You’ve read this one before, right?

Or something like, “Selling the unsellable?”

This is one of those posts where I show properties that have been on the market at various prices, maybe even with various agents, but aren’t selling?

Yes and no.

Earlier this year, I showed you a variation of this theme, whereby a couple of home sellers had listed low, then listed high, then listed low again, when all the while, that “strategy” made zero sense, and failed spectacularly.

Today, I want to dumb things down a little bit and simply show you three sellers who are (gasp!) asking too much for their homes.

It sounds simple enough, but each one has a story, and each one is for a different property type, price range, location, and has a different set of screw-ups.

A lot of people believe that “a house will sell itself” in this market, which the following will clearly demonstrate is false.

As I’ve mentioned over and over, the stakes have never been higher in Toronto, and there’s never been so many ebbs and flows, positive and negative, based on the work a seller does or doesn’t do on the house, not to mention how the listing agent performs his or her job. I told a prospective seller over the weekend, “Your house, today, as is, would sell for $1,300,000. In the third week of September, after we take the steps I’ve outlined, we would sell the house for upwards of $1,500,000.”

He snarled.

There was a faint “snort” in there too, but regardless, he didn’t trust my math – even though I’ve demonstrated on occasion that I know my Roman Numerals…

His house, to be perfectly honest, is a rat’s nest. It’s disgusting. It’s 40 years’ worth of “stuff and things” in the home, and he seems to have three of everything. “Is that a lobster trap in the living room?” Yes, and there are two more in the basement.

I proposed that we take 90% of the possessions out of the home, then paint the entire house from top to bottom. Then we would do a whole lot of minor repairs, and we would extreme clean, stage, and he’d live off site for ten days while we showcase the home.

There’s smoke and mirrors here, and even more lipstick on a pig.

And in the end, I know I could get a buyer to pay a sky-high number for this house because of the location, property type, and price point.

But as it is now? If somebody walked in there? He’d be taking a haircut, and, not getting the market premium I know we can obtain.

The stakes are high.

No house sells itself.

And the sellers have to listen to the experienced professionals around them, otherwise they end up like these folks below.

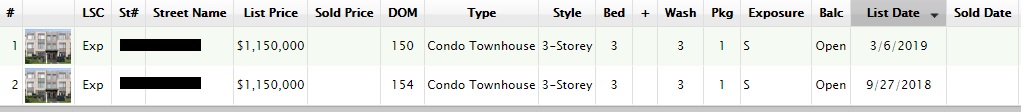

Here’s a property I’ve been watching for some time:

This property was first listed for sale in September of 2018, for $1,150,000.

There was absolutely, positively, no reason to think the property was worth anywhere near that much.

On a good day, maybe this property could sell for over $1,000,000.

But not a single good day ever greeted this home, and I should know, because I showed it to clients.

This property was essentially being used as an illegal rooming house for New Canadians. It was obvious in so many ways.

Our first impression of the property was the FOR SALE sign, which in this case, was just the post. I tried to dig up the photo, as I had used it in an MLS Musings blog a while back, but seriously – just the white, wooden post was in place, and there was no sign.

We rang the doorbell, and nobody came to answer.

I took the key from the lockbox and opened up the unit, and a woman came to meet us. She spoke zero English, and just motioned with her hands for us to stay put. She came back about five or six minutes later with a young man who had clearly just woke up, who told us, “Please have a look, but there are people sleeping upstairs.”

Great way to motivate a buyer eh?

The property was not in good shape. It was pretty worn, but it was gross, to be honest.

There were “instructions” posted throughout the main floor, and a schedule posted on the kitchen wall about who, in the house, is responsible for certain tasks on which days. It reminded me of summer camp.

The powder room on the main floor was being used for storage, which was odd. A toilet and a sink, but boxes stacked throughout, rendering the bathroom unusable.

There was a locked door on the main floor with an orange “KEEP OUT” sign.

Upstairs, there actually were people sleeping. On thin mattresses, on top of cardboard, on the floor.

The house stunk to high hell. I’m just saying.

And for a 3-bedroom condo, I counted six people home in the middle of the day.

My clients didn’t want to see past the main floor, but I felt really bad and didn’t want to insult these people (even though they weren’t the owners), and so we toured the whole property.

We left, they laughed, and we all washed our hands when we got home.

I’m not knocking the people, the plight, or the personal circumstances. I’m just saying that in no way were we to know that the property was in this condition, especially considering the price! I’d have thought the walls were made of gold!

The property was on the market, as you can see above, for 154 days.

Then it was re-listed at the same price, and sat for another 150 days, before it expired.

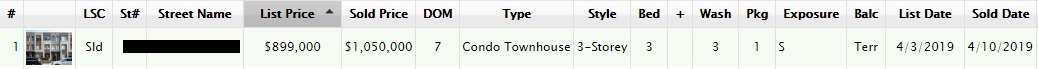

During that second listing, the identical model came onto the market, looking beautiful, and staged, and it promptly sold:

Not bad, right?

$1,050,000, a new record!

And yet despite this comparable sale, the unit above, with people living in their own filth, remained on the market for another 3 months, $100,000 higher.

–

The next property is one that I had a personal experience with, and while I struggled with whether or not to tell this story, since I don’t really kiss and tell, I’m going to detail it anyways because I think it’s a good lesson.

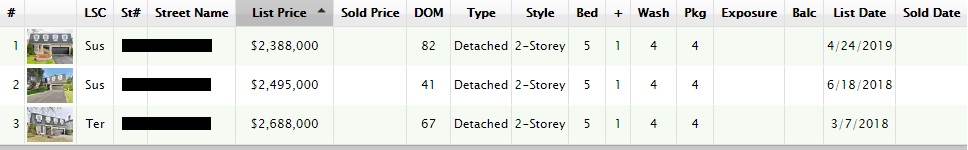

Here’s the history:

This property was listed for $2,688,000 with another firm in March of 2018, and didn’t sell.

A colleague of mine brought me in to meet the owners in May, and we all seemed to get along fairly well.

We felt that the property was over-priced, but also didn’t show to its potential since nothing had been changed from how the sellers lived in that home, every day.

The owners were armed with comparable sales, and they made a compelling argument. As I’ve said many times, you can make numbers say anything you want.

They were two of the sweetest people I’ve ever met, and the pride of ownership was like nothing I’ve ever seen. They knew every single feature of the home, and I can see them hand-picking individual blades of grass from the lawn that don’t meet requirements.

But they, like so many people in early 2018, hadn’t really mentally recovered from the pronounced drop in 2017 that occurred in the Toronto market, or in their area, north of the central core, which was hit the hardest.

Having staged the whole house, painted, and implemented our traditional marketing initiatives, we settled on a list price of $2,495,000 which we knew (or so I thought we all did) was high, but figured that buyers in this area would make lower offers, and thus we had a negotiating cushion.

I knew the price was high, but they wanted to sell, wanted to move out of the country and into retirement, and I was also under the impression that we would let the market decide what this home was worth, and we would work with the feedback we were given.

As you can see from the above, the listing was suspended after 41 days. We just weren’t on the same page with respect to price, as well as expectations.

We received one offer, and it was for $1,900,000. We did not sign the offer back.

The buyers in this area all wanted the house for land value, even though there was a house on it. The land value was probably $2,000,000, but the house really only made the property worth $2,200,000. The buyer pool was limited for this home, since most buyers wanted brand-new, and would pay $3.5M for a brand-new house on this lot, or they wanted to build new, and thus wanted the land for around $2.0M.

We continued to explain to the sellers that we over-priced strategically, and that if they wanted to sell, we needed to reduce.

They refused.

We took the property off the market and were going to come back in the fall, but again, we assumed it would be for at least $100,000 less, perhaps more if we actually wanted to sell.

They disagreed.

So we let the contract expire and told them they were free to re-list with another firm. Sometimes, the players in the room need a new voice, from a new coach, and I’m not one to hold people hostage. We wished them the best of luck, and meant it.

This spring, the property came back onto the market with a third brokerage, but for about $100,000 less this time around. This was still, however, too high. I didn’t understand.

In the spring of 2018, we were about $200,000 high, which I thought was strategic in nature, but they thought reflected fair market value. This area is one of the few in the city that has probably depreciated over the past year, so we could argue the house is worth $100,000 less.

And yet they sat on the market for almost three months, with no price reduction, while the market continued to move around them.

I don’t understand. I just wish these nice folks would pull the trigger, take their tax-free capital gain, and move on to the next phase of their lives. I’m sure they could move this house for $2.2M, and that’s a huge windfall!

So what’s the problem? A few typical ideas come to mind. Pride. Greed. Overconfidence. Misinformation. Misperception.

These were not market novices. They were very smart, very successful people, and for the life of me, I can’t understand the strategy here. Is it going to take four brokerages, and two years, to sell a house in Toronto?

–

The last one is a doozie, folks.

“A picture paints a thousand words,” so let’s allow the

No, seriously? Right?

Right?

Am I crazy, or does that screenshot above, for one property that was bought in 2017, subsequently listed thirteen times in the next two years, remind you of a scene in a movie, like this:

Or if it were a TV show, and we added some colour, it would look like this:

I don’t know about you, but upon seeing thirteen listings across two years, with both sales and leases, low prices and high prices, it reminded me of a crazy person staring at their notes on the wall.

The owners of that home paid $1,895,000 at the absolute peak of the market in April of 2017. I mean, maybe this was like six days after the peak, but it was honestly the damn PEAK of the market!

Then nineteen months later, they tried to sell it for $444,000 more, or 23.4%.

Um, did they not read the newspapers? The price of real estate dropped a wee-bit after they bought, and while it did come back up, I don’t think it came up 23.4%.

So what did they do after their gargantuan $2,339,000 price didn’t catch any flies?

They re-listed a whopping $40,000 lower, left it on the market for over two months, and put the house up for lease! Of course, the lease price was too high as well, but what did we expect?

So after the two-months-and change at $2,289,000, they re-listed at a……….(ahem)……..lower price. How much lower?

$24,000.

Or about one percent.

Um, if you’re on the market for 71 days at a given price, I think it’s fair to say that if your home were worth 99% of the asking price, somebody would have offered it to you.

Price reductions like this make no sense. You’re better off leaving the price as is.

As you can see from the listing summary above, they have listed the property another six times for sale, three times for lease, and even tried the old, “Let’s list low, hold back offers, and try to get above asking” game that never works in these situations, but people try anyways.

And where are they now on price?

$3,000 higher than what they paid for it in 2017, and $441,000 lower than what they first asked for the house last fall.

Am I crazy, or is this a monumental waste of time?

The sellers and the agents are nuts, and I don’t know who is more to blame.

–

So tell me if you’ve heard this rant before, be it once, twice, or thirty-seven times.

And tell me I’m being rude, insensitive, unsympathetic, or unnecessarily-sarcastic with respect to these three would-be home sellers above.

Then I’ll tell you again, for the MCXVII’th time, that there’s the right way to sell real estate in this city, and then there’s everything else that people try. And for the life of me, I just don’t understand those folks. Not when there’s so much money involved…

Appraiser

at 6:25 am

TREB numbers for July released this morning:

Sales are up a whopping 24.3 %

Average price up 3.2%

HPI composite benchmark price index up 4.4%

Active listing down -9.1%

The market continues to tighten with demand outstripping supply. Conditions are ripe for further price gains going forward.

Drops mic.

Housing Idiot (Bear)

at 10:03 am

You won the bet, name changed. As per my comment last year; Would have rather bet on July 2020 being lower than 2018. Willing to go double or nothing

Appraiser

at 10:59 am

Yup! You’re on.

Double or nothing it is.

Derek

at 1:04 pm

Congrats! I forget what the bet was, exactly. I recall it had something to do with average price at the end of July 18 for the GTA? Can one of you post the parameters of the bet? And, give us something to live for over the next calendar year too 🙂

Housing Idiot (Bear)

at 1:10 pm

@ Chris

Do you still have the link to the original bet?

Darcy

Chris

at 1:18 pm

Sure thing:

https://torontorealtyblog.com/blog/cruel-cruel-cruel-summer/#comment-90311

Housing Idiot (Bear)

at 3:45 pm

Thanks

Professional Shanker

at 4:46 pm

Appraiser

August 7, 2018 at 1:54 pm

Just for the sake of posterity lets review the average sale price for July over the past 5 years. Who’s betting the number next year will be lower?

2014 $550,625

2015 $609,236

2016 $710,471

2017 $746,218

2018 $782,129

2019 – $806,755

Appraiser what do you see for 2020 – Another 3% increase – $830k?

Appraiser

at 4:51 pm

@ Housing Idiot.

Just so we are clear.

The ‘double-or-nothing’ bet is based on your contention that the July 2020 average price on TREB will be lower than the July 2018 average price, not 2019.

Yes?

Mxyzptlk

at 9:47 pm

Last year, Bear, you wrote “but I would prefer to say July 2020 will be below 2016 prices.” Surely that was a typo, considering the July 2016 average was $710,471. You meant to say 2018, right?

Housing Idiot (Bear)

at 11:54 am

@ Mxyz..k – I meant what I said at the time. Back then I did not believe the FED was going to be backing off so soon, and I thought CBs as a whole would fight to protect the relative value of their currencies a whole lot more. The backdown and the explosive growth in negative-yielding debt seem to be a real paradigm change. Long term this will make things worse but could keep the party going longer. Trump doesn’t want the US economy to blow up right before next election.

@Appraiser – I will take the bet that 2020 will be lower than 2018 in nominal terms. Meaning TREB average will be lower than $782k.

In real terms, it could be lower than in 2016(710.5K in 2016 is worth more than 770K in 2020 for example),

Chris

at 11:42 am

Sales volume for July of 8,595 is above 2017/2018, below 2014/2015/2016 and almost identical to 2013.

Average price obscures a dichotomy in the market; detached homes aren’t doing so hot, while condos are still seeing strong price growth. In the 416 specifically, detached home average price is -9.1% YoY while condos are +7.7%.

Comparing to April, 2017 really highlights this. From then to today, 416 detached average price has fallen 22% ($1,578,542 to $1,227,301), semi-detached down 11% ($1,104,047 to $981,802), townhouse down 4.7% ($793,129 to $755,401), while condos up 8.5% ($578,280 to $627,927).

Kudos on winning your bet though.

Professional Shanker

at 4:42 pm

This shows an overvaluation in the condo market, too many investors bidding up the price in my opinion.

Using prevailing condo prices (sale price), condo rents (long term tenancy) are approx. equal to the carry costs (property taxes, condo fees and interest costs). Condo investors are only betting on price appreciation going forward, seems risky unless the investors expect a decreasing interest rate environment.

What is the value of an asset at nominally zero interest rates…….

Appraiser

at 5:02 pm

To bears, it always seems risky to invest in condos. Always.

We’ve been hearing the same old same old for over a decade now, but the reasons seldom change: too much product, glut of investors, etc. etc.

It’s like a religion.

Facts have no chance against deeply held beliefs based on blind faith and dogma.

Appraiser

at 5:18 pm

@ Shanker: I see a 3-7% increase in prices by next July, as listing inventory remains low and interest rates weaken a little. No recession either.

Professional Shanker

at 6:11 pm

Are you saying a 3-7% increase in prices pending no recession or a statement that there will not be a recession by 2020 in addition to the price increase?

FreeMoney

at 9:53 pm

Plus the probability of higher interest rates twelve months hence has dropped precipitously since the spring.

Appraiser

at 5:15 pm

I see you forgot to mention that the HPI index (a far more accurate tool for assessing price changes) for detached homes in the 416 was actually up 1.93% year over year. But I bet you already knew that.

Chris

at 5:32 pm

Sure, we can look at HPI if you’d like, appraiser.

From May, 2017 to present, 416 detached HPI has fallen by 7.8% ($1,228,500 to $1,134,300), while condo HPI has grown by 20.3% ($477,600 to $574,700). Pretty big dichotomy even when using this metric.

Derek

at 11:09 am

You guys emphasize different numbers or aspects of the numbers, but I always wonder what is the conclusion you are making. I can infer, but I wonder if you guys can state it. Chris, for example, seems to be inviting the conclusion that the overall market is not healthy because 416 detached is down a large percentage from peak and ascribes less significance to condos’ extraordinary percentage rise in price and share of total sales. Is that a reasonable conclusion–that the market is tenuous because detached has slid and not recovered while condos are masking it in a combined number? Is it really a negative thing or is it indicative of a new normal where condos will drive the “market” going forward?

Chris

at 11:21 am

The conclusion I invite is exactly the one I stated; there is a curious dichotomy in the market, with detached homes performing comparatively poorly, while condos see strong price growth.

Perhaps this is a result of an unhealthy market? Perhaps it is because of the B20 stress test making more expensive detached homes less attainable, and pushing buyers to condos? Maybe declining detached prices will spread to condos, and their values will fall as well? Or rising condo prices will allow these owners to upgrade, and provide support to detached prices?

I don’t have the expertise to untangle all of these factors, nor predict the future.

As for appraiser, his conclusions are pretty clearly indicated as well: “Conditions are ripe for further price gains going forward…3-7% increase in prices by next July…No recession…”

Professional Shanker

at 11:54 am

Is it really a negative thing or is it indicative of a new normal where condos will drive the “market” going forward?

Could be a new normal if end users and long term condo investors are purchasing the condos. If condo prices are being driven by speculation via short term investors then the increase is a blip in history similar to the detached euphoria in 2016 and 2017, investors got hurt bad and are still attempting to unload there losses.

I am more bullish on detached prices than condos over the next 5 years, affordability of the detached segment remains a concern though.

Is a new normal upon us of closer to nominal interest rates is a question to ponder, what is real estate worth if your money earns you negative interest in a so called bank, pays to load up on tangible assets as the fiat currency people hold deflates away…..

Ed

at 7:51 am

What was that last seller thinking don’t they know it’s not MMXVII anymore.

Peggy

at 5:27 pm

The house with so many people sleeping in it reminds me of the house that we actually ended up buying in 2000. I couldn’t even count the number of people that were residing in the house, as there were so many. As we were potential buyers, they were not happy to see us and made this quite obvious. The place smelled like mouse feces and we were greeted by a hoard of cockroaches crawling up the walls as we came in. The seller made an attempt to paint. This turned out to be a bad idea, as they used thin cheap paint that mostly ended up on the floor. As we had strong stomachs and could somehow see the potential, we ended up buying the house. The house had been on the market for 1 month prior and we were able to get it for 90% of the asking price. No bidding wars here! I have often wondered why the seller didn’t just take the steps to clean, paint and spray properly. He would have gotten his asking price as this was and is, a great house–a real diamond in the rough. I might add that these were the days before people understood the benefits of staging properly. In our case it was definitely good for us that this place showed so badly.

AAustin

at 9:53 pm

Ugh. You gave that first seller great advice. I hope he stops huffing and takes it! Change is hard. Removing lobster traps is no joke- but it’s all worth it in the end.