results from lowering interest rates previously.

Appraiser

at 7:32 pm

Vancouver sales were up 23.5% in July and 15.7% in August, year over year.

Detached sales alone were up 24.5% in August year over year.

Sure looks like the correction in Vancouver is in the rear view mirror. The trend is your friend.

https://www.rebgv.org/market-watch/monthly-market-report/august-2019.html

Chris

at 8:24 pm

“Greater Vancouver home sales bounced in August, up 16% year-over-year. Purchasing activity still well below historical averages dating back nearly two decades.” – Steve Saretsky, Sep. 3, 2019

“The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $993,300. This represents an 8.3 per cent decrease over August 2018 and a 0.2 per cent decrease compared to July 2019.” – REBGV

The trend is your friend.

Jimbo

at 11:53 pm

What were the average sales price in Vancouver?

With the climate in Asia changing it will be interesting to watch what protester capital leaves and stays in the next 5 years.

Appraiser

at 7:44 pm

Also the Bank of Canada commented on the Canadian Housing Market today:

“Housing activity has regained strength more quickly than expected as resales and housing starts catch up to underlying demand, supported by lower mortgage rates.”

https://www.bankofcanada.ca/2019/09/fad-press-release-2019-09-04/

Chris

at 8:28 pm

“In this context, the current degree of monetary policy stimulus remains appropriate.”

Sounds like BoC doesn’t foresee a Fall interest rate decrease.

FDP

at 8:41 pm

Interest rates are low. Now is the best time to buy a house in the GTA Lock in, and save. It won’t pay to “wait”.

Pessimism over last little while will turn into regret.

Jimbo

at 9:21 pm

Maybe the wino was onto something when they said there wasn’t any good shopping or fine dining…..

Hard to believe they couldn’t get you into the room you booked, almost as bad as Air Canada.

Andrew

at 9:23 pm

David I don’t know how clear your first point was; are you saying that buyers will be affected by world events or that they won’t? You sort of argued both sides. I see what you’re getting at. These are crazy times indeed, and although we have access to news add an instant like never before, I feel as though more people are also uninterested than ever before. There are so many things vying for our attention, we often don’t follow what is most relevant.

Stephen

at 12:08 pm

Brexit and this current US/China trade war will be footnotes in history books.

The burning of the Amazon is a far more concerning issue and will unfortunately impact all of our lives – especially your children’s generation.

Sergio

at 2:01 am

I believe that is one of the such a lot significant info for me. And i am happy studying your article. However want to observation on few basic things, The site taste is perfect, the articles is actually great : D. Excellent activity, cheers|