For years, I dreamt of a remote starter for my car.

Literally years.

It’s really not all that complicated, however. You just take your car somewhere that installs these things, pay a few bucks, and voila!

But despite the dreams and the simplicity of it all, I never actually took my car in and added this novel feature.

I got a new car in the summer of 2022 and during the “delivery,” which I made them promise would take under three minutes, they asked me if I wanted to download the Lexus app.

Health and safety alerts, vehicle status, scheduled maintenance notifications, car park location, drive pulse and trips, guest driver profiles, speed limit monitors, and all kinds of crap that I would never use in a million years.

I looked over at my friend at the dealership who knows how crazy I am, and I said, “Is there anything on here I’ll actually use?”

He smiled and said, “Remote starter?”

I took a seat, a deep breath, and said, “You had my attention; now you have my interest.”

Total game-changer, folks!

Every day, I start my car from my phone ten minutes before my daughter and I hope inside and hit the road. And on a day like we had on Friday, when it’s -18 degrees outside, that remote starter seems like the brightest of bright ideas!

But then, when your dog gets you up at 2:30am on Saturday morning to go outside and pee, and your dog refuses to come in because she’s frozen like a statue, heading outside in only one article of clothing (you need not guess…) while wearing your wife’s Ugg slippers simply undoes the bright idea with a poor one. It was -23 degrees, by the way. My poor dog!

Damn, it’s cold outside, folks!

When it was -18 on Friday afternoon and we were all complaining about the temperature, Richard said, “It’s -48 degrees to me.”

We asked for an explanation and he said, “I just got back from Mexico, people! I’m netting out the temperature with what I had and what it is!”

It was also on Friday afternoon that I sat down to look at the January TRREB stats and, well, damn, that’s cold.

Don’t get me wrong; we knew this was coming. We discussed this last Friday.

But compared to January of 2021 and 2022, it still takes some getting used to.

The market has been slow to start the year and up to this point, I’ve continued to say that it’s, in part, because of a lack of inventory. I predicted in last Friday’s blog that we would see about 3,000 sales in January, and as I’ll explain, I wasn’t far off. I also predicted that we’d see the average home price remain flat, not only because of inactivity but because the higher-end market is non-existent right now. With a sample size of half, a reduction in higher-end sales is going to have a major impact on price.

The average home price in January checked in at $1,038,668, which is down 1.2% from December.

For those expecting a higher price in January, you wouldn’t have been wrong to take that view, based on historical precedence.

Here’s a look at how every December price has led into the following year:

In 14 of the previous 20 years, we saw an increase in the average GTA home price from December to January.

This year, we saw a decrease of 1.2%.

That jumps out a little bit, although we’ve seen outliers where a particular stat is the only example in the past twenty years. Here, we’re looking at a 70/30 split in the past two decades, so the decline isn’t completely unexpected.

But for those who want to take a more bullish view on pricing, I would suggest looking back at that five-month period of “stability” I kept referring to last fall.

It looks something like this:

From July through November, we saw the GTA average home price remain within a very small 1.3% band; between $1,074,754 and $1,089,428.

That is what we call “stability.”

The decline in December was fully expected, as December is typically a slow month.

However, there are two views we could take on the January figure:

Bearish: “The average home price has now dropped 4.0% from the average of those five months of ‘stability,’ thus signaling a decline from that point.”

Bullish: “December is the slowest month of the year and January is going to be slow in any ‘down’ market, so it’s all downhill from here!”

Er, I mean, downhill as though things looking up.

What’s with that saying, anyways?

In the end, I predicted the average home price would remain “flat” and it declined by 1.2% which could fall within the definition of flat, or could mean that I was wrong. It’s right on the edge.

When it comes to inventory, however, I was spot on.

There were 3,100 sales in January and I said there’d be “3,000’ish,” so the market stats definitely align with my gut.

As I noted in last week’s blog, the lowest sales in the month of January ever is the 2,670 recorded in 2009.

So the 3,100 recorded last month are the second-lowest:

The second-fewest ever.

And what’s more is that the average number of sales from 2002 through 2022 is 4,604.

That means the 3,100 sales recorded last month were 32.7% below average.

I knew there wasn’t much selling last month but that’s because, as I continue to suggest, that there was just nothing out there to sell.

Last Friday, I also noted that the lowest sales-to-new-listings ratio ever recorded in January was 25.8%, and I thought we’d see an SNLR between 40-50% last month when all was said and done.

What I found, when I dug into the data, was actually quite surprising.

First, here are the New Listings in January from 2002 onwards:

As you can see, we saw the second-fewest number of new listings in the month of January since I started tracking this data in 2002.

And the average number of new listings from 2002 through 2022 is 9,702.

That means the 7,688 new listings recorded last month were 20.8% below average.

But take note here, folks. This is important.

Sales and new listings in January were both the second-fewest in any month of January.

However, while sales were 32.7% below average, new listings were only 20.8% below average.

I already know what this is going to mean.

Let’s take a look at the sales-to-new-listings ratio for each year from 2002 to current:

On the one hand, the SNLR was 40.3% which was within the range I suggested on Friday.

And we saw the second-fewest number of sales, but, we also saw the second-fewest number of listings.

So I could rest here and suggest that my feeling on the market last month was proven accurate.

But 40.3%?

That’s not the market that I felt out there, not even close.

3,100 sales based on, say, 6,000 new listings? An SNLR of 52%?

Yes, that would be in line with what I was feeling, but we didn’t see anything even close to that.

In fact, we saw the 18th-highest SNLR out of the last 22 years, from which we would have to conclude that the January market was weak.

Damn, that’s cold!

I feel like I’m disagreeing with myself here, but I don’t know what else to say.

The feeling in the market was, “There’s nothing for sale.”

And while that’s technically true, seeing the second-fewest number of new listings in any month of January, the follow-up quote of, “Nothing is selling because there’s nothing for sale” just isn’t true.

So where is this weakness coming from?

Upon closer inspection, it would seem the condo market did not fare very well in January.

There’s a lot to be discussed about the condo market, and I might save that for Wednesday.

But right now, let’s look at the 416 condo market and where things ended in December and where they picked up in January:

Damn, that’s cold!

Remember, the average GTA home price shed 1.2% from December to January, so this 4.1% drop in the 416-condo market is 3 1/2 times as large!

Somebody who’s well informed and good with stats might now argue, “David, the 416-detached average price dropped a whopping 8.7% in the same time period! Why are you making an argument about condos?”

Well for two reasons.

First, the detached metric is far more volatile and far more cyclical. Condos are condos. They’re listed and sold all the time, regardless of price, location, size, or style. High-end homes aren’t typically listed in January, and there’s a dearth of $2M+ houses right now.

Secondly, the 905 condo market moved in the opposite direction. Have a look:

Damn, that’s………..not cold (?)

Huh.

I couldn’t help but take notice of the discrepancy between the 416 and 905 condo markets, and it’s not like there was an inventory problem in the 416 versus the 905.

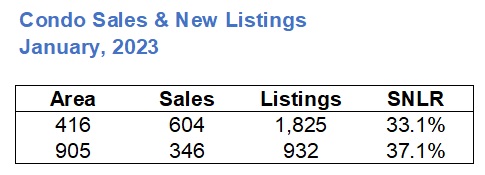

In fact, the SNLR is almost the same for both markets:

I find it very strange that there’s an SNLR of 33.1% in the 416 condo market and prices drop 4.1%, and there’s an SNLR of 37.1% in the 905 condo market and prices rise by 2.1%.

Who ever thought we’d be in this position, actually lauding the 905 for something?

I sure didn’t.

I’d like to continue this conversation in depth, so let’s break here until Wednesday.

Nota Bene:

We will be doing server maintenance here on TRB on Tuesday morning, so comments will be temporarily disabled.

I appreciate your comments and contributions, so for the time being, just find a stranger on the street and tell them what you wanted to tell the other TRB readers. ????

JF007

at 6:55 am

Luv when we get two blogs out of the stats.. ????

Keith

at 8:12 am

Good thing you didn’t get a remote starter installed at some random garage. They often void the dealership warranty or contradict the terms of your lease.

Appraiser

at 8:27 am

Very unusual market. Picky buyers and stubborn sellers. Investors not flooding the market with inventory. Record high rents. Interest rates stalled.

And to top it off, at prevailing interest rates affordability is worse than it was during the peak, despite a 20% + decrease in prices:

“Homebuyer blues: dreadful affordability gets worse in Canada” https://thoughtleadership.rbc.com/homebuyer-blues-dreadful-affordability-gets-worse-in-canada/

Ace Goodheart

at 10:07 am

BoC just turned dovish in the middle of an inflationary rush.

For anyone not familiar with how Central Banks work, the BoC’s abrupt pivot is similar to a fire person dumping a small amount of water on a dumpster fire and then saying “we’re done” while the flames are still raging.

Paul Volcker is probably rolling over in his grave.

Watch now as five year rates dip, folks lock in pre approvals and the whole spring market madness erupts again in Toronto (like it does every year).

I still think that Trudeau and Mr. Macklem have a closer relationship than they publicly admit to. There is no way that inflation is under control. And yet a dovish central bank? The Toronto spring market for detached and semis should be epic.

Serg

at 1:02 pm

Congratulations with making history – you are in NYT!

David Fleming

at 10:00 pm

@ Serg

I did a two-hour interview and I got one quote about the Greenbelt “not being holy land.”

Cue the outrage. I’ve already received six emails/texts of congrats or support, and only one from an unhappy dissenter.

The problem with the Greenbelt “debate” is that those who don’t want it touched at all are often unwilling to listen to anything. I never said repeal the legislation or build on it – I said we have to be open to the idea, at some level, at some point, somewhere in the Greenbelt, if we’re going to take the bulk of 500,000 newcomers every year for the forseeable future.

But I also feel that the problem is many of the “don’t touch the Greenbelt” crowd are upper-middle-class and wealthy who already own a house, a cottage, a vacation property, and won’t be affected by the 500,000 people coming to Canada each year and the lack of housing for them. It’s such a luxury for them to pat themselves on the back for all the good they’re doing…

Serg

at 10:18 pm

Totally agree on all points!

jerry

at 4:59 am

However, it’s really not that difficult. Simply bring your automobile to a shop that installs these components, shell out a few dollars, and presto! But despite my fantasies and how easy it would be, I never actually took my car in to have this innovative function implemented.

Professional Real Estate Agents in CA