I was in the car with clients today and one of them asked, “Do you think the end of quantitative easing by the government is going to have an effect on the market?”

I’m going to have to answer that question a lot in the coming days.

The words “quantitative easing” appeared in a multitude of newspaper headlines this week, for example:

In the Globe & Mail:

“Bank Of Canada Ends Quantitative Easing Program, Moves Forward Timeline For Rate Hikes”

In the Wall Street Journal:

“Bank Of Canada Ends Quantitative Easing”

In the CBC News:

“Bank of Canada Ends Quantitative Easting Bond Buying Program, A Sign That Higher Rates Are Coming”

More news coverage is on the way, and then will come the columns on how an interest rate increase in 2022 will lead to lower real estate prices.

Except that it won’t.

I explained to my clients that I believe many of the “standard” or “time-tested” measures and metrics used to forecast the real estate market are no longer valid in today’s world, and that textbook thinking doesn’t always play out in reality. The idea that higher interest rates will lead to lower housing prices is exactly that: an idea. It makes perfect sense in a textbook, in theory, in a conversation among economists, and in a vacuum. Many of you are going to call me out for saying this, but talking about “higher interest rates” in regards to a 25-basis-point increase in the fall of 2022, and then trying to make a bearish argument on the Toronto real estate market, is a stretch.

I further explained to my clients that over the last few years, I’ve argued that we can no longer look at debt-to-income ratio as an indicator or predictor of real estate trends, since, to be blunt, poor people don’t buy houses. People who rack up consumer debt and credit card debt are not in the housing market, so the idea that a national debt-to-income ratio of 170% being a red flag for the housing market has been a misnomer for over a decade.

I have also argued that the time-tested, much-believed-in indicator of the market, called “ratio of wage growth versus real estate growth” is also an out-dated metric.

Why?

Well, because there’s been no greater transfer of wealth in the history of modern civilization than the dough that Baby Boomers have gifted to their kids. So if real estate prices in Canada are going up 10% per year, but wages are only going up 3%, the idea that this is unsustainable, based on historical precedence, is inaccurate.

How much money parents are giving to their children to use as a down payment for their real estate purchases has been a topic of much debate.

We’ve long speculated, but this week, CIBC Economics put out a great report which boils it all down, and specifically includes data on Toronto and Vancouver, in addition to the country as a whole.

Since I started writing this blog mid-week, I’ve already seen the story picked up by multiple media outlets, which have provided their condensed version of the story. So I figured we should simply look at the entire report rather than getting bits and pieces from BlogTo, Posthaste, et al.

HERE is the PDF if you want to download.

Here is the report in full:

CIBC Economics

IN FOCUS

October 25th, 2021

Gifting for a down payment – perspective

By Benjamin Tal

benjamin.tal@cibc.com

It is hardly a secret that home buyers are increasingly turning to parents for support. But how big is this phenomenon? Using CIBC data, the following brief note sheds some light on that issue.

The share of first-time home buyers that received help from family members was just under 30% during the past year. Note that this is not a new phenomenon as that share stood at close to 20% in 2015 and has risen gradually since then, alongside home prices. Interestingly, the share of first-time home buyers receiving help did not rise during the pandemic (Chart 1, left).

As for the size of the gift, in 2015 it stood at just over $52,000 and has risen steadily since then. Note, however, that while the share of gift receivers did not rise during the pandemic, the average gift has risen notably to reach a record high of $82,000 (Chart 1, right).

First time buyers are not the only ones receiving gifts. Just under 9% of mover-uppers also receive help. While that share has been on a declining trend (Chart 2, left), the size of the gift has risen dramatically to reach $128,000 in September 2021 (Chart 2, right).

As illustrated in Chart 3, the average size of a gift is highly correlated with home prices. In fact, over the past half a decade, growth in the average size of gift outpaced home price inflation, averaging 9.7% per year—a full two percentage points faster than growth in home prices.

No less than two-thirds of first-time buyers that received a gift indicated that the gift was the primary source of their down payment (Chart 4, left).

Naturally, here the gift is more substantial, averaging $104,000 for first-time buyers and no less than $157,000 for mover-uppers (Chart 4, right).

Overall we estimate that over the past year, gifting amounted to just over $10 billion, accounting for 10% of total down payments in the market as a whole during that period.

By province, the most expensive provinces naturally see the largest share of gifting (Chart 5).

Zooming in on Toronto and Vancouver, Charts 6 and 7 illustrate the dramatic increase in gifting those cities.

The average gift in Toronto during the first 3 quarters of 2021 is now estimated at more than $130,000 for first-time buyers while mover-uppers enjoyed a gift of almost $200,000. In Vancouver, those gifts are even larger, averaging $180,000 and $340,000 respectively.

How do parents come up with this money?

The narrative is that many of them get themselves into debt to support their kids.

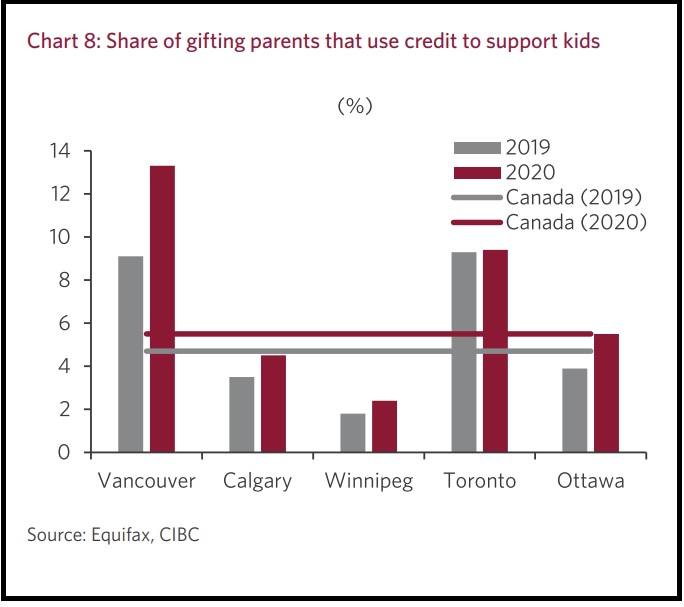

The evidence, however, questions that assertion. Based on Equifax information, we estimate that only 5.5% of gifting parents use debt to finance gifting. That rate is higher than seen in 2019 but it’s still relatively low (Chart 8).

No surprise, the highest share of parents using debt to assist are in Vancouver and Toronto. Therefore, it seems that a large portion of the gifting comes from parents’ savings, which of course grew notably during the pandemic— allowing for the increases in the size of the average gift.

Given the trend and the size of gifting, it is clear that this phenomenon is becoming an important factor impacting housing demand and therefore home prices in Canada.

As for the impact of wealth inequality, clearly gifting acts to narrow somewhat the wealth gap between gifting and non-gifting parents.

At the same time, however, gifting clearly works to widen the wealth gap between receivers and non-receivers. That increase in the gap is much larger than the actual gift size as it might make the difference between owning and not owning a house, with receivers potentially benefiting from future home price appreciation.

Furthermore, gifting also works to reduce the size of the mortgage and therefore leads to significant savings on interest payments over time.

That’s it for me, have a great weekend, everybody!

JF007

at 6:34 am

In my social circle I have friends who plan to gift entire houses to their kids at some point in time and hence multiple property purchases that are then rented out in a self sustainment mode..overall that could be another phenomenon to explore vs just gift for a down payment.

Francesca

at 7:31 am

That’s what our intention is. To buy a condo in a few years for our now 14 year old daughter, rent it out temporarily and then gift it to her when she’s done university as a stepping stone in life so that one day if she gets married and has a family she has some equity to sell the condo if she doesn’t want to live there and buy something else. Home prices are rising so fast that we figure the down payment we would need to gift her in 10 years would be larger than buying a condo in the near future.

My husband and I were both gifted 50 k from our parents in the early 2000s as down payments for our condos so I don’t think this phenomenon is new to the younger generation now. Most parents when they can financially will do what they can to help their kids own.

Appraiser

at 8:44 am

Makes perfect sense in an ever-rising property market, doesn’t it? And not just for the children.

The phenomenon you describe can also work to one’s own advantage. My partner and I bought our retirement condo 5 years ago and have been renting it out since.

When we eventually decide to live there, we will have “gifted” ourselves the difference between what we paid for the condo 5 years ago and whatever price the unit will fetch on moving day.

The added benefit of buying your next home as early as possible, is that you will not be staring down the barrel of future real estate prices in a severely supply-constrained market.

One might be left with the conclusion that the best time to buy real estate (for yourself or the kids) is yesterday.

Chris

at 8:43 am

“…but talking about “higher interest rates” in regards to a 25-basis-point increase in the fall of 2022…”

“The bond market is now pricing in 6-7 BoC rate hikes in the next 36 months with the first hike in March.”

https://twitter.com/robmclister/status/1453361475381301258?s=21

Meanwhile, Derek Holt of Scotiabank was reiterating their call for 8 rate hikes over the next two years:

“Definitely in 2022 I think we’re going to see several rate hikes… We had forecast four rate hikes in the second half of next year starting in July, and we’re contemplating the risk of bringing that forward. I think it’s very feasible that those rate hikes ring in the New Year, if not January, then at a minimum next spring or thereabouts.“

Appraiser

at 8:56 am

Scotia is out on a limb here as the only major voice calling for such increases.

And is being ridiculed by one of your favorites:

“This will go down as the worst forecast of 2021.” Steve Saretsky

Chris

at 9:34 am

Did you miss the Rob McLister qoute above discussing 6-7 interest rate hikes?

CIBC is forecasting 4 increases over the next 2 years, though this was made before the BoC’s latest comments. They’ll likely adjust this as a result.

“Market-based measures have shown a notable repricing of interest rate hikes on rising inflation concerns, with the OIS curve now pricing in three interest rate hikes by the summer of 2022. We do not expect the central bank to move this quickly, but the Bank’s statement is likely to flag upside risks” – TD, again made before BoC’s comments.

“As noted earlier, we think it’s appropriate to pull forward our expectation for an initial interest rate hike into April of 2022. We wouldn’t be surprised if that is followed in June by another hike and we now see 100 basis points of total policy rate tightening in 2022 as a distinct possibility.” – National Bank of Canada

“Our call has been for two rate hikes in the second half of 2022 (July and October) though risks were already tilting toward earlier liftoff. An April start to tightening looks increasingly likely as long as we see continued progress in the economic and labour market recovery over the next six months.” – RBC

Even Saretsky seems to be backtracking:

“The rate hikes are coming, maybe one, two or even three. Once asset prices fall it will be back to the printing press. Don’t shoot the messenger, you’ve been warned.”

https://twitter.com/SteveSaretsky/status/1453792646191714309

Condodweller

at 10:41 pm

You gotta take the Scotia advice with a huge grain of salt as it came out about a week before their fiscal year-end. They may be trying to get people to pull the trigger before rate rises or switch from a variable to fixed mortgages.

Chris

at 12:08 am

If you don’t like Scotia’s, pay more attention to CIBC, TD, NBC, RBC or OIS market, all referenced above.

Joel

at 9:22 am

I am a mortgage broker and these numbers are not in line with what I see. It is also taking into account gift size as an average and not including those who don’t receive a gift.

For parents gifting to move up buyers the large majority I see of that is parents who sell their house and gift the money to their kids, then move into the house with their kids, but are not on title. This is fairly common and a large gift to a move up buyer is pretty rare.

Chris

at 9:42 am

Would be interesting to see a couple more measures of gifts provided, such as 25th, 50th and 75th percentiles. Averages can be skewed by outliers.

Sirgruper

at 12:27 am

It all averages out. It’s quite common for wealthier parents to buy each kid a condo or move up house outright so each will have a tax free investment. Sometimes they will put a mortgage on from the parent to have control or to plan for a marriage to protect the asset.

Chris

at 8:44 am

How do we know it all averages out?

They’ve excluded from calculating the averages those who received no gift.

I would also suspect there’s more likely to be outliers to the high side, e.g. a $1,000,000 gift, rather than to the low side, e.g. a $20 gift.

When looking at other figures, like household income or net worth, you can see how much of a gap there is between averages and medians. I’d be curious to know if that’s the same for this dataset.

Appraiser

at 1:46 pm

“Toronto Rental Market Hot as Average Rents Up 19% in Past 7 Months”

“The Greater Toronto Area (GTA) rental market shows signs that the pandemic’s volatile days are well in the past, as average rents throughout the region have increased for the sixth straight month in a row in September.” https://storeys.com/toronto-rental-market-september-2021/

Condodweller

at 10:03 pm

So BOC is expecting the inflation uptick to peak mid 2022 and hopefully reverse later in the year:

“The recent increase in CPI inflation was anticipated in July, but the main forces pushing up prices – higher energy prices and pandemic-related supply bottlenecks – now appear to be stronger and more persistent than expected. Core measures of inflation have also risen, but by less than the CPI. The Bank now expects CPI inflation to be elevated into next year, and ease back to around the 2 percent target by late 2022. The Bank is closely watching inflation expectations and labour costs to ensure that the temporary forces pushing up prices do not become embedded in ongoing inflation. ”

I haven’t looked at this website in a while and it’s the first time I notice all the various manipulated CPI numbers. It’s interesting that their target is still 2% but the range is now up to 3%. Technically they have a lot of wiggle room if they use one of the “manipulated” CPI values since the CPI-common is still below 2%. I guess we’re safe until all of them climb above 3%:

https://www.bankofcanada.ca/rates/indicators/key-variables/key-inflation-indicators-and-the-target-range/