Complain all you want about how tough Toronto’s real estate market is, but as with anything else in life, you can always find something worse.

Under-listing, bidding wars, bully offers – Toronto’s 2015 real estate market is unfair, right?

Well let me introduce you to a little-known term that comes from our good friends in the United Kingdom. It’s known as “gazump,” but to the people it happens to, it’s known as “gazumped.” For those who experience it every day, it’s “gazumping.”

Whatever you want to call it, just be thankful it doesn’t happen here in Toronto…

Do you know what one of the most frustrating aspects of gazumping is? Spelling it.

I swear, it took me twenty minutes to find it on Google.

Gazunk, I thought.

Gadzunk?

Gadzonk?

It’s a lot harder to spell than you’d think, and while you all read the subject line, imagine hearing an old British dude use the word in the middle of a conversation, and then try and figure out what he was saying a week later…

Here’s how Wikipedia explains Gazumping:

–

Gazumping occurs when a seller (especially of property) accepts an oral offer of the asking price from one potential buyer, but then accepts a higher offer from someone else. It can also refer to the seller raising the asking price at the last minute, after previously orally agreeing to a lower one. In either case, the original buyer is left in a bad situation, and either has to offer a higher price or lose the purchase.[1] The term gazumping is most commonly used in the UK and Australia, although similar practices can be found in some other jurisdictions.

With buoyant property prices in the British residential property market of the late 1980s and early 1990s, gazumping became commonplace in England and Wales because a buyer’s offer is not legally binding even after acceptance of the offer by the vendor. This is because, by s.2 of the Law of Property (Miscellaneous Provisions) Act 1989 and in order to prevent dishonesty, a contract for the sale of land must be in writing, a requirement of English law that dates back to the Statute of Frauds of 1677. This requirement was originally intended to promote good faith and certainty in land transactions.

When the owner accepts the offer on a property, the buyer will usually not yet have commissioned a building survey nor will the buyer have yet had the opportunity to perform recommended legal checks. The offer to purchase is made “subject to contract” and thus, until written contracts are exchanged either party can pull out at any time. It can take as long as 10–12 weeks for formalities to be completed, and if the seller is tempted by a higher offer during this period it leaves the buyer disappointed and out-of-pocket.

–

The only thing unclear to me at this point is whether the original contract need be oral, or written.

I completely understand the idea of “gazumping” if the original contract is oral. An oral contract is not a contract. I do not have a law degree, but even in a 4th year university “Business Law” course, we were introduced to the Statute of Frauds. I don’t think any contract is really enforceable without having it in writing, unless you and a buddy make a bet, shake hands, and consider it a “gentleman’s bet.”

If somebody called me on the phone and said, “David, my client will give you $268,000 for your listing on Front Street, do you accept,” if I said, “yes,” then what does that really mean?

But I suppose the confusion has to do with the way that real estate is sold in the United Kingdom.

I don’t understand what constitutes an “accepted offer.”

And who makes an oral offer?

Is this the problem? Are folks in the UK going around saying, “I’ll give you seven hundred quid for your flat,” and believing that this constitutes an offer?

Here’s another explanation I found on a law blog from the UK:

–

The problem is that until contracts have been exchanged, the sale agreement is not legally binding. Once your offer has been accepted, either you or the seller can pull out at any time until the exchange of contracts. Unfortunately agents are legally obliged to inform sellers of all offers made on their property, even after one offer has been accepted. But during this period between the acceptance of your offer and exchange, you as the buyer spend a considerable amount of money on surveys, solicitor’s fees, and confirmation of your mortgage offer. If the sale falls through you do not get this money back, and have to fork out all over again next time round – that is, unless you have been put off the idea of buying a new home. If you are part of a chain of sales, you could even be affected by someone else being gazumped.

–

What does this mean?

“Until contracts have been exchanged.”

“Once your offer has been accepted, either you or the seller can pull out at any time until the exchange of contracts.”

It’s confusing as hell, and while we can get past the language barrier in a few seconds to understand that a “brolly” is an umbrella, I think we’d have to forget everything we know about Toronto real estate in order to understand how it works in England.

What is the “exchange?”

Whatever it is, it sounds like that’s the point when the offer goes firm.

Think about how we have conditional agreements in the Toronto real estate market. If you purchase a condominium, you may put in conditions on mortgage financing, or a satisfactory review of the condominium corporation’s finances. Once you sign the waivers and make the deal firm, then that’s the date for buyer and seller to breathe that sigh of relief, and know that the deal is, for lack of a better term, “all good.”

In the UK, it seems there is a gap between the “acceptance of the offer,” and the “exchange of contracts” whatever that may be.

In this time, nothing on paper is worth a damn.

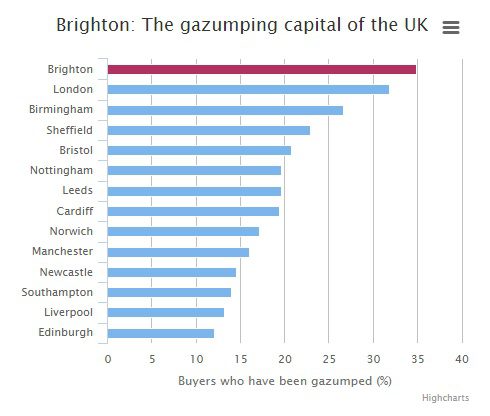

Here’s a rather scary graphic about the percentage of buyers in the UK who have been gazumped:

That’s insane.

And it creates a domino effect that reverberates through the entire market.

Imagine that you buy a house in Riverdale, and then you sell your condo on Front Street in anticipation of moving to Riverdale. Five weeks later, you find out that you were “gazumped,” and you’re no longer the buyer of the Riverdale house.

Now, you have no choice but to pull out of the sale of your condo on Front Street.

But the buyer of your condo on Front Street sold his condo in Mississauga in order to move to Toronto, so he has to pull out of his sale as well.

The buyer of the Mississauga condo, who was looking forward to moving out of his mother’s basement, now has to face another two months of mom turning the heat up to 85-degrees at night so she doesn’t “catch a chill.”

And so on…

I still, for the life of me, don’t fully understand gazumping.

The “why” isn’t even the issue. It’s about money.

But the “what” isn’t clear!

I’ve heard about buyers being gazumped the day before closing! So what does this “exchange of contracts” refer to? Is that what they call “closing?”

Wouldn’t that be something?

If you could be gazumped at any point from the day you have an “accepted offer” up until closing?

Imagine buying a house today – March 2nd, and agreeing on a 90-day closing. Then almost three months later as June approaches, the seller says, “Sorry, I have a higher offer. Best of luck.”

What do you do?

It’s insane.

Absolutely insane.

I can’t believe the market works like this, and the more I read on gazumping, the more I think, “This can’t be true. This can’t really happen.”

It’s not like we’re talking about some corrupt, unsophisticated country here. It’s the home of our dear Queen!

Say what you want about the real estate market in Toronto and how tough it is. But just imagine how much tougher it would be if we threw gazumping into the mix.

Think about that $599,000 listing that gets 18 offers and sells for $767,000. Now imagine that five weeks from now, the guy who bid $701,000 and got absolutely creamed, decides to come up to $780,000 and gazump the high bidder at $767,000.

It would be chaos.

I never thought I’d say this, but after reading about the market in England, I think I’m okay with the way things work here.

Now if you’re reading this, and you happen to be British, please shed some light on this practice of gazumping.

Either we’re missing something here, or you guys over there are missing a LOT…

Appraiser

at 8:37 am

“The scary part is that, by most accounts, 2012 is going to be the year when housing prices start heading south.”

Macleans Magazine, January, 2012.

GAZUMP!

grasshopper

at 9:07 am

“Until contracts have been exchanged.”

This means that nothing is firm until the title has changed. No deal is a done deal until that point. So, even if you have a signed contract, until the day that you actually have the title (closing day), the other person could sell it to someone else.

Joe Q.

at 10:11 am

That’s actually incredible, if that is really what’s going on. It’d mean buyers have a strong incentive to make “exchange of contracts”, what we would call “closing”, happen as soon as possible, and sellers would have a similarly strong incentive to delay it as long as possible.

Joe Q.

at 10:16 am

Actually, on Googling around a bit, I’m not sure “exchange of contracts” is analogous to what we would call “closing”. “Exchange of contracts” seems more like what would be acceptance of a firm offer in our system (after all conditions have been satisfied etc.)

Joe Q.

at 10:36 am

To follow up, and because I really enjoy replying to my own comments, it also seems that in the UK (or at least England) verification of title to the land is required for offers to become firm (whereas here we proceed with the assumption that the title situation is OK and buy insurance in case it isn’t) — it also seems, judging by popular-press articles about the UK real-estate market, that the “title search” process in England is painful (the records are a mess, the process is fully manual, etc.)

Paully

at 9:34 am

You learn something new every day…I always thought that “Gazumped” was someone having carnal relations with a Gazelle!

David Fleming

at 12:22 pm

@ Joe Q.

I enjoy talking to myself, so it’s sort of the same thing.

I also enjoyed asking questions out loud in class, and then answering them!

Amelia Haynes

at 12:41 pm

What I want to know is how many gazumpers get gazumped after gazumping!?

Kyle

at 1:35 pm

Is it still called gazumped when the buyer leaves the seller hanging or is that called Zagumped?

Appraiser

at 2:54 pm

Interesting quotes from a recent interview with Peter Norman of the Altus Group:

“…the price of home versus rent, or price to income, or income to debt, etc. — are interesting metrics, but turn out not to have much predictive power when it comes to measuring market instability…”

“…Housing busts are rare and do not have anything to do with debt to income or price to income. Busts are always caused by the unexpected or catastrophic events. On another front, bubbles or overvaluation is sometimes seen as the result of unusually high price inflation, but that’s clearly not the case in Canada either, where housing prices have risen 3.4 per cent per year over the past five years, about the same as wage inflation…”

Gordy

at 3:20 pm

3.4%?!

Nope, sorry bud.

bugeyedbrit

at 10:19 pm

Once an offer is accepted, the property is usually taken off the market, and the race to ‘complete’ is on, the property is deemed to be ‘under offer’ at this point, but in reality it means this is the time to do your searches, which means ensure the owner has clear and free title to actually sell the house/flat in question, the local authority have no boundary issues, there are no Liens on the property, that sort of thing. All the while, you get a survey on the property and a valuation done,arrange mortgages etc.

Sometimes there is some horse trading between buyer and seller concerning apparent faults with the property, chattels to be included in the sale price, but as here, not much in a sellers market.

Now its once all that is cleared and still there is no reason not to proceed, contracts are exchanged and a completion date is set (when funds and title are exchanged).

As above Gazumping can happen at any time before exchange, there is also another practice called Gazundering, which is the opposite of Gazumping, where a buyer suddenly decreases their offer, thinking they have the seller over a barrel at an inopportune time.

All of this goes on up and down the chain, and break anywhere can also cause chaos, as all ducks have to be in order for the chain to move.

I tend to like the Canadian way of doing it, at least there is a degree of finality to it somewhat lacking in the UK.

My own experience was as a seller, my first time buyers tried to withdraw from purchasing my house as they were concerned about a snapped stone windowsill, I called their bluff offering to reduce the price commensurate with the cost to replace it, they then having no room left to argue, caved in and proceeded to exchange and completion.

Joe Q.

at 12:08 pm

Thank you for clarifying this for us!

FroJo

at 10:23 pm

Hello dumb-dumbs, I was hoping it had something to do with the Great Gazu.

BTW, oral contracts are contracts; they’re just more difficult to prove. Also, there are certain things that, by statute, cannot be exchanged via oral contract. Like property (real and intellectual).

David Fleming

at 12:26 pm

@ Everybody

Just to keep this topic current…

Last night at 11:15pm, somebody called me to ask why my Starbucks card wasn’t working.

It’s been a MONTH since I sent that flyer out.

Now, can I suggest that some people lack logic?

What’s worse – the 11:15pm phone call about a coffee, or the public thinking that I put $2,000,000 on a Starbucks card?

Ed

at 1:16 pm

Lack logic. That’s being very PC.

I would say people are fricking idiots.

Ed

at 1:17 pm

oh and by the way, sorry for calling so late.

mortgageJAKE

at 6:28 pm

David, have you done any research into the open bid process in Australia?

I do remember reading a NYTimes article that in OZ, where open bids are welcome, houses do tend to sell for higher on average because of the “emotion” involved in such a process, vs what we have here (i.e. you never know if you get one, or more shots at the table)

Dermot Power

at 3:33 pm

If you believe it cant happen in Toronto, think again. My dauhghter has just been gazumpzed in Toronto.