Here’s a story for you…

I have a rental listing on the market for $9,000 per month.

It’s in the “luxury” category, and with that, if I may be so bold, comes an extra layer of choosiness on the part of the landlord.

I mean, every landlord out there is choosy, as they should be. We’ve discussed the state of the rental market in Ontario at great length over the last few years, especially as it pertains to the impossible task of removing a problem tenant, securing unpaid rent, and using the Landlord & Tenant Board to legally evict a tenant and for cause, so it should come as no surprise that landlords are being more choosy (diligent?) than ever.

When it comes to a $9,000 per month rental, however, I would argue that there are fewer scam operators knocking on the door. I did uncover one scam a few years ago for a $12,000 per month furnished luxury rental downtown, but overall, I’d say that scammers stick to the lower price point where there’s more volume and where the calibre of agents and landlords is poor.

I received an offer on the condo last week for $8,900 per month.

The tenants were a family and they were very qualified, albeit perhaps missing some essential documents like a credit report (haven’t been in Canada long enough), and only one was employed, but they had substantial financial resources and offered to pay eight months of rent up front.

But that $8,900 offer on a $9,000 per month listing was really curious to me.

I called their agent and asked, “Why would they offer $8,900 per month on a $9,000 per month rental when they’re providing eight months of rent up front?”

The agent said, “Because they want a deal.”

I thought she was kidding. So I waited for a follow-up comment, but nothing came.

I said, “Are you serious?”

She said, “Yes, they want a deal. They want to feel good about their decision.”

$100.

How good does that make a person feel?

Their decision to provide eight months of rent up front, instead of the traditional two, means an extra $53,400.

So why do they care about $100 per month?

I told her, “With respect, I think that’s a really odd move. You’re giving us eight months of rent up front. Why wouldn’t they just make this easy?”

Again, she said, “Because they want a good deal!”

I presented the offer to my landlord client and he too raised an issue with this.

It was like we were both staring at one of those 3D puzzles that were all the rage in the late 1990’s, and we just couldn’t get our eyes to focus in a way that would allow us to see properly.

Amazingly, my landlord client said, “I don’t get a good feeling from these people. There’s something off about this. I’ve got a very good track record of sussing out the squeaky-wheel tenants, problem tenants, and people who just drive ya nuts, so I’m going to pass.”

So he passed.

And when I told the agent on the other side, she simply said, “Thank you for letting me know!” and that was that.

What was a stranger occurrence:

a) The landlord’s decision not to proceed with an offer $100 under the posted list price

b) The tenancy agent’s decision not to try to revive the offer, resubmit, or get back on side?

I suppose you could point to the decision to offer $100 under list to begin with, but overall, this was a really odd experience.

There are agents out there right now saying that the rental market is hot and others are saying that it’s slow as hell. I suppose it depends on the day and who you ask.

But it also depends on the building and the level of competition!

Imagine you’re trying to rent your 2-bedroom, 1-bathroom condo in a building where there are a slew of units for lease.

But now imagine that, in addition to competing to other 2-bedroom units, you’re competing specifically against your exact same model unit five times over.

That’s exactly what’s happening with the “11” model unit here:

6th floor, 7th floor, 8th floor…

…17th floor, 21st floor, 26th floor.

And what’s with the pricing? It’s all over the map!

There are countless other examples of this throughout the downtown core and the buildings that are new and/or just registered are the hardest hit.

The last time we looked at the rental data, it was the first week of January and we were looking back at 2024’s fourth quarter.

Oh, January.

It was a different time! Three months ago, sure, but didn’t the world have an entirely different feel?

In any event, with Q1 now behind us, let’s take an updated look at the downtown condo rental market.

Through three months, the inventory levels are somewhat on par with 2024:

While I don’t think going from 2% to -1% to 8% is necessarily a trend, I do have a theory on this…

What if all the would-be condominium sellers who listed their properties for sale in January and February, only to find out that the market was weak, decided to keep the condos for another year or two and post them for lease?

What if that explains the increase in inventory in March?

Maybe I’m making something out of nothing. It’s only 8%, after all.

But if we see a surge in April and May, then my theory will prove correct.

Let’s look at the above data in our chart, and you tell me if it provides you with a slightly different perspective:

Do you see it?

Inventory levels in January and February were on par with 2024 and 2021, but in March, we hit a new “high.”

Is that the start of a new trend?

From the graph, it sure looks like it…

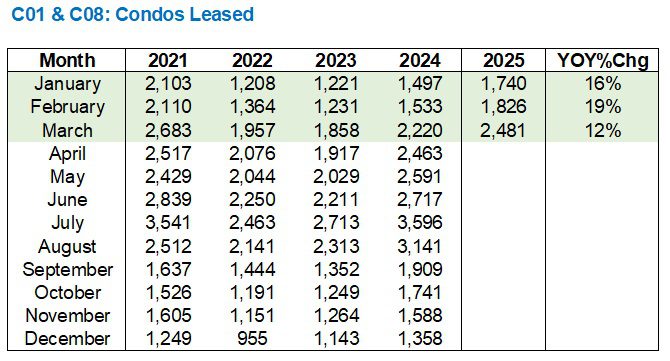

As for condos leased, here’s a data set that speaks to strength in the rental market:

That’s significant. No question.

No matter what “stories” you’re hearing out there about the rental market, double-digit year-over-year increases in all three months speaks to market strength.

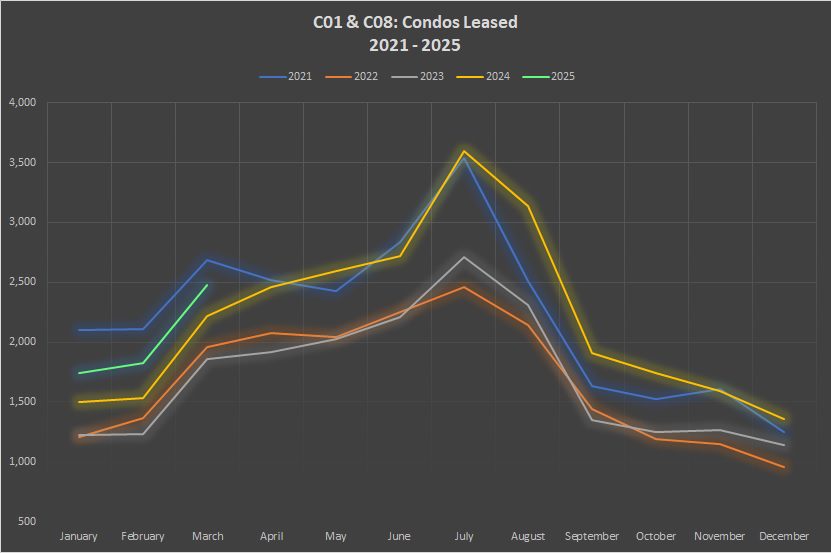

Our chart confirms this:

That’s what I would call “in the healthy range.”

Leases are plummeting. People still need a place to live.

But leases aren’t skyrocketing either, as there’s no sign of a major shift in how or where we live.

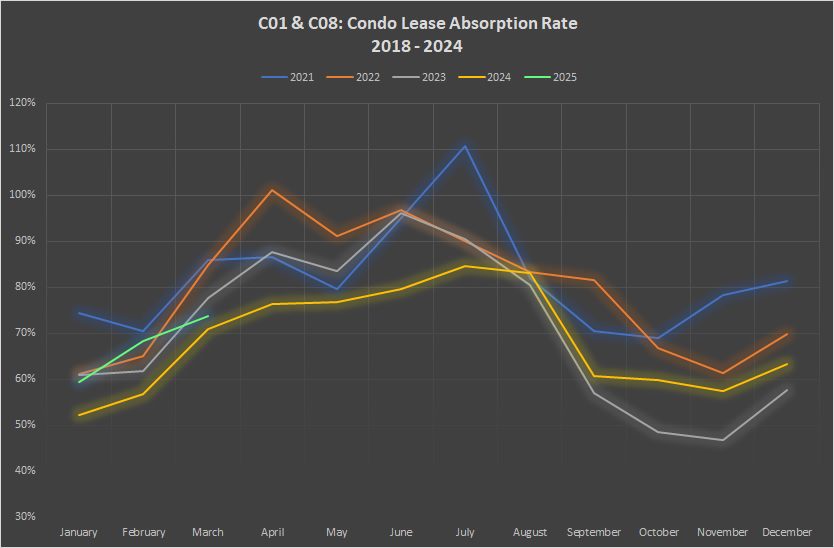

Now, how this all ties together is via the ratio of condos leased to condos listed, ie. our absorption rate:

Theoretically, an increasing absorption rate should lead to an increase in rent prices.

In practice, however, rent prices are down year-over-year.

According to Rentals.ca, the average rental price in Toronto declined by 6.8% in 2024.

If you want to get more specific, here are are the rental stats for March:

1-Bedroom:

Down 2.0%, month-over-month

Down 6.4%, year-over-year

2-Bedroom:

Down 4.5%, month-over-month

Down 9.8%, year-over-year

What does our chart of absorption rate tell us?

To describe it in a single word: meh.

Or to use a turn of phrase: par for the course.

These are pretty unremarkable statistics at a time when everything else seems extraordinary. You can’t expect less than an 800-point swing up or down on the DOW Jones these days, and the news cycle gives us hyperbole after fake news after doomsday scenario.

Not that we’re complaining, of course.

Sometimes, relaxed, modest, and calm is a welcome change.

Have a wonderful Easter weekend, everybody!

Appraiser

at 7:14 am

A strong rental market is helping to assuage what should be a nosediving resale market. Rents are still relatively high after many years of acceleration.

Many long term investors have options and can ride out the storm – they don’t have to sell. If they did, the condo market would experience a real correction.

Affordability is still off the charts in the GTA. Renter or buyer.

Serge

at 9:24 am

I have always thought that all big American and Canadian cities are on decline since the millenials peaked. They are only propped demographically by foreign migrants inflow. The investor condo boom in Toronto was fed by inflow of young professionals, temp workers and students (that is a guess, as there is no demographic stats on condo population). Now, recently, Feds published Toronto’s population “estimates” where it went in 2023-2024 from 2.9 mil to 3.3 mil. 300K+ people, 10% of population, in just 2 years! (No fanfares from the city hall, though.)

How does David’s stats, condo absorption or prices, reflect those numbers? It seems they are not affected.

As to the growth of condos both for sale and rent, it seems they are mostly investor condos, that lost current renter and owners decided to quit. Increase of this number shows that more and more of such condos are losing tenants.

On the other side, tens of thousand of new condos got to the market over those 4 years – but they did not budge the numbers….

Derek

at 10:20 am

Caveat that I typically don’t think on these rental market posts too much. But, wondering if there is any perhaps counterintuitive feedback loop element to the condos leased numbers. By that I mean, can the leased numbers have a bump up in a period of declining rents where tenants see an opportunity to get a better place for similar rent or get a similar place for less rent. As a result, they add to the leased numbers when they otherwise might have stayed uncounted where they were, month to month.

Marty

at 9:16 am

I think your client is probably right turning down that $8,900 offer, does seem very odd.

green

at 8:51 am

Great insights into the current downtown rental market—really appreciate the data-driven approach. It’s interesting to see how urban trends differ across regions. For those looking at emerging real estate markets abroad, Green City Estates are among the top real estate developers in Adibatla, India—a fast-growing hub with exciting investment potential.

https://www.greencityestates.co.in/