Inventory may have slowed down over the last couple of weeks, but the amount of photos I’ve found MLS (and been sent by readers!) hasn’t fallen off one bit!

Today we have a few slapstick, a few thinkers, a few “mmmm, yes, that’s funny, quite,” and a few that will make you scratch your head…

–

Okay, I’ve done some renovating, and I want your honest opinion.

Do you like my new floors?

Yes?

No?

Hmmm.

Wanna play checkers?

–

Virtual staging.

Yep.

So real, you can hardly tell…

What kind of coffee maker is that, anyways?

No, seriously, who virtually-stages a bowl of green apples? Are real apples too expensive:

–

Micro-condos are so hot right now.

I mean, who needs rooms anyways?

Why not just combine a few rooms into ONE big room?

Like, I dunno, say, the living-kitchen?

Who needs TV when you can sit on your couch and watch your sink?

But if you think that was good, how about this:

Combine “closet” with “office,” and you get….

–

All that’s missing from this photo is Will Ferrell and John C. Reilly…

Okay, okay, I know what you’re thinking, so here – enjoy!

Seriously though, this is what Toronto real estate has come to: two beds in a kitchen. This is essentially the whole condo, minus the bathroom:

–

This isn’t exactly the most spacious bachelor condo either.

when you have to put the TV across from the fridge, you know your condo is small:

And yet the owners thought “370 square feet” and “wall-mounted electric fireplace” go together like peanut-butter and jelly!

–

Again, why wait for your client to move out of frame? Just take the damn photo! Hurry!

–

Is there something cool about the “spy camera” look-and-feel to photos?

I don’t understand these:

I literally feel like I’m one step from the toilet-cam.

Who’s idea is this? The listing agent? The photographer?

Are there no checks and balances here? Did anybody stop to think maybe these don’t “showcase” the condo?

–

When you list a condo with a fantastic view, you take a photo of said view.

But this view, I would probably not highlight…

Yes, that is the Gardiner Expressway.

Yes, that was included in an MLS listing, for a property currently for sale, as a “view” photo.

But how about this one….

….how about this “CN Tower View” per the listing:

Well, I can’t say there isn’t a C.N. Tower view.

It’s behind an auto-body shop, an alleyway, and a grocery store, but for people who are far-sighted, I guess it works?

–

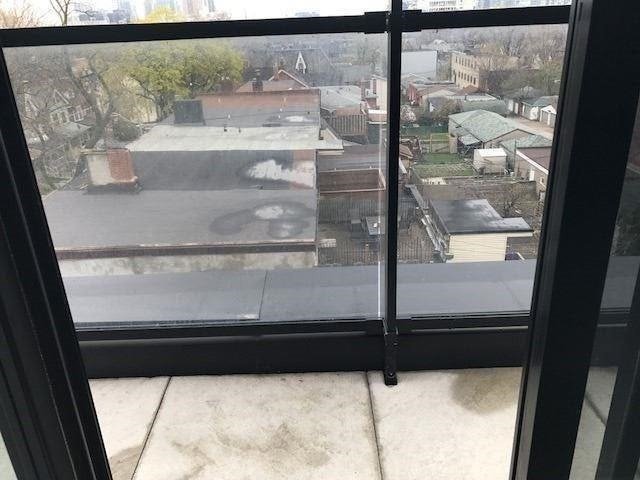

Is this photo showcasing that beeeeautiful view? Or is it showcasing that massive 2-foot deep balcony?

Maybe both?

Maybe while standing on your 2-foot balcony, you can reach out and touch the folks hackin’ darts in the yard below?

–

Was this photo taken by an agent too lazy to open the sliding door? Or is that chicken wire?

Novel, I’ll admit.

But you’re still on the second floor, overlooking the dumpsters…

–

If that door leads to the ensuite bathroom, how many times do you think the person who sleeps in this bedroom would walk into that pole after going to the bathroom in the middle of the night, half-asleep?

–

This property is unreal – four acres, overlooking the Scarborough Bluffs.

But wasn’t the four acres enough of a selling feature?

Did they really need to photo-shop deer in there?

–

Last, but certainly not least, a question about staging.

Now, I’m not the biggest porn guy, but even I have to wonder what else this setup could be for?

While I’m not a professional stager, I don’t know that the people walking into this room are looking to read a book.

Have a great weekend, everybody?

Mike

at 8:47 am

I’m Ron Burgundy?

Appraiser

at 8:59 am

Latest report from CMHC:

“Toronto and Hamilton have seen the degree of overall housing market vulnerability decrease from high to moderate. This reduced vulnerability results from an easing in the overvaluation rating from moderate to low as house prices continued to evolve more in line with housing market fundamentals like personal disposable income, population and interest rates.”

https://www.cmhc-schl.gc.ca/en/media-newsroom/news-releases/2019/toronto-hamilton-housing-market-vulnerability-ratings-drop-high-moderate

Chris

at 9:08 am

“Are Toronto house prices overvalued? Not a chance according to CMHC. They reduced the risk of overvaluation to Low today.

While this might be great for business, as someone who analyzes the housing market and tries to provide objective analysis of it, I find this very odd. In Q4-2016 just before house prices peaked CMHC rated the risk of overvalution in Toronto house prices as High. The avg house price at that time was around $760K. Today, average house prices are around $850K – $90K higher.

Have incomes soared since then? Nope! Yet somehow, in three years even though house prices are $90K higher, we have gone from a market that is at high risk of overvalution to a low risk of overvalution.

Now don’t get me wrong, I’m not particularly bearish about Toronto real estate in the short term, but I don’t know how any unbiased organization looking at Toronto’s housing market can say that there is a low risk of an overvaluation in house prices. These are the types of conclusions one expects from self-interested organizations like realtors and builders and apparently now government backed mortgage insurers.

Despite what CMHC says, house prices at 8X income is not normal and balanced – they are elevated and at the very least have a moderate risk of overvaluation. While I have no idea where prices will go in the future, one thing I know is that it is always better to be a bit concerned about the current level of house prices.

When you’re overly confident about the market because of analysis like CMHCs, it can lead to lazy decisions. It helps you rationalize spending $1,800 for a pre-con condo because hey, our government just told you there’s little risk that condo prices are overvalued. They have nowhere to go but up!!!

It’s better to remain cynical & cautious because it leads to more informed decisions.

It’s worth noting that the last time Toronto house prices were at a High risk of being overvalued according to CMHC was 12 months ago. What has changed since then for the risk to be reduced to Low? No idea! House prices are up 6%.”

– John Pasalis

Appraiser

at 9:40 am

It’s disappointing that Mr. Pasalis seems to be pegging the bulk of his argument on such a simplistic metric as price to income.

I (mistakenly) thought his analysis was more sophisticated than that.

Derek L

at 9:57 am

Good point but I wonder what the CMHC report is based on then? They do mention disposable income.

Chris

at 10:14 am

Per CMHC:

“Overvaluation: House prices are higher than levels supported by personal disposable income, population, interest rates, and other fundamentals.”

So, CMHC also seems to place weight on the price to income ratio when assessing overvaluation.

I haven’t come across much evidence that personal disposable income has shot up over the past 12 months. Population has grown, but doesn’t seem to be at a dramatically faster rate than in previous recent years. And mortgage interest rates have fallen from 3.19% at this time last year to 2.49% today (per Ratehub), but that would seem insufficient in the face of a concurrent 6% price increase to allow for overvaluation to move from high to low.

Appraiser

at 12:38 pm

Income is but one variable.

That’s precisely why a multi-variate approach, as utilized by CMHC, is statistically superior to a bi-variate approach, ala Pasalis.

Some variables are biased, weak or even unnecessary; and if removed from the calculation, will have little or no effect on the correlation coefficient.

Like price to income ratios…for example.

Chris

at 2:34 pm

“Household disposable income plays a key role in shaping house price trends. The higher the real per-capita disposable income (RPDI) of households, the more they can spend to purchase a house or service a mortgage, pushing up house prices. Average annual growth in RPDI is positively correlated with that for house prices in our sample countries (Figure 6). Interestingly, this bivariate relationship has a slope exceeding unity.”

– Fundamental Drivers of House Prices in Advanced Economies, Nan Geng, IMF Working Paper, 2018

Further, Pasalis is not advancing a bivariate model of analysis. He is criticizing CMHC’s analysis by pointing out that in the past 12 months, none of the measured variables have moved significantly enough such that it would warrant the risk of overvaluation falling from high to low.

Appraiser

at 1:12 pm

From today’s Statscan Employment Report:

“Despite the small decline in the number of jobs, wage growth in October held steady. Average hourly wage growth, year-over-year, for all employees was 4.3 per cent for the month, the same as September.

Wage growth continues to accelerate because the labour market remains tight, said ZipRecruiter labour economist Julia Pollak in a written statement about the latest job numbers. “That means Canadians are seeing real increases in their purchasing power.”

https://www.cbc.ca/news/business/employment-steady-october-statistics-canada-says-1.5352718

Kyle

at 3:11 pm

The answer is obvious, CMHC got it wrong when they made their call in 2016.

In fairness to them, the economy is also very different. Rates are clearly not rising, B20 has pretty much ensured people are buying well below their means, and jobs are gang busters.

Kyle

at 3:19 pm

Furthermore, the fact that CMHC is re-evaluating their rating in the face of new information (unlike the IMF, who keeps pumping the same garbage analysis year after year) should add to their credibility not detract from it.

Chris

at 3:23 pm

CMHC made a call of overvaluation being a high risk in Toronto as recently as 12 months ago. Pasalis is referring to the difference in calls between late 2018 and today, not 2016.

Unemployment rate has fallen a touch, mortgage interest rates have slid down a little, wage growth is a bit lower today, population growth is roughly equivalent, B20 was in place at both points, and home prices have climbed 6%.

Kyle

at 3:26 pm

Have you considered that they were wrong up until 12 months ago too?

Chris

at 3:34 pm

Definitely possible. Or they’re wrong today.

Either way, would be curious to hear them expand on what led to the change from last year to today, because it doesn’t seem to jive given the movement of the variables they consider in assessing overvaluation. Perhaps some change made to the model itself?

Kyle

at 3:40 pm

Even you bears have to admit the risk of overvaluation are lower today. All the headwinds you guys have been betting on are gone now. And none of them have stopped this market. Foreign buyers tax? Nope. B20? Nope. Rising rates? Nope. The only thing you guys have left is a recession.

But if there’s a recession, that tanks the economy and the prices of everything (including real estate), then it wasn’t really about real estate being overvalued.

Chris

at 3:55 pm

Oh I would agree that overvaluation is less of a risk today than it was a couple years ago, particularly in many areas of the 905 where prices remain well below their peak. I think Pasalis is correct when he says there is at least a moderate risk of overvaluation.

Seems as though there’s another foreign buyer and speculation tax on the way, courtesy of the Trudeau Liberals.

I wouldn’t bet on the direction of interest rate movements over coming years. A Trump-Xi agreement, reversal of Brexit, resolution in Hong Kong, etc., could quickly change the Feds’ tune. Far too uncertain to call at this point.

If there is a recession, will be interesting to see what happens to real estate, given how heavily many Canadians are leveraged and invested in this asset class.

Appraiser

at 9:44 am

Say what?

Canada is at full-employment, wage growth is taking off (4.3%) and population growth hit a record high in Canada in Q#3.

“Nominal population growth in Canada hit record high in Q3 while single-detached housing starts sit at 09 levels. ” ~Ben Rabidoux

https://twitter.com/BenRabidoux?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Wilyvanker

at 5:49 am

Pasalis is a bear as long as he has been around.

I don’t know how many listings he gets but who wants to buy from someone who keeps yelling the bubble is about to burst. He’s lost all credibility.

nanner nanner

at 9:38 am

I find Pasalis more of a bull wearing bear-face, in a rather transparent attempt at creating an aura of street-cred with consumers and the media.

Tends to fancy himself an intellectual.

Oh, and not the best housing analyst. By a long shot.

Marina

at 9:55 am

All I can hear when I look at the spy camera photos is a creepy landlord whispering “Ve are vatching you”.

Appraiser

at 1:29 pm

More CMHC data:

“The national housing agency says the seasonally adjusted annual rate of housing starts last month slowed to 201,973 units in October compared with 221,135 in September.”

(Only one month’s data, but decreased new home supply generally doesn’t bode well for lower prices).

https://www.cbc.ca/news/business/housing-starts-october-2019-1.5353014

condodweller

at 7:19 pm

I went to a condo opening recently, I haven’t been to one in a year or so, and I am amazed how developers are still shrinking the sizes and increasing the prices. The kitchen in the living room concept seems crazy to me. This builder has three bed units well under 700sqft. If the idea is that people don’t cook at home anyway then why dedicate the entire wall of the living room to kitchen appliances and cabinets?

I also never understood why one would want a corner bedroom. I find it a waste as I’d much rather have the living room with corner exposure. Not to mention the cold from those windows, mind you dome people like cold bedrooms but still.

The unit with the CN tower view will lose it when new condos go up in place of the collision shop across the street.

I tend to look at the glass as half full than the other way around so I would still prefer to have a two foot balcony than a Juliet balcony or no balcony at all.

The studio with the two beds is truly just a shelter. Again, when space is that small why not just put small appliances in one corner?

Now that the iPhone has a wide angle lens I expect to see more of these fish eye shots. I mean we can’t really expect busy agents to photoshop out the effect.

The unit with the checker floor almost looks like it was used for business. Anyway, I’m sure the owner liked it so there is no point in making fun of him/her. I would not spend the money to redo the floor to appease buyers.