Wanna hear something depressing?

I sprained my ankle on Saturday.

Bad, eh? But that’s not actually the depressing part.

I rolled my right ankle, essentially stepping on my own foot, by doing one of the following:

a) Chasing a purse-snatcher down Bloor Street West after he stole an old lady’s handbag

b) Running into the endzone during an epic game of pick-up football at the park

c) Raking leaves on my front lawn, merely ten minutes into the exercise

Man, I’m not as spry as I used to be…

I swear, all I did was take a step over the front hedge and there was a slightly uneven surface on the lawn, from God-knows-what, and (insert sound of ankle squishing here), my right ankle rolled right over.

I fell down in pain, screamed out, and grabbed my ankle. The pain sucked, but having rolled/twisted/sprained/broken each ankle now at least five times since I was fourteen years old, I knew that this was at least a three-week injury and I had planned to go for my first 16 KM run on Sunday, so this really depressed the hell out of me.

Even more depressing, however, was the look a passer-byer gave me as she was on her run, paused to stop and check on me, but then kept going!

Ah, I don’t blame her. She was probably doing an early-season personal best, and why mess all that up just to help some random moron laying on his lawn, tangled up in orange extension cords from the Shop-Vac and the leaf-blower?

I’ve lost count of the ankle injuries. 1994 jumping from a playground. 1999 playing basketball. 2001 training for a karate tournament. 2002 doing Bosu-ball jumps at the Dunfield Club. 2005 training karate, again. 2013 during my bachelor party. I know there are many more but (thankfully?) I can’t remember.

Perhaps it’s better to forget?

They say, “Time heals all wounds,” but I think they’re talking about emotional ones.

I’ll be gearing up for a May return to physical activity, as depressing as that is.

Time is passing pretty quickly, isn’t it? I mean, it was just Christmas, and yet summer is right around the corner.

Last fall must have flown by because I realize now that I missed my quarterly installment of this blog theme!

Based on the quarterly analysis, we should have re-run these numbers in early-January!

So before looking at how the rental market has performed thus far in 2022, let’s look at how last year finished.

For those new to this feature, we want to look at the following:

-New Lease Listings

-Units Leased

-Absorption Rate

We’re only looking at condominiums, and while there are purpose-built rentals downtown, they’re a fraction of the data set and it’s much simpler to merely look at condos. I do believe that the condo-only data paints a very accurate picture of the downtown rental market.

When we last looked at the data in November – looking back at July, August, and September, we had seen a new trend emerge in the form of a huge drop in the number of new listings.

That trend continued through Q4:

The 51% drop that we saw in September led to a peak of -54%, and then the decline tapered off.

But if we look at 2021 vs 2019, we’ll see that in actual fact, it was merely 2020 that seemed like an outlier.

New listings were up year-over-year in Q1, but that’s because we compared to pre-pandemic levels. Once the pandemic was underway in 2020, we saw new listings double over 2019, and thus the 2021 data looks like a return to “normal.”

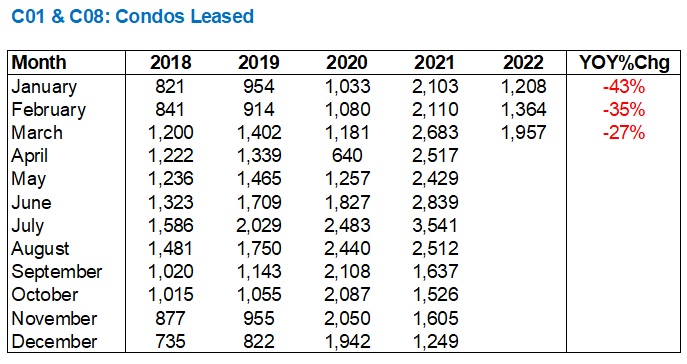

The same conclusion can be drawn from looking at Condos Leased:

You can start with that glaring ‘640’ figure in April of 2020, where the eye is drawn. Or, perhaps your eye is drawn to the ‘293%’ figure for YOY change in April. Either way, you start to realize that the 2020 pandemic skewed this data somewhat, and thus the 2021 over 2020 comparison is slightly misleading.

As we discussed last year, the spike in Condos Leased in June/July/August of 2021 was surprising, but note that the YOY trend came down significantly in Q4.

Having said that, the YOY absorption rates were still up in Q4:

Interesting, right?

Even with leasing activity down, we saw an increase in the absorption rate.

While early-2021 may have trailed 2019, Q3 and Q4 both saw an absorption rate higher than 2018 through 2020 inclusive:

The July and December peaks in absorption rate are worth noting.

Alright, now that we’re through last year’s analysis, let’s move on to 2022.

Some colleagues were lamenting last week that they’re losing bids on rentals left, right, and centre. One colleague said she lost twice in the same day with the same tenants!

Is that what’s happening out there right now? From speaking to a few other colleagues, it would seem so.

But is the data from Q1 going to support that, or are we merely seeing the market heat up in early-Q2?

Let’s look at Q1 New Lease Listings:

New Lease Listings are down 30% in January, year-over-year, but consider that they’re also down from 2020!

Last month, we saw New Listings up over 2019, 2019, and 2020, but not 2021:

It’s so hard to look at these graphs with all the 2020 data in there.

While we analyzed this data in both 2020 and 2021, I kept saying, “In a few years, we’ll know if this as an outlier due to the pandemic or just a sign of increased activity moving forward.”

I think it’s clear that, while condo leasing activity is moving higher, perhaps the 2020 levels aren’t quite a new benchmark to base future years from.

As for Condos Leased, the year-over-year declines were larger than the year-over-year declines in New Lease Listings:

Again, we saw absolutely ridiculous activity in 2021, so how do we draw conclusions?

As you can see in this graph, the trend for 2022 thus far is following 2021, even if it’s not at the same level:

It’s interesting, because for all the talk last year about how Work From Home is a trend that’s going to change the face of the downtown rental market, we saw much higher leasing activity.

So far in 2022, we are beyond 2018, 2019, and 2020 levels, but clearly trailing last year.

What was it about 2021 that made so many people transact in the rental market? Was it the return to downtown of all those people who left during the 2020 pandemic? Time will tell.

But so far in 2021, the downtown condo lease market looks to be busy, so long as we’re not comparing to 2020. The stories I’m hearing about multiple offers on leases are reminiscent of those very busy and very frustrating times in the rental market over the last few years.

When we tie this all together and look at the Absorption Rate, we see that the the trend thus far in 2022 is toward a tightening market:

It’s tough to draw comparisons when we have months that were slow because of the 2020 pandemic and year-over-year figures that were affected as well.

However, the absorption rate in January and February was down from 2021, but it’s drawn just about even in March.

Then again, compared to 2018 and 2019, it’s down.

If the trend continues, we should see an absorption rate in April that’s pushing 90% or more, which would indeed make for extremely tight market conditions.

Last year, we saw the absorption rate peak in the summer, and the chart shows you that this is actually quite common:

While I run this column quarterly, I will most certainly take a look at the data in two weeks when April is through.

Rental prices have increased.

According to Bullpen Research & Consulting who sends out a monthly rental report, Average rent in the GTA was up 11% annually in February, from $1,988 per month in February of 2021 to $2,206 per month in February of 2022.

I don’t have March data, but I’m willing to bet that by the time we move through April, we’ll see not only a higher year-over-year rental increase but a higher absolute rent as well.

If any of you are in the lease market or happen to be looking to lease, I’d love to hear your first-hand experiences on current market conditions.

Appraiser

at 8:56 am

“Your enemy is not higher interest rates…Your enemy is rapidly rising interest rates. Every economic recession over the past 40, 50 years was helped, if not caused, by monetary policy error in which central bankers raised interest rates way too quickly.”

~Benjamin Tal, Deputy Chief Economist CIBC World Markets

David Fleming

at 8:57 am

@ Appraiser

Don’t keep us in suspense! What’s your prediction?

Condodweller

at 11:24 am

Yes, I would be interested in seeing the bull’s narrative now as well. I believe it’s going to be either of denial like above, or it will be crickets. Last week’s article where mortgage payment has increased by ~$2000/mo due to the recent rate increases should be an eye-opener for people. The narrative has been oh a .25% or a few hundred $ increase here and there won’t have a meaningful effect on people making their mortgage payments. I’m guessing they are going to feel the $1000+/mo increase.

Appraiser

at 8:44 am

My prediction is that the bears will be tripping over each other to predict the worst economic scenarios possible. Talk of foreclosures and jingle-mail will make the rounds once again. And we will witness unprecedented confidence in their undying belief that a devastating housing crash is looming “right around the corner.”

There’s also an outside chance that Hilliard MacBeth will write another book entitled “Told ‘Ya So”

Condodweller

at 11:16 am

“Against this background we have three main messages this morning.

First, the Canadian economy is strong. Overall, the economy has fully recovered from the pandemic, and it is now moving into excess demand.

Second, inflation is too high. It is higher than we expected, and it’s going to be elevated for longer than we previously thought.

Third, we need higher interest rates. Our policy interest rate is our primary tool to keep the economy in balance and bring inflation back to the 2% target. This morning we raised our policy rate by 50 basis points to 1%. And we indicated Canadians should expect further increases.”

https://www.bankofcanada.ca/2022/04/opening-statement-2022-04-13/

Keep in mind that inflation is around 7% and as stated previously, in order to bring it back to the target of 2%, rates need to be increased to the inflation rate. The BOC has also stated that they will in fact raise rates to achieve the target of 2%. Adding two and two together, even if they only raise rates to half of inflation they have to triple it from the current rate which has just been quadrupled from .25%.

Also, those who weren’t born in this century may know that past interest raises were done to get ahead of inflation in order to keep it at 2%. I hate to say this time it’s different, but this time we already have inflation significantly above 2% and the BOC is playing catch up.

Average Joe

at 12:34 pm

This is will be interesting to watch for folks who are liquid. The neutral rate is thought to be 2-3% and they said they’d be willing to overshoot that “briefly” to get things under control.

Mike Stevenson

at 9:43 pm

Great summary. Really hard to know how this ends because there’s so much debt. Higher rates used to favour savers, but it will be different if politics dictates massive debt forgiveness and government intervention.

I love how they say “excess demand” where a normal person would say “shortages”.

ProspectiveBuyer11

at 9:53 am

David, any plans to do a post on downtown condo prices? It appears that the market is softening dramatically. It would be interesting to hear if you expect this to persist throughout the year as rates hike.

Sirgruper

at 11:31 pm

Sorry about the ankle. Hope you get running soon.

Saw 2 accepted offers each conditional on the sale of another property. First time in probably 15 years. Definitely people getting a little nervous about selling outside the hot areas or categories.

JF007

at 10:44 am

among all this chat we forget one important thing that probably nowhere else in the world owning a place to stay is considered a basic necessity and the same is fanned by the political class and clearly we don’t have more houses or condos than people willing to own them..so 1 for demand 0 for supply need i say more…

Appraiser

at 1:08 pm

Average Toronto 2-Bedroom Rents Up 16% in March: Rhttps://storeys.com/toronto-2-bedroom-rents-march-2022/eport

Appraiser

at 1:11 pm

Also: Vancouver average rents up almost 30% https://www.reminetwork.com/articles/vancouver-average-rents-up-almost-30/#.YmGA6Sh5xZ4.twitter

J G

at 1:40 pm

You mean the rent went back up to where it was before Covid?

Pretty sure bunch of landlords lost cashflow since the same unit down the hall was $300 cheaper.

J G

at 1:38 pm

From the same new source, solid chance BoC will raise by 1% (yes 1 entire %) next meeting – https://storeys.com/1-percent-rate-hike-bank-of-canada-june-inflation/