Why is real estate so expensive in this city?

Gawrsh, I mean, come on! We all “should” be able to live here, and “should” be able to afford our own home, and the powers-that-be “should” make that happen.

In an unrelated story, can you guess my most-hated word in today’s society?

Let’s turn that on it’s head, for a moment.

There shouldn’t be over $200,000 of government charges, on average, for every unit of new housing, but there is.

It shouldn’t cost $950 per square foot to build B-level condos in the downtown core right now, but it does.

And upon speaking to a rep for one of Toronto’s largest developers yesterday, I learned that this $950/sqft figure is real, and it’s spectacular!

Imagine that?

$950/sqft for construction costs.

So even if you’re successful at assembling land for $100/sqft, unzoned, and even if you can rezone that land from “neighbourhoods” to “apartments,” at a significant cost, and even if you can convince buyers to take on a large percentage of the development charges, HST, and associated fees and costs paid to all three levels of government, just how easy or difficult will it actually be to turn a profit?

This is why so few developers are buying land right now, and even fewer are building. Er, I mean, many are selling, but how many are actually going to build remains to be seen.

In the meantime, I’ve been monitoring pre-construction condo prices just to see what developers think they can charge, and by association, just how much they might need to charge in order to make a project viable, and I remain absolutely astounded.

Does anybody want to add some colour here?

I know that a lot of the TRB readers dabble in pre-construction condo investing and many of the agents who read this blog sell projects as well.

Over the last couple of years, the well has run a little dry. More and more people are waving the same flag as I am, saying, “These prices make no sense.”

But what happens when the real estate market slows down?

What happened to all those people who were fine to pay $1,500 per square foot for downtown condos in pre-construction, when comparable resale was selling for $1,200?

Where are they now?

Lots of questions, lots of answers, but that’s not even the topic du jour.

Today, I want to show you a handful of pre-construction projects that have hit my inbox in the past month, and we can weigh the pros and cons of each project.

As I said, I’d love some colour commentary to anybody that is:

a) Still active

b) Formerly active, currently on the sidelines

c) Never active

Shall we?

The first project I want to look at is called “Four Me.”

fourme

All lowercase, and I’m not sure it’s a form of word play, but it might be because it’s a 44-storey building comprised of 440 units, or at least it was when they applied for their zoning by-law amendment earlier in the year.

This is located at Markham & Ellesmere in Mississauga.

The developer is the Lash Group who built both condos at the corner of St. Clair & Bathurst, among others.

This project is currently selling and they are hosting an “event” on Wednesday night.

This was in the email I just received:

This is one of your final days to secure suites before one bedroom condos increase by $20k and two bedrooms increase by $30k.

A story like that’s gotta be true!

As for the prices, any ideas on what you’d expect to pay for a pre-construction condo at Markham & Ellesmere?

On a per-square-foot level, or on an absolute basis, give it a think.

Then when you’re done, look at this:

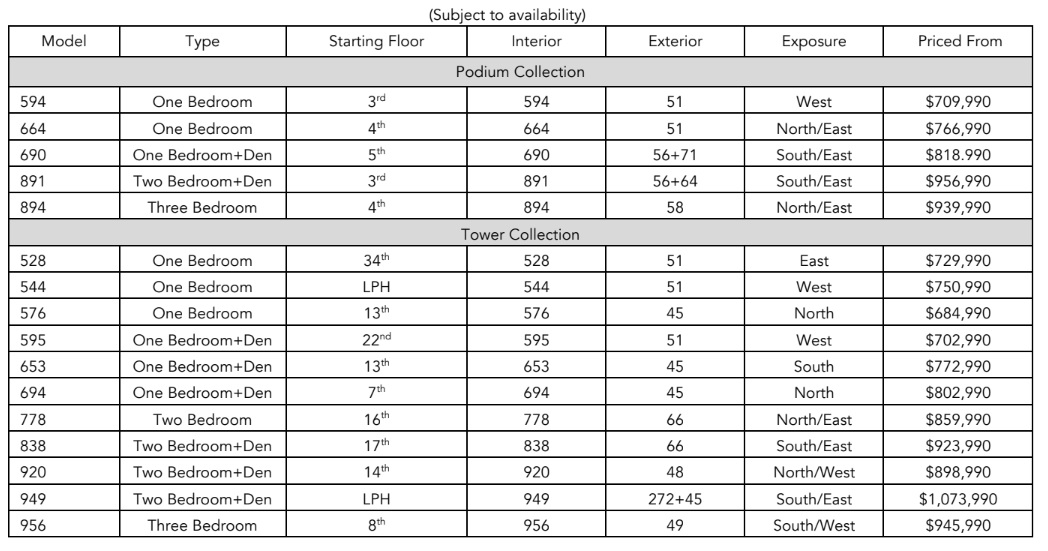

I’m not sure how well that loads for you, but you can probably click to enlarge.

I often judge a project by the price per square foot of its cheapest condo. In this case, that’s the 594 square foot, 1-bedroom, 1-bathroom, priced at $709,990.

That’s $1,1995/sqft.

Of course, there are cheaper units.

You can get a 3-bedroom, 956 square feet, for $945,990, or $989/sqft.

Then again, the cheapest “tower unit” checks in at a whopping $1,382/sqft.

Their “incentives” include:

-right to lease during occupancy

-reduced assignment cost

-development caps

-free flooring upgrade

-discounted parking

I laugh when I see “right to lease during occupancy” since it underscores everything I think is wrong with pre-construction (ie. that you start paying before you “own” and have rights, among other things…) and there really shouldn’t be a cost for assignment, but I digress.

–

Next up is “The Bedford” at Bedford & Davenport.

The developer, Burnac, seems to be into wholesale produce as well as real estate, but those go together like peanut-butter and……………..feet?

Nevertheless, this is a self-described “luxury project,” in an upscale location, with an extremely well-done website, if I’m being honest.

The website reaffirmed what I already know about myself, namely that I’m not very classy. Otherwise, I’d have loved this Picasso-like drawing of the building, which looks like a child drew it in J.K., and I wouldn’t be amused by the oxymoron in the caption below:

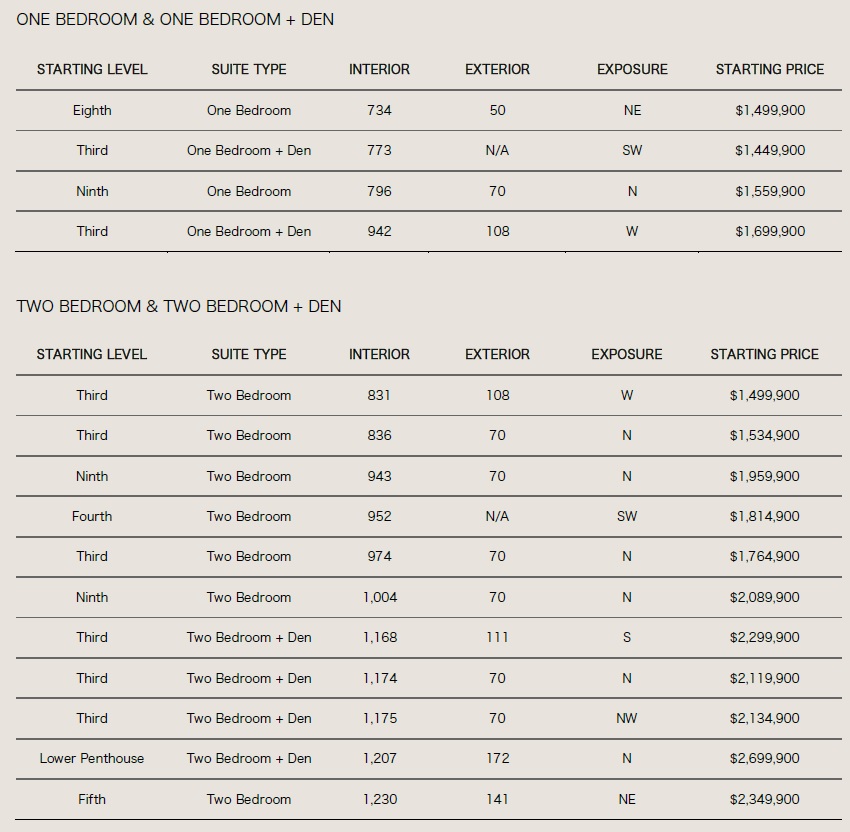

Alright, so let’s get to the pricing.

What will one of these units run you?

I hope you’re sitting down for this, folks…

Starting again with the lowest-priced one-bedroom, we find a 734 square foot model on the 8th floor for a mere $1,499,900.

That’s $2,043/sqft.

The highest-priced unit in the building, Lower Penthouse, is priced at $2,237/sqft.

However, parking spaces are $125,000 each. That increases the price, assuming only one parking space, to $2,340/sqft.

I will applaud this developer, however, for including their “development fees” in the marketing material.

They are as follows:

-1 Bedroom & 1+Den: $16,000 plus HST

-2 Bedroom & 2+Den: $18,000 plus HST

-3 Bedroom & Up: $20,000 plus HST

So on the one hand, you’ve got to shell out more money. But on the other hand, your fees are capped, and God only knows what the city of Toronto is charging!

The deposit structures are interesting:

CANADIAN RESIDENTS:

$20,000 on signing

Balance to 5% in 30 days

5% in 180 days

5% in 540 days

5% in 900 days

5% on occupancy

INTERNATIONAL:

5% on signing

10% in 120 days

10% in 270 days

10% in 365 days

While I know it might be more interesting to talk about the “international” deposit structure, whether it’s the whopping 35% they want inside the first year or the fact that there’s actually an advertised “international” deposit structure, I found the “residents” structure more interesting.

Why?

Well, I think this is the first time I’ve seen 900 days followed by 5% on occupancy.

They’re not even going to joke about an “estimated occupancy” of the fall of 2024 like most developers. They’re being honest, which is nice, but it’s also quite depressing. Especially when we’re so accustomed to seeing developers lie about estimated occupancy…

–

Last, but not least, let’s look at something other than condos.

How about townhouses in Pickering?

This project piqued my interest for a few reasons.

First, the location.

Their marketing material shows the following:

I don’t know Pickering, but this seems to be a batch of trees in between two retail areas, just on the other side of Highway 401.

Is this area up-and-coming?

Inquisitive minds want to know.

They are offering four models in their current email blast:

“Starting price” has an asterisk, just saying.

But what I found most helpful about this email blast was that it included the following:

They have whited-out the MLS#, the “days on market,” and the seller’s last name, but we know his first name is Dan…

But do you want to know the really fun part?

This “comparable” is 1,324 square feet.

The units they’re selling range from 1,028 square feet to 1,115 square feet.

Their $809,900 model, measuring 1,115 square feet, is priced at $726/sqft.

The “comparable” model, measuring 1,324 square feet, is priced at $668/sqft. Oh, and it’s built by reputable developer, Daniels Corp, and not some one-off. It’s also finished, as in you can walk through it, touch it, and feel it, unlike the pre-con being offered at Central District Towns.

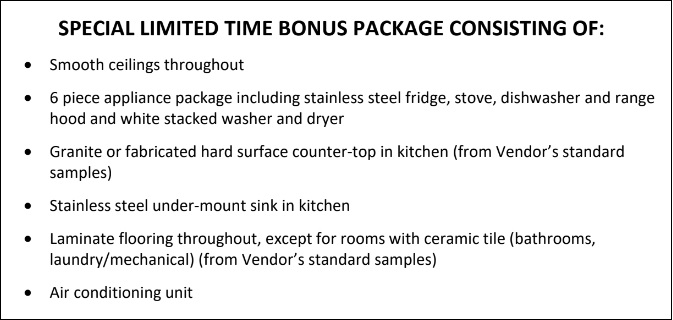

What about incentives?

Oh yeah, there are incentives!

Per the marketing:

-Permission to lease during occupancy*

-development charges capped at $10,000**

Those asterisks are in their marketing, but there is no explanation of what they are.

But there’s also a “Special Limited Time Bonus Package” as follows:

You had me at “air conditioning.”

What an upgrade, wow!

How about the deposit structures?

RESIDENTS:

$20,000 on signing

Balance to 5% in 30 days

2.5% in 90 days

2.5% in 180 days

2.5% in 270 days

2.5% in 365 days

5% on occupancy

INTERNATIONAL:

$20,000 on signing

Balance to 10% in 30 days

10% in 90 days

10% in 180 days

5% in 270 days

So they want 20% deposits for “residents,” whereas The Bedford wanted 25%, but both want 35% deposits for “internationals.”

–

Well, folks, I don’t know what conclusions you drew from today’s blog, but I’m happy to compare notes.

Developers are going to get creative in their efforts to lure both buyers and buyer agents, and I think the pre-construction industry is about to show some collective humility that hasn’t been shown for quite some time!

I also think that a lot of projects aren’t going to get built, so it will be interesting to see how the Ontario government’s crackdown on “condo cancellations” will take shape in the coming years, since developers are still launching projects and taking deposits even though there are zero certainties down the road.

If you’ve got a pre-construction “worksheet” or price list that you think I should see, and which perhaps we need to analyze on TRB, email me!

Libertarian

at 9:57 am

Last time I checked Markham and Ellesmere is in Scarborough, not Mississauga. I know “Scarborough” is a bad word in this city, but that’s taking it a little too far.

All that talk about “should” applies to landlords as well. They think they should be able to charge whatever they want, do whatever they want, and be guaranteed a huge return. Life’s not fair to everybody, stop you’re whining.

Geoff

at 1:11 pm

does the price include kevlar in the walls ?

Condodweller

at 10:41 am

David, I used to be “active” and in my experience, you have no other choice but to go to the sales centre and ask them for a price for a specific unit. The units listed on these lists are always the cheapest least desirable crappy units nobody wants. The stars on prices usually reflect this fact and that they increase with each floor you move up. Add to this that by the time you go the lowest available floor might be 27 and you have 0 chance of getting those prices.

Regarding unrealistic prices, there will have to be a day of reckoning and a washout. Once reality sets in that inflation is not going back to 2% any time soon and prices are staying at these levels if not decreasing further because people simply can’t afford them or simply don’t want to pay them developers and pre-constructions buyers will simply have to take the pain.

I don’t know how well developers are financed but in my experience, they isolate each project so that if one fails creditors can’t go after their other assets. I assume we will see many current projects fail where developers will have to eat the loss.

The days of charging future prices today are over but if their business model needs those prices to be financially viable what do they do? I’m guessing there will be opportunist investors who can buy them out at low enough levels that the buyer can turn around and sell them for a “reasonable” price and still make some profit, or a lot of profit since they will be in a very strong bargaining position to take these projects off the developers’ hands.

It will be interesting to see how this plays out. I think pre-con prices will have to come down to market values or even below with the uncertainty of the project getting finished. But who knows, if there are enough desperate buyers who are not knowledgable they might jump all over these amazing new units with smooth walls, a/c, and what, level floors? If you give them electricity and water how can anyone say no to these units? Well, perhaps $100,000+ parking may be an issue, they will have to work on that.

Even individual investors who were ok with counting on future price growth and taking on units with negative cashflows will probably readjust and will not pay future prices which will eliminate the majority of pre-con buyers overnight.

People who kept their powder dry should have great opportunities to get units for much more reasonable prices.

Kevin

at 11:38 am

Anybody buying one of these units may also be interested in the magic beans I have in my right hand. But they’re magic so you can’t see them. You just know they’re in my hand because I’m telling you they are. Also, they’re magic.

Ace Goodheart

at 2:00 pm

So the last folks on the list above are going to try to sell newbuild condo towns WITHOUT air conditioning?

Considering anything on the outside of the condo town’s walls is considered to be a common element, how exactly would that work?

The buyer cannot install their own AC unit (that would be installing an AC unit on top of a common element, which you are not allowed to do).

That makes little sense.

Also, these towns come WITHOUT appliances, unless you pay extra? What planet are they building them on? Mars?

Adrian

at 5:10 pm

The funny thing about the bottom falling out of the pre-con market is that it just delayed the start of new projects… which is only going to make our supply problem worse? Not to mention that the government just announced an increased immigration target of 500,000 people per year. In other markets where pre-con has crashed the common factor was that those markets were overbuilt. Toronto is nowhere near overbuilt. The addition of HST on assignment sales had pretty much killed that market before all of this happened and that was where the “easy money” was anyways. True investors are prepared to close and hold, rental demand isn’t going anywhere any time soon.

Agreed that if you bought at the peak it may be a while until those prices recover… for most Toronto condos buying pre-con in Feb 2022 the closings won’t be until 2026. Will prices recover in 4 years to allow those investors to close? I predict that closing issues will be with pre-con in the suburban GTA- townhomes or low-rise with only a year or two until completion. However I don’t see this as a systematic risk as I believe there are still many well capitalized investors who will be swooping in (at discounted purchase prices of course) when mom and pops aren’t able to close on their units.

Sirgruper

at 7:04 pm

Nice Seinfeld reference. Yep the owners of Burnac started at the food terminal. And lash are the first initial of the developers kids names. That and I can’t see anything but true A future developments going forward for the near future.

John

at 6:57 am

What do you think about the new harbourwalk releases that are part of the upcoming lakeview village in Mississauga? I think they’re going for about 1320/sqft right now which is pricey but I’m also intrigued by the master plan aspect and the potential for this to become a tourist/attraction hub. Curious to hear your thoughts.