Uh oh, overflow, population, common group

But it’ll do, save yourself, serve yourself

World serves its own needs, listen to your heart bleed

Tell me with the rapture and the reverent in the right, right

You vitriolic, patriotic, slam, fight, bright light

Feeling pretty psyched

It’s the end of the world as we know it

It’s the end of the world as we know it

It’s the end of the world as we know it

And I feel fine

–

Those are the words of John Michael Stipe, aka Michael Stipe, the lead singer and formidable lyricist of R.E.M.

There are few voices in late-20th century music that were as distinct as his, and the same could be said for his musical style, tone, cadence, and the speed with which he often sings, which can range from painfully slow to so fast that he’s basically muttering.

“It’s The End Of The World (As We Know It)” might not be R.E.M.’s most famous song, but it’s my second or third favourite to “Stand,” from the album Green.

Most people believe that “It’s The End Of The World (As We Know It)” is a song from 1988’s Eponymous, which is possibly the most ironic album title of all time, but the song is actually from their 1987 album Document.

The song is basically a stream of consciousness sung at lightning-speed that, if you listen closely, makes little sense.

The song may have been written in 1987, but the lyrics, “save yourself, serve yourself,” and “world serves its own needs,” preceding, “it’s the end of the world as we know it” was almost foreshadowing a dystopian future, one perhaps laying ahead in 2024 when Donald Trump, Vladamir Putin, Xi Jinping, and Kim Jong-Un rule the world.

Or maybe not.

Maybe I just spent a lot of time on the weekend going down that rabbit hole.

I’m sure I’m not the only one who’s questioning how we can film Tik Tok‘s and take photos of our salads to impress our friends on Instagram when the world is at war. For those Baby Boomers among us, perhaps you can regale us with stories about what it was like to live through the Viet Nam war. I lived through the Gulf War, but it didn’t seem like a “generational” war, nor did Afghanistan for the next generation, I’m sure.

I don’t know that the world is on the brink of true war, but the events of the last week are undeniably reminiscent of the late-1930’s when much of the world watched and hoped that maybe this was just a one-off invasion and annexation of land that once belonged to the invaders, but that it would all end there.

Right. Rabbit hole. Right…

Can we get excited about buying Cheerios on sale at Loblaw’s and saving $2.50 when there are tanks rolling through Kiev?

So how do we submit an offer for a condo, among 26 other bidders, while there’s a war in Europe?

Life must go on, right?

I had planned a blog about interest rates for a couple of weeks now, but with the conflict in Ukraine, I can’t imagine that whatever was planned by the Bank of Canada and the U.S. Federal Reserve are still in order. While our respective governments have likely wanted to forge ahead with interest rate increases for some time, it’s tough to “hold the line” when there’s a dramatic shift in world politics which will likely lead to higher prices for goods which we rely upon every day. In turn, this will likely lead to higher inflation, which is the last thing in the world that our countries need, especially Canada.

Here’s a great Tweet from my colleague Ben Rabidoux last week:

Click HERE to access that chart, which whos just how heavily the United States relies upon Russian oil.

Perhaps many of you aren’t interested in this subject matter today, and I don’t blame you. But the fallout of what’s happening in Europe is going to affect more than just the stock market. It’s going to affect commodity prices, international trade, inflation, and eventually, monetary policy.

Is it at all possible that whatever monetary policy plans the Bank of Canada had on, say, February 15th, are still in place today?

Not a chance. Not with what’s happening in Europe, and not if we’re being responsible and adjusting to what’s happening around the world and in our economy, both presently and with an eye for the future.

Does an active home-buyer in Toronto right now need to monitor the conflict in Europe and adjust his or her plans accordingly?

No.

But if a home-buyer is thinking about interest rates, then it’s worth keeping an eye on the globe.

Rumours of interest rate hikes here at home have been pervasive from the moment we turned the page to 2022, in fact, we heard lots of banter about this last fall, and even in the summer.

“Experts” all over the country were predicting three, four, five, or six rate hikes in 2022.

October of 2021, Bloomberg news gave us this:

Traders are betting that the Bank of Canada will be forced into raising interest rates earlier than expected, posing one of the stiffest tests yet for Governor Tiff Macklem.

Bets in the overnight swaps market are increasingly tilting toward a move early next year, well ahead of the U.S. Federal Reserve. Traders have now priced in three hikes in Canada by the end of 2022, which would bring the policy rate to 1% from the current 0.25%.

That’s about 50 basis points higher than markets were expecting just a month ago. The shift in pricing is increasingly at odds with Macklem’s guidance that borrowing costs won’t increase until slack is absorbed and inflation returns sustainably to its target range.

That was talk about three rate hikes in 2022.

Later that month, Scotiabank economist Derek Holt, predicted four rate hikes in this Bloomberg interview:

“Once they start going, we’re of the conviction that the Bank of Canada is going to hike four times in the second half of next year, and four more times in 2023, taking the policy right up to 2.25 per cent by the time they’re done,” he said.

In November of 2021, Scotiabank’s chief economist forecasted up to eight interest rate hikes within two years!

However, there’s always been dissent.

In December of 2021, renowned economist, David Rosenberg, laughed off the idea of 5+ rate hikes in a year in this Financial Post article:

“Five rate hikes priced in for next year for Canada? To me that’s absolutely ridiculous,” he said on BNN Bloomberg Television. “I don’t even know if the Fed’s going to go three times next year.”

Rosenberg, a former Merrill Lynch economist who in 2019 launched his own firm, Rosenberg Research & Associates Inc., said there’s no evidence in the U.S. or Canadian payroll reports that a wage-price spiral is taking hold.

“The central banks might want to raise rates. They won’t raise them as much as what the market’s got priced in, and that’s really what the back end of the curve is telling you,” he said. “Too much debt, it’s not going to take much to raise rates and actually tip the scales towards much slower growth in the next 12 to 24 months.”

December of 2021, the CEO of the C.D. Howe Institute, William Robson, wrote in the Globe & Mail:

Bank of Canada governor Tiff Macklem, like U.S. Fed chairman Jerome Powell, is clearly starting to view continuing high inflation with concern. A change is coming in monetary policy. With demand outrunning supply, our central banks’ policy interest rates need to rise – and may rise a lot….

…even the mildest of these scenarios exceeds forecasters’ predictions and market expectations. Hardly anyone expects an overnight rate above 2 per cent before the end of 2023. But loose monetary policy has contributed to high inflation, and it will take tighter policy to contain it. Investors, homeowners, businesses, and our big-borrowing governments need to get ready. Higher interest rates are coming.

Fast-forward a little, and many people were expecting the first rate hike to occur in January.

But on January 26th, the Bank of Canada hed the policy rate at 0.25%.

From TD’s Senior Economist, James Orlando:

This was always going to be a close call. Markets were priced for a hike, but the BoC decided it needed to move in a methodical fashion. It did this by stating that overall slack caused by the pandemic has now been absorbed and that it would end its exceptional level of forward guidance. In other words, it is now ready to hike.

Even with growth being impacted by omicron, inflation should be the main concern for the Bank. Consumer prices are growing at 5% and financial imbalances (housing) continue to rise on the back of low interest rates. From our lens, the BoC needs to move quick. We expect a rate hike in March and three more in 2022. This should lift government bond yields and mortgage rates. Hopefully this will cool some of the froth.

Sidenote: is anybody tired of the word “froth” to describe the markets? I certainly am…

March 2nd became this “D-Day” of sorts for interest rates, and that day is coming this week.

Is this the end of the world as we know it?

Many market bears seem to think so.

Others believe this is merely the start……………of the end of the world.

How’s this for a headline:

“Bank of Canada March Interest Rate Hike A Done Deal, Economists Say”

That article appeared in the Financial Post last Thursday.

And if you read the article, the headline is based on a survey.

From the article:

The Bank of Canada will raise interest rates by 25 basis points on March 2, earlier than previously thought and ahead of the U.S. Federal Reserve, according to economists surveyed in a Reuters poll, which also showed expectations that rates will be higher by year-end than previously thought.

Just one month ago, economists predicted the BoC would wait until the second quarter to hike rates. But persistently higher inflation, which accelerated to a 30-year peak in January, prompted them to bring forward expectations.

Other major central banks, including the Fed and the Bank of England, are also expected to raise rates in March to tackle inflation which is at multi-decade highs, with some economists calling for an aggressive 50 basis-point move by the Fed.

Of course, it’s possible that some of you are reading this without context so here’s a brief refresher:

Yes, we’ve been at 0.25% since the onset of the pandemic. And while that was (seemingly?) a necessity at the time, many are concerned that we’re simply “stuck” at this level.

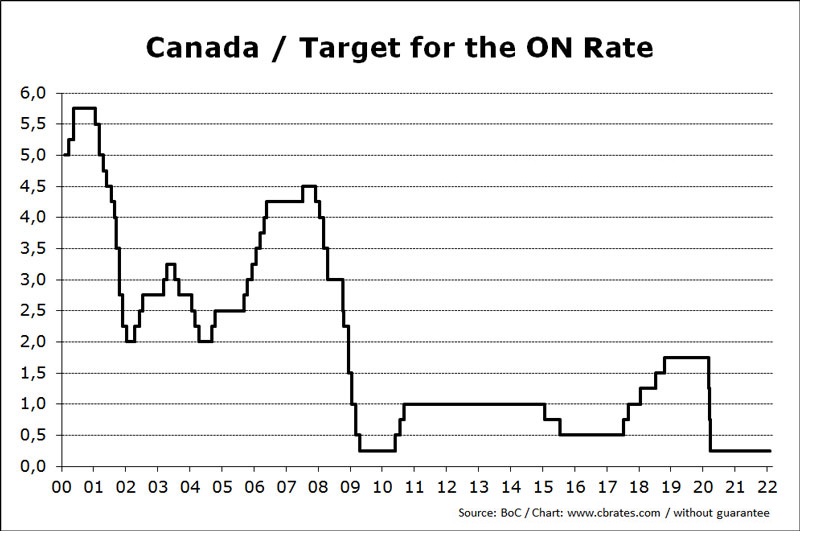

Perhaps more context is needed, ie. context that reaches out more than five years!

Scotiabank economist, Derek Holt, said: “…the Bank of Canada is going to hike four times in the second half of next year, and four more times in 2023, taking the policy right up to 2.25 per cent by the time they’re done.”

When was the last time that the overnight rate was at 2.25% or higher?

It’s clearly not shown in that chart above that dates back to 2016.

Any guesses?

How about 2008?

Here’s a chart that goes back to the start of the millennium:

We did see a period when rates were at 0.25%, like they are now, way back in 2009-2010, but as the chart shows above, the Bank of Canada made a concerted effort in 2018 to get rates back up to something resembling a “normal” level.

On June 1st, 2010, the Bank of Canada raised the overnight rate from 0.25% to 0.50%, which marked the first hike since July of 2007. Two more rate hikes soon followed.

The rate remained untouched at 1.00% from September of 2010 to January of 2015, when rates were dropped again.

The rate sat at 0.50% from July 15th, 2015 through July 12th, 2017 when the first of five rate hikes too, the overnight lending rate up to 1.75%.

And if not for the pandemic, who knows where we’d be.

While an effort was made back in 2010 to raise rates, they only made it to 1.0%, and they remained there for four years.

The effort from 2017 through 2020 seemed different. Five hikes from 0.50% to 1.75% and the rate remained at 1.75% from July of 2017 through March of 2020 when we saw the first of three straight 50-basis-point rate cuts, and fifty-beeps is something we’re not accustomed to seeing. In fact, we only see 50-point drops in desperate times…

We saw three straight 50-basis-point drops in 2008 when the world was in a financial crisis, and two more in 2009 as a continuation of the meltdown.

September 17th, 2001, we saw a 50-basis-point drop, followed by a whopping 75-basis-point drop in October, and another 50-points in November. But what happened in September of 2001? Well, September 11th happened, of course. And while the Bank of Canada was already cutting rates in 2001, with cuts in January, March, April, May, July, and August, September 11th helped speed things up significantly.

So what does September 11th and the 2008 financial crisis have to do with what we’re talking about today?

Nothing, really.

And that’s the point.

We’re discussing a 25-basis-point increase in the overnight lending rate like it’s the end of the world, but we had a glimpse of “the end of the world” in September of 2001 and a glimpse of “the end of the financial world” in 2008, and both times came with serious cuts to interest rates.

So a 25-basis-point increase in March of 2022 isn’t really anything to get worked up about, is it?

I suppose you could, if you were so inclined, group these four events together:

1) September 11th

2) Financial crisis

3) Worldwide pandemic

4) Russian invasion

You could, if you were so inclined, point to the fact that massive interest rate activity typically follows catastrophic events.

But the first two events triggered interest rate cuts.

We’re talking about interest rate hikes.

So again, I ask: is a 25-basis point increase on March 2nd the end of the world as we know it?

Or has it merely been talked about to death and beyond?

Because I’m of the mindset that this real estate market is going to continue its pace regardless of whether there’s a second rate hike in June (because there’s no way we’ll see successive increases on March 2nd and April 13th).

If, and it’s an if, rates increase in June, the spring market is already over and we’re heading into the summer lull. An overnight lending rate of 0.75% will be absorbed by the market and we’ll have time to adjust before fall.

So, I’m taking bets: do we see a third rate hike in 2022? I bet “no,” and I’d put money on it.

In fact, I’d say they’ll put a Man on the Moon before that happens.

On that, I Stand my ground, even as I Try Not To Breathe.

Otherwise, I’d be Losing My Religion.

Okay, I’m done. I’m quitting now because I have no clue how to work The Sidewinder Sleeps Tonight into any half-decent play on words about interest rate predictions.

Have a great day, all you Shiny Happy People!

Bal

at 6:40 am

i don’t think Bank of Canada will touch the interest rates … they don’t care about inflation ….otherwise they would have started raising last year…. so my bet is no rate increase at all…how can they raise now when war is happening …they always have some kinda exuse …before the said supply chain issue caused inflation and now they will blame War…. that’s all ….life is tough for middle class aka me

Ed

at 9:18 am

Heard a commercial on the radio yesterday.

Variable 5 year mortgage at 0.98%

Tony

at 9:19 am

Over/Under on number of comments from angry Yukoners today???

Daniel

at 10:48 am

It’s still early morning in the Yukon.

Give it a few hours. There will be multiple comments by this afternoon. They’re still posting on last week’s blog!

Appraiser

at 10:33 am

Relieved to see you mention the war today. Everything else seems so petty right now.

Not to be alarmist but here is what the Bulletin of the Atomic Scientists thinks :

At doom’s doorstep: It is 100 seconds to midnight

https://thebulletin.org/doomsday-clock/

Appraiser

at 11:29 am

Here’s a selection of “long tubes” that carry oil currently connecting Canada and the U.S.

https://www.capp.ca/wp-content/uploads/2021/04/2020-CAPP-Pipeline-and-Refinery-Map-LARGE-fo-linking-only.jpg

Condodweller

at 11:49 pm

David I’m confused with your bear comment. Higher interest rates is bullish and indicates the economy is doing well.

In the mean time here’s some material for future blogs:

https://globalnews.ca/news/8637896/xiao-jianhua-family-companies-150-million-toronto-real-estate/

30 million land bought for cash, multimillion mansions bought by foreign, politically connected directores of shell companies etc. Should be enough material for another 3 part series…

Average Joe

at 6:56 am

Yep, lots of material there. Remember the government IT guy that stole all the Covid funds that were supposed to go to children? Turns out he’d been steering contracts for years and getting kickbacks. Seven properties in GTA (after he sold some) and plenty more overseas.

https://www.thestar.com/politics/provincial/2020/11/27/court-freezes-7-properties-owned-by-family-members-allegedly-involved-in-theft-of-covid-19-relief-funds.html

https://www.cbc.ca/news/canada/toronto/toronto-covid-relief-fund-1.6185794

Appraiser

at 8:35 am

Alternate Headline:

Savvy Canadian citizen of Chinese descent who admires Warren Buffett makes killing in GTA real estate.

Condodweller

at 11:43 am

Yes, your regular oligarch who pulled a vanishing act. He probably joined you in your alternate reality.