Happy Friday, folks!

While I have a very lengthy and somewhat contentious blog post lined up for next week, let’s first take a look at some stories from the week that are now in the rear view mirror…

The Weird Gets Weirder

It’s a difficult market out there and many agents don’t know how to work within it.

But can you blame them?

Some of them haven’t seen a market like this. Others are brand-spanking new. Then some can’t work within the market because they’re not actually agents.

Wait, hold on. I’m like the Boy Who Cried Wolf here. You know how, sometimes, I like to exaggerate and describe the fly-by-night agents as “not really being agents?” That’s not this. Let me explain…

Last weekend, I was paged on a Friday night to call an agent about a listing. An Agent. That’s what the page said.

I called the number provided but it went to some woman’s voicemail, and the agent was a man. Weird. I didn’t leave a message, thinking perhaps it was a wrong number.

On Saturday, I received another page to call the same agent, with the same woman’s phone number.

I tried the number again, literally minutes after I received the page, but there was no answer.

Moments later, my phone rang and the call display was that woman’s number, so I answered.

“Hello, um, this is Manny,” the man said. “I’m an agent and I have clients interested in your listing.”

He went on with some preamble which, although unnecessary, is perhaps a good way to build rapport.

“The house is beautiful,” he said. “My clients aren’t super fussed on specific location and they can do this pocket here or they can go north or south of the main road,” he explained. He went on to explain that they need four bedrooms, they really wanted a garage (which this house didn’t have) but he was able to convince his clients that the house was worth pursuing even without the garage.

He asked about the closing date, the rental items, and the inspection.

But really he was just buying time to ask about the price.

It’s sort of like, as my father explained, how you bought booze in the 1960’s when you were 18-years-old.

“Lemme have a pack of Chiclets, some mouth wash, that black comb, a six-pack of Miller Lite, a tube of that hair paste, and a safety-razor, please.”

Except as my dad explained, a savvy shop owner would put all those items on the counter, ring them in, and then say, “I just need some ID for the beer, please.” Oh, how many times did the boys walk out with all that pharmacy crap that they didn’t need?

In any event, I said to the agent, “Look, you’re angling toward price right? You want to ask about price?”

He stuttered and said, “Oh, um, well how is it going over there? What’s the interest like?”

I said to him, “Look man, in this market, transparency is important. You want to know about price? Just ask me about price.”

He said, “Well, my clients are on a budget. I’m just trying to figure out how to advise my clients.”

I said, “What’s the budget?”

He said, “I can’t just start throwing out numbers.”

So I replied, “We’re listed at $1,600,000. We’ve been out on the market for three days. We’ve had lots of interest. So if you’re client’s budget is $1,600,000, then we’re in business.”

He told me, “My clients are looking more around the $1,350,000 range,” to which I immediately shot back, “I thought you weren’t going to ‘throw out numbers’ though?”

He was very quiet.

I told him, “Honestly, I wouldn’t bother showing the property. You’re way off on price and I want to save you the time, as a professional courtesy.”

He then answered, “Well, I mean, I’m just trying to figure out how to advise my clients.”

Again, I told him, “And I would advise them to skip this one as we’re just way too far apart on price. You’re $250,000 under list here, so we’re just not speaking the same language.”

I said, “Good chatting, I gotta run,” and he thanked me for my time.

As luck would have it, we received a notification of a registered offer later that day.

I was very excited, however upon opening the offer on my phone, I was surprised and confused.

The price was fine: $1,575,000. The closing date in November was fine too, and I could deal with the one condition for three business days.

But the name of the buyer?

Manny.

Manny?

Yes, Manny.

Oh, Manny.

This guy called me, under false pretenses, lied about being a real estate agent, lied about “having clients,” and misrepresented himself as well as the agent who would eventually submit the offer.

The agent was shocked and embarrassed. Completely stunned.

It didn’t really matter in the grand scheme of things. In fact, it worked against Manny, since he came in way higher on price than he should have.

But it was the very first time in my career – at least that I know of, that a random buyer called me and lied about being a real estate agent.

Weird phone call.

At first, I thought he was just a really bad real estate agent.

But by the time we had finished the transaction, I realized he was just inadvertenly good at acting like a bad real estate agent…

Muhammad Ali Said, “It Ain’t Braggin’ If You Can Back It Up!”

Here’s a story I heard through the grapevine.

A real estate agent has a $14,000,000 listing. This agent is one of the top agents in the city, well-known, well-liked, and I’ve never heard a bad thing said about this person.

Twelve months go by and the property doesn’t sell. The owner refuses to reduce, and the listing runs out.

Another agent gets the listing immediately thereafter, but there’s a caveat: the seller now agrees to reduce to $11,000,000.

The property sells in twelve days.

The new listing agent sends out a flyer advertising: “Listed With Another Agent For Twelve Months. We Sold The House In Twelve Days.”

No mention of the price.

Offside, or fair ball. ?

Selling Half A House?

Attention, real estate lawyers: we’re going to need your help on this one.

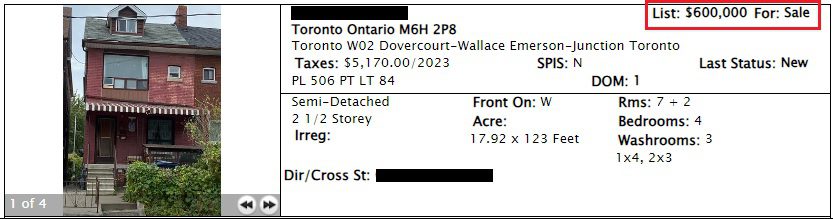

I saw a listing last week that looked too good to be true.

Even if you have minimal knolwedge of the market here in Toronto, surely you must see this is a downright steal:

This makes no sense.

It’s a semi-detached, 2 1/2 storey house on an 18 x 123 foot lot, currently set up as a 4-bedroom, 3-bathroom.

Even if this house were in derelict condition, it must be worth more than $600,000.

I mean, if I had to guess, I would think it’s worth somewhere in the neighbourhood of double.

It looks too good to be true, and in this market, that means it probably is.

As you may have guessed, there is an explanation here. But it delves off into the world of “firsts” in that this is the very first time I have ever seen this in an MLS description:

![]()

Huh.

Is that legal?

I mean, it is in theory, and it all depends on the type of ownership.

This comes down to “joint tenants” or “tenants in common,” as a lawyer will more succinctly explain.

We typically distinguish between joint tenants and tenants in common when it comes the death of one owner.

Joint tenants benefit from the “right of survivorship,” in that if one of the two property owners dies, the other one automatically inherits the other half of the property.

Tenants in common own their respective “halves” of the property, assuming each owns the same amount. So if one of the two owners dies, instead of the deceased’s half passing to the other owner, it passes to the deceased’s estate.

In the case of the above property, if there are two owners and the property is owned the two individuals as “tenants in common,” then the one owner can sell her 50% interest.

Could she sell her 50% interest if they were joint tenants? I’m not sure.

Any lawyers in there, feel free to weigh in.

But I’ll say this: I’ve never seen half of a property being sold on MLS before, and I don’t know how in the world the market is going to make sense of this. I also don’t know who in the world is going to buy this…

Moving To London?

Remember the 2022 campaign by the Province of Alberta that sought to recruit Torontonians in need of more affordable real estate?

I wrote about this on my blog a few times last year.

Here’s the article:

“Alberta Is Calling’: Marketing Campaign Calls On Toronto Residents To Move Out West”

City News

September 26th, 2022

The campaign made light of Toronto’s high housing prices, compared them to Alberta’s, and suggested that life was better out west.

“It’s mountain time somewhere,” one advertisement read.

“An engineer, accountant, walk into a province. They all get jobs,” was featured in another advertisement.

These ads were littered throughout Toronto, especially on the TTC.

Ironically, as I posted on TRB in late-2022, the campaign backfired in some ways when people started to come out of the woodworks and suggest that they moved to Alberta and were now moving back to Toronto…

“I Moved To Alberta And Hated Everything About It. After Three Months, I Came Back To Toronto”

Toronto Life

December 13th, 2022

In any event, a reader sent me this photo on Wednesday:

Have you seen this?

I hadn’t!

But I went to the website, www.donttelltoronto.ca, and it’s a very interesting take!

From the home page:

Hello, Torontonian. Look, we love Toronto, too. It has lots of great people, but let’s face it, it’s tough out there. Tough to find affordable living, tough to find a bit of green space, tough to find parking when you need it. We have a lot of great London opportunities at some of Canada’s best employers, and London is a great place to live – green space, backyards and driveways, room for a family and a Great Dane, trails, the Thames River, great music and theatre scene, international cuisine, and a ton of festivals. Your next career can be here – and don’t worry, we won’t tell Toronto if you don’t.

There’s really not a lot to the site other than the above blurb, some quick stats about London, and a form field.

I haven’t been to London since I toured the University of Western Ontario campus in 1998.

So what say ye?

Any takers? Anybody moving to London for greener pastures?

Recruiting Season!

This one is more for the real estate agents who read TRB, but for those of you who watch real estate television shows and want to know what really happens in the industry, you might find this interesting as well.

It’s recruiting season for managers and brokers, and the phone has been lighting up. Many brokerages are having trouble right now, so the thinking goes, “I need more agents! I need new agents!”

Kudos to the brokers and managers for “working the phones,” but what I always find fascinating about recruiting is that, all too often, the company that is trying to recruit you is a far, far lesser brokerage.

For context, imagine a minor-league hockey team calling Sidney Crosby and asking him to come play for them.

While I recognize that, “There’s no harm in trying,” and that “You miss one hundred percent of the shots you don’t take,” I find the efforts to be so incredibly misplaced.

I was called this week on behalf of an agent who I have never heard of, working for a brokerage I have never heard of, but the agent himself wasn’t calling me. No, he had outsourced this to a call centre which was clearly in another country. After the call, I looked the agent up in a third-party system we have that lists all Realtor transactions, only to find he has completed four transactions in the past twelve months. And he started his own brokerage? He’s trying to recruit seasoned agents?

It’s just so odd.

We were in our team meeting this week and Tara’s phone rang. It was a recruiting call from – again, a brokerage we had never heard of. She politely declined, and then five minutes later, Matthew’s phone rang. He smiled and showed us the Caller ID. He let the call go to voicemail, and then three minutes later, Chris’s phone rang! This broker was clearly working down a list, but never stopped to think that agents who work together might actually be sitting together at the time of these calls?

I’ve seen a lot of experienced agents decide that they don’t want to work and grind anymore, and who try to start their own brokerage and recruit. It’s not working. And it’s not going to…

Not The One?

I have written countless blog posts on the perils of pre-construction condominium “investing” over the years, dating back to the very inception of this blog in 2007.

A few years ago, I started to call on the actual buyers of the pre-construction condos to take accountability and responsibility and acknowledge that investments carry risk. I argued that it was time to stop questioning “Why did this condo project fail?” and start asking the question, “Why did I invest in this, and did I understand the pitfalls?”

Case in point:

January 22nd, 2021: “The Friday Rant: Hate To Say I Told You So”

This, of course, refers back to the original cancellation of a project called “MUSEUM FLTS,” which we should have known would fail, since they didn’t have enough money for the missing “A” in “FLATS”.

Here’s that post:

November 13, 2017: “Another Pre-Construction Condo, Cancelled. Who Is To Blame?”

And yet here we are, six years later, and buyers of a failed project are still complaining and asking all the wrong questions.

Most of you read this story, I’m sure:

“Frustrated Buyers Want Out Of The One Condo Project – But Can’t Get Refunds Or Complete Assignment Sales”

Toronto Star

October 24th, 2023

It reminds me of the time that I bought shares of Nortel Networks for $50 per share, and when they went down to $35 per share, I said, “I want out.”

I wanted my money back.

All of it.

But of course, that’s not how a market works, nor is it how investing works.

And in actual fact, I didn’t ask for my money back, because I was logical enough to understand the risks of making a bet on a stock.

The buyers of condos at “The One” knew that, or at least should have known that.

So to see them line up to complain to whichever newspaper reporter gives them a forum is very, very disappointing.

I thought we were past all this?

There are risks to pre-construction investing. Many. It’s why I have never sold one in twenty years.

And these investors shouldn’t just be worried about getting their deposits back today, or in a timely manner, but rather they should be worried about losing a large percentage of it.

I didn’t want to touch this topic today, but so many people have emailed me the article or asked for my opinion.

I’m sure this won’t be the last we hear of “The One” and I have to wonder what will come first: the registration of this condominium after completion, or the year 2028…

Have a great weekend, everybody!

Marina

at 8:38 am

The recruiting thing is the same in every industry. When you outsource recruiting, they literally source lists and call everyone on the list. They don’t spend time finding out about them. I get recruited ten times a week for a job for someone with far less experience, and with much lower pay, but so do all my colleagues. That’s because it’s cheaper to hire an offshore caller to dial everyone, than to have a seasoned recruiter actually vet the full list.

I know of four people who moved to Alberta, and one who moved to Port Elgin. It’s about half and half in terms of happiness with the move. Which makes sense.

The one guy who hated it the most will honestly not be happy anywhere. He’s just a sad, angry person. He’s just sad and angry someplace else.

The happiest person is 25. He moved from a 90k job in Toronto to a 85k job in Calgary. Instead of paying $2500 a month in rent, he bought a condo in a trendy area for $300k. His commute went from 1 hr each way to 10 min. Goes to the mountains every weekend.

So it can definitely make sense for some people. But even he has noted that if you are not into mountain sports, things to do get limited fast.

David Fleming

at 9:22 am

@ Marina

I still don’t understand outsourcing recruiting. Quantity versus quality?

What about:

“A job worth doing, is worth doing well.”

“If you want a job done right, do it yourself.”

I get calls from people saying, “I’m calling on behalf of Jane Smith.” But Jane Smith is a nobody and I wouldn’t take a meeting with her if she called me herself and offered to take me to lunch on the moon. But if Jane Smith can’t even call me herself, and has somebody at a call centre in India do it, what’s the point?

I guess recruiters think “It’s a number’s game,” but I know that the really good broker/owners will spend YEARS recruiting top agents, and do so themselves.

Like everything else, I suppose some people are good at it, but most aren’t.

Marina

at 11:21 am

Oh absolutely, but lots of people hope they will win the lottery.

It’s the same as those guys that underbid on property after property, hoping they find someone to take their sh*tty offer. After all, “if you want their business”, you’ll accept.

Sirgruper

at 8:48 am

David

An owner as joint tenants, simply transfers a 50% interest to themselves and severs the joint tenancy. Then it’s 50/50 as tenants in common. Happens all the time when couples are getting separated.

You can theoretically sell 50% in a house but practically it pretty much never happens. You will see it in commercial real estate at rare times but usually you would only do so with a joint venture agreement or a huge discount.

Graham (the OG Graham aka G-Unicorn)

at 9:02 am

I moved to London from Toronto in 2014. I guess I got a head of the curve on that one? But I went to UWO back in the day, so the city wasn’t completely unknown to me. I guess it depends on your priorities and lifestyle. I miss the food in Toronto and the ability to walk to most things I needed (I lived at Yonge and Eglinton).

David Fleming

at 9:24 am

@ G-Diddy

But you miss Shark City though, right?

Graham (The OG Graham aka G-Diddy)

at 10:50 am

I miss Shark City the most… I wonder if that bartender who worked there made a name for himself?

Nobody

at 9:39 am

There are some new brokerages trying to poach big fish that aren’t crazy.

Serhant launched in the middle of the pandemic and has done amazing stuff. But Ryan is famous, does an absolutely massive amount of business, and was one of the very few people with books and classes who wasn’t running a scam.

There’s a newer brokerage in Toronto that has very interesting backers that make it an interesting possibility. But super rare.

Outsourced call centers are worth everything you don’t pay them.

The One has been obviously in trouble for a long time. They were looking around Asia for project finance – not healthy when you’re calling up rich people in Taiwan, Singapore, etc for money for your project that’s years and years into the process.

Anyone trying to assign a new build has huge problems. The psf prices on these things in Markham and North York are CRAZY. North of 2k. Giving assignments away still doesn’t make sense financially. People are going to have to declare personal bankruptcy to get out of these things.

Jenn

at 11:17 am

What’s the new brokerage??

London Agent

at 11:04 am

Welcome to London everyone! It’s intriguing to see an organization make this kind of push to attract talent to London. I’m biased (obviously) but there really is a lot of opportunity here for anyone that prioritizes owning real estate over the lifestyle that Toronto has to offer. I do wish we had more walkable neighborhoods, a car is almost mandatory.

I will say that people moving from Toronto or the GTA to London is nothing new. While most of the “talent” is attracted to job opportunities in our healthcare field, there are plenty of folks that buy homes in the south end of the city and still commute via the 401/402.

I’ve lived in London almost my whole life and I like it here. I’m hopeful for the future of the city and its development. I also have a ton of friends that have either lived in Toronto or plan to. Some of them move home, a lot of them don’t!

Vancouver Keith

at 11:14 am

We’ve got one on the go in Vancouver, but at 163 days on the market it’s getting stale. Co ownership with strangers is a tough sell.

https://www.zolo.ca/vancouver-real-estate/2044-turner-street

ailice

at 2:19 am

Its language is profound and easy to understand, exuding the light of wisdom and rekindling my passion for life. I feel so grateful for this book, it is an integral part of my lifehttp://www.zhisenplastic.com/product_detail/26376.html