I recently came across this old edition of Toronto Life from July, 2010, and I want to take a moment to reflect upon their real estate “predictions.”

Stop me if you think it’s unfair, but shouldn’t predictions carry some merit?

How about a classic Super Mario Brothers reference to start the week? If you don’t understand the photo above, then you clearly were not a child of the ’80’s…

So what can we say about predictions?

Are predictions just for fun? Should they be all reward, no risk?

Whether making predictions for the Stanley Cup Playoffs, the American Republican Nomination, or for 2012’s best growth stocks found on the TSX, I feel like predictions should carry some merit, no?

If you stood up in September of 2011 and said, “I predict the Columbus Blue Jackets will win the Stanley Cup,” then what do you deserve today? Do you deserve scorn and ridicule? What about some sort of hindsight analysis?

What good are predictions in today’s world?

Last week, I was helping my manager clean out two old desks in our office that have been collecting garbage for a decade. I found a box of flyers advertising an open house on Briar Hill Avenue…….from 2007!

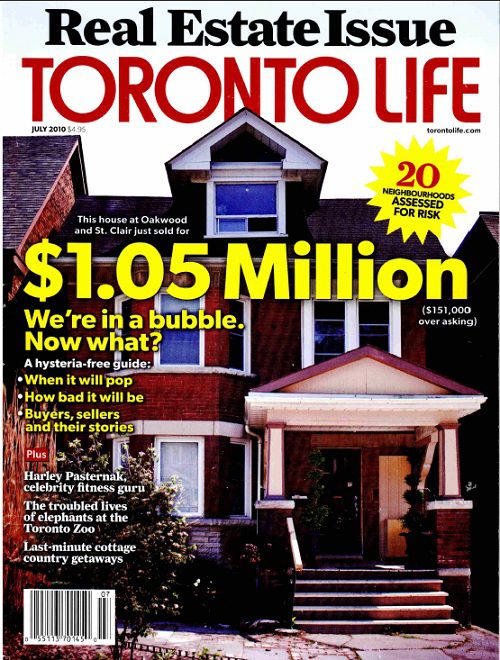

But upon rooting through this time-warp, I found this Toronto Life back-issue from exactly two years ago, pictured below:

In July of 2010, Toronto Life released this issue whereby they stated, emphatically, that Toronto was in a real estate bubble that was right at the top, and seconds from bursting.

Upon closer inspection, it seems that the market has increased some 15-20% since then, depending on where you look. But I digress…

I’m not Garth Turner – predicting doom and gloom, every year, forever.

I’m not a prototypical real estate salesperson, predicting nothing but sunshine and rapid appreciation, every year, well into the future.

I am a realist, and I pride myself upon working in today’s market, not tomorrow’s, and not yesterday’s. I predicted in 2011 that prices would level off and we’d see 1-2% growth, and instead, prices rose double-digits in some areas.

I’m honest, and I can admit when I’m wrong, but I’m not an eternal optimist.

However, there are those eternal pessimists that have been predicting the real estate apocalypse since the market first turned around after the 1989 drop-off.

I’m not going to say that Toronto Life has been more cup-half-empty, but they’ve certainly jumped the gun at one time or another! They’re no Tony W(r)ong or Garth Turner, but this July 2010 edition of the real estate Armageddon has to be re-visited just so we can see how off base they truly were.

Say what you want about their “guts” to go out on a limb and suggest that July 2010 was the Toronto real estate peak, but their predictions were so far off base, and that’s not just hindsight talking.

Have a look at this graphic below, which demonstrates what would happen if interest rates hit a level they most certainly were not going to hit:

They say, “mortgage payments will nearly double.”

Well no kidding, they’ll double, when/if rates go from 4% to 8%. But YOU were the ones that made that suggestion!

How ridiculous!

And who really thought in July of 2010 that mortgage rates were going to head from 4% to 8%? I didn’t. Did you?

Of course, I also didn’t see them going down to 2.99% during the “rate wars” between banks, but did anybody see a DOUBLING of mortgage rates?

Again – say what you want about today’s low-low interest rates, whether good or bad, but to suggest all this doom-and-gloom regarding rates at 8% was simply irresponsible. And to headline a graphic with “mortgage payments will double,” based on your own hypothesis that they will, is counter-productive.

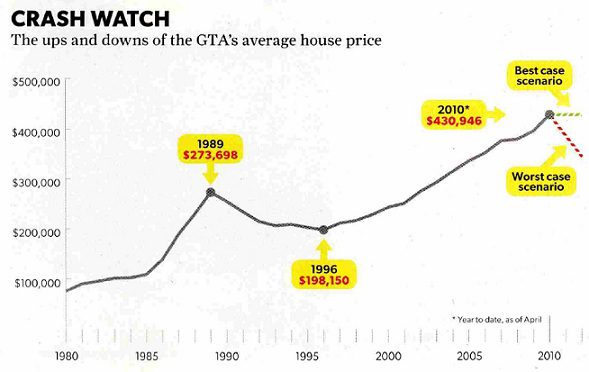

Next, have a look at the graphic entitled “Crash Watch,” where they show you the “best case” and “worst case” scenarios, based on nothing concrete, whatsoever:

Their “best case” scenario looks like a level line, or perhaps a line that is decreasing ever-so-slightly. Maybe it’s my vision in my old-age, or maybe it’s a poor graphic, but that looks like the line is trending down about 0.5%.

The “worst case” scenario shows a decline in average house price from $430,946 in 2010 to what I would estimate is just over $300,000, in what also looks to be by 2012.

Well, I can tell you that the Toronto real estate market did NOT drop 30% or thereabouts, as this graphic predicts, in fact, the market increased by double-digits in every single pocket of the city.

So what to we make of their “best case” and “worst case” scenarios?

Well, the worst case doesn’t matter. That was the worst case, which never transpired. They could have predicted that prices would hit $100,000 in the “worst case,” and there’s really no repercussions.

But the “best case” is what troubles me. To suggest that in the absolute, best, most amazing, most fantastic, eternally-optimistic, fantasy-driven scenario, prices would increase about 0.5% is also irresponsible and naive. Was there nobody at Toronto Life who thought that maybe, just maybe, prices would increase by 2%? What about maybe 4%? What about 70%? Why is the “best case” zero percent, or thereabouts?

I understand that they were predicting the Toronto market would decline, but the need for a hard-and-fast “prediction” changes when you bring the “best” and “worst” case scenarios into play! They were giving themselves an out; a mulligan, if you will, since I spent all day Monday playing golf and it was awesome, FYI! But they chose not to use it, and instead, look like fools. They could have predicted a “best case” of 20% appreciation, and looked smart having hedged their bet between the up and the down.

Alas, it was not to be.

I’m not harping on the massive pessimism, but rather in the way this column was written.

They took twenty neighbourhoods and assessed them for risk, but in many of the cases, they used one single house as a case-study from which they drew conclusions.

For “THE KINGSWAY” area, they wrote, “106 Westrose was listed at $829,000 in October of 2008, before the downturn had registered in some sellers’ minds. It was back on the market a year later, and the price had fallen to $679,000.”

So what?

That’s one house. So out of the thousands in the area, they’re using this ONE house to demonstrate, what, exactly? That the market had dropped 17%?

What they didn’t write in this column, however, is what I just looked up in the MLS archives – that this house was listed seven times in two years, by a brokerage that no longer exists! That’s hardly the house to use for a case study, wouldn’t you agree? This is more the house to use as an example of “how not to sell real estate,” on this blog, which I have done many, many times before.

You know that saying, “you can make numbers say anything you want?” Well the same can be said for journalism, when you take an angle on a story, and need numbers to back it up. This Toronto Life story used bizarre studies instead of common-place studies, and the whole thing is a bit shady, in my opinion.

I know this is all in hindsight. I get it.

But if this were July of 2010 and I was reading the article, I’d probably say the same thing…

Joe Q.

at 9:19 am

Toronto Life swings both ways. They were trumpeting the overheated housing market back in 2005-2006, but they also run a monthly highlight about first-time 30-something buyers, what they do for a living, and how much they’ve spent on their first home (often way over their heads).

In any case, as always, the analysis is more important than the “prediction”.

Sidera

at 9:52 am

As much as I appreciate your insight into the Toronto RE market, Canada is in for a very big shock.

Incomes have not kept pace with the cost of housing. This fundamental indicator never fails to signal a correction in prices. Furthermore, the Canadian economy is solely dependent on the increase of housing. Flippers, condo developers, insurance agents, construction workers, cabinet makers, you name it, etc every other person is directly in the industry.

Demographics alone do not support higher home prices, let alone prices at this current level.

There is no manufacturing, no jobs besides FIRE jobs. That is a huge problem. The level of malinvestment that has occurred over the last decade will take another decade to correct itself.

The most damning indicator of the Canadian RE market is that the CMHC is leveraged HIGHER!!! than Freddie Mae and Fannie Mac were at the height of the US bubble. The CMHC has left the taxpayers with billions in insured mortgages that the banks will reap the benefits, regardless of the situation. That is not capitalism. This is central planning at its finest. Thank the socialist in charge in Harper. People will be calling for Flaherty’s and Carney’s job once every wakes up from this delosuion.

Ralph Cramdown

at 10:28 am

Geez, if only I could go back in time and buy that place on a narrow lot at Oakwood & St. Clair for $1.05MM — wouldn’t I be sitting pretty!

“The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.” — Rudiger Dornbusch

“If something cannot go on forever, it will stop.” — Herbert Stein

“Nobody ever lost money taking a profit.” — Bernard Baruch

jeff316

at 12:07 pm

If you ended up buying something similar for 1.25 then yeah, you’d be sitting pretty. That house is not on a narrow lot, it’s actually quite wide and has three stories.

“They bought it. Incredible, one of the worst performances of my career, and they never doubted it for a second.” – Ferris Bueller

Regular

at 2:19 pm

David,

Last summer you predicted a robust fall but as I recall it was not as expected with hardly any listings. I’d like to see a follow up post about that…..what happened, why were there no listings, etc.

Scott

at 12:01 am

What are you talking about, Regular?

“Hardly any listings” last Fall? Where do you get your information, from Toronto Life?

Dan Dickinson

at 7:08 pm

Sure, it’s all hindsight, but I also remember reading that article, and thinking at the time that a) the 4%->8% rate scenario is a ridiculous one given the way the BoC aggressively manages rates, and b) Toronto Life’s habit of using singular examples to represent overall trends is maddening. Not exactly surprising: good math never did sell many lifestyle magazines. I think this might have been the issue that finally made me cancel my subscription though.

Meanwhile: I kind of want to reply to Sidera, but I can’t figure out whether he/she is a troll, or simply has a terrible understanding of the economy. Either way I don’t think I have the energy for it.

Scott

at 12:02 am

I think the answer is “both”, Dan.

jeff316

at 9:46 am

Re: misrepresenting a bad example as a trend — yes, yes, yes! — I’ve always found it frustrating about Toronto Life. Sure, it is a magazine (and a lifestyle one at that) but I’m surprised how little integrity they have. Then again, the editor gives her husband space in every other issue, so what do you expect.

The way they used this was very misleading. I used to walk my dog out that way a lot, and as mentioned above I’m pretty sure that house is three stories, likely at least four bedrooms, on a 25-30 foot lot with front parking surrounded by large houses. It’s Regal Heights or the western vestiges of Humewood/Hillcrest. $1 million certainly isn’t my price range and “St. Clair and Oakwood” was a technically correct descriptor but with even the slightest bit of thought it is obvious it was picked to make this house sound like it is two steps from a Money Mart and a churrasqueira.

On the bad predictions, well I really don’t think it’s all that embarassing to be wrong. (Maybe because I’m wrong a lot!) I was pretty wrong on the post-2010 market too. Not as wrong as some, but definitely ‘wronger’ than David.

What I don’t understand, however, is that we see same/similar analyses leading to same/similar predictions that are completely incorrect, over and over. Isn’t that an indication that the analysis is off? (mine included) Isn’t that an indication that we’re missing some factors? And what are those factors? We see little discussion of this in the media, and more pointing/dodging, which doesn’t improve our understanding of what is going on.

Vlad

at 3:19 pm

Excellent post, jeff316.

Good questionas at the end too.

Als, levity doesn’t sell as well as alarmism.

Joe Q.

at 9:28 am

The funny thing about St Clair and Oakwood (I live in the area) is that you can be in Regal Heights or the western edge of Hillcrest Village and yet still be “two steps from a Money Mart and a churrasqueira” (plus a bunch of dive bars and tattoo parlours).

The neighbourhood is definitely in transition — but to what, I’m not sure.

Sidera

at 11:31 am

I am not a troll. I am simply providing relevant information to the housing discussion that some people may gloss over and underestimate their significance.

The Bank of Canada will keep interest rates until the cows come home. Carney’s posturing this summer was nothing more than lip service. He has no intention of raising rates. That would instantly cause the Canadian economy to seize.

Canadians fail to see the impact the CMHC has had to the housing market. Insured mortgages given the gold stamp by the Feds has created all of this mess. Banks no longer carry any risk associated with handing out a mortgage. Who wouldn’t give every single person a mortgage that walks into a Bank with 5% down and a little income. The same thing happened in the States with Freddie and Fannie; history repeats itself.

David Fleming

at 12:25 pm

Enough name-calling! That’s childish!

Dan Dickinson

at 11:50 am

Sorry David. As you know a lot of people leave non-sequitur comments in an attempt to pick a fight online — hence the saying, “don’t feed the trolls”. However: Sidera, since you say you’re not a troll and just trying to provide relevant information, I apologize.

So let’s address the information you provide in your two comments:

“Incomes have not kept pace with the cost of housing.”

Clearly.

“This fundamental indicator never fails to signal a correction in prices.”

I don’t have data to suggest otherwise, though I don’t see any data in your comment to confirm your claim either, so I assume you’re referring anecdotally to the US correction?

“Furthermore, the Canadian economy is solely dependent on the increase of housing. Flippers, condo developers, insurance agents, construction workers, cabinet makers, you name it, etc every other person is directly in the industry.”

What I struggle with is the exaggeration. Claiming that the ENTIRE Canadian economy is dependent on real estate is hyperbolic and inaccurate. See below.

“There is no manufacturing, no jobs besides FIRE jobs.”

As of 2010 FIRE jobs represented 18.9% of Canadian GDP. Not 100%. Also, manufacturing represented 17.4% of GDP, despite your claim that’s it’s nonexistent. I’ll assume that you were exaggerating for effect, but to be clear these sectors represent roughly the same proportion of Canadian GDP. Source

“The most damning indicator of the Canadian RE market is that the CMHC is leveraged HIGHER!!! than Freddie Mae and Fannie Mac were at the height of the US bubble.”

I’ll assume you could point to data for this, but I buy it. So, this suggests the government is more exposed should homeowners begin defaulting on their home loans, and the above home-debt-serving-to-income ratio data would suggest they might. I would point out, though, that there are other factors (e.g., less predatory lending practices, lack of tax-deductible mortgages, massively different in-arrears rate, difference in default recourse) which makes a spike in default rates less likely — though obviously not impossible — in Canada than it was in the US a few years back — which, from what I can tell, is the reference point you’re using.

“The CMHC has left the taxpayers with billions in insured mortgages that the banks will reap the benefits, regardless of the situation. That is not capitalism. This is central planning at its finest. Thank the socialist in charge in Harper.”

Harper = socialist. Yeah, I’m just gonna go ahead and assume this is some more hyperbole.

“The Bank of Canada will keep interest rates until the cows come home.”

Ummm…I THINK we agree on this one?? I’m guessing that what you were saying here is that the BoC will keep rates LOW for now.

“Carney’s posturing this summer was nothing more than lip service. He has no intention of raising rates. That would instantly cause the Canadian economy to seize.”

Again…I could go along with what you said right up up until “instantly” and “seize”. The hyperbole makes it hard to distinguish which parts of your statements are reasoned arguments vs. talking points. But history suggests that — while it would never be as drastic as Toronto Life warned — the Bank of Canada isn’t afraid to raise rates if they see the economy expanding too quickly. Unless you have some other insight into Carney’s plans?

“Banks no longer carry any risk associated with handing out a mortgage.”

I’m no expert in this area, but a quick look at a few Canadian banks’ annual reports indicate they provision about $2B per year to loan losses. Granted, that would cover all types of loans, but unless you have some insight or data to suggest that 0% of banks’ total loan losses are from mortgage defaults, your statement is inaccurate. I certainly can’t quantify exactly *how much* risk they carry, but I can safely assume it’s not zero.

RBC: $1.96B in 2011

TD: $2.31B in 2011

CIBC: $1.65B in 2011

“Who wouldn’t give every single person a mortgage that walks into a Bank with 5% down and a little income.

If you buy my logic in the previous point, then it follows that the banks would still do diligence on borrowers. CMHC obviously protects them from some downside risk, but not all. I do have anecdotal evidence here (friends/relatives who’ve been turned down for mortgages) but that’s all it is — anecdotal.

“The same thing happened in the States with Freddie and Fannie; history repeats itself.”

See above. Some of the history here is different. Certainly not so different that Canada is *immune* to a bubble crash, but not identical such that a crash is a foregone conclusion either.

David Fleming

at 1:52 pm

@ Dan

Holy hell, this is the most detailed response I think I’ve ever seen!

Even “DaveyTheJ” has to bow down to this detail and research!!!

dave

at 3:50 pm

ha, indeed!

…i’m not worthy…

…I’m not worthy…

slowly backs away

Dan Dickinson

at 5:24 pm

I was on a very long conference call and had some time/attention to spare.

Sidera

at 12:14 pm

Thanks for the response.

You are correct saying that banks cover loses in their loan divisions. The loses are currently small and minor, maintaing strength in the banks. But when the party stops and the home values stall, then drop, loses will become rampent.

Fannie and Freddie are to America what the CMHC is to Canada. Plain and simple. When the US crashed in 08, Canadian RE took a slight downturn. To combat this downturn, Flaherty instituted the 0 down 40 year mortgage. This combined with home owner tax credits, reno tax breaks and an all out assault of government subsidies HGTV porn has made people crazy!

Though Canada may have some manufacturing, the money in Canada is made by people in the FIRE industry. In the States the construction industry represented 5.5% of employment, now it is 4.5%. Construction in Canada represents 7.5% of employment. If construction employment even slows down a little, one can see the drastic effects.

Have you seen the Toronto RE market lately? Hell the person on the Mash said all these houses were going to sell for way above asking. Not any more! Price drop here, de list there. The party is over. Vancouver is already down 10% sells are collapsing. No one can move a single property.

Canada will have a big wake up call very soon.

Devore

at 7:58 pm

Perhaps Toronto Life should stick to what they do best. But magazines/radio/tv always take today’s buzz, take it to the nth degree, and run with it. One might be well advised to do the exact opposite of what these buffoons are printing when hysteria is at the peak.

dave

at 9:52 am

The difficulty with economic projections such this is to get the timing right.

There were many people who were predicting the US housing bubble as early as 2003, and subsequently had to endure several years of mockery. Take a look at this cringeworthy video from 2006

http://www.youtube.com/watch?v=60CLQse27p8

Clearly at the very least, Toronto Life’s timing is wrong and they were foolish to present a best case scenario of zero further price appreciation. But they’ve published more than their share of pro-real estate features over the last several years, and their recent critical article was not inconsistent with many others in the market, and indeed the recent federal gov’t mortgage changes.

My personal belief is that Canada will revisit the 2009 price lows, and articles like Toronto Life’s will be proven correct, albeit several years off the mark.

God

at 3:46 pm

professionals react to prices, amateurs predict them.