…we finally got a piece of the pie!

I could have called this blog post, “Don’t Call It A Comeback,” but I’ve used that before. I know this, of course, because I started writing today and it sounded quite familiar, so I actually Googled my own website and found a 2020 blog post about clauses “making a comeback,” complete with the 700-word rant about Sirius XM, 80’s hip-hop, and the brilliant lyricist himself, LL Cool J.

So how about a reference from The Jeffersons then?

I will admit: I’ve never seen the show. After all, it ran from 1975 to 1985 and I was born in 1980. I suppose it could have been played in syndication, but I was busy watching Who’s The Boss and Growing Pains in syndication. I never really got into Cheers, but don’t hate me…

I actually didn’t learn about The Jeffersons until I saw the whole cast in an episode of The Fresh Prince Of Bel Air.

But everybody knows the song!

Well we’re movin’ on up, to the east side

To a deluxe apartment in the sky

Movin on up

To the east side

We finally got a piece of the pie

Last week, I received a phone call from somebody who’s number was saved in my phone, but for who’s name I simply couldn’t place.

He said he had spoken to me about five or six weeks ago about a listing I had and that I mentioned I might have one coming out in the area this spring.

I did recall this conversation, after a few minutes.

He had called on an early-January listing in Davisville Village; one that wasn’t without issues (only a 2-bedroom, all electric heat, facing apartments and developments, etc), but which represented entry-level in the area.

He said, “You told me a few weeks back that you might have something coming out in March?”

I replied, “Yes, that’s true. Good memory.”

He laughed and said, “Yeah, well I’m trying to get something and there’s not much out there. So I remembered we had spoke and you said you had a 3-bedroom semi coming out, and you said it might be around $1,100,000, so I wanted to see if you’re coming to market soon or if they’re interested in selling now.”

I answered, “Well, yeah, they’re coming to market, but I don’t think they’re at $1,100,000 anymore.”

He said, “Oh yeah?” with a hint of excitement.

I said, “No, I mean, we spoke in the second or third week of January. The market has moved since then. I think they’d be upwards of $1,200,000 now.”

“Whaaaaat?” he answered. “You mean they expect more?” he said.

“Yeah, of course,” I replied. “The market has moved.”

“The market has moved up?” he answered, sounding utterly confused.

But to be honest, I was confused. How could anybody not see this?

And then I gave it about two seconds’ worth of thought and realized: the market changes so quickly out there, the media is always three months behind, and people who aren’t working with buyer agents and just keep calling listing agents on properties aren’t being educated about what’s happening in the market.

This poor guy. He was stuck in December or January. But how is anybody to know?

When the market changes, whether it goes up or down, there’s just this feeling out there that’s hard to describe.

I remember in 2017 when the market stopped moving in April and we started to see properties not selling on offer nights and being re-listed. It was happening frequently and we started printing listings and pinning them up on the wall in the board room, like we were the FBI creating a map of a fugitive’s movement on the wall. All we were missing was the string…

The market started very slow this January but things started to ramp up toward the end of the month. It starts slow, with a colleague saying, “Hey, did you see they got 17 offers on 123 Smith Street?” and then momentum builds from there.

By mid-February, things felt busy.

By the end of the month, we were all saying, “The market is back.”

Back to what?

Normal. Back to normal, to be honest. We’ve basically been in a seller’s market for two decades and dare I say we’ve been in a “hot” market for two decades. That is what we’ve accepted as “normal,” as crazy as that sounds. Anything but hot is abnormal.

On Friday, I sat down and went through the TRREB stats expecting to see signs of a market that’s making a comeback. But what I found were signs of a market that’s already back.

Across the board, with virtually every stat, it looks like the market is moving again.

Let’s start as we almost always do with price.

The average home price in the GTA increased 5.5% on a month-over-month basis, which is shades of 2022 when we saw increases of 7.3% and 7.4% in January and February.

Now of course, we saw a decrease this January, so we’re not anywhere near the path we took in 2022.

But it’s important to note that the GTA average home price is now higher than any month in the fall.

For all the buyers out there that didn’t buy in the fall, after a 5%, 10%, or 20% dip in prices in their target neighbourhoods, because they wanted to see if the market would drop further in 2022, well, they took a gamble and it looks as though they lost.

They lost if the market continues the way it’s going, but honestly, raise your hand if you expect the average GTA home price to be lower than $1,095,617 in March? You, there, the one person with your hand raised – lower it. You look like a clown.

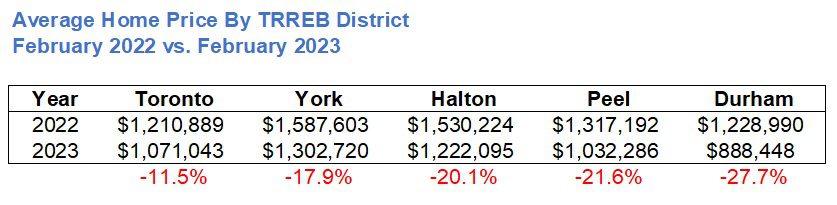

I’d be remiss if I didn’t mention that we’re still off 17.9% from the peak in February of 2022, but the decline is over, folks. Kudos to anybody that jumped in during that dip, because it’s moving on up from here.

Now, does this mean that everybody’s house is worth 17.9% less today than one year ago?

Of course not. The law of averages tells us as much.

So how does this 17.9% decline in prices look if we break it down by TRREB district?

Like this:

This is what you would expect, right?

A house or condo in the 416 isn’t going to move in tandem with a property in Durham Region, right?

The wild bids of February, 2022, were about 11.5% higher than they would be today for the same house, but meanwhile in Durham Region, sellers can expect 27.7% less than last year?

Sure, it sounds correct on a relative basis.

But some folks in Durham Region might only take an 8% haircut from last year. It just depends on where they are and what they’ve got.

A recent sale on Bessborough Drive in Leaside for just shy of $3.4 Million told me, “This price is on par with what would have been paid in February of 2022.” I mean maybe, maybe, they’d have gotten $3.5 Million last year? But we’re not off by 11.5%. That price is hand-in-hand with February of 2022.

I think what it comes down to, as it always does, is the level of inventory.

The tighter the market is, the higher prices will move.

Last month, we saw 4,783 sales and 8,637 new listings.

That’s a sales-to-new-listings ratio of 55.4%.

What does that mean for the market?

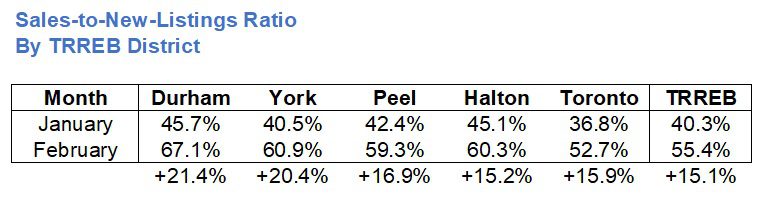

Well, if I want to know, Then I’m going to look at this on a relative basis. I’m going to look at how this figure compares with prior months, and it looks something like this:

It’s said that anything over 50% is a “seller’s market,” and anything under 50% is a “buyer’s market.”

I think we could all agree that April, May, and June of 2022 were not buyers’ markets, despite what the SNLR shows.

But in Toronto, we’ve grown accustomed to seeing SNLR in the 60% range with regularity.

In fact, in 2021, the lowest SNLR in any one month was 64.3%, and the average that year was 77.2%.

That’s a hot market. Maybe not quite a “normal” market, but closer to normal than what we saw in the latter half of 2022.

As you can see from the chart above, the 55.4% SNLR in the GTA in February is higher than any month from March through November of 2022

That’s kind of crazy when you think about it.

The market is tighter now than it was at any point from March through November, and the December stat is always inflated because nobody lists in December.

From this data, I’m seeing a hotter, tighter, more competitive market than last fall or summer.

Is there any other way to interpret this?

Simply look at how month-over-month sales and new listings changed:

New listings are only up 12.3% from January to February.

However, sales in the same time period are up 54.3%.

What greater sign could there possibly be of a surge in demand in the face of stagnant inventory?

If there was more offered for sale, more would have sold. Easy.

Give us another 3,000 listings and we probably would have had another 1,800 sales, or at least, statistically, 1,662, based on that 55.4% absorption rate noted above.

But that’s the TRREB figure; 55.4%.

And there are five major districts in TRREB: Halton, Toronto, York, Peel, and Durham.

When we look at each individual TRREB district, you can clearly see just how much the market has tightened.

Here’s a comparison of the SNLR from January to February:

That’s incredible.

Durham Region, of all places, saw an increase in SNLR from 45.7% to 67.1% in a month’s time!

And ironically, Toronto, where prices have increased the most, “only” saw a 15.9% increase in SNLR on a month-over-month basis. Not to mention, the 52.7% SNLR is actually the lowest o of the five TRREB districts. Imagine what would happen to prices if that topped 60%?

That might be where we’re headed and yet it might not be.

New listings are going to skyrocket this month, and sales will too. But on a relative basis, to top a 60% SNLR, we’d have to see sales increase by 72% if listings increased 50%.

For those who followed that math, we should start a club…

Of course, I wouldn’t be telling the whole story if I didn’t show you this for context:

All this talk about the red-hot market and yet we saw the second-fewest number of sales in February since 2002?

Yes.

So for those who still have a bearish outlook, feel free to use that in your rebuttal.

Then again, if you’re going to do so, please look at this too:

Any bearish outlooks floating around out there?

If there are, I’d love to hear from you!

Because in my view, this market is doing nothing but moving on up…

Post Scriptum:

Somebody just emailed me this from their Instagram feed:

No wonder there’s so much confusion in the market.

BlogTO is to Toronto real estate what Fox News is to viewpoints on Joe Biden…

Peter

at 8:48 am

Let the battle with BlogTO rage on!!

Ed

at 10:02 am

David you are quite the optimist.

Prices are basically back to October levels and the SNLR is nothing special.

I see the path forward being very similar to 2018 and 2019. Depressed but steady sales and steady prices.

Oh and interest rates will be going up, as we can’t be far behind the Fed as the CDN will drop too much.

Nobody

at 10:04 am

Given recent economic results central bank rates are going up by another 100BPS minimum in the next 90 days.

It also takes a while for things to get transmitted… Florida was hitting the gully in 06, a couple funds got annihilated in June 07, market crashed in August 07 for a few days, Bear Stearns died March 08, and Lehman exploded in September 08. Short sales were ongoing through 2010. Miami bottomed out in 2011. Greenwich Ct, land of hedgefunds, peaked in 06 and didn’t recover that peak in median prices until the pandemic buying spree in 2020 for suburban and exurban properties.

Time from first frost to final resolution is just so much more than people expect.

Derek

at 11:17 am

I have a bearish outlook!

Different David

at 10:46 am

https://www.thestar.com/business/2023/03/07/more-canadians-are-taking-out-private-mortgages-and-a-rise-in-defaults-could-follow.html

QuietBard

at 11:22 am

David – will you be doing another blog post on the stats for the condo market? I think it would be interesting to see how the numbers compare to January.

Also, is the 2mil+ homes segment “hot” as well?

Vancouver Keith

at 11:49 am

Liquidity, liquidity liquidity. The bull has a master, and Canada and our central bank are not in control of our fate. One of the few correlations in the world of economics that approaches 1.0 is the relationship between the U.S. fed interest rate and the Bank of Canada interest rate. The BOC has done a good job on Canadian inflation but there is much work to be done in America.

The U.S. fed rate is likely to increase further, which will hurt the purchasing power of the Canadian dollar and increase inflation in Canada. The battle of inflation is a nine inning game and we aren’t even halfway there. There are very likely more rate increases to come, and at least a moderate recession is more likely as GDP is grinding to a halt.

Historically inflation is difficult to defeat, and sticky on the way down. We are living in an accelerated world, but we are a long way away from the BOC goals for employment, inflation and growth. The process of getting there will be lumpy and take some unexpected turns. Interest rate changes take a year to fully impact the market, so there are a lot of increases that are still working their way through the economy.

Sirgruper

at 11:51 pm

Wow VK. Great timing!

Francesca

at 1:39 pm

Glad to see you are featured again David on another real estate article. May be an interesting future blog post

https://www.ctvnews.ca/canada/real-estate-broker-weighs-in-on-class-action-lawsuit-against-realtor-commissions-1.6300539

Alex

at 1:51 pm

Media and general public are generally 3 months behind those who work in the R.E field. Yet when you try and give facts, you are are roasted. I know that most agents have agendas but numbers don’t lie and when you eat, breath and sleep real estate then you get a sense and feel a shift. If interest don’t go up this spring, we are in for a very very busy quarter with good sales and prices going up. For those that know, they know. And not sorry for all those bears out there waiting for 2008 prices again, if you didn’t buy last Summer/Fall, you missed out again.

Different David

at 9:11 am

The other aspect is that a recovery in the real estate market is not click-bait. People who hold and own their property treat it as business-as-usual, and investors are hoping for MORE growth – they treat any gains as recovery of 2022’s loss.

On the other hand, house values dropping XX% are news for both retirees who’ve put their entire nest egg into this one investment, and people eager to enter the ownership segment

Adrian

at 2:38 pm

I’m wondering if this February increase is directly related to mortgage rates falling over the past couple months, in february some people were getting mid-4s for a 5-year. Now that 5-year fixed rates are up around 5%, will we see a slowdown in activity? Although I’m bullish on Toronto (but not burbs with no transit) I can’t help but wonder if we’re really just at the mercy of mortgage rates at this point.

Ace Goodheart

at 6:53 pm

Looks like the Fed is bumping rates again, which means we either follow, or our currency becomes devalued (which means more inflation, which means higher rates).

It will be interesting to see how many more rate increases the real estate markets can take.

Tiff is about to get backed into a corner

Different David

at 12:49 am

Isn’t there an option 3, where we let our currency sag down to the 60 cent level, and let our goods become cheaper and drive investment in Canada? True, it means that snowbirds and leisure travellers to the US take it on the chin, but for the country as a whole, isn’t it a good thing?

Average Joe

at 10:56 am

We generally export raw materials and parts, and import finished consumer goods. Driving the currency down imports inflation. Our manufacturing base is still much higher in costs and has much longer approval processes than Mexico. Labor availability is already zero and Canada has a poor track record on worker productivity outside the energy sector. Central banks are trying to reduce economic heat to slow inflation, not generate more spending/investing. Interests rates have been low for almost 15 years driving crazy asset multiples (driving up tech values in the U.S. and housing values in Canada). This cycle is over.