One of the younger agents in our brokerage lamented the other day, “I can’t believe my rental client was just rejected for the third time!”

I bit, and asked, “Bad credit?”

She said his credit score was 828. That’s fantastic, for those who don’t know.

I asked, “Poor income?”

She said he made $122,000 per year and was looking to rent for $2,650/month. That’s a 26% GDS ratio, with the standard being around 36% or less.

So why was he rejected, you ask?

My colleague told me, “There were six offers and apparently, somebody put down twelve months’ rent up front.”

Such is the state of the downtown Toronto rental market right now, at least, from what I’m hearing.

“Tales from the trenches” like these are very common.

Then again, I also hear stories for which I have little sympathy.

Another agent in my office was telling me that she’s having trouble finding a 3-bedroom condo for her clients, two of whom are unemployed. I mean, one is sort of employed, as he derives income from social media ventures, but that’s not something for which the standard employment letter applies, nor does that income show on your T1.

The agent further explained that two of the tenants have credit scores under 600, but that one of them has an 840 credit score and makes six-figures.

But wait: two of the tenants have ‘partners.’

And the two with poor credit have guarantors.

So how many people are renting this condo? And how many are employed? How many are going on the lease?

I’m sure that my colleague could concisely explain the entire tenancy situation to the listing agent, but most landlords are simply going to say, “Way too complicated, I think I’ll wait for the next offer.”

I told my colleague, “You’re wasting your time, nobody is going to rent to this group of seven individuals,” but she told me that she’s not the type to give up, and that she’ll work extra hard, and that she wont rest until she’s found them a rental!

For that, she deserves a medal. Or I deserve scorn. Or both.

I’m a realist, what can I say?

It’s a really tough rental market out there, and nothing should be taken for granted.

I remember back in 2005, renting a house in The Annex to four men in their late-20’s, one of whom said, “We know we’ll all be married with kids one day, so this is our last shot at living the single life with the boys, goofing around, and just enjoying this time in our lives.”

I’ll never forget the landlord walking in during our showing. She was an older woman who had a look of shock on her face when she saw five men in her house. One of the guys, however, sweet-talked her like I’ve never seen, and she ended up renting to them!

That would never happen today. No chance.

Four single men, aged 25-29, renting a Victorian house in The Annex?

Times have changed.

The rental market has changed.

Landlords have changed, society has changed, and not all of it is for the good.

Stories about rental woes are a dime a dozen these days, but let’s switch gears and look at the stats and see what they’re telling us.

When last we ran this feature in April, we saw a massive drop in year-over-year activity.

As this first chart will show, the trend continues, but not to the same extent:

It would seem to me that the year-over-year decline is diminishing, just a little bit.

Not only that, new listings spiked in the summer of 2021, so unless we expect that to happen again, we’ll see those red figures on the right-hand side continue to decline.

Graphically, we really get a sense of how 2022 is shaping up:

New listings hit the moon in 2020 due to the pandemic, so it’s going to take us a few years to remove that grey curve from our graphs! In the meantime, we can look at yellow, orange, and the light/dark blues, and compare and contrast.

Throughout 2022, new listings have trailed 2021, across the board. They’ve been consistently ahead of 2018 and 2019, although that gap is shrinking as well.

Note that new listings moved in tandem in the fall of 2018, 2019, and 2021. I’ll be very interested to see if 2022 follows suit.

As for the number of downtown condos leased, we saw a similar pattern as we noted with new listings above:

We began 2022 with year-over-year declines of 43%, 35%, and 27%, but that first quarter was significantly harsher than the second quarter, where we saw declines of 18%, 16%, and 21% respectively in April, May, and June.

This jives with what we’re hearing anecdotally, as agents and tenants fight for access to properties, and multiple offers on leases become very common.

In fact, “offer nights” on leases are becoming common!

Wait, what?

Yes, as sad as this might be, it’s a real thing:

Let’s look at the condo leasing activity graphically:

While we trail 2021 activity, the gap is shrinking, especially when you look at January, February, and March.

In all five years, we see activity “peak” in July, which might seem a little odd, but when you consider that July is the time when tenants secure leases for September, it actually makes sense.

It will be very interesting to see how July fares and whether or not we see the same “spike” from June as we did in 2021, or whether the increase is more gradual like in 2018 and 2019.

Now, let’s put it all together!

The ratio of leases to units listed for lease is our absorption rate, and while the first two charts seem to show an unspectacular leasing market, year-over-year, this one tells a very different tale:

The absorption rate has completely changed from the first quarter, which is as easy to note as it is to see red versus black.

Year-over-year, the first three months of 2022 saw a decline in absorption rate, but we’ve seen a huge increase in April, May, and June.

It’s very rare to see an absorption rate over 100%. In fact, in the 54 months included in the chart above, we’ve only seen 100%+ on three occasions. That’s how hot the rental market was in April, as the absorption rate hit 101%.

With an absorption rate of 97% in June, I wonder whether we’ll see 100%+ in July, as we did last year.

Now, look at the absorption rate graphically, which should put 2022 into perspective:

We seem to be outpacing 2021 already, and we’re only halfway through the year.

If not for the slow start in January and February, we’d be looking at a record year in the rental market.

Just how hot is the rental market?

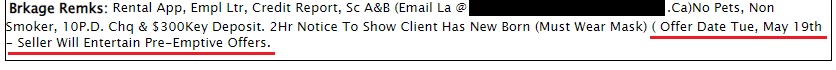

This tells you all you need to know:

Imagine an offer date on a rental? Crazy, right?

But now consider the idea of a pre-emptive offer on a rental listing?

That’s insane.

It also shows you that the listing agent has no clue what he or she is doing, since rentals aren’t merely about price, like sales are, but rather the candidacy of the tenants. If you have a $1,995/month listing, with an offer date, and you get a $2,250/month “bully offer,” you shouldn’t be jumping at the offer in the same way as you would if you got a bully offer of $2,250,000 on a $1,995,000 listing. I mean, what is the tenant’s credit score? What’s their income? How much debt are they carrying?

A bully offer on a lease. Man, I never thought I’d see the day.

The rental market is also tough because there are a lot of “management companies” who handle the listings, and they don’t work like typical real estate agents.

Case in point:

Real estate is a 24/7 business, and yet these management companies only work Monday through Friday from 9-5.

Not only that, they don’t answer the phone.

Call me old school, but that’s my preferred method of communication.

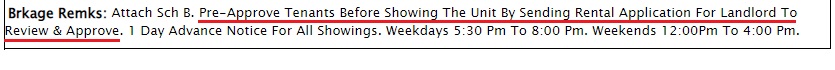

Last, but not least, I’m seeing more of this:

This is crazy to me.

It’s just asking for a rental discrimination complaint.

I’m not going to pretend that rental discrimination doesn’t exist, nor will I pretend that any of us can accurately define, but that’s another story.

If you receive an offer from a candidate that you don’t like, for any reason, you can say, “Thanks, but we’re going with another offer,” whether you have another offer or not.

But when you tell agents that you want a rental application so you can “pre approve” the tenants in advance, and this rental application does not have the tenants’ credit score and it does not include an employment letter, then what criteria are you using to “approve” them?

I shudder to think.

In any event, we’ll meet back here in October to see how the third quarter of 2022 goes down, but I suspect it’s going to be a busy one in the downtown condo rental market!

Condodweller

at 9:10 am

David, based on some recent comment some of us would be interested in stories from the trenches on how investors are handling rate increases. It would be good to see stories of people who purchased recently or have purchased preconstruction and waiting for delivery with prices decreasing, if condo prices are in fact decreasing, and raising interest rates.

High absorption rates and prices returning to previous highs should help. With punitive tenant laws, a large downpayment commitment, and perhaps better opportunity costs I wonder what a typical investor profile looks like today.

You have indicated that some “pros” have sold recently and moved on. I would have loved to have sold since 2017 highs and in recent recovery but with the new issues of selling with a tenant and other considerations there is the tantalizing option of maxing out a HELOC and leverage the markets as they bottom during the upcoming recession.

Bryan

at 10:49 am

+1 on this

Appraiser

at 9:46 am

“Three young couples on trying to rent in Toronto’s post-COVID market:

Rental rates are rising, demand is skyrocketing, and landlords are asking for anything they want” https://streetsoftoronto.com/rental-rates-rising-demand-skyrocketing-toronto-landlords-asking-for-anything-from-tenants/

Condodweller

at 10:30 am

Yeah, the issue with charging sky-high rent is that these tenants will be the first ones to leave the second they can find a cheaper alternative or realize they can’t afford it. I have had the same tenant for over a decade by charing near market rates which has become well below market rates due to the rent control laws implemented. I think the coroner will be involved in me getting my tenant out.

David, what’s the record stay that you know of for a tenant? I once checked a multiplex that had a 90+ year old lady as a tenant who I was told had been there 30+ years IIRC.

JF007

at 10:55 am

Its a confluence of factors i suppose- rising rates means investors/landlords need to raise rents wherever they can to offset the increase (ideally), loss of income due to non-payment in last 2 years, LTB being slow and pathetic in addressing issues, demand going higher..all add to the upward surge and we haven’t factored in restarting of skilled immigration program which was on pause since last 18-20 months..

S

at 10:49 am

The story about the guys living in the Annex house reminded me of my first experience renting here. I moved to Toronto in 2011 and the first place I lived was a 3-bedroom Victorian semi near Queen and Broadview. I was moving with two friends who had gotten bored in the mid-sized southwestern Ontario city where we were living, and only one of the three of us had a job lined up in Toronto. I’d dropped out of university a couple of years earlier and had worked mostly temp jobs since then. My one friend had been working a series of retail and food service jobs, so that left just one of us with a steady job in a white collar profession. Anyway, we all hopped on a Greyhound to Toronto one weekend and saw this house, thought it looked pretty nice, told the landlord we wanted to take it, and that was that. I don’t think he even checked our credit. We split the rent three ways, pro-rated by room size. I think I paid $600 for my room that looked out over the backyard. The house had 10-foot ceilings on the main floor, laundry and dishwasher, laneway parking, and an unfinished basement for storage. It had its quirks and the neighbourhood was still a little gritty at the time, but for three kids in their early to mid 20s it was the height of luxury. Imagine pulling that off in 2022!

Bryan

at 10:59 am

That’s crazy. I think stories like these are why the young folk moving to the city now get so mad when newspapers blame their housing struggles on all the avocado toast they eat!

2011 was really not so long ago. At ~$1800 a month at Queen and Broadview nowadays you could get, maybe a 1 bedroom basement (and only with pristine credit)? Maybe you could have convinced one of your friends to live on the couch in the living room/kitchen combo and the other to sleep in the bathtub?…

JF007

at 2:24 pm

How are countries where rentals are higher in ration than ownership fairing in these times? is there a surge in rental prices there too?