I saw this on Bloomberg Business at the end of business day on Wednesday, no doubt in response to the Bank of Canada holding the overnight lending rate steady.

I’m not sure if there’s any merit to this story, or if it’s just speculation, since nobody in government is really talking, and no sources were named.

But I’ve talked to a couple mortgage brokers and economists who say that indeed, this idea has been tabled, and it’s not that much of a long-shot after all.

However, the idea of a “two-speed” housing market in Canada really has to be considered before any new policy is written…

First, take a look at this wire from Bloomberg Business:

“Canada Officials Said To Favour Higher Down Payments On Homes”

Canadian government officials are pushing for tighter housing finance rules to cool soaring real estate markets in Toronto and Vancouver, according to people familiar with the plans.

The finance department recommends raising the minimum down payment on insured mortgages to as high as 10 percent from 5 percent for homes above a certain value, the people said on condition they not be identified because the deliberations aren’t public. Former Finance Minister Joe Oliver rejected the recommendation earlier this year. Department officials raised the proposal again at an October meeting with industry, according to one of the people.

Finance Minister Bill Morneau, who replaced Oliver after the October elections, has said the housing market was among the first issues department officials briefed him on. The new Liberal government will need to decide whether the nation’s C$1.3 trillion ($970 billion) mortgage market needs tighter regulations to prevent a housing crash.

Toronto and Vancouver home prices remain on a tear and are perceived by some economists to be overvalued. That puts policy makers into a delicate balancing act: how to cool markets in those cities without precipitating a major decline in places like Calgary or Montreal, where prices are flat or falling.

Jack Aubry, a spokesman for Finance Canada, said the department doesn’t “comment or speculate on possible policy actions, or discuss what might be under consideration.”

In a bid to target the more costly markets earlier this year, Oliver considered raising the required minimum down payment, currently 5 percent, on homes worth more than C$500,000. He ultimately rejected the proposal, one of the people said. His department, which had recommended the measures be applied immediately, initially recommended an even lower threshold on concern C$500,000 wouldn’t have much of an impact, the person said.

Vancouver housing prices have soared, boosted by an influx of foreign buyers. November sales were the second highest on record for the month, with the average price for a detached home jumping to almost C$1.6 million, according to figures released Wednesday.

Under Canadian rules, home buyers must have a minimum 5 percent down payment to qualify for mortgage insurance. Buyers putting at least 20 percent down aren’t required to take out insurance.

Morneau hasn’t said whether the government will enact any new housing measures.

Okay, so there’s not really anything concrete in there, other than:

1) Anonymous, unidentified “people” in government say that officials might be pushing for higher down payment requirements.

2) This idea was already shot down by Joe Oliver earlier this year.

But the news reports and the idea have people in and around real estate buzzing, and a colleague asked me, “Do you think this would have an effect on the market?”

Yes, absolutely.

How much of an affect is the bigger question though, and in what part of the market would we see the greatest change.

Personally, I think we’d see the biggest effect in the entry-level buyer segment of the market, which sadly, is up to $400,000 right now in Toronto, but could represent a 4-bed, 5-bath mansion in some other parts of the country!

Many of my first-time buyers have only 5% down, plus closing costs.

Think of the buyer who wants to purchase a $300,000 condo, with $15,000 down (and with first-time buyer rebate on land transfer tax, they’d only pay about $975).

We’re not here today to debate the merits of this purchase, short-term or long-term, but we may as well state that this $285,000 mortgage would carry for $1,323.71 per month, of which an average of $686 per month comes back to the buyer in the form of principal in year one.

Factor in about $350 per month for maintenance fees, and $150 per month in taxes, and this unit costs the buyer $1,137.71 per month as a sunk cost, which is far less than the unit would rent for.

Ha. Well, I said we wouldn’t get into the merits of the purchase, but, well, I couldn’t resist…

In any event, that buyer has the “right” to pay $1,137.71 for that unit today, rather than rent it for $1,500, since that buyer can purchase with a 5% down payment.

But if the minimum down payment was increased from 5% to 10%, that buyer would need $30,000 as a down payment, rather than $15,000.

If that buyer didn’t have the $30,000, then he or she would be forced out of the market.

There goes that “right” to pay less for the unit, although the bears will be quick to cast doubt on whether that’s a worthwhile venture to begin with.

So by increasing the minimum down payment from 5% to 10%, we’re going to see the biggest effect at the lower-end of the market, and that’s because this is where the most five-percent-down buyers are found.

Do buyers purchase $800,000 houses with 5% down? They sure do!

$40,000 down, and if you can carry $3,500 per month, it’s all yours!

To each, their own. And some people make fantastic incomes and can easily carry the monthlies, but don’t have the down payment.

I had two clients recently purchase for $850,000 with 5% down. The mortgage amount seemed massive, but their combined income was over $250,000. They’re both professionals, who paid off massive loans that accumulated as they went to school into their early-30’s, but are now in their “earning years” and it didn’t take them long to save the $40,000.

I had another client, who would love if I referred to him as a “young hot-shot,” who could probably have put down 50% on his $925,000 bachelor pad, but he said, “Why wouldn’t I take this 2.59% interest rate, plus modest CMHC premium, as far as it’ll go, and then invest the rest?”

Although I disagree with his assessment that he can make 10% “risk free,” if he has an “in” at his place of work that can see him earn double-digit returns, then I suppose it makes no sense to use that money at 2.59%.

Now let’s throw another log onto the fire: what if the “increase to 10% worked on a sliding scale?

Robert McLister posted this sliding scale on his blog the other day:

- 5% down for $0 – $500,000

- 7% down for $500,001 – $700,000

- 10% down for $700,001 – $999,999

- 20% down for $1,000,000+

That certainly changes things, does it not?

Now all those poor, unfortunate, would-be first-time condo buyers in Toronto, with their $15,000 savings, still can buy a condo and reap the rewards of paying less than the cost of rent!

So maybe the only affect this policy change will have may be in the $700,000 – $1 Million range?

At the end of the day, we have to remember that this policy is not being enacted in Toronto, but rather for the whole of Canada.

And while we Torontonians live in one of the hottest real estate markets on the planet, surely we have to take notice of what’s going on outside the Golden Horseshoe, no?

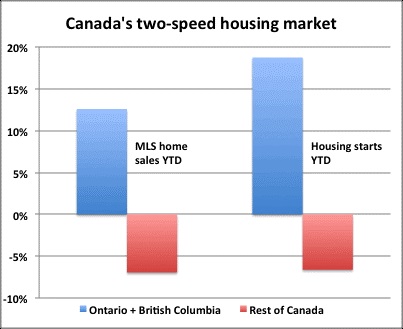

I’ve talked to some people who believe that we are in a “two-speed housing market” here in Canada, with Toronto & Vancouver going one speed, and the rest of the country going another.

This policy would be implemented to cool the “Canadian” housing market, and while Toronto and Vancouver are the target, clearly it would have an effect on every other city and town as well.

So what does the “two-speed housing market” look like?

This:

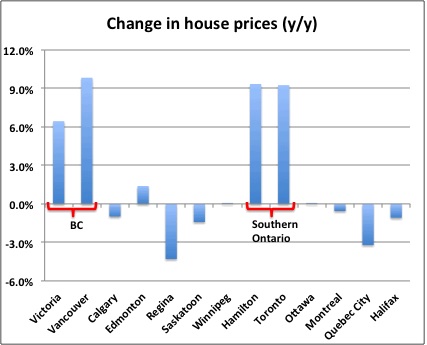

(Charts are all courtesy of Ben Rabidoux from North Cove Advisors)

And this:

–

You simply can’t talk about “Toronto’s housing market” in the same breath as “Canada’s housing market,” as it’s far more drastic than comparing apples to oranges.

Some areas of the country are already bleeding red, and this policy change for increasing the minimum down payment requirement would only sink them further.

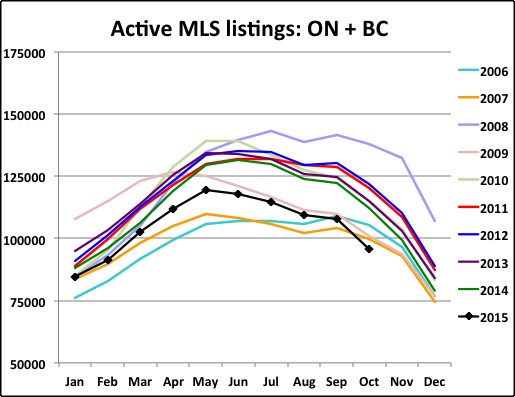

The reason why Toronto and Vancouver’s markets have been increasing for the past twenty years, and why, more specifically, they continue to increase today even though logic “should” have dictated they’d cool already, is simple: supply and demand.

Active MLS listings in Ontario and British Columbia are lower than they’ve been all decade, and this is even with the supposed construction boom:

–

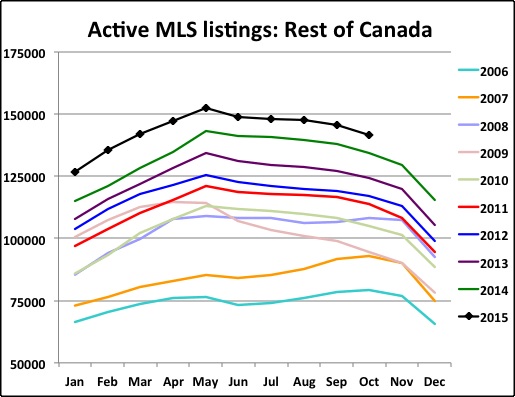

Now what does the same picture look like for the rest of Canada?

Right.

Listings are at all all-time high.

Our housing market is going at two very different speeds, depending on where you live.

A change from a 5% minimum down payment to a 10% minimum down payment might cool the market in Toronto in Vancouver, ever-so-slightly, but the prospects for the rest of the country wouldn’t be good.

It’s not my decision to make, and call me biased, but I’d prefer at the moment to simply leave well-enough, alone…

Appraiser

at 8:39 am

Cooling the markets in Toronto and Vancouver may be one of the goals of these proposed rule changes, but I believe that reducing CMHC’s market dominance and the level of perceived tax-payer exposure is another. There is no doubt that this can be achieved by mandating that buyers put more skin in the game.

The Department of Finance has made it clear in recent years that it wishes to diminish CMHC’s market share. So far they have imposed a $600B insurance cap and severely restricted the amount of low-ratio (portfolio) insurance that lenders can purchase. This has resulted in a steady decline over the past several years in the total amount of insurance in force for CMHC.

However, the present rate of decline may not be fast enough for the DoF, so they are exploring other methods of achieving those goals.

Kyle

at 12:04 pm

One of the things i’ve always wondered is how stringent CMHC is in investigating before paying out a claim. If there is one thing that i’d like to see CMHC do (maybe they already do this), is to investigate each lender’s claim and deny it if fraud is detected, thus putting the onus back on the underwriter to do thorough due diligence. As a taxpayer if i had assurance that this were taking place then i don’t care if they insure $600T in mortgages.

Kyle

at 9:42 am

Overall, i am all for increasing the minimum downs. However whenever a sliding scale is used, what usually happens is pressure relieved from one segment of the market ends up building up somewhere else. I suspect on a net this will maybe cool the sales activity, but will not do much to cool prices. If anything i see this raising the price of condos in Toronto and doing very little to homes priced above 500K, since it basically forces new buyers to buy something sub-500, until they’ve built up enough equity to move up.

Joe Q.

at 10:57 am

I agree that the sliding scale (with hard cut-offs) ends up distorting the market. It’d be better (though less simple) to apply an actual formula, so there is a continuum of minimum down-payments.

Fro Jo

at 11:13 am

Well said, Kyle.

Joel

at 1:45 pm

I completely agree with this assessment. Raising the minimum amounts is going to drive up the lower brackets and make it even harder for the first time condo buyer in the 300-400K range.

Buckley B. Buckington

at 10:28 am

Ban mortgages all together. My bank stocks may go to zero, but the deals on houses would sooooooooooooo be worth it!

condodweller

at 1:19 pm

I’m no economist, therefore I don’t know what the overall effect of raising minimum downpayments would have in terms of jobs, building permits etc. Of course government has to balance the economic impact with the personal impact, but looking at it from the personal point of view I would raise minimum downpayments to 20%. It would keep borderline cases out of the market and stop them from shooting their brains out, and it would also nicely protect the rental market as those who can’t buy will rent, keeping investors safe with a solid rental pool.

I’m no bear and don’t have a problem with people taking on monster mortgages (referring to the size here not to the broker of the same name) as long as they can afford it, but how do you explain to them, and I’m going to use my favourite line from Jurassic Park again, that just because you can, doesn’t mean you should. I mean if you have a 250k income and you can pay off a 600k mortgage in less than ten years, by all means go for it. I’m concerned about people with a $100k income taking on a 600k mortgage where that income is by no means guaranteed.

The difficulty with controlling behaviour with policy changes is how do you differentiate between the above two cases? Perhaps it can be done by only allowing 50% of one’s income in the qualification so that if one person in a couple loses their job, or a single person can only replace his/her job with a lower income would still be ok. This wouldn’t be a stretch as we already have this with allowing 50% of rental income to be used for rental properties. I would argue that rental income is safer than personal income therefore why would you allow 100% of personal income to be used?

Ultimately I’d just raise the downpayment because the marginal cases would be kept out of the market, and the case where a professional with high income can easily come up with the downpayment, he/she just needs to wait a bit to buy, but they will be able to buy. The marginal cases will be protected two-fold. Once, forcing a higher downpayment will not let them take on unmanageable mortgages, second while they accumulate their downpayment the markets have a chance to correct and they would be in an even better situation i.e. higher downpayment and lower prices.

I know I’m going to be called a bear due to that last sentence. I disagree and say it makes me risk averse.

Joel

at 1:56 pm

Don’t you think this is a government overstep? I understand that there need to be regulations, especially when there is taxpayer money involved, but people need to have the ability to make their own decisions.

Always erroring on the side of caution in this situation only hurts those who do not already have a lot of money. Rents would increase as there would be a much greater demand as less could enter the market. Those with money would be purchasing rental properties and making great money off of them.

It’s not alright to punish those who haven’t bought yet, perhaps they are just starting their careers and you are taking away their ability to own.

No lender wants to foreclose and people need to have the ability to make decisions (good or bad) on their own.

As a side, houses in default in Canada is at an all time low. I believe it is at 0.4% which is a very low number.

Libertarian

at 2:48 pm

Government overstep is the fact that CMHC exists at all. There are private insurers. The Big 5 Banks all make kajillions in profits every year, so why not dissolve the CMHC and let the market dictate who gets a mortgage (and all of the details associated that come with it).

Once government gets involved in anything, you know that it will eventually lead to expanding government powers to try to correct a problem that it created by getting involved in the first place.

Kyle

at 3:24 pm

The concept of mortgage insurance is a sound one that benefits all mortgage holders (not just insured mortgage holders). By pooling the risk of defaults on the highest ratios, rates come down for everyone.

Not to mention the benefit it has for all of society. It helps in financial intermediation which adds to our economy and CMHC has also contributed over 18B to the Government, lowering the amount of taxes we would otherwise have to pay.

So in summary without CMHC, mortgage rates would be higher, GDp would be lower and taxes would be higher.

Libertarian

at 4:19 pm

I don’t have a problem with mortgage insurance. As I wrote above, there are private insurers who provide the service (Genworth and CanadaGuaranty). So the benefits you describe could still be achieved without the CMHC. The question is whether it’s part of the government’s mandate to be in the mortgage insurance business at all. Politicians of all stripes have revised CMHC policies over the years, which had to then be reversed because they did not have the intended effect. This leads to this latest debate today of whether to increase down payments once again. I would argue that government should serve a basic function in society – create laws, provide education, infrastructure, health care, national defence, etc. Anything other than should be left to society. After all, we are always bragging in this country that we have rights and freedoms, but we’re becoming more and more socialist state every day as people clamour for an increased nanny state or big brother. Politicians are of course happy to oblige because there isn’t a politician out there who isn’t turned on by more power, more control, more taxes, bigger budgets, etc. But it’s not possible to have a continually expanding public sector supported by a shrinking private sector. That’ll lead us down the road to becoming the next Greece.

jeff

at 3:02 pm

Couldn’t the argument be made why is the government insuring 5% mortgages in general – without the government there is a good chance it would harder to get a mortgage anyway.

Kyle

at 3:11 pm

I agree with Joel, one enormous unintended consequence of your idea is that there will be a large increase in the wealth gap.

Real estate is one of the largest contributors to Canadian wealth as measured by Stats Can: http://www.statcan.gc.ca/daily-quotidien/150603/dq150603b-eng.htm. Any policy that only allows the “haves” (i.e. those who can come up 20%) to participate will only help the rich get richer. While the “have nots” will have no choice but to rent, adding upward pressure to rents, and making it even harder for them to ever get ahead.

So is the “risk” that you see at the margins (Keep in mind, Ontario’s arrears rate is 0.15% – a record low) really so worrisome that such consequences are worth it?

condodweller

at 11:34 pm

@Kyle. See my response to Joel. The wealth gap will be much larger when the rich step in to buy the poor guy’s house he just lost at lower prices.

Kyle

at 4:15 pm

@condodweller

The risks you’re talking about are not addressed by increasing minimum downs, if your worry is that people are maxing out the amount they can borrow to the limit of their affordability and not leaving any cushion, then someone with 5% down borrowing the max is as vulnerable as someone with 20% down borrowing the max. In fact, these days i would argue that many who have the 20% downpayment (often received as a gift from Mom and Dad) are probably higher risks than those with the wherewithal to scrimp and save up 5%. To reduce the risk you are talking about, they would have to lower the GDS. Increasing the minimum down does nothing to solve what you see as a risk.

As for the wealth gap, the fact that a policy restricts participation in a certain segment to those with a certain level of wealth is going to increase the gap over the long run, regardless of what happens in the short term.

condodweller

at 11:27 pm

@Joel. I hear you, I see where you are coming from, and I would agree with you if we weren’t at record levels. I suggest there isn’t much wealth building left for new buyers in real estate at current prices. I have no problem with letting people making good or bad decisions, I do have a problem with people taking on a huge mortgage with a shaky job that they are going to lose when things go sideways and possible triggering a crash. They are going to be the first ones to ask why the government did not protect them instead of accepting responsibility for their bad decision.

Therefore I don’t think it’s an overstep if it is going to protect people and in turn, the market and even jobs. If the government put in place rules in 88 that developers had to pre-sell 80% of their building before proceeding with construction, don’t you think the 89 crash would have been averted? Kyle probaly has the stats on how low the default rates were in 88. That number probably increased a little bit after 89. I think raising the downpayment minimum would have the same effect.

Joel

at 10:09 am

I suppose the problem here is that we are seeing this from different sides. I don’t see the Toronto market crashing and people loosing their homes. From everything I have read it seems more plausible to me that there is going to be a soft landing in the Toronto market.

CMHC was/is predicting that single family homes are overvalued,but the correction won’t be a depreciation, but rather a lack of significant increase over the next 3-5 years. If properties go up by 2-3% instead of the 8-12% they have been going up by we won’t see this crash. The higher down payment only works to delay first time home buyers and makes moving to the next step harder.

condodweller

at 10:17 pm

Of course, if you don’t believe in a crash or even a decline in prices there is nothing to worry about. That’s not entirely true because there is still the jobs and the interest rate issue that could raise its ugly head. I think the 2-3% yearly increase over the next 5 years, however, is a best case scenario. Worst case scenario is prices reverting back to their mean, or in many cases the pendulum swings the other way meaning prices going back below the mean which, given current record prices would be a significant crash. It’s a cyclical market which means by definition prices will decline at some point. The million $ question is when and by how much.

Appraiser

at 2:25 pm

@condodweller

The way that lenders “differentiate” between borrowers is not a secret and has been utilized for decades. Buyers are qualified based on their employment history, credit scores and Gross Debt (GDS) and Total Debt (TDS) service ratios.

Had you ever applied for a mortgage or been involved in a real estate transaction you would already know this. Instead you ramble on incoherently, while offering up your own amateurish ideas about mortgage underwriting.

condodweller

at 11:57 pm

@appraiser. Your name calling is getting old. I’m going to skip your remarks in the future as obviously you don’t have anything to add to the conversation. I’m perfectly aware what lenders use to qualify borrowers including the income to mortgage ratio you don’t know about as I’m sure you would have included it in your post to make yourself look smarter. You completely missed my point because lenders do not differentiate between borrowers who qualify with flying colours vs. those who qualify by the skin of their teeth.

There are four others who seem to have understood my point and contributed intelligently and respectfully to the topic. May I suggest you find another forum that matches your level of comprehension.

Appraiser

at 11:22 am

@condodweller

Recognizing that someone is an idiot is not name-calling. It’s just an observation.

WhatAFuckingDouche

at 7:40 pm

That would be you, Appraiser.

crazyegg

at 4:22 pm

Hi All,

This is a terrible idea in itself.

Increasing the down have the unintended consequence of having more foreign ownership for homes. The ones who will get the shaft are hardworking Canadians who have been saving for their entry home, as well as hardworking Canadian investors if the 20% goes up to 25%.

If the government wants to pull on this lever, it also needs to implement foreign ownership rules at the same time (which is probably never going to happen / impossible to fully enforce).

We (Canadians) will be the ultimate losers.

Regards,

ed…

Just some guy

at 5:52 pm

Can you imagine an insurance program where the beneficiary is not the entity that pays the premiums?

Not only that, but if said insurance company doesn’t have enough money to pay the insurance claims, the government will pay the claims for them.

Well then you have discovered mortgage default insurance.

condodweller

at 12:09 am

You have an interesting point here. To me, insurance should protect me against a risk. When I buy fire insurance, the insurance company will pay to help me rebuild my house. Am I the only one crazy enough to think that when I buy mortgage insurance, the insurance company should bail me out when I default on my mortgage? At the risk of sounding naive, why am I paying a premium to protect the lender?

Regarding your point about CMHC running out of money, I don’t know their policy well enough, if CMHC went bankrupt during a crash, would taxpayers have to cover their obligations because it happens to be a government entity?

Kyle

at 4:19 pm

“Am I the only one crazy enough to think that when I buy mortgage insurance, the insurance company should bail me out when I default on my mortgage?”

Because if you paid a premium that bailed you out (i.e. paid out the rest of your mortgage) when you defaulted, then why would you ever make a single mortgage payment? There already exists insurance that protects you the borrowers against stuff like death of one of the spouses, or loss of job, etc, but these costs way more than CMHC insurance.

condodweller

at 9:49 pm

Naturally, I wouldn’t expect CHMC to bail me out if I chose not to pay my mortgage. Before addressing your point and to determine if increasing the down payment made sense, I thought a review of the very reason for CHMC’s existence might be in order. After all, what is CMHC’s mandate in the first place? If you intimately familiar with CMHC you can skip most of this post. For those of you who don’t know, this link is a worthwhile read:

https://en.wikipedia.org/wiki/Canada_Mortgage_and_Housing_Corporation

Interestingly enough CMHC’s origin goes back to WWII to ensure returning soldiers, and fellow Canadians had an affordable and quality home:

“The agency was created in 1946 in response to housing demands after the return of World War II veterans and societal changes after the war included a policy that every family in Canada have their own home.

With so many people coming back to Canada, a number of problems would arise, one being that there may not be enough housing existing to accommodate the soldiers and their desire to have families.”

I interpret this to mean that everyone has a place to live, not that they own their home. Considering we have a vacancy rate for rentals and the fact renting is cheaper than owning, then why have mortgage insurance in the first place? To ensure people on the fringe are covered as well:

“CMHC invested $1.9 billion (2009-2014) for housing and homelessness programs for “homeless people and those at risk of homelessness-low-income Canadians, seniors, people with disabilities, recent immigrants and Aboriginal Canadians”[15] and $2 billion (2009-2011) more towards the construction and renovation of existing social housing units.”

This is an eye-opening fact considering mortgages are one of the biggest, if not the biggest revenue generators for the banks today:

“One of the main functions of CMHC is to manage the federal Mortgage Insurance Fund (MIF), which was introduced in 1954 to provide protection to banks reluctant to enter the mortgage lending market.”

Resulting in:

“As part of CMHC lending and insurance mechanisms, low-risk borrowers would have to pay insurance premiums if they wanted to borrow with small down-payments.”

Notice the “low-risk borrowers” qualifier.

Coming back to your comment Kyle, you are right, you can get individual insurance, which raises the question why their premiums are so much higher? Does it mean CMHC’s uderwriters are wrong, or perhaps the risks are lower because, as you said in the past, people cut everywhere else in order to keep paying their mortgage and they can also sell before they lose their home.

In the end, CMHC has been tweaking the rules to make it more difficult for people get into trouble and as prices rise further tightening of the rules makes sense to me. Whether it’s larger downpayments, lower maximums, or higher premiums. Once prices return to normal, they can relax the rules again. There is no need for people to buy a home as long as there is a cheaper alternative i.e. renting. The wealth gap is a separate issue in my mind.

Kyle

at 9:36 am

“…why their premiums are so much higher? Does it mean CMHC’s uderwriters are wrong, or perhaps the risks are lower because, as you said in the past, people cut everywhere else in order to keep paying their mortgage and they can also sell before they lose their home.”

You’re not comparing apples to apples. The reason mortgage insurance is cheaper than other forms of insurance that protect the borrower comes down to basic insurance theory, premiums are mostly determined by the probability of loss x the expected loss amount. Despite where you and others *think* the market is going and how much risk there is, the reality is they’ve calculated the risk of mortgage defaults and the expected loss in the pool of insureds to be relatively low, hence the relatively cheap cost to insure a mortgage vs other forms of insurance. CMHC then goes and routinely stress-tests their own assumptions to make sure they hold up. Per Evan Siddall, CEO of CMHC, “…I am pleased to report that our stress testing confirms that CMHC would survive a 2008-2009 U.S.-type housing and financial crisis, if that were to occur in Canada.”

CMHC has a long, reliable track record of managing mortgage insurance risk, in fact i would consider their decades long track record to be pretty spotless, especially when held up against the track records of those that often criticize it. Let’s be honest, some of CMHC’s critics can’t go an entire week, without making a wrong call. They have decades of housing data and professional quants that understand how to crunch numbers far better than you or i, based on this i would consider any sort of assumption that they’ve mis-priced the risk to be pretty presumptuous and unfounded.

Savio

at 8:31 pm

Increase the down payment only for Investors and do not allow home owners to rent out their basements and use only for their personal use, unless they are legally registered with the city.