“One, two, three, four, seven, eight.”

That’s what my daughter just said, for no apparent reason, as she sits at the dinner table next to me and eats her noodles.

Yes, I am writing a blog as she eats, but that’s life. That’s my life.

I remember life before my daughter, and while most people with kids rhetorically ask, “What did we even do before we had kids?” I remember. Vividly.

For one thing, I would play golf every Sunday.

I mean, why not?

Did my wife care? Not in the slightest! We were footloose and fancy-free, not tied down, with the only responsibility in our lives being a dog, and I guess, each other.

After working 7-day weeks for the better part of a decade, I cut back to six days several years ago and decided I would golf every single Sunday, so long as I could find a partner.

Call me a creature of habit, or simply let me admit that I like routine, but every Sunday at 10am, I would pull up in front of the Tim Horton’s on the southeast corner of Jarvis & Dundas, order a “Bagel BELT” and a large regular coffee, and proceed to head north on the 404 for about 45 minutes to one of a couple of golf courses we frequented.

Upon meeting my friend at the driving range, he would always see the Tim Horton’s coffee cup and ask, “Any stories this time?”

For those of you that remember that particular Tim Horton’s location, let’s just say it was a bit………..odd.

Jarvis & Dundas was never a great corner, but the area surrounding Jarvis & Dundas can be a bit sketchy, depending on which way you walk. And many Sunday mornings, that Tim Horton’s would resemble The Walking Dead, with zombies stumbling around out front, and often inside the Tim’s.

We’ve all seen aggressive pan-handlers in our lives, but how about inside a restaurant? How about a foaming-at-the-mouth vagrant leaning over you and your breakfast sandwich, asking you for the 9th, 10th, and 11th time if you have money for (apparently) food?

That Tim Horton’s was a scene, man. Let me tell you.

But it was my Tim Horton’s scene, and the experiences always gave me a story to tell.

There was one neighbourhood resident who was always inside wiping down tables, hoping that people would give him change. The folks at Tim Horton’s let him do it; I’m not sure why, but perhaps they saw that he was making an effort, and he was polite, and presentable. After a couple of months, I saw him one weekend wearing a Tim Horton’s t-shirt and hat. I didn’t think it was my business to inquire, but I wondered if they officially gave him a job, or if they just let him wear the gear, and threw him a few dollars.

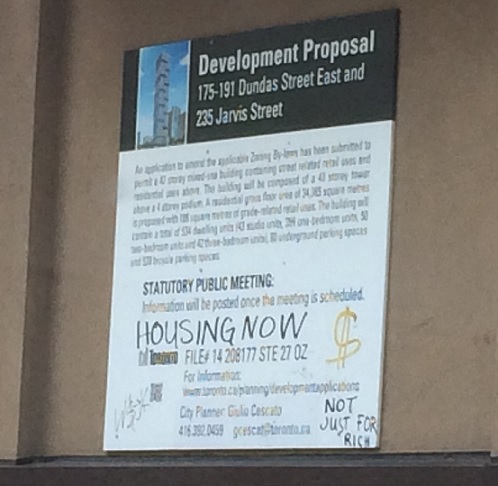

Eventually, the inevitable “DEVELOPMENT PROPOSAL” sign went up on the west-side of the building, and I remember taking a photo of the sign after a couple of weeks, which I shared on my blog:

At the time, I remarked that the whole “Housing Now” demand was a sign of things to come, and the “Not Just For Rich” was, in itself, a bit rich. After all, truly “rich” people would not be investing in condos at Dundas & Jarvis.

The building was torn down in either 2015 or 2016, I can’t quite recall. But I do know that the following summer, I changed my pre-golf routine to frequent the Tim Horton’s at King & River Street instead.

And boy was it ever boooooring!

In any event, if you returned to the intersection of Jarvis & Dundas today, you simply would not recognize it.

There are condos on three of the four corners:

SW: 159 Dundas Street East – Pace Condos – 35 Storeys, 272 Units, Built in 2016.

SE: 181 Dundas Street East – Grid Condos – 47 Storeys, 528 Units, Built in 2018.

NE: 200 Dundas Street East – Dundas Square Gardens – 48 Storeys, 968 Units, Built in 2018.

Not to mention, just south of 159 Dundas Street East is a new 30-Storey student residence called “HOEM,” which was finished in 2017.

Now to be totally honest, and here is where I run the risk of angering people who live and/or own in these buildings, let me say this: there are many areas of Toronto in which I would rather live than Dundas & Jarvis.

I think everybody would agree, except, um, you know – those that live and/or own there.

Now if the area offered a substantial discount from, say, King & Jarvis, then eventually the potential purchase would make sense for the right buyer.

Where prices are going is exactly the underlying topic of today’s blog, and I say “underlying” because it’s actually a by-product of the surface topic, which is the insane amount of inventory currently available at Grid Condos.

Grid Condos was registered as Toronto Standard Condominium Corporation #2694 late in 2018.

Many unit owners had already leased their condos out during “occupancy” (the time between taking the keys, and the condo being registered), but many, as is often the case, did not.

Now that the building is registered, we’re starting to see units hit MLS, and this is where my eyes just about popped out of my head today.

For context, there are 528 units in the building.

Can you guess how many units are up for sale at the moment?

4.

Four units up for sale, out of 528 units in the building. That’s less than one percent!

Can you guess how many units are up for lease at the moment?

Well, hold on. I’m not going to give it up that easy.

For context, how many units are up for sale in some of the more sought-after buildings further south?

33 Lombard Street – 1

55 Front Street – 2

230 King Street – 1

168 King Street – 1

39 Sherbourne Street – 2

333 Adelaide Street – 3

112 George Street – 2

138 Princess Street – 1

Okay, fair.

So how many units are up for lease at 181 Dundas Street as of this writing?

151.

That’s not a typo.

One-Hundred-Fifty-One.

Be honest – what are you thinking? I’m dying to know.

Kind of a lot, wouldn’t you say?

Now my opponents will simply say, “David, you know this is common. The building was just registered, and that’s when people look to lease or sell.”

Very true, and I’m not denying that.

But, I mean, what if there were…………….say………….forty? Forty units? Would that be a lot? Because I think it would be!

151 units for lease in a 528 unit building. That’s almost thirty percent. And while I don’t track this sort of thing and can’t provide context on a relative basis, I think we can all agree that on an absolute basis, 151 units for lease at the same time is just nuts.

Not only that, an even fifty units have already been leased in the building, and that’s only since January 13th!

Do the math – that’s 1.19 units being leased every day!

So what happens now?

Now that there are still 151 people in the building looking for tenants?

Well, now we see the powers of supply and demand work in the opposite way that we’re used to. Now we see unit-owners under-cut each other on price in a way that we see in bear markets. Now we see a glimpse of a world that would-be-buyers, market bears, and dreamers of all kinds long to experience in Toronto!

In terms of what is available in the building, I think there are 91 one-bedroom units and 60 two-bedroom units, but because so many owners of “1-bedroom-plus-den” models are trying to pass the den off as a second bedroom, I can’t be sure.

The one-bedroom units range in price from $1,800 per month to $2,400 per month, but of course, these are different layouts.

So let’s pick one particular layout and see just how messed up the pricing is in here.

The floor plans don’t have cool names, so we’ll just have to settle for one called, “GRID560,” which appropriately measures 560 square feet.

There are currently eighteen of this particular model and layout, with the same view, and the lease list prices are as follows:

$1,850

$1,850

$1,950

$1,950

$1,950

$2,000

$2,000

$2,050

$2,050

$2,100

$2,100

$2,200

$2,200

$2,200

$2,250

$2,300

$2,300

$2,400

Now I’m no math major here, folks, but I’d say that the delta between highest and lowest in this case is a little too high!

And not only that, you might need to ready the rubber-room for the folks priced at the higher end of the spectrum, because they’d have to be nuts to think they can get that kind of action.

I honestly can’t tell you how often I come across this kind of lunacy. Whether it’s a seller over-valuing, or a wishful-thinking buyer hoping that an offer of the “full list price” has a hope in hell against nine competing bids, lunacy is alive and well in real estate.

What goes through the mind of the person priced at $2,400?

“Well, there are two units up for lease at $1,850, and three more under $2,000. The median seems to just over two-grand, so, I think, hmmmm…….I think…….I think I’m going to ask $2,400.”

You might be wondering, “Is there anything different about this particular unit?” and the answer is “no.”

It’s not furnished, it’s not a penthouse (as though you’d pay $550 more per month to be up a few levels?), and no toilet-seat-warmer, corian counter, or slightly-better engineered hardwood floor can make an $1,850/month unit worth $2,400.

These units are essentially all identical, as they’re all owned by investors who bought off floor plans and didn’t put any thought into “upgrades.”

Now guess how many of this model have been leased thus far?

Two.

And guess how much they were leased for?

$1,850 and $1,875 per month, respectively.

So did those owners just bite the bullet, or is that what this model is actually worth?

Fun question, right?

“A property is worth what somebody is willing to pay for it,” the saying goes. So in this case, could we argue that even if the two properties that leased were owners “biting the bullet” that it doesn’t matter, and that this is the true value of the property for lease?

What if the next two units lease for $1,825 per month? Then the next one goes for $1,800? Where does this end up?

There’s a real prisoner’s dilemma here, or call it unorganized collusion, but if I were the owner of one of these units, I’d look to get a tenant in there asap at $1,850 per month. I don’t see prices going up any time soon, with 18 of the same model up for lease, and another 70-something 1-bedroom units still competing.

In the end, I’m not surprised by any of this.

These buildings were never going to be targeted by end-users; not based on what was in this location to begin with.

Nobody who frequented that Tim Horton’s restaurant and said, “You know something? If they ever tear down this place, and the cheque-cashing place next door, and the sketchy convenience store next to it, I’d really, really like to live here.”

This building, and likely those in close proximity, were always going to be targets for “investors,” and I put that in quotations because they are so-called investors, as evidenced by those trying to get $2,200 – $2,400 per month for an $1,850 unit, all while competing against 90-something other listings.

With 151 units currently up for lease, 50 already having been leased, and more being listed every day – all in a 528 unit building, I think it’s safe to say this building was primarily bought out by investors. There’s nothing necessarily wrong with that, as this is the case for many other condos in the downtown core, some of them being great places to live, but I bring this story to your attention because it provides a warning that few will ever choose to notice.

If you were an “investor” in a building where 151 units were up for lease, and your unit was sitting vacant, burning a hole in your pocket every month, you should be scared sh!tless.

Vacancy rates in Toronto are less than 1%, so the market will eventually absorb all of this inventory, but at what price? And after how long? How many of these investors worked this into their forecast when they first purchased? How many can absorb the financial repercussions of settling for $1,850 per month when they thought (or were told/promised by the developer and/or property management company) that they could get $2,300, all after four months of vacancy?

We’re constantly told that real estate is foolproof in Toronto, and that losses are near impossible. On a long enough time horizon, I would agree. For an experienced individual, of above-average intelligence, financial literacy, and general business savvy, I would think it’s tough to miss in the long run.

But there are going to be some losers in this project, that’s for sure.

I don’t know how long it will take for the market to absorb 151 more units, after having already taken on 50 in a mere forty-two days, but I would imagine several people are going to take it on the chin here.

Comically, as the rest of the market suffers from drastic under-supply, in virtually every price point, geographic area, and property type, we’re sitting here looking at a building where 30% of the units are up for lease.

Real estate.

She has a fickle heart…

Andy

at 9:25 am

David, do you know of any other buildings downtown that currently have even 10% or more of the units on the market?

This looks disastrous to me. But as you said, context is needed.

Jackie

at 9:59 am

I see that this includes just listings on MLS, does not take into account anything listed on kijiji.

Libertarian

at 10:49 am

If that’s the situation at Grid Condos, I’m curious about the situation at Dundas Square Gardens where the same number of storeys has almost twice the number of units.

Another David

at 11:08 am

You should take a look at 87 Peter street, completed many month earlier than Grid, but currently still showing 45 units for rent out of 500+ total units.

I suspect as the year go on we will see a lot more of these things showing up. As the drastic run up in prices in 2016-2017 made lots n lots of people believe real estate is a sure bet. At the intersection of Strachan Ave & E Liberty St, I see three condos under construction at the SAME time!

Jason

at 1:07 pm

I’m an investor and I have a unit at 87 Peter that I took possession of in September 2018 and it just registered in January 2019. Of the approximately 550 units in the building, there are 497 studios and 1 bedrooms, including 1 bed + den. That’s 90% of the building. I generally like to purchase units in smaller, mid level boutique buildings where the number of units doesn’t exceed 300 units. In larger building, I would buy a unit type that I know is not going to have a lot of competition. In this building, I bought a 2 bed, 2 bath unit with locker and parking and it leased rather quickly and there was only 1 other comparable listing on at the same time.

Carl

at 11:09 am

Very interesting. It is good to have some real numbers, as an antidote to empty speculation. Even more interesting would be to come back in six months to see what has happened with those units currently listed.

Mike

at 11:18 am

This reminds me of how quickly the Sugar Wharf project sold out. Clearly the “investors” had never set foot anywhere near that factory in the summer months.

Professional Shanker

at 12:24 pm

But that is close to the water front, stinky sugar factory aside.

That area is growing like a wildfire! Being close to the water and proximity to the financial district, good combo.

Condodweller

at 4:26 pm

Also, the sugar factory might not be around forever. This is akin to the slaughterhouse at Keele and St. Claire. When I saw those townhouses go on sale I questioned who in their right mind would buy there. But over the years the neighbours forced the shutdown of the plant and it’s all good now. Especially if people were able to buy at a discount due to the stink.

Appraiser

at 12:14 pm

Note to bear / clowns eagerly consuming outliers and anecdotes to bolster the brand.

Has that condo crash of 2013… ’14 ’15 ’16, ’17, ’18 still not happened yet??

Professional Shanker

at 12:35 pm

One key reason – Airbnb. Condos have become a form of short term hotel rental. Currently, policing Airbnb rentals is not working and this drives up the price of condos. How much, well that is hearsay but I believe it has been a massive tailwind to short term prices. Why because you can’t make money as an investor long-term buying at $1,000/sq ft renting at $2k/month. Appraiser care to disagree on this?

Let me guess you knew the impact Airbnb would have on condos back in 2013, right?

Interesting Airbnb article posted in the NY times – worth a read. This is happening (obv to a lesser degree) in all large cities across the world. Will post the link.

Professional Shanker

at 12:36 pm

Airbnb New York lawsuit link – worth a read

https://www.nytimes.com/2019/02/23/nyregion/airbnb-nyc-law.html

daniel b

at 4:37 pm

so 40 units / month being leased with 150 units available for lease – ie 4 months of inventory. I dunno, the strong takeaway from this to me is that the rental market is strong and those units will get absorbed up pretty quick. As with all forward looking statements – who the hell really knows! But this particular data point to me is a purely bullish read.

Also, at 40 leases per month being signed, you’d clear the lower priced units pretty fast. Maybe the landlords holding out at $2100 will only have to wait two months to lease their units and net out ahead?

Anyway, as mentioned, the future is murky but if you read this as bearish then what is a bullish indicator?

Another David

at 11:34 am

In earlier part of the article, the author mentioned most units tends to be rented out before building is registered. Thus seeing so many units listed for rent after the building is registered is clearly a surprise.

Also, I did a count on Condo.ca. I only see 16 units rented out in Jan and 27 in Feb as of 2019-02-26 (perhaps data is delayed by a few weeks). And the number of listing had only gone up.

The rent market was very tight, but part of that was due in part to Airbnb taking away supply (6.5k units by one estimate). You should check out the legal appeal case regarding a new Toronto Bylaw if you are interested. If the appeal fails, it would be illegal to rent out investment properties on Airbnb in Toronto, putting back thousands of rental units back on the market.

Daniel

at 11:36 am

that sounds like great legislation. 6500 units should cover like two months of additional supply the city needs to keep up with household formation. Now, I don’t like airbnb in apartment buildings because i think it’s a nuisance and a fire risk for other residents. But to argue 6500 units being held off the market for air bnb is the cause of the housing market problems or that reversing it is going to crater the condo market, is to completely misunderstand the scale of things. Namely that the inflow of residents and the housing shortage backlog.

To be clear, i make no firm assertions about which way things are going, however, if anyone reads this specific article as a sign of impending doom in the toronto market then they’ve clearly got REbear derangement syndrome.

daniel b

at 11:36 am

also, i’ve heard the developer did no interim occupancy on the project, which would explain the units all hitting at the same time.

Condodweller

at 12:06 am

Agreed, I don’t see this as a bearish sign. It’s a temporary oversupply due to all units hitting the market at the same time. There is no way around it. If we were to see a previously established building suddenly with 50+ available units that would be concerning.

Gary

at 12:55 am

This condo building was marketed as something close for students of Ryerson university. It should all lease out in June/July.

Housing Bear

at 5:01 pm

Thanks for sharing David. It will be interesting to see how the for sale/ for lease ratio plays out for this building over the next couple months. Not sure how normal it is for a new build to have this many rental units hitting the market all at once, but I am interested to see if any of them start to move over to the for sale side.

steve

at 8:06 pm

Many “investors” have poured lots of money and resources into all kinds of rental housing (including triplexes, or other luxury units) in expectation of top level rents. Well, there are only so many people earning enough to cover such rents (above $2000 for a one bedroom). I suspect we may need a long pause here, if not a correction. Wages are just not keeping up, no matter how many tech jobs are created here.

Condodweller

at 12:01 am

When did sales begin in this building? If investors bought 5-3 years ago their calculation for rent should have been in the 1800 range anyway since prices really jumped over the last few years.

As for the price range variance isn’t this the same thing as sale prices? These are MLS listings correct? Which means it’s the agents who are setting the prices and they are probably playing the same games as with sales i.e. some are under priced to attract multiple tenants and some are asking above market rates so they can accept offers that come in below asking.

I was concerned when I purchased in a new building and saw many units come onto the market but they were quickly absorbed and I had no issue renting out as soon as I took possession at the rate I was forecasting.

Even if the number seems large, patience is a virtue. Let the market absorb the units with the low prices and then yours can fetch more realistic market rates.

The only wrinkle is rent control. Once you accept a lower than market rate to find a tenant quickly, you can’t raise at renewal to bring it up to market rate. It may be worth it to hold out for a few months and then get a higher rent.