I couldn’t resist putting “the government” in quotations, since most people who have a problem in 2017 suggest that “the government” should do something about it.

That’s society’s answer to everything these days.

The government. The solution to all of our problems, right?

There’s been a lot of talk about spikes in rent in the past two weeks, and I want to highlight two stories that got the most press, then discuss what, if anything, “the government” should do about it…

It never fails to amaze me when journalists find somebody to pose for the camera, giving an otherwise mundane story that much needed “artwork” to make the article pop.

I get calls all the time from reporters who want a buyer, seller, tenant, or any of the above to go on camera, pose for a photo, or even talk to them, on the record.

Nobody wants to do it.

Ever.

So I stopped asking a long time ago.

Not since 2009, and I remember the exact client, have I had somebody agree to put their name out there.

It makes sense. As one client put it when I asked him, “It’s all well and good now, since I’m 25, and I don’t really care. But the Internet is forever. I don’t want to be on the outside looking in for the big CEO job when I’m 42-years-old, but some random newspaper article from 2010 shows ‘little John Smith’ posing in his living room for some story about downtown living.”

Totally fair.

And since then, having asked maybe a couple more times, getting a “no thanks” each time, I’ve stopped asking.

When reporters do call me, and I tell them I stopped asking, I tell them, “I’m always amazed when you find these people to pose for the camera, with that little rain-cloud perched above their head, looking all sad, for whatever piece you’re currently running.”

One reporter replied back to me, “So am I, but I’m sure as hell not going to tell them that.”

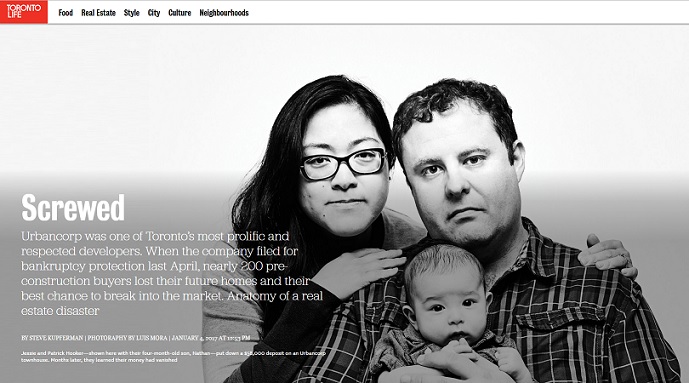

Toronto Life ran an awesome piece about now-bankrupt developer Urbancorp, who I’ve been complaining about for a decade, and in the piece they interviewed a host of buyers who had been screwed by the developer, and got these people to pose for the camera.

This is their feature photo for the online story:

I feel bad for that couple, as I do for everybody who bought into Urbancorp’s projects.

But I’m just amazed when people go on the record, and then pose for photos.

How about this other couple featured in the piece, who were extra sad when the flashbulb went off:

It’s incredible!

Kudos to Toronto Life for the incredible expose, but also for finding people to add “artwork” to the piece.

Personally, I would never agree to that.

Would you?

No offence to these folks, and I don’t want to sound insensitive here because I know they got royally screwed, but as my client told me years ago, “This is now on the Internet forever.”

But maybe none of this matters in 2017?

Maybe we’re so forthcoming with our social media, and life stories blasted on multiple platforms for all the world to see, that this is simply to be expected?

Log on to Facebook, Twitter, Instagram – you can find out what everybody you know had for breakfast, and what sized bowel-movement each of their children had this morning.

So maybe, just maybe, I shouldn’t be surprised when every real estate story these days has “a face” to accompany it.

And with that long lead-in, let me explain why all this matters.

Last week, a CBC reporter named Shannon Martin gave us a great piece called, “No Fixed Address: How I Became A 32-Year-Old Couch Surfer”

This piece blew up, big time.

It was, as the younger kids in my office tell me, “trending.”

The piece appeared in print, and online, and it also came with videos, which racked up thousands of views.

The online article has a whopping 607 comments right now.

If you haven’t read the article, and didn’t click above, let me summarize.

Shannon Martin was renting a 454 square-foot condo in downtown Toronto for $1,650 per month, and her landlord recently gave her notice that the rent would be increasing to $2,600/month.

There’s an audio conversation in the video piece with somebody from the Ontario Landlord & Tenant Board, who simply tells her, “You’re screwed.”

This piece went viral for a few reasons.

For starters, there’s a face and a name to the article. It’s not random, and it’s not anonymous. As we know from the Toronto Life article above, stories get far more attention when there’s real people involved, and when you’ve got artwork!

Secondly, this isn’t just Jane Smith, some random person that Toronto Life, or The Globe & Mail found to tell their story, and then snapped a photo of. This is a public figure – a reporter who is on camera, online, and you can read about her at your leisure through a simple Google search.

Thirdly, and tell me if I’m wrong here, but I think the fact that she’s a single, 32-year-old woman helps. If this was a middle-aged man sitting on the couch in his basement rental apartment, with his pot-belly bulging through his Def Leppard t-shirt, I don’t think it wouldn’t get as much attention.

And last but not least, this is a story that a lot of people can relate to. Real estate is, and has been for some time, the biggest story in Toronto. Whether you’re a renter, an owner, or a would-be of the two, you’re feeling the heat of this red-hot market.

All told, this story has been shared, re-Tweeted, and talked about at the proverbial water cooler (do offices still have those?)

And the take-away, as usual, is whether or not “the government” should do something about it.

I’ll save you my political rant, but as is often the case when anything goes wrong in society today, many of the onlookers, commenters, and those on the unhappy side of the real estate equation are calling on “the government” to step in and “do something.”

Do what?

What is this…….something, that people want done?

In this case, it seems, some people want the government to step in and create rental increase guidelines for condominiums – something that currently does not exist.

The rental increase guidelines only apply to units built before November of 1991.

And with about 98% of downtown Toronto condos having been built after that date (we could probably the 20-25 buildings older than 1991 if we wanted to), it means we essentially have no rent control in the downtown core.

But should we?

Should we have rent control for downtown Toronto condos?

That is the question people are asking after reading Shannon Martin’s story, and as rents continue to skyrocket.

That is also the question I want to pose to you all today. Have your say in the comments section below, and I’m guessing this will be one of the fiercest debates in a while.

People seem pretty evenly distributed on the matter, but I feel as though it is 100% dependent on their own individual status.

Can you detach yourself from your financial and living situation to give an unbiased opinion?

Let me try first.

I believe in capitalism, I believe in the free market, and I believe in hard work.

I’m a social liberal, but a fiscal conservative.

And I believe that increasingly in society today, there’s a jealousy toward people who have more, so much so that we’re forgetting that being successful isn’t a crime.

If a person works long and hard enough to be able to purchase a condo as an investment, and can rent it out for $1,650 one year, and $1,850 the next, then good on them.

I think what happened to Shannon Martin is terrible, but it’s also exceptionally rare. I polled the agents in my office and asked, “Is there anywhere downtown where you see a 454 square foot condo renting for $2,600/month?” The answer was a slew of “No’s.”

I’m not doubting Ms. Martin’s claim, but rather I think this was a case of the landlord wanting her out, not the landlord being able to get $2,600/month for the unit. In my professional opinion, that rent is absolutely, impossible to obtain on a standard one-year lease.

So excluding these outliers and exceptions to the rule, do you think that a landlord should be able to charge market rent, or should a landlord’s actions be limited by some wing of government?

If it’s the latter, then by how much?

Because if the real estate market is going up 20% in a year, then how can you possibly set rental increase guidelines?

Or how about this – if property taxes went up 10%, then is it really fair for the government, who increases the taxes/expenses on the condo, to follow up with a limit on the increase in rent by, say, 2%?

As I said, the feedback seems evenly distributed on this.

And Ms. Martin’s first article spawned a second.

Check this one out:

“Why Toronto’s Condo Market Is Described As ‘Ridiculous'”

Yet another “real, live person” who put her name to the story, and posed for a photo.

Her rent was increased too.

There’s that saying in the media, “Don’t read the comments.” It’s what journalists tell each other, since so much of the commenting these days focuses on the writer or author, rather than the content.

But I like to troll the comments to see what the anonymous public thinks.

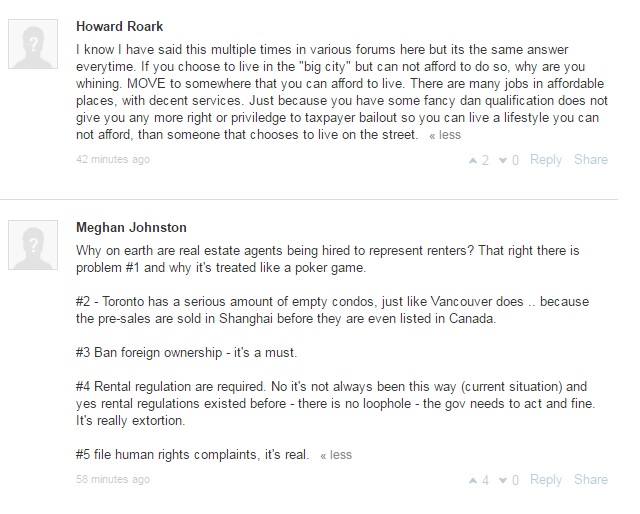

On that story above, the first two comments were the following, and do not skim these:

Could they be any different?

This is what I find so interesting! People are so evenly split!

And once again, I have to put in my two cents, for what it’s worth.

I completely agree with the first person, and I think his point hits the mark.

I completely disagree with the second person, who I deem to be uninformed, naive, and possibly of simple-mind.

The point about “living in the big city” being a “choice” is exactly what I’ve always said.

And along with that, comes the idea that being successful isn’t a crime, and dare I say that on the opposite side of the coin – being unsuccessful, doesn’t mean you should always be bailed out.

A good friend of mine finds himself unable to afford housing in Toronto, and he laments his situation.

I was honest with him a while back. I told him that in 1998, the day before we went off to university, he made a personal choice not to go, but rather to stay behind and chase his dream of being a rockstar.

It didn’t work out. The millions didn’t flow in. And as a result, he’s not building a house next to Drake on The Bridle Path.

There will always be haves and have-nots in society. It’s impossible not to see it this way.

And as “Howard Roark” points out, those who make a choice to live in Toronto, need to pay the going rate for Toronto housing. Otherwise, there are options outside the city. Living in Toronto is not a fundamental right, and “the government” shouldn’t subsidize everybody and anybody who can’t afford to live here.

As for “Meghan Johnston” and her comments, I don’t think she really knows much on this, but rather wanted to hear the sound of her own voice.

“…the pre sales are sold in Shanghai before they’re even listed in Canada.”

This is what 2017 has come to. People just say things, with no idea what they’re talking about, and zero burden of proof because they’re anonymous.

“The govt needs to act and fine.”

“It really is extortion.”

“File human rights complaints. It’s real.”

Where do people get this stuff?

Is this representative of public opinion? Does this person’s ideas, and her ability to self-express, represent a good section of society out there today?

Does somebody really think you can file a human rights complaint because your landlord raised your rent?

I have to agree with “Howard Roark.” Many people out there today feel entitled to “a lifestyle they can’t afford.”

The second article has a sub-heading, in bold, that reads, “Everybody wants to live here.”

So maybe that is the real problem?

Needs versus wants?

Supply versus demand?

If “everybody” wants to live downtown, then that skews the balance between supply and demand, right?

Is it any wonder that prices are going to increase?

And before somebody says, “Well why does every landlord have to charge more money just because they can,” I’ll tell you that I’m not prepared to get into a debate about human nature today.

So what do you say, folks?

A Grant

at 8:26 am

I think that this is just another symptom of a generation who – for the first time – will be worse off financially speaking than their parents.

With respect to Howard’s comment – I really hate the word “entitled”. I find it’s being used more and more by people who think: “I got mine, **** everybody else.” Previously, complaints like his were reserved for those who couldn’t afford to buy a house in Toronto – “You’re not entitled to a house” they would claim. “Why don’t you rent?!” Now with rents as high as they are, people who can’t afford it are increasingly forced to live at home with their parents. And yet again, these folks are seen as entitled, living at home, mooching off their parents, because they are too lazy to get a job that pays well enough afford housing.

The problem with Howard’s line of thinking is that we forget what impact it would have on the city as a whole. We don’t our youngest/brightest to leave and for the city to suffer a brain/population drain — we want the city to grow and thrive. But without sufficient affordable housing, the only option for people is to live outside the core, which would require a massive investment in infrastructure to be sustainable.

So the way I see it, “the government” needs to do one of two things. 1. Implement policies that would help to make housing more affordable, thereby encouraging more people to live in the core; or 2. Increase spending substantially on mass transit to make living outside the city sustainable.

Kyle

at 9:05 am

I disagree with the brain drain thesis. Toronto has become a hub in many well paying industries, and over the last decade has been attracting more and more of the young/brightest in Finance, Tech, Legal, Education and Research, Marketing, Health Sciences, Management, etc. These are the same people who can afford and to a great extent have been driving the price increases. They are not the ones being forced out. In fact if you just look at the people you see living downtown, it’s actually teeming with a very young demographic.

jeff316

at 10:37 am

We are having the opposite of a brain drain – the problem is that unless you have a very specialized skill-set, it is near impossible to get a well-paid job outside the GTA in this province.

T

at 12:13 am

Top talent is recruited and relocated to the Bay Area, Seattle, NYC and almost all Texas is also hot right now.

Toronto will always be services based economic circling bank jobs and commodity exchanges.

Kyle

at 9:36 am

Commodity exchanges in Toronto, eh?

T

at 5:15 pm

Yes, a lot of trading in Toronto firms are focused on Canadian commodities. This is what Canada was built on, resources. With our major cities starting to centralize around service based industries.

Daveyboy

at 12:57 pm

Kyle , your an idiot.

Chris

at 3:54 pm

Daveyboy, Kyle likely now thinks you, T and I are all the same person.

Boris

at 1:16 pm

Tell me T, what are the names of the commodity exchanges based in Toronto?

T

at 7:10 pm

You misread the comment.

Daveyboy

at 5:49 pm

So glad I sold and left Toronto. An etf balanced portfolio is now paying(if I choose) for my house in the u.s. Moved to a much more balanced life. No crazy house horny people here in North West Arkansas.

Kyle

at 9:33 am

@ T

Love how you commented, went about some google searches, and came back a few hours later to correct yourself….Sound familiar?

Ralph Cramdown

at 8:27 am

When I read the Star article, I thought exactly the same thing — no way the landlord gets $2,600. He just wants her out.

To your question of what’s “fair.” Look at commercial leases. If you own a retail plaza and your terms for tenants are that they’re on a rolling one year lease, and you’ll adjust the rent to whatever you think you can get every year, what kind of tenants do you get? Herbalife, Cash for Gold, discount clothing jobbers and maybe a cellphone shop. Saying that residential landlords should be able to treat their tenants in a way that most decent and respectable commercial tenants would not accept is just saying that you’re OK with the result of unequal bargaining power.

You may say “well, that’s a free market,” but just try to turn a house near the subway into a sixplex — landlords definitely get the benefits of some limits placed on otherwise “free” markets in housing.

jeff316

at 10:22 am

Bingo. This is the most rationale response I’ve seen on this to date.

jeff316

at 10:25 am

I meant rational.

kd

at 8:33 am

I heard last night about 18 offers for a nondescript home – in Midland.

Toronto’s housing contagion is doing massive damage to many communities far beyond your borders. While I agree that no-one is entitled to live near a subway nor own a 3 car garage, we are all entitled to shelter that is warm, dry, safe and “affordable.” For increasing numbers that is impossible.

I too am very wary about government involvement but something needs to be done before things get far worse.

The system is rapidly breaking down. Something is going to give. When even the banks are saying this is unsustainable, you know we’re at the edge of a cliff and staring into an abyss.

Now is the time to act. Not when the election cycle is favourable or when the media has finished whipping up a frenzy but right now.

Are you listening Kathleen?

T

at 11:55 pm

We need to penalized speculators, foreign and local, which should effectively take care of the majority of the 100,000 unoccupied units.

A hefty vacancy tax would be nice perhaps. One which increases as the time if vacancy does, incentivizing selling or leasing immediately at current market prices. The market would naturally decide what those prices are.

We don’t really have a housing supply problem, as we the units, we just need them to come available for actual residents as either sale or lease.

This would also have the effect of removing one source of buyers, speculators. I think we can all agree this would benefit everyone.

Boris

at 1:14 pm

Do you understand property rights? It means you can do whatever the F you want with your property assuming you aren’t breaching the rights of other property owners.

Capitalism rests on these rights.

Chris

at 1:27 pm

Great system; land owners can do what they want on their property, so long as they don’t infringe other land owners! To hell with social cohesion, let’s revert to feudalism! Get bent, serfs!

By your logic, if I own land I should be able to:

– Build any kind of structure I want, regardless of height, width, etc., and without needing any kind of permits; it’s my land after all, to do as I please with

– Kick out a renter with no notice; it’s my land after all, to do as I please with

– Create a boarding house/slum; it’s my land after all, to do as I please with

– Raise and slaughter livestock; it’s my land after all, to do as I please with

But why stop there! Not only should municipal and provincial laws/statutes be null and void on private land, but let’s cast aside federal law as well!

– Beat my wife on my land; it’s my land after all, to do as I please with

– Sell drugs on my land; it’s my land after all, to do as I please with

– Assault trespassers who enter my land without permission; it’s my land after all, to do as I please with

Hmm yes, this sounds good. What could possibly go wrong!

Boris

at 1:12 pm

Yeah, you;re a complete idiot

Chris

at 1:21 pm

Boris, you literally said landowners “can do whatever the F you want with your property”. I gave you numerous examples (some were admittedly extreme) of why this is a terrible idea.

You retort with no reason, logic, or evidence. As the icing on the cake, you managed to sneak a spelling error into five word sentence.

Daniel

at 9:10 am

Great rant!

But anybody under 25 is going to tear you apart on here.

The new Canadian Dream is based on this generation watching “Friends” on Netflix. A waitress at a coffee house who works 25 hours per week can afford a loft in Manhattan, and spends all her time hanging out with friends.

Too bad life can’t imitate art.

Ralph Cramdown

at 9:34 am

The one where that guy thought under-25s watch ‘Friends.’

T

at 11:50 pm

Ha! Right?!

Kyle

at 9:19 am

I’ve done the math on income properties in Toronto and in my opinion the returns don’t justify the risks, even as it is now when you can charge market rents. Putting in further controls will simply likely kill the rental market supply and be a boon for Airbnb.

The best cure for over-demand is to increase supply, if it weren’t so damn hard to be a Landlord more people would do it. I know many people have contemplated converting parts of their house to collect a stream of income, but one look at the rules and they’d rather use their basements to store Christmas decorations, rarely used appliances and never used exercise equipment then have a tenant.

T

at 11:46 pm

Please, show me this ‘math’ you speak of. I’ve read many of your comments in this and other posts. It’s obvious you don’t have a clue about anything financial, investment, valuation, or math. Normally I ignore commenters like you on various sources I follow, but people need to wake up. People like you are part of the problem. Making comments and misleading people like you have any real insights.

Kyle

at 9:24 am

The math is very simple, i want a property that from Day 1 is cash flow positive based on 11 month’s of rent with 20% down.

Please explain to me where i am wrong or misleading people. Or better yet provide relevant, well-supported counter arguments, instead of barfing up your opinions. Else it is you who is misinforming people with your delusional comments.

Chris

at 9:56 am

Hey Kyle, did you read up on what an ETF is yet?

T

at 5:06 pm

Let’s say, $600,000 condo. 900-1000 sq ft, two beds, two baths, just outside of the core.

$120,000 down; 25 yr mortgage on $480,000 $2177.61 a month (2.6%)

$650 month maintenance (still on the low side)

$300 month in property taxes

To scrape by you would need to rent that unit for $3100 a month. Not likely, market is sustaining a $2600 a month right now for that same property.

That leaves you out of pocket of more than $500 a month.

Opportunity cost in $120,000 in a safe, balanced portfolio is 6% (low end), $600 a month, compounding over term of rental ownership.

You are now paying at least $1100 a month to be a landlord and this does not include:

– land transfer taxes

– tenant acquisition costs

– appliance repair / maintenance / replacement

– appreciation of property value after capital gains taxes

– costs of selling property to realize gains, unlock equity

– challenges with tenants including missed payments, unable to collect payments, possible court costs if it goes very bad

– costs of reconditioning a rental property between tenants

This also does not touch on principal payment on the mortgage. The longer you hold the more you build; as long as rates and prices don’t normalize you could break even after several years and then maybe eek to positive territory on the investment. Lots of risk all over this strategy right now.

Where did I obtain these numbers? Experience with my own properties as a landlord and investor until I sold all several months ago as the numbers stopped working in favour of rental investments. There are far better investments moving forward into the near to mid future, with a lot less risk.

Kyle

at 5:14 pm

LOL, did you seriously waste all that time typing just to prove my point?

I said, “I’ve done the math on income properties in Toronto and in my opinion the returns don’t justify the risks”

T

at 5:20 pm

I asked for your math, you asked for mine. It was a simple reply to educate the masses and had no derogatory tone towards you.

Stop being a troll.

Kyle

at 5:29 pm

No derogatory tone? I believe your exact words were,

“It’s obvious you don’t have a clue about anything financial, investment, valuation, or math. Normally I ignore commenters like you on various sources I follow, but people need to wake up. People like you are part of the problem. Making comments and misleading people like you have any real insights.”

I will quit pointing out how utterly stupid and clueless you are, because frankly you’ve already given us more than enough examples today to prove that your arrogance is only outmatched by your ignorance.

T

at 5:36 pm

Ha! You need all kinds of help my friend.

Chris

at 6:30 pm

Kyle, you are a shining example of the Dunning-Kruger effect.

Now go read about what an ETF is already. I told you to do that weeks ago. Improve your financial literacy instead of just “LOL”ing at everything.

Kyle

at 7:42 pm

Oh petty, petty Chris. Proven wrong by me and just can’t get over it.

Chris

at 8:06 pm

You proved me wrong, huh? I must have missed that. Or you’re day dreaming. Who knows. Maybe Drs. Dunning or Kruger could shed some light for you.

Did you figure out what an ETF is yet? Or do you still think it’s a single stock? As everyone’s favourite logic rejecting troll would say, “LOL”.

Boris

at 1:12 pm

T:

Boris says you suck.

CMHC is garbage, taxpayers should not be exposed to insurance risks, government has no place meddling in capital markets.

If rates were 6% tomorrow, CMHC would be insolvent.

Housing in Canada is WILDLY subsidized by the government via CMHC. It’s quite disgusting really.

T

at 7:09 pm

CMHC is not helping the current situation, and could use an update, but to say it’s garbage is a little short sighted. Families need a place to live and grow.

I suggest limiting CMHC backed loans to 350% of annual income, thus limiting available leverage and CMHC risk exposure.

O

at 9:38 am

You want rents to go up? Then please, get the government involved. Lets start with all those people screaming “raise the taxes in Toronto!!!!” Raise the taxes? Rent goes up.

Bad tenant does 5 grand in property damage? Landlord has no legal way to get that money back. The next tenant is paying more to cover that.

Have a tenant living rent free while gaming the system to drag out an eviction? Landlord says F this, pulls unit off the market, lowering supply which leads to….higher rents.

We have room for two apts in our basement, but will NEVER rent out that space unless I can a) Collect a serious damage deposit or at least have confidence that I will be compensated for any damage done to my unit and the vandals criminally charged.

b) Have the ability to evict someone the day they don’t pay. This is such a no brainer. Name me one other industry where you can enjoy services, not pay, and then get the government to help you not pay.

Someone once said that if the government was in charge of Thanksgiving there would be a Turkey shortage every year. You want rents to go down? Make it attractive for people like me to add units. I want 1500 for my room but the guy next door is only getting 1100? Better lower my rent. Does this make any sense? Is anyone getting this? Am I off?

Ralph Cramdown

at 10:04 am

You’re off. A landlord with a vacant unit has zero pricing power, and has to compete with every other vacant unit, even David’s buyer clients who are buying a cash flow negative loft on purpose. Plenty of landlords in Toronto — in fact most landlords everywhere — can’t afford to pull their units off the market because they need the rent to pay the mortgage.

A landlord with a leased unit and no rent controls has a fair bit of pricing power because moving is such a hassle.

If you want to be a landlord with no hassles, buy a REIT. There’s even some whose properties are concentrated in places with no rent control.

Kyle

at 10:17 am

@ Ralph

Your arguments are actually supporting what O is saying. A Landlord with a vacant unit has to compete with other vacant units (i.e. lower his rent to get someone in there). If the deck wasn’t so outrageously stacked against Landlords, there would be more of them and more thus more competition, thus lower rents. And the reality is Landlords have been pulling their properties off the market, and putting them up for short term rentals.

O

at 10:26 am

Ralph said “Plenty of landlords in Toronto — in fact most landlords everywhere — can’t afford to pull their units off the market because they need the rent to pay the mortgage.”

I need to rent space to pay off my mortgage? That is news to me. Re read what I said. I do NOT need to rent out my space. I am paying my (very small) mortgage just fine. I have room for units and CAN rent them out if I choose to make some extra$$$$ but WILL NOT as it is not in my interest based on my reasons above.

However, if I (and people like me) choose to rent out their extra space, there would be many new landlords who would have to compete for their tenants, which would lower costs for the renter.

Ralph Cramdown

at 10:37 am

From what you’ve written, you don’t currently have any vacant units you could rent. So you’re not a landlord, and you’re not a potential landlord with vacant units. You’re just an owner with a basement. Nothing I wrote contradicts your position.

O

at 10:52 am

Ralph said , “you don’t currently have any vacant units you could rent. So you’re not a landlord, and you’re not a potential landlord with vacant units. You’re just an owner with a basement.”

Sigh. Again, every owner who has empty space is a potential landlord. If more “potential landlords” became “actual landlords”, there would be MORE UNITS available which would lead to LOWER PRICES due to COMPETITION.

However, due to government red tape, many people like me remain “potential landlords” and never become “actual landlords” The space that COULD BE used for a young family is instead being used to store my junk.

Ralph Cramdown

at 11:23 am

“I’d be a landlord, even though I don’t need the money, if rents were lower” (and a few tenancy laws were changed).

Yeah, right. Forgive me for thinking that you’re either trying to fool us, or you’re fooling yourself.

O

at 11:38 am

Anyone other than Ralph have an opinion on this?

Kyle

at 11:59 am

If i include the basement, there is close to 900 sq ft of space per member of my household. Needless to say a lot of that space goes unused, i love my house and neighbourhood, so i’m not the least bit interested in downsizing, nor am i hard up. That said, would i like to collect $1200/month for the basement that i use only to store sports equipment, junk and tools? If i could guarantee myself a good tenant, i’d do it tomorrow. Problem is there is no guarantee, in fact most of the people i’ve spoken to who have ever had a tenant have regaled me with all sorts of traumatic and expensive experiences which can all be traced back in one way or another to the one-sided tenancy rules, and the few that haven’t had issues all consider themselves to be incredibly “lucky”.

If the 1200/month income stream relies on me being “lucky”, then in my view it’s really nothing more than gambling. Having talked to many of my co-workers, friends, neighbours and acquaintances, trust me when i say this, i am not the only home owner out there to come to that conclusion.

T

at 11:37 pm

Kyle,

If you were to rent your basement of your beautiful house, the day you sell your entire sale price will not be tax free gains qualified under the principal residence exemption. Be careful.

Kyle

at 9:10 am

@ T

I’m well aware of the tax implications of renting out my basement. You are wrong (unsurprisingly), principle residence exemptions still apply if the suite’s use is considered “ancillary”.

“Partly rented principal residence – what are the implications?

The Canada Revenue Agency (CRA) recognizes situations where your property may be partly rented. One of two situations would develop in this case.

First, it is possible that the “divided-use” rules would apply. This effectively results in a proportionate amount of the property being eligible for the exemption, based on the personal use vs rental components. Again, a good example is living in 1/3 of a triplex, where 1/3 qualifies for the PRE.

Secondly, and more advantageous, is where the business or rental use is considered ancillary to the personal use. In such cases, the entire property is considered to qualify for the PRE . The term “ancillary” essentially means that the business or rental use of the property is secondary to the main use of the property as a principal residence. However, if structural changes are made to the property to accommodate the business or rental use, or if capital cost allowance is claimed on a portion of the property, then the full property will not qualify as a principal residence.”

http://bdoreinvestor.ca/2016/08/31/2209/

T

at 4:37 pm

Thanks Kyle.

Renting a basement will unshelter a proportional amount of gains in the property. After tax earnings on the basement rental often, especially lately, will be less than the tax on unsheltered gains. You are basically paying to have someone live in your house.

Kyle

at 4:53 pm

LOL, you’re next-level clueless and you have the gall to call people financially illiterate.

I thought bolding the text would be enough, but clearly not. Let me dumb it down for you: If the suite’s use can be deemed as ancillary (i.e. you’re not structurally changing your house or claiming capital cost allowance), then your whole principal residence is sheltered from gains.

Perhaps you should try taking some of your own advice. Try reading more and getting more involved. A little financial literacy wouldn’t hurt you either.

T

at 6:15 pm

Kyle,

Renting your basement as an apartment is by no means covered by the clauses you reference. I like your effort, however.

Kyle

at 7:32 pm

While it isn’t the uninformed, unsupported opinion of a clueless internet person named T (which you seem to think trumps all), I have a professional opinion from MNP LLC, when i asked them about converting my basement to an apartment that says, that is exactly how that clause works.

T

at 4:51 am

Kyle,

Please see the following case reference. There is quite a lot of info. To sum it up – if in your primary residence you rent an apartment of any size, in this case 33% of the homes square footage (basement apartment), does trigger capital gains taxes when the property is sold.

http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/29684/index.do?r=AAAAAQAmYmFzZW1lbnQgc3VpdGUgQU5EIHByaW5jaXBhbCByZXNpZGVuY2UB

You may want to source new accountants, if in fact they did say this to you.

Kyle

at 9:29 am

I think you’re missing the whole point, so let me recap:

Over the last few blog posts, you’ve been A) trolling the comments B) calling people financially illiterate, clueless and misinforming. C) And calling out people who mis-state something and then correct it.

So now A) i hand your ass back to you on a plate and you’re all like, “quit trolling me”. B) I Point out that it is actually YOU who is clueless and misinforming people with your claim that all basement apartments will unshelter a property from PRE, and then C) After you go and google some actual data that CLEARLY DISPROVES YOUR ORIGINAL CLAIM, you think you’re going to get away with trying to make it about my Accountant?

Let’s be clear the point is not what i discussed with my Accountant, nor that an ancillary apartment can’t be more than 33% (which by the way pretty much represents the basement in just about every house in this city excluding bungalows). The point is that you are a complete and utter moron, and should not be calling people out, until you get a clue and can actually support your arguments.

the point isn’t who my Accountant is, or what i want to do with my basement,

T

at 2:31 pm

Kyle,

Instead of reading the case and learning something, as you don’t have a clue, you continue your rant. It’s funny – but doesn’t make you more informed or less of the ignorant sack that you are.

You don’t know much about anything. It’s obvious. When I have been calling you out in the comments it has been for good reason. You are a complete and utter idiot, acting like you know all when you know very little. I have proven you wrong on many of your comments.

Kyle

at 2:58 pm

“I have proven you wrong on many of your comments.”

Name one time.

T

at 7:05 pm

Lol! Special!

Kyle

at 8:25 pm

Thought so.

T

at 5:33 pm

All anyone has to do is read through this thread to see you being corrected, with supporting fact and documentation, and to understand how ignorant and wrong you are.

Kyle

at 10:10 am

This is bang on.

In any other situation when prices rise there is a major incentive for Supply to rise, which stabilizes things. Today with house prices/rents as high as they are and vacancies as low as they are home owners should be tripping all over themselves to add income producing units to their homes, Developers should be throwing the boat at building rentals not condos. But instead the supply of rentals are stagnant or shrinking, renters can thank the Government for that.

Ralph Cramdown

at 10:47 am

There’s a ton of new rental units being built. Plus at least 1/3 of new condo completions become rentals. I don’t know whether broke-ass homebuyers are still converting their basements to rentals — the man in plaid on HGTV seems to have changed his schtick.

Kyle

at 10:54 am

The growth in new purpose built rentals only seem like a lot, relative to the last two decades when none were being built. If you’re talking about stemming rising rent, t’s a major case of too little too late.

“Dormant for two decades, purpose-built rental apartments are resurgent in the GTA, with eight buildings (2,458 units) under construction and 37 (9,207 units) proposed, according to a new report from Urbanation. SVP Shaun Hildebrand unpacks the renewed enthusiasm for purpose-built rental.

Only 34 rental projects were built in the GTA since 2005, a mere 6,723 units. “Construction has been flat over the last 10 years,” Shaun tells us. (Indeed, compare that to the plethora of condo buildings that cropped up in the same period.) ”

https://www.urbanation.ca/news/77-purpose-built-rental-market-poised-75-growth

Kyle

at 11:14 am

I’ve also observed that most homes downtown that have or used to have income units are being converted back to single family usage. In the last decade probably tens of thousands of rental units have been removed from the market. Entire neighbourhoods of homes that use to be majority multi-family housing have been converted back to majority single family housing (i.e. The Annex, Bloordale, Dufferin Grove, Parkdale, Roncesvalles, Trinity Bellwoods, Beaconsfield, Cabbagetown, etc). So even with the cost pressures of today’s market, even broke ass homeowners would prefer to keep or convert back their homes to single family, instead of taking on a tenant. Again renters can thank the Government for that.

O

at 11:40 am

Thank you Kyle, you seem to understand what I have been saying.

jeff316

at 1:22 pm

Or they can thank the children of homeowners, for whom homeowners want the basement space.

T

at 11:41 pm

You need to look at tax laws and gain some financial literacy. What you explain in this post is financially unsound, especially in Toronto these days.

Kyle

at 9:16 am

@ T

You need to start actually supporting your arguments with more than just a pompous intonation and accusations of financial illiteracy. If you have something of substance to say, please starting supporting it with facts, data or evidence. And to be clear, adding a pompous tone to your comments, doesn’t magically convert your (oft-clueless) opinions into facts, anymore than adding an haughty tone did for Meghan’s comments.

T

at 5:35 pm

Kyle,

I do and you seem to ignore and continue with your behaviour. You must be a troll, purposely disagreeing with people and carrying on for the fun of it.

Whatever floats your boat.

jeff316

at 10:32 am

By and large it’s not the young professional demographic that’s being squeezed out, its the creative class or working class demographic getting the shove. Older homeowners and renters on lower incomes. I thought the article with that 32 year old newsreporter showed that she had awful judgment. She’s part of the problem, not subject to the problem.

My favourite was an article a few months back with Ralph Benmergui going on about how great Downtown Hamilton was, in part because he could buy a huge house with the profits of his former Toronto home and in part because Hamilton was the kind of place with a good working town vibe and grit and the working classes. Wow. Who did he think he displaced? People will say anything to the media, even media types.

crazyegg

at 11:39 am

Hi All,

Agreed. Jacking the residential rents significantly means that the landlord wants the tenant out. That is the underlying motivation.

Finding a good tenant is not easy as many landlords will attest to.

I have good tenants and I am charging around 15% below market rental rates. I have only modestly raised the rent $25 every few years or so.

Having the unit vacant even for one month coupled with the risks involved of having a new tenant as not really worth it.

Regards,

ed…

Condodweller

at 9:38 pm

I’m in the same boat. My philosophy is that as long as you treat people with respect it will be reciprocated. While I’m willing to go along with the charge what the market will bear capitalism, I also believe in carma and would not be surprised if extreme greed will be met with some blow back.

T

at 11:30 pm

Do you have a big one bedroom looking over the water in harbour square? Preferable 33, 55, or 65?

Good, respectful, high net-worth tenant looking for a good landlord. 🙂

Condodweller

at 2:19 pm

Not at the moment, no.

O

at 11:50 am

Hahah..new article on why people do not want to be landlords…one quote which backs up what I have been saying:

“But knowing the truth about the way the system works now, and how biased it is, and how little protection it affords you on your own property — I’m done,” Newbigin says.:

http://www.cbc.ca/news/canada/toronto/landlords-no-fixed-address-1.4000142

crazyegg

at 2:28 pm

Hi O,

Great read. Thanks for the link..

I’m sure that there are less astute landlords that will rent it out the first lowest common denominator that walks off the street. These are the ones that we read about.

Meanwhile, the other 99% of GTA landlords are quietly padding their nest egg, thank-you very much.

Regards,

ed…

There are bad apples in every revenue generating opportunity. Do your due diligence and trust your gut.

Ralph Cramdown

at 11:54 am

I have to agree with “Howard Roark.” Many people out there today feel entitled to “a lifestyle they can’t afford.”

This is certainly true, but it’s true for a lot of homeowners as well as renters. Looking at statistics on debt, savings, RRSP and TFSA contributions. one gets a picture of a lot of Canadian households whose retirement plans are a) win the lottery, b) inherit from a more frugal relative c) 73 year old Walmart greeter. Just because these people already own their homes doesn’t mean they can afford the lifestyle they’re living.

N.B. In case the irony escaped you, ‘Howard Roark’ is a fictional character whose most famous act was dynamiting an affordable housing project.

Joel

at 12:14 pm

@ David, what is your take on Mylan and their increases of the EpiPen? They charged more because they could and there was enough demand.

At some point we do need people to step in, trying to increase the wealth gap is not a good thing for society. I think that it is very reasonable to cap the amount that rent can increase within a year. Housing is something that is a necessity and there are large costs involved in moving. If a renter had each landlord raise the rates by 50% or more each year and was forced to move they would be incurring thousands of dollars in moving expenses each year.

Housing costs can waiver slightly for an owner (increases in ppty tax and electricity) but they are never going up by 50%-100% in a year. If they decide to move then the increase in the housing market is something that they have to deal with, not while continuing to live in the same property.

It doesn’t cost the landlord anymore to own that property from one year to the next that would justify an increase over 5% a year.

Julia

at 2:07 pm

I fully agree with the above. In the perfect world where everyone has a functioning moral compass, government intervention/’tinkering’ would not be necessary but we live in a real world where some people will take advantage of others if they are able (eg the Epi pen example) and so some government guardrails are necessary. And no, I’m not a renter – the last condo I rented was back in 2005.

Boris

at 2:30 pm

Needing an Epi Pen and living in Toronto are as far apart as an old porn stars ‘lips’.

Joel

at 5:31 pm

I don’t think anyone is asking for rent control to be Toronto specific. Everyone in Canada should have a sense of stability in knowing that rent will not increase to an unmanageable amount within one year.

Condodweller

at 9:53 pm

The qualification process should go both ways. A potential renter should have a conversation with the landlord to have some sort of comfort level on what to expect in the future. Of course now that agents got into the game it’s more difficult.

When I first rented my place out I had a good conversation with my tenant where we were both happy with each other. He/she was concerned about being kicked out prematurely so I assured him/her that he can stay as long as he/she wants as it’s a long term investment for me. I had a good feeling from day one that he/she is respectful of my property and everything will be fine. Everything has been great and I have no worries. I followed my gut and turned away a number of others I would never rent to.

Ralph Cramdown

at 3:02 pm

A better example to give to a real estate agent might be local number portability — being able to keep your phone number when you switch mobile providers. In a free market, the government shouldn’t legislate that Rogers has to allow your old phone number to be transferred to Bell, right?

T

at 11:26 pm

– property taxes

– maintenance fees / strata fees

– hydro

– property repairs and maintenances

– appliance repair and replacement

Just a few expenses which go up annually and / or are large one off expenses but are fairly regularly occurring.

This does not include income tax payable on any revenue generated from the unit, which is going up for higher tax bracket earners as well. Who do you think really pays for that? The income earner or the end user? End user always pays, income earner increases income from streams to compensate.

Why is it so many people can’t see the bigger pictures? The comments to this post are enlightening. Shocking actually.

People, you need to read and be more involved. Some financial literacy wouldn’t hurt either. Not all – but definitely many.

Kyle

at 9:33 am

“End user always pays, income earner increases income from streams to compensate.”

Wow, the real-world illiteracy of some people who claim to be financially literate is enlightening. Shocking actually (not really). The answer of who pays depends on many factors (e.g. this little thing they call “the market”) that pertains to that particular property.

T

at 4:15 pm

It’s called the invisible hand.

Kyle

at 4:24 pm

Yes, and that invisible hand just slapped your absurd claim that Landlords can pass through all costs out into orbit.

T

at 6:07 pm

If you looks at rents lately they have drastically increased along with all costs of ownership.

http://www.ctvnews.ca/mobile/business/rent-prices-among-the-casualties-of-hot-housing-markets-1.2878932

Kyle

at 7:36 pm

So what? If you look at rents in Alberta, you’ll see that rents can drop even as a Landlord’s costs increase i.e. a Landlord can not always pass on increasing costs to their renters.

T

at 5:12 am

We are talking about rentals in Toronto, not Alberta. Increased costs to landlords and increased property values will equal higher rents, thereby the end user pays more.

Alberta is going the other way right now, the province is in a recession. Invisible hand still at work, invisible backhand maybe?

Kyle

at 9:08 am

You’re kidding right? Still doubling down when you’ve already been proven wrong? The invisible hand can work in favour of Landlords OR in favour of renters depending on market factors .

Your claim that Landlords can always pass costs onto their renters is categorically wrong. It isn’t a Toronto vs Alberta thing, it is just wrong. A Landlord up at Jane & Finch, who experiences increased costs will find it very difficult to raise his rents to pass the costs through.

T

at 2:25 pm

Kyle,

You are so out of touch it’s making me laugh. Go troll on someone else. You are a complete waste of time and effort. I’m sure many others see through you.

Kyle

at 5:17 pm

Clearly the response of someone who has no response.

Libertarian

at 12:19 pm

isn’t the solution to all of these problems the upcoming expo about real estate wealth??

Tony Robbins and Pitbull (Mr. Worldwide) are going to tell all of us how to get rich in real estate!!

Once we’re are all rich, who cares about rents.

David – are you going to go undercover and do your Tom Cruise impression?

Dude

at 2:33 pm

I really want to go to that expo…

To see Pitbull perform tbh.

Boris

at 2:29 pm

For idiots like Meghan, you can attribute part of this mindset to stupidity, but also a good part to the socialist indoctrination of young people in Canada by universities. We pay for it too. Disgusting.

Steve

at 8:37 pm

100% agree

David (Not the david who runs this website)

at 4:55 pm

Shannon Martin should have a look at apartments that are not condos. There are lots of them out there that are renting for much less than what she was paying or being asked to pay with the latest rental increase. Wasn’t it rent controls that got us into the situation we’re in now? Up until recently no one was building rental apartment buildings. I wonder if we’d have as many condos as we do now if rent controls had never happened.

Kyle made an interesting point, “They are not the ones being forced out. In fact if you just look at the people you see living downtown, it’s actually teeming with a very young demographic.”

Well that’s true, I do see all kinds of people in this city but to be honest, most of them look like they are hardly capable of finding their own backsides, never mind holding down a responsible job and being able to pay a mortgage.

I’m always amazed at how many people are aimlessly wandering around the city in the middle of the day, apparently with nothing to do, why aren’t they at work? How do these people afford to buy or rent all those expensive homes and apartments when they don’t seem to be employed? I have a demanding job and there’s no way that I could take half the day off and meet my deadlines.

Condodweller

at 9:57 pm

Perhaps they work to live, not the other way around? Or they are the students where 8 rent a 3 bd condo and their rent is actually cheap?

T

at 11:15 pm

As someone who has recently sold my Toronto real estate assets, a condo and a detached house, and looking for a rental over the past few months – I can assure you the rents for professionally managed buildings are not less expensive than what you find in the condo rental market. Unless you are willing to slog it out in an old multiplex or basement apartment, $2000 / month for a small one bedroom is entry level going rate, some like the manulife centre up at $2700 / month for a one bed. And generally a long waiting list as well.

David (Not the David who runs this website)

at 9:05 am

I’ve lived in a professionally mananged apartment building for many years and the rents here a lot less than what most condos rent for. Also my apartment is on the Yonge subway line, so it’s not like it’s far away. I’ve also looked at a lot of apartments recently and the rents are no where near what condos rent for.

I’ve seen places like the Manulife Centre and they are dirty, over priced dumps. You can rent a very nice apartment that’s a short distance from the “core” for a reasonable price. Most of the so called professionally managed apartment buildings are old and I need of maintenance. I can see why some people prefer to rent condos, especially new ones but then it makes sense that you would have to pay more.

What I find really silly is that people only look at condos in the downtown core and complain about the cost. If you look a little further out of the core, there are places that are reasonable.

Condodweller

at 2:17 pm

Yes, I was referring to the older rental buildings that used to have rent control, and I believe they still do. That’s probably why they are in need of maintenance as they can’t recover the costs through rent increases. The new rental buildings are a different story.

I never want to be part of the crowd. Now everyone want to rent/own condos and these older rentals which are often in good locations near transit are ignored.

T

at 4:11 pm

I’ve been looking out as far as Pickering, and rental prices are only a few hundred less than the core. It’s expensive everywhere.

If you know of anything someone should be looking at for a single bed, 700 – 1000 as ft, on a subway line, clean, and less than $2000 please reply with your suggestions. I would appreciate it.

Bee

at 8:42 am

Hi cheap rent can be found along the Sheppard line. U can get a 1 bedroom at emerald city for about 1,500-1,700/month or you can try park place on Leslie station for about the same. All under $2,000/m. If you are ok away from the subway. Try world on Yonge which is Yonge and steeles – very short distance from finch station. GL in your search.

Condodweller

at 10:44 am

take a look at viewit dot com and look at the Yonge and Eglington area. There is a jr 1 bed listed at $1,280 on a high floor with a nice view. A jr. 1 bed in an old building should be about 700 sqft. That is much cheaper than a 500 sqft condo downtown for $1,700-1,800 range. It’s on the subway 10-15 minutes from downtown in one of the most desirable locations. There are also units at Mt. Pleasant and Davisville with Jr. 1 bed starting at $1,250.

Mark N

at 7:45 pm

Rents in Toronto are relatively inexpensive compared to cities such as London (England) and New York City. People starting out in those cities either rent well outside the core and commute further (made possible in cities that have a real transit systems like London), or they share spaces we would not. Imagine having a roommate in a 1 bed 1 bath apartment? In Hong Kong whole families live in small apartments because it is simply too expensive to do otherwise. NYC has spawned another solution – the micro apartment. The point is, as real estate values skyrocket so do rents, and for those who are priced out of the market there are ways to make living in the city more affordable as long as you are willing to give up personal space. What do you call a paying couch surfer? A roommate – and get used to it because if you can’t afford it you are not entitled to it without making compromises that people in London, NYC, and Hong Kong have taken for granted for a very long time.

T

at 11:10 pm

I really despise the comparison of Toronto to NYC and the like. Shows how out of touch Torontonians are. Toronto is not on par with any of these mentions cities. Not in income, not in services and infrastructure, not in employment opportunities, and certainly not weather.

Toronto is a nice city, I’m very fond of it myself and have lived in Toronto most of my life. But let’s get a grip here please.

Also – you might want to look at rents in NYC for comparable Toronto properties. I think you may be shocked to find we aren’t that far apart at this present time. Try zillow.

Steve

at 3:19 am

I would have agreed with you a few years ago. But in the past 5 years, a lot of new wealth has been generated . If you are a wealthy family in Middle East , Eastern Europe or Asia, there are only a few English speaking countries you would consider immigrating to or sending your kids to for education ; these are generally USA , Canada , U.K. And Australia …. From this standpoint, I think you can compare Toronto to other desirable global cities including London and New York .

T

at 4:08 pm

Toronto is not nearly the level of NYC, London, even the Bay Area in any facet including education. Not even the same ballpark. Toronto is not a world class city.

Kyle

at 5:05 pm

Sure, because some clueless guy with a propensity for barfing up biased, unsupported opinions masquerading as facts (like the above example), said so…

T

at 6:01 pm

Let’s play a game you are probably familiar with.

Which one of these is not like the other?

Stanford, Caltech, Cambridge, Oxford, MIT, UofT, Harvard, Princeton

https://www.timeshighereducation.com/world-university-rankings/2017/world-ranking#!/page/0/length/25/sort_by/scores_overall/sort_order/asc

Tired of looking like a fool yet? I would be if I were you.

Kyle

at 7:41 pm

Seriously? A survey of school rankings is your evidence that is supposed to disprove Toronto’s World Class-ness and make me feel foolish? I truly applaud your first attempt to actually use evidence to prove a point, seriously it’s real progress….

But here’s a tip when you select data, it should actually support the argument you’re trying to make.

https://www.atkearney.com/research-studies/global-cities-index

Steve

at 12:27 am

@T

I’m not saying toronto is a NYC or London from a global significance perspective (global transport hub, international finance centre , etc) . All I’m saying is that the comparison of Toronto rents to NYC or London rents is a valid one .

T

at 5:15 am

Steve,

Yes definitely a valid comparison.

Do you think rents should be on par with NYC though?

T

at 2:22 pm

Kyle,

You are the worst type of troll. You don’t even read before replying.

We were on the point of where the best schools are for foreign students.

You are a lost cause.

Chris

at 2:27 pm

T how dare you throw logic in Kyle’s face?! He doesn’t have time for that rubbish! Bringing up school rankings in a discussion about global education driving immigration?? He LOL’s on you!

…Anyways.

As I said before, our good friend Kyle is a glittering example of the Dunning-Kruger effect in full force. For those of you unfamiliar:

“The Dunning–Kruger effect is a cognitive bias in which low-ability individuals suffer from illusory superiority, mistakenly assessing their ability as much higher than it really is. Dunning and Kruger attributed this bias to a metacognitive incapacity, on the part of those with low ability, to recognize their ineptitude and evaluate their competence accurately.”

Put more simply (for your benefit, Kyle), stupid people are so stupid that they’re unable to recognize that they’re stupid (and wrong).

Kyle

at 2:42 pm

Oh petty, petty Chris, i LOL you and your buddy (aka your other posting handle) T, because you are petty jokes. You slurp up the bear bait “news” articles and get all butt hurt when i punch massive holes in every one of their thesises. While you have yet to once poke the slightest holes in any of my arguments. Obviously that is why you are getting so upset and taking these pathetic petty jabs.

Your definition of logic is the same 30 year old quote from the Globe that you bring up everytime, your ass gets handed to you by me, which has become countless now. I reject it because it isn’t logic, it’s kool aid for gullible idiots such as yourself.

Seriously buddy, how many times are you going to keep recycling these senseless Dunning Kruger and ETF reference. This is what the 5th time now on this one post alone. If you need to cling to those two items as some sort of perceived victory over me, after the multiple times i’ve pointed out what a dumb ass you are over the years, then fill your boots, but it’s just making you look even more like an idiot.

Chris

at 3:05 pm

Kyle, did you not learn spelling and grammar in high school? It doesn’t really help your arguments when they’re riddled with errors. Anyways…

Somehow I figured you would assume T and I were the same person; I have no way of convincing you that we’re not, so whatever, believe what you would like. It’s no skin off my back.

I think you mistake my ridicule for me being upset. I’m not mad in the least Kyle. I don’t live in Toronto, I don’t own property there, and I don’t want to. I have no skin in this game.

You though, are clearly becoming increasingly emotional in each of your posts and lashing out more and more. So yes, I say some harsh things back. But let’s not pretend I’m getting all worked up.

I re-hash the ETF reference because it is a clear and glaring example of when you were absolutely 100% wrong. To assert that an ETF is a single stock (and as risky as one) is a shocking display of financial illiteracy, and should lead a rational person to question any further advice you give on the matter of investing.

As I said before, please enlighten me as to where you’ve proved me wrong? Just because you keep saying you “proved me wrong”, etc., doesn’t make it true. Repeating yourself again and again doesn’t turn fiction into fact.

Kyle

at 3:51 pm

Re-read the comments, i never asserted an ETF was a single stock. SO sadly the one time you *think* i was wrong (that you’ve been rehashing and waving around like a lottery jackpot ticket) is actually just you misreading my comment you dumb ass. SO you don’t even have that, now you really look stupid for repeating it over and over again, as if that one time outweighs the dozens of times, i’ve proved you wrong.

Let me refresh your memory:

You said,

“Additionally, it’s pretty well documented that, over the long run, equities outperform real estate.”

I said,

“Meanwhile those “financial illiterates” have been wiping the floor with the so-called financial literates for the last two decades.”

You said,

“If, in 1997, if someone had decided to put all their eggs in Apple stock instead, they’d be up 16,908% today. ”

I said,

“Not sure why you’re bring up individual stocks – i’m referring to your mention of Apple stock you dumb ass – . You were arguing “it’s pretty well documented that, over the long run, equities outperform real estate.” Equities (with an ‘s’, as in the broad market). ”

And then you blathered on ridiculously,

“Oof, but unfortunately, your financial illiteracy is showing. The S&P500 index is an index of 500 stocks, not an individual stock. So yes, this would count as equities (with an s, as in the broad market). By comparison, buying Apple, the other example I gave (which returned over 16,000%), would not be buying equities (not plural, as in a single stock). Have a read:

Not even sure what you’re defining this because at no time did i say the S&P500 was a single stock And not sure what the hell you’re going on and on about ETF’s for, cause at no time were we talking about that.

Chris

at 4:12 pm

Ok, Kyle, just keep calling me a dumb ass, stupid, and other childish names. It definitely makes you look like the smart one in this conversation.

Your quote, including my statement, was:

““If someone had invested in an S&P500 index in 1997, they’d be up 193% today. I’d hardly call that ‘wiping the floor’”

Not sure why you’re bring up individual stocks.”

So you quote my sentence about the S&P index, yet somehow that was supposed to be in reference to Apple stocks? Ok, well then I question your ability to implement proper sentence structure. I guess that goes hand in hand with poor spelling and grammar though, doesn’t it?

I brought up Apple stocks as comparison to the single asset strategy that over-leveraging yourself to buy a house is. Then I brought up the S&P500 index, which you can invest in through an ETF (which is why we’re talking about ETFs), as an example of well-diversified investing, and how it’s returns have been strong as well.

Not to mention, in that same conversation, your math was way off; you calculated a return of 345% when it was actually 265%. But sure, I’m the dumb ass.

By the way, have you been reading the news lately? Four of the big five Canadian banks sounding the alarm on Toronto real estate.

But hey, what do they know, bunch of so-called financial literate CEOs and Chief Economists, right? I bet they’re all dumb-assess just like me.

Kyle

at 4:35 pm

Your thesis is that the 99K unoccupied homes is largely representative of speculators buying homes and leaving them empty.

WRONG – The “unoccupied” number does not represent speculators buying homes and leaving them empty – FACT it actually represents unresponded census surveys. Which is corroborated by the fact that Toronto’s 4.5% “unoccupied” rate is WAY lower than: Kingston’s (11%), Sherbrooke’s (9%), St John’s (8%), Saskatoon’s (8%), Moncton’s (8%) and 18 other Canadian cities.

Based on your (lack of) logic, all these cities must be experiencing close to double the speculators buying and leaving their homes empty as Toronto, right Chris? After all these are Stats Canada numbers, and therefore they can’t possibly be flawed. https://twitter.com/GRIDSVancouver/status/829902628351938560

Chris claims, “it’s pretty well documented that, over the long run, equities outperform real estate.”

WRONG using your own calculations Toronto real estate rose 265% vs S&P 500’s 193%

Chris claims, “Supply shortage is another myth. Toronto (CMA) grew by 344,976 people from 2011 to 2016, ~69,000 people annually. According to CMHC, Toronto CMA had 42,287 housing starts in 2015 and 39,027 in 2016. From the 2011 census, Toronto has an average of 2.8 people per dwelling. So, with 69,000 people arriving each year, we’re building housing to fit 109,000-118,000 people. What supply shortage?”

WRONG – first, a housing start doesn’t get completed for anywhere from 5 to 6 years. So by the time those 42,287 2015 starts are completed there will have been another 345000-414000 people who arrived. Second, the 2.8 people average is from the exiting mix of houses to condos. Those completions are mostly condos. Only a fool would assume that households buying condos contain 2.8 people.

Kyle

at 4:54 pm

That’s great news for you about more banks raising alarms, more bear bait for you to slurp up…

Like i said before, being right isn’t a strength in numbers thing. That’s why both you and T still haven’t proven me wrong, yet you both have been clearly proven wrong by me numerous times.

Chris

at 6:28 pm

Odd…you didn’t address most of what I stated in my last post, but instead just gave examples where you think you proved me wrong. But sure, I’ll respond to you.

Neither yours nor my opinions are facts. I proposed that speculation is a large cause of the empty homes in Toronto, and the price appreciation. You proposed otherwise. So, we may disagree, but that does not mean you are right and I am wrong, nor vice versa.

Comparing Toronto to Moncton…has anyone said there is a supply problem in Moncton, or any of those other cities you listed? The fact that we constantly hear about lack of housing supply in Toronto, yet the un-occupancy rate remains at 4.5%, is the issue. As for unresponded surveys, we’ve been through this Kyle, the response rate for the most recent census was 98.4%. It’s available on Statistics Canada’s website for you.

When someone says “long run” in economics, they don’t mean from the time the last bubble burst until now. Long run means in the order of many decades. For example, the Case-Shiller Home Price Index tracks back to 1890. That is long run. It is why TD predicts home price appreciation in the long run to revert back to 3% annually.

Sure Kyle, but it’s not like there were no housing starts five to six years ago either. It’s a constant stream. Yet again, you’re arguing your opinion as if it were fact. The fact is, there is an average of 2.8 people per household. Some households will be bigger and some will be smaller.

It’s glaringly obvious that you are heavily invested in real estate, and react with emotion and rage whenever someone suggests that it may be the golden goose you hope it to be. Are you counting on your home to fund your retirement? I could see why you’re so upset in that case.

As I’ve stated multiple times, I don’t own, live in or want to buy property in Toronto. I have no skin in this game.

If you want to put your head in the sand and ignore the warnings of a growing chorus of bankers and economists, well, you are certainly entitled to do so. Nobody can stop you from continuing to prattle on about how bankers and economists and all those so-called “educated” people with their fancy spelling are dumb assess.

T

at 7:04 pm

Kyle,

You are special. Don’t let anyone else ever tell you otherwise.

Chris

at 7:31 pm

T, are you me? Kyle seems to think so. Now I’m doubting myself…

Kyle

at 9:32 am

@ Chris

While you may not have a horse in this race, it doesn’t mean you aren’t super-biased. It clearly shows in how you selectively choose to (mis) interpret data.

In fairness, you didn’t have the City rankings when you came up with your hypothesis that “unoccupied” represents vacant home speculators. And when BetterDwelling threw out that bear bait that showed that juicy 99K number in the headline, you fell for it hook, line, sinker….reel, rod and boat! However even after seeing the rankings, you fail to acknowledge that there is little to no correlation between the “unoccupied” rate and speculation. In fact a logical, truth-seeking person, may look at Sherbrooke ranked 2nd and Vancouver ranked 10th, and argue that the data actually shows an inverse relationship between ranking and vacant home speculation. And therefore a logical, truth-seeking person would reject your hypothesis. What a logical, truth-seeking person wouldn’t do is continue to claim that the hypothesis hasn’t been proven wrong. While this is technically true, since in hypothesis testing sometimes the best you can do is to disprove a hypothesis is correct, a logical truth, seeking person wouldn’t then make excuses to try to validate why the hypothesis holds for one particular sample, despite it failing for every other sample. This is because a logical truth-seeking person would recognize that is logic-rejecting, head in the sand behavior….hmm where have I heard that before?

The earliest TREB data I could find is from 1971 with the average home price being $13,085. Today it is at $875,983 for a gain of 6,595% gain. The S&P 500 closed at 100.31 on Jan 1 1971, today it is at 2,383.12 for a 2,281% gain over the same period. So when we look further back, Toronto real estate has unequivocally wiped the floor with Equities.

The housing starts from 5-6 years ago are basically all pre-sold by completion, so they do nothing to alleviate the shortage being experienced now. What I am getting at by pointing out these flaws in your model, is that you’ve gone out of your way to find data that muddies the water in your attempt to disprove the housing shortage. Housing starts are a notoriously bad proxy for supply. Many starts never complete (e.g. Urbancorp), most are presold well before completion, and when they get completed is anybody’s guess. Add to that using smoothed out population growth x the average household size (that may or may not be relevant now) is an obviously bad proxy for demand at a point in time. By insisting on these measures, it is clear that you are trying to use data to obfuscate and hide behind rather than explain.

Instead, let’s start from first principles. If someone said, “go see if there is a bread shortage”. A logical, truth-seeking would walk the aisles of grocery stores. If shelves were brimming with loaves then there is no supply shortage, if however there are only two moldy rotten loaves left in each store, then yes they would conclude there is a supply shortage. What they wouldn’t do, is go to the bakeries and count bags of flour and then try to determine how many loaves that equates to, they wouldn’t then see if that aligns with annual population size and average loaves/ household, because that again is logic-rejecting and head in the sand type behavior. Currently there is under one month’s of inventory and historically speaking that is the equivalent of two moldy loaves. The housing shortage is real.

Both you and T have this same propensity to make accusations of me, then immediately proceed to do the very thing you’re accusing me of. Like when he calls me financially illiterate and clueless and then gets schooled by me on tax and economics or like when you call me logic-rejecting and head in the sand and then you react to contradictory data like the church reacts to evolution theory and dinosaur bones. Until now I have never met anyone who flings poop, misses his target then proceed to dive in it and smear it all over themselves, let alone finding two people with that habit. So I think logical, truth-seeking people will forgive me for thinking you are the same person.

Chris

at 11:11 am

Kyle, I have an opinion, and debate towards my opinion. That is not a bias. A bias would be if I had some underlying factor inclining me towards that opinion. But, as I have no horse in this race, my reason for holding this opinion is based on research and analysis I have encountered. You, being a Toronto home owner, have an inherent bias in holding the opposing opinion, as it benefits your financial situation.

I don’t think anyone could logically argue that real estate speculation in Sherbrooke is at similar levels as Vancouver. Rather, we should be comparing other major cities, such as Toronto, Vancouver, New York, London, Paris, Los Angeles, etc. I know you don’t seem to love Better Dwelling, but they’ve put together a chart here:

https://betterdwelling.com/vacant-homes-global-epidemic-paris-fighting-60-tax/

I have no idea where you found that TREB data, but I found data that contradicts your figures. Here is TREB’s Historical Statistics in a .PDF:

https://www.google.ca/url?sa=t&rct=j&q=&esrc=s&source=web&cd=7&ved=0ahUKEwik0MbtmcLSAhXE4IMKHakZAuMQFghBMAY&url=http%3A%2F%2Fwww.trebhome.com%2Fmarket_news%2Fmarket_watch%2Fhistoric_stats%2Fpdf%2Ftreb_historic_statistics.pdf&usg=AFQjCNGYWtBopJgRagVJAfg7KL4qhOpvBQ&sig2=M3t5ZwiNtkCGNEJNmHt4mQ&bvm=bv.148747831,d.amc&cad=rja

In 1971, the average Toronto home price was $30,426, a far cry from the figure you gave. The S&P 500 in January 1971 was at $95.88 (make sure to uncheck inflation adjustment):

http://www.macrotrends.net/2324/sp-500-historical-chart-data

So, that is a gain of 2,779% for homes and 2,385% for equities. Not quite as well as the 6,000% gain you were citing. Additionally, this gain does not consider dividends paid by equities, nor does it consider interest, insurance and maintenance on homes. So, I will conceit to you that Toronto real estate has had a good number of decades, but any downturn of the likes seen in the United States, Ireland, Spain, Japan, etc., would quickly change this picture.

You have cited one company, Urbancorp, and have extrapolated this to assume that “many” starts are never completed. I don’t think I need to delve into the flawed methodology inherent in this assumption.

You are equating the supply of home listings, with the supply of homes overall. They are not the same. Taking your bread example, that’s like saying there’s a bread shortage, when in reality there are a few people buying up loaves of bread as they are finished baking, and storing them, in order to re-sell them for a premium later. Is this a concern? Absolutely. But to say there’s not enough bread to feed everyone is incorrect; the market is being distorted.

We have seen from census results that population growth is not driving Toronto’s housing price appreciation. We also know that inflation and income growth is not driving it (as these have been paltry for recent years). That leaves speculation, low interest rates, and foreign capital as the primary causes.

As I’ve said, I have no way to prove that I am not T or Daveyboy, or anyone else in this discussion. For all anyone knows, you (Kyle) and I could be the same person, just posting different sides of the argument. So I won’t bother with this topic.

Kyle

at 1:34 pm