There is a LOT of incorrect information floating around on this topic, and as a result, buyers and sellers in the real estate market are misinformed.

Many are making mistakes, as evidenced by the clauses we’re seeing included in offers dealing with compensation for tenants who are being evicted upon the sale of a unit.

Let’s take a look at “Form N12” which clearly specifies when compensation applies, but first, we’ll trace the legislation back to where it began…

In case you’ve been living in a cave…………on the moon………………with your eyes closed and your hands over your ears (Simpsons quote, I believe?), you’ve heard about the Liberal government’s “Fair Housing Plan” and the associated changes to the Residential Tenancies Act.

There are many notable changes, but the one I want to explore today is regarding the compensation for tenants who are legally evicted.

Once upon a time, a landlord could serve a tenant, who was on a month-to-month term, with Form N12, and evict the tenant for “personal use.”

We all know that “personal use” clause was a farce.

Tenants all over the city would say that their brother, mother, or sister was going to move into the unit, and then simply re-rent it, or put it on the open market.

Going back a few revisions ago, the “personal use” clause wasn’t even detailed on the Form N12. The form used to be a lot simpler, and a lot easier to manipulate.

After stories broke in early 2017 about landlords increasing rents by 80%, and during the real estate boom/crisis/peak/insanity, the Liberal government decided they needed to step in and make things more “fair.”

Enter: The Fair Housing Plan, much of which was deemed, by people who own real estate, to be unfair.

The Liberal government was very, very slow to detail what they had planned.

Their “16 Point Plan” contained few specific measures to be implemented, but rather made references to areas that would be explored, committee’s that would conduct studies and provide findings, and the usual government red-tape rhetoric.

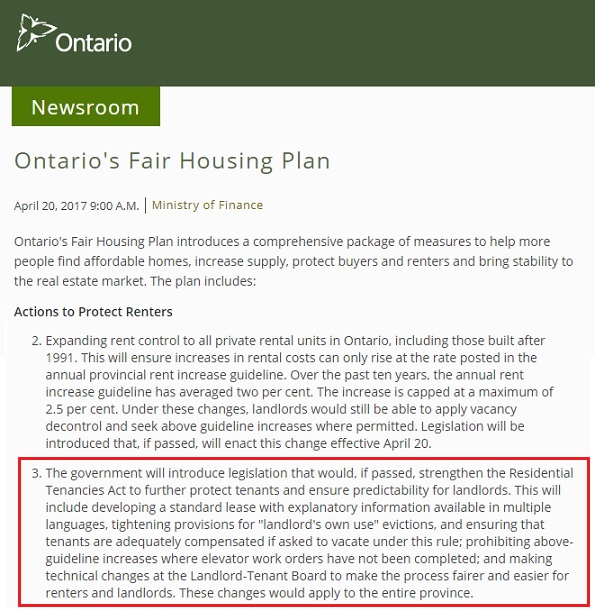

The section regarding “protecting renters,” specifically their #3 point of sixteen, referred to legislation, but made no specific promises:

“Introduce legislation that would, if passed, strengthen the Residential Tenancies Act…”

It looked as though, as was the case with most of the points, nothing had firmly been decided.

“Adequately compensated” could have meant absolutely anything, and of course, the government could have just ignored the whole idea, and moved on.

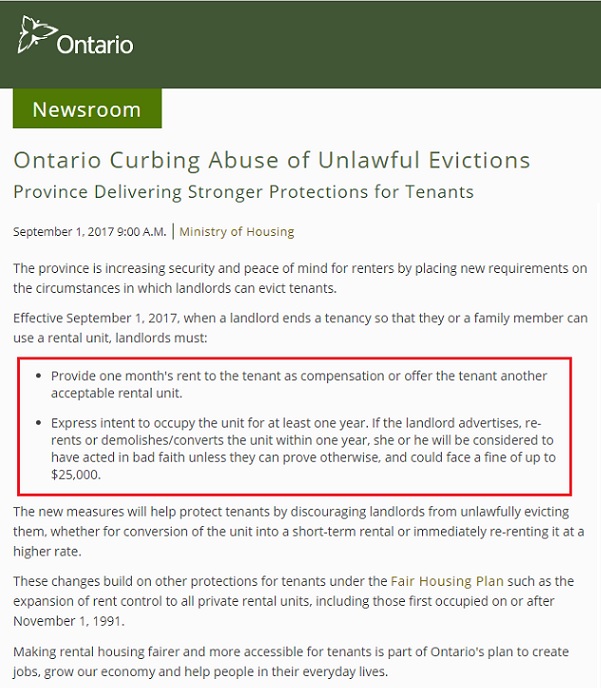

But in September, they implemented the “adequate compensation,” which was determined to be a full month’s rent:

Many of us were shocked.

Fair or unfair, perhaps it’s a topic for another day.

But the penalties – up to $25,000, would surely scare away any landlords that thought about trying to play outside the rules.

But somewhere along the way, the market and its participants – landlords, tenants, buyers, sellers, real estate agents, and even lawyers, became confused about when the compensation applies.

This idea that “Once a tenant is in the unit, you can never get them out” began to circulate, which simply wasn’t true.

The mistake at hand, is predicated on the idea that ALL tenants must be compensated during ALL evictions, and that’s not the case.

Bill 124, Rental Fairness Act, 2017, contains amendments to the Residential Tenancies Act, 2006.

You can read the bill in full HERE.

Scroll down a few paragraphs, and you’ll see the following:

Notice of termination by landlord under section 48

Currently, subsection 48 (1) allows a landlord to give a termination notice if the landlord requires possession of the rental unit for the purpose of residential occupation by the landlord, a member of the landlord’s family or other specified persons. Under subsection 48 (1), as amended, the landlord must require possession for the purpose of residential occupation for at least one year. Under new section 48.1, a landlord who gives a termination notice under section 48 is required to compensate the tenant in an amount equal to one month’s rent or to offer the tenant another unit acceptable to the tenant.

Notice what isn’t present there?

Anything about the buyer of the property paying compensation.

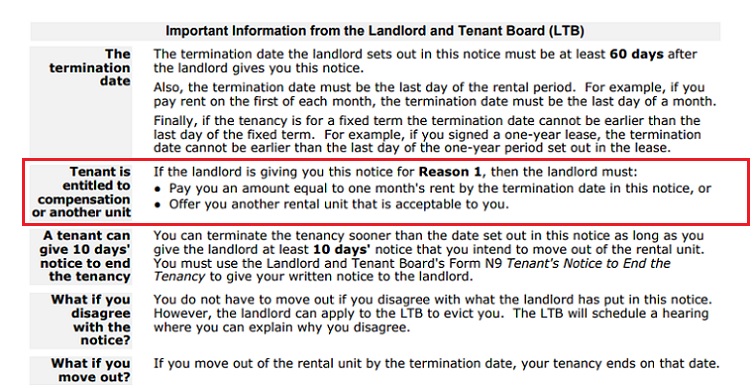

The new “Form N12” is exactly the same as the old Form N12, save for the inclusion of the highlighted box below:

Notice that “Reason 1” is bolded.

What is reason 1?

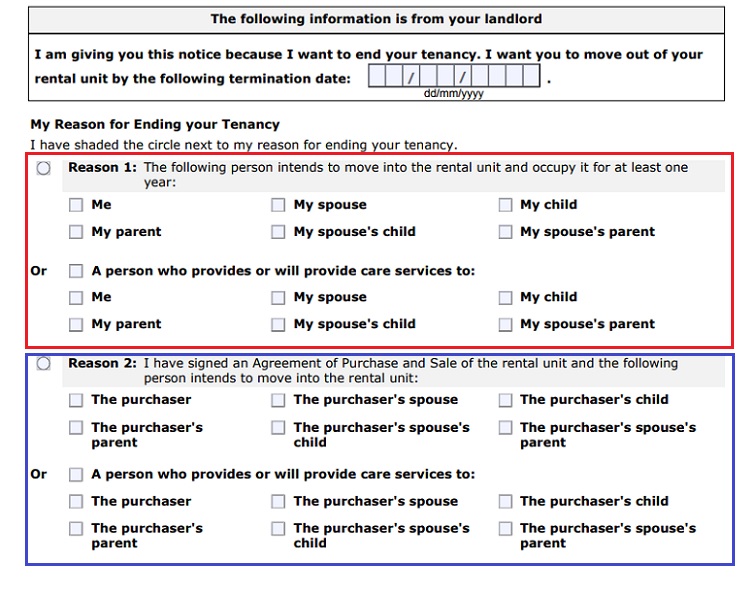

Refer back to the first page of Form N12, and you’ll see two reasons, as follows:

Notice that Reason 1, refers to ending the tenancy so the landlord and/or family can occupy the unit.

Reason 2, refers to ending the tenancy because the landlord is selling the unit, and the buyer intends to occupy the unit.

Here’s where the confusions sets in for many people.

Because while I see this as pretty cut and dry, I’ve spoken to tenants who believe they need to be compensated when the unit in which they reside is sold, and they’re provided with a legal eviction on behalf of the buyer.

I’ve also spoken to a lawyer who believes that “all month-to-month tenants being evicted” need to be compensated, and who suggests that this Form N12 is flawed!

Is it possible that this is what the Liberal government had first intended?

Because from where I stand, the seller of a condo, with a month-to-month tenant, shouldn’t be punished for wanting to sell his or her asset.

But maybe it doesn’t matter if it’s the current owner who is evicting, or the future owner who has contracted to purchase the property. An eviction is an eviction, right? And the government is trying to help evicted tenants, correct?

I’ll be very interested to see if there are any cases at the Landlord & Tenant Board in this regard.

There are so many people out there that are under the impression, either because it’s what they’ve heard, or what they feel is just, that ALL tenants are due compensation regardless of the situation, that I almost feel as though the legislation is unclear.

But if you’re a landlord, make sure you know what the Form N12 says!

David

at 9:22 am

Hi David,

I am curious if my case applies here. Me and my roommate signed a one year lease with a previous landlord scheduled to end on Nov 1st this year. But in August, our landlord said he sold the unit and we have to move out by Oct 1st since he no longer owns the unit, reluctantly, we signed the mutual release form.

However, on the move out day, he personally came to collect our keys along with new tenants! When we questioned if he actually sold the unit and provide proof, he did not respond back.

Do you think we have a case here? Since we signed a mutual release form, does that mean we can no longer complain/sue to Landlord and Tenant Board?

Chris

at 12:25 pm

Yeesh…that’s pretty slimey.

I’d probably be putting a call into the LTB. Even if you did sign a mutual release, it was predicated on false information/straight out lies.

AT555

at 12:28 pm

You can very easily check if the condo was actually sold or not on MLS (through a realtor) to confirm it. Even though you signed the mutual release form you still have a case as you signed it based on the false information provided by your landlord.

Greg

at 12:57 pm

Dave first I would make a trip down to the Land Registry Office (or speak to a realtor friend) to verify that the landlord lied to you and did not in fact sell the place. Him showing the place to new tenants does not mean much. He could be showing them on behalf othe new owner who is his friend for example.

Assuming that LRO trip verifies that the unit was never sold … well first of all … wow. Brutal. I’m sorry to hear that Dave.

Sounds like a landlord trying to circumvent the new rent controls rules put in place. I’d be curious how much those new tenants are paying. I would not be surprised if it is more than the maximum increase (1.5% if I recall correctly) mandated by law for 2017.

It’s just me,, but stuff like that is worth my $200 for a 1/2 hour of a lawyers time. If I can afford the $200 and a lawyer tells me I have a strong case that is likely to succeed., it is then worth my time and effort to take it even further and hold such people accountable assuming that any claim is under the $25k small claims threshold which it sounds like this would be. More than $25k and the legal system becomes much more expensive.

Judges are very reluctant to void signed contracts (i.e. the release form). He said/she said evidence is rarely enough. Things like witnesses and/or showing that you incurred significant losses with little/no offsetting gains would help to sway a judge that you signed the release form under false pretense. Only a lawyer (and I’m not one – just someone that has been through a similar situation) can tell you if the evidence you have makes a case likely to succeed.

Good luck Dave. And again sorry to hear about your situation.

Appraiser

at 9:26 am

As a landlord, I would appreciate clarification if one month’s free rent satisfies payment in lieu of the “payment equal to one month’s rent” clause. I assume it does.

This arbitrary and capricious ‘rule change in the middle of the game’ nonsense and apparent war on law-abiding landlords, will only further discourage legitimate private rental investors.

It’s tantamount to a new tax on landlords, with no recourse to recover lost revenue due to the newly minted and wrong-headed rent control regime.

The vast majority of economists agree that rent controls have the exact opposite intended effect in the long run by eventually reducing supply.

Looks like a double-whammy of incompetence from the province. Ouch.

Ralph Cramdown

at 9:46 am

Yep, it’s all that. So are you selling your properties? Voting for a different party in the next provincial election? Regretting your real estate purchases? Alrighty then.

Appraiser

at 11:56 am

I weep not for me, but for all of those that require housing. Owners and renters alike. Supply is the major issue. Discouraging new and existing landlords won’t help the cause of having a roof over every head.

Chris

at 12:12 pm

“Supply is the major issue.”

Do you have any research to back up this claim? Or is this just the talking point you have heard TREB championing?

Because the Ryerson City Building Institute and Prof. Josh Gordon disagree with that assessment.

“The conclusion is that supply-related dynamics simply cannot come close to generating the kinds of prices Toronto is currently experiencing under normal demand conditions. The Appendix also shows that this conclusion holds when it comes to geographic constraints, which are arguably most pertinent to the Greenbelt debate. Instead of supply issues there must be extremely strong demand pressures at work in the GTA.”

“Figure 8 backs up this point by simply looking at Toronto’s population in census years relative to the total number of dwelling units in those same years. The ratio is consistently falling, suggesting that construction is keeping up with demographic demand.”

“This data shows that housing construction is keeping up with population demographics, thereby suggesting that shortfalls in supply are due to demand factors not captured in population growth, such as foreign investment and multiple-property ownership by both domestic and foreign investors. In sum, there is no compelling evidence that insufficient housing is being built relative to demographic needs.”

The full report (which I highly doubt you’ll read) is available here:

https://www.citybuildinginstitute.ca/wp-content/uploads/2017/05/Policy-Paper-In-High-Demand-Final.pdf

Daniel

at 2:18 pm

Gordon’s research is a bit shaky insofar as the avg household size number is anyone’s guess b/c census collection of this stopped in 2011.

The point of his that you reference in figure 8 is that since housing has been growing faster than population that surely we’re not underbuilding.

I suggest you refer here to chart 3 in the following statscan report (i’m quite certain you’ll read it!).

http://www.statcan.gc.ca/pub/11-630-x/11-630-x2015008-eng.htm

You’ll note how households have been growing faster than population since the 1950’s, which by professor Gordon’s logic would mean we’ve been overbuilding housing for the 70 years!

When thinking about housing supply, i suggest the following thought experiment:

If the percentage of the housing stock that is unoccupied has been declining over time, and the vacancy rate is declining overtime, is it possible for the market to not be under-supplied?

I’ve read a lot (perhaps all) of Gordon’s work and IMHO his politics inform his analysis to a substantial degree.

Also note, i’m not taking a position on where prices should be, just whether we’re building enough housing or not. That said, as someone who works in the industry and looks at the data on a regular basis, i find anyone making the argument against a supply shortfall over the last 5 years is insane. The problem for most people (Gordon included) is that to accept undersupply is to accept that we need more development to solve the problem and, as everyone knows, development is horrible, developers are evil, and development has ruined Toronto.

Kyle

at 2:29 pm

“I’ve read a lot (perhaps all) of Gordon’s work and IMHO his politics inform his analysis to a substantial degree.”

Could not agree more. about Josh Gordon. The number of single family households has grown by 8.7% from 2011 to 2016 and now make up about 30% of households. The number of 2 person households also grew, but i don’t have the exact numbers: https://www1.toronto.ca/City%20Of%20Toronto/Social%20Development,%20Finance%20&%20Administration/Shared%20Content/Demographics/PDFs/Census2016/2016%20Census%20Backgrounder%20FamHHldsLang%2020170802.pdf

You can not use population changes to determine the appropriate number of housing without accounting for rapidly shrinking household size.

Chris

at 2:41 pm

Daniel,

Appreciate you taking the time to actually read the resources, and formulate a coherent and logical rebuttal.

I would definitely agree with your assessment that Gordon’s politics colour his analysis. I tend to share some of his political views, and thus I am probably bias in agreeing with some of his conclusions.

Your point about declining household size is also valid; however, in Chart 1, we can see that the decline in household size has slowed dramatically from approx. 1991 onwards. Before this point, the pace of household size decline was much steeper. While we don’t have data on household size for 2017, I wouldn’t personally expect it to be significantly lower than the 2.5 found in 2011. Perhaps you disagree, but I suppose until we have concrete data, we won’t really know.

With regards to your point about unoccupied housing stock, this is another area in which our data is lacking. We have discussed on this blog previously the Statistics Canada figure of “private dwelling occupied by usual resident” and how the inverse of this (aka dwellings not occupied by usual resident) does not serve as a great proxy for unoccupied homes. As with household size, until we have some better data that assesses the number of empty homes, we’re left guessing. That being said, some politicians, such as John Tory, have highlighted this as an issue worthy of examining and attempting to resolve, so presumably it has become a bigger problem in recent years.

Because these two important pieces of data outlined above are missing, how can we truly know if we are overbuilding or underbuilding? All we have to go on is old data and talking points from politicians, real estate agents, developers, home owners, renters, etc., almost all of whom have an agenda or interests they’re seeking to advance.

Kyle

at 2:44 pm

” The problem for most people (Gordon included) is that to accept undersupply is to accept that we need more development to solve the problem and, as everyone knows, development is horrible, developers are evil, and development has ruined Toronto.”

Hit the nail on the head right here. There is no doubt that there is undersupply, but because of the way zoning works, the only ones who can provide supply are deep-pocketed developers with lawyers and planners and risk appetite to change the zoning. And then those developers economically need to build as big as they can to get an appropriate risk adjusted return for their troubles. Which then means massive changes to neighbourhoods that rile up the NIMBYs. This is the problem! The zoning and planning department are massively broken in this City. If the rules were relaxed gentle density, and missing middle would organically get built, large detached houses could become “flats”, laneway garages could become laneway houses. All leading to more needed supply without having to build high rises at every corner.

Chris

at 2:48 pm

Kyle,

You say “There is no doubt that there is undersupply”. But as I outlined in my previous post, how do we know this for certain? Prof. Gordon has used data available to him to argue that there is not undersupply. Do you have data or evidence to refute this, and show that we have been underbuilding?

We lack recent data on household size and unoccupied dwellings. Without these figures, how can you claim with certainty that we are undersupplied with regards to housing?

Kyle

at 3:05 pm

As Daniel alluded to, i would look to Supply and Demand. If Demand for housing exceeds Supply you are under built, and if Supply of housing exceeds Demand you are over built. The non existent vacancy rate that Daniel pointed out is a good indication. And what is going on in the new homes/condos market is further proof. If demand was satisfied, there would be no line ups at new project launches and condo showrooms.

Kyle

at 3:17 pm

Sorry meant to say, ” The number of single person households has grown by 8.7% from 2011 to 2016…

Chris

at 3:20 pm

As Daniel alluded to, i would look to Supply and Demand. If Demand for housing exceeds Supply you are under built, and if Supply of housing exceeds Demand you are over built. The non existent vacancy rate that Daniel pointed out is a good indication. And what is going on in the new homes/condos market is further proof. If demand was satisfied, there would be no line ups at new project launches and condo showrooms.

But Supply and Demand has two interworking components; supply, and demand.

You are arguing that the demand for homes is rational, and based on fundamentals such as population growth, income growth, etc. Given this, in your opinion, sustainable amount of demand, supply is inadequate.

Prof. Gordon is arguing that the demand for homs is irrational, and based on fleeting factors such as speculation, extrapolative expectations, etc. Given this, in his opinion, the demand is unsustainable, and trying to match supply to this demand is a losing proposition. He instead offers that supply has been adequate for what he considers funadamental demand, and offers that building more supply did not quell unsustainable demand in American markets, and in fact, made the correction worse.

These two arguments are at loggerheads, and I really don’t know how, without an accurate count of unoccupied dwellings, as well as an accurate count of household size, we can find which side of the argument has more backing in fact.

At this point, it’s pretty much a matter of opinion. Personally, I subscribe more to Prof. Gordon’s view (shocking, I know).

Chris

at 3:21 pm

*Sorry didn’t mean to copy your post into my post above. Omit my first paragraph!

Kyle

at 3:52 pm

I agree both Josh Gordon and i are defining Supply and Demand differently, i’d point out that my definition of supply and demand refers to actual real world supply and demand that is currently observed in the market, while he is referring to some hokey, theoretical supply and demand arrived at in a round about historical manner, with a key flawed assumption – that household sizes remain the same.

Chris

at 4:03 pm

I agree both Josh Gordon and i are defining Supply and Demand differently, i’d point out that my definition of supply and demand refers to actual real world supply and demand that is currently observed in the market, while he is referring to some hokey, theoretical supply and demand arrived at in a round about historical manner, with a key flawed assumption – that household sizes remain the same.——————

For sure, the big difference is that he is obviously suspicious of a bubble, leading to unsustainable demand, whereas you are a proponent of this demand being sustainable.

However, you say that he makes a flawed assumption, that household size remains consistent. He does address this in his report:

“That said, a falling ratio is consistent with an expansion in the share of housing that is made up of denser, high-rise units, which will house fewer people on average.”

Further, in the StatsCan link that Daniel shared, we can see that the pace of household size decline has slowed dramatically in recent years:

1971 3.5

1976 3.1

1981 2.9

1986 2.8

1991 2.7

1996 2.6

2001 2.6

2006 2.5

2011 2.5

From 1971 to 1981, it fell quite quickly, as households shrank in size. However, from 1991 onwards, it has moved much more slowly, and remained consistent from 2006 to 2011.

Unforunately, we don’t know what the figure is for 2017, to the best of my knowledge. But, I don’t believe it is that much of a stretch on Prof. Gordon’s part to assume that household size has not fallen dramatically from 2011 to present. I would be suprised if it had declined beyond 2.4, if indeed it has moved at all.

Chris

at 4:17 pm

…I left your paragraph in my post again. So once again, please disregard my first paragraph haha.

Kyle

at 4:27 pm

We’ll have to see when the data comes out, but reality is by the time they print 2017 data it will already be stale. Because one other thing that i would point out, is that supply is relatively easy to count. Demand is more nebulous, household formation typically occurs when children move out of their parents home, which used to happen at a far younger age (something Josh Gordon doesn’t consider). Today, there are more adult children then ever living in their parents home. This is basically a massive growing pool of shadow demand. And demographically the peak millenial population is still only in their late 20’s (not quite their prime home buying years yet). If apartment and house hunters are having difficulty finding housing now, good luck in 3-4 years, when a massive flood of millenials enter their 30’s.

Chris

at 4:35 pm

Demand is definitely a difficult metric to accurately measure. Supply is far simpler; just look at listings of re-sale homes and/or construction of new ones, depending on which type of supply you’re trying to assess.

The millennials living with their parents does throw an unknown into the equation. I suppose my counter to that would be the large number of baby boomers approaching retirement with thoughts of downsizing, moving out of the city, or securing cash to finance retirement or pay down debt (which as I pointed out in another post, they have a lot of).

While we may have more millennials seeking to purchase their first home, adding to demand, we may also get more baby boomers seeking to sell their homes, adding to supply. Quantifying the impact of both of these factors is extremely difficult, if not impossible, so we’re pretty much left to speculate on what will happen.

Phillip

at 8:15 pm

I have been in my suite for 13 years just got an eviction notice landlord saying he wants to live here but I think he just wants to rent for more money never late on rent maintained the yard .I am 72 feeling lost

Condodweller

at 10:12 am

This is a good article! I believe unfortunately this the case of a few rotten apples spoiling the bunch again. Tenants have to be protected yes, but I would like a more balanced approach. On one hand tenants get one months rent if they are forced out, which they should be aware of being a possibility going in BTW, and getting compensated it seems by default. On the other hand they can stop paying rent and the landlord has to wait months just for a hearing and lose over a year’s worth of rent and possibly the property if the tenant knows how to play the game.

I have no problems with protecting the tenant this way as a landlord who deals with good faith should not be affected by this. But if the tenant stops paying rent I would want to be able to get a hearing within a month and have them evicted within a few months with the possibility of garnishing wages to recover lost rent.

If the government is going to threaten me with a $25,000 fine for acting in bad faith, I want them to protect me when the tenant is acting in bad faith which will potentially cause significant financial harm!

Ralph Cramdown

at 11:29 am

I think there’s a class of undercapitalised landlords. If you own six hundred units, you’ve got bad tenants all the time and they are a cost of doing business. If you’ve got few enough units that a bad tenant is creating acute cash flow problems within months, maybe the problem isn’t that the court system is too slow, but that the landlord is undercapitalised for his risk. Just buy REITs.

If you want to be a landlord, you have to know that there are some bad tenants and some superbad tenants, and you want another landlord to be stuck with them, but you know there’s a risk it’ll be you. The court system grinds even more slowly for everybody else’s

property and commercial disputes.

But really! Every landlord who’s held property for a at least a few years has seen HUGE capital gains (and more recent landlords certainly weren’t buying for the cap rate), and I think it’s a bit churlish to complain about a possible one-time exit charge of one month’s rent: That’ll be smaller than the broker’s commission, your capital gains taxes and maybe mortgage break fees but bigger than your legal fees if you sell, and smaller than the LTT and maybe the mortgage insurance if you’re buying. David’s advice seems to be that you’ll always do better selling a vacant, freshened and staged unit, and getting a tenant out without moving in is a negotiated process — the new legislation hasn’t changed that at all. For anybody who wants out of the landlord business in the 416, now seems to be a great time to sell.

With the prospect of tighter mortgage qualifying, possible higher interest rates and the new landlord-tenant legislation, now would seem to be a great time to exit rental condos for any landlords not in it for the very long haul, and the dearth of 416 condo listings certainly suggests that a lot of investors are standing pat. Badmouthing the legislation is to be expected but, rhetoric aside, they don’t seem to be voting with their feet.

Condodweller

at 2:47 pm

@Ralph You touch on a very good point. Perhaps the current problem resolution process was established at a time when typical landlords were corporations with rental buildings. I frequently hear the figure of about 50% units being rented in a condo building. It’s probably less outside the core but that’s still a significant number of condos rented where presumably most are owned by individuals and a typical owner has 1-3 units.

These landlords as you correctly point out carry a much higher risk compared to a company. Due to this fact I think the resolution process needs to be revamped to suit the needs of the new type of owners. Wheather it’s through updating the law or revamping the system to allow for a faster resolution is debatable.

My issue isn’t with the new law as I indicated I don’t see it affecting me personally. 1 month’s rent is not unreasonable to pay for putting someone out on the street. The $25000 fine seems a bit steep but I doubt anyone will see the maximum fine handed out. My issue is that renters can cause a significant financial harm to a landlord without having to worry about any recourse which may have been fair and part of doing business for a company, but IMHO it’s not fair for an individual landlord.

I noticed the small claims court amount has been raised to $25,000 which when I learned about it was 3 or 5 thousand. By that definition three missed periods put you over the small claims amount.

I agree there are recent landlords who are undercapitalized to use your words. Most should be well capitalized due to the huge price increases. I am not at risk of losing my place if my tenant decided not to pay rent for a few months but should that be the cost of doing business? I don’t think so. A mechanism should be in place to either allow me to kick out the tenant or recover the loss.

Personally, I have gone into it with eyes wide open but I tend to be a bit more prudent and conservative than most, so I’m mostly speaking for others. I did go in for the long term, however ever since my value doubled I have had an itchy trigger finger. Even though I went in for the long term I’d love to lock in my capital gains now but unfortunately crystalizing them now along with the transactional costs doesn’t excite me.

Your point on REITs true for most. The issue here is how much money are you leaving on the table with the high costs of running a REIT? I rather manage the risk of a bad tenant myself than give up the bulk of the profits. This brings up another point. I’m surprised the insurance industry hasn’t come up with a product for bad tenants. We have had title insurance for a while now, how about adding tenant insurance?

Appraiser

at 12:07 pm

Toronto rated safest city in North America and fourth safest city in the world.

https://globalnews.ca/news/3798979/toronto-safest-city-north-america/

No wonder Toronto is a magnet for the best and brightest.

AT555

at 12:32 pm

It was a great read till I found Chicago at #19 :/

Appraiser

at 12:40 pm

Fortunately, the index considers multiple variables – not just the murder rate.

Chris

at 12:47 pm

Uh I think any rational person is more interested in the murder rate than the “ability to curb cyber threats”. Good try though.

Chris

at 12:48 pm

But Appraiser, why then are Tokyo and Signapore, safe cities #1 and #2, so much more affordable than Toronto???

DHI Median Multiple

Tokyo – 4.7

Singapore – 4.8

Toronto – 7.7

Please explain!!!

Appraiser

at 12:34 pm

Latest CREA Data is out: http://www.cbc.ca/news/business/crea-house-prices-1.4353165

“Further tightening of federal regulations aimed at cooling housing markets in Toronto and Vancouver risks creating collateral damage in markets elsewhere in Canada,” CREA’s chief economist Gregory Klump said.

Chris

at 12:50 pm

Collateral damage??? Cooling housing markets???

But Appraiser, I thought you said we would have continued appreciation in Toronto! No more freeholds! Best and brightest!

Please explain!!!

Daniel

at 2:20 pm

Chris, you’re normally fairly accurate in your critiques, however, here you’re clearly misreading the quote. It references collateral damage IN MARKETS ELSEWHERE IN CANADA. As in markets that are not Toronto or Vancouver. Sorry to all caps at you but i can’t figure out how to bold or underline.

Chris

at 2:44 pm

Daniel,

No worries on the caps haha.

Would we not expect damage in Toronto and Vancouver from cooling measures too though? Collateral damage typically implies damage to the target as well.

For example:

“We bombed the building, reducing it to rubble, but the church across the road was collateral damage.”

We’re arguing semantics now though haha

Kramer

at 2:32 pm

Because the only way to slow it down was provincial and federal regulations aimed at cooling markets!

If they continue regulating at this rate, in 50 years no one will live in Toronto at all.

XYZABC

at 3:50 pm

Chris, Kramer, Ralph, Appraiser pffftt….

Can we please have Chroslckh (sp.?) back? I miss him!

Kramer

at 8:03 pm

No, sorry.

Libertarian

at 4:47 pm

Chris wrote the following in one of his posts below (I couldn’t reply to it because that comment thread is so long already):

“You are arguing that the demand for homes is rational, and based on fundamentals such as population growth, income growth, etc. Given this, in your opinion, sustainable amount of demand, supply is inadequate.

Prof. Gordon is arguing that the demand for homes is irrational, and based on fleeting factors such as speculation, extrapolative expectations, etc. Given this, in his opinion, the demand is unsustainable, and trying to match supply to this demand is a losing proposition. He instead offers that supply has been adequate for what he considers fundamental demand, and offers that building more supply did not quell unsustainable demand in American markets, and in fact, made the correction worse.

These two arguments are at loggerheads, and I really don’t know how, without an accurate count of unoccupied dwellings, as well as an accurate count of household size, we can find which side of the argument has more backing in fact.

At this point, it’s pretty much a matter of opinion. Personally, I subscribe more to Prof. Gordon’s view (shocking, I know).”

This sums up my opinion of real estate in a nutshell as well. Are there enough houses/condos/etc. in Toronto for the population? Yes. Are there enough houses/condos/etc. for all the people who want to invest in real estate and be hands-on landlords? No.

So, should we as a society decide to build anywhere and everywhere (get rid of the green belt, fill in Lake Ontario, Glen Abbey, laneway houses, etc.) just so that everyone can become McGivillary and “take cheques to the bank”? If we were to hold a referendum on that next week, my vote would be “NO.”

I don’t think we as a society owe anything to real estate investors.

Mr. Late

at 6:30 pm

that sounds about right …

Kramer

at 8:02 pm

Yah because we’re super unique and the only city in the world with real estate investors and McGillvray wannabes.

It’s ok fellas, it’s just growing pains, you’ll get over them.

Chris

at 10:13 pm

It is an interesting question though.

If we assume that Prof. Gordon’s calculations are correct, and that we have built, and continue to build enough homes to house our growing population, should we continue to develop land beyond what we need, for investment purposes?

The capitalist in me says yes, if the market is willing to pay the price, then sure, build away. The environmentalist in me says no, we shouldn’t pave over the province just so people can own multiple houses.

I don’t really know what the answer is, but Libertarian’s post made me think about that question.

Kramer

at 11:06 pm

Maybe I’m missing something but…

For the most part, people who own multiple properties in Toronto rent them out to people who need to rent… good clean demand for rental housing that must be filled. For the most part they are not vacant. I believe this negates anything previously mentioned in this string?

In addition, consider how many people have rental units within their very houses (WHICH is what McGillvrey is partly about and it’s not about speculating, it’s about “taking cheques to the bank” to reduce your mortgage payments which is admirable and entrepreneurial, and it’s not free money, it’s work and it’s sacrifice… but that’s a side point). These units within already occupied houses are being rented to people who need rental housing.

Last I heard the rental market is tight and tenants are able to pay higher and higher rents over the last 5 years. If the rental market was in such a vulnerable state, the first rental units to empty would be crappy basement apartments as the tenants would move into all the empty hot new condo units with nosediving rents. I think we’re far from that happening.

Toronto is going to keep increasing its population. New housing development does not exist here so that investors can buy a 3rd property and have it sit vacant. That was indeed a huge part of the problem in the ’08 crisis in the USA: empty speculative poorly-financed and mortgage-fraud-fueled demand driving truly unnecessary housing development. Comparing that to Toronto is completely inappropriate.

Personal story: When I sold my rental unit a year ago, a Calgary businessman bought it… he works in Toronto 3-4 days per week on average, so he lives in it when he’s in town. I share this because I thought it was an interesting source of demand, and something you will occasionally see in a city like Toronto where the banks and most other corporate headquarters are. Sure, maybe it serves as part of his investment portfolio, but it is not dirty, empty, speculative demand. It’s sparkling clean.

Chris

at 8:39 am

Kramer,

My question was more of a thought experiment.

I was just ruminating on if development should be allowed to go ahead full steam or should be moderated and matched to population growth. Not commenting on if we’re truly over or under building, because, as I said to Kyle, it’s hard to know without some key stats.

Kramer

at 9:30 am

I am responding to the thread in general, and the thread in general boils down to a question of population growth and immigration policy. So you all need to start including that in the discussion if you’re gonna discuss housing development and going as far as comparing it to 2008. As long as there is significant immigration into Canada, a predictable % of this immigration will live in the GTA, and development will continue to accommodate the growing population.

If anyone has a NIMBY problem with it, don’t take it out on real estate investors who are a crucial part of this growth… and i’m referring to this statement: “I don’t think we as a society owe anything to real estate investors”. We owe something to our targeted population growth: housing.

If you want to rally and protest and protect from more development in the GTA, then you’re essentially protesting against immigration. If you’re not, then explain where everyone is going to live after say 10 years of immigration and development shut down because we don’t owe anything to real estate investors.

Libertarian

at 11:55 am

My comments weren’t about immigration policy or NIMBYism. People have been immigrating to Toronto for decades. It’s about housing policy.

People compare Toronto to other global cities – New York, London, Paris, etc. Are they building condos in New York’s Central Park? Are they converting Big Ben in London to lofts? Are they filling in the Seine in Paris to build rows of townhouses? At some point, each of those cities said enough.

Besides, even if we were to fill in Lake Ontario for condos. David has railed against pre-construction condos for as long as he has had his blog. The builders have VIP parties. Do they invite millenials looking to enter the housing market to these parties? Of course not. They invite investors. And all the rage these days is to rent out units on Air BnB. So, do we solve anything by filling in the lake to build condos? No. The only thing that happens is a bunch of investors can add units to their portfolio and tourists have a nice view of the lake. It does nothing to address the needs of Toronto residents.

David’s post today (Oct 16) discusses rental housing and how it should be built. Builders were in the process of having rentals completed, but now because of the gov’t changes, they’ve converted them to condos. One of the commenters already noted that Air BnB is one of the issues. All of this comes down to housing policy. We need the 3 levels of gov’t to co-ordinate smart housing policy.

Kramer

at 2:16 pm

Last I checked in London and NYC… their real estate prices are way higher than Toronto… so if they have slowed development (by choice or because of running out of space to develop), could that be why their real estate is so expensive? And Big Ben? Really? I must have missed it, did they announce they are turning Queen’s Park into lofts? If so, I WANT IN!

If a rental-only building project is launched, who do you think gets invited to a party? Millennials looking for a place? Investors are invited… and not mom and pop real estate investors looking for a taste, but the big dogs looking for 13% ROI on a portion of their $100 million portfolios. At least with condos, millennial have a chance to invest if they want.

Whether it’s a company or a group of wealthy real estate tycoons making the investment into a rental-only building, or if it’s hundreds of individuals making the investment into condos units to rent, if left alone, the market will determine the most efficient allocation of capital in meeting market demand for units.

Toronto is growing (in population and otherwise), and growth REQUIRES INVESTMENT. If you regulate so much that you shut out huge potential sources of investment, then the city will not grow, and you better shut off the immigration tap while you’re at it. Why so much anger toward individual real estate investors? They’re providing the capital (and taking the risk) for projects to get built so the city can grow.

So who’s gonna do the investing? What perfect world do you picture here?

Max

at 11:16 pm

I’m a little surprised by the amount of time people have to make extensive postings on this forum (multiple times…) and quoting others authors’ analyses or statistics or news as a supporting point. It makes the forum discussion seem so irrelevant and boring.

Kramer

at 11:23 pm

Don’t let the door hit your arse on the way out.

JCM

at 1:50 pm

It seems pretty clear that the form is correct. Section 48.1 of the RTA, which provides for compensation, only refers to section 48 of the RTA. Section 48.1 provides as follows:

48.1 A landlord shall compensate a tenant in an amount equal to one month’s rent or offer the tenant another rental unit acceptable to the tenant if the landlord gives the tenant a notice of termination of the tenancy under section 48.

Section 48 relates to eviction for the landlord’s personal use. Section 49 relates to eviction for the personal use of a purchaser.

leila

at 4:14 pm

my landlord gave us the N12 Form and he gave us to move out less than 2 months when I looked the form the reason says the landlord signed an agreement of purchase and sale of the rental unit a person who is willing to move in. He lied, I didn’t sign any agreement to anyone, people still coming to look the unit without 24 hours notice, what is my right?

Saman

at 11:54 pm

Really ridiculous ideas to compensate after the termination of agreement! My tenant ask me two months compensation after three years occupancy just because I want to back from other province to ontario!

Chris

at 11:30 pm

Hi. I just moved out because my landlord presented me with an N12 citing Reason 2 – “purchaser” required unt for personal use. When doing a final inspection of the unit with the landlord, I casually asked about the “purchaser”. The landlord told me that the new owner is his son. This appears to be a bad faith N12 with the landlord trying to avoid having to pay compensation. Is my interpretation correct? Am I owed compensation?

Chris

at 12:06 am

Depends, other Chris.

http://www.sjto.gov.on.ca/documents/ltb/Notices%20of%20Termination%20&%20Instructions/N12.pdf

If the N12 was because their son is moving in, then it is reason one, and they owe you compensation.

If they signed an Agreement of Purchase and Sale with their son, and have sold the home to them, then it is reason two, and I don’t believe they would owe you compensation.

May want to clarify this with your landlord.

Wendy Cladman

at 5:30 pm

After renting a house for nearly 6 years and paying rent on time every month and taking good care of the house, my landlord decided to evict us so that her son could move in, but in reality they wanted to rent it out at a much higher rent. I found a mistake in the eviction form and we stayed on. 2 months later they tried to evict us to completely renovate the basement. At that point we agreed to move as soon as we found a suitable place. They agreed in writing to give us one month compensation for moving. Then the pandemic started and there were very few houses available to rent, we lost part of our income and landlords didn’t want to rent to us. Our landlord harassed us constantly to move out ASAP so her son could move in. When we finally found a house and moved out, our landlord then refused to give us the compensation month rent (actually I took the compensation rent early, with their permission, to make my bank account look better. We moved out as soon as we could but the landlord refused to refund me my last month’s rent deposit). It was nearly impossible to get through to the Landlord Tenant Board. They’re interested in evictions only now. The house is sitting empty for 4 months now. The son never moved in. They did no renovations but it is now up for sale. After all that stress they put us under, they refuse to give me my money back. Can I claim anything? We were harassed. I have videos, letters and emails to prove it. Who do I go to for help?

Thanks.

Jay

at 7:42 am

I have a question, if a tenant is late on rent, by one or two months and is issued an n12, is the landlord required to provide an additional months rent for compensation, or is it considered as paid by excusing one of the months late rent. Let me know If anyone has info on this. Thanks

Dean

at 11:46 pm

I’m also looking for this info. Can the landlord deliver a letter to the tenants that states their compensation has been reflected and deducted from their outstanding rent amount?

Dean

at 12:03 am

Found it:

TNT-05879-18 (Re), 2018 CanLII 113853 (ON LTB)

It is noteworthy that section 48.1 does not state that the landlord must pay compensation of one month’s rent to the tenant; rather, it states that the landlord must compensate that tenant in an amount equal to one month’s rent. That compensation could be provided in a form other than a payment of one month’s rent. For example, a reduction equal to one month’s rent in outstanding rent arrears or a waiver of the payment of rent for one month could be compensation equal to one month’s rent. So long as a landlord compensates a tenant in an amount equal to one month’s rent, the requirement of section 48.1 may be satisfied.

Sherri

at 3:15 pm

If your tenant has been served the n 12 and has accepted the compensation are they agreeing to leaving the property

Kymberley Redden

at 3:39 pm

I would like to know if I am entitled to compensation and what my rights are and when I need to leave the unit…. My landlord just sent me a text message stating that he is giving my boyfriend and I 2 months notice that we need to vacate the property as he wants to move his 3 kids and mother in…. And then a text 2 minutes later stating that he would like us to evacuate the property ASAP…. Please help!!….

Brenda Horwood-Geijsbeek

at 10:20 am

My comment is this.

My husband and I have rented a main floor of a single dwelling home for 3 years and yes there was a tenant residing in the basement apartment fir one year. No, it wasn’t a legal apartment. And the owner of this home would not put any money into it legalized it.

This July 2021 we get an email short and not sweet that we must vacate the home in 60 days which would be September 30 2021, because she the owner and her daughter were to move in.

Yah right!

So, frantically looking and so torn up with lots of emotions and stress we found a place to call home. This was not easy after numerous bids in several places.

Bottom line is that we moved out on August 31st and signed an N9 requested by the landlord.

She refused to come to meet us and exchange key deposit fir keys and to compensate 1 months rent but instead this was handled through email or text messages but not entirely. They ask me to take pics of the keys and where to hide them on the property then they will send the money.

So far no key deposit back, no compensation in full just $1000.00 by etransfer.

After many attempts to contact them still no money sent.

What are my options?

Wagdy Botros

at 7:13 pm

Please tell me if you file N12 and have not paid the one month compensation to the tenant is that a valid N12 application ?

Linda

at 10:36 am

What if you give your existing tenants an N12, as your true intention is to move in. Vacate day arrives and they move, you provide compensation of one months rent and don’t file N12 with tribunal as tenant moves. In turn, you have your existing home for sale and it doesn’t sell, so now you either have to re-rent unit or sell?

Lucy galle

at 9:49 am

My landlord forced us to sign an n11 now he’s trying to evict with threats of filing and the date we signed it was july 16 my email lucygalle60@icloud.com

Indra

at 5:20 pm

Was assaulted by super,his brother and 3 women.They pinned me in the laundry room.Thete is a recording. Asked for it and manager does not want to givee a copy

Soma

at 8:17 pm

Hi, we have a unique situation where we emailed a n12 to our tenant, they didn’t reply and after 1month they emailed back stating they didn’t receive the form, then we forwarded the form again however they emailed back and disregarded our notice the reason being, it should have been a hard copy.

Then we gave them a valid N4 as they withheld some rent and didn’t follow up on N12.

They moved out of the unit after receiving N4, and we got an order from LTB for rent owed!

Now they are filing a T1 to ask for 1month compensation for the disregarded N12!

We wanted to know if there is any chances for them to get the compensation!

Thanks

Michael

at 1:52 pm

Hi David

We are currently in a house we have rented for 5 years with the hope of buying the house but our credit rating and current situation made it impossible. Now the landlord has said he sold the house but the N12 notice has the 1st of the month as our eviction date when we are on a month to month rental. Because of the wrong date is this N12 considered voided? We have been searching but there are no comparable rentals available.

Just wondering where we stand and what are next move should be?

Thank you so very much for your time.