I’ve had one foot out the door of my condo for, oh, I’d say about two years now.

Combine my extreme obsessive compulsive disorder with my thoughts and opinions as a Realtor, and result is that I simply cannot find the “perfect” condo for myself.

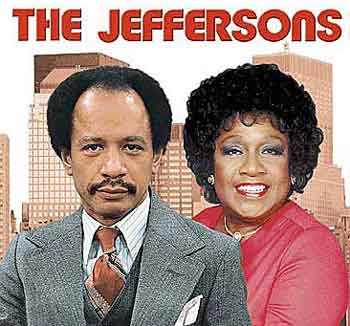

The truth is: I’d love to be movin; on up!

So here I sit about to enter the fifth year in my condo, which I love dearly.

Five years is far above the average time that a condo-owner will spend in one unit in downtown Toronto, but I’ve planted some very deep roots in this condo – roots that have dug far deeper than they ever should have.

Perhaps I need a lesson in the basic “wants versus needs” that I always talk about as it relates to one’s principal residence, but simply put, I have outgrown my condo.

As I look around the living room, I see a bookshelf with so many books stacked on top of the unit itself that I’ve begun a small pile on the floor.

I started the floor-pile of DVD’s at some point last year, and have since bought a larger DVD shelf that is far too large for my space.

I’m constantly cleaning out my closet and giving clothing to Goodwill because of my limited wardrobe area, and I can’t tell you how many things (skiis, snowboard, golf clubs, hockey equipment, baseball gear, winter tires) I keep in seasonal storage in my mother’s basement.

Not only have I outgrown my space, but I can afford far more now as well.

Just because you can buy something doesn’t mean you should, but I’m almost certain that I’m at the point where I need a larger space.

So what’s the problem?

Well as I alluded to above, I’m very picky. Part of my speciality as a Realtor is that I’ll weed through 200 units to find 5 to show a client, and then I might only advise them to consider one of them, if any. I don’t act all “la-dee-da” like many agents and just try to jam clients into anything.

I guess when it comes to my own space, I’m even pickier.

I basically want MY condo, but larger.

I want to keep my 440 square foot terrace, and maybe add to it.

I have a 585 square foot, 1-bedroom condo, and ideally I would have well over 1200 square feet, with an even larger terrace.

Last year, I wrote about a unit I was considering at 383 Adelaide Street East – an authentic, hard loft with 2-storeys and about 1200 square feet. But the 400 square foot terrace was off the bedroom and not the living space (where it would be most useful) and the living space was too small to fit a 4-person couch, let alone the 10-person sectional couch that I desire if I’m truly going to “move on up.”

But even if I did find the right condo, which I’m growing doubtful that I ever will, the question of timing is wrecking havoc with my brain.

I’m going to be 31 years old very soon, and I’m wondering if it makes sense to purchase a $700,000 condo.

My Dad certainly doesn’t think so.

He thinks I should tough it out here for another couple of years and then look to purchase a house, since I will one day be married with kids.

Marriage and a family are #1 on my list of priorities in life, but I don’t see kids for at least 4-5 years.

So can I stay in this tiny condo for another few years? I certainly hope not.

More and more often, I’m being asked to take on a second role as a “life planner” for my clients.

Indirectly, they are asking me to help them figure out their place in this world.

For those that want to move up, they might ask, “House or condo?”

Then they might ask, “When should we move up?”

Well, it depends.

How old are you?

Are you married? Getting married?

Are you going to have kids?

Where do you work? Any chance of a transfer?

What can you afford?

What is your lifestyle like?

Where do you hang out?

Where do your friends live?

There’s so many things at play here, and often not knowing a client for more than a couple of weeks, I can’t decide if a 28-year-old couple, who are getting married in July, should sell their 1-bedroom condo and buy an $800,000 house in North Toronto even though they live and play downtown, or whether they should buy a larger $550,000 condo in their current neighbourhood.

I can barely plan my own life, let alone those of my clients…

So let’s make some assumptions here, and even though I have basically divulged everything about myself on this blog (did you know I was expelled from Junior Kindergarten in 1984?), I’ll keep you all on your toes with some half-truths…

Let’s assume that I own my condo in cash, and I have no mortgage.

For whatever reason, I would rather keep my money in my condo (and pay off a 4.99% mortgage with a very small penalty), then throw darts at the board known as the stock market, or take on even more real estate holdings.

I pay only $370 per month for maintenance fees, and about $175 per month in taxes. My utilities are included in my maintenance fees, so my all-in cost of living is only $545 per month. Not too shabby.

Now let’s say that my “dream unit” comes on the market just down the block or across the street. Unfortunately, I found my dream unit last week but it was at King & Niagara. For $819,000 (or likely $775,000…), the unit is 1500 square feet with a main floor terrace of 200 square feet and a second-storey terrace of 420 square feet. The best part is: it’s a one-bedroom. A 1500 square foot, 1-bedroom is a rarity indeed, and is exactly what a “guy like me” is looking for.

Pretend for a moment that this exact unit was for sale in the St. Lawrence Market area, to which my obsessive-compulsive nature has forever bound me.

So let’s assume that I bought this unit for $775,000 and put down $375,000.

My $400,000 mortgage, with a 35-year amortization (before March 18th) and a 3.69%, five-year-fixed rate would carry for $1,690.91 per month.

Maintenance fees on this unit are a reasonable $595 per month, but I’d have to pay my own heat and hydro, so add $100.

Property taxes are more than DOUBLE my current place – so ring it up at $375 per month.

Including my mortgage, taxes, maintenance, and utilities, I would be paying $2,760 per month.

Right now, I pay $545 on my mortgage-free, utilities-in condo.

So how does this look on paper?

It looks ridiculous! I’d be paying FIVE TIMES as much each month as I do now!

Or at least that’s how some people would look at it…

Call me corny if you want to, but let me ask you this: “Can you put a price on happiness?”

Maybe you can! Maybe that price is $2,760 per month!

How much happier would I be in my 1500 square foot condo with two terraces, one balcony, and a shower with eight jets? The mind can only wander…

I’m far, far from unhappy in my current condo. It’s just that I desire more, and I feel as I deserve more!

I don’t want to sound like a complete ass, or in any way shallow, pretentious, or ungrateful, but I feel as though I’m living beneath my means.

I have been nothing but smart with my money, and I’ve been living in a very small condo for a very long time.

Every day of the week, I show million-dollar condos to clients, and it serves as one giant tease.

I have a client at the moment who is in a similar situation as me, but even more intense! He is living in a bachelor condo which he owns in cash, and I’d say he’s got a good half-million dollars sitting in his mattress. He is living, far, FAR beneath his means! Who knows – he may even have a million bucks, liquid.

I truly admire him for sticking it out in his condo, and although prices have risen since he was looking at condos in 2008, he’s been incredibly smart and conservative with his net worth.

And on the other end of the spectrum, I’ve had clients purchase for $1,000,000 and more with 0-5% down. Imagine paying $10,000 per month in combined carrying costs?

So at what point do I pull the trigger? I suppose when the “perfect” condo comes along.

But do I pull the trigger? I’d have to think “yes.”

I’ll have a house and kids one day, but even if I spend $2,760 per month on my “new” condo and even if it costs me $50,000 in transaction costs and/or depreciation (assuming the worst), can’t I just chalk that $50,000 up to “life lived from 31 to 35 years old?”

I hope so.

And you can guarantee that if and when I do find the perfect place, I’ll detail the finding, the offering, the purchasing, the renovating, and the moving all on this very blog…

moonbeam!

at 7:56 am

How about finding a house in your area? The nice renovated ones are rare but do exist!!

Joe Q.

at 8:43 am

You can still amortize over 35 yrs after March 18th if you have a down-payment of 20% or more, as in your example. The 30-yr maximum amortization length that comes into effect then only applies to CMHC-insured mortgages with LTV over 80%.

Geoff

at 9:03 am

Isn’t assuming the worst to be more like what happened to real estate, especially condos, in the US | Ireland | England ?

IE 50%+ Peak to valley drops in price?

How would that $800K condo look now?

Mila

at 11:21 am

You never know what will happen in 4-5 years… You may purchase a large condo now and indeed have kids in 4-5 years. Or you can wait it out and wait to purchase a big house and never marry… Or perhaps you will have a kid sooner than you think 😉

Anyway, my point is, don’t base your decisions on something that hasn’t realized yet (unless its about to happen really soon) Also, moving to a house also meaning changing your lifestyle. Are you ready for that in a couple of years? Even if you have kids, while they are small you can still live comfortably with them in a 1200sqft condo… (They don’t have to have their personal ensuite at age 2) I guess you get my point. I think you deserve to upgrade your condo 😉

Good luck!

Victor

at 12:41 pm

I think your major concern right now is whether you will have a job 2 or 3 years from now. The real estate bubble is just about to burst, we have boomers who will be putting their homes on the market soon. There will be 17,000 vacant condos in Greater Toronto alone this year. Interest rates will be rising. There will be a huge supply and very little demand. I would say you should start looking at a new career now, preferrably outside of real estate. The best thing you could do today is sell your condo fast and start renting.

Dan

at 2:38 pm

Condo prices are totally out of whack at the moment. Without low interest rates there is no possibility that current prices can be sustained. Everyone has leveraged themselves to the absolute max. The cruel irony is that truly successful professionals are being forced to live beneath their means. The current “shoe box” condo craze has created a product with built-in obsolescence. As you are finding out, is is difficult to deal with such tight confines (and you live in an above average unit). As frustrating as it is, you have two options, stay put or cash out your equity and rent. The current market only rewards leveraged investors and debt-addled real estate drones. Its basically reached the point of absurdity. There is no reason that a luxury condo in Toronto should cost more than $500,000. But just wait until interest rates rise, and there are no more naive first time buyers to exploit. I guarantee you will find something very appealing that will take care of you for the next few years.

buk

at 3:30 pm

next you will be getting bottles at dolce.

Chris

at 4:56 pm

Does your building have a two bedroom unit with a similiar terrace?

David Fleming

at 7:30 pm

@ Victor

You’re absolutely right, and your argument was formulated with sound logic.

Effective tomorrow, I will no longer be a registered real estate salesperson.

Please let me know if you are looking for an an assistant to whatever it is that you do for a living, assuming you do more than just make ridiculous comments on my blog…

David Fleming

at 7:31 pm

@ Chris

The 440 square foot terrace that I have is one of only six in the building, and all six are on the 2nd floor with the same square footage as mine.

I dream (literally…) about a 1000 square foot unit in my building with a similar terrace to mine.

Tiny

at 10:24 pm

It’s OK to desire for something better. The idea is to find a more approachable and reasonable goal.

I had been looking for a new home for a while. I am picky and I have strong preference on location with a rather tight budget. After some unsuccessful attempts, I sort of gave up but I continued to check property listings and keep in touch with my agent. Recently, I accidentally found a place that I really like and the price was slightly beyond my budget. I gave it some thoughts and finally decided to go for it.

Sometimes, finding your ideal home is not that different from finding your soul mate.

Good luck!

Joe Q.

at 10:49 pm

I have to agree to some extent with the “planned obsolescence” comment about condos.

As a non-condo-dweller it’s something that has long puzzled and fascinated me — the idea that condos are, to a great degree, marketed at the very group of people (young, single, upwardly mobile folks) that are most likely to outgrow them within a few years of purchase. They either sell and move on just a few years after buying in, or hold on to the unit as an investment property. Both of these options may have worked out OK for condo owners over the last 5-6 years, but that kind of strategy doesn’t work well in every market.

Chris

at 12:44 pm

hmm.. buy the one next door and connect the two to make a “2 bedroom unit” with super sized terrace and same building/floor plan?

Clara

at 6:46 pm

You said that 5 years is longer than most people stay in one condo.. so if your planning on having kids in 4-5 years, wouldnt now be the perfect time to move?

Kyle

at 9:53 am

If it were anybody but you, i would say your dad’s advice is 100% right. Holding off and buying a house makes way more financial sense for the vast majority of people. Why buy a bigger place that you know you’re not going to stay in more than 5 years? But there’s one thing that makes you different, you sell condos in the city core. And most successful real estate agents live a version of what it is they are selling, or at least they give that impression. When i think of Janet Lindsay or Fran Bennet’s homes, i imagine they are somewhere in the centre of “Oldmoneyville”. I picture Patrick Rocca living in Leaside, and the Battles living in The Kingsway. Brad Lamb can afford to live in a Rosedale mansion but instead he lives in a condo. Maybe it’s worth considering what your clients would imagine you living in.