You know I’m not really a “guest blog” type person. Never have been, through thirteen years, and don’t ever plan to be.

But once in a while, there’s something just too good to turn down. And today is one of those examples.

We’ve talked a lot this year about people moving out of the city, and many of our friends and family members have chosen to move to cottage-country full time.

I don’t know cottage-country, and I certainly don’t have access to the statistics.

But a colleague of mine, Ken Davenport, from Sutton Group Incentive Realty, has put together an unbelievable analysis of 2019-2020 sales.

It’s my pleasure to share the following with you today!

–

Ken Davenport

Sutton Group Incentive Realty Inc.

kdavenport@sutton.com

705-795-3922

Overview:

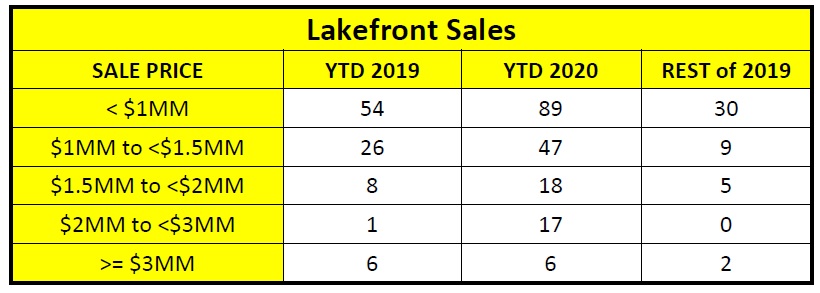

I recently reviewed 427 lakefront homes which for sale between January 1st 2019 and September 24th, 2020. All properties are freehold detached houses located directly on Lake Simcoe or Lake Couchiching.1 Key findings are:

- 329 homes (or 77% of properties) were purchased2, 57 houses were pulled off the market unsold and 41 listings remain active.

- The average YTD sale price in 2020 was $1.28 million. Over the same period last year the mean hit $1.14 million, yielding an average price hike of 12%.

- Volumes soared in 2020 (i.e. YTD 177 vs 95 last year).

- 102 houses were bought in May through July this year, some 113% more than in 2019. Activity has since slowed: 40 homes were bought in August and the first 24 days of September; this was 18 more (or 82%) than over the same period last year.

- However, we’re not done yet. In the last 3 months of 2019 some 42 properties were bought, more than half of them in October. That month tied with July for 2019’s busiest. It will likely be a strong sales period once again this year.

What & Where:

Sales under $1.5 million showed good growth in the first part of 2020, but were outpaced by those between $1.5 and $3 million, which more than doubled. Noteworthy was the $2MM to < $3MM category which was on fire. Last year-end saw an uptick in $3MM+ purchases plus a leap in sales of sub-million dollar homes. This year mid-range properties will likely be strongest.

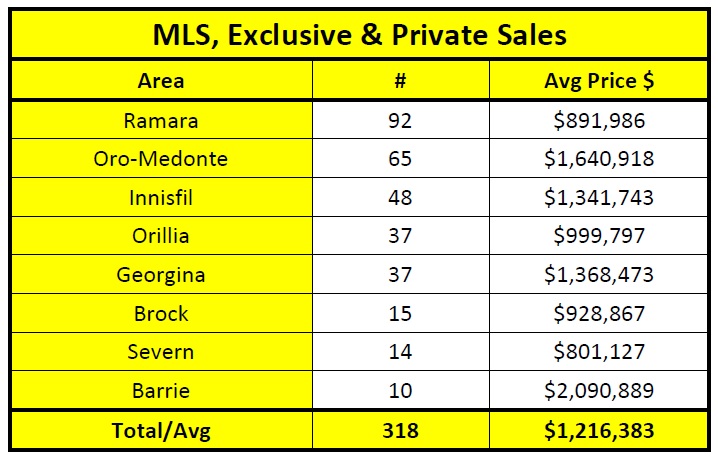

The bulk of sales have occurred in Ramara, Oro-Medonte, Innisfil, Orillia, and Georgina with just a trickle happening in other places. Barrie, Oro-Medonte, Georgina, and Innisfil average prices were significantly higher than those in Severn, Brock, and Ramara. This state partly reflects tight supply and geographic limits in some communities. Severn, for example, has many high-end homes on smaller lakes that aren’t included in this analysis.

Who Helps:

The sale of homes across the two lake market is extremely fragmented. The 694 MLS tied transactions3 involved at least 128 independent real estate brokerages and more than 364 separate realtors/teams. Over the course of the nearly 21 months examined, only 17 of these agents/teams were involved in five or more lakefront transactions and a mere five people/groups were engaged in 10 or more relevant trades.

No-one has a commanding market share. Combined the 10 largest brokerages account for 52% of listings, 54% of MLS sales and 43% of sales made with identified buyer representatives. The top 10 teams/realtors mostly belonged to the big brokerages. This group was involved in 24% of sales, managed 23% of listings, and represented 17% of those with identified buyer representatives.

The majority of agents (i.e. 62% of buying realtors and 70% of listers) were involved with only a single lakefront transaction (a sale, a purchase or an unsold listing) over the nearly 21 month period.

No realtors or brokerages have a presence across the full two lake market. While there are a handful of local waterfront specialists in Oro-Medonte, Brechin, Innisfil, Orillia and Georgina, these local experts rarely venture outside of the tight confines of their preferred neighbourhoods. This approach makes a great deal of sense if purchasers are primarily locals but is harder to defend when so many buyers come from outside local communities.

Wither MLS? While realtor transactions dominate (i.e. 297 purchases or 91% were listed on MLS), some 32 deals were either purely private contracts or realtor exclusive sales in which an agent sold the property without listing it first on Realtor.ca. In addition, there were 15 purchases made within six months of a listing being terminated on MLS. These sales were arguably impacted by the owner agent’s marketing effort and have been attributed to the listing realtor in this report. In many of these cases, the realtor would have been compensated for the sale but the transaction wasn’t reported to their home real estate board.

In 57 other purchases (or 27% of MLS linked sales with confirmed buyer representatives) the listing agent/ team also dealt directly with the buyer. Dual agency (or multiple representation) of this sort is illegal in British Columbia and discouraged by the Ontario Real Estate Association due to the potential for conflict of interest. Nevertheless, it is an important practice in markets with limited liquidity and the need for specialized real estate expertise.

The classic concern about dual agency is that the seller and/or buyer will be rushed into a transaction prematurely and that one party will accept too little or pay too much. This doesn’t seem to be the case with these lakefronts. The average discount from the last list price was 5.4% versus 4.4% for regular MLS sales. The mean dual property was also on the market 70 days from the most recent list date, in line with the 66 day average for the others. A mere 4 dual homes (or 7%) were sold within a week of being listed, a smaller share than regular MLS sales (i.e. 10%).

There also isn’t a clear-cut pricing pattern. While 44% of up-market Barrie MLS sales were multiples, 36% of lower-priced Brock deals also involved a single realtor. Mid-range markets such as Oro-Medonte (26%) and Innisfil (23%) had fewer multiples, while in all other places the dual share was less than a fifth. Also, while 25% of overall $3 million-plus sales were duals and 30% of buys from $1.5 to $2 million were made with one agent/team, only 18% of those from $2 to $3 million could claim the same. Under $1 million 17% of sales were multiples while between $1 and $1.5 million the proportion was 27%.

Dual agency sales were also widely dispersed among many realtors and no agent seems to be actively (or at least successfully) pursuing double–end multiples as a main operating strategy. These 57 trades were conducted by 44 realtors/teams, four-fifths of whom completed a single dual lakefront deal over the nearly 21 months reviewed. Five agents/teams did it twice and two local specialists managed it three times. One of Canada’s largest mega-teams pulled it off 5 times.

So, on the surface, nothing nefarious seems to be going on. Instead, a sizable minority of buyers seem more at ease dealing directly with listing agents. Since few lakefront buyers are likely to be first-timers, most would have used a realtor to sell their old home. So, it seems that for whatever reason, an unusually large share of buyers (albeit still a minority) are dropping their old agent and purchasing without having someone explicitly and exclusively represent their interests.

While this dual agency caveat emptor model may be working fine for some lakefront buyers, it’s unclear if the Ontario government will continue to permit the practice to operate unhindered for much longer. On February 27th, 2020 the provincial legislature passed the Trust in Real Estate Services Act which, among other things, allows regulator RECO to introduce new restrictions on “multiple representation”.

Earlier RECO had advocated for a partial ban on the practice. Under their proposal, dual agency would be permitted at the brokerage level but not at that of the individual agent. Instead, another realtor would usually be drafted to assist with the deal regardless of the wishes of the seller and buyer. The new regulations remain to be implemented, but If RECO does adopt a hard line, the sale of lakefront properties could become more cumbersome and costly in the near future.

Sizzling Summer

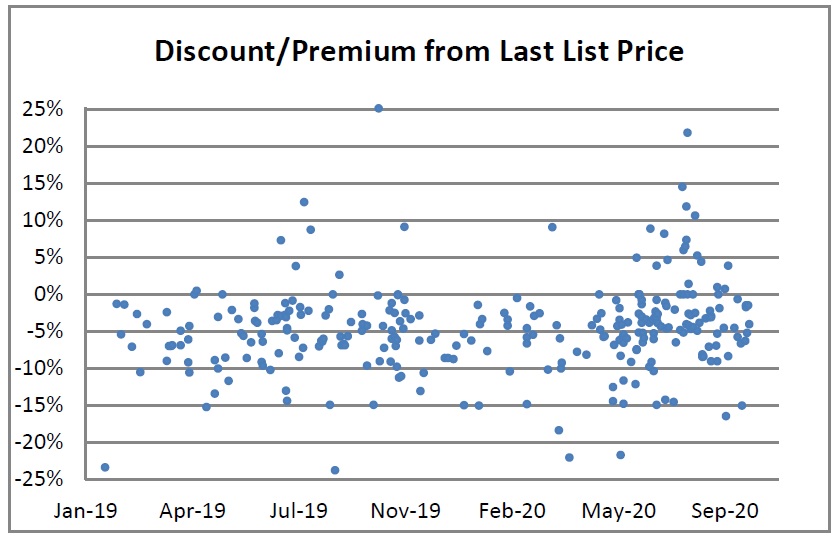

A hot weather surge altered the traditional lakefront pricing pattern as high demand and multiple offers pushed some successful buyers to bid beyond list. From June 10th through September 5th, twenty-two buyers paid premiums, far more than the 5 who did so in 2019. The euphoria peaked in July and seems5 to have slowed since. With October likely to be another strong month, it will be interesting to see if premiums re-appear.

Although the 2020 rise in over-list offers is undeniable it’s also important to recognize that the vast majority of properties purchased this year came in somewhere between the last list price and a 10% discount. Moreover, when the final sale price is matched against the peak (usually the original) list price, the full discounting pattern becomes more obvious. A significant number of successful sellers in 2020 needed to drop their price 10% to 30% in order to sell. Many others managed to discount a bit less, but the vast majority of owners needed to lower their initial expectations markedly to meet marketplace reality.

Notwithstanding the recent euphoria and the outpouring of COVID weary refugees from the GTA, the lakefront discounting pattern hasn’t really changed that much. Many sellers, especially those in the bottom half of the market, would benefit from more aggressive pricing upfront. While competitive bids are rare among these homes, they aren’t unheard of. I know of two cases in recent weeks which attracted 5 and 7 bids respectively. These owners were quickly rewarded for their aggression. Others could benefit from following their lead.

The Old Guard:

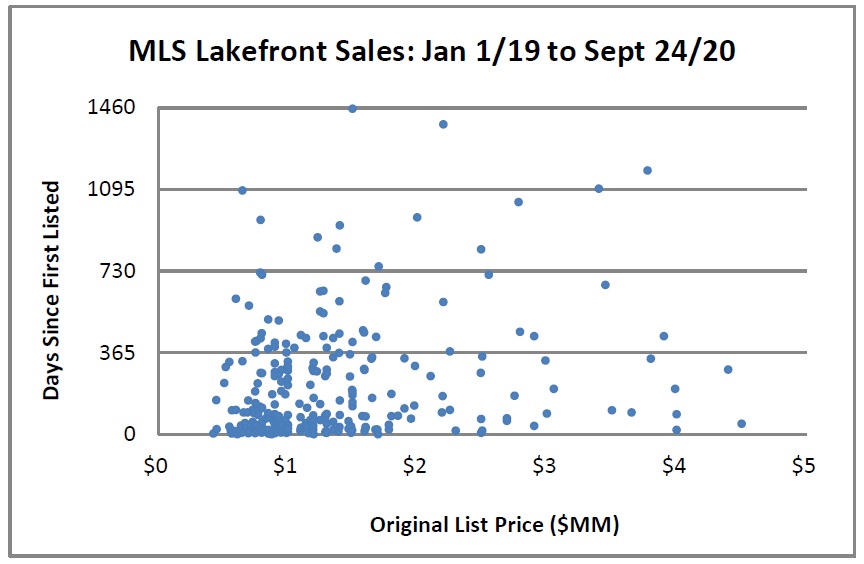

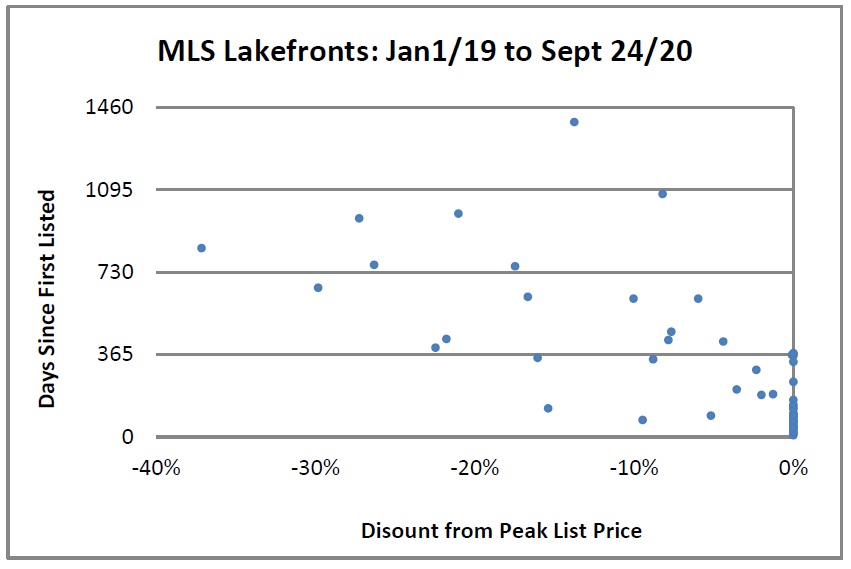

A number of lakefront homes are listed for long periods and on multiple occasions before a satisfactory deal is struck between a buyer and seller. Those listed on MLS and purchased between January 1st 2019 and September 24th, 2020 had an average period between first listing and sale of 231 days. Active and conditionally sold listings as of September 24th chronicled 333 days, while those which had been withdrawn unsold sometime since January 1st 2019 recorded 427 days.

In most cases, the long sales tenure is not because of limited demand for these homes, but simply because many sellers have unrealistic price expectations. As the chart shows, many lakefront homes sold within a few weeks or months of first being listed, while a majority accepted an offer within 12 months. However, a large group of properties took years to sell. In one extreme case, the seller first listed more than 6 years before finally selling. He also dropped his price over three hundred thousand dollars before finally attracting a willing buyer.

Hopes and Prayers:

As the chart shows, there is a definite relationship between a property’s market tenure and the discount required to close the sale. Generally the longer the time since a home was first listed, the steeper the discount. In more than a few cases successful sellers have dropped their original price by more than a quarter to seal the deal. That’s a lot of time and money wasted. Most of the time, owners are far better off choosing a realistic list price and accepting 4% to 6% less. Setting a list price well above market is just asking to be disappointed. Only extremely patient, super optimists should even consider it.

Waiting for Deep Pockets Godot:

In the United States, the real estate juggernaut Zillow has a website feature called “Make Me Move,” which they describe as the “dream price” a semi-motivated seller would accept if it was offered. A hardcore group of lakefront sellers are effectively employing such a strategy by listing high and hoping to get lucky. As shown in the chart many of those who have pulled their homes off the market since January 2019 listed for a brief period of time and made a token price drop before giving up. A significant share refused to lower their list price at all.

Unfortunately for these folks, the average successful seller had to agree to a discount from their original list price of 10.8% in order to sell. Arguably this rate may now be obsolete. In recent months the demand for lakefront homes has been exceptional and prices have been higher than ever. As a result, most of these off-market owners would obtain good prices if they chose to sell today. Of course, their definition of good and the market’s may differ, but so long as sellers adopt a flexible outlook, they have a very good chance of walking away with a lot of money in their pockets.

Now What?

There are currently six homes listed for sale over $3 million and another 46 on the market below that level. Eleven of the forty-six have sold conditionally (see shaded bars in the chart). Most of the conditional sales should firm over the coming couple of weeks.

For many other sellers, it may be too late. As shown by the chart’s jagged line, few owners with properties listed below $2.5 million have made meaningful price adjustments so far. Some will do so in the first week of October and hope to catch the late-season rush. Many others though seem likely to misjudge the market and miss the sales window completely. A number of these sellers seem bound to pull their homes off the market once November hits and try again next May or in 2022.

Que Sera, Sera. At this point, most waterfront buyers should be getting ready to get serious, since there will be deals to be had between now and Halloween. Anyone considering selling in 2020 would also be wise to get on with it. Those who have been on the market for several weeks or months need to think very carefully about their next move, as there is very little time left this year. While many people are likely to do well over the next five weeks, the busy season is rapidly drawing to a close.

October looks like it’s going to be a great time for lakefront sales on Lake Simcoe and Lake Couchiching. By November though, things may change drastically, especially if the second round of COVID intensifies. There is also a mountain of uncertainty about next spring and the pandemic’s economic fall-out. So far the lakefront real estate market has performed unbelievably well, but it is far from certain this will continue for very much longer. If you hope to benefit from the unusually strong conditions, now’s the time to act.

Many thanks to Ken for putting this all together!

As a stats-junkie, I respect the time that this took to compile as well as the ingenuity that few real estate agents possess.

On Wednesday of this week, one of my long-time clients closed on the sale of her Toronto loft and relocated to Collingwood permanently. She was one of several clients who have moved out of Toronto this year, but moving to a cottage full-time was something unexpected.

I can handle clients telling me they’re moving to Burlington to be near family, or moving to Oakville to get more space. But moving to cottage country? That’s jealousy-inspiring right now!

Don’t forget about me, C. I’m stuck here in the city! Enjoy the new life, you guys deserve it!

Appraiser

at 8:42 am

Great data. Well done.

Somebody’s got a stats background, knows their way around scatter dot charts and the concept of standard deviation.

AmIrite?

Verbal Kint

at 9:05 am

Contest idea: Guess the X axis on chart #6, Active Listings <=$3 Million

Bonus round: What do the different bar colours signify?

Francesca

at 9:38 am

I don’t understand the appeal of living in cottage country year round permanently unless you also love winter and are a huge winter outdoor sports fan. Personally I would be bored out of my mind living there all year round and not have the amenities that city life offers. I’d like to know what happens to these people when all of a sudden they cannot work remotely anymore and it gets too cumbersome to commute back into the city if eventually their office job comes a calling or they change jobs where remote work isn’t possible. Those who are buying cottages as a vacation home, different story, but those moving there permanently good luck. I’d be curious to see how long they end up staying or if there are regrets.

Professional Shanker

at 10:09 am

The majority of the activity (even currently) in cottage country is either vacation property purchases or relocation from city (older generation either retired or getting ready to which COVID has accelerated life planning).

The WFH crowd plays a role but not a significant one yet. They are definitely front running altered work practices, but what if part time office work becomes the new norm long term, then they would have timed their relocation and purchase perfectly.

I know this is difficult for Toronto RE bulls to hear but if WFH or partial WFH is normalized Toronto city prices (smaller sq ft properties) will be pressurized while rural property prices would benefit.

Appraiser

at 10:49 am

I disagree. The move out of the GTA is nothing new, it is elevated slightly now, but is still a very small segment of the market. The “great exodus from the city” rhetoric is way overblown.

What we are witnessing though is an unprecedented increase in demand (and prices) for detached properties in the city and in the GTA. That’s the real story.

Chris

at 11:09 am

“The move out of the GTA is nothing new, it is elevated slightly now, but is still a very small segment of the market. The “great exodus from the city” rhetoric is way overblown.”

Source?

“We’re definitely seeing an exodus out of cities”

– John Pasalis

https://twitter.com/TheAgenda/status/1310649189194518529

Appraiser

at 3:00 pm

The plural of anecdote is still not data.

Chris

at 3:26 pm

So where’s your data? All I see is your opinion that the exodus is overblown, with zero support for that assertion.

Professional Shanker

at 12:15 pm

Completely agree with your statement regarding the relative strength in the detached market in the GTA – COVID and WFH is putting a premium on larger sq ft homes and ones with larger lots which allow for pools.

I remarked many times during the condo (Airbnb induced) price run up that I would go long detached and short condo – COVID accelerated this move.

On the great exodus narrative, activity is undeniably higher than normal so that narrative on a short term basis is not overblown. Med to Long term – that all depends on future work practices, give me a sec while I look for my trusty crystal ball.

Appraiser

at 3:04 pm

LG’s latest September data for TRREB:

Average sale price $972K (+15%) – Yet another all-time high.

Sales volume up +39% over 2019.

Months of inventory: 1.7

https://twitter.com/JohnPasalis/status/1312049158094757890

Chris

at 3:34 pm

“The growth in sales was driven by strong suburban demand. Sales were up in:

Halton 73%

York 50%

Durham 55%

Peel 45%

Sales in the City of Toronto were up 18%

New listings were up 12% for low-rise houses in the GTA but active inventory (total number of homes for sale) is still down 20% over last year.

But things look very different in the condo market where new listings were up 73% over last year and active listings are up 99%

When sales picked up in June they did not come back strong enough to make up for the lost sales in April and May

In Q2 and Q3 this year, condo sales are down 19% over last year while low-rise sales are at the same level

The decline in demand is also behind the rise in inventory”

– John Pasalis

Appraiser

at 3:11 pm

“Greater Vancouver home sales jumped 56% Y/Y in September. The highest number of sales for the month going back over 20 years.”

“As for CMHC’s forecast of a 9-18% drop in the average sales price. Average prices were up 13% in September, although almost entirely due to composition change. Way more expensive detached houses selling vs condos. Still a bad look for CMHC.”

https://twitter.com/SteveSaretsky

Chris

at 3:32 pm

Whoops, you missed a couple of the tweets in the thread:

“New listings also ripped to record highs for September, up 32% from last year. Overall inventory levels still lower, down about 7% from last year.

Very segmented market right now. Condo inventory at 6 year high, prices are dropping. Detached inventory at 6 year high, prices are rising.”

https://twitter.com/SteveSaretsky/status/1312048334304022528

Ken Davenport

at 3:23 pm

Damn! I was looking forward to MLS musings.

Hi David and all. Thanks for all your kind words. They’re much appreciated.

Hey VK. The X axis are individual active listings $3MM & under . Black bars are conditional sales.

Ken Davenport

Brian Sherman

at 3:36 pm

We have been trying to buy a cottage for several years. This summer as you can imagine was especially frustrating. Maybe the fall will be more promising. Flexible on location but price an issue.

Jimbo

at 8:32 pm

Look to Utah or Idaho, Wyoming and Montana near Yellowstone.

Very nice area to go to for your family time and you can rent out all year.

Flora & Gary

at 11:27 pm

My husband retired 5years ago and I’m planning to retire soon too. We have been trying to buy cottage for the past 2years .this year we just could not find the right price we want since the cottages triple their price . Hoping we will be able to buy water front lake cottage anywhere on Kawartha Lakes or Haliburton area this winter .

Lloyd vacek

at 11:19 pm

Im selling on Lake Dalrymple

Anna

at 6:50 am

The majority of the activity in cottage country is either vacation property purchases or relocation from the city. I don’t understand the appeal of living in a cottage country year-round permanently unless you also love winter and are a huge winter outdoor sports fan. but things look very different in the condo market where new listings.

Susan Suter

at 4:39 am

I have a beautiful historic home, an 1871 stone schoolhouse , 2,750sq.’ Zoned r/I, on .99 treed acres, very private. How do I interest people in the GTO area, property is close to PortDover.https://www.facebook.com/reel/691930951943162?fs=e&s=TIeQ9V&mibextid=0NULKw