I think a lot of you have been waiting for this; both the numbers, and my response to them.

The short of it is: the bears were wrong…..for one month, at least.

The long of it is: time could prove the bears right….because nobody knows what lays ahead.

Let’s look at September’s key real estate metrics, and I’ll share some of my own experiences from the past month, trying to navigate the difficult Toronto real estate market…

Sometimes, that’s how I feel when trying to make sense of the TREB numbers; like Matt Damon in front of a blackboard, attempting to solve a complex math problem.

I actually have no idea what the heck those symbols are. They look like asterisks to me. Actually, they look quite a lot like a map of airport terminals.

I think it’s been about 15 years since I had to find a derivative, or anti-derivative.

And it’s definitely been 20 years since I drew a parabola, or knew what sine, cosine, and tangent were.

Secant, cosecant, and cotangent?

My brother did a 5-year Hons. B.Math at the University of Waterloo, and I remember the textbook for one of his courses was twenty pages thick. Twenty pages. For an entire year. I guess you’d spend an entire week trying to solve one problem.

There are no Fibonacci sequences in the September TREB numbers, which you can read at length HERE.

But there are a few statistics that make little sense, or that only confuse where we are in the market.

Recall my “Predictions For The Fall Market” blog post from September, which spawned a TRB-record, 202 comments.

I made one bold prediction, that I stuck to even as contrarians fumed: that the average sale price in September would be higher than that of August.

And honestly, how in the world is that to be considered “bold?”

As I said in September’s post, “This is a no-brainer.”

The average sale price couldn’t possibly dip from the $732,292 low that resulted in August. It would have been impossible, in my mind.

Having dropped from over $920,000 in April, it just didn’t seem reasonable, in my mind, that we would see a fifth straight monthly decline in the average sale price, especially when you consider that, a) August is slow, b) September is busy.

The average sale price in September, in fact, increased by 5.6%, from August.

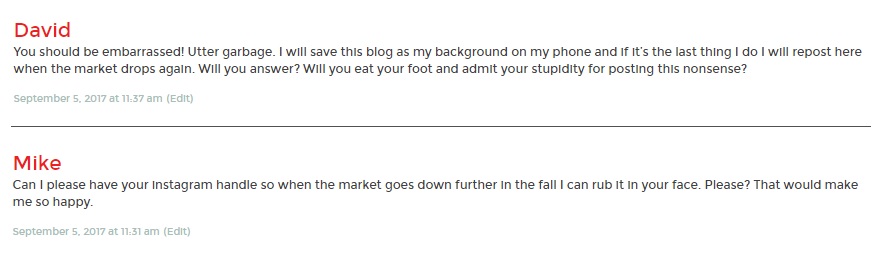

Recall that I took a lot of flak from people for that “Predictions” post after Labour Day, with comments like these:

No, this isn’t an “I told you so” moment, but rather I wanted to highlight another ongoing theme in this current real estate market, one that is gaining serious momentum: anger.

Read any newspaper article online in the Globe & Mail, National Post, or Toronto Star. Any columnist who has the audacity to write a positive article about real estate gets absolutely eviscerated by the commenters.

Why are people so angry about real estate?

I have a theory, as you know. And it’s one that a lot of you won’t like.

It’s that most market bears do not own real estate.

The folks championing this 30-40% market decline? Most aren’t home-owners, I’ll tell you that.

The ones attacking newspaper columnists online, and hating anybody who has anything to do with real estate? They don’t go home to their $2,000,000 detached in Playter Estates at night, I’ll tell you that too.

I suppose you could argue the opposite – that I sell real estate for a living, and I’ll continue to argue that the market is healthy, and will trend upwards, even though I’ve reiterated many times that I will sell real estate in markets up, down, and sideways.

But I’m not vicious. The online comments for real estate news articles are downright nasty! Why are people so mad about the direction of the real estate market, and why are they so spiteful and malicious at anything shining a positive light?

In any event, there are three key numbers I’d like to examine from this past month’s TREB numbers.

While we could look at a host of different statistics, these are the ones I find the most interesting:

1) Average Sale Price, Toronto

2) Average Sale Price, Condominium, 416

3) New Listings, Toronto

Let’s start with the one that gets the most attention…

–

1) Average Sale Price

As previously noted, the average sale price increased 5.6% from August to September, which I really don’t find surprising at all.

I think a lot of us realized that the August figure was artificially low, partially because it’s the second-slowest month of the year, outside December, and partially because the ratio of condos to houses increased dramatically as the spring went on (you can read more about this in my September 11th post – “Making Sense of the Drop In Average Home Price”)

Let’s see where things stand, compared to my post in September:

The 5.6% increase stops a 4-month trend in a declining average sale price.

And the decline from April to September is now less pronounced at -15.77%, whereas this number had reached -20.5% in August.

The average home price is now back up over January’s level, however the big question in my mind remains: where does it go from here?

Look at the fall of 2016 for a moment.

We saw a 6.0% increase from August to September, which is exactly in line with this year’s 5.6% increase – yet another reason why I figured the average home price increasing in September was a no-brainer.

But after that big jump, we saw only a 0.9% increase in October, and then a 1.8% increase in November, before the yearly drop-off in December – a whopping 6.3%.

It bears mentioning here, just to get sidetracked if for only a moment, that a December drop-off is normal. That doesn’t mean your home is worth 6.3% less in December than it was in November, but rather there are very few, if any, luxury homes sold in December, and the ratio of condo sales to home sales increased dramatically.

So back to the question at hand – what do we expect for October and November?

As I predicted after Labour Day, I do expect the average home price to increase 10% this fall, which would bring it back up over $800,000.

Not quite the same “no-brainer” as the average home price increasing from August to September, but I do think it’s going to happen.

We need only see the average home price increase another 3.1% to get to $800,000, and I think that could happen in October alone, let alone by the end of November.

–

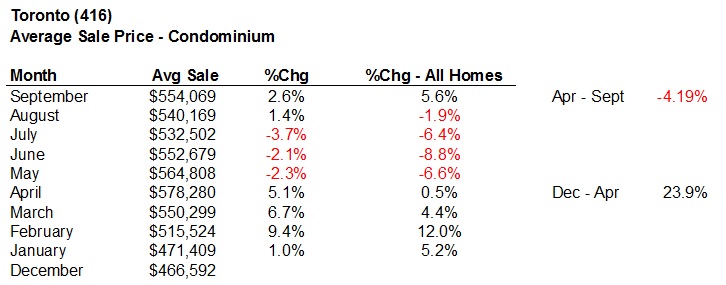

2) Average Sale Price – 416 Condominium

Raise your hand if you haven’t heard at least once this past month, something to the extent of, “The condo market is holding steady.”

Had I made any sort of prediction in the past few months that the housing market would outpace the condominium market, as it always does, and should, I would have been dead wrong.

Another one of my bold predictions from the past was, “Fifty years from now, only the city’s elite will own freehold properties.”

I still stand by that prediction.

Simply put, there will never be any more freehold properties built. Maybe tearing down a bungalow on a wide lot, and building two semi-detached homes on its place gives you another one home. But as a percentage increase, specifically in the central core, we’ll be trending pretty close to 0.00% from here on out.

About 99% of “new” housing in the core will be in the form of condominiums.

And it doesn’t take Good Will Hunting to do the math, and see how the supply-and-demand equation will affect house values.

Having said all that, the numbers for the condo market are shocking.

Let me show you the average sale price for condominiums, specifically in the 416, and compare the monthly increase/decrease to that of the overall average sale price:

As you can see, the condominium market has been far less volatile.

But the decrease has also been far less pronounced.

The December-to-April increase in average sale price was 23.9%, in line with the 26.05% we saw in the overall average sale price in Toronto.

But the decline of the latter was 15.77%, as shown in the first chart, compared to a much smaller 4.19% decline in the average 416 condo sale.

Who would have ever predicted that the condo market would outpace the housing market in 2017?

What I’m seeing out there in the condo market right now is shocking.

Not to name names, but I showed a unit to investors on the weekend – east-side, 495 square feet, original 2004 finishes, priced at $399,900. That’s already $808/sqft, with no parking, and no locker.

But wait – there’s a hold-back on offers, and the listing agent told me on Saturday night, “I might be getting a bully offer, or two, tomorrow.”

So what does that mean? $425,000? $450,000?

Are we really going to see a 2004-condition condo, no parking, no locker, break $900/sqft?

Whether it “only” gets $808/sqft, or whether it breaks $900, the activity is just insane.

And it can all be traced back to the lack of product available on the market, which, of course, the TREB numbers do not show…

–

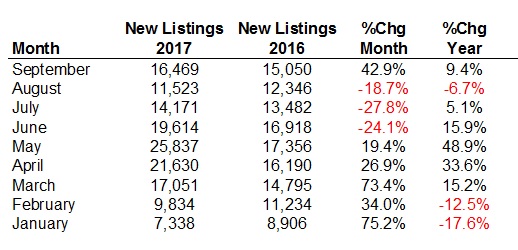

3) “Increase” In Listings

This is where things get really interesting.

It’s also where many people, bullish or bearish, can be seen to “make numbers say anything they want.”

The September TREB number show:

New Listings +42.9% from August

New Listings +9.4% from September, 2016

Active Listings +15.8% from August

Active Listings +69.0% from September 2016

So first of all, what’s an active listing, and what’s a new listing?

“New Listings” are exactly as you would assume – a count of all the new listings that month in TREB, including those for properties that have already been listed, regardless of month. The “New” listings does not sort, filter, or clean the data – it’s just all new listings.

“Active Listings” refers to the number of listings on the market on the last day of the month.

And to this day, nobody can really figure out why or when one is higher than the other. Except Good Will Hunting, but he won’t tell us the secret…

I’ve always preferred to look at the “New Listings,” and while I know double-counting properties that have been listed more than once is the drawback, I find my buyer clients don’t care about an active listing that’s been on the market for 92 days; they seek new listings that hit MLS, which we need to see right away.

So the TREB numbers show massive spikes in listing, across the board. There are four “+” symbols above.

New listings are up 42.9% since August, which is an insane increase. But August is slow. It’s the second-slowest month of the year, behind December, in the minds of real estate agents (ie. the number of sales, listings, et al, notwithstanding).

New listings are up 9.4% from September of last year, which I find encouraging, since prices increased 6.0% in September of 2016, and the more listings we see, in theory, the lower the prices should be.

So where does the confusion set in? I mean, other than trying to understand how and why the “active listings” data is so far from “new listings,” and the increases have seemingly no correlation?

Well, if you were to ask any Realtor, “Are you seeing inventory out there?” the answer would be an emphatic, NO.

There’s no inventory, folks.

I don’t care what the numbers say. There is just nothing to sell.

I know that sounds crazy, given the TREB numbers, but I don’t work in an “on paper” market, nor do I work in a theoretical one. I work out there, in real market conditions, and whether I have a buyer looking for a house or condo, low-end or high-end, east or west, there’s just nothing to sell them.

I made fewer for buyer clients in September than in any month this year, and I have more buyers looking than any month this year. Do that math.

And no, it’s not because the buyers aren’t looking, or are waiting for the crash – my buyer clients are ready to buy, today, if the right property comes out. But we just aren’t getting the listings.

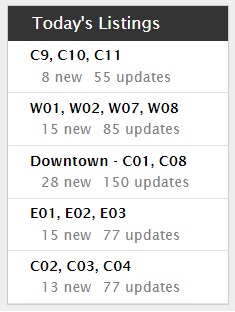

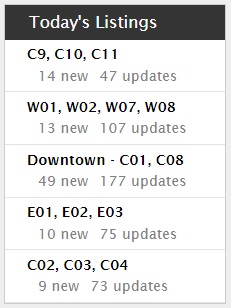

Let me show you last week’s listings from Wednesday and Thursday.

On every Realtor’s MLS home page, they can customize their “listings pane.”

Mine are broken down into the areas I find I work the most, which explains why you see the five groupings below.

Here’s a shot of Wednesday’s listings:

That’s right. On Wednesday of last week, in C09, C10, and C11 combined, which is Rosedale, Moore Park, Leaside, Davisville Village, and parts of Yonge/Eg, there were only eight new listings, and that’s for both houses and condos.

Eight.

So let’s say that’s one house in Rosedale and Moore Park combined, one in Leaside, one in Davisville, then five condos at Yonge/Eg.

How many buyers are looking for houses in Leaside? How many price points do they represent? How does that one new listing for a house satisfy the market?

Here’s Thursday’s screen-grab:

From 28 “downtown” listings on Wednesday, to 49 on Thursday.

I’ve always told people that when the market is busy, you’re getting 60 per day.

When the market is really busy, you’re getting 80+.

When the market is crazy, you’re getting 100+.

And at certain peak times, on peak days, you can see 130-140.

So how in the world does 28, and 49, satisfy the market?

This is what I mean when I say, “There’s no inventory,” and yet we keep hearing about record inventory levels.

Let’s look at those inventory levels through the last year, and specifically look at the month-over-month increases, as well as year-over-year:

Again, if you look at the 42.9% increase in new listings month-over-month from August to September, it’s a big number. But last month’s new listings only represented a 9.4% increase from the same level last year, which is a better comparison.

Seeing where inventory levels were in January and February certainly explains the run-up in prices. You might argue the same for the 25,000+ listings in May.

But is 16,000 new listings “enough” to satisfy the market in a busy September?

And where are those new listings?

Why are we seeing such a dearth of new listings in the areas I track? Why are my buyer-clients without options?

When I decided to title this blog “making sense of the September TREB numbers,” it was mainly in reference to your own interpretation, and as an unavoidable response, your predictions.

But it’s also in reference to actually making sense of numbers like the new listings, because what I’m seeing out there completely contradicts what I’m seeing on paper.

“No product” has been the theme this fall.

–

Now, I certainly don’t expect to see another 202 comments on this blog post, but I do expect to see a healthy debate.

What do you guys think?

Was September and aberration? Will the new stress-test cut off the real estate market at the legs?

Do you think the October average sale price will be higher than September?

So many questions, so much to talk about.

And now you know why I left this blog for Tuesday…

Appraiser

at 8:10 am

“Why are people so angry about real estate?”

Bitterness. Of a type that seeks only vengeance, I’m afraid.

As for Mr. Market, sales are still happening, prices have softened slightly in some areas namely outside of the 416; and we still need WAY more listings to balance this one out.

Prices are still running ahead of last year on an annual basis. And last year was crazy high, just like the year before…remember?

Mike

at 9:10 am

Imagine how angry you’d be if you decided in 2007 to wait for “the crash,” only to see the market go up 150%.

Now you’re relegated to a lifelong renter.

That would make just about anybody angry.

Kyle

at 9:58 am

Fair enough it’s a natural response to be angry about an unhappy situation, especially when it is a self-inflicted situation. But the more constructive thing to do would be to accept that you can’t change the past, and stop letting bear ideology guide you, and instead open your mind to data, evidence, logic and those who have consistently been bang on (like David).

Kind of like what this guy did: https://beta.theglobeandmail.com/report-on-business/rob-magazine/why-telling-people-to-rent-rather-than-buy-is-bad-advice/article36421582/?ref=http://www.theglobeandmail.com&

Ralph Cramdown

at 10:05 am

That’s no way to go through life. Probably also killing themselves wondering “what if I’d married the smart one instead of the good-looking one?” and “why didn’t I buy that stock?” But of course never “why didn’t I save and invest more of my earnings?”

Juan

at 12:43 pm

The majority of people who are angry (justifiably) are millenials who don’t come from wealth.

They are graduating in the most difficult economic period of the last 80 years, and have to deal with astronomical RE prices. This is the first cohort of people who are having to face the idea of never being home owners (even condo ownership requires a high income and lots of savings). I think it’s fair that they aren’t responding positively to this new economic climate.

Condodweller

at 1:12 pm

It’s not good for your mental health to be angry about things over which you have no control. We all have to deal with the hand we are dealt. It’s up to us to do the most with it. You can spend all your money and be angry that you can’t afford a home, or you can live below your means and save up your money so that you are prepared for when the opportunity presents itself. Even if prices keep going up and you can never afford a home it’s still better to have wealth and options.

A

at 1:23 pm

Two observations:

1) Totally agree – (as Kenny Rogers? once said) it is not the cards you are dealt that determine what you are made of, but it is how you play your hand

2) it is not that the millenial co-hort cannot ever be home owners, it is just that they are not willing to pay for what they are able to buy.

A

at 1:15 pm

but waiting for a crash was a decision those people made… and they should live with that decision. I would feel differently for those who were not in a position to buy in 2007.

Carl

at 12:25 am

Then they should take it out on Garth Turner, not David.

Jack

at 8:36 am

An interesting theory about angry bears. That’s one kind of anger. Then there is anger directed at governments because of their attempts to cool the market. There must be theories about that too.

My theory is that most people are not really angry. They only seem to be online.

Carl

at 12:23 am

I like that.

ed

at 9:05 am

I only know the market which I follow and that is W08. Sales seem to be slow, prices are down about 10% from May. The big difference from the Feb-April market seems to be that back in the spring it didn’t matter what the house was, nor the condition, nor the location it would be listed and it would be sold. Now the nice properties are still selling but the ones that are not reno’d, not great location, not great lot are just sitting and sitting. I would imagine that they are getting their fair share of lowball offers though.

Kyle

at 9:26 am

Zolo is showing average price at $857K, over the last last 28 days:

https://www.zolo.ca/toronto-real-estate/trends

And yes i agree, lots of angry bears in the Fall Predictions comments, who throw around accusations at anyone who makes a comment that they disagree with. And now that they’ve been clearly proven wrong, rather than man’ing up and owning what they’ve posted, i suspect we’ll see a whole bunch of fresh new handles regurgitating the same Garth Turner tropes.

RPG

at 9:50 am

David, congrats on taking the high road man!

I would have been flipping double-birds at all the jerks who posted in September, none of whom will show their virtual faces on here today.

I agree with Kyle though, were gonna see a lot of new names representing the same spiteful voices.

Chris

at 11:51 am

“I would have been flipping double-birds at all the jerks who posted in September, none of whom will show their virtual faces on here today.”

I’m still here, showing my virtual face, using the same name, saying the same things!

Kramer

at 1:43 pm

To directly quote the Christian Bale Terminator movie…

“We the bulls may have won the battle in September… but the war rages on.”

Direct quote.

Real estate millennial

at 9:56 am

last weeks annoucement from OFSI I think will bring clarity to where the market will be heading. The market feels slower from a transactions basis since April I remember getting 6-7 request for appraisals daily now it’s down to 2-3 daily. From talking with lenders there’s this sense that the reduction in purchasing power is going to have the largest affect on the market going into the new year depending on how the new rules are structured. I see the end of the fall market being a little busier as buyers and seller look to beat the rule changes but the most dramatic change will come in the spring market with prices decreasing because purchasing power will decrease significantly for all buyers taking out mortgages. I’m curious David to hear your take on the OFSI rules you’re big on supply and demand but we can’t forget there’s the correlation between the cost of money and demand which side do you think will have the greater affect? Tight supply or (an artificial) greater cost of money?

Kyle

at 3:12 pm

With respect to the mortgage industry, i don’t see these changes being much of a game changer. Similar to how experienced RE Agents over-estimated the number of listings in Sept, based on their industry heuristics, I think the mortgage industry is over-estimating the impact of B20.

Fundamentally i am all for the new rules from a prudence stand point, but i think the new rules will have lots of unintended consequences, like driving borrowers to non-OSFI regulated lenders, shifting mortgage debt to HELOC debt and mostly because it will create greater wealth disparity by giving an advantages to the “haves”.

As i’ve detailed before, a borrower with wealthy parents willing to get a loan and pass it through to them, basically can buy the exact same amount of house after the rules as before.

Ralph Cramdown

at 9:56 am

For me, fall market puzzle #1 is “where did the move-up buyers go?” Lots of activity and advancing YoY prices in the condo segment, so why aren’t the SFH moving in tandem, at least in volume if not in price? Are many of the condo sellers just investors taking money off the table?

#2 is “can we really ignore what’s going on in the 905?” YoY price drops, and dollar volumes in some areas down by half — that’s big. Yesterday, I drove along King Road from Highway 27 to Yonge. I’m guessing I passed well over $1 billion in property whose owners are, er, worried.

Kyle

at 11:37 am

I think you’ve wrongly assumed that those selling condos can only move up to SFH. A big part of the jump in average condo prices this year is due to a compositional change to people buying larger more luxurious condos.

“One market is growing in sales is luxury condos. YTD to July 31, sales over 1 million are 86% higher than for same period in 2016”

https://twitter.com/Remaxcondosplus/status/906257538634698755

Unless those people in the 905 bought late last year with short term intentions of selling for a profit, i don’t see any reason why they should be worried.

Chris

at 11:49 am

“Unless those people in the 905 bought late last year with short term intentions of selling for a profit, i don’t see any reason why they should be worried.”

Kyle,

I think you and I have discussed previously the research that John Pasalis conducted, showing that some areas in the 905 had very high levels of speculative activity. While I agree with you, if these buyers bought a home to live in for the long term, they should be ok, it appears that many homes were bought precisely with the intention of selling for a profit (particularly as many of them were cashflow negative when rented out, thus all the hope for monetary gain is placed squarely on the shoulders of appreciation).

It is interesting that the areas that Pasalis identified as having very high levels of speculative activity are the very same areas that today have exceptionally high Months of Inventory, and are seeing prices fall by steeper margins than within the City of Toronto.

Condodweller

at 1:01 pm

“It is interesting that the areas that Pasalis identified as having very high levels of speculative activity are the very same areas that today have exceptionally high Months of Inventory, and are seeing prices fall by steeper margins than within the City of Toronto.”

This is an interesting piece of information. Good insight.

I agree people buying for the long term to live in their home should be ok as long as they can continue to make their mortgage payments and don’t need to sell at lower than the purchase price in the future if markets were to dip. I know people who bought their house a few years after the 89 crash whose value stayed below their purchase price for many many years. Not to mention those who bought near the top. They had to wait about 25 years to see their value return to the purchase price.

Kyle

at 2:32 pm

@ Chris

I think the 905 MOI build up, could have as much to do to with a drop off in absorption (i.e. demand). How much of this is due to reduced foreign buyers or people opting to buy 416 luxury condos as opposed to 905 SFH vs speculators trying to sell, is up for debate.

If Pasalis can prove the inventory that is up for sale in the 905 were all purchased in the last couple of years then i’d agree with you, but right now i am not convinced that speculation is the driving force.

Chris

at 6:10 pm

Kyle,

I was more pointing out the correlation, rather than proving causation. I certainly do suspect the two are related, and that the high speculative activity earlier lead to big price gains in these regions, which has now faded away, thus resulting in spiking MOI and tumbling prices. But, as you pointed out, without someone with access to the data doing a thorough analysis, my hunch will remain, for lack of a better word, speculation.

Ralph Cramdown

at 12:52 pm

No, I just assume that a fair fraction of SFH demand comes from move-up buyers selling their condos to new market entrants. So if the condo market catches cold, it decreases SFH demand. Hasn’t happened here — the median condo price last month in the 416 was $487,900 up 23.5% from $395k last year, but the median detached in 416 is flat YoY, with fewer sales and more listings — it’s like this spring never happened.

Juan

at 12:37 pm

Rental/Airbnb prices have gotten to the point where investors are seriously weighing the option of purchasing a house vs. purchasing 2-3 condos.

Chris

at 11:44 am

As I said in last week’s post, David was correct on the direction of price movements, but overly optimistic on the scale.

“I suspect that the Average Sale Price for the month of August will be somewhere in the $740,000 – $760,000 range”

Came in at $732,039.

“We’re going to see prices pick up right off the bat, and that Average Sale Price will push back over $800,000 in September.”

TREB average GTA home sold for $775,546 in September.

I fully admit that I did not buy into his predictions for the fall market. I stated:

“As most who have read my posts before may have suspected, I disagree with predictions number one and two.”

David’s second prediciton was that the fall market would be reminiscent of the spring market. I don’t think that one came true. Despite David’s assertions that there just isn’t any inventory out there, listing numbers are up, and sales volumes remains paltry. Doesn’t seem similar to the spring market, from my view.

The other part of my post in response to David’s predictions was a discussion of OSFI regulation changes, and continued interest rate increases, both of which have yet to fully impact the market.

Finally, as to why people are so vitriolic regarding real estate, I don’t think it’s just non-property owners who are bitter. I mean, this probably plays a role, but this sounds very similar to dismissing any real estate bear as a “priced-out renter”. Further, I’ve seen similar vitriol from those who are bullish. I don’t think this attitude or behaviour is exclusive to one side of the debate. Personally, I think the internet just makes it all too easy for people on all sides of any debate to ramp things up to 11, and lash out.

Pk007

at 11:58 am

First time poster here..have been following this blog for a while now. Have always found insights helpful..I personally think that condos would be preferred mode of living going forward as freehold prices will keep increasing over time..we will possibly see a trend of more condos with lesser square footage hitting the market to cater to affordable price points..500-700 sq ft condos would be the norm..as for freehold prices don’t see how they would come down when builders are increasing prices by leaps and bounds..new towns in Brampton west are being sold for 800k..detached for 1.3-4 mil..don’t see anyone buying those will sell them for say a mil or less..as someone mentioned properties still being snatched quickly if they are good and well staged and marketed right but not every crap will sell in this market

O

at 12:04 pm

David said

Why are people so angry about real estate? I have a theory, as you know. And it’s one that a lot of you won’t like. It’s that most market bears do not own real estate.

Thanks for addressing this…I admit that one of the reasons I read real estate related stories/ blogs is because of the over the top hatred in the comments…the “YOUR HOUSE WILL CRASH BY 300% THEN I WILL SWOOP IN FOR A DEAL AND LAUGH AS YOU SUFFER” types.

The bitterness is just too much. It reminds me of the old joke….2 poor neighbors, one saves his money and buys a cow. Now his family has milk, cheese etc. The other guy finds a genie. What is his wish? For his neighbors cow to die.

I do not believe anyone hoping for a crash is doing it for altruistic reasons. They just missed out and want others to suffer. It has been said that the worst karma comes from wishing bad karma onto others. Just saying.

Chris

at 12:13 pm

I think that’s a bit cynical.

I don’t think those who are hoping for a real estate crash are doing so out of spite. Rather, many are probably doing so because they feel locked out. Despite having a decent income, they are not able to afford anywhere near the type of home that people 5, 10, 20 years ago, at a similar income level, were able to.

This Macleans article explores that attitude:

http://www.macleans.ca/economy/realestateeconomy/praying-for-a-real-estate-crash/

And on the other hand, many who own property want the goverment to keep their hands off, and not interfere. It’s not out of spite (“screw anyone who didn’t buy, I got mine and that’s all that matters!”), but rather about protecting your own interests. Why would a homeowner cheer a policy that could pull their property value down?

We all have our own interests and motivations, and obviously, many of us act and espouse opinions which advance these interests. It’s just human nature.

Kyle

at 1:04 pm

@O

In my experience, i don’t think it is necessarily bitterness (at least it isn’t just bitterness) at play. I think a lot has to do with pride. For the cowless neighbour to accept a free cow from the genie, he would have to first admit that he was wrong all those times in the past that he said, “owning a cow is for fools”.

Kramer

at 1:56 pm

I agree with David’s generalization that most Raging Bears don’t own… or they are in a position where they want to buy more.

So, I would further generalize and simply say MOST people are biased to the direction that will help improve their financial prospects.

As for Raging Bulls (R.I.P. Jake LaMotta)… most are heavily entrenched in real estate in one way or another, either as an investment or are simply focused on their personal balance sheet and “Net Worth” figure at the bottom.

And then 1 out of every 1000 leaves their biases aside and tries to look at all the data from both sides and THEN decide if they are a bull or bear.

So… Are YOU that 1 of 1000?

Kyle

at 2:20 pm

If you’re asking me, my take is this. Forming/sharing/debating opinions is one thing, putting your money were your mouth is is another. I won’t say that i’m free from biases, because i own a lot of real estate. But my approach has and always will be purely scientific – Reject or accept, but never dismiss. Consider all information and arguments, but challenge them. Reject anything that can be easily disproven and accept only what you can not disprove. So far it has worked incredibly well for me.

Kramer

at 2:41 pm

Kyle please, I know you are a 1 of 1000 good buddy! For god sake, we’re “co-conspirators”!!!

I was asking the general world of bulls and bears. All should look in the mirror and answer that question. It would help.

Juan

at 12:34 pm

Toronto has been building condos at record pace for about 6 years now. I would love to see someone try to quantify how much housing supply we should be building.

Because if there really is a shortfall of condos (lack of other housing types is understandable) then this is a huge blunder on the government’s behalf.

TOPlanner

at 12:57 pm

The City already tracks this annually in a report called How Does the City Grow. Last one published April 2017: https://web.toronto.ca/city-government/planning-development/trends-analysis/how-does-the-city-grow/

Condodweller

at 12:34 pm

They say nobody rings the bell at the bottom/top of the market. This is true by virtue of time has to pass to prove that prices have stopped rising/declining in order to establish a bottom/top. Based on what has transpired over the last year I get the sense that our real estate market has topped in April. I thought back in May that this may prove to be the case. When a realtor spins negative numbers in a positive way that only strengthens my belief. Prices went down 20% but they are up 5.6%. That’s a negative for me. Then David goes further by rounding up 5.6% to 6%. I get that he has brushed up on his math and anything .5 and up should be rounded up but 6% sounds so much better than 5.6% doesn’t it? The fact there is a higher activity in the condo market also indicates to me that people are giving up on the house and going for a more reachable condo which when combined with rising interest rates and tightening qualification reinforces a new reality for me.

“Who would have ever predicted that the condo market would outpace the housing market in 2017?”

I suggested in the past that as prices continue to increase people will have to move down the food chain and the less desirable housing option will, in turn, become hot. Over the last few years, we have seen semis become hot followed by townhomes and now it has come to condos as people are priced out of the rest of the market.

“Another one of my bold predictions from the past was, “Fifty years from now, only the city’s elite will own freehold properties.””

This is a bold prediction indeed. I hope we are both around in 50 years to find out, however, depending on the definition of “elite” of course, I predict this will never happen. If for no other reason, I don’t think we have or will have enough “elite” people to own all the homes in the GTA. I suppose the elite can buy up all the homes and rent them back to the non-elite but I don’t see that happen.

In any case, let’s see how far higher prices manage to climb the rest of the fall season and what the spring market brings. If average prices will have been lower in the spring, will that confirm last April was the market top?

Kramer

at 2:32 pm

I think that “Elite” (in David’s prediction) may mean more like “Haves vs. Have Nots”…

You can look look at Rosedale today… there are no more lots/houses being developed in Rosedale. Anyone who owns/buys there is either ‘elite’ inheriting a house, or ‘elite’ wealthy, or an ‘elite professional’, if you will, who can afford it.

Now blow this out to all other neighbourhoods in Toronto. Eventually any single family home is so expensive either you elite inherit, you’re elite wealthy, or you’re an elite professional.

Basically means if you’re starting from zero and making average income, you’ll never be able to buy a house no matter how much you save from your paycheck.

Like in NYC.

I can see this in 50 years for Toronto.

50 years is a long time.

Woodstock was 48 years ago.

If:

– House supply stays same

– Population grows

– Average income stays the same or increases

Then: Housing will up faster than average income.

Because: Within a growing population and flat or increasing AVERAGE income, there is an increasing NUMBER of high (and low) income earners, but still the same number of houses for the growing number of high income earners.

“In the 1970s houses could be purchased for what today seems like a song. For instance, the average price in 1971 for a house was just $30,426 — or a mere $190,388 in 2014 dollars. BUT the average price in 2014 for a house in the GTA was $566,696”.

Obvious, but this gap (growth) is because not all real estate is created equal… as overall income and wealth in the city grows, the prices on better real estate goes up… certain demographics are crowded out of certain pockets… and as long as the city is ‘growing’, this continues.

The ship sailed on Rosedale ages ago.

The Lawrence Park, Annex, Forest Hill ships is also long gone. North York, York Mills, etc, big lots, close enough to downtown, see ya.

Leaside, High Park and the Beaches are almost “All aboard”.

I believe Toronto will continue growing. And in 50 years… What pockets within Toronto will still be accessible if you are not inheriting, already have wealth, or are an elite professional?

Condodweller

at 8:34 pm

@Kramer

See this is what I meant because if you expand the definition of elite to include elite professionals and people who inherit a home or anyone for that matter who might come into possession of a home then of course only the elite will be able to afford a home.

“Basically means if you’re starting from zero and making average income, you’ll never be able to buy a house no matter how much you save from your paycheck.”

I completely disagree with this because you are assuming the market will continue to go up and get further out of reach for the “poor working class”. The market is cyclical and given we are past record highs, by definition it will have to come down at some point. People may have to be patient but eventually, it should happen and if they were smart enough to save, they will have an opportunity to enter the market. First time buyers will just need to get more creative to raise the downpayment. The longer the wait the higher the savings.

The other point is that your $667k price is an average which means there were houses for 1 million and some for perhaps around $400k. $400k would be within reach for a working couple with some savings. If first time buyers started out in a condo, with the recent boom in condo prices helps them get close to a house. For the price of a two-bedroom condo downtown one can get a house in Toronto. In my old building, two bedroom condos are now going for close to $800k! That’s ABOVE the average home price today. Or two singles who bought one bedroom condos downtown can easily buy a home in Toronto as one beds are now over $500k and between two of them that is also above the current average home price. You certainly don’t have to be elite to do this. BTW my definition of elite would be the top few percent earners. Some elites might take offense at your definition!

Kramer

at 12:58 am

I get what you’re saying. And I know, the Elites in the Toronto Life high life schmoozing party photo section would take offence, but I don’t think that David actually meant that multi-millionaire definition elites would be living the houses at Jane and Finch (no offence to those who live at Jane and Finch).

I look at it this way… Take, for example, Danforth between Broadview and Main…6-8 years ago this was classic territory for a WIDE range of first time buyers to get into a semi for $400K or a detached for $550K… with a vibrant main strip and subway access. You didn’t need a household income of $150K+ per year. Today, semis are $700K and detached $1MM (generalizing), and as a first time home buyer, to get into this area you either need to have an almost-elite level job (and a good chunk of downpayment saved up for it from this job) or assistance from your family (…or maybe one inherited the house). Today, young double income families and lawyers buy there and not as a puddle jump on their way to Rosedale, but to settle there for the long haul. For the most part, a person starting from zero with an average job can no longer buy there… or like you said they need to get very creative in some other way… I agree in that you can always grind really hard to get in… but most people don’t grind that hard.

I see this trend continuing in the desirable spots… spots that have some X-factor if you will, be it subway access, near the lake, near a good stretch of shops/restaurants, good schools, whatever it is.

It will take a long time for all Toronto areas to evolve to have a desirable X-factor… so yes maybe in 50 years some of the currently less desirable neighbourhoods will still be affordable, but anything that is desirable and affordable TODAY will be long long gone in 50 years.

And yes I absolutely do expect house prices to keep going up over the long run… with some cyclical valleys sure, but long term trend is upward for this city. I know it’s considered hokey to say on this message board, but this is one of the greatest countries on earth, and Toronto is it’s biggest city and business hub (ex-oil production). Long-term in Toronto, prices are going UP.

Kramer

at 1:01 am

And when I say most people don’t grind that hard I mean because they want to have other things in their lives too, experiences, traveling, decent furniture, an extra kid, and don’t want to be house poor for their prime-time 30’s… which is a personal choice and as good a choice as any other.

Condodweller

at 11:19 am

“so yes maybe in 50 years some of the currently less desirable neighbourhoods will still be affordable, but anything that is desirable and affordable TODAY will be long long gone in 50 years.”

You are changing scope again by restricting it to desirable houses. David’s statement was that only the elite will own homes in Toronto in 50 years. I simply stated that’s never going to happen, well maybe not never but certainly not in 50 years, using the commonly accepted definition of elite and no further qualifications.

I get what you are saying but even with your tighter definition, you will be able to own a home as the city evolves. Ok, you won’t get a starter home in Rosedale but is that truly realistic? The cold hard truth is beggars can’t be choosers. If you can’t afford a house in a desirable location you start on the low end and move up if you absolutely want to live in Rosedale. When I was in high school I liked Porsches. Did that mean I went out and bought myself a Porsche as my first car? No, I bought a 10 year old Mustang for a $1000. A funny thing happened along the way: I got to a point where I could have afforded to buy a Porsche and yet I chose wealth building vs. wealth destroying and bought my first condo. Even after I got my condo there was a time I could afford a Porsche and yet again I chose to buy a second condo instead.

This is a longwinded way of saying that people would be much better off if they focused on wealth building instead of wanting a house. That may sound contradictory because owning a house could be part of wealth building but it’s not the start. At least not today.

Another thing is that you don’t necessarily have to grind for it. It’s interesting to note though that once you set a goal and grinding will help achieve that goal in a short to medium term, you don’t mind the grind so much. In fact, it might make you grind harder so that you can stop grinding sooner. You just have to be smart about it and make some good decisions along the way.

I never had a desire to live in Rosedale or any other “desirable” neighbourhood. I just wanted to start building equity. My first place was in a far from desirable location however it was perfectly fine to live there. There will always be a place that one could afford which is less desirable but just find to live there.

It saddens me to see people complain about their situation when they could significantly improve it with some relatively minor adjustments.

I should start my own blog to provide financial coaching instead of hijacking David’s blog 🙂

Condodweller

at 11:44 am

Take a look at David’s hot loft at 99 Coleman. It’s under your $550k that a first time buyer could afford and it’s a 5 minute walk to a subway station. You can have it today. It’s not a SFH but it’s close, in function. It’s basically a town home.

Kramer

at 11:49 pm

I may be changing scope, but only to discuss David’s 50-year prediction in a more practical way. Thinking practically, I understand what David is trying to predict and I think he’s more correct than incorrect.

I don’t think he TRULY believes that EVERY damn “SFH” in The City of Toronto will be owned by “Elites”.

– Yes, there will be neighbourhoods and areas exempt.

– Yes, there will be home sizes/conditions/situations exempt.

I simply believe that:

– 50 years is a VERY long time horizon.

– Toronto fits within a certain profile where continued growth (in practically every relevant metric) is highly likely.

– They are essentially not building any more SFH within a certain radius of the downtown core.

And hence… just as many people TODAY are crying out that SFH are generally not affordable… in 50 long years this will only get way WAY worse.

You’re right that if we really want to argue this then many elements need to be defined and the first would be what is an ELITE? My definition would be take the form of a financial qualification exercise such as:

Either:

– Net Worth > $X

or

– Net Worth > $Y, and Gross Household Income > $Z

or

– Gross Household Income > $W

Also, the geography needs to be defined. I only believe this prediction to a certain radius of the downtown core (again, with practical exemptions as per above). Haven’t decided what that radius is yet, I need to study the SFH markets in NYC, Tokyo, London first.

Kyle

at 1:44 pm

” It’s not a SFH but it’s close, in function. It’s basically a town home.”

99 Coleman is a 1+ bedroom condo, full stop.

Kramer

at 2:20 pm

Yah… that was a terrible example.

BJA

at 4:25 pm

“by definition [the GTA RE market] will have to come down at some point”

Not if population continues to grow at a faster pace than new housing is built. And I see little if any evidence that population (either worldwide or in the planet’s more desirable cities) will be on the downswing anytime soon (barring a Trump-induced nuclear disaster).

David Fleming

at 7:10 pm

@ Condodweller

Where did I round 5.6% up to 6%?

I’m not being facetious here – I’m asking, because I didn’t mean to, and I don’t see any place where I did.

Thx!

Condodweller

at 7:49 pm

My mistake David. The two places you listed the 6% increase it was in reference to 2016. I must have forgotten that fact by the time I wrote my comment. Sorry I don’t have time to re-read the article to fact check!

BTW it’s funny how percentages work as we need a 25.6% recovery to get back to the price before the 20% drop. Make that 26% 🙂

Sevyn

at 3:04 am

How can you not agree with David’s prediction of only the elite will own freehold homes? You’re silly not to agree. There’s only so much land to build homes. You can’t make more land!! Or maybe you feel somehow you can? RBC made the same statement last year, hence why I just bought a detached home in this market and left my townhouse behind last month. The government wants more condos and townhomes built and that’s their mandate. No more detached homes. It does make sense because you can build 4 townhomes or 6 urban townhomes on the same lot as a detached home. I hope you have one. Good luck in 50 years trying to get one!!!

Libertarian

at 2:42 pm

My two cents: people are upset because they believe that the run up in prices has not been tied to fundamentals – just as this CMHC report outlined

https://www.thestar.com/business/real_estate/2017/10/06/puzzling-toronto-real-estate-market-could-frustrate-push-for-price-fix-cmhc-says.html

What I find more interesting from the report is CMHC admitting that it doesn’t have the data to give definitive answers. That’s a black eye to the industry. We live in the age of big data, where everything can be traced, but not in real estate in this country. At least the gov’t seems to be trying to change that:

https://beta.theglobeandmail.com/news/british-columbia/court-orders-developer-to-reveal-condo-flipper-info/article36528239/

I’m a homeowner, so I have no problem with people wanting to own rather than rent. But I don’t think the craziness of the markets is being driven by primary residences – it’s amateur investors. The three levels of gov’t seem to be targeting this group, so I suspect that prices will cease to increase so dramatically.

David

at 7:26 pm

Excellent observations!!! Supply and demand are the main drivers. We are blessed with a huge country to live in and many of my clients make the economic choice to live outside Toronto. The same is true of any world class city

Tony

at 9:18 pm

David,

I would like to hear your comments on the recent new headlines by the major publications of “17,000” condo units being sold in the next two months and how this will affect the Short and Long-term condo market downtown.

I am neither a bear or a bull, but rather a realist understanding like most countries it becoming a place of “Have and Have nots”. Not saying it is right nor it will last, but it is what it is today.

Ralph Cramdown

at 9:07 am

For your consideration:

“Everybody says they’re completely open; flexible, willing to compromise, make concessions, etc. In practice, however, I find most buyers have no idea what “concessions” really are, and when you’ve got Cadillac-tastes on a Pontiac-budget, in this market, it makes it very difficult to get in tune with reality. Many of these buyers, unfortunately, get left behind.” — David Fleming, Sept. 25, 2017

“And no, it’s not because the buyers aren’t looking, or are waiting for the crash – my buyer clients are ready to buy, today, if the right property comes out. But we just aren’t getting the listings.” — David Fleming, Oct. 10, 2017

Thoughts?

Kyle

at 10:24 am

First quote is in the context of new buyer clients just entering the market and starting their search. Second quote refers to his roster of buyer clients (i.e. ones that he is actively working with and whom he presumably has familiarized with market conditions).

As an aside, noticed some of the more bearish commentors trying really hard to catch David in a gotcha moment these days, by pulling things out of context, mis-reading the posts, etc. IMO, lends some support to the angry bear image.

Ralph Cramdown

at 1:41 pm

For myopic bears, it’s hard to tell the difference between somebody who’s ready to buy today (except who won’t settle for any of the stuff

on MLS) and a sideline sitter. It’s October — most of the best inventory for the fall market is already listed.

“Things will get back to normal in the fall,” they said. Now it’s October, and the Leafs are #1 and averaging 6 goals a game, and Julian Fantino wants to sell me a bag of weed. Some normal.

Libertarian

at 2:03 pm

How about this one:

“I don’t believe that today’s buyer agents, many young, many inexperienced, many poor “A.F.” as the kids say, have any clue what any condo is worth. As a result, I often price my listings higher than they’re worth, because I know some rookie buyer-agent who needs a paycheque is going to do the “selling” for me.” – David Fleming, October 2, 2017

“What I’m seeing out there in the condo market right now is shocking.

Not to name names, but I showed a unit to investors on the weekend – east-side, 495 square feet, original 2004 finishes, priced at $399,900. That’s already $808/sqft, with no parking, and no locker.

But wait – there’s a hold-back on offers, and the listing agent told me on Saturday night, “I might be getting a bully offer, or two, tomorrow.”

So what does that mean? $425,000? $450,000?

Are we really going to see a 2004-condition condo, no parking, no locker, break $900/sqft?

Whether it “only” gets $808/sqft, or whether it breaks $900, the activity is just insane.

And it can all be traced back to the lack of product available on the market, which, of course, the TREB numbers do not show…” – David Fleming, October 10, 2017

David – which is it? Are condos really that valuable or are lazy agents simply telling their buyer clients to bid ridiculous amounts of money because they need a paycheque?

Where are all the veteran agents to smack some sense back into the marketplace by saying that a 2004 condo with no parking or locker does not sell for $450,000?

Juan

at 12:42 pm

Can we compare the proportions of home types sold from August-September? Or is that only done when average price drops?

Kyle

at 1:06 pm

Zolo graphs the Sales Volume by Property Type over time:

https://www.zolo.ca/toronto-real-estate/trends

Geoff

at 8:17 pm

I don’t get the anger either. Am I angry at those who bought Amazon when it was a penny stock? Of course not. Am I angry at those who bought bitcoin when it wasn’t a common thing? Of course not. So why are people angry at those who bought a house when they didn’t or couldn’t? This just in, life isn’t fair. There are winners and losers, and risk takers don’t always get rewarded. And those who don’t take risks, sometimes are. What I find funny is those who call ‘market peak’ or ‘market bottom’ when it can by definition only be known in retrospect. But in either case I think civil conversation is hard sometimes, especially on the internet. As Socrates said “you raise your voice when you should reinforce your argument’ comes to mind.

steve

at 6:11 pm

You don’t have to buy stocks or bitcoin, but you do have to pay for housing. Many see housing as a “right”, and expect prices to be within a reasonably affordable range.

Appraiser

at 10:06 am

According to TERANET numbers out today, Toronto prices are still 18% ahead of last year and Vancouver has risen like a phoenix from the ashes of a silly and possibly illegal and racist foreign buyer tax.

“In September the composite index was up 11.4% from a year earlier, a second consecutive deceleration from record 12-month gains of 14.2% in both June and July. The September 12-month rise was led by Toronto (18.0%), Hamilton (19.5%) and Victoria (14.7%). Vancouver’s rise of 10.5% from a year earlier was strong but below the countrywide average.”

Chris

at 11:33 am

Hahahaha racist? I didn’t realize “non-resident speculator” was a race now. News to me!

As for Teranet, you should probably read into how it is a very slow moving and lagging home price index. Even in the doldrums of summer as average price dropped, the Teranet index was surging. It’s a good Index for a retrospective look; for the present or future, not so much.

Kramer

at 10:48 am

Anecdotal:

There is a street near where I live that is a bit of a microcosm in terms of prices ($3MM+) which I track because it is easy to.

– From May through September, there were ZERO sales.

– In October, two sales, $3.1MM and $3.5MM.

Buyers are coming back, more detached houses in higher price ranges will appear in sales, and average price will increase again in October.

Chris

at 11:37 am

Kramer,

I’m just not seeing the “buyers are back” type of changes that you are. Sales figures remain paltry, MOI has been climbing, credit is tightening. A quick glance at Zolo shows sales down in all market segments, between -23 to -38%.

416 doesn’t seem to be faring as badly, but there are some areas in the 905 that are ice cold (York region comes to mind).

Kramer

at 12:19 pm

I admit that I don’t have much anecdotal evidence on 905.

Anecdotally, I personally focus on what’s happening along the subway lines… it just helps me keep a proper eyes-on grasp of at least something.

If semis near Lansdowne Station dive back below $500K, I’ll be the first to let you know!

Chris

at 12:34 pm

Haha fair enough. And as I’ve said before, I fully expect the 416 area to be much more resilient to correction.

But TREB covers a big area. And I personally cannot fathom why areas like Uxbridge, Stouffville, Georgetown, and Whitby are as expensive as they currently are. Comparable homes in regions of comparable distance/commute time to Manhattan are significantly cheaper.

I think the 905 is in for a much ruder awakening.

Kramer

at 1:08 pm

I hope you’re right… because I really want to buy some land between here and Georgian Bay one day.

Kramer

at 1:08 pm

Sorry that was meant as a reply to Chris below.

Chris

at 1:14 pm

I mean I can’t predict the future, but unless Barrie is now also among the ranks of “World Class Cities”, I don’t think there’s fundamental support for the current prices in those regions.

Jack

at 4:55 pm

Let’s look at some numbers, to see who will live in freehold homes in Toronto in the year 2067. There are now something like 400K such homes (detached, semi and row) in the city of Toronto, so at 2.5 person per household that makes a million occupants. Some new houses will be built and some torn down, but barring some natural or man-made disaster the number will not change much. The official plan assumes 3.4 million people living in the city in 2041. Let’s be generous and add another 1.6 million in the 25 years after that, for the grand total of five million Torontonians in 2067. So 20% of the people living in Toronto in 2067, give or take a few percent, will live in freehold properties.

Of course, that doesn’t tell us who will own those homes, as distinct from living in them. It is possible that by 2067 the freeholds will be owned by 10 or 5 or 1 percent of population, or by investors from elsewhere.

steve

at 6:05 pm

I think the bears are simply envious, and are likely wishing to see their more fortunate neighbours get taken down a notch …….. as for the future of the market, it seem to me the stress test will definitely has an impact on the market. Smaller mortgages will mean either far larger down payments, lower future prices, or both.

Luke

at 7:58 pm

Some words of wisdom for those “poor millennials” priced out of the market:

James 3: 14-16

14 But if you harbor bitter envy and selfish ambition in your hearts, do not boast about it or deny the truth. 15 Such “wisdom” does not come down from heaven but is earthly, unspiritual, demonic. 16 For where you have envy and selfish ambition, there you find disorder and every evil practice.

Appraiser

at 6:15 pm

Here’s Royal Lepage’s latest number crunching stats on the market: Courtesy CBC.

“The firm said that in the third quarter home prices in the Greater Toronto Area, Greater Vancouver, Greater Montreal Area, Calgary and Ottawa all went up by between 1.5 and 3.5 per cent from the second quarter. Royal LePage said those increases are indicative of a “much more balanced” Canadian residential real estate market.”

http://www.cbc.ca/news/business/real-estate-royal-lepage-1.4351590

Chris

at 8:44 pm

“”Marginally higher borrowing costs should dampen domestic demand somewhat, and with less currency-adjusted purchasing power, foreign buyer activity is off peak levels and will likely stay that way in the near-term,” he said”

Soper isn’t exactly painting a bright picture for continued appreciation!

“In a separate report, the Teranet-National Bank house price index in September showed its first monthly decline since January 2016, weighed down by falling home prices in Toronto.”

But Appraiser, you told me earlier the Teranet index was all roses?? This article seems to imply otherwise!

“A sharper slowdown in price inflation is unavoidable, said David Madani of Capital Economics.

“And with interest rates on the rise and mortgage financing rules likely to be tightened significantly later this year, the worst is still to come,” he said.”

Who to believe??

Appraiser

at 6:40 pm

Another reason that freehold properties won’t be flooding the market any time soon, aside from the fact that they aren’t making any more. Reverse mortgages hit record high:

http://www.mortgagebrokernews.ca/industry-news/homeequity-bank/homequity-bank-posts-record-growth-for-may-2017-229062.aspx

Many boomers (who own most of the freeholds) are choosing to age-in-place.

They don’t want to move and they’re living longer than ever. You can have my house…from my cold dead hands!

Chris

at 8:50 pm

Pretty sure they’re still making freeholds in many locations in the GTA. You do realize it encompasses more than just Toronto, right?

The article talks about tapping into equity to help children buy homes…but says nothing about staying in homes longer. Just more debt added to a generation that is statistically ill-prepared for retirement.

https://www.theglobeandmail.com/globe-investor/retirement/retire-lifestyle/many-boomers-wont-change-lifestyle-despite-worries-about-retirement-savings-poll/article34014998/

John Smith

at 7:11 am

I don’t know. If I was in the position to buy a 400k house in 2007, but chose to rent, I woud be bitter too, like really really bitter.