Well, that was certainly an interesting month, wasn’t it?

Raise your hand if you turned the page from 2024 to 2025 and simply expected life, as we knew it, would continue.

For the record, my hand is raised…

On January 1st, we just expected to continue along our merry way from 2024 into 2025, with a sort of “nothing to see here, folks” mentality.

On January 6th, the children went back to school, we all went back to work, and the 2025 real estate market got underway!

But then? Oh, then…

On January 7th, Prime Minister Justin Trudeau announced that he would step down as the leader of the federal Liberal party and eventually as Prime Minister.

On January 7th, ie. later that same day, Justin Trudeau announced he would prorogue Canadian Parliament until March 24th, ensuring the country is without a functioning federal government for almost three months.

On January 20th, the second tenure of Donald J. Trump’s American presidency began.

On January 28th, Ontario Premier Doug Ford announced that he had officially called the next provincial election.

On January 31st, U.S. President Donald Trump announced that he would enact tariffs on imports from Canada, the very next day.

And that’s only January, folks!

If there’s a line from the COVID days that will forever live in infamy, it’s “these uncertain times.”

We all said this. Over and over, and in many different contexts.

But we thought that those days were well behind us.

Today, the conversation about “uncertainty” has been rejuvenated not because of a first-ever, worldwide pandemic that could apparently wipe out the population of the earth, but rather because of politics.

Do we have any more certainty today than we did in April of 2020?

In mid-January, I was talking to a client who was weighing his real estate choices for the year ahead, and he said, “I think I’m going to sit on the sidelines for a bit. Just a week, maybe. Just until Donald Trump takes office, and then we’ll move ahead and make a decision.”

I asked him why this date was important to him – January 20th, 2025, that is, and what he expected to happen on that day.

He said, “I just think that once Trump takes office, we’ll have a bit more certainty. Mainly with this tariff-business. I just want a clearer picture. I want some certainty.”

I took off the kid-gloves and told him, point-blank, “You might be a bit naïve to think that certainty, or any element of it, is coming on January 20th. Naïve, at best. Wishfully optimistic, if we’re being honest.”

My two cents, for what it was worth, were this:

“The Canadian Prime Minister just stepped down. Except his father also stepped down and then served another term as Prime Minister, so who knows where this is going. Canada has no Parliament until March 24th. There’s a federal leadership race underway in the Liberal party. The Ontario Premier is going to call an election, and that election will happen before the federal Liberal leader is chosen. And we’re days away from the 47th presidency of the United States which will leave us on our toes every single day for the next four years.”

But then I added one more thought that has become my mantra of late:

Uncertainty is the only certainty right now. It’s our new normal.

Over the last few weeks, you’ve undoubtedly read countless headlines or heard far too many sound bites about “tariffs,” and that’s just something we’re going to have to get used to.

And over the last two months, you’ve likely heard more about politics and elections, provincially, federally, and on the other side of the border, than you had in the previous twelve months combined. This is something we’re going to have to get used to as well.

Despite all the “uncertainty,” there’s one thing that we all need to realize: the world continues to spin, as it always has before. Life goes on.

Far too many real estate agents are out there right now espousing outlandish economic theories without the education or knowledge to do so, or championing protectionist consumerism in the face of these “threats” from south of the border, but I really don’t think that’s our job.

Does anybody care what Becky the Realtor thinks about Canadian-made cheese versus cheese from Wisconsin?

No?

Alright, then we’re on the same page here.

Because from where I stand, people still need to live somewhere, and people will continue to buy and sell real estate, as they always have done before. My job is to make sense of the Toronto real estate market, provide insight, analysis, and advice, and empower the real estate consumer with my experience and knowledge.

So without further adieu, let me run down the January TRREB stats, which were not all that inspiring…

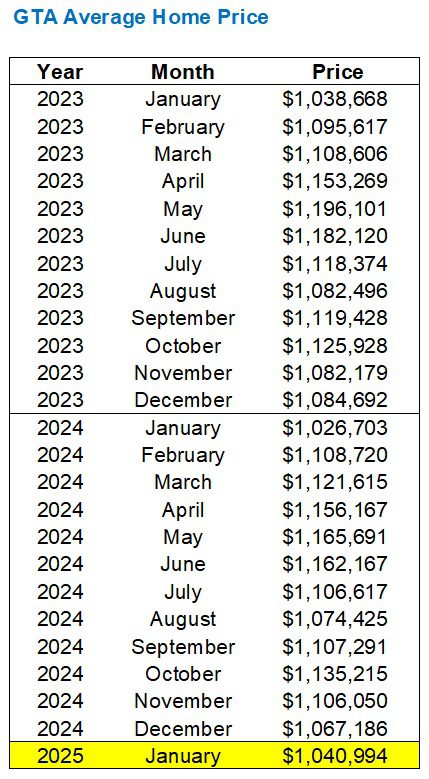

The GTA average home price decreased from December to January, which you would think is a very odd thing to see:

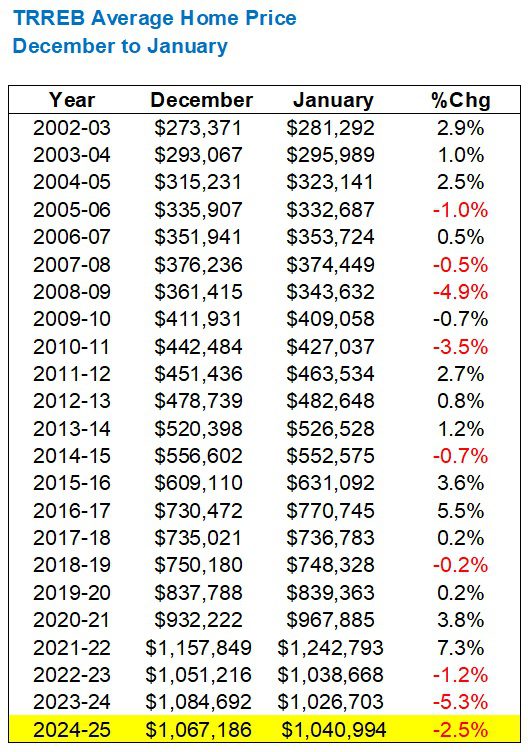

In this space last year, I noted that the average home price declined a ridiculous 5.3% from December to January, and one blog reader in particular suggested that this price would only decline further into Feburary, March, and beyond.

That obviously didn’t prove correct, as the average home price increased from January to February by 8.0% and continued to increase from there.

But it was an odd sight to see!

A decline in average home price from the slow month of December into the generally optimistic month of January? What was going on?

Well, here we are, one year into the future, and we just saw it happen again. In fact, it’s the third straight year we’ve seen a decline from December to January after only seeing this happen six times in the previous twenty years:

I wouldn’t have expected a major increase in the average home price, but I did find the January market to be sluggish.

All of our freehold listings sold, however, the number of offers was always fewer than expected, as were the sale prices.

I think the buyer pool out there right now just isn’t that motivated.

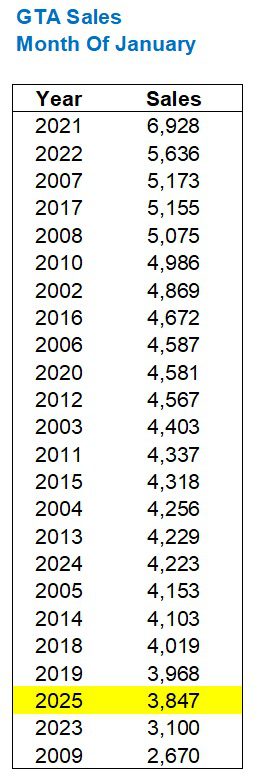

While there isn’t a huge delta from top to bottom in terms of total sales in January, as the following chart shows, we still saw the third-fewest sales in any month of January from 2002 onward:

Wow, remember January of 2023?

That was somethin‘!

And while another 500’ish sales would have put January of 2025 in the middle of the pack, many buyers didn’t purchase because they couldn’t find what they were looking for, or because so much of what was “newly” listed was actually representing re-lists and thus weren’t all that attractive.

I’m not saying that every re-listed property in the city should immediately be cast aside, but there are two reasons why re-listings are far less attractive than listings which are actually new:

1) Buyers in the market in January, who were in the market last fall, have already seen these properties – and passed on them.

2) A property which is re-listed more than likely has one or more reasons why it didn’t sell, and more often than not, it’s price.

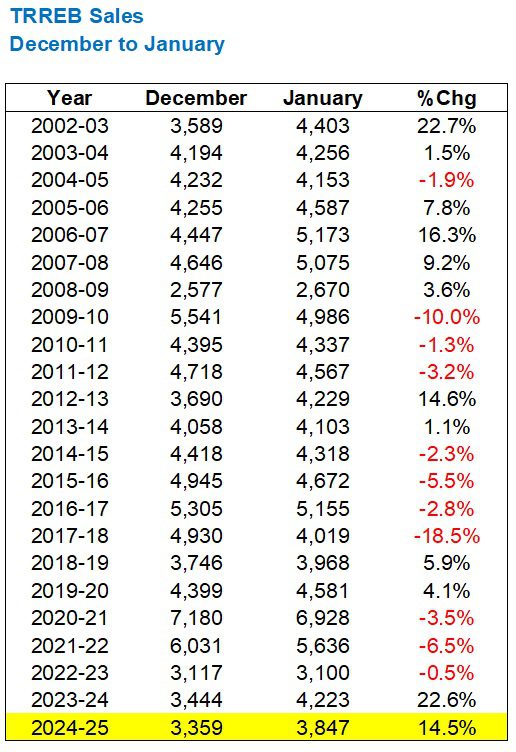

Sales did increase by 14.5% from December to January, but is that enough?

What do we typically expect to see in this section of the real estate calendar?

This:

Very interesting!

In the previous twenty-two years, we saw a decrease in sales from December to January eleven times and an increase in sales eleven times.

Previous to last year’s monster +22.6%, we saw three straight years where sales declined from December to January.

So feel free to conclude:

a) Sales in January were poor

b) Sales in January were strong

You’ve got an argument for both.

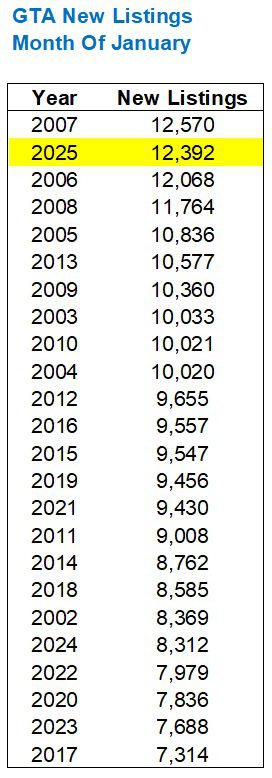

As for inventory, we saw 12,392 new listings last month, and that places last month 2nd all-time in the month of January:

I know what you’re thinking:

Third-fewest sales in January. Second-highest listings in January.

We’ll come back to that shortly…

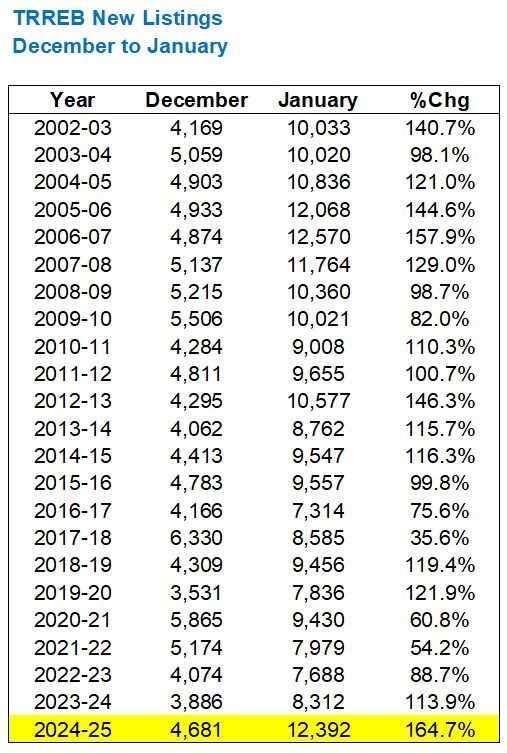

Seeing only 4,681 new listings in December, is that jump to 12,392 new listings in January considered “normal?”

Umm……sort of…

While we saw an average December-to-January increase of 106.0% in the previous twenty-two years, that 164.7% increase is the highest since we started charting this data in 2002.

“That’s a lot of inventory!”

Yes. Fair point.

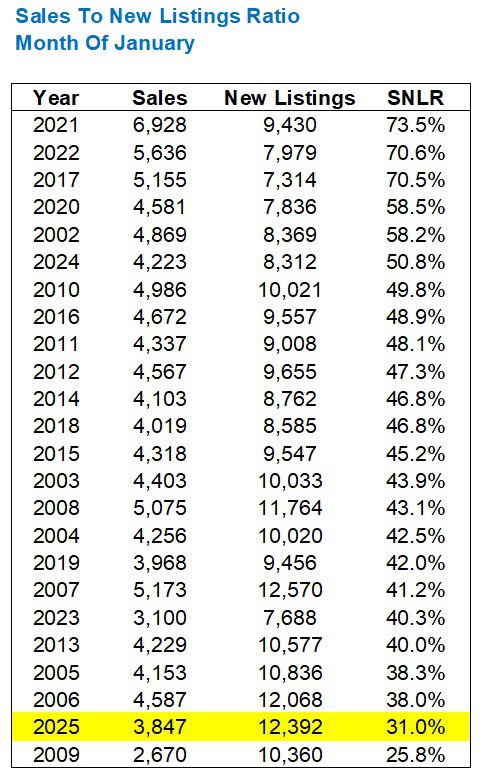

And when we consider the relationship between sales and new listings, specifically how “well” properties are selling, we look at the 3,847 sales against the 12,392 new listings and find an absorption rate of:

31.0%.

That’s low.

Very low.

Not quite the lowest of all time, but very, very close…

If you’re wondering why 2021 and 2022 (at least the first four months…) were so insane, just look at the absorption rate in the chart above.

If you didn’t work in that market, you simply can’t imagine what it was like.

Just to give you some context, here’s a look at the absorption rate in each month over the last four years, and including this past January:

Feel free to draw your own conclusions, but I will give you mine.

Also feel free to tell me I’m a cheerleader, you want…

There was a lot of “noise” out there in January and I don’t think that every would-be buyer of real estate is able to transact with that level of distraction. Do I think there’s more clarity or certainty on the way in February or March? Some. But not much.

It’s going to take a while for this market to ramp up.

I was certain that we would have a hot(ter) start this year, and it didn’t happen. But I remain certain that, especially due to declining interest rates, we will see a very hot market this spring.

Sales will skyrocket in February and that absorption rate will return to the 50% threshold – from its ridiculous 31%.

The condo market will remain cold and that will drag down the overall stats, but as I write this – Saturday afternoon, sitting in the Bosley Queen West office, in between four sets of buyer clients, demand remains high among the freehold buyers.

Now, how about a Superbowl prediction? By the time you read this, the game will be over.

What I want to see:

Philadelphia 34, Kansas City 27. Saquon Barkley MVP.

What I’m afraid we’ll see:

Kansas City 34, Philadelphia 31. Patrick Mahomes MVP.

I’m not the type of guy to hate on those who have achieved tremendous success. In fact, I hate those people who hate.

However, I really just want to see something new and different.

Don’t you?

Appraiser

at 8:08 am

Excellent data and analysis – as usual.

Interest rates are coming down, inflation is under control and the unemployment rate is declining rapidly after an unprecedented 211,000 new jobs were created in the past 3 months.

https://www150.statcan.gc.ca/n1/daily-quotidien/250207/dq250207a-eng.htm?HPA=1

Normally these conditions would indicate a real estate market about to take flight.

Serge

at 9:13 am

Almost no price appreciation last three years… investors take flight. But, who is going to buy them out?

Derek

at 10:32 am

In the next few months, should we, at worst, expect some sales mix price increase? Solid $2M+ action against depressed low end condo action?

Jenn

at 12:18 pm

Sounds like another bet?

Geez you TRB guys are addicted. 😝

Brent

at 12:29 pm

Without further adieu?

Derek

at 4:06 pm

It’s funny, well not “haha” funny, but funny that the avg. sale price is only $2,300 higher than the price that grounded the, “was that the bottom” and “when will we peak again” contest, 2 years ago. Time flies.

Derek

at 11:00 pm

All the industry folks who said prices gonna be flat for two years, take a bow! You nailed it! (List too long to acknowledge everyone)

Ace Goodheart

at 2:18 pm

Still an almost complete lack of quality listings. Just watched a boring, cheaply renovated semi with two small bedrooms and a third bedroom/hall closet that you couldn’t fit a full size bed into, sell.for over 1.8 mil in a bidding war. Simply because there was nothing else for sale that you could live in.

Nobody is selling anything that’s worth buying.

If the spring market heats up, you are going to see some very highly contested sales with people struggling to purchase the few liveable properties that are actually for sale.

Derek

at 2:13 pm

Ace, they could’ve had that one on Glenlake for a lot less!!

Ace Goodheart

at 7:18 pm

They could have! I walked past the Glenlake one (we live quite close). The big problem I could see from the curb was the driveway. Both that house and the neighbouring house had additions to the back. The result was that you could not get a car down the shared drive to that beautiful two car garage. There was a pinch point at the back where the two rear additions came together, that very few, if any cars could get past. So in reality, there was no parking.

If you know Glenlake in that area, it is a narrow, steeply sloping road and although there is street parking available, it is often quite hard to find a spot.

The lack of parking probably depressed the price a bit (the 1.8 mil semi had a garage off a laneway).

Shawn

at 9:57 am

You got your Super Bowl wish and much more. Great stats and info. Thanks.