Geez, that’s like a Toronto Sun headline. But who doesn’t love alliteration!

As I write this, I currently have three clients looking for high-dollar, income producing properties, and all three have different goals and objectives.

How can you have different objectives, you ask? Isn’t the goal to simply “make money?”

Not necessarily. Let’s take a look…

Whenever I get a client who is looking for an income-producing property, I always start by asking them what their goals are when they invest in the stock market.

Now I know that the two markets are exceptionally different, and the comparison isn’t exact, but it’s a starting point, and it really helps hammer home their risk threshold, and objectives.

When you buy a stock, would you be looking for a steady 5-6% annual dividend, with lower-than-average risk? Or are you looking for a non-existent dividend, with the potential for the stock to increase substantially in value?

Now in the 2014 market, the question is hardly fair.

Shares of Royal Bank were trading around $64 to start 2014, and the dividend yield was around 4.2%. But since then, the shares have increased 25% to around $80, so who really cares about the dividend being increased from $0.67 per share to $0.71 per share when you’re looking at such a monumental appreciation in price?

Everybody in today’s market seems to be after massive gains on share prices as opposed to steady returns in the form of dividends, or payments from income funds, exchange traded funds, bonds, etc.

I have a friend who works for a pension, and several who work for a well-known wealth management companies, and while their opinions and objectives might differ, their companies are still looking to average around 8% per year for their clients.

Do all these people know something that the masses don’t?

“Slow and steady wins the race,” unless your goal is a learjet, of course.

So kudos to you if you’ve got your money out right now averaging 28% per year for the last two years. I’m sure many of you do, and that’s fine – depending on your risk tolerance, and long-term objectives.

When it comes to investing in income-producing real estate, the questions about risk tolerance, financial objectives, and long-term goals still apply.

Cap rates in Toronto will vary, but they’re between about 3.5% and 6.5%, and if I saw a cap rate at 7%, I just wouldn’t believe it.

So having said that, if you were looking at one property with a 3.5% cap rate, and another property with a 6.5% cap rate, what would have to happen for you to take the first property over the second?

For argument’s sake, let’s assume you’re looking at two properties, both priced at $1,000,000, where one provides a net income of $35,000, and one provides a net income of $65,000.

That $30,000 can be significant, or not, depending on your financial situation.

But what would the first property – the one with the 3.5% cap rate, have to possess that the second property does not, in order to make it the “better choice?”

This is where most buyers hit the fork in the road, as their objectives differ.

If the first property is in a prime area, and the second is not, then perhaps a buyer will look at potential long-term appreciation of the property as a massive advantage.

If ten years from now, the first property is worth $1,500,000, and the second property is worth $1,200,000, then where do we stand?

Well, the second property netted $30K per year more each and every year, and that’s $300,000. But the property also rose in value $300,000 less than the first one, so it’s a wash, all things considered.

The example is basic, but the point should not be lost.

The buyer of an income-producing property in Toronto needs to balance:

1) Monthly cash flow

2) Potential growth

These are the two main criteria, but it doesn’t stop there. What about:

3) Maintenance, condition, age of property

4) Management

Expenses can make or break your investment, as can upkeep and repairs. And if you’re going to manage the property yourself, you’d better consider how much you can take on.

But let’s add a fifth criteria here, and it’s something that should come as no surprise:

5) Location

Now certainly #2 – potential growth, is a function of location. But it seems more and more that buyers are willing to take on a lower cap rate to get a premium area.

So with that in mind, I want to look at two properties with similar cap rates, both that sold in the past year:

123 Huron Street

Style: Detached, 2 1/2 Storey, Built In 1914

Lot: 54 x 146

Units: 18

Parking: Laneway, No Garage, 4-Spaces

Utilities: Gas – Radiant, No Central Air

Net Income: $141,000

Sale Price: $2,755,000

Cap Rate: 5.1%

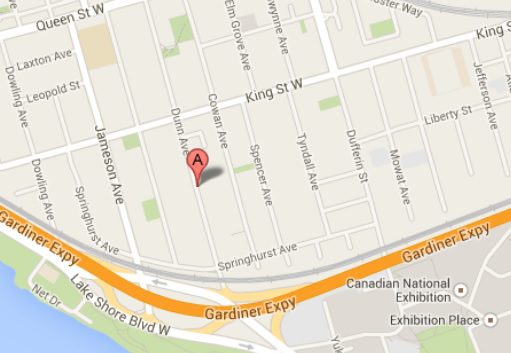

133 Dunn Avenue

Style: Detached, 3-Storey, Landmark 1882 Victorian

Lot: 52 x 165

Units: 9

Parking: Private Driveway, No Garage, 10-Spaces

Utilities: Electric Baseboard, No Central Air

Net Income: $120,000

Sale Price: $2,250,000

Cap Rate: 5.3%

–

Now I know that the information provided above is basic and certainly not enough to make a $2M decision, but since these properties provide generally the same cap rate, I’m curious to know how a buyer would balance:

1) Location

2) Number of Units

3) Growth Potential

I would have to think, hands-down, that 123 Huron Street is a better location. It’s absolutely prime:

Spadina & College, right in the heart of downtown.

It’s an established location, popular with renters, and close to transit and amenities.

Not only that, you have to figure that the demographic of renters will be young professionals who work in the area, or mature students in graduate school.

As for Dunn Avenue, we’re essentially in Parkdale:

It’s not as prime a location, and you might not attract as good a demographic.

But that’s truly judging a book by its cover, and perhaps over-generalizing.

What I find interesting between these two properties is that Dunn is nine units, and Huron is eighteen. So you might assume that the average unit is half the size at Huron, and thus the rent would be half as well.

So maybe you have eighteen low-end renters at Huron, versus nine higher-end renters at Dunn?

Again – we’re just throwing out ideas here.

But I would also consider how much more management goes into eighteen tenants and eighteen units at Huron, than the nine at Dunn. Shall we say twice as much management? Twice as many people to collect rent cheques from, hound about utility bills, and oversee?

Is eighteen units too many for Joe Investor to manage himself? Can he handle nine? Or perhaps we should adjust that 5.1% cap rate downwards, as it likely doesn’t account for a massive management expense that the new owner will incur.

The properties are both old, no doubt. One built in 1882, and one in 1914. So in terms of maintenance, we can assume they’re probably similar.

But is there any value in the 1882 Victorian mansion, perched above Lake Ontario where the city’s elite used to live? Will this area ever be what it once was? Or is that just nostalgia, with no tangible value?

This property will likely never be converted back to a single-family dwelling – all 8,000 square feet of it, over 3-storeys. That must have been some mansion back when Sir John. A. Macdonald was in his second term as Prime Minster of the newly-formed “Canada.”

The same goes for 123 Huron Street, as I highly doubt anybody would ever convert this back to single-family. So perhaps the style, history, architecture, and nostalgia of a home only applies to an owner who actually lives in the dwelling?

At the end of the day, I have to think most readers of this blog would “choose” the house on Huron Street, since the location is better.

But what if I told you that the rents at Dunn were low, and could be increased as renters move out? What if the cap rate there was 6.3% instead of 5.3%? Would that make a difference?

For me, I’d have to say, “no.”

A 5.1% cap rate for today’s market is more than reasonable, and the Huron Street location is an A+ location. But that’s just me. Every investor is different.

Then throw the idea of commercial properties into the mix, and it’s a whole other ballgame.

With the new Eglinton Crosstown LRT being built, a lot of commercial buildings along Eglinton Avenue West are going up for sale.

Would you purchase a 2-storey building with two stores on the main level and four apartments on the second level, if it came with a 3.5% cap rate, to try and “time” the market in 2020 when that real estate becomes more valuable?

Or would you stick to prime real estate like Huron Street, collect a lot more income each year, and take out some of the risk and speculation, while throwing away the potential for a bigger payoff?

Maybe in 2020, all those commercial properties on Eglinton Avenue West are being bought and packaged by a condominium developer who is looking to break ground, and suddenly you’re sitting on a gold mine.

Maybe. Maybe not.

Personally, I’d rather have what is prime real estate today than a chance it could be even more prime tomorrow.

And that goes for Huron over Dunn as well, even if the property is more expensive to manage, and generates less income.

But that’s just me.

So a quick show of hands – Huron or Dunn, in this example?

Have a great weekend, everybody!