I know I’ve told this story before on TRB, maybe more than once, but it underscores the thought process behind a new type of student housing that investors are flocking to.

I went to McMaster University from 1998 to 2002, and my brother and my girlfriend both attended Wilfred Laurier University, 45-minutes away in Waterloo.

After I finished school and started a career in real estate, the first thing I wanted to do was purchase an investment property. Go figure.

Cap rates in Toronto were a paltry 5.5% (we would kill for that now…) and yet for a student residence in Waterloo, we were looking at double-digits.

I made an offer to purchase a 10-bedroom student property for $500,000, and I lost. I lost in multiple offers, of all things, which was ironic considering it was commonplace in Toronto, and yet I was told by the agent in Waterloo that he had “never seen more than one offer on a property.” Imagine that!

I lost, which was a good thing. I was in no position to manage a 10-bedroom student residence, with or without the help of my brother as he attended 4th year business school, but more importantly – I didn’t really want to own a 10-bedroom student residence. At least, not after I saw how most students live.

We can all remember being students, right?

I know, I know – you guys never did anything wrong. You ate well, studied hard, and were making your parents proud.

But other kids were making an absolute mess of wherever they lived, often intentionally, just to see how quickly drywall burns when doused with lighter fluid…

From a long-term appreciation standpoint, any property makes sense as an investment. And as I’ve mentioned on TRB before, a small bungalow on a large lot on Ezra Avenue that I considered for around $350,000 was eventually torn down so that a massive 10-apartment complex could be built in its place. So, yeah, call it an opportunity lost.

But the idea of actually renting to 19-year-olds, having been a 19-year-old myself, having seen how both the best and the worst 19-year-olds live, simply did not appeal to me.

Does it work the same way in the Toronto market?

We have it made here. You can advertise a 1-bed, 1-bath unit for lease near University of Toronto, and get nine applicants, then pick and choose to whom you want to lease. If you don’t want to lease to a student, you don’t have to! Pick whomever you like.

Of course, you may find the “right” student, whatever that means to you, and decide to go forward.

This isn’t the same thing as a ten-bedroom house in the student ghetto in Waterloo. In Toronto, we’re talking about a 1-bed, 1-bath condo, for one student!

But what if we could split the difference?

What if, instead of buying a ten-bedroom house for students, and instead of buying a 1-bedroom condo downtown that you might rent to a student, you purchased a 1-bedroom condo unit in a purpose-built student residence?

I had alluded to this about a year ago when I wrote about the market in Waterloo, and how condos were selling very well there, and I included a condo in a purpose-built student building.

But now we’re seeing, get ready for this, pre-construction condos in purpose-built student residences.

What will they think of next?

There’s a project called “Luxe London” which, if you read their marketing material, basically sounds like the best investment in the history of mankind.

Luxe London is slated to be a 19-storey, 311-unit condominium strictly for students.

It’s currently being sold in pre-construction to investors who are being promised, among other things…..wait for it…

…100% assured rental income up to $75,000 over three years!

Yes, that necessitated bold and italics.

There’s an asterisk next to the $75,000 in all the marketing material, so if there’s no catch per se, it at the very least refers to the fact that this figure is applied to the larger and more expensive units. But from what my research tells me, these units have a waiting list, so maybe it’s not far-fetched for the developer to guarantee the rental income.

These units also come fully furnished, and for some reason I felt like that needed to be bolded as well. Anybody who has managed student rentals before will tell you that while there’s a lot of wear and tear on furnishings, students moving in and out every year (or semester) creates even more wear and tear on the house itself.

There are 2-bed, 3-bed, and 4-bed models, I suppose depending on your appetite for student rentals. Interestingly-enough, no 1-bedroom layouts.

This is the 970 square foot “Oxford” floor plan, with four bedrooms:

I think you could do a lot worse for a student rental! We’ve all been there.

Around 2005, I started to see this type of “apartment” layout being built within larger developments around Wilfred Laurier’s campus, only this would represent one “unit” in a 6-unit building. Essentially three levels, with two 4-bedroom units on each floor, and of course, built on the ground where a crummy bungalow once stood – one that housed five kids.

Developers were constructing these buildings and selling them based on the income stream, so they’d be looking for, say, $2,000,000 for the whole building.

There’s a small market for that kind of investment, but what if you could own one of these units, instead of the whole building and all six?

That’s where the condominium style of ownership comes into play, and it’s no surprise that developers are taking this approach.

What I find interesting about the layout above is, unlike with Toronto real estate, where more square footage means a developer is going to cram more dens, baths, and beds into the floor plan to charge more money, these layouts don’t follow suit.

There is a three-bedroom model called the “Cambridge” which is larger than the four-bedroom model; 995 square feet compared to the 970 square foot unit above:

I’m not sure if this would hold more appeal to investors, however.

I think I would rather pay less on a per square foot basis for a 4-bedroom, 970 square foot unit, home to four different rent cheques, than a 3-bedroom, 995 square foot unit, housing only three kids.

Now as for the amenities, here’s where I think the condominium-style of investing might have the traditional model beat. Don’t get me wrong, I would still rather own a crummy house on a piece of land, knowing I could sell the land down the line, just like the folks on Ezra Avenue in Waterloo did. But if you’re asking, “How can I get students to pay the absolute most money possible for a bedroom?” it would be by owning a unit with these amenities:

-Fitness centre

-Changerooms with Cedar sauna

-Yoga studio

-Movie theatre

-Spa lounge with tanning beds

-Video game centre

-Billards room

-Games room

-Cafe lounge with TV and fireplace

-Laundry room

-Rooftop terrace with lounge seating and stone fireplace

-Study lounge with private board rooms

Amazing that the only thing related to actually doing school work was last on the list. But, I mean, who has time to study when you’re busy tanning, playing video games, and doing yoga after a movie?

Damn, things have changed since Brandon Hall at McMaster…

Geez, I sound like I’m actively selling this project. I’m not, FYI. Just making a point.

So what are we missing here?

What’s lacking from this discussion?

Oh yeah, the price!

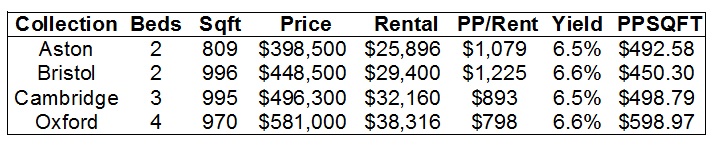

There are four models in the complex; the two shown above, and then two 2-bedroom units.

Here’s the breakdown:

It should be noted that the “Bristol” model comes with an awesome 855 square foot terrace. Although personally, I wouldn’t want students owning a terrace. Call me naive, and call this stereotyping, but I just don’t see them lasting more than a week without pissing over the railing, and eventually throwing beer bottles.

So a couple of things jump out at me here:

1) Do students really pay $1,225 each? That seems a bit high to me, but then again, it’s been 17 years since I leased a small, 1-bedroom apartment off campus in Hamilton for $590.

2) The premium for the terrace is $146 per month, per student.

3) The rental yield is almost exactly the same for each unit.

4) The price per square foot is highest for the largest space, which also has the lowest rent per person.

And I guess I could add the obvious: the price per square foot is a wee bit less than here in downtown Toronto!

I have access to the cash flow statements, which I’m not going to share here. But I will tell you that the cap rates for these units are as follows:

Aston – 4.6%

Cambridge – 4.6%

Oxford – 4.8%

No expenses were provided for the Bristol, but because of that terrace, I’m assuming it’s a rare model.

The marketing material shows a Return on Investment of about 33% per year for all three units.

This is based on the mortgage principal paid, plus net monthly cash flow, plus an assumed 4.5% appreciation, all as a percentage of a 20% down payment.

Of course, I wanted to work backwards and see what the ROI would look like if we assumed zero percent for appreciation, and in the end it’s about 10.5%. Still not bad, and better than Toronto. But, and there’s a multi-point but here:

1) You have to rent to students.

2) You own in London instead of Toronto.

There are other benefits here though worth noting, however:

1) These units come furnished.

2) Three years of free property management.

3) The deposit is a paltry $20,000.

Here’s what a recent email blast about the project claimed:

Their “Top 5” point #3 is interesting. Student housing is a “recession-proof” investment.

While a recession would undoubtedly knock down the asset value, I don’t disagree with the idea that “kids have to live somewhere.” And much of the marketing material for this project speaks to the incredible increase in university attendance rate in recent years, the addition of far more foreign students, and the need for more purpose-built rentals.

That last point sounds familiar for those of us living in Toronto, but that’s another story.

So to the investors among you, real or armchair, does this project make the grade? I’m all ears…

Ed

at 9:08 am

Hey David,

you showed the 4 bedroom layout twice.

Is there a link for the 3 bedroom layout?

I can’t see it on their website.

David Fleming

at 10:51 am

@ Ed

Thanks for the head’s up! I’ve corrected it.

The 3-bedroom layout clearly picks one student who is better than the other two…

Ed

at 8:01 am

Student owner with two tenants.

Condodweller

at 9:19 am

NOTE: You’ve uploaded the same floor plan twice.

This is interesting. A student housing landlord takes a special kind of person. There are so many variables it’s hard to judge based on the presented information and it would take considerable due diligence to evaluate this.

1. it’s great that enrollment is increasing but I’d want to know about the competition. Is the building walking distance for students and how much existing housing is near by and how much available land is nearby that can be turned into similar housing?

2. Is there enough demand that you could stipulate a full year lease and not have to have the unit empty for 3-4 months/year?

3. My biggest concern would be the maintenance of the common elements. I would want security cameras covering every square inch of the place so that damages can be billed back to a unit otherwise maintenance fees are going to be a big problem.

4. What are the legal ramifications of renting to students?

5. what are similar student rentals prices in the area? If this is a new type of housing it may be hard to predict a realistic income level.

Regarding their pros:

#2 how would it be less wear and tear?

#3 That’s probably true though would enrollment not go down if parents can’t afford to send their kids to uni?

#4 this is a big one. Are they willing to back that up with a written guarantee where they pay all or portion of the rent if the unit is vacant? A guarantee is not worth anything without an obligation.

#5 Would these units not be considered condos and therefore don’t come under rent control? They look like a condo to me but it raises the question of what type of ownership is this? Are they going to be registered as condos and regulated under the condo act?

These are my initial thoughts. I personally look for value and while they are cheaper than Toronto condos they don’t jump out as good value at these prices (at first glance).

bijan

at 8:40 am

#5 Condos fall under rent control, but students usually don’t stay long term so you don’t have to worry about rent control due to turnover.

Kyle

at 9:21 am

I heard about these yesterday and my thoughts, were the following:

– Seems to be marketed to Torontonian investors, which makes me think locals who are more familiar with the market are not really interested. Maybe they know things we don’t, and when it comes time to sell, will you have to find another Torontonian to buy it?

– I’ve heard the stories about condos that are predominantly renter occupied and those are actual adults. I don’t think i want to own something in a building that will be completely occupied by people who have lived under their parents’ roof up till now.

– What happens if market rents don’t live up to the guaranteed rent after 3 years, will everyone be trying to sell at the same time? And to whom?

– Most purpose built Rental Developers care about rental supply and demand and long term rent outlook before they build, but in this case the Developer is just off-loading any future rent risks, so what’s to stop him from building a dozen more of these types of projects after you’ve bought?

– Far more flexibility and better value (IMO) to buy a home like this one to rent out:

https://www.realtor.ca/real-estate/20261312/4-bedroom-single-family-house-1079-richmond-street-london

Graham

at 9:22 am

Luxe London has been built and occupied for at least three to four years now, but I believe the developer has maintained ownership of all the units and rented them out to students.

Maybe they are now trying to sell the units to investors?

Condodweller

at 9:43 am

This is good information to know. On one hand, if it’s such a great investment why are thy trying to off load them now? On the other hand if they have a few years of history and can prove 100% occupancy along with photocopies of all cheques or other proof of payment then it might be worth considering.

Jason

at 10:07 am

As an investor, I have been approached quite a bit in the last 2 years or so about this same model in University towns across the GTA as well as Kingston and Ottawa. It seems to be increasingly popular. As a general rule of thumb, the returns are higher on student rentals, but that comes at a cost. Student rentals, are for the most part, going to require much more active property management than a regular investment condo will and maintenance costs will be much higher due to the wear and tear of the student lifestyle. This may not be apparent in the first 2-3 years, but over time these units will not hold up very well and if the unit is outside the area where you live, professional property management would be necessary which will further eat into profits. Also, many student landlords will include weekly cleaning services in order to maintain their investment and as a way to check in on students. Finally, the biggest issue that I see and the main reason why I haven’t invested in them is what’s the exit strategy down the line with this model. No end user will purchase these units in the future and live in a student dorm so you’re marketing your unit to another investor who wants to invest in student rentals. If you have an entire building (6, 8, 10, 12 units) who can easily sell to other investors who will be looking for scale and multi-family opportunities, but for a single unit in a larger building, I think it would be difficult to exit the investment and recoup your capital to deploy elsewhere, if necessary.

Appraiser

at 10:13 am

Too much maintenance for me, both mentally and physically.

J

at 10:23 am

The numbers above for yields and cap rates don’t quite add up for me. For example, the Aston has a gross yield of 6.5% and a cap rate of 4.6%. If I’m correctly understanding what these figures mean, this implies operating expenses of 1.9% (6.5% – 4.6%) of the property value or $630/month for both units ($398,500 x 1.9% / 12).

Property taxes alone in London are 1.35%, or about $450/month in this case (although it could be less depending on the assessed value).

That leaves about $180 per month to cover the following expenses for all units:

– Maintenance / condo fees (a rule of thumb for maintenance is 1-3% per year, which equates to $333 to $1,000 per month…and with furnished units with high turnover and students, there would be wear and tear in spite of their claim otherwise in reason #2 in their top 5)

– Insurance (just guessing, but this probably isn’t cheap when you cram a bunch of students into a small space)

– Utilities (assuming the claimed market rent numbers above are inclusive of water and hydro)

– Internet (are the claimed market rental prices inclusive of this?)

– Property management – this is a big consideration especially with turnover every 4/8/12 months. Even if you do all this yourself, your time is worth something. Typical property management fees are around 5-10% of rent, or $50 to $100/month in this case.

– Vacancies and delinquencies

And please don’t get me started on that 33% ROI figure. If a mutual fund were advertised in the same way, the manager would likely be fined, barred for life, and possibly thrown in jail (and that’s in Canada’s lax regulation environment).

Libertarian

at 11:11 am

Your last paragraph took the words right out of my mouth. How can the real estate industry continue to get away with stuff like that?

Something else that might change the numbers is our Premier Dougie. He’s changing the tune on tuition/grants/loans etc. We don’t know how that’ll impact students going forward.

Kyle

at 11:29 am

Maybe not jail, but there’s precedent for them to still be sued for making any negligent or misleading representations.

https://business.financialpost.com/real-estate/property-post/trump-hotel-toronto-building-set-to-be-sold-after-developer-defaults

J

at 12:20 pm

That’s a fair point. However, I believe that case was a civil lawsuit brought about by the investors. As far as I know, there’s no regulatory body in Canada/Ontario that prevents real estate developers from making grandiose claims to investors about ROI.

Libertarian

at 4:40 pm

The OSC looked into it the Trump Tower, but declined to take action.

https://www.theglobeandmail.com/report-on-business/osc-wont-take-action-against-torontos-trump-tower/article5958123/

Based on that, the civil suit didn’t go anywhere.

http://urbantoronto.ca/news/2015/07/court-and-osc-rulings-vindicate-trump-tower-developer

But this is another example of why I believe the rate of return of real estate is always overstated, especially by the investors. This is worse because it’s the developer!

Gabby

at 4:54 pm

Do you mean investors (i.e. pension funds, mutual funds, etc.) or “investors” (i.e. retail folks)? If the latter, then, well, I shed no tears for them.

A Grant

at 10:38 am

Am I missing something re: the condo pricing/yield breakdown? Specifically the costs associated with condo fees? I’d expect that these would be a lot higher than a typical condo unit, given the tenants (i.e. higher maintenance requirements for common areas, increased security, etc.)

Moonbeam!

at 12:00 pm

David – when I went to Western (in the 60s!) there was an off-campus townhouse complex called University Village owned entirely by Grebb of the Hush Puppy company….. only renting to students! The units were furnished 2-storey, 2 bedrooms, built around a grassed quad with a tuck shop and a free hourly school bus service to campus. I lived in one unit with 3 room-mates for 2 years. I have the best memories of living there. Sadly I learned that years later, the complex was sold and the units were sold as condos

London Agent

at 12:51 pm

I’m a bit surprised to see this project come up on this blog. While I think it’s cool that our small university town is being noticed by you folks in the big city, I wish it wasn’t about this project! As per Kyle’s comment, I don’t know anyone in our city that has sold one of these units to an investor in London. When this project was originally launched, the VIP launch event was held at an international business centre in Mississauga, surprisingly not in the city where the project is located!

When we were originally told the prices of the units, I was astonished at the prices these were being advertised at. A 4 bed condo for almost 600k??? You could buy three, 3 bed townhouses by the college for that amount. I was then sent the projected income/expense statement from an agent in Mississauga (who was beyond excited to try and sell me on these) and it made even less sense to me. While David is right that these statements indicate these units offer a 4.6-4.8% cap rate, the only expenses they take in to account are taxes and condo fees (which combined, range from 7500-10,100/year depending on unit). Maintenance? Delinquency? Vacancy? Property management (only free for two years)? Even if you ignore these inevitable expenses, your new 4 bedroom condo provides $4100 in cash flow over the entire year (other units provide less cash flow).

Yes, this building was built ~5 years ago and has been fully occupied since. (There is a main floor commercial space that has remained vacant the entire time). Having been inside this building, the units and amenities are superior to anything else in the city as far as a student might be concerned. It’s within walking distance to the school, is surrounded by other high density student rentals, and is in high demand.

I don’t think the rental income guarantee means a whole lot in a city where the vacancy rate has dipped to 1.8%. This developer is also building another student rental building further north of the university FYI…

David Fleming

at 3:12 pm

@ London Agent

While this remains TORONTO Realty Blog, I’ve always loved looking at real estate outside the city to gain perspective. Whethere it’s in the Golden Horseshoe, or comparing to other world-class cities like New York, or showing off my own private Idaho, I feel it only adds to the overall knowledge base of the TRB reader.

Thanks for sharing your insights!

Verbal Kint

at 3:54 pm

Wait, David says “Luxe London is slated to be a 19-storey, 311-unit condominium strictly for students. It’s currently being sold in pre-construction to investors […]”

And on-the-ground agent says it’s been built for ~5 years now??? Big difference between… yeah, never mind, whatever…

crazyegg

at 4:37 pm

Hi All,

This type of investment seems to be the current flavour of the month.

There are student condo units going up also in Oshawa and Ottawa, etc.

As an experienced investor and landlord, I think I will have a pass on this one.

Finding tenants is generally not an issue in Toronto, so having a having a “100% occupancy rate” becomes a moot point.

There will be no owners living in these student condos so the level of engagement and pride of ownership will be nil (i.e. there will be ZERO emotive input in the purchase decision which means no bidding wars). These factors will negatively impact future resale value.

Regards,

ed…

Joel

at 6:49 pm

As a mortgage broker I have had a few people trying to secure financing on a similar unit that is just closing on Waterloo.

No lenders want to touch these. They hear student rental and worry about the resalability. If you are looking to buy plan to have 35%-50% down and rates that are significantly higher than standard rentals.

Not sure why developers dont think about this ahead of time. I know many buyers dont think ahead as they are thinking about the money they could make. Can be a very costly lesson.

Ed

at 8:07 am

The insights provided by London Agent and mortgage broker Joel are excellent.

Sarah

at 12:57 pm

@David Flemming

Please please please case study Patry Inc. in Kingston Ontario who build student rentals that closely resembled this (however, the developer was the LL – I don’t believe they were sold to individual owners). TOTAL DISASTER!! The building is a dump, and a mockery of the town.

Not sure if it has improved over the years but.. buyer beware (or in this case, renter beware)

Mark

at 9:02 pm

What are the monthly condo fees? Do the marketing materials say what the property management fees will be once the 3 free years are over?

Shawn

at 2:42 pm

I think this property appeals to GTA would-be real estate investors who might be priced out of the Toronto market. They might also like the idea of a hands free opportunity. You don’t have to meet, screen or find tenants. A 5 year fixed property management fee included doesn’t hurt. If you combine that with a fixed rate mortgage, your only big wildcard is an increase in maintenance fees (and you have a couple hundred$$ wiggle room before going cash negative) . With a 400K entry point, and a contracted (no vacancy) rent of $25,680 per year, that’s not easy to find in GTA. Sure, If you are living in London, a 5 bedroom student rental will cash flow more, but its a bit of work. And if you have to commute from Toronto, it sounds like a part-time job. The appreciation rates sound a little optimistic, but if you assume the appreciation will only be at inflation (2%) The numbers still don’t look too bad. If you don’t like speculation ie. I ONLY make money on this Toronto condo if I have low vacancies, AND the market continues the double digit growth that we have seen in the last several years.

Here, if growth slows to almost nothing, at least it cash flows. Also, there is a growing upper middle class around the world, who want to send their kids to Canada to be educated. I think the demand for a self contained two bedroom in a nice building walking distance to the campus, stacks up well compared to sharing a 5 bedroom house with other students. I don’t see vacancy ever being an issue.

Chris

at 12:34 am

Great Stuff

some students want to be able to study in their dorm rooms, colleges offer quiet housing options for students who need a calmer environment than the average residence hall might offer. visit:https://www.themyriad.com/

TANSUKH PARMAR

at 5:17 am

Sir, my son is currently in Waterloo, and working, I am sharing my thoughts when I visited Waterloo for the first time in 2022,

I have known and experienced that nowadays students are compromising a lot in terms of accommodation and food.

This problem for the students gave me a business idea, and I wanted to look at a chain of four houses next to each other on Orb Street in Waterloo, but I was unaware that I would get permission to demolish the existing building and build student housing. Or not, while investigating the matter, it came to know that in Waterloo it takes a long time for all kinds of construction permits,

I am interested in constructing student housing in Waterloo, Kitchener or suitable place, so please kindly advise me in this regard,