Let’s pick up Monday’s conversation about how much maintenance fees should increase, and talk about a condominium’s reserve fund, what it is for, and how much should be in it.

Perhaps it sounds silly to discuss “what the reserve fund is for,” but honestly folks, many condo residents and/or board members have very different ideas about how the reserve fund should be treated.

Some think it’s a fund that should never be touched, under any circumstance.

Others believe it’s money that was collected from residents, and should be spent on the residents’ home.

And while we’re at it, let me show you an example of an absolutely brutal condo reserve fund…

Ask ten different people the question, “How much money should be in the condo’s reserve fund?” And you’ll probably get ten different answers.

Just as I explained in Monday’s blog, when we discussed how much maintenance fees should be increased, I think you’ll find that when it comes to the reserve fund, everybody has a different idea of what that money is for, what it represents, and thus how much should be in the fund.

Some folks refer to the reserve fund as the “rainy day fund,” since that’s essentially what it’s for.

The maintenance fees collected each and every month serve in part to run the condominium, but also to save for a rainy day.

And perhaps this is where we should make a very important distinction: an “increase in contribution to the reserve fund” and an “increase in maintenance fees” is not the same thing.

If your condo maintenance fees are $500 each month, that doesn’t mean that $500 goes into the reserve fund.

In fact, in ten downtown Toronto condos, you’ll probably find ten different percentages with respect to how much money from each monthly payment goes into the reserve fund.

Keep in mind, condos cost money to run, and that is primarily what your maintenance fees are for. Only a small portion of that money goes into the reserve fund, for example, say $50 per month of that $500 described above.

Every condo is different, and every condo is free to:

a) Raise maintenance fees

b) Raise the contribution to the reserve fund

c) Both of the above

You don’t necessarily have to raise maintenance fees to raise the contribution to the reserve fund, although in order to do the latter, you’d have to find efficiencies somewhere else, or you might fall short of the estimated budget.

Too many people, whether residents, prospective buyers, or real estate agents, believe that the reserve fund contribution and the overall maintenance fees run hand-in-hand. It’s very important to distinguish between the two.

The words “special assessment” automatically send a cringe down your back, but don’t forget that this IS a necessary tool, and a good one, when running a condominium.

If a major expenditure was contemplated, and the reserve fund was not adequate to cover it, then a special assessment may be necessary in lieu of higher maintenance fees. After all, if you need $200,000 today, then what good is raising maintenance fees for each of the next four years? All that means is that the condominium corporation likely has to borrow money to pay off the repair, thus incurring interest. It’s like the same conversation we had on Monday about freezing maintenance fees, in that you’re just looking for immediate gratification.

So what “should” a typical reserve fund look like?

It depends on the building, and that goes without saying. But the very first question to be asked in response is: “How old is the building?”

A new building will have a much lower reserve fund than an old building, although that’s probably only true nine times out of ten, as I’ll show you in a few minutes.

Any brand-new building MUST start off with money in the reserve fund, which is paid by the condominium developer.

From the Condominium Act:

“A developer’s initial budget must include an annual contribution to the reserve fund that is based upon calculations of the estimated long-term repair and replacement costs and life expectancies of the common elements and assets of the corporation. The contribution must be the greater of the calculated amount or 10 percent of the other common expenses (i.e., other than contributions to the reserve fund) until such time as a reserve fund study has been carried out.”

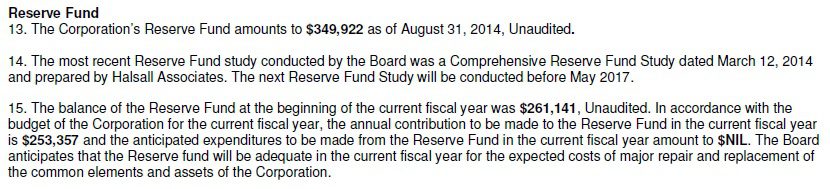

I recently sold a unit at 318 King Street East, and I told my client, “I’d expect this building to have about $150,000 – $200,000 in their reserve fund, based on the age of the building.”

I was absolutely shocked when I saw this:

Amazing.

Absolutely amazing!

I don’t know why they have so much money for a 2013 building, and also keep in mind that there are only 215 units. Maybe they have a very smart board of directors, or a great property manager, or the developer built a fantastic building. Maybe it’s all of the above. They also have zero anticipated expenditures from the reserve fund in the upcoming year, which is exactly what you want with a new building.

As I said at the onset, the reserve fund is for the proverbial “rainy day.”

You don’t want to be taking money from the reserve fund to run the building on a day-to-day basis. Your maintenance fees make up a portion to run the building, and a portion to put into the reserve fund for down the road. If you’re not getting enough money from the maintenance fees to run the building, then you need to revisit your budget, and potentially increase fees.

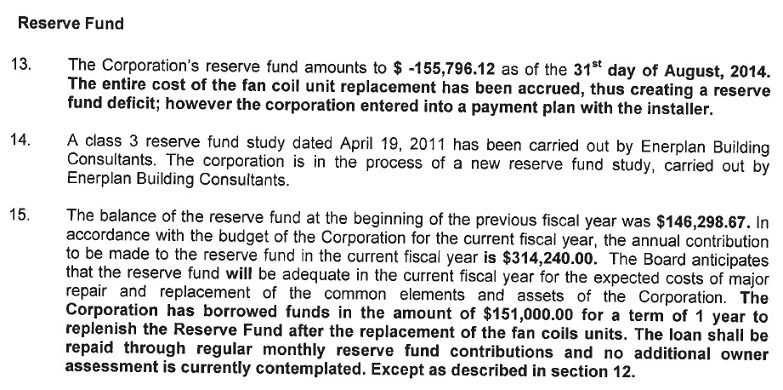

Now let me show you something I’ve never seen before, in all my years in real estate:

That’s a negative balance in the reserve fund.

This building was constructed in 1977, and suffice it to say, there have been major expenditures and repairs along the way. This is NOT unusual, although I have to wonder why and how it got to the point of having a negative balance in the reserve fund.

This building has a long history, and over the last few years, they’ve had special assessments, and their maintenance fees have fluctuated substantially.

In fact, they coupled a special assessment with an increase in maintenance fees during the late 2000’s, rather than levy one massive special assessment.

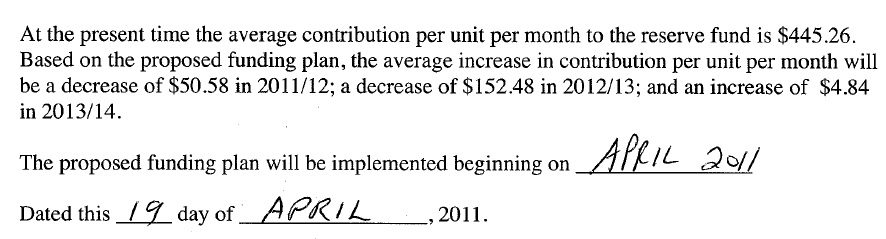

As noted before, the contributions to the reserve fund can be increased, but they can also be decreased, as was the case in this building.

Here’s a note from 2011:

They increased their fees massively in 2009 and 2010, and then unwound those increases starting in 2011-12.

Let’s say, hypothetically, the building required $20,000 per unit owner. Rather than levy a $20,000 special assessment, perhaps they chose to levy a $10,000 special assessment, and increase fees enough to collect an additional $10,000 over three years.

This isn’t the same as the case we discussed in the beginning about “delaying the inevitable,” but rather it could be viewed as a compromise in a case where the huge special assessment could be too much for many unit owners to overcome. If a unit owner doesn’t have the wherewithal to come up with $20,000, they might decide to sell, as might others. Then you might end up with a huge run on the building, and if twenty people listed their units for sale, it might drastically impact unit values.

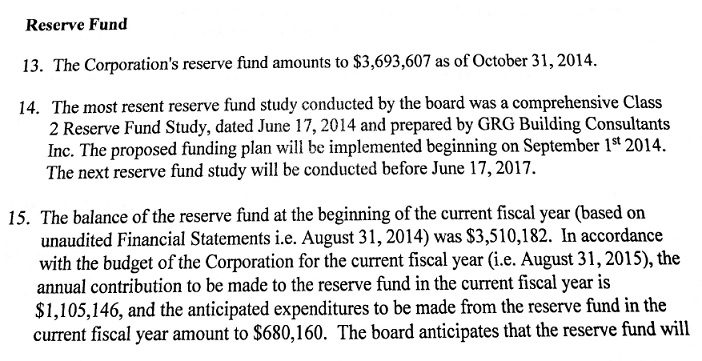

It’s important to note that not ALL older buildings have financial problems. In fact, some older buildings are insanely well run.

Here’s the reserve fund note for a building constructed in 1987:

Yowzas!

Just as I have never before seen a reserve fund with a balance of negative $155,000, I have also never seen a reserve fund with $3.7 Million.

As the note further explains in Section 15, they’re planning on spending $680,160 on repairs and improvements, which for some buildings, might deplete the reserve fund. But in a building with $3.7 Million, what’s a paltry $680K?

Maybe it’s fair to say that some expenditures are simply out of your control, or that they’re the result of “luck.” Why would one 25-year-old building cost more to run, maintain, and repair, than the next 25-year-old building? Is there any way to see that coming? Is it dependant on the developer who built the condo? The property manager, lawyer, accountant, or board of directors?

Some things are just out of your control, as a buyer, unfortunately.

If you’re buying a condo with a 10-year time horizon, it’s going to be near impossible to forecast the financial health of the building when your time comes to move on. Sure, you can use the developer’s track record as a benchmark, but what if the developer doesn’t have a 10-year track record, because they started building in 2010, and have built six buildings since?

Ultimately, this discussion, and the problems that can arise from a condominium’s finances, is another reason to hire a very, very good Toronto condo lawyer when you buy a condo. I can’t tell you how many people I see (sometimes, even my own clients…) who hire a lawyer from outside the city, who tells the buyer, “Seen one condo, seen ’em all.”

I refer my clients to a condo lawyer who, when they retain him and hand over the Agreement of Purchase & Sale, usually says, “Ah, yes, I know this building. I’ve closed six deals in here this year.”

That is what you want, and that is why you pay a real estate lawyer to review the Status Certificate.

In the end, if you’re looking for some magic number for how much money sholud be in the reserve fund, I simply don’t have one.

One lawyer told me it’s $1,000 per unit, per year, so a 3-year-old building with 300 units should have $900,000. But by that logic, would a 500-unit building that’s 6-years-old have $3,000,000 in the reserve fund? Highly unlikely.

How much money “should” be in the condo reserve fund is highly dependant on the age of the building, but that number goes UP, and then eventually DOWN.

Thankfully, the Condominium Act dictates that every condominium built after 2001 must have a Reserve Fund Study completed every three years, so even if a board of directors is completely out to lunch, they’ll probably be brought back for a light snack in 36 months…

Tom

at 9:51 am

Very informative article!

Can you suggest where one night start in finding a good Toronto condo lawyer?

Gord McCormick

at 11:21 am

Here is a Toronto condo lawyer I met a year or two ago and was quite impressed with:

Address: 500-425 University Ave. Toronto , Ontario M5G 1T6

Lawyer Firm: Iannazzo, Nick

Phone: 416-598-2002

Fax: 416-598-8183

Email: niannazzo@on.aibn.com

Andrea

at 11:27 am

Great information David! Thanks for sharing

natrx

at 2:51 pm

How about kickbacks to certain condo board members, crooked contractors, and lavish unnecessary spending items.

Given how many condos there are there now, the longer-track record, it should be more well-known and projected what a depreciation schedule should look like and thus funds needed to stay on top. Given that these are large corporations financing these things, it wouldn’t take a rocket scientist to figure this out.

The buyers should also be aware or requesting these things. Not being blindsided and acting ignorant. Or they should realize that they got the unit at a discount as the purchase price should also incorporate an amount for the maintenance capital expenditure.

But the system we have is it’s a Bush League system with amateurs trying to figure it out, being influenced on the side.

AC

at 7:07 pm

Upgrades are not the intention of the Reserve Fund expenditures. Only replacement cost of existing ” as built “standards as set out in status certificate and corporate declaration. Special accessments should be replacement upgrades

Frances

at 11:19 pm

Obviously, the size of the reserve fund will depend on the age and size of the building. That said, a reserve fund of $900,000 strikes me as far too small. I own a 1950s house and last year we had blocked drains in the basement that cost us more than $5,000 to repair. (They had to dig up part of the basement floor). Anything remotely comparable in a condo would cost a small fortune. And if you don’t want to have special assessments then you need a good size reserve fund.

ABB

at 8:15 pm

David, you are mistaken, dude.

The Reserve Fund is NOT a rainy day fund. It is NOT a savings account for future surprises.

The Reserve Fund is calculated against projected capital replacement needs of all building components into a 30-year future. Items such as carpeting, roofing, boilers, elevators, fans, corridors decorating, etc.

A proper reserve study by an engineer will have line-by-line detailed summation of ALL the components of the building that will require replacement (at end of useful life) or preventive upkeep throughout the upcoming 30 years.

So a comprehensive and complete study covers all possible aspects of the building that will require replacement over time. Nothing should be a surprise for a rainy day — if the study is done in a complete and diligent manner.

Keith Harker

at 3:45 pm

This a question.Replacement of floor carpet has a Reserve Fund proposed budget of $45,000. the replacement cost will be $70,000..Will the total cost be covered by the fund or will a special assessment be required?

Bedford , Nova Scotia

Conny Manero

at 6:19 pm

Our 30 year old condo building has $550,000 in its reserve fund. Is this enough?

Over the past 5 years, our maintenance fees went up with over 35% and another 7% is planned for 2017. Is this fair?

We, the residents, suspect our board of directors to be fraudulent, but we cannot afford a lawyer to investigate them. I have approached newspapers, condo associations and event the police, and nobody can help us.

AC

at 6:56 pm

By law condo boards Financials must be audited by certified accounts appointed and accountable to the owners only. They are not accountable to the directors or selected by the Board.

Direct your inquiries directly to the auditors. Audit expenses are condo corporation expense item. They should be present at annual meetings and not simply a audit report. It is the owners right.

Jeff Berman

at 12:45 pm

Is there a way to calculate what our reserve fund balance should be? I live in a townhouse/condo property in North York that is 50+ years old, is approx. 11 Acres, and has 160 units.

Thank you

AC

at 6:30 pm

Strictly my opinion.

Non profit verses profit generating corporations.

Taxable profit is typically defined as income exceeding expenditure within a tax year.

Reserve funds are exempt of profit tax. All funds in a reserve fund are owners money after tax contributions for future owner expenses 10, 20 to 30 years down the road. Estimated future cost including inflation (3% in our fund) plus .6% interest on income on deposit forecast over 30 years. All in keeping with ontario condo laws as I understand.

At 75 years old my chances of seeing a material return (for repairs) is very highly unlikely. Future generations of owners will inhirate my contribution ( after tax dollars ) to guarantee their future repair expense. A kin to guaranteed income ..tax free. My contributions to the fund are non refundable including interest earned and non tax deductible.

My Big question is How effective is the real estate industry at reflecting these funds as real property value. Current Reserve funds law must be projected over thirty years which is a crystal ball period based external consultants opinions and building science for repair and replacement only!

Operating expenses for “routine” maintenance , utilities and services are the corporate board budget accountability or in a fiscal 12 month year based on each corporation year end.

I do not know of any other law or corporate body the has this fiscal accountability period of 30 years.

As a present owner like a corporate a share holder (for the lack of a better description) I have has no sense of ROI.

As a past volunteer board member who has some CCI training courses certification plus the good fortunes of legal board support I remain astonished that board member of non profit condos do not require certified with proven experience to manage major corporate funds. Audits who represent the owners preform annual due diligence for expenditures not specific to corporate declaration necessary and Ontario condo laws. I have absolutely no concerns of the board members honesty doing their best but I think the condo laws are expecting unreasonable reserves to cover long term repairs and replacements for future generations of unit owners. Properties change ownership many times in a 30 years period. My taxable retirement income is funding future generations of tax free guaranteed expense income.

I also believe Status certificates for new owner are not available without an offer to purchase at purchases expense. I Think the status certificate should be part of the listing. Our corporation charges $100.00 for issued status certificates.

Reserve funds are prepared by certified independent consultants by condo law and not the board of directors. The board only prepares operating budgets for the 12 month fiscal year which includes reserve fund contributions as separate line item account. Shared Common facilities gym, pool, exercise, building, utilities etc. Is an additional line item of sharednoperating budgets.

No reserve is suppose to be in a negative position at anytime by law as we were told at our town hall meeting last week. Because our class 2 reserve fund study indicated a negative position 10 years down the road ($10,000)contributions were increased 7.7% per year for the next three years for future generations of owners. They inherit my contributions plus interest.

Major repairs and roof replacement has been completed to all units in the past 8 years of this 17 year old development. Fees have increased over 66% in 10 years plus special accessments of $1000.00 per unit over and above monthly fees on this year 2000 development. We have lived hear 8 years.

Because our condo has over 25 units audits are required as an expense.

Because each condo corporation has unique declaration or constitutions plus the Ontario condo act plus each level of government laws, it requires a lawyers advise to understand the condo act with no clearly defined in condo laws act.

Seek legal advise and remember reserve funds are donations to future condo repairs and replacement only not operating expenses or routine maintenance. A good condo lawyer and cerified condo accountants is your best resource for advise. It is very challenging. Research and research again to gain the knowledge for comfortable decisions. Special accessments as required are far fairer for current owners in my opinion.

Candice

at 10:39 am

I am surprised folks are complaining about about having to put money away to upkeep a building. For one as a buyer I do not want to buy a unit in a building that is in disrepair or they might not have the funds to cover the swack of expenses that show up in older buildings; therefore I have passed in buildings or I would offer way less as its not worth it if its likely to have a special levy in a year. So not a great investment for your children if you are passing in the unit. It is also not fair to other current owners that they bought into a building assuming others around them would also care about maintaining a building… If you don’t care about your home as an investment at least recognise that not having the funds to upkeep the building is literally affecting your neighbours. I see so many buildings around the 25 year year mark are in big trouble with their financials… Multiple units for sale and those folks are stuck there and unable to sell. What a shame when young couples want to move out and have a family or a senior wants to move cities to be closer to family 🙁

Ted Carr

at 7:47 pm

Good article, to many variables in an older building to say if it is in a poor, good or great position, Condo reserves are not a money making venture, yet there has to be moneys for future repairs and capital cost.

A question I have, the reserve fund study is only for improvements above the ground, out of sight out of mind, sewer, water, below the ground who who one hire to estimate and study the deterioration and state of these utilities?

Lynda Weinrib

at 2:01 pm

When should windows be replaced in a 72 unit building that was completed in 1987 please? Our current board feels it should be left until 2035 even though we are spending Over $30K per year on repairs.

Betty Durant

at 7:17 pm

An single owner allowed three adults and three kids and a dog to move in with her in a two bedroom condo. How do we get rid of them.

George Dunning

at 12:10 pm

Question for Condo Boards— the interest from Reserve fund investments? Must this money be put back into the reserve fund or can it be used elsewhere? Example– we have an overage for snow removal this year– could the interest be used to pay this?

Eric

at 9:22 pm

In a couple of years,

we were shown that our reserve fund is going to be -$800,000.

A 1969 17-floor high rise and 6 townhouses.

7 units per floor.