Alright, let me set the scene here folks, because things are moving quickly…

It’s currently 1:45pm on Tuesday afternoon and I’ve received not one, not two, but three phone calls on my condominium listings.

Who says the condo market is slow, right?

The first agent said, “Hey, I’m showing four units in the building and I’ve mixed up all the keys. Do you remember if your key has a FOB attached? That would help me narrow it down.”

Alright.

The second agent said, “Any chance you’re having an open house this weekend? I work out of Niagara On The Lake and I don’t really want to drive in to show the condo to my clients, if I don’t have to.”

Sure.

The third agent said, “I just showed your condo listing and it’s not what my client is looking for, but she fell in love with that dining table and chairs. May I ask you where your client purchased it?”

Of course.

If that doesn’t sum up the current state of the condo market, then I don’t know what does.

Don’t get me wrong, we’ve sold many of our condo listings this year, while others remain on the market. But the quality of the conversations that we’re having with agents is at an all-time low.

Or maybe the quality of agents themselves out there is the problem?

About two weeks ago, I received an email from a buyer agent who showed one of my listings. He had some questions about the fitness studio located in the commercial portion of the condominium (ie. a separate business…) and so I told him I would get back to him with answers.

I reached out to the property manager and to my client, both of whom responded, and it turns out that the condominium corporation has a deal with the fitness club that allows a 12-month membership for free, one per unit, with additional memberships discounted by 50%.

I emailed this to the buyer agent and he called me immediately.

He was laughing.

Laughing in a good way, however.

“David, I’ll be honest: I showed five condos in the building on the weekend and I emailed all five listing agents about the gym. You’re the only person who wrote me back.”

He went quiet after that, unfortunately. I was hoping we might see an offer!

Six or seven days later, I called him and said, “What’s going on? Have your clients bought? Are they still interested?”

He told me, “They’re interested, but they want to offer something really low. I’ve had this conversation with other listing agents, and everybody’s like ‘don’t bother, don’t bother,’ so I just figured you’d be the same.

Really?

What type of listing agent tells a buyer agent not to make an offer?

I told him, “Any offer you submit will be well-received and I’m happy to work with you.”

The next day, he submitted an offer. It was low, no doubt about it, but it was an offer nonetheless. My client’s condo had now been listed for over seventy days and we had already reduced the price, so despite the low offer, he was happy to have something in writing.

It took four days and six sign-backs, but eventually, we got a deal done.

I wonder what all those agents saying, “Don’t bother, don’t bother” are doing with their listings now?

There are some really awful character traits and emotions dominating this cooling condo market right now, and the worst of them are apparent from the moment the listing agent answers his or her phone:

-Delusion

-Ego

-Entitlement

-Naivety

-Aggression

I don’t understand it.

The goal is to sell the condo. The job is to work for your client.

And yet so many of these listing agents are acting like it’s 2022 and they’re being overwhelmed with showings.

With the first-quarter of 2025 now behind us, let’s take a look at the GTA condo market, which we know is slow, but it’s time we put some data to the “feelings” out there…

First up, let’s check in on the number of listings:

New listings were up 33% in January, 6% in February, and 23% in March.

Overall, through Q1, new listings were up by 20.1% over the same period in 2024.

This could be much ado about nothing, provided sales reflect the same increasing trend. But as most of you already know, sales are actually declining.

It’s worth noting that those sales figures for each of January, February, and March are higher than any of 2021, 2022, 2023, or 2024.

Graphically, January obviously stands out, but February remains at least somewhat in line:

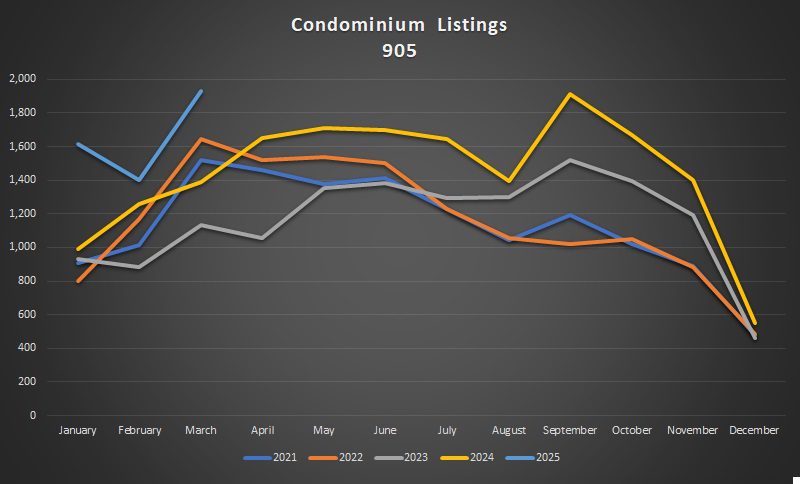

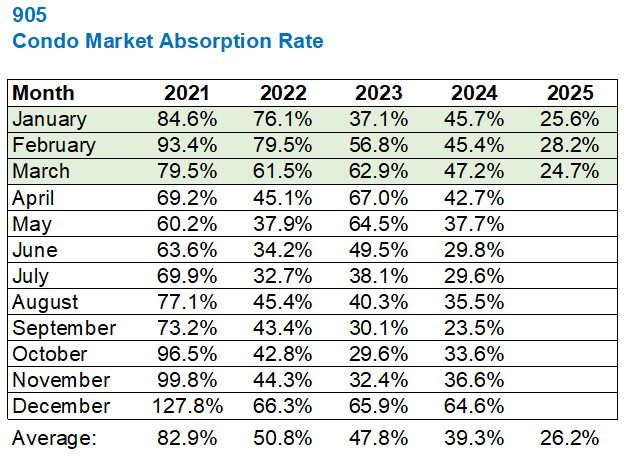

As for the 905, the data is a little more striking:

New listings were up 63% in January, 11% in February, and 39% in March.

Overall, through Q1, new listings were up by 36.0% over the same period in 2024.

That’s very different from the 416 data!

And unlike the 416 chart, which showed the data somewhat in line with prior years, the 905 chart shows us that 2025 is looking like a true outlier:

As I mentioned above, it’s fine to see new listings increase so long as sales increase around the same pace.

Failing that, the absorption rate falls, and theoretically, so too should prices.

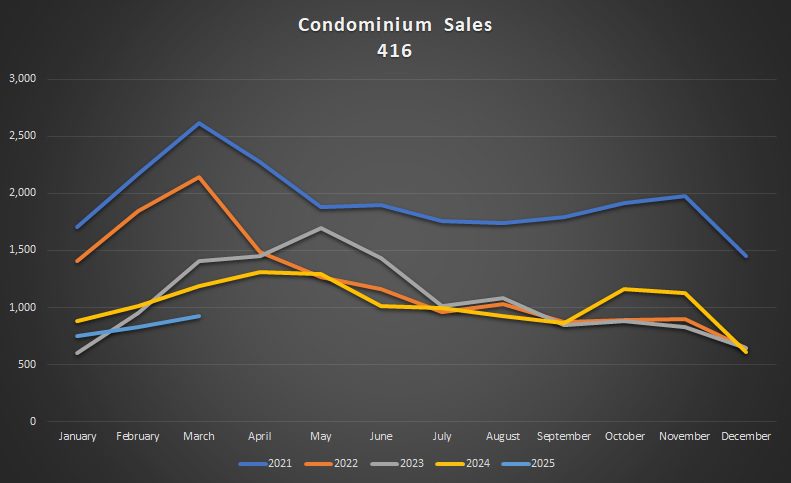

Having said that, sales did not move in tandem with new listings. In fact, sales declined:

Sales were down 15% in January, 18% in February, and 22% in March, and while I’m no genius, that feels like a “trend” to me.

For the entire first quarter, those 2,504 sales are 18.8% lower than the 3,083 sales recorded in January, February, and March of 2024.

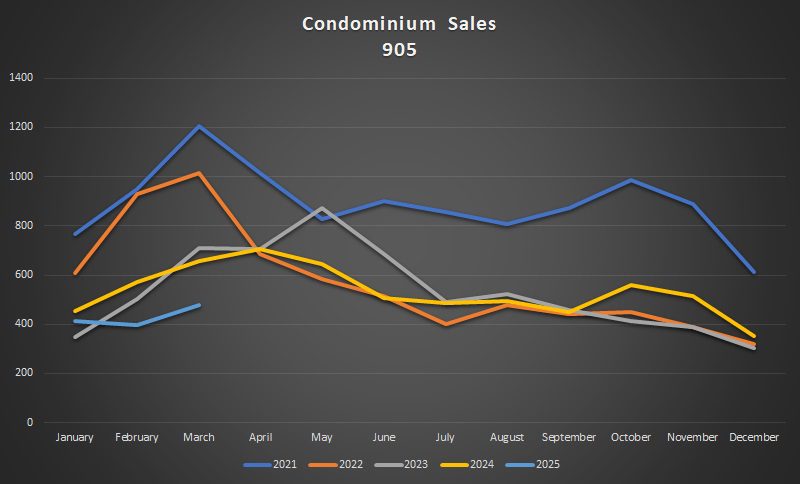

In the 905, the data showed a market that’s slowed at a much greater rate:

While the year-over-year decline in sales was only 8% in January, it rose astronomically to 31% in February, before finishing down 27% in March.

For the entire first quarter, those 1,286 sales are 23.5% lower than the 1,680 sales recorded in January, February, and March of 2024.

For those playing along at home, let’s do a quick catch-up with the year-over-year data for Q1:

416 listings: up 20.1%

416 sales: down 18.8%

905 listings: up 36.0%

905 sales: down 23.5%

That’s going to affect the sales-to-new-listings ratio, right?

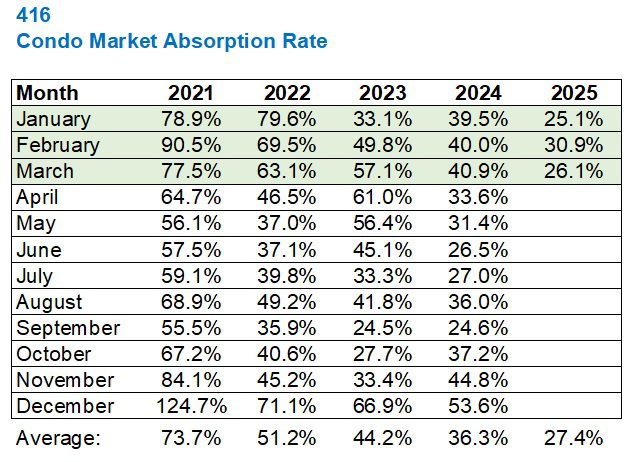

Here’s how the 416 looks:

An average absorption rate of 27.4% through the first three months does not inspire confidence in the condo market, however, this doesn’t take into account the massive number of re-listings, since TRREB stopped publicly sharing that data in the fall of 2024.

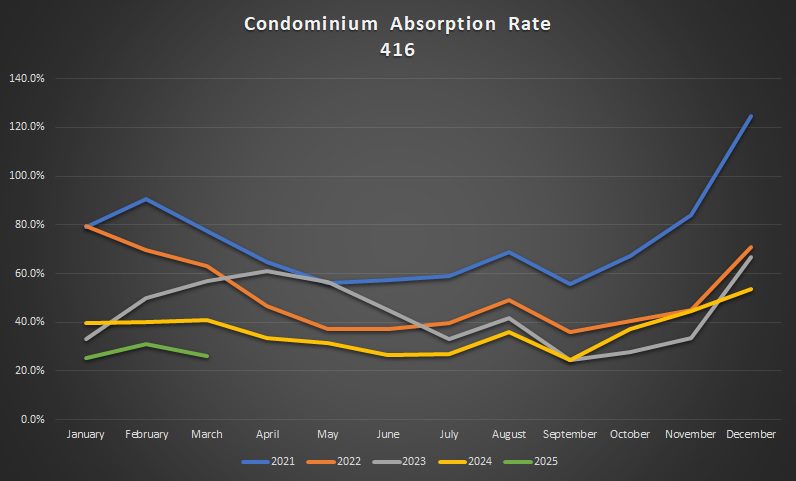

A picture paints a thousand words, so here’s the chart:

Last year at this time, we were talking about how our “yellow line” was trailing prior years.

Now in 2025, our “green line” is even lower on the chart.

While the absorption rate in the condo market was higher in the 905 in 2024 than in the 416 (an average of 39.3% versus an average of 36.3%), the opposite is true this year:

We’ve seen an average of 27.4% in the 416 and an average of 26.2% in the 905.

Either way, our “green line” is going to be well below the rest in the 905 too…

Make no mistake, condo listings are selling.

They’re just taking longer to sell.

“Sixty days is the new thirty days,” as I told a client last week.

But try this on for size:

The average 416 condo price is only down 1.8%, year-over-year, in the month of March, and it was only down 0.3%, year-over-year, in the month of February.

With an absorption rate nearing one-quarter, you would expect to see a monumental decline, no?

This is the same argument that I made in Monday’s blog post and it speaks to the resiliency of the condo market.

Times are tough out there and I would point to the following five factors:

1) Sales are down

2) Listings are up

3) Re-listings are rampant

4) Sellers aren’t being realistic

5) Listing agents have no idea how to work in this market, act like it’s 2022, and get aggressive on the phone.

The last one sticks out for a reason, and not only because it’s the longest. This one is a major hurdle in the market and it’s a major reason why more units aren’t selling.

If you’re a seller in this market, now isn’t the time to hire the one-off agent, the cousin, the out-of-towner, the discount guy, or the like.

And in case you simply can’t get enough stats, I’ll be back here on Monday to talk about the rental market statistics for Q1.

Have a great weekend, everybody!

RICK MICHALSKI P.APP ACCI

at 9:06 am

David with another dollop of facts that nails it again!!! 110 % right condo market is holding up very very good with prices extremely resilient

Thisll piss off all the bears like Derek the dunce but truth hurts and as rates drop back to near 0 price will surge up from it’s currently near record high level

Derek

at 4:12 pm

Can I borrow a match for the gaslight?

JG

at 5:23 pm

Hahahaha

JG

at 5:23 pm

When is your Uber shift starting?

Serge

at 12:05 pm

“the massive number of re-listings, since TRREB stopped publicly sharing that data in the fall of 2024” – merci! That answers my previous question.

It looks like there is a huge unsaleable ballast, and a few saleable items do not discount the average price much (yet). David is lucky (or worthy) to get some of the latter…

Derek

at 4:16 pm

Is TRREB not sharing the relist data because people can’t handle how bullish it is? It puts such a positive spin on the state of things we’ll keep it under wraps?

Serge

at 9:50 pm

They should send Musk to TRREB after DOGE.

Francesca

at 1:33 pm

This senior lady in our building is moving into a retirement home and has had her unit in my building up for sale since mid January. She hired a fairly good local agent that typically sells larger homes and not condos. Their first strategy was to list at market price with an offer night that got nowhere. Then she lowered the price for two months got an offer close to asking but rejected it and now it’s back on the market at an even lower price with another offer night scheduled for next week! This to me shows me how unrealistic both the seller and her agent are as to I think the unit would have sold by now had they not continued to play these games! I’m waiting to see now if it finally sells next week and for how much. Timing is terrible as our building is starting a nine month parking renovations project so if she doesn’t sell before then I doubt anyone will want to buy during this major restoration.

Ali

at 11:48 pm

Toda builder and they work together ocupation fee they getting 7.2 person create when they close no one know ocupation many is going to builder and bank they steal people many one years they star a lot of many

No one talk abouts you can write that one

Jennifer

at 2:10 am

As one who is trying to sell a condo (estate sale) in a down market, I get the impression that agents do not really how to do that. On an ‘up’ market it’s easy and everyone looks good but when the market is down agents do not have strategies in their toolbox so everybody suffers. Great agents show their strengths in a down market without slashing the price and basically giving condo away. It is not just about the price. There are other elements to the marketing piece (product, packaging, placement & promotion). Agents think it is all pricing. If a site(promo) is getting lots of hits, whose responsibility is it to turn that into action. Read an article quoting a post which says 74% of agents sold zero properties, two percent sold between 11 and 20 and only 0.14 percent sold 45 or more abd that 95% of the business is controlled by 5% of the agents in any given area.

I do feel that the model of pushing meodocre people into a career as a real estate agent is flawed as it looks easy but in reality hard work and may not be their competency thus creating the above stats. Not everybody can sell, market a product properly, etc and a course does not make someone an expert, especially in a down market, when top notch skills need to come into play.

Sellers and buyers get stuck with agents not willing to do the hard work or knowing how to do the hard work so success rate is negligible (not even the 80 /20 rule).

Truly a Seller and Buyer beware.

Appraiser

at 7:29 am

I’ts been a very long time since the GTA has seen anything approaching a balanced real estate market.

A market currently dominated by fear and hesitancy.

With Trumpty Dumpty in charge, fear is the winner – for now.

Appraiser

at 7:36 am

ALSO: “Sell when everyone is buying; buy when everyone is selling” ~ W. Buffett

Serge

at 9:16 am

Is not that exactly what David did?

J G

at 10:32 pm

Balanced market?!? lol

416 Condo, especially downtown is very very much a buyers market.