Sounds like a familiar topic, am I right?

“Listing and re-listing;” you can even Google the phrase, and I’m sure 2-3 of my blogs will pop up, all from the last couple of years.

But in the past, my blogs have focused more on the overall market trends, strategies employed by sellers, and how those strategies change as the market does.

But what about actual quantifiable data on this topic? Wouldn’t that be telling?

During the stats-based blogs of the last couple of weeks, a few readers, and several colleagues, have asked something to the effect of, “How many houses have been listed and re-listed?”

From there, people also want to know, “How did those properties fare?”

And then, “What is the true days on market?”

The latter is a question that a lot of folks ask.

If a property is listed for 15 days, then the listing is terminated, and re-listed again for 18 days before it sells, then the true “DOM” is 33, not 18, as would appear in TREB stats. But that’s not the point of today’s blog.

Today, I wanted to look at properties that have been listed and re-listed, specifically because the sellers did not get what they wanted on offer night.

So here’s what I did:

I downloaded all the “Unavailable” listings in E01, E02, E03 (I know, back to the east side, but it’s my default), from September 1st to November 27th when I started the research.

That was 630 listings.

Then I did the same for the “Available” listings, which added another 183, for a total of 813 listings to sort through.

I simply sorted the 813 listings by address, ran an “IF” function in Excel, voila!

We had our list of re-lists.

And yes, I checked the data for misspellings of the addresses or abbreviations, but none were present, which is very surprising, given the assumed rate of human error.

The function would also count properties that were re-listed more than once.

So before I give you that number, I want you to produce a guess.

What percentage of ALL listings on the east side represented re-lists, out of the 813 total?

I just polled three people in my office, and their guesses were 12%, 5%, and 10%.

What’s your guess?

Don’t read any further.

Take a second, and think about it.

Got your number?

Mine was 13%.

And the number is…………18.1%.

147 out of the 813 listings were re-lists.

And keep in mind, I’m using available listings that could still be re-listed next weeks, but those could be offset by listings from September 1st onward that represented re-lists from properties on the market in late August.

18.1%. Wow. I’m shocked by that number. Are you?

Now to be fair, that doesn’t represent 18.1% of properties. That’s simply saying that 813 listings counted 147 listings for properties that had already been listed, which is not the same thing as saying 18.1% of properties are re-listed.

Of the re-lists:

101 were for properties re-listed once.

20 were for properties re-listed twice.

2 were for properties re-listed three times.

Add those up, and you have 147 re-lists, representing 123 properties.

So now the best part!

We had 813 total listings, 147 re-lists, representing 123 properties.

That means we had 666 unique properties listed.

123 of those properties were re-listed, or 18.5%

Round up, and that tells us that one-in-five properties that comes onto the market will eventually be re-listed.

What a great piece of insight, if I do say so myself. This is a number I have never researched before!

So 18.1% of all listings represent re-lists, and 18.5% of all properties will eventually be re-listed.

And to be fair, when I asked my colleagues, “What percentage of listings represented re-lists,” they might have assumed I was asking, “What percentage of houses were re-lists this fall.” Thankfully, the numbers are only apart by 0.4%!

So now what I really wanted to know was: of the properties that were re-listed, what was the trend?

Were these properties increased in price after a failed offer night?

Were these properties decreased in price, legitimately?

Or were these properties decreased in price, to try and play the “holdback and get multiple offer” game? That’s always been a failed strategy, in my mind, because you’ve already played your hand. You never get a second chance to make a first impression.

So let’s look at the 101 properties that were re-listed once, since that will give us the most data, and probably avoid the outliers such as crazy sellers and agents with absurd pricing games.

Of the 101 properties that were re-listed once, 42 of those are currently on the market, and 12 were terminated without being re-listed.

That leaves 47 properties to examine.

Of the 47 properties:

22 were re-listed at a lower price.

19 were re-listed at a higher price.

6 were re-listed at the same price.

As for the latter, why would anybody re-list at the same price, you ask?

We call this “re-starting the listing.”

If you are at, say, 28 days on the market, and you don’t want the listing to get stale, and you want the listing to show up in Prospect Match, Collaborate, New Listings et al, but you do not want to reduce the price, you simply terminate the listing, and re-list at the same price.

So first, let’s look at the properties that were listed at lower prices.

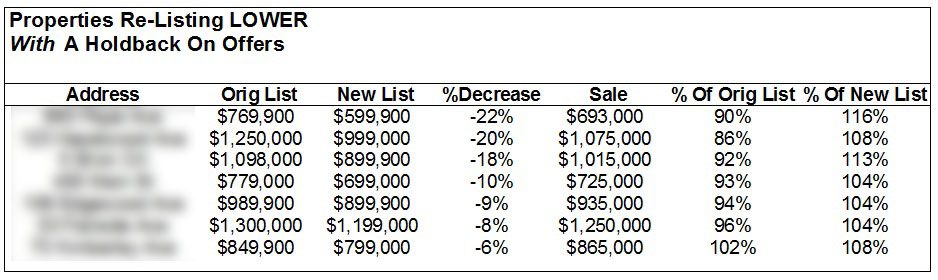

Of these 22, seven were re-listed at a lower price, with a holdback on offers. That’s the “strategy” I’m referring to above:

So take the first property, for example. They listed for $769,900, didn’t sell, and then decided, “Let’s list this super-low, and hold back offers!”

So they did. They listed at $599,900, which was 22% lower, and then sold for $693,000, which was 116% of their list price.

But is that good?

Because from where I’m standing, $693,000 for a $599,900 list price sounds great, except that they were originally listed for $769,900!

The second sale doesn’t look any better.

Check out the “% Of Orig List” column. Only 86%! Listed for $1,250,000, they eventually took a bath at $1,075,000. Sure, the stats will show that they sold for 108% of their $999,000 list price, but surely these folks can’t be happy, given their original ask.

Now look at the last property for sale. This one makes zero sense.

The house was listed for $849,900, and sat, unsold.

So the seller re-listed lower at $799,000, with a holdback on offers, and multiple bidders lined up – one of them paying $865,000. That’s $15,100 more than the original price for a house that wasn’t selling. That buyer could have probably had this house for $825,000 two weeks earlier.

Overall, I’m surprised to only see seven out of 101 re-lists employing this strategy. Don’t get me wrong, I don’t like this strategy, but I know how out to lunch some people are.

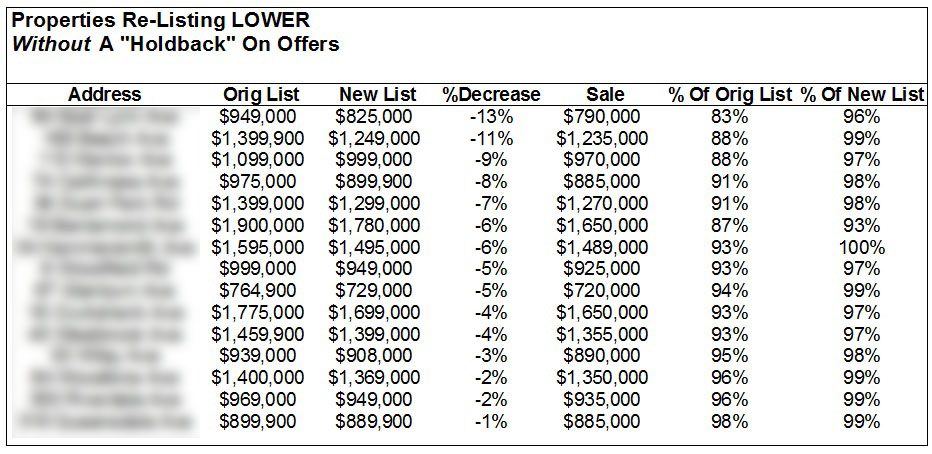

So now let’s look at the properties re-listing lower, without a holdback on offers.

These are essentially just your standard price-drops:

In a “normal” market, this is how properties are re-listed: lower.

You would only re-list higher in a hot market, where the participants are insane, as I’ll detail in a minute.

Here you can see that houses sold for as low as 83% of the original list price, after the price-drop, but of course that number shows up as 96% on MLS, and in sales reports.

As with the “Days On Market,” we can see that the “Sale-To-List” ratios for sales in Toronto are often quite misleading as well.

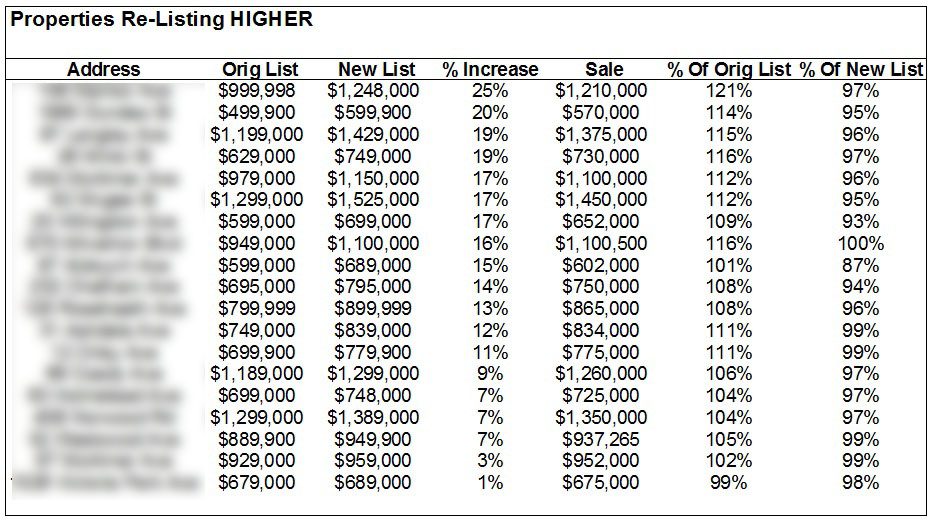

Now let me show you the flip side of “pricing low, holding back.”

These houses represent the sellers who listed low, held back offers for an “offer night,” didn’t get what they wanted, and then re-listed HIGHER:

This is quite common in today’s market, especially for sellers who refuse to accept November, 2018 prices for their homes, and believe they are entitled to a higher number.

Take the first sale, as an example.

These folks listed at $999,998, held back offers, didn’t get what they wanted, and then raised the price to $1,248,000.

It’s anybody’s guess as to what offers they received at $999,998. Did they get five offers, the highest of which was $1,150,000, and decide not to take it? Who knows. But they re-listed for 25% higher, and then sold for 97% of their list price, or 121% of their original list price. That’s not bad.

And of the 19 properties to be re-listed higher, only one of them sold for below the original asking price. But this also happened to be the house that “only” increased the price by 1%, so a $679,000 original list price, with an increase to $689,000, ultimately selling for $675,000, isn’t anything to write home about.

If anything, the fact that 18/19 properties sold for more than the original list price tells me that at least these sellers know what they’re doing. They seem to have had a “Plan-A,” and were ready to enact “Plan-B,” which in the end had a 95% success rate.

The fact that 18/19 of these properties sold for more than the original list price, and sold for an average of 109% of the original list price, tells me that buyers are not deterred by “pricing games.”

Nobody likes pricing games, in any market, for any product or service.

In the real estate market, we have almost grown accustomed to the “list-low, holdback offers” strategy, and it’s not unusual to see properties listed multiple times, at mulitple prices, with multiple strategies.

In a bear market, you wouldn’t see these 18/19 properties sell for an average of 109% of the original list price, and not with the efficiency that these properties did – an average of 11.8 days on the market (at the new, higher price).

That tells me that buyers are willing to buy, despite the pricing games, and are not put-off by having to try to hit a moving target.

–

I actually had a lot of fun with this!

As an occupational hazard, I spend a lot of time poring over real estate data, and I’ve researched just about everything there is to research.

But looking at what percentage of properties are re-listed? That’s a new one.

Of course, this is only on the east, side, and certainly there are differences throughout the city. But the whole reason I choose the east side, as mentioned before, is because it’s a very good representation of what an entry-level freehold buyer in the central core can come to expect.

And before anybody asks – I’m not doing this again for the west side! 🙂 It took me about six hours, and three coffees. I’m embarrassed to admit this, but I’ve started getting XL in the morning at Tim Horton’s instead of Large. I suppose I should also be embarrassed to admit that I drink Tim Horton’s, but that’s a debate for the coffee aficionados out there…

Tim Tavares

at 9:42 pm

Great research and insight. We now have CDOM which stands for “Cumulative Days on Market” on our MLS system. It shows how many total days listed from prior listings for the same property address listed. Its helping slow down the re-list strategy and provide a better picture of the market for those who don’t do there research. TREB should do the same. Keep up the good work David. I enjoy following your blog.

Carl

at 8:04 am

Great work. Very informative. Now if only we could find out how the bidding went, the first and the second time …

Appraiser

at 9:22 am

No wonder the downtown condo market keeps surging.

“Hyper-concentration’ of jobs occurring in Toronto’s downtown, report says”

https://www.theglobeandmail.com/canada/toronto/article-hyper-concentration-of-jobs-occurring-in-torontos-downtown-report/

Bftsplk

at 9:40 am

Cue the “I don’t believe it! The crash is coming!” responses.

Appraiser

at 2:19 pm

@Bftsplk

Sing it sister / brother / other.

Even after 10+ years of shame, it’s the same simplistic, dogmatic, sophistic and seemingly endless rhetoric of the perma-bears.

Housing Bear

at 10:34 am

Last year – The reason the suburbs are growing so fast is because its the last places where people can afford to buy actual homes, and the golden horseshoe is running out of land. If it means getting that family home the commute is worth it. Toronto is the economic hub of Canada, you got to do what you go to do to get a piece even if it means commuting 2 hours/day to get downtown for work.

This year (as most of the suburbs are correcting) – Forget the family home, people dont want to commute, they just want to live as close to work as possible. Its the new normal! People will give up space for convenience! The reason the condo market is doing so well is because its the last affordable option for most buying today. Toronto is the economic hub of Canada, you got to do what you go to do to get a piece even if it means going smaller and paying 500k for 500sq feet of construction materials in the sky so that you can live downtown close to work.

Finzi

at 1:03 pm

You do realize that, broadly speaking, you’re talking about two different groups of people (families, singles), right? And you’re aware of the implicit assumption that “last year” and “this year” should somehow exhibit the same characteristics? Thought so.

Housing Bear

at 2:07 pm

Well don’t think to hard and hurt yourself. My only point was that every bit of information coming out is a reason to buy today and is a justification for why prices will always remain high…. at least to some………… until of course there is mounting evidence that prices are not remaining high in more and more areas, and then we just stop talking about those places.

Appraiser

at 2:23 pm

You must be a real blast at parties.

Finzi

at 3:41 pm

Okay, but by the same token, every bit of information coming out is a reason to sell today and is a justification for why prices are going to crash….to some. I’m not naming names.

EarlUrl

at 3:52 pm

@Housing Bear

Just as Appraiser generally (aka always) concentrates on stories that confirm his rosy view of Toronto real estate, you almost invariably pooh-pooh such stories out of hand, presumably since they contradict your bearish view. But if both of you are simply ideologues hurling insults at each other, what’s the point?

Housing Bear

at 4:26 pm

Fair play to both of you. But I would like to think that I at least usually (not above) substantiate my points rather than cut and paste a cherry picked quote or article headline. Should also point out that bearish views are very much in the minority here, not one of the feedback loop cheerleaders.

The point originally was to try and challenge my perspectives……….. now its more just to hurl insults at Appraiser. We have a bet in place.

But if you want to hear some recent news that could work against my position. It looks like the BOC and FED will be re evaluating their inflation targets in the spring. This is code for we might try to run inflation higher to devalue our currencies to devalue debt. While RE values will still fall in a relative sense, this would help maintain their price points in CAD, as everything else here will just become more expensive in comparison. BOC also announced a change so that they can buy up government backed mortgage bonds. This is us preparing to do our own quantitative easing/ bailout if things get bad. Bad sign that they feel they need to prepare for this, but good that we will have it in place before hand if needed. This can help to prevent a huge credit contraction in Canada where rates spike and no one can get a loan period.

Professional Shanker

at 5:58 pm

Bear,

Isn’t what you are saying really the only logical way of debasing debt for central banks in a developed countries where real growth will be lower for longer? Soft landing are pipe dreams – always have been.

Housing Bear

at 6:28 pm

Is the only way to debase/ devalue debt yes. In simple terms, 2% inflation target is supposed to have all prices rise by 2% a year and allow debts to be devalued at 2% a year (not counting for interest). If inflation is rising above 2% you raise interest rates, if it is lower you lower. If you move the target to 5% than you can devalue debts much faster. Just now other prices are growing by 5% a year. Not to say they will move it to 5%.

EarlUrl

at 5:32 pm

@Housing Bear

You’re right, recent noise from both central banks hints strongly (can a hint be strong?) at a rather sudden turn toward dovishness, at least in the short term. But it should be noted that some economists, most notably Paul Krugman, have long felt the FOMC’s inflation target of 1% to 3% is too low. Interesting to see how this develops, beginning tomorrow with Poloz.

FDP

at 4:10 pm

Speaking of listings David, can we talk about the influence of our historically cold and wet seasons over 2017 and 2018. This might sound crazy, but is there a link between weather and sales activity in the gta? All the seasons are all over the place… what made spring “busy” and “winter” slow may be an outdated way to look at things (did we even have a spring or fall?) considering the impact “diabolical” weather impacts the market.